Get Your 25% Interest Rate Discount1 2

Contact us. Well walk you through your options. With your rates, terms and benefits in hand, youll have everything you need to take the next step.

Ask questions, explore your options. Call us or schedule a time to have us call you.

Mon-Fri: 8:00 a.m. 8:00 p.m. ETSat: 9:00 a.m. 3:00 p.m. ET

Meet with a mortgage loan officer near you.

Good Mortgage Rates Look Different To Everyone

What is a good mortgage rate? Thats a tricky question. Because many of the rates you see advertised are available only to prime borrowers: those with high credit scores, few debts, and very stable finances. Not everyone falls into that category.

Of course, you can look at average mortgage rates. But how reliable are those as a guide?

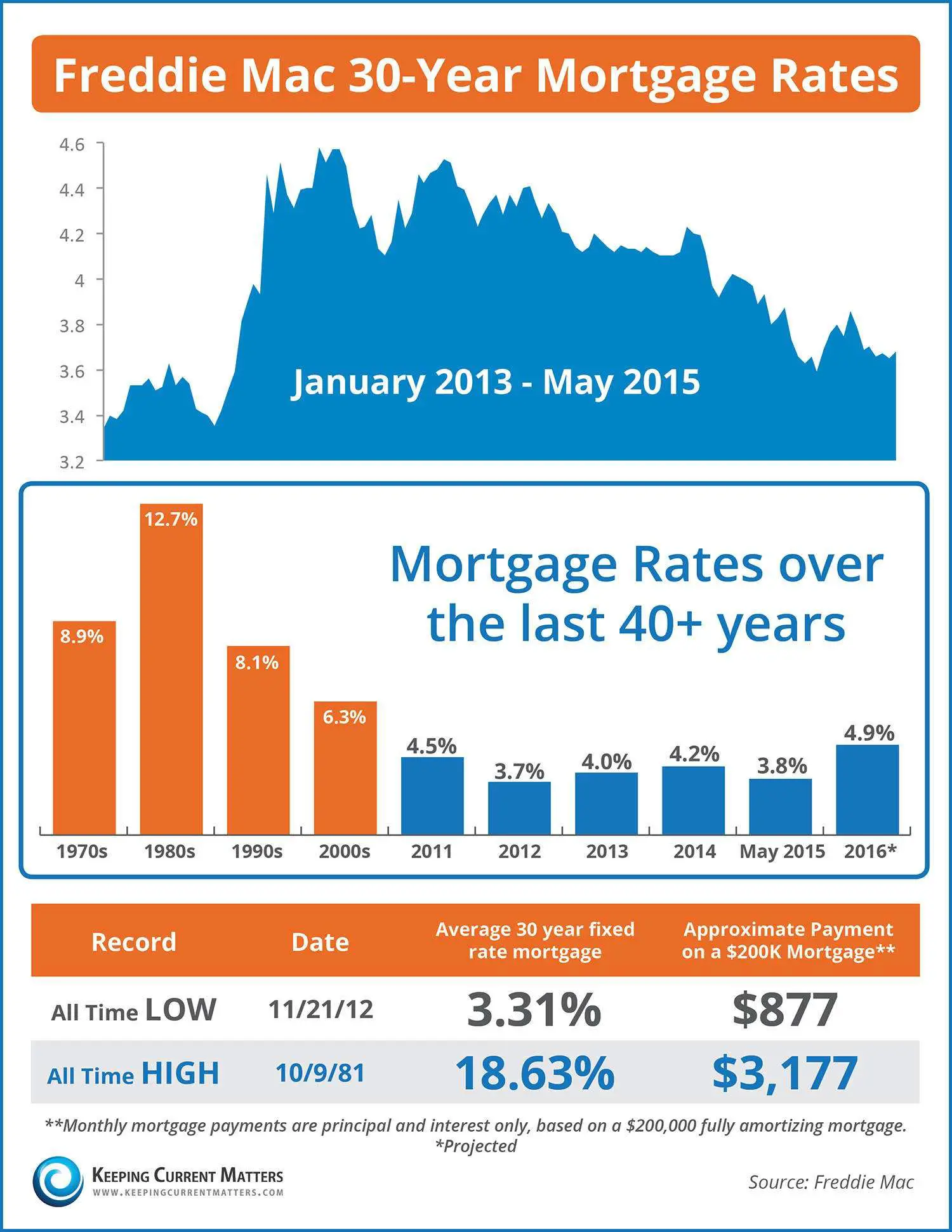

On the day this was written, Freddie Macs weekly average rate for a 30-year, fixed-rate mortgage was 2.99%. But the daily equivalent on Mortgage News Dailys website was 3.13%. So theres clearly a lot of variance across the market.

What If My Mortgage Rate Can Change

When looking at your interest rate on the first page of the loan estimate, check the right-hand column: Can this amount increase after closing? If it says Yes, then youre taking out an adjustable-rate mortgage.

With an ARM, your interest rate can change following an initial fixed period, which means the APR wont reflect the maximum interest rate of the mortgage.

Your loan estimate should explain how your interest works in the Projected Payments table on page 1. Heres what your loan estimate might look like for an ARM:

There are also a couple of tables on page 2 the Adjustable Payment table and the Adjustable Interest Rate table that provide additional details on your ARM. Heres an example of what these tables look like:

Check Out: How to Find the Best Mortgage Lender

You May Like: Usaa Car Loans Review

Determine What Mortgage Is Right For You

When finding current mortgage rates, the first step is to decide what type of mortgage best suits your goals and budget. Most borrowers opt for 30-year mortgages, but thats not the only choice. Typically, 15-year mortgages have lower rates but larger monthly payments than the more popular 30-year mortgage. Adjustable-rate mortgages usually have lower rates to begin with, but the downside is that youre not locked into that rate, so it can change over the life of your loan.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Read Also: Usaa Credit Score Range

So Whats A Personal Apr

When you apply for a loan, its likely that the rate you receive will be based on your personal circumstances. It will take into account your credit history and finances, as well as the loan amount and length of your borrowing. This is your personal APR.

Its important to realise this before you apply particularly if youre shopping around based on the representative APRs you see advertised.

The representative APR is a useful comparison tool, but not necessarily the rate youll receive. Indeed, its likely that customers will get a personal APR even if they are in the 51% who receive a rate that is the same as, or lower than, the representative APR.

You might not know your personal rate until after youve applied for a loan, and simply applying could affect your credit rating.

This is because lenders will usually check your financial background with a credit reference agency before deciding whether to make you a loan offer, and the checks will be recorded on your file. Once you take out a loan, the lender has to update your credit file.

If you bank with us, we might be able to tell you what your personal loan rate could be up front before you apply, with no impact on your credit score.

What Is An Annual Percentage Rate For Mortgages

While interest is charged on the principal loan balance owed monthly, the APR also includes the other charges or fees and is calculated by spreading your upfront costs over the life of the loan and expressing this as a percentage of the loan amount that you pay each year.

That matters because if you pay off a loan early, your true APR may be higher than the one on your loan documents since those costs will be spread over a shorter time period. If your loan includes prepayment penalties, then your actual costs will be even higher, so in some cases the APR your lender provides will be a poor gauge of your actual expenses.

While this may cause the APR to be higher when recalculated based on the shorter period of time you have the loan, you will most likely save a lot of money by paying down your mortgage or paying it off early. You will pay less in actual interest than if you take the full term of the loan to pay it off.

Remember, the amount of your mortgage payment each month that is applied to interest is calculated on the actual principal balance owed. The lower the principal balance the interest is calculated on, the greater the portion of your monthly payment that gets applied back to that principal balance.

You May Like: Usaa Auto Refinance

How Do I Find The Right Credit Card

Different credit cards and companies will offer you different APRs so it’s best to shop around even if you have a lower credit score. Some credit card offers include introductory APRs or no interest at all for new cardholders even if they do not have good credit. It’s important to also consider other perks when choosing a new credit card like cash rewards, cashback, and no annual fees.

Mortgage Apr: How Does It Affect Your Homes Cost

Your mortgages APR reflects the total cost youll pay to borrow the money expressed as an annual rate. It includes interest, lender fees, points, and more.

Edited byChris JenningsUpdated October 12, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

After you apply for a mortgage, youll see something called APR listed on your loan estimate. This number measures the costs you can expect to pay for the loan expressed as a yearly percentage rate. Because it reflects total costs and not just interest paid APR is a good way to compare mortgage offers from different lenders.

Heres what you should know about mortgage APR:

Don’t Miss: Refinance Avant Loan

What Are Todays Mortgage Rates

The average 30-year fixed mortgage rate rose to 3.05 percent, up 2 basis points from a week ago.The 15-year fixed mortgage rate rose to 2.30 percent, up 1 basis point from a week ago.To compare todays customized rates from a variety of trusted lenders, use Bankrates mortgage rates comparison tool.

| 3-month trend |

|---|

| 3.380% |

How To Use This Calculator

The APR calculator determines a loans APR based on its interest rate, fees and terms. You can use it as you compare offers by entering the following details:

- Loan amount: How much you plan to borrow.

- Finance charges: Required fees from the lender, such as an origination fee or mortgage broker fee. Situational fees, such as a late payment fee, generally arent included in APR calculations.

- Interest rate: The interest rate that the lender charges on the loan.

- Term: The number of years you have to repay the loan.

Often, the Federal Truth in Lending Act requires lenders to tell you the APR, so you wont have to calculate it on your own. In some cases there are even templates that lenders must use, such as the Loan Estimate form for mortgages. When reviewing that form, you can find the interest rate on the first page and the loans APR on page three.

However, if youre comparing loan offers from different lenders, its sometimes helpful to look into the details and do the APR calculations on your own. For example, mortgage lenders might be able to exclude certain fees from their APR calculations, and you want to make sure the APRs you’re comparing are based on the same financing charges.

You May Like: Usaa Car Loan Pre Approval

How To Compare Mortgage Offers

The APR and interest rate are the best places to start when comparing mortgages. Bankrate has the latest mortgage rates from multiple lenders, broken out by APR and interest rate and including the costs and estimated monthly payment.

Its also important to compare mortgage offers overall, including lender requirements like credit score, down payment and reserve minimums. Keep in mind that your credit score has an outsized effect on the interest rate you qualify for, so if you have work to do to improve your standing, do your best to address that before applying for a loan.

When your credit is in shape, you can get loan estimates from several lenders, but try to do so within a relatively short window about 45 days, the CFPB recommends. This is because when a lender pulls your credit report, the credit check is added to your credit history, which affects your score. Getting quotes from multiple lenders within a few weeks of each other will only be counted as one inquiry to minimize the hit, so youre free to compare as many offers as youre comfortable with.

If you want the basis for a more accurate comparison, however, aim to get quotes on the same day, since mortgage rates change day to day, and often multiple times a day.

Calculating Your Credit Card Apr

Your credit card’s monthly interest cost is determined by dividing your annual APR by 12. If you pay in different installment periods, just use the number of payments divided by 12 to determine your APR.

If your APR is 27.99 percent, then 2.3 percent is applied each month. So, a $1,000 loan would have a charge of $23 monthly, equating to $276 a year in interest.

Because the annual APR isn’t effective for calculating your realized interest costs, many people find APR confusing.

Now it gets even more confusing when you factor in the effective APR calculations. Your effective APR rate is the figure determined by your compound interest. This rolls in the interest that was applied to your card in previous months.

As a result, a high APR rate can make the amount you owe in interest inflate very fast.

Read Also: What Is An Rv Loan

How Are Interest Rates Calculated

You may be wondering, how are mortgage rates determined? Your lender calculates your interest rate using your individual data. Every lender uses their own individual formula to determine how much youll pay in interest. Its possible to get 10 different interest rates from 10 different mortgage providers. Lenders also take into account things like current market interest rates and real estate economy conditions when they calculate your rate.

There are a few ways that you can get a lower interest rate from your mortgage lender. Anything that you do to lower the risk for your lender will in turn lower your rate. The first thing that you can do is raise your credit score. Your credit score is a three-digit number that tells lenders at a glance how you use credit. If you have a high credit score, you usually make payments on time and you dont borrow more money than you can afford to pay back.

Lenders see you as riskier if you have a low credit score. You may have a history of missed payments, so a lender may compensate for the risk that your score presents by offering you a higher interest rate.

Here are some ways to raise your credit score:

- Always make your minimum loan and credit card payments on time.

- Limit the amount of money that you put on credit cards.

- Pay down as much of your debt as you can.

- Avoid applying for new loans when youre preparing to get a mortgage.

What Factors Determine My Mortgage Rate

Lenders consider these factors when pricing your interest rate:

- Loan term

- Interest rate type

Your . Lenders have settled on this three-digit score as the most reliable predictor of whether youll make prompt payments. The higher your score, the less risk you pose and the lower rate youll pay.

Lenders also look at the amount of your down payment. For instance, if you put 20 percent down, youre viewed as a lower risk, and you might get a lower rate than someone whos financing nearly all of their home purchase. From the lenders viewpoint, the more skin the borrower has in the game, the more likely the mortgage will be repaid on time and in full.

Rolling additional closing costs into the loan affects your mortgage rate as well. With these costs added to what you owe, youll typically pay a higher interest rate than someone who pays those fees upfront. Borrowers might also pay higher rates for jumbo loans mortgages above the limits for conforming mortgages.

Use our mortgage calculator to see how different interest rates, down payments, loan amounts and loan terms would affect your monthly mortgage payments.

Recommended Reading: Is Bayview Loan Servicing Legitimate

What Does The Mortgage Payment Include

Mortgage payments consist of principal and interest. The principal amount is the amount you borrowed. The interest is a specific percentage that you accepted before signing your loan, and this goes directly to the lender. When you make additional principal payments , this reduces the amount of interest you owe.

Mortgage interest rates are fixed or adjustable. While fixed rates remain the same throughout the loan period, an adjustable rate mortgage can increase or decrease throughout the length of your loan. When your rate adjusts, your payment changes too. ARMs have rate caps that limit the amount the interest rate can change each year and over the life of the loan. Most ARMs also have an initial fixed rate period before the rate can start to change. For example, homeowners with ARMs might have a fixed rate of 4% for five years, then it may change each year if the index changes..

The rate lenders offer depends on several factors, including:

- The amount you want to borrow

- How much you plan to put down on the loan

- The length of the loan you want

- Your on-time payment history

- The type of loan you want

- Your location

Using Apr To Compare Mortgage Offers

Comparing APRs is not the best way to evaluate mortgage offers. Instead, its more useful as a regulatory tool to protect consumers against misleading advertising.

Federal Regulation Z, the Truth in Lending Act, requires lenders to disclose a loans APR when they advertise its interest rate. As a result, when youre checking out lenders websites to see who might give you the best interest rate, youll be able to tell from looking at the APR if the lender with the great interest rate is going to charge you a bunch of fees, making the deal not so great after all.

Page 3 of the loan estimate that lenders are required to give you when you apply for a mortgage shows the loans APR. By comparing loan estimates , you can easily compare APRs.

Still, most borrowers shouldnt use APRs as a comparison tool because most of us dont get a single mortgage and keep it until its paid off. Instead, we sell or refinance our homes every few years and end up with a different mortgage.

If youre looking at two loans and one has a lower interest rate but higher fees, and the other has a higher interest rate but lower fees, you might discover that the loan with the higher APR is actually less expensive if youre keeping the loan for a shorter term, as the table below illustrates.

You May Like: How Much To Loan Officers Make

What Are Mortgage Interest Rates And Aprs

A mortgage interest rate is a small percentage thats applied to your loan balance to determine how much interest you owe your lender each month. When you begin to repay your loan, your rate will be used to calculate the interest portion of your monthly payment.

For example, if you owe $100,000 and your interest rate is 5%, your annual interest expense will be $5,000, and youll pay a portion of that every month as part of your mortgage payment. While the calculations are actually more complicated than that, this example helps explain the general concept.

An APR is also a percentage, but it also includes all the costs of financing, including the fees and charges that you have to pay to get the loan. The APR for a given loan is typically higher than the mortgage interest rate. An APR is never used to calculate your monthly payment.