What Credit Score Do I Need For Capital One Auto Loan

Capital One auto loans vs. While Myautoloan.com requires a 575 minimum credit score, Capital Ones minimum is 500.

Is Capital One preapproval guaranteed?

Capital One Auto Finance does not require a hard credit inquiry upfront. Your final terms will depend on the hard credit pull done at the dealership pre-qualification does not guarantee that youll get financing. You can use the Capital One financing or accept another offer from the dealer.

How Long Will Capital One finance a car?

Loan terms: 24 to 84 months. Maximum vehicle mileage: 120,000 miles. Maximum vehicle age: 10 or 12 years, depending on state.

Can I Make A Capital One Payment At Walmart

You can pay your Capital One credit card bill in person at Capital One bank branches, and the Money Services counters in Kroger brand stores. Payments can also be made at MoneyGram and Western Union locations, which are often found inside Walmart, Rite Aid, Walgreens and Money Tree.

Will Capital One make payment arrangements?

There are payment plans or extensions, deferments, payments arrangement programs as well as other forms of support. The hardship programs offered by Capital One provide a variety of assistance, including waiving interest for up to a year, debt settlements, deferrals, and a wide variety of payment plans.

What is the payoff address for a Capital One auto loan?

Capital One Auto Finance Auto Loan Payoff Address. Capital One Auto Finance. Auto Loan Payoff Address. Regular Mail: PO Box 60511. City of Industry CA 91716. Overnight Physical: 2525 Corporate Place.

How Capital One Auto Refinancing Works

For auto loan refinancing, borrowers work directly with Capital One. The application process is 100% online, including e-signing the contract and uploading documents. If they pre-qualify, applicants will see several offers with different rates and terms, based on a soft credit inquiry. This inquiry will not affect credit scores and lets the applicant see if refinancing a car loan will save them money.

Pre-qualification decisions for refinancing are typically returned in less than one minute. After applicants choose an offer, they complete the refinance application online, resulting in a hard credit inquiry.

While pre-qualification is useful for shopping loan rates or speeding up the process at a dealership, it is not a guarantee of loan approval. Also, pre-qualified loan offers can change after a hard credit inquiry. But, if the information initially submitted was accurate, the pre-qualification offer and final loan terms shouldnt differ greatly.

You May Like: Is 10 Interest High For Auto Loan

Capital One Headquarters Contact Info

Have you ever wondered what people did before credit cards became popular? In the past, people relied on their chequebooks or cash to pay for their purchases, and credit cards werent an element of their daily lives.

Capital One Services issued its first credit card in 1996, and they are now one of the UKs top ten credit card service providers.

Capital One team offers multiple customer services to customers who purchase their credit cards via telephone and mail.

Capital One Headquarters Address You can use the below-mentioned address for sending a courier to them.

1680 Capital One Dr,

Website You can visit their official website for any more information related to Capital One. Customers and investors can use this official website.

Capital One Insurance Address :

PO Box 390907,Minneapolis MN 55439

- If you have paid off your loan, but Capital One Auto Finance still has your title, you can verify your title status or the lien release through your online auto loan account or via the companys automated phone system. Timeline for title release depends on the state, and whether the settlement is made through certified or uncertified funds.

- If you want to pay off your auto loan online, you can do so via online banking. Use the Capital One Mobile App or login to your online account to get the required payoff amount, after which you can schedule the payment.

Recommended Reading: What Is The Best Interest Rate For Personal Loan

Capital One Auto Finance Purchase And Refinance Loans: 2022 Review

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Auto loan reviews

-

Auto loan refinancing

The bottom line:

Best for borrowers wanting to check rates without affecting their credit score and buying within Capital One Auto Navigator network. Capital One Auto Finance also refinances existing car loans.

Do You Still Send Posts

Well, if you do, Capital One has got you covered here too. No organization will say no to accepting a post mail only we have outgrown it. If you still believe in the age-old system of sending posts, Capital One wont say no to it.

Even better, they have provided three different mail addresses to make sure that your post lands on the right station. For payments sent via post, the address goes like this Capital One Auto Finance, P.O Box, 60511, City of Industry, CA 91716.

Overnight payments must be addressed to Capital One Auto Finance, 2525 Corporate Place, 2nd Floor, Suite #250, Monterey Park, CA 91754. For general correspondence, the letter must reach Capital One Auto Finance, 7933 Preston Road, Plano, TX 75024-0410.

Read Also: What Do You Need For Va Loan

What Was Exposed In The Capital One Hack

Capital One said about 140,000 Social Security numbers and 80,000 US bank account numbers were exposed, as were birth dates, addresses, phone numbers, credit balances, transactions and credit scores.

An additional 1 million Canadian credit card customers and applicants had their Social Insurance Numbers stolen.

No login information or credit card account numbers were obtained by Thomas, the bank said.

Capital One Refinance Review: The Waycom Summary

Overall, Capital One auto refinance offers a balanced mix of options for almost any customer credit score. The pre-qualified offer is a great way to find if youre eligible for refinancing without affecting your credit score. While meeting all the eligibility criteria can be a chore, it wont be more than any other lender. You can confidently choose Capital One for refinancing if it meets all your loan needs.

You May Like: How To Sell Car With Loan Still On It

Capital One Auto Loan Availability

You cant use a Capital One auto loan for just any vehicle on the market. Once you get prequalified with Capital One, you can shop from 12,000 dealerships nationwide. These dealers are part of the Capital One Auto Navigator network. The Auto Navigator buying service allows you to browse the inventory of dealerships in your area.

Your Capital One auto loan is only finalized when you visit a dealership. So, you may not know the exact APR and payment amounts until you visit a dealer in person. You can only prequalify online, not start the official loan.

How To Contact Capital One Auto Finance Customer Service

Capital One is a pioneering service provider working in the realm of credit cards, auto loans, and other banking. With a presence in three developed nations of the world, Capital One is the second largest company in the sphere of automotive finance.

The auto loan wing of Capital One is equipped with customer-friendly products and solutions. From financing solutions available on new and used cars, Capital One also provides refinancing on the existing auto loans.

All the services pertaining to auto loans have an efficient customer care service. However, to get the exact response, it is essential to contact them via the right channel. Up next we tell you how to get in touch with Capital One Customer Care Service.

You May Like: How To Qualify For Capital One Auto Loan

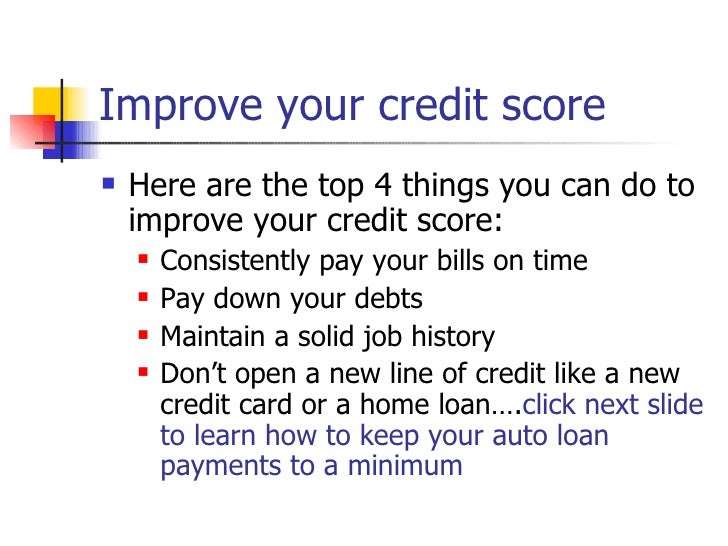

Other Factors Affecting Capital One Auto Loan Rates

Your credit score is perhaps the most influential factor in your auto loan rates from Capital One and other lenders, but it isnt the only one. The following factors also affect the rates youll get from a creditor:

- Financing terms: Opting for longer terms will get you a lower monthly loan payment, but youll likely find higher rates, too.

- Down payment: Whether in cash or as a trade-in, the amount you put down on a car, truck, or SUV affects the loan-to-value ratio . This is the amount you borrow compared to the value of the vehicle. If you have a lower LTV, you can probably get a lower rate.

- Vehicle details: The age, make, model, and mileage of your vehicle are all factors in your rates. Loans for older vehicles and high-mileage cars sometimes come with higher rates.

Capital One Auto Refinance Review Introduction

Capital One is one of the countrys most popular banks when it comes to auto loans and refinancing. Headquartered in McLean, Virginia, it has three divisions Credit Cards, Consumer Banking, and Commercial Banking.It is the second-largest auto finance company in the US, with a range of auto loan services available in 48 states. It commands a stable 5% share in the auto loan and refinance market. Therefore, Capital One Auto Refinance should definitely be on your list of refinance lenders to check out!Here, the Way.com Refinance team has done a thorough review of Capital One refinance auto loans, including the eligibility criteria, benefits and drawbacks. You can read on to know more and make an informed decision before refinancing your auto loan.

You May Like: Is Fha Or Conventional Loan Better For Seller

Unique Features Of Capital One Auto Refinance Auto Loan

Lets take a detailed look at some of the core features of the Capital One refinance auto loan process.

- Minimum Income: Capital One refinance auto loans require a minimum annual income of $18,000, which is lower than the average.

- Wide range of refinance rates: Capital One auto refinance rates start at 4.1% for excellent credit scores and go as high as 24.99%

- Poor credit score accepted: Credit scores as low as 540 can still get you decent loan terms

- Vehicle age: Your car should not be more than 10 years old

- Co-signing accepted: Having a co-signer can reduce your refinance rates to a manageable level

- No origination fees: Capital One will not charge you a processing fee during application

- Can refinance large loans: Capital One will refinance loans ranging from $7,500 to as high as $50,000

Choose Your Vehicle Or Dealership

The first step to getting a Capital One auto loan is to browse the Auto Navigator site for vehicles and dealers in your area. If you narrow your choices down to a single vehicle, you can get prequalified right on that page for an auto loan. You can also simply view dealership inventory in your area and find out which dealers work with Capital One.

Recommended Reading: Do Loan Officers Approve Loans

Capital One Auto Finance At A Glance

-

Origination fee: None.

-

Personal information needed: Social Security number or ITIN, address, time at address, phone, email, birthdate, employment status, employer name, housing payment amount.

-

Pre-qualification available: Yes, via soft credit check. Pre-qualified offer valid for 30 days.

-

Online, in-person or both: Application to pre-qualify for a purchase loan is submitted online and then completed at the dealership. Auto loan refinancing is 100% online, including document upload.

-

Approval speed: Typically within 24 hours for auto refinance loans. Did not disclose for purchase loans.

-

Funding speed: Did not disclose.

-

Minimum FICO credit score: Did not disclose.

-

Minimum credit history: Has minimum. Length not disclosed.

-

Minimum annual gross income: $18,000.

-

Maximum debt-to-income ratio: Did not disclose.

-

Bankruptcy-related restrictions: Has restrictions but details not disclosed.

-

States covered: All except AK, HI.

-

Assistance provided: Dedicated phone numbers are provided for auto loan applicants to call for assistance. Applicants can also log in to a portal to see their loan application status.

-

Availability: MonFri 9 a.m.-9 p.m. ET.

-

Contact options: Phone, online chat.

-

Pre-qualify with a soft credit check.

-

Auto Navigator offers car shopping and loan pre-qualification by website or app.

-

Charges no origination fee.

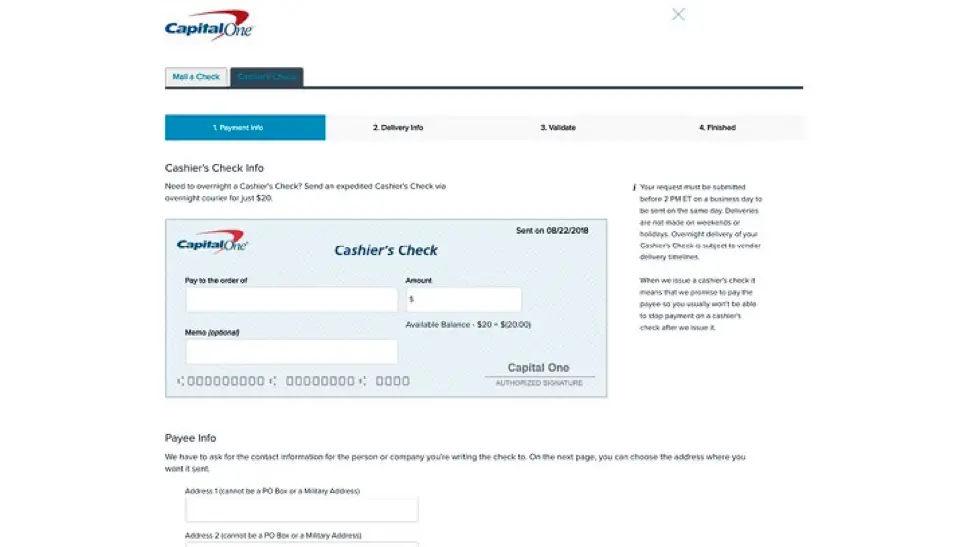

What Is The Payment Address For Capital One

The mailing address for Capital One payments is Card Services, P.O. Box 60501, City of Industry, CA 91716-0501, according to the official website. The overnight address is Card Services Inc., ATTN: Exception Dept, 2012 Corporate Lane, Suite 108, Naperville, IL 60563.

Capital One cardholders should check their credit card statements for the appropriate mailing address, notes the website. They can also opt for the one-time payment option, which allows crediting of payment on the same day of payment if cardholders pay before 8 p.m. Eastern Time. Another payment option is AutoPay, which requires a one-time setup and automatically schedules payments a day before the due date. Both the one-time payment and AutoPay options have no extra charges.

Don’t Miss: Who Has The Best Student Loan Refinance Rates

Capital One Auto Refinance Requirements

Before applying for a Capital One refinance auto loan, ensure you check all the qualifications and Capital One Auto Refinance requirements as defined in the table below:

| Criteria |

|---|

- Capital One will only refinance new and used vehicles, minivans, light trucks, and SUVs for personal use.

- Capital One auto refinance does not cover vehicles no longer in production, commercial vehicles, motorcycles, or motor homes.

- An important thing to remember is that you cannot apply for refinancing from Capital One if your original loan was serviced by it.

- Your current lender must be reporting to a major credit bureau, must be FDIC or NCUA insured, or accredited by the Better Business Bureau and a registered lender in the state.

- If you are a serving member of the armed forces, the Capital One refinance auto loan rates offered to you will be covered under the Military Lending Act.

- You will need to send your vehicle title to Capital One if you reside in Kentucky, Minnesota, Michigan, Maryland, Missouri, Montana, New York, Oklahoma or Wisconsin. For all other states, Capital One will get the title directly from the state agency.

- You may also need to sign a limited Power of Attorney document to show Capital One as the new lienholder.

New Auto Purchase Loan Review

-

Pre-qualify with a soft credit check.

-

Auto Navigator offers car shopping and loan pre-qualification by website or app.

-

Charges no origination fee.

-

Borrowers can choose loan payment due date.

Cons

-

Not available in a few states.

-

Must purchase vehicle at a participating dealership.

-

Does not offer rate discounts for automatic payment.

-

Social Security number required to submit initial application.

Best for applicants wanting to pre-qualify for financing and find a new vehicle online, before visiting the dealership.

Recommended Reading: Can I Buy Two Houses With Va Loan

Capital One Auto Loan Review: Pros And Cons

Capital One is well known for its credit card offers, but it also provides a variety of banking services, including auto purchase and refinancing loans. This review can help you decide if a Capital One auto loan is worth considering.

If youre trying to secure a low-interest loan, read our review of the best auto loan providers. We compare interest rates, loan terms, the application process, and customer reputation. Read on to see how Capital One scores in these categories.

Up to 722.25%

- Low rates for good credit customers

- Strong industry reputation

- Average monthly savings of $150

- Work with a personal loan concierge to compare options

- A+ BBB Rating

- A leading provider in refinance loans

- A+ BBB rating

Up to 723.99%

- Great for customers with limited/no credit

- Offers special military rates

- Average monthly savings of $145

- Online Application

Up to 723.99%

- Great for customers with limited/no credit

- Offers special military rates

Up to 842.49%

Capital One Auto Finance Overnight Payoff Address

Most people will need to know the Overnight address for their Capital One Auto Finance loans and other mortgage services.

However, if you need to know the overnight mailing address, this section of the guide will assist you.

The Capital One Auto Finance Overnight Payoff Address is 2525 Corporate Place, Second Floor, Suite 250, Monterey Park CA 91754.

That is the overnight address which is sometimes different from the regular mailing address for mortgage or auto loan payments.

For confirmation or verification of the overnight address, please contact the Mortgage or Loan department.

Read Also: Can I Use Balance Transfer To Pay Off Loan

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Is The Capital One Auto Finance Phone Number

Capital One Auto Finance customer service can be reached at the following phone numbers:

Main Capital One Auto Finance Phone Number: 1-800-946-0332

Capital One Auto Finance FAX Number : 1-866-722-0410

Capital One Auto Finance New and Used Financing Applications: 1-800-689-1789

Capital one Auto Refinance Applications: 1-888-263-4582

Hours: Mon Fri, 8 a.m, . 9 p.m. ETSat, 8 a.m. 6 p.m. ET

Recommended Reading: Can I Refinance My Car Loan With The Same Company

Capital One Auto Finance Payoff Address Routing Number Swift Code Phone Number Hours Customer Service Near Me Car Loan

At a Glance:

- If you have no idea about the Capital One payoff address? and Are you searching for a Capital One overnight payoff address?

- We have created a list of all of Capital Ones hours, routing number, phone number, payoff address, mailing address, overnight payoff address, locations, and other contact information sorted according to loan type and service.

- By having access to the Capital One payoff address, you can get the information you need fast.

Did you know?

Under a finance perspective, incurring debt is not a bad thing, even in business. Flourishing companies keep a healthy balance in its liabilities since it is considered wise to maximize the use of their credit line. In such ways, available cash can be invested or used for more urgent needs rather than using them all as full payment for purchases.

Quick Navigation