Applying For Federal Financial Aid

The process for obtaining federal financial aid is relatively easy. You fill out a single form, the Free Application for Federal Student Aid and send it to your schools financial aid office. Then they do the rest. The FAFSA is your single gateway to Stafford loans, Perkins loans and PLUS loans. Many colleges also use it to determine your eligibility for scholarships and other options offered by your state or school, so you could qualify for even more financial aid.

There is really no reason not to complete a FAFSA. Many students believe they wont qualify for financial aid because their parents make too much money, but in reality the formula to determine eligibility considers many factors besides income. By the same token, grades and age are not considered in determining eligibility for most types of federal financial aid, so you wont be disqualified on account of a low GPA.

What Are The Standard Interest Rates For Personal Loans

Actual interest rates will vary depending on an applicants credit score, repayment history, income sources and the lenders own standards. Interest rates also vary with market conditions, but for 2019 the interest rates for personal credit ranges from about 6% to 36%.

If we compare the average interest rate of personal loans to other forms of financing, we can see they have rates below that of a credit card, though charge a bit more than most secured forms of financing. The big benefits of personal loans for those who take them is they are unsecured and the approval type is typically faster than other forms of financing.

| Financing Type |

|---|

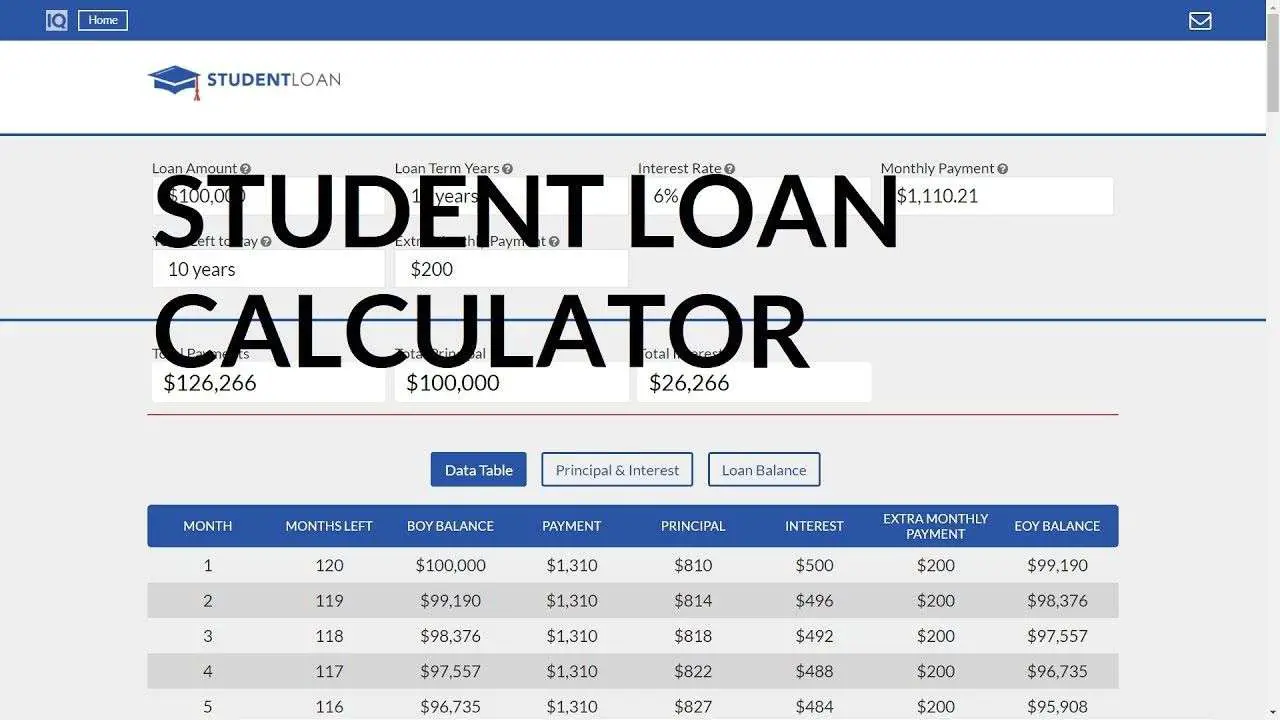

Use Various Combinations In The Loan Amortization Calculator

The examples above change just one variable for the sake of clarity. Of course, your loan calculations may not be that straightforward, which is why you can change multiple variables in getting the information you need. For example, you may want to refinance at a lower rate but for a shorter term. You can compare the variables of the loan you have now to a loan with a lower rate and a shorter term in order to figure out your monthly payments.

Also Check: Is It Too Late To Apply For Ppp Loan

Capitalization Increases Interest Costs

In most cases, youll pay off all of the accrued interest each month. But there are a few scenarios in which unpaid interest builds up and is capitalized, or added to your principal loan balance. Capitalization causes you to pay interest on top of interest, increasing the total cost of the loan.

For federal student loans, capitalization of unpaid interest occurs:

-

When the grace period ends on an unsubsidized loan.

-

After a period of forbearance.

-

After a period of deferment, for unsubsidized loans.

-

If you leave the Revised Pay as You Earn , Pay as You Earn or Income-Based-Repayment plan.

-

If you dont recertify your income annually for the REPAYE, PAYE and IBR plans.

-

If you no longer qualify to make payments based on your income under PAYE or IBR.

-

Annually, if youre on the Income-Contingent Repayment plan.

For private student loans, interest capitalization typically happens in the following situations, but check with your lender to confirm.

-

At the end of the grace period.

-

After a period of deferment.

-

After a period of forbearance.

To avoid interest capitalization, make interest-only student loan payments while youre in school before you enter repayment and avoid entering deferment or forbearance. If youre on an income-driven repayment plan for federal student loans, remember to certify your income annually.

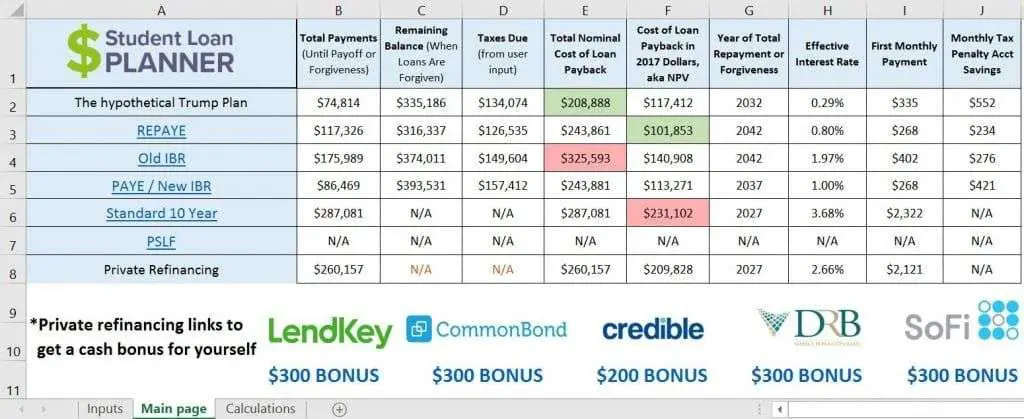

Understand Your Repayment Options

After you know who and how much you owe, and have a sense of your personal budget, it’s time to learn about your repayment options. Your repayment plan determines how much you pay each month, including what you may pay in interest, over the life of your loan.

This means that choosing a repayment plan is usually about paying as much as you can afford each month , but not more than you can afford (to avoid missing payments.

Read Also: Is Federal Student Loan Forgiveness Real

Find Out How Much This Totals Each Month

Take this figure and multiply it by the number of days since your last payment. If you are making monthly payments, this should be 30 days.;

For example: $1.60 x 30 = $48.00

The typical monthly payments for a person who owes $20,000 with 3% interest using a 10-year fixed-interest repayment plan is about $193. This means that $48 of this payment would be going towards interest while the remaining $145 would go towards repaying the principal.;

This math shows just how significantly interest can impact your monthly student loan payments and millions know just how much those payments impact their finances. Even before the pandemic hit and unemployment spiked, more than 20% of student loan borrowers were behind on their payments.

Don’t miss:

Auto Loan Amortization Calculator

You can use this as an Auto Loan Amortization Calculator as well as an Amortization Schedule Calculator for your student loans. Whether you are plugging in fixed student loans figures or auto loan figures, it makes no difference. In both cases, you will be paying more in interest at the beginning of your loan, and more of your payment amount will go towards interest as time goes on.

Recommended Reading: Can You Pay Off Sofi Loan Early

How To Calculate Your Monthly Student Loan Payment

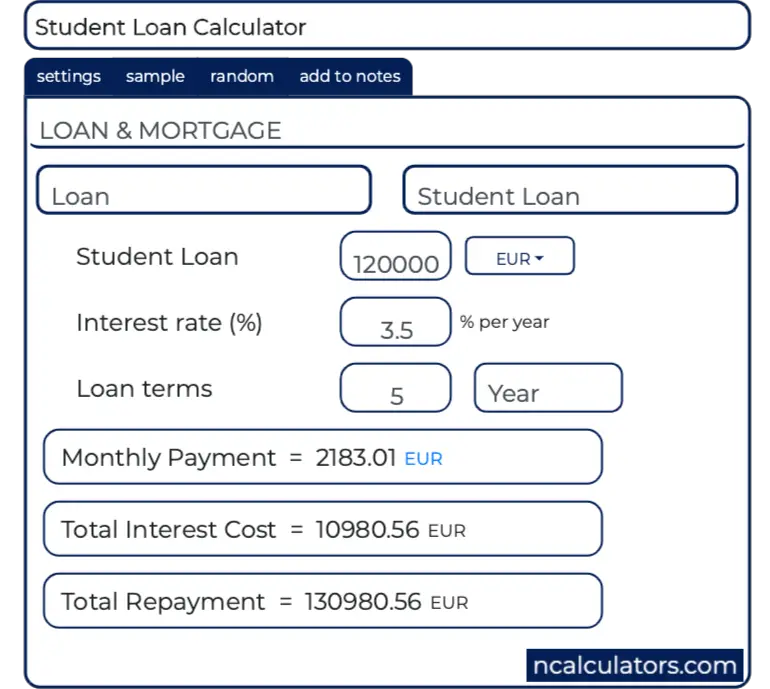

Your monthly payment will depend on how much you borrowed, your interest rate, and the loan repayment term . If you have federal student loans, you can usually enroll in an income-driven repayment plan with monthly payments that are based on a percentage of your income.

Estimate how long itll take to pay off your student loan debt using the calculator below. You can also use the slider to see how increasing your payments can change the payoff date.

Enter loan information

If You Dont Repay Your Loans

If you don’t make your loan payments, you will be in;default.

An OSAP loan is considered to be in default when no required payments have been made for 270 days.

Being in default means:

- your debt will be turned over to a collection agency

- you will be reported to a credit bureau

- you could be ineligible for further;OSAP;until the default is cleared

- your ability to get a car loan, mortgage or credit card can be affected

- your income tax refund and;HST;rebate can be withheld

- interest will continue to build up on the unpaid balance of your loan

Your OSAP debt will only be erased when you have paid it off in full.

Also Check: Will Refinancing My Auto Loan Help My Credit

How You Can Use The Loan Amortization Calculator

You can use the information generated in the Amortization Schedule Calculator to quickly determine

- How much you must pay for various balances by adjusting the loan amount box.

- How much extra you need to pay each month to pay off your loan by a specific date by adjusting the loan term box.

- How your monthly payments and loan terms will be affected if you refinance and get a new interest rate by adjusting the loan rate box.

How To Calculate Student Loan Interest

To see how to calculate student loan interest in practice, get out your pen and paper and follow along using the following example. Not a math person? Our;student loan interest calculator below does the calculation for you.

For this example, say you borrow $10,000 at a 7% annual interest rate. On a 10-year standard repayment plan, your monthly payment would be about $116.

1. Calculate your daily interest rate . Divide your annual student loan interest rate by the number of days in the year.

.07/365 = 0.00019, or 0.019%

2. Calculate the amount of interest your loan accrues per day. Multiply your outstanding loan balance by your daily interest rate.

$10,000 x 0.00019 = $1.90

3. Find your monthly interest payment. Multiply your daily interest amount by the number of days since your last payment.

$1.90 x 30 = $57

For a student loan in a normal repayment status, interest accrues daily but generally doesnt compound daily. In other words, you pay the same amount of interest per day for each day of the payment period you dont pay interest on the interest accrued the previous day.

Also Check: Can You Use Fha Loan If You Already Own House

Number Of Monthly Payments

If you take advantage of the six month non-repayment period, 114 monthly payments represent a total repayment period of 9.5 years .

If you do not take advantage of the six month non-repayment period, 120 monthly payments represent a total repayment period of 10 years .

You can select a shorter repayment period by entering a lower number of monthly payments.

How To Calculate A Monthly Payment In Excel

wikiHow is a wiki, similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 15 people, some anonymous, worked to edit and improve it over time.The wikiHow Tech Team also followed the article’s instructions and verified that they work. This article has been viewed 544,849 times.Learn more…

Excel is the spreadsheet application component of the Microsoft Office suite of programs. Using Microsoft Excel, you can calculate a monthly payment for any type of loan or credit card. This will allow you to be more accurate in your personal budgeting and to allocate adequate funds for your monthly payments. The best way to calculate a monthly payment in Excel is by using the “functions” feature.

Also Check: Can I Roll My Closing Costs Into My Va Loan

Average Student Loan Payment: Estimate How Much Youll Pay

The average monthly payment for recent graduates is $393 but that could be higher or lower based on your degree.

Matt CarterUpdated July 13, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

When borrowing for college, its important to figure out what your average student loan payment will be after graduation. That way, youll know what to factor in and wont break your budget.

The overall average student loan payment is $393, but yours could be quite different especially depending on your degree. But dont worry, were here to help you figure all that out.

Here are average student loan payments depending on your degree:

Extend Your Grace Period By Another Six Months If You:

You make loan payments to the National Student Loans Service Centre, not to OSAP.

Your payments are based on a 9;½ year pay-back schedule. This pay-back schedule is the average amount of time it takes to pay back an;OSAP;loan.

You can make payments on your loan at any time to repay it faster.

Get repayment assistance:

If youre having trouble repaying your loan, you might be able to get repayment assistance.

If you have a severe permanent disability and you cant attend work or school, you can apply for the Severe Permanent Disability Benefit. Contact the National Student Loans Service Centre.

Extend your repayment period:

You can lower your monthly payments by extending your repayment period from 9;½ up to 14;½ years. Log in to your National Student Loans Service Centre account.

Recommended Reading: What Is The Maximum Va Loan Entitlement

What Is An Amortization Schedule Calculator

Amortization is paying off a debt over time in equal installments. Part of each payment goes towards the loan principal, and part goes towards interest. This loan amortization calculator, also known as an amortization schedule calculator, can help you to determine how much you can afford to borrow, what loan term you need and when it might be wise to refinance.

The loan amortization calculator will help you determine how much each of each monthly payment goes towards the principal of your loan and how much goes to pay off interest. The ratio of principal and interest does not remain the same every month. At the beginning of your loan, more of your money goes towards interest than in later payments. The amount that goes towards principal gradually grows each month as the amount that goes towards interest decreases.

Average Student Loan Payments

An appropriate monthly payment is based on multiple variables. The indebted students income is a significant factor in determining monthly payments. The total debt and interest rate as well as the borrowers repayment timeline may all affect the dollar amount of their monthly payments.

- $393 is the average monthly student loan payment.

- 10% of your gross income should go toward paying off debts according to federal guidelines.

- $393 is 10% of $47,160.

- 36% of income is the maximum amount that should go toward paying off debt according to the same federal guidelines; $393 is 36% of $13,100.

- Financial experts and the federal government list 10 years as the ideal timeline for paying off undergraduate student loan debt.

- The mean starting salary for among all new graduates is $55,800.

- 10% of the mean starting salary is $465.

- The most commonly used federal student loans have an interest rate closer to 3%.

- The average debt per borrower is $36,140; the majority of undergraduate borrowers owe less than $30,000.

- The average debt per enrolled student is $30,000. These are the only parameters available for some historical data.

| Monthly Payment |

|---|

| $34,800 |

You May Like: What Is Certificate Of Eligibility Va Home Loan

Average Medical School Student Loan Payment

- Standard repayment plan $3,533

- Refinance into 10-year loan at 5% $2,912

- Refinance into a 5-year loan at 4% $5,057

With an average medical school debt of $251,600, new doctors must cope with sizable monthly student loan payments. But they typically earn a lot, too, once they have completed their residencies.

If you tried to start paying off your medical school loans right after graduation on the standard 10-year repayment plan, youd be looking at monthly payments of $2,870. Many doctors cant afford to do that, and put their loans in forbearance or enroll in an income-driven repayment plan like REPAYE during residency.

| Repayment plan | |

|---|---|

| 10 years | $361,645 |

| Average monthly payment for $251,600 in medical school debt with a weighted average 6.6% interest rate at graduation. REPAYE estimates based on $56,000 salary during residency, $211,000 after residency. |

What Interest Rate Will I Pay

Note: Effective April 2021, the Government of Canada has suspended the accumulation of interest on Canada Student Loans until March 31, 2022. Subject to federal Parliament approval, the Government of Canada has proposed to extend this measure until March 31, 2023.

The interest rate for the Canada portion of your integrated student loans is either a variable interest rate or a fixed rate.

The Canada portion of your integrated loan will automatically be charged the variable interest rate unless you choose to change to the fixed rate. Switching from a fixed to a variable rate is not permitted.

No interest is charged on B.C. government-issued student loans as of February 19, 2019.

You May Like: How To Qualify For Sba Loan

Estimate Your Student Loan Payment

Estimate your student loan payments under a standard repayment plan using the calculator below.

- This is only an estimate! Your actual payment amount is determined by your loan holder based on the amount that you borrowed. However, most student loan programs require at least a $50 payment each month, no matter how small your loan amount.

- Your interest rate depends on your loan type and when you received the loan. for a chart with Direct Loan interest rates.

- The calculator is preset to 120 months and an interest rate of 6.8 percent. You may adjust these.

- It is recommended that your student loan payment be less than 8 percent of your gross income. The minimum salary field is based on this recommendation.

- If you have not made payments while in school or during your grace period, you may have capitalized interest Accrued interest that is added to the principal of your loan that will be added to the principal amount of your loan. This amount should be included in the principal amount in the calculator below in order to give a more accurate estimate of the loan repayment information.

Enter your Principal Amount of Loan, Simple Interest Rate, and Number of Monthly Payments.

How Long Does The Approval Process Usually Take

The length of the approval process will depend on the lender type. For credit unions and banks, the approval process can take anywhere between a few days to a few weeks. Banks normally have stricter loan processes and higher approval standards than nonbank lenders.

If applicants opt to lend from peer-to-peer lenders, loans can get approved within a few minutes up to a few business days. Approvals tend to be faster if the applicant has already prepared all of the needed documents and other information beforehand. Repeat borrowers are likely to be approved quickly if they repaid on time during previous loans.

Online direct lenders tend to have the fastest processing periods. The application process usually takes a few minutes, and if applicants submit all of the needed documents, financing can be approved almost immediately.

Read Also: What Is The Commitment Fee On Mortgage Loan

Amortized Loan: Fixed Amount Paid Periodically

Many consumer loans fall into this category of loans that have regular payments that are amortized uniformly over their lifetime. Routine payments are made on principal and interest until the loan reaches maturity . Some of the most familiar amortized loans include mortgages, car loans, student loans, and personal loans. The word “loan” will probably refer to this type in everyday conversation, not the type in the second or third calculation. Below are links to calculators related to loans that fall under this category, which can provide more information or allow specific calculations involving each type of loan. Instead of using this Loan Calculator, it may be more useful to use any of the following for each specific need:

| Personal Loan Calculator |