Why An Increased Credit Score Is A Red Flag

The coronavirus-related safety nets available to student loan borrowers have presented a great opportunity for struggling consumers to regain stability and avoid default, says Bruce McClary, a spokesman for the National Foundation for Credit Counseling . Yet, he warns that the underlying circumstances that caused individual financial hardships in the first place such as a lack of savings or too much credit card debt may not be resolved before the federal student loan deferment program expires.

Unsecured consumer debt sits at an all-time high of $1.4 trillion, McClary says, and those who have reached out to the NFCC asking for help managing their debt come with an average of $16,000 in debt across five accounts.

“Even with some recent increases in savings rates among consumers, most Americans are nowhere near where they need to be to survive another major financial disruption,” McClary says. “A recent example of this is from last year’s federal employee furlough. It was only a matter of weeks before many families ran out of cash after their paychecks stopped.

“That leads me to believe that some will end up right back where they were or worse when the moratorium on payments and interest comes to an end,” he says of student loan borrowers.

For borrowers facing prolonged periods of hardship, make plans beyond the temporary relief programs and consider affordable repayment options that can help keep your loans out of default.

Defaulting On Student Loans

If your student loan continues to be delinquent, the loan may go into default . The point when a loan is considered to be in default varies depending on the type of student loan you received.

For a loan made under the William D. Ford Federal Direct Loan Program or the Federal Family Education Loan Program, youre considered to be in default if you dont make your scheduled student loan payments for a period of at least 270 days .

For a loan made under the Federal Perkins Loan Program , the holder of the loan may declare the loan to be in default if you dont make any scheduled payment by its due date.

The consequences of defaulting on your student loans can be quite severe, including the following:

The entire unpaid balance of your student loans, including interest, could be due in full immediately.

The government can begin to garnish your wages by up to 15%, meaning your employer is required to withhold a portion of your pay and send it directly to your loan holder.

Your tax return and federal benefits payments may be withheld and applied to cover the costs of your defaulted loan.

You could lose eligibility for any further federal student aid.

If you are having difficulty making regular payments on your student loans, there are steps you can take before the consequences of defaulting kick in. For instance, you could apply for a student loan deferment, which allows you to temporarily stop making your federal student loan payments.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: Can You Pay Off Mortgage With Home Equity Loan

How To Rebuild Credit After Student Loan Default

Federal student loans come with two structured ways to get out of default, both of which can help you rebuild credit:

- Student loan rehabilitation: When you rehabilitate a defaulted federal loan, you agree to make nine on-time payments within a 10-month period. You’ll generally pay 15% of your monthly discretionary income during this time. For Perkins loans, your loan holder will determine the monthly payment.Once your loan has been rehabilitated, you’ll regain benefits including access to federal student aid. Wage and tax return garnishment will end. Rehabilitation also offers the advantage of removing the default notation from your credit report. Your pre-default missed payments will remain, but the removal of the default record could benefit your credit.

- Student loan consolidation: You can also turn your defaulted student loan into a direct consolidation loan to get out of default. This process requires you to either make three full, on-time payments toward the defaulted loan before consolidating or to repay the new loan on an income-driven repayment plan.If you choose this route, the default record won’t come off your credit report. But consolidation can be a faster process than rehabilitation, and your new consolidation loan will be listed as current on your credit report as you make on-time payments.

You can also work to rebuild credit on your own after defaultwhether you have federal or private loansby making use of responsible credit habits:

Refinancing Student Loans With Earnest

But the biggest motivation for me wasnt the savings. It was getting away from my awful loan servicers. The Department of Education doesnt allow students to choose their servicers when you start repayment. And my servicers were always really hard to get ahold of when I needed help. When I could get someone on the line, it seemed like they barely listened and offered me very little help.

Unfortunately, most student loan refinancing companies and private lenders at the time had credit requirements I couldnt meet. If Id applied, I would have been rejected flat out. When I learned about Earnest and their flexible underwriting process, I wanted to put that to the test. I applied to refinance about $33,000 of my student loans.

On paper, my credit score said I wasnt a safe bet to lend to. But Earnest looked at other factors. Student Loan Hero was doing well, and my income had grown. My free monthly cash flow was good, my accounts were in good standing, I kept spending under control, and my debt-to-income ratio was low, too.

An Earnest underwriter also called me while they were processing my application. Obviously, thered been a few bumps in my credit history. But the underwriter listened as I explained my situation, how Id fixed it, and how I was managing my money.

Im proof that student loan default doesnt have to ruin or even define your finances. It will take time, but start the journey now and in a few years, you could be writing your own student loan success story.

Don’t Miss: Will Ally Refinance My Auto Loan

What Can I Do About Defaulted Student Loans

Once your student loan repayment plan begins, youâll have to make monthly payments by the due date, each and every month. Late payments usually result in fees and possibly other penalties, but not all late payments will appear on your credit report.

Federal student loans that are 90-days past due will be reported to the credit bureaus and appear on your credit report. A federal student loan payment thatâs been delinquent for 270 days will be reported as a defaulted student loan.

Private student loans donât have to follow the federal student aid guidelines. Private lenders will report late payments and default according to the loan terms, which the borrower accepts when taking out the loan. Private student loan payments can be reported as past due as soon as 30-days after the first missed payment. Private student loans are often reported as defaulted after 120 days of delinquency, but can be classified as in default after a single missed payment. When a student loan account is in default, the entire balance of the loan becomes due.

Getting Out Of Student Loan Default

At first, I was skeptical of this collection agency that claimed to have $16,000 worth of defaulted student loans in my name. After all, I had been tracking my student loans pretty well, and this agency said I owed a debt I couldnt trace.

Wary of a potential scam or servicing error, I didnt want to be on the hook for loans I didnt actually owe. I did my due diligence to verify the debt and the lender to make sure it was legitimate. I got the original promissory note to verify that the student loans they were trying to collect were actually mine. In all, it took me three months to wrap my head around the fact that I was, in fact, in default.

When you find yourself in default on your federal loans or private loans, the faster you can get out, the faster your FICO score can improve. Youll also be able to get onto an income-driven plan or another affordable repayment plan faster.

Its never a good idea to kick these things further down the road.

My one regret is not getting started faster on a plan to rehabilitate my defaulted loans. Its never a good idea to kick these things further down the road it just damages your credit and payment history more and allows interest and fees to continue racking up.

There are typically three options for getting out of default: 1) pay the debt off in full, 2) consolidate your student loans and begin making payments, or 3) rehabilitate your loans. I chose to rehabilitate my loan.

You May Like: What Are Conventional Loan Rates

Can A Debt Reappear

As stated just above, a FFEL loan could reappear upon transfer to Dept. of Ed. Another event that brings back a trade line for federal student loans would be getting the loan out of default. Once out of default, the loan is in good standing and will reappear on a credit report, if it had aged off. At this point, none of the negative items will return. It will appear as a loan in good standing.

Heres an interesting thing that may sway your decision on how to get out of default, be it rehabilitation or consolidation. When consolidation occurs, a brand new trade line appears, because consolidation is a brand new loan. If the underlying loans aged off, they stay hidden. If a FFEL is rehabilitated, a new trade line appears, because in order to complete rehabilitation, the holder of the loan is required to sell the loan. Technically its a new loan, thus a new trade line appears. If the former FFEL loan is still showing a trade line, the word DEFAULT is deleted. If the former FFEL already aged off, it stays off. BUT, if a DL is rehabilitated, and the trade line has aged off, the trade line returns as if the default had never occurred. No late payments show, no default shows, nothing. It will look as if youve had this loan from the original consolidation date with NO ISSUES! That could help a person looking to improve their credit rating.

How Credit Scores Affect New Student Loans

All of your student loans can affect your credit. But you dont need good credit to take out a student loan in the first place.

-

For federal loans: Most types of federal student loans, including all federal loans for undergraduates, dont require a credit check. Federal direct PLUS loans, available to parents and graduate students, do require one. However, your credit score wont affect your rate all PLUS loans disbursed in the same year have the same rate.

-

For private loans: Private loans require that at least one borrower have good credit. The lender will perform a credit check to determine whether you qualify for the loan. The higher your credit score, the lower the interest rate youll likely receive. Often, undergraduate students need a co-signer to qualify for private student loans.

About the authors:Teddy Nykiel is a former personal finance and student loans writer for NerdWallet. Her work has been featured by The Associated Press, USA Today and Reuters.Read more

Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Recommended Reading: How Much Do We Qualify For Home Loan

How Does Idr Affect Credit

IDR , doesnt affect credit at all. At least, not in a bad way. Many people think that IDR is a less-than-minimum payment, but its not. IDR is an acceptable payment plan, allowed by law. As long as the IDR payment is made on time, credit looks just fine.

What if the borrower is looking to make a major purchase like a home? Doesnt it ruin the debt to income ratio ? On the contrary, it could help it. DTI looks at monthly payments, not necessarily total debt load. The mortgage company wants to know that the borrower is not over burdened and can afford the mortgage payment in addition to the bills the borrower already has. Since IDR is usually more affordable than balance based payments, the borrower is more likely to afford the mortgage payments. NOTE: Im not getting into the argument that a person on IDR shouldnt be buying a house. Thats a statement based on a false stereotype.

Re: Student Loan Showing Closed

Hello,

Just to be clear, you’re absolutely sure your account is in good status? They make a lot of errors and you have to be vigilant because they will not be held accountable unfortunately.

I would double-chrck the account with the servicer and with the National Student Loan Database website. Make sure the status is good. If they’d okay you should be in the clear.

One small thing. You mentioned an administrative forbearance and then later a deferment. Those are different. An administrative forbearance is typically for when your turn in paperwork, like for a payment plan, and it’s processing. It’s usually automatic and a month or so. Can you elaborate what it was for?

If you had that large of a point gain, also wanted to double check if got had any lates on the account. When it comes back those will prob reappear. Sorry about that.

Thank you.

Don’t Miss: How To Apply For Student Loan Forbearance

How To Dispute Student Loans On Your Credit Report

Youll have a hard time removing student loans from your credit report if the negative information is legitimate. But there may be instances when the details are inaccurate. In these cases, you can dispute the information with your creditor or the credit reporting agencies.

If you want to start with your loan servicer or lender, heres how to dispute delinquent student loans or loans in default:

- Write a dispute letter: Its best to complete this process in writing, so you have a paper trail you can refer back to in the future if needed. Write a letter to your servicer notifying them of the inaccuracy and requesting that they remove it from your credit reports.

- Gather supporting documentation: Before you send your letter, gather some documentation to support your claim. This can include bank statements or emails from the servicer showing you made on-time payments or any other reason why you believe the delinquency or default notation was made in error.

- Wait for a decision: Once you submit your letter, it may take a couple of weeks to get a response. If you dont hear back in two or three weeks, contact the servicer to follow up on your letter.

If youre having a hard time dealing with your loan servicer or youd simply rather not deal with them, you can also file a dispute directly with the credit reporting agencies. You can typically do this online, but still, make sure you provide supporting documentation for your claim.

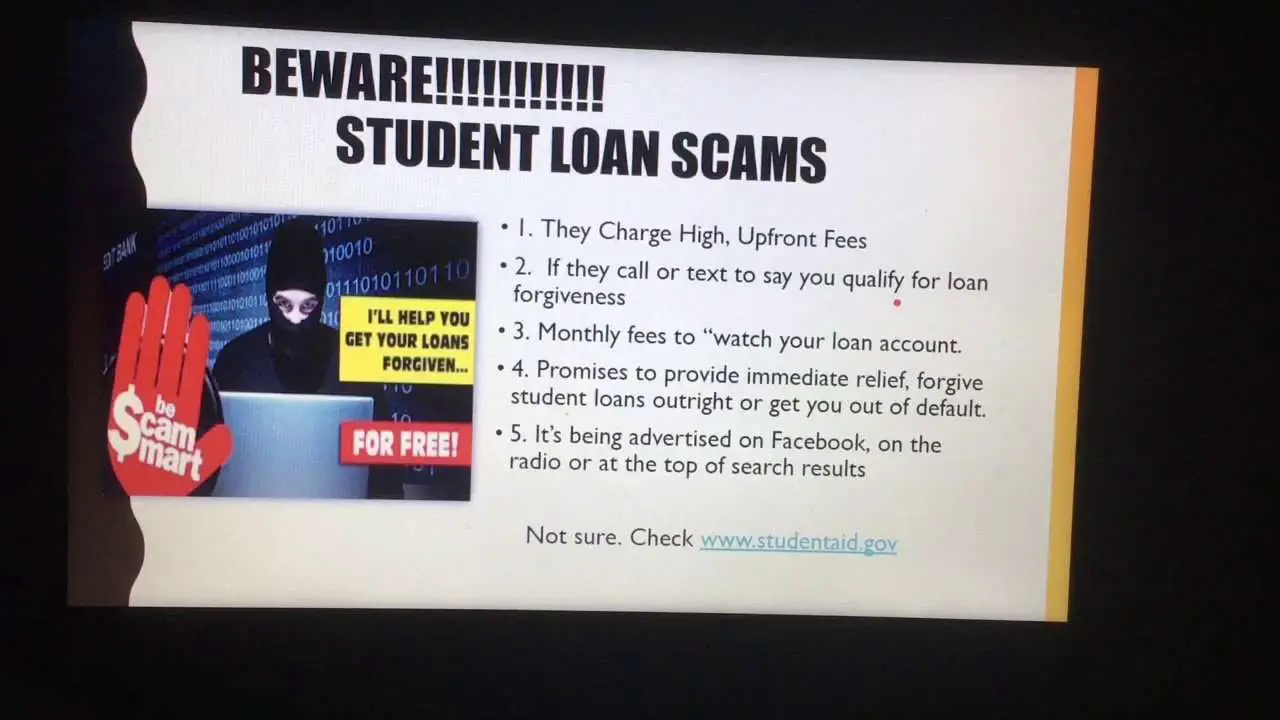

Can Credit Repair Remove Student Loans

Credit repair is a service offered by numerous companies and is the process of fixing inaccurate credit history reports that appear on your credit report. Credit repair canât remove student loans that are correct on your credit report. You can dispute errors on your credit report for free. Be mindful of scams when it comes to companies offering credit repair.

Recommended Reading: What Is The Current Sba Loan Interest Rate

If You Pay Late Or Skip A Payment

Forgetfulness happens, and a brief bout wont impact your credit. Your score will start to drop only after your lender reports your late payment to one or more likely all of the three major credit bureaus.

How long before its reported depends on the type of loan you have:

-

Federal student loans: Servicers wait at least 90 days to report late payments.

-

Private student loans: Lenders can report them after 30 days.

However, lenders can charge late fees as soon as you miss a payment.

If your lender does report your late payment, also known as a delinquency, it will stay on your credit report for seven years.

The more overdue your payment, the worse the damage to your credit. For instance, your federal student loan will go into default if you dont make a payment for 270 days. That will hurt your credit even more than a 30- or 90-day delinquency.

Select A Repayment Plan For Your Federal Student Loans

Within the grace period you may receive information about repayment from your lender. Youll have a choice of several repayment plans. Find the right one for you.

Most federal student loans are eligible for at least one income-driven or income-based repayment plan . These repayment plans are based on a percentage of your discretionary income. Theyre designed to make your student loan debt more manageable by reducing your monthly payment amount.

Don’t Miss: Is The Student Loan Help Group Legit