Is It Better To Have A Conventional Loan Or Fha

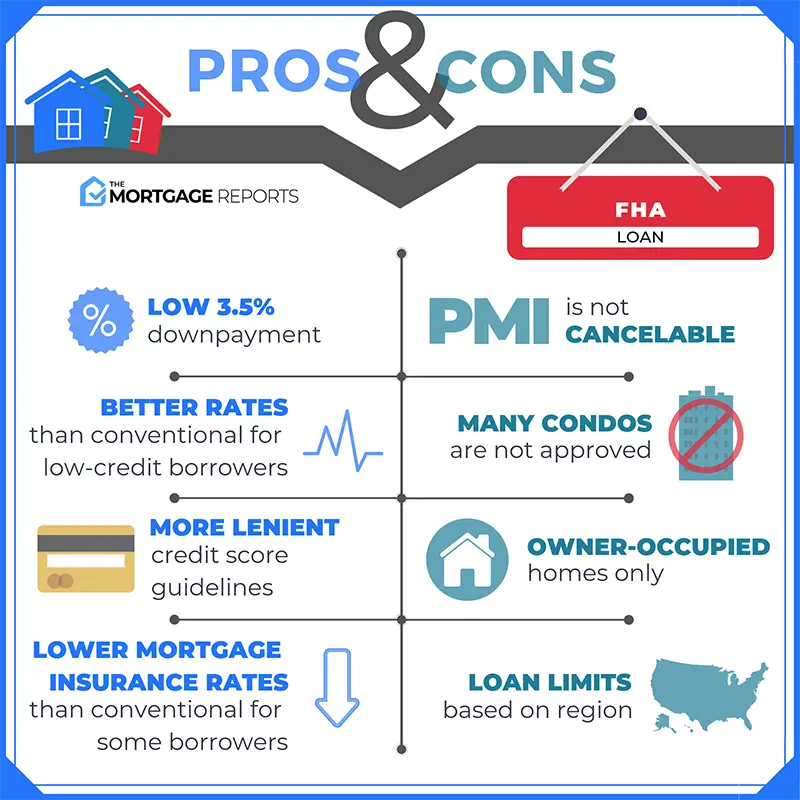

FHA loanhaveConventional loanhaveThe Federal Housing Administration loan program offers two primary benefits to home buyers a relatively small down payment, and more flexible guidelines:

- Borrowers who use this program can make a down payment as low as 3.5%.

- Borrowers with credit problems in the past may find it easier to qualify for FHA.

Fha Mortgage Rates Today

According to the daily interest rate survey by The Mortgage Reports, the current 30-year fixed-rate FHA loan interest rate starts at 2.75% .

Due to their government support, FHA loan interest rates are competitive even for borrowers with lower credit. However, the interest rate from one lender to another can vary greatly, so be sure to shop around to get the best offer.

Cardinal Financial Company: Best For Low

Cardinal Financial Company, which also does business as Sebonic Financial, is a national mortgage lender that offers both an in-person and online experience and a wide variety of loan products.

Strengths: Borrowers have a range of options with Cardinal Financial, with the lender able to accept credit scores as low as 620 for a conventional loan, 660 for a jumbo loan, 580 for an FHA or USDA loan and 550 for a VA loan. The lender also offers speedy preapprovals, and some borrowers have been able to close in as little as seven days .

Weaknesses: Cardinal Financials current mortgage rates and fees arent listed publicly on its website, so youll need to consult with a loan officer for specifics pertaining to your situation.

> > Read Bankrate’s full Cardinal Financial Company review

Don’t Miss: Usaa Auto Loan Process

How Does My Amortization Period Affect My Mortgage

When deciding between a short amortization or a long amortization, you will need to take into account your financial situation. A long amortization means that your individual mortgage payments will be smaller, which might allow you to qualify for a larger mortgage amount based on your futuredebt service ratios. Likewise, higher mortgage payments from a shorter amortization may reduce themortgage amount that you can afford.

You wont be able to get a CMHC-insured mortgage if your amortization is more than 25 years. While your monthly mortgage payment might be higher with an amortization that is 25 years or less, youll be able to make a smaller down payment that can be as low as 5%. Otherwise, youll need to make a down payment of at least 20% for an uninsured mortgage with an amortization greater than 25 years.

You can use ourmortgage amortization calculatorto see how changing your amortization period can affect the cost of your mortgage. For example, the table below compares the cost of a mortgage and the amount of each monthly mortgage payment for different amortization periods.

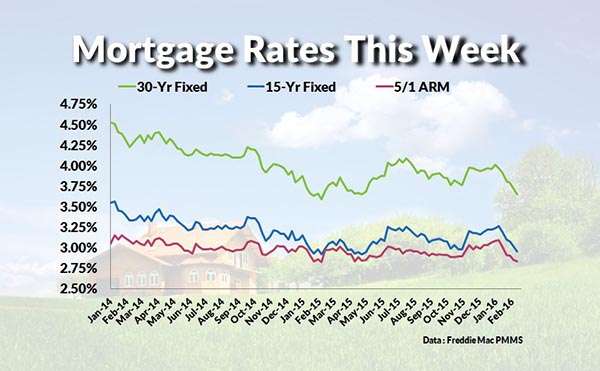

Should I Get An Adjustable Rate Mortgage Or A Fixed Rate Loan

While fixed rate loans have interest rates that stay the same over the life of the loan, an adjustable rate mortgage fluctuates depending on the market, but usually has a cap limiting fluctuation.

While both offer advantages, your circumstances can determine which might be right for you.

An adjustable rate mortgage:

- Can be a popular option for new homeowners as they offergreat upfront savings.

- Have an initial fixed interest period.

- Cap how much a loan can adjust so borrowers can try to plan accordingly.

Consider an ARM if you expect to make more money in the future, plan to move early in the life of your loan,or refinance before your loan adjusts.

There are many types of fixed-interest rate mortgages, including 30-Year and 15-Year mortgages. They offer a clear view of the future, as borrowers are able to more accurately account for costs over the life of the loan. For those who want greater stability when planning their monthly costs, fixed-interest mortgages are popular.

Recommended Reading: What Loan Options Are Strongly Recommended For First Time Buyers

Are Fha Interest Rates And Apr Different

Lenders charge an interest rate for borrowing money on your behalf. An annual percentage rate allows individuals to accurately calculate the cost of borrowing because it takes into account all costs of your loan. An annual percentage rate is a useful tool in comparing rates and mortgage insurance between lenders.

Tips For Getting The Lowest Mortgage Rate Possible

There is no universal mortgage rate that all borrowers receive. Qualifying for the lowest mortgage rates takes a little bit of work and will depend on both personal financial factors and market conditions.

Check your credit score and credit report. Errors or other red flags may be dragging your credit score down. Borrowers with the highest credit scores are the ones who will get the best rates, so checking your credit report before you start the house-hunting process is key. Taking steps to fix errors will help you raise your score. If you have high credit card balances, paying them down can also provide a quick boost.

Save up money for a sizeable down payment. This will lower your loan-to-value ratio, which means how much of the homes price the lender has to finance. A lower LTV usually translates to a lower mortgage rate. Lenders also like to see money that has been saved in an account for at least 60 days. It tells the lender you have the money to finance the home purchase.

Shop around for the best rate. Dont settle for the first interest rate that a lender offers you. Check with at least three different lenders to see who offers the lowest interest. Also consider different types of lenders, such as credit unions and online lenders in addition to traditional banks.

Finally, lock in your rate. Locking your rate once youve found the right rate, loan product and lender will help guarantee your mortgage rate wont increase before you close on the loan.

Read Also: Usaa Personal Loan With Cosigner

Can You Ask Your Mortgage Company To Lower Your Interest Rate

If youyourmortgageyou canareduce your interest ratelower yourA lender willyourmortgageyouaThe smaller your balance, the less interest you’ll pay to the bank.

Fha Energy Efficient Mortgage

This program is a similar concept to the FHA 203 Improvement Loan program, but its aimed at upgrades that can lower your utility bills, such as new insulation or the installation of new solar or wind energy systems. The idea is that energy-efficient homes have lower operating costs, which lowers bills and makes more income available for mortgage payments.

You May Like: Can I Use Va Loan For Investment Property

What You Should Know

- Variable mortgage rateshave historically performed better than fixed mortgage rates, although interest rates have generally fallen over the past few decades

- 5-year fixed mortgages are the most popular in Canada

- Insured high-ratio mortgageswill have the lowest possible mortgage rate, but youll need to pay formortgage default insurance

- Typically, longer mortgage term lengths will have a higher mortgage rate compared to shorter mortgage terms.

- Closed mortgage rates are lower than open mortgage rates, but open mortgages allow you to make principal prepayments of any amount withoutmortgage penalties

Qualifying For A 30 Year Fixed Mortgage

Those applying for a 30 year or 15 year fixed mortgage will first be required to be preapproved.

Why you should have a credit preapproval:

Read Also: Usaa Prequalify

Annual Libor Index History

LIBOR stands for London Inter-Bank Offered Rate. It is based on rates that contributor banks in London offer each other for inter-bank deposits.

In October of 2007, the U.S. Federal Housing Administration ruled in favor of insuring ARM loans based on the one-year LIBOR index.

At the same time, HUD also ruled to allow the one-month LIBOR to be used for calculating adjustments to interest rates for monthly adjusting Home Equity Conversion Mortgages.

Below is a chart of the annual LIBOR rates over the last 35 years.

LIBOR loans normally have lower margin rates than CMT .

This is particularly helpful to senior borrowers since the CMT margin became increasingly less desirable when selling the loans in the secondary markets and the change helped insure the availability of the market for ongoing lending.

If you had an annual adjustable rate in January 2001 with a 2.50% margin your fully indexed note rate would have been 7.67% for a total interest charge to your outstanding loan balance of 8.17%.

Note: That same reverse mortgage in 2001 with an open line of credit would have grown in availability by that same rate of 8.92%

Example: $200k Line of credit would grow in availability by $1,486.66 which then compounds month after month, year after year.

Be sure to read more about this important line of credit growth rate.

Scoring A Low Interest Rate

If you are looking to purchase a home, applying for a home mortgage now might be a good idea. Currently, interest rates are historically low, but as the employment situation and economy improve, you can expect those rates to spike soon.

While the aforementioned factors impact the average interest rate, you can control certain elements and help secure a lower interest rate for a home loan.

Recommended Reading: Usaa Auto Loan Rates Today

The Driving Force Behind Mortgage Rates

Mortgage rates are a substantial element of the home buying process. While you likely know what a mortgage rate is if you have begun your home purchase journey, understanding what drives those rates may not be familiar territory.

The average interest rates affixed to home mortgages often fluctuate based on a few different factors. Understanding these can help you better comprehend when your chances increase for a lower interest rate.

Interfirst Mortgage Company: Best Non

Interfirst Mortgage Company is a combo-direct mortgage lender, wholesale lender and correspondent lender.

Strengths: Interfirst has an A- rating from the Better Business Bureau and high marks from borrowers on Bankrate and elsewhere. Plus, with its multiple business channels, the lender can offer several loan options for many types of borrowers.

Weaknesses: Interfirst isnt licensed in every state, and if youre trying to compare mortgage rates, you might have a harder time, since this lender doesnt showcase rates publicly on its website.

> > Read Bankrate’s full Interfirst Mortgage Company review

You May Like: Should I Get A Fixed Or Variable Student Loan

How Does Payment Frequency Affect My Mortgage Payments

More frequent mortgage payments means that each mortgage payment will be smaller. However, mortgage payments do not scale linearly. For example, a bi-weekly mortgage payment amount is not exactly half of amonthly mortgage payment amount. Instead, bi-weekly payments are slightly less than half of a monthly payment.

For example, for a $500,000 mortgage with a 25-year amortization and a mortgage rate of 2%, a monthly payment would be $2,117, while a bi-weekly payment would be $977.

A bi-weekly payment of $977 is equivalent to paying $1,954 per month, but choosing a mortgage with a monthly payment frequency will require a monthly payment of $2,117. Thats because with bi-weekly payments, youll be making 26 bi-weekly payments per year. That is equivalent to 13 months of mortgage payments per year, accelerating your payment schedule. Your more frequent payments will also reduce your mortgage principal faster, allowing you to save on interest and pay down more off your principal with each payment.

For example, 12 months of $2,117 monthly payments will result in roughly $25,400 being paid in a year.

26 bi-weekly payments of $977 will result in roughly $25,400 being paid in a year. The total amount paid per year is the same.

The table below compares monthly payments, bi-weekly payments, and weekly payments for a mortgages total cost of interest for a 25-year amortization at a 2% mortgage rate.

Choosing A Mortgage Term

There are other considerations to your mortgage term length besides just the mortgage rate. Breaking your mortgage, which happens when you sell your home and move or renegotiate your mortgage before the end of the term, will come with significantmortgage prepayment penalties. You will be able to avoid mortgage penalties if you wait until your term expires. A short mortgage term would be more suitable if youre thinking of selling your home soon or refinancing your mortgage.

Theres also a chance that mortgage rates might not move in the direction that youre predicting it will, or it might not move as much as you thought it would. For example, a 10-year fixed mortgage rate might be at 5% while a 5-year fixed mortgage rate might be at 3%.

If interest rates stay the same for the next ten years, youll be paying a mortgage rate of 5% while you could have had a mortgage rate of 3% for two 5-year terms.

If interest rates increase by 2%, where the first 5-year mortgage term has a rate of 3% and the second 5-year mortgage term has a rate of 5%, youll still be worse-off with a 10-year mortgage as youre paying the 5% rate for the first five years rather than 3%.

Mortgage rates will need to increase significantly for a 10-year mortgage term to break-even over shorter-term options.

Don’t Miss: Loan Originator License California

Where Are Mortgage Rates Heading This Year

Mortgage rates sank through 2020. Millions of homeowners responded to low mortgage rates by refinancing existing loans and taking out new ones. Many people bought homes they may not have been able to afford if rates were higher. In January 2021, rates briefly dropped to the lowest levels on record, but trended slightly higher through the rest of the year.

Looking ahead, experts believe interest rates will rise more in 2022, but also modestly. Factors that could influence rates include continued economic improvement and more gains in the labor market. The Federal Reserve has also begun tapering its purchase of mortgage-backed securities and announced it anticipates raising the federal funds rate three times in 2022 to combat rising inflation.

While mortgage rates are likely to rise, experts say the increase wont happen overnight and it wont be a dramatic jump. Rates should stay near historically low levels through the first half of the year, rising slightly later in the year. Even with rising rates, it will still be a favorable time to finance a new home or refinance a mortgage.

Factors that influence mortgage rates include:

Understanding Federal Housing Administration Loans

In 2021, you can borrow up to 96.5% of the value of a home with an FHA loan. This means you’ll need to make a down payment of just 3.5%. You’ll need a credit score of at least 580 to qualify. If your credit score falls between 500 and 579, you can still get an FHA loan as long as you can make a 10% down payment. With FHA loans, your down payment can come from savings, a financial gift from a family member, or a grant for down-payment assistance.

It’s important to note that with an FHA loan, the FHA doesn’t actually lend you money for a mortgage. Instead, you get a loan from an FHA-approved lendera bank or another financial institution. However, the FHA guarantees the loan. Some people refer to it as an FHA-insured loan, for that reason.

In order to secure the guarantee of the FHA, borrowers who qualify for an FHA loan are also required to purchase mortgage insurance, and premium payments are made to FHA. Your lender bears less risk because the FHA will pay a claim to the lender if you default on the loan.

Though FHA loans require lower down payments and credit scores than conventional loans, they do carry other stringent requirements.

| For How Long You Pay the Annual Mortgage Insurance Premium |

|---|

| TERM |

Is an FHA Mortgage Still a Bargain?

Read Also: Fha Loan Maximum Texas

Comparing Current Mortgage Rates

Borrowers who comparison shop tend to get lower rates than borrowers who go with the first lender they find. You can compare rates online to get started. However, to get the most accurate quote, you can either go through a mortgage broker or apply for a mortgage through various lenders.

The advantage of going with a broker is you do less of the work and youâll also get the benefit of their lender knowledge. For example, they might be able to match you with a lender whoâs suited for your borrowing needs, this could be anything from a low down payment mortgage to a jumbo mortgage. However, depending on the broker, you might have to pay a fee.

Applying for a mortgage on your own is straightforward and most lenders offer online applications, so you donât have to drive to an office or branch location. Additionally, applying for multiple mortgages in a short period of time wonât show up on your credit report as itâs usually counted as one query.

Finally, when youâre comparing rate quotes, be sure to look at the APR, not just the interest rate. The APR reflects the total cost of your loan on an annual basis.

Are Fha Loans Fixed

Though the vast majority of FHA loans are 30-year, fixed-rate mortgages, other options are available, including both shorter-term fixed-rate mortgages and adjustable rate mortgages . In recent years, fixed-rate mortgages have been much more common, as home buyers have sought to lock in low interest rates. But if you dont plan to stay in the home long, an ARM may be worth a look.

Read Also: How Long Does It Take Sba To Approve Loan

The Latest Rates On Adjustable

- The latest rate on a 5/1 ARM is 2.458%.

- The latest rate on a 7/1 ARM is 3.803%.

- The latest rate on a 10/1 ARM is 4.043%.

An adjustable-rate mortgage could be a good option for borrowers who plan on selling their home or refinancing in a relatively short period of time. ARMs will start with a low, fixed, interest rate that will eventually start adjusting at regular intervals. For instance, the rate on a 5/1 ARM will be fixed for five years, then change every year. The potential drawback is that once the interest rate becomes adjustable, it can increase significantly, raising the monthly payments along with it.