Bank Of America: Best Big Bank Option

Overview: Bank of America offers flexible and convenient auto loans you can apply for directly on its website. Rates are competitive, and you can qualify for additional discounts if youre an eligible Bank of America customer.

Perks: Bank of America will finance a minimum of $7,500 and requires that the car be no more than 10 years old, with no more than 125,000 miles and valued at no less than $6,000. Financing is available in all 50 states and Washington, D.C. Bank of Americas APRs start at 2.89 percent for a new car and 2.99 percent for a used car.

If youre a Bank of America Preferred Rewards customer, you can qualify for a rate discount of up to 0.5 percent off.

What to watch out for: If you’re applying online, the term range you can apply for is limited you can pick only a 48-, 60 or 72-month term.

| Lender |

|---|

| None |

Shop For Car Loan Rates At Credit Unions

See what types of rates are being offered by a local credit union, even if you’re not a member, suggests Charlie Chesbrough, senior economist for Cox Automotive. You might find its easy to become a member, if you want a car loan.

“Many credit unions have been aggressively lending into the auto market,” Chesbrough said.

Chesbrough said shoppers should talk to different dealers about options for getting a lower rate, as many dealerships may know of lenders who are actively promoting car loans for borrowers who have less than perfect credit. Consumers need to ask plenty of questions.

“They have to be very diligent in their shopping,” Chesbrough said. “There are other offers out there that they do qualify for.”

Car Loan Interest And Credit

If youve never had to take out a loan before, then you may be venturing into new territory with all this talk of credit score. First, well break up those brackets that we mentioned earlier, explaining what they mean precisely.

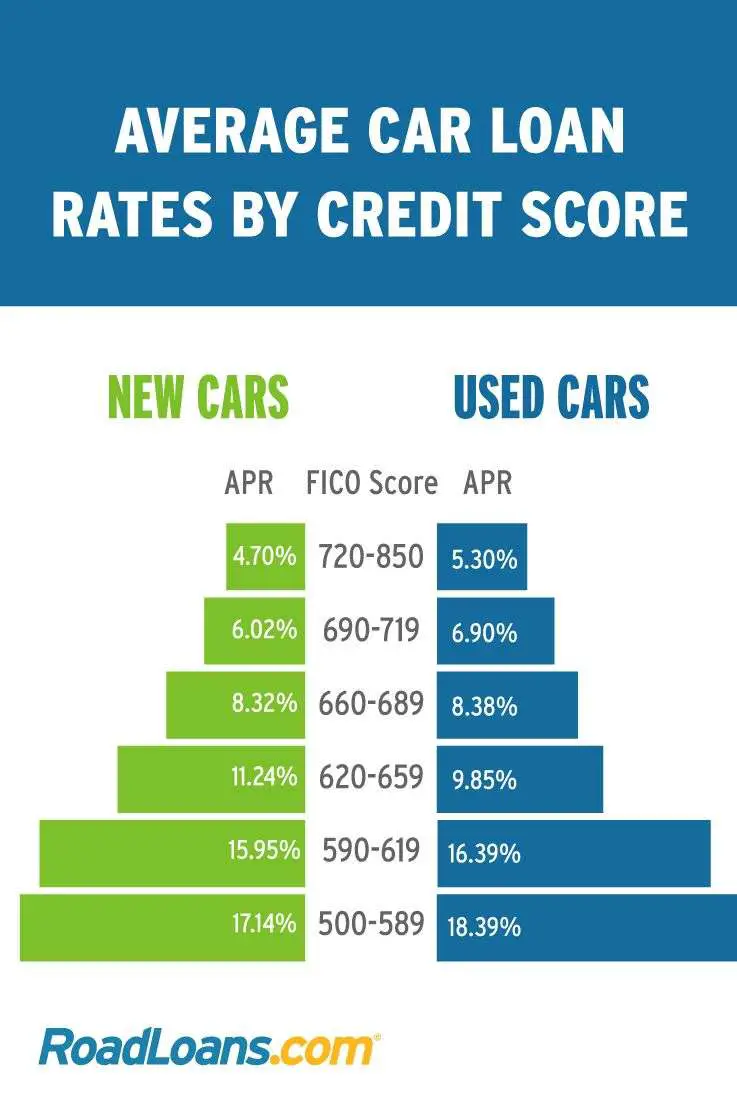

Your credit score can range from super-prime to deep subprime. To illustrate the monumental difference in APR between these brackets, we can look at the data in a handy list.

So, what is the interest rate on a car loan?

- Super prime will net you an average APR of 2-4% on a car

- Prime will be between 3-6%

- Nonprime can be expected to be somewhere between 6-11%

- Subprime has an APR of 11-18%

- Deep subprime will carry a hit of 14-21%

As you can see, bad credit car loans can be brutal. Can you refinance a car loan? Yes, but car loans for bad credit will not typically get any better. Credit union loans for cars are an option, but they’ll have similar rates.

Generally, auto financing has set standards regardless of whether or not it’s a bank. Figuring out how to get a car loan with bad credit will always be an uphill battle.

If you want to know how to pay off a car loan faster and you are struggling, have a look at these tips.

So that begs the question of how to get a car loan. A Chase car loan makes things a little less complicated since they’ve got a car loan calculator! A Bank of America car loan might also be worth a look.

You May Like: Do Loan Companies Verify Bank Statements

Capital One: Best For Convenience

Overview: Capital One will let you borrow as little as $4,000, but it requires you to purchase the car through one of its participating dealers. In a lot of ways, its financing works as a one-stop shop for your auto loan and vehicle purchase.

Perks: The Capital One Auto Navigator site lets you search for inventory in your area and gives you the ability to see how different makes, models and features will impact your monthly payment. This will give you a lot of information before you head to the dealer. Also, the quick prequalification allows you to check your rate through a soft inquiry, so your credit score wont be impacted.

What to watch out for: You can only use Capital One auto financing to shop at one of its participating dealerships, which makes this a poor option if you find a car you love elsewhere.

| Lender |

|---|

| Late fee |

How To Claim Injury In Car Accident

Category: Cars 1. Personal Injury Insurance Claims After a Car Accident | AllLaw As soon as possible, contact your automobile insurance company to report that an accident has occurred. Your insurance company will assign a claim number and a However, following an accident you have the right to expect to

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Shop Around With Different Lenders

Many lenders will show you your preapproved rates and terms online after you fill out and they generate a soft credit pull. Taking the time to get quotes from different lenders, both national and local, will give you more leverage in negotiations because you’ll understand the going rates with your particular credit score for the car you’re interested in.

Don’t just take into account the listed interest rate calculate the total interest you’ll pay over the life of the loan based on your overall loan amount and term length.

While this may sound simple, a lower overall price will reduce the amount of interest you’ll pay on the loan.

You can reduce the sales price by declining add-ons like seat warmers and rear seat entertainment systems. You may also get a lower interest rate on a new car than on a used car, as used cars often have more mileage, expired warranties, and increased wear and tear. Lenders bake the increased risk of mechanical breakdown into the interest rate.

Can I Get An Auto Loan With Bad Credit

It is possible to get a car loan with bad credit, although having bad credit will raise the rates you’re offered. If you’re having trouble getting approved or finding acceptable rates, try taking these steps:

- Improve your credit: Before applying for an auto loan, pay down as much debt as you can and avoid opening new accounts, like credit cards.

- Make a large down payment: Making a larger down payment will lower your monthly payment, but it could also help you qualify for better rates.

- Consider a co-signer: A co-signer with good credit will take on some responsibility for your loan if you default, but they can also help you qualify.

Don’t Miss: How Much Car Can I Afford Calculator Salary

How Do You Negotiate A Good Interest Rate On A Car Loan

What can I do to negotiate a good interest rate on a car loan? I know that there is some haggling involved in car buying and that makes me kind of nervous. How do I negotiate?

Answer

- Improve your credit. Credit scores influence a loanâs interest rate, so improving your credit is one of the best ways to get a better rate. If your credit is poor, you can also get a cosigner with excellent credit to help you get better terms.

- Offer a large downpayment. Many lenders will lower the interest rate on your loan if you can make a large downpayment. If possible, save up before you purchase your new car.

- Negotiate the price of the car. If you finance your car through a dealership, you can try to negotiate the price of the car itself rather than the interest rate. If you can get a lower price on the car, youâll pay less in interest over time.

- Do your research. Shop around before committing to a lender! That way, youâll know what kind of interest rates to expect. You can ask the lender for a better rate based on whatâs available to you or if you find a lower rate elsewhere.

How Do Lenders Decide What Interest Rate To Charge You

When it comes to deciding the interest rate for a car loan, lenders will consider many different factors, including:

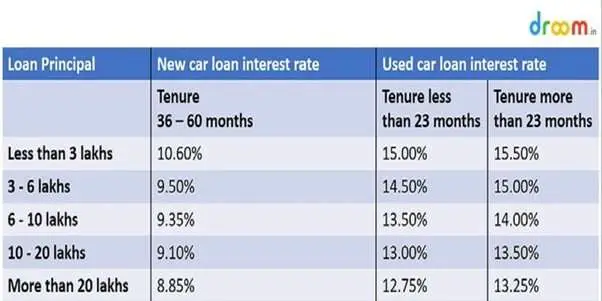

Car Loan Terms

When buying a new car, lenders often offer longer loan terms to accommodate new buyers. However, the longer loan term will certainly be accounted for in the interest rate. Generally, a longer loan term equates to a higher interest rate and a higher overall price.

Vehicle Status

If you opt for a secured personal loan, your car will act as security or collateral in the event that you cannot pay the lender back. Cars are quickly depreciating assets so, lenders will account for that throughout the term of the loan. If you cannot pay your loan and your car has depreciated or malfunctioned, the lender takes a risk. They may increase the interest rate after some time has passed. Furthermore, old cars tend to encourage higher interest rates. New cars may encourage lenders to offer lower interest rates.

Experts recommend knowing your before you apply for a car loan. Your credit score is important to a lender, as it lets them look at your history of debt repayment. If you have a lot of debt and expenses, lenders will see you as a higher risk borrower, resulting in a higher interest rate. If you have a great credit score, you have a higher chance of securing a lower interest rate.

Down Payment

Debt-to-Income Ratio

Employment Stability

The Economy

Don’t Miss: Can You Buy A Mobile Home With A Va Loan

What Is A Good Interest Rate On A Car Loan

While the sticker price can tell you how much a vehicle is worth, the interest rate on an auto loan can make a big difference in how much you pay. So, what is a good interest rate on a car loan? Youll generally find interest rates ranging between 3.17% and 13.76% depending on how good your credit is. Since youll want to pick up a new Mercedes-Benz with the best loan package, youll also want a good understanding of what the average interest is on a car loan. Weve put together a quick and easy guide to fill you in.

What Is A Good Interest Rate For A Car Loan

JOHN C. BALDWIN| NOV 29, 2021

Its that dream car youve always wanted, but you cant reasonably afford to put out the cash to buy it, so youve turned to a car loan for help. Before you hit the road, though, theres some critical information you should consider about the interest rates.

The average auto loan interest rate can vary as significantly as almost 13% between two borrowers, depending on credit score. Thats a world of difference, one that could make or break your decision to buy that new car depending on your financial situation.

How do car loans work though? What are current loan rates? What is a car loan?

Also Check: Fha Vs Conventional 97

More Ways To To Get A Good Interest Rate On A Car Loan

Aside from raising your credit score, opting for the shortest loan term you can afford, and choosing the right car, there are several other ways to get a better loan rate.

Shop around. A 0% promotional offer from a manufacturer or dealer could be hard to beat. Otherwise, you may find that dealer financing is more expensive than going through your local bank or or using an online lender. With a bank or credit union, you can apply for preapproval, which will tell you how much money they are prepared to lend you and at what interest rate. Being preapproved for a loan also gives you leverage in negotiating with the car dealer.

Negotiate. Just like the price of the car, the interest rate youll pay on a car loan can be negotiable, particularly at the dealership. Car dealers often work with one or more lenders. After they have reviewed your financial information, the lenders will propose an interest rate to charge you, known as the buy rate. The dealer, however, is likely to pad that rate and offer you a higher one as a way to increase their profit margin. That gives you some room to negotiate.

Get a cosigner. If a low credit score is the problem, then asking a relative or other person with a better score to cosign the loan could help you get a lower rate.

How Do You Get A Better Rate For A Car Loan

There are many ways for you to influence your chance of getting a better rate. Lets take a look at a few of them:

Improve Your Credit Score Before Applying

Improving your credit score doesnt happen overnight. Over time, you need to show that you are responsible with your debts. This includes making your credit card payments on time and keeping the balance within 30% of your limit and building a diverse but manageable combination of debt. For more information about improving your credit score, check out Loans Canadas article on Improving Your Credit Score.

Increase Down Payment

No-money-down car loans may seem like a great deal, especially if you have trouble saving however, this route can almost certainly guarantee you a higher interest rate. Consider waiting a little longer before purchasing your car so that you have a sizeable down payment. Experts recommend at least 20%.

Get A Co-signer

Compare, Research, and Consider Pre-Approval

If you want to be prepared and well informed about the different deals and interest rates available to you, you might want to consider pre-approval for a loan. Dont worry a pre-approval wont damage your credit score. On the contrary, they can actually be quite helpful in helping you assess what youre eligible for. Furthermore, being able to compare rates with loans you are pre-approved for gives you more knowledge and in turn more power in negotiating a rate with a dealership.

Negotiate

Recommended Reading: How Do I Find Out My Auto Loan Account Number

Can I Get A Low

Yes, though it depends on what you consider to be low interest. An auto loan interest rate for someone with fair credit could qualify for an interest rate thats almost a third of what a subprime borrower would pay.

You may think loan rates on used cars are lower than rates for new cars, but the opposite is true. Lenders have little interest in repossessing used cars because they have lower resale value than new cars, which partly leads to higher interest rates on used-car loans.

The average interest rate on all used-car loans for subprime borrowers was 16.88% in Q4 of 2019 about 5% higher than the average rate for new car loans for the same subprime borrowers. For prime borrowers, the difference in average loans rates wasnt as severe: 6.15% for all used-car loans versus 4.75% for new-car loans.

The best place to get a car loan when you have bad credit is from online lenders. They dont have the overhead that branded dealerships and banks have, allowing them to make loans to people with low credit scores.

Just know ahead of time that such offers usually come with higher interest rates.

What Is The Lowest Interest Rate For Used Car Loan

Category: Cars 1. Best Car Loan Rates of September 2021 Investopedia For the most creditworthy borrowers, APRs start at 2.39% for new vehicles. Used vehicle loans start at 2.59% APR, while refinances start at 3.39% APR. Customers How Do Car Loans Work?What Should You Consider When Choosing an Auto Loan?

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Evaluate The Interest Rate Youre Offered

Customers with an excellent credit score may qualify for a single-digit APR loan, while those with average credit will usually be able to access a loan with 10% APR.

At Birchwood Credit, our average rate is 15%. We will help you find a payment plan that fits your lifestyle and budget, even if you have bad credit.

What To Know Before Applying For An Auto Loan

When looking for a car loan, it’s best to shop around with a few lenders before making your decision. This is because each lender has its own methodology when approving you for a loan and setting your interest rate and terms.

Generally, your credit score will make the biggest impact in the rates offered. The higher your credit score, the lower APR you’ll receive. Having a higher credit score may also allow you to take out a larger loan or access a broader selection of repayment terms. Choosing a longer repayment term will lower your monthly payments, although you’ll also pay more in interest overall.

If you’ve found a few lenders that you like, see if they offer preapproval going through this process will let you see which rates you qualify for without impacting your credit score.

Read Also: Does Va Loan Work For Manufactured Homes

Current Auto Loan Rates For 2021

Auto loans are secured loans that help borrowers pay for a new or used car. They are available from dealerships and a variety of lenders, so it’s important to shop around in order to find the best interest rates and terms for your vehicle. The lenders profiled on this page are a great place to start.

Secure A Shorter Term And Make A Large Down Payment

You should try to avoid taking on a loan with a long term. The lower monthly payments might seem attractive, but you end up paying more in interest the longer youre locked into a loan. Car loan terms usually range from 12 to 72 months and you can save thousands of dollars in interest by opting for the shortest term you can afford.If you cant afford the full price of the car, but have some money to put towards a down payment you should do so. You will end up paying less in interest because the total amount you need to borrow will be lower.Birchwood Credit Solutions offers flexible in-house financing and specializes in car loans for people with bad credit. Fill out our quick and easy online application today or get in touch to learn more about our services.

You May Like: Can I Refinance My Sofi Loan