How Long Will It Take To Get An Award After I Fill Out My Fafsa

This really depends on when you fill out the FAFSA. Awarding for new students does not begin until the April before the fall semester begins and returning students are awarded in June/July. During other times of the year, the turnaround varies. For planning purposes, we recommend that you plan for a minimum of six weeks from submission of the FAFSA to receipt of an award notification from our office.

My Grade Level Is Going To Change Will I Be Eligible For More Aid

You might be eligible for more Federal Subsidized Student Stafford or Unsubsidized Stafford loans. Once your Fall/Spring grades have been posted on the Student Information System, if your grade level has increased from a Freshman level to a Sophomore level , or has changed from the Sophomore level to a Junior level you may be eligible for more Federal Student Stafford Loan or Federal Student Unsubsidized Stafford loan. This depends on your Cost of Attendance and the amount of your initial financial aid award.

If you would like your eligibility for a loan increase to be reviewed, contact us with your specific request. If you are eligible, the loan amount will be increased and you will receive a disbursement as scheduled. . Direct Loans will mail a disclosure statement to you reflecting the award increase. The increase could affect your loan eligibility for the upcoming summer if you plan on attending and receiving federal loans.

Can I Reject All Or Part Of My Loan Can My Direct Loan Be Adjusted Or Cancelled

Yes. If you have applied for aid with a FAFSA then you may receive a loan offer. However, you are not required to accept the full amount of the offer. You can borrow less than what is offered or you can decline the full offer through your myBama account. You should only borrow what you need, therefore if you accept a loan but determine that you do not need the full amount contact our office to make an adjustment or to cancel your loan. If your loan has already disbursed to your student account our office can process any requested adjustment within 30 days at which point you may return the funds to the Department of Education.

Also Check: Fha Loan Limits Harris County

How To Maintain Your Fafsa Eligibility

Just because you qualified for federal aid last year doesnt mean youll be eligible this year. You probably know that significant changes in your familys financial situation can affect your ability to qualify, but so can some other general issues. To make sure you continue to meet basic FAFSA requirements, watch out for these scenarios:

How Does A Family Decide Who Should Be Counted In The Household Size

Anyone in the immediate family who receives more than 50% support from a dependent students parents or an independent student and spouse may be counted in the household size. For example, a sibling who is over 24 but still receives the majority of his/her support from the parents can be included. Sibling who are dependent as of the date the application is completed are also included, regardless of whether they receive more than 50% of their support from the parents. Any other person who resides in the household and receives more than 50% support from the parents may also be counted, as long as they will continue to reside within the parents household and the support is expected to continue through the academic year. An unborn child who will be born during the academic year may also be counted in the household size if the parents, or independent student and spouse, will provide more than half of the childs support through the end of the year.

NOTE: Household size and tax exemptions are not necessarily the same. Exemptions look at the previous year or tax year and household size refers to the school year for which the student is applying for aid.

Read Also: How Far Back Do Underwriters Look At Bank Statements

Is The Fafsa A Loan Or Free Money

The FAFSA application is not a loan. It is simply an application that you fill out in order to determine your eligibility for receiving a federal loan. There are three main types of financial aid that a student may be deemed eligible for after completing a FAFSA application. Some of this money is free money, some must be earned through work, and some must be repaid.

Can I Transfer My Financial Aid To Another School

If you transfer from UA to another institution within an academic year, you must check with your new schools financial aid office about how you will receive your aid. Due to availability and other factors such as cost, you may not be able to receive the same amounts and types of aid. However, you will not have to complete a new FAFSA again, but you would have to send your information to your other school by adding their school code to your application.

Read Also: Refinance Usaa Auto Loan

What Types Of Federal Aid Programs Are Available

Your financial aid package may include funds from any of the following major federal student aid programs:

Other aid programs that are awarded based on need and availability:

- Federal Supplemental Educational Opportunity Grants are grants available for undergraduates only.

- Federal Work Study provides jobs to undergraduate and graduate students, allowing them to earn money to help pay education expenses.

Aid That Must Be Accepted To Be Applied To Your Bill

After the May 1st deadline, once you accept your offer of admission to Penn State and pay the required fees, you can accept, decline or decrease your financial aid. Keep in mind that we typically award for both Fall and Spring together, so you are accepting thetotal amount for the year. The exceptions would be if you applied for a one semester Graduate PLUS or Private Alternative Loan.

The following types of aid must be accepted in order to be applied to your bill:

- Federal Direct Subsidized Loans

- University Loans

- Federal Work-Study

Scholarships do not need to be accepted. However, please refer to your scholarship award letter for information on writing a thank you note.

Don’t Miss: Usaa Auto Loan Interest Rates

How Does Financial Aid Work

After you submit your FAFSAand depending on whether you qualify for aid, based on the information you provideyoull receive a financial aid award letter from each school that you list on it. Each letter explains the federal and nonfederal financial aid options that the school is offering you.

Youre not obligated to accept the aid that is offered in your award package. You can compare your offers from different schools before you decide.

Whether you accept or decline an offer, you need to respond to the school to let it know your decision. Be sure to check each schools deadline so that you reply on time.

Q: How Can I Get Federal Work Study

A: Federal Work Study is a need-based program, so students must be eligible for FWS based on their FAFSA data. Students interested in FWS should submit a request online through their financial aid notification.

FWS funding is limited to undergraduate students, and not all requests for funding are granted. Requests are reviewed in the order they are submitted.

Read Also: Fha Title 1 Loans

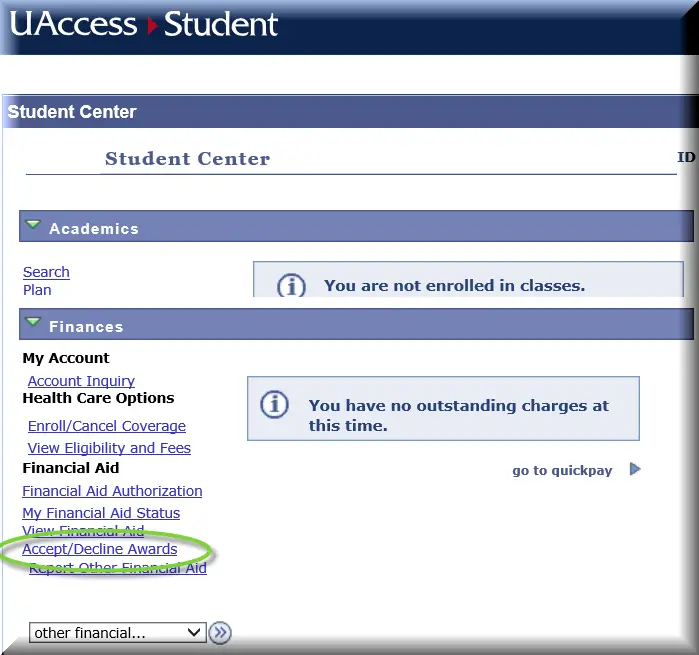

How To Accept/decline Your Financial Offer

The financial aid you’re eligible to receive is determined based on the information you provided on your FAFSA and the Cost of Attendance at Minot State. Your financial aid may consist of grants, loans, scholarships, work study employment or other federal and state programs.

If you wish to reduce or decline any of the financial aid offered, you have the option of doing so in Campus Connection. Keep in mind there are limits for the total amount of loan funds you can borrow as an undergraduate and graduate student. For more information on these limits, visit StudentAid.gov.

Accept/Decline Your Financial Aid Offer in Campus Connection

- Go to the Financial Aid tile in Campus Connection.

- Select the appropriate aid year.

- You will need to accept or decline each offer.

- Note: If you do not want to accept the loan offered, be sure to decline them.

- All grants and scholarships are offered in accepted status.

- Reduce the amount of aid offered to you.

- Choose “Accept”, check the “Reduce” box, change the loan amount and Submit.

6 Steps to Receive Your Financial Aid Offer

| Important: You must be enrolled in at least six credits to be eligible for Federal Direct Loans or Federal Nursing Loans. |

Keep track of how much you owe at the National Student Loan Data System . Minot State reports all Pell Grant and Federal Loan disbursements to the NSLDS.

What Is The Expected Family Contribution And How Does It Affect Financial Aid

The EFC, derived from information on the FAFSA, represents the amount that the federal government expects a students family should be able to pay towards the students education. The EFC is an indicator of your familys financial strength to pay for educational expenses and is not the amount of money that your family must provide. Rather the EFC is a tool, which, when subtracted from the Cost of Attendance, determines a students need and therefore the type of aid for which a student is eligible.

Don’t Miss: Usaa Auto Refi Rates

Who Is Eligible To Apply For A Covid

Do I Need To Accept The Whole Loan Amount

You dont need to accept the entire loan amount offered in your financial aid package. Perhaps youve decided to stay at home, so your living expenses wont be as high as the school estimates, for example. You can ask for a smaller loan amount or decline the loan altogether. Speak to your schools financial aid office to learn how to adjust your loan amount.

Financial aid can ease your money worries when youre attending college. Its vital that you read the instructions that come with your aid offer and follow them carefully, to successfully accept the aid.

Don’t Miss: Maximum Fha Loan Amount In Texas

Accept Decline Adjust Loans

Students can now log into the UMW Banner Portal to web accept or web decline student loans. Please follow the directions below:

- Login to UMW Banner Portal 654-2255)

- Once you have completed this step, please submit the page.

***Please note that if you are a first time borrower, you will also need to complete Direct Loan Entrance Counseling and a Direct Loan Master Promissory Note.

This is the only way to accept or decline all or a portion of offered student loans. Please contact the Office of Financial Aid at or 654-2468, if you have any questions.

Accept The Loan Or Work

Read Also: Auto Loan Payment Calculator Usaa

Q: If I Drop A Course How Will This Affect My Financial Aid

A: Students may freely add/drop courses until the 10th day of the semester. If a course is dropped during the add/drop period, the total number of credit hours is reduced which may result in an adjustment of tuition and fees along with eligibility for certain types of aid. Students who received a refund based upon higher enrollment may need to repay funds. For information regarding how enrollment affects the most common types of financial aid, please visit this link.

Why Am I Still Considered A Dependent Student

Federal student aid programs are based on the concept that it is primarily your and your familys responsibility to pay for your education. Because a dependent student is assumed to have the support of parents, the parents information has to be assessed along with the students, in order to get a full picture of the familys financial strength. If you are a dependent student, it does not mean that your parents are required to pay anything toward your education, including their information is simply the method The Department of Education uses to look at everyone in a consistent manner.

Determining a students dependency status is important in determining a students eligibility for federal aid programs. Your answers to questions on the FAFSA determine whether you are considered a dependent or independent student. An applicant is considered to be a dependent student unless he or she can answer Yes to one of the dependency status questions on the application and are able to provide supporting documentation. If student applicant answers No to all of the dependency status questions then he or she is considered to be a dependent student for federal student aid purposes and must provide parental information.

Also Check: Usaa Refinance Auto Loan Rates

Accept Decline Or Reduce Your Financial Aid Award

We assume that you accept all financial aid offered, including federal student loans. If you would like to either reduce or cancel a portion of your financial aid award, please submit your request through the SFS Service Portal.

Please note that federal loans may only be cancelled on a students behalf up to 14 days after disbursement.

How To Accept Aid

After reviewing your award notice, all thats left to do is to accept or reject your offers for the award year. The majority of grants free money that does not need to be paid back are automatically accepted on your behalf. However any loans offered will require your decision, and at this point you will need to report any private scholarships you received.

While no official deadline for accepting aid exists, keep in mind that financial aid will not credit to your Purdue invoice until aid is accepted. The DFA recommends you accept aid no less than four weeks before the start of the semester. Each type of aid has unique requirements for acceptance.

Federal Direct Loans, Federal Work-Study

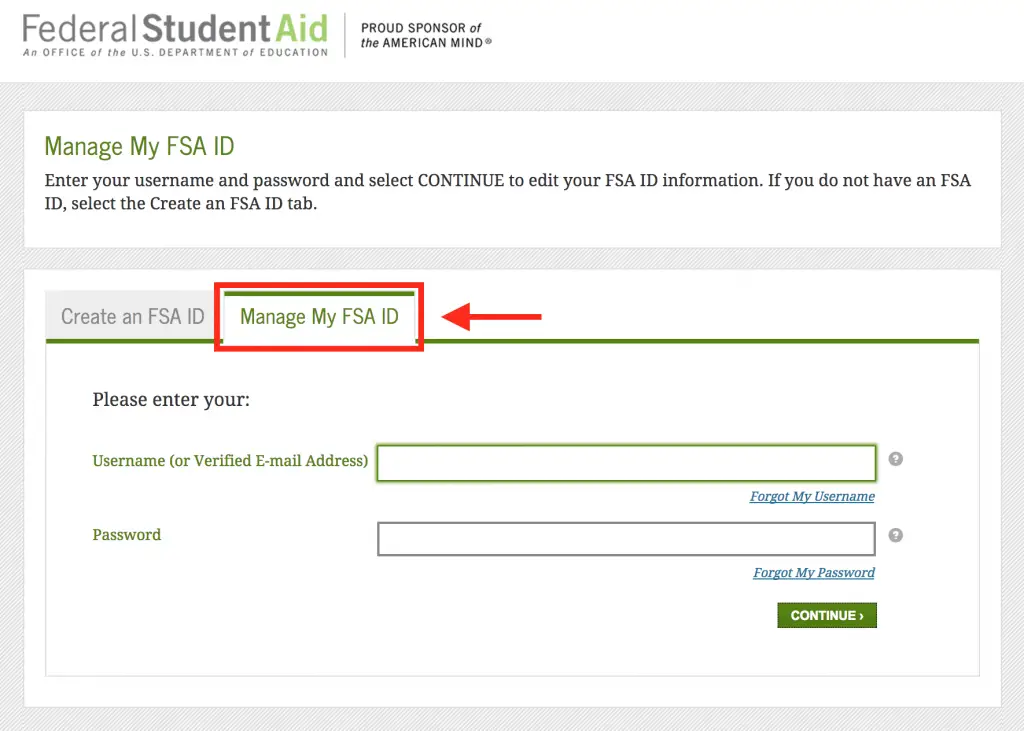

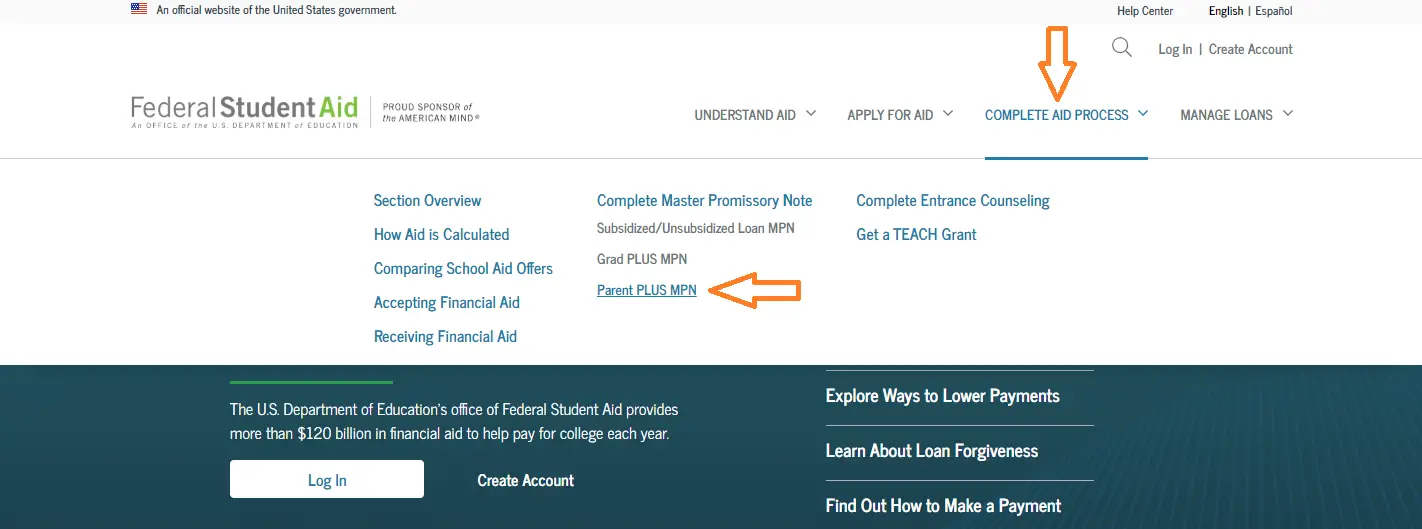

Subsidized/Unsubsidized Direct Loans

You will need to complete a Master Promissory Note and Loan Entrance Counseling at studentaid.gov. Sign into the website with the student information and click Complete MPN or Complete Counseling.

Federal Work-Study

Parent PLUS Loans

Graduate PLUS Loans

You will need to complete a PLUS Loan application at studentaid.gov. Sign into the website with the student information and click Request PLUS Loan.

Private Loans

Private Scholarships

Recommended Reading: Usaa Home Loans Credit Score

If I Am Approved Will The Covid

No, approval of your COVID-19 Emergency Grant will not affect the amount or eligibility for other financial aid that you have already received.

Please note that each student can receive ONLY ONE Emergency Grant per semester from UIC. If you have received a previous Emergency Grant from your department or another UIC source, we will review your eligibility to determine which grant provides the most assistance to you.

What Is Financial Need

Financial need is the difference between your cost of attendance, as determined by our office, and your expected family contribution. Many federal student aid programs require applicants to demonstrate a financial need to be considered eligible for that program. The amount of your financial aid award will be affected by whether you are a full time or part time student and whether you attend school for a full academic year or less.

You May Like: How Much Loan Officer Commission

Q: If I Realized I Did Not Borrow Enough Federal Loans How Can I Apply For More

A: Students who accepted a partial amount of the federal loans are still able to request an increase in loans. Students must access the financial aid notification online at under the Finances tab. At the bottom of the first page, click the button that says Request Changes. On the page that follows, students can submit a request in the text box to have loans increased. Click Continue to submit the request.

Students will receive a revised financial aid notification after requested changes are updated. Typed requests should be as specific as possible.

Q: The Semester Has Started Why Don’t I Have A Financial Aid Notification

A: Only students who have completed a Free Application for Federal Student Aid and submitted any required documentation will receive a UIC financial aid notification.FAFSA processing time can take 2-3 weeks before a financial aid notification is issued. Students will receive e-mail notifications when their financial aid notification is available online.

If you submitted your FAFSA over two weeks ago and still have not received a financial aid notification, you may have outstanding requirements. Students may need to submit Dependent/Independent Verification Worksheets, US Citizenship documents, Selective Service status, etc. Students will receive e-mail notifications from SFAS requesting additional documentation or they can view requirements at www.my.uic.edu under the Finances tab.

Financial aid may be cancelled for students who fail to meet the Satisfactory Academic Progress .

You May Like: Refinance Auto Loan Usaa