Calculate Your Monthly Estimated Payment

If you already know your estimated monthly loan payment, you can skip this step. If you dont, you can easily estimate your monthly car payment on a spreadsheet by typing the formula below into a cell.

=PMT

The result is your estimated monthly payment. It will be a negative number, but dont worry. You didnt make a mistake. Keep this number handy for calculating your APR.

Lets say you want to finance $13,000 with a loan term of 60 months and an interest rate of 4%. Heres what your formula would look like with those numbers plugged in.

=PMT

Using this example, your spreadsheet would calculate your monthly payment to be $239.41.

Why Do Banks Charge Different Interest Rates

While the cash rate is one of the main things banks will consider when setting commercial interest rates, itâs not the only one. Banks will also be keeping an eye on overhead costs, as well as maintaining a healthy margin between the loan and deposit rates theyâre offering.

Generally speaking, online banks tend to offer cheaper home loan rates and more generous savings account rates than their larger counterparts, as they have fewer overhead costs to worry about. The flipside to this is that larger banks tend to offer more when it comes to physical branches and face-to-face services.

Calculate Your Car Loan Repayments

Estimate your monthly car loan repayments with our calculator below.

Use our car loan calculator as a general guide on what your car loan repayments will look like.

This calculator will also tell you how much you may pay in total over the life of your loan. To use this calculator, simply enter your estimated vehicle value, loan term, any initial deposit, and the amount of any balloon payment .

Car Loan Calculator Assumptions

The figures provided should be used as an estimate only, should not be relied on as true indication of your car loan repayments, or a quote or indication of pre-qualification for any car loan product. The figures are based upon the information you put into the calculator. We have made a number of assumptions when producing the calculations including:

- Loan term, vehicle purchase price, and loan amount: We assume the loan term, vehicle purchase price, and loan amount are what you enter into the calculator.

- Interest rates: We assume that the rate you enter, is the rate that will apply to your loan for the full loan term.

- Interest and repayments: The displayed total interest payable is the interest for the loan term, calculated on the entered interest rate.

- Payable over 3/4/5 years figure excludes any balloon payment

-

Available for purchasing new and demo vehicles from dealers only

-

$5,000 to $100,000 loan amount

-

Choose between a low fixed or variable rate

When you get a car loan we lend you the money to buy a vehicle.

Recommended Reading: Loan License In California

Buying A Car With Cash Instead

Although most car purchases are made with auto loans in the U.S., there are benefits to buying a car outright with cash.

There are a lot of benefits to paying with cash for a car purchase, but that doesn’t mean everyone should do it. Situations exist where financing with an auto loan can make more sense to a car buyer, even if they have enough saved funds to purchase the car in a single payment. For example, if a very low interest rate auto loan is offered on a car purchase and there exist other opportunities to make greater investments with the funds, it might be more worthwhile to invest the money instead to receive a higher return. Also, a car buyer striving to achieve a higher credit score can choose the financing option, and never miss a single monthly payment on their new car in order to build their scores, which aid other areas of personal finance. It is up to each individual to determine which the right decision is.

Dealership Financing Vs Direct Lending

Generally, there are two main financing options available when it comes to auto loans: direct lending or dealership financing. The former comes in the form of a typical loan originating from a bank, credit union, or financial institution. Once a contract has been entered with a car dealer to buy a vehicle, the loan is used from the direct lender to pay for the new car. Dealership financing is somewhat similar except that the auto loan, and thus paperwork, is initiated and completed through the dealership instead. Auto loans via dealers are usually serviced by captive lenders that are often associated with each car make. The contract is retained by the dealer but is often sold to a bank, or other financial institution called an assignee that ultimately services the loan.

Direct lending provides more leverage for buyers to walk into a car dealer with most of the financing done on their terms, as it places further stress on the car dealer to compete with a better rate. Getting pre-approved doesn’t tie car buyers down to any one dealership, and their propensity to simply walk away is much higher. With dealer financing, the potential car buyer has fewer choices when it comes to interest rate shopping, though it’s there for convenience for anyone who doesn’t want to spend time shopping or cannot get an auto loan through direct lending.

Read Also: Usaa Refinancing Car Loan

How Do I Know What My Apr Is

Once youve received a formal and final offer on a loan, you can find out what the APR is in one of two ways.

Fixed Rate Vs Floating Rate Of Interest

Car loans are offered at fixed as well as floating interest rates. The fixed rate will remain unchanged for the tenure of the loan but the floating rate is subject to change from time to time. The different factors that can affect interest rates include applicable taxes, liquidity, inflation, etc.

- Fixed Rate EMI Calculation

- Floating Rate EMI Calculation

Under the fixed rate EMI calculation, the EMI you have to pay towards the car loan remains unchanged throughout the loan tenure. This is so because the company offered a fixed rate of interest for the whole period.

For example, for a car loan equal to Rs.5 lakh at 10% p.a. interest for a 3-year tenure, the interest payable will be Rs.16,134 per month. This will be the amount payable throughout the tenure of the loan.

Under the floating rate EMI calculation method, the EMI payable differs based on the interest rate applicable at the time. The floating rate of interest changes based on the market lending rate.

Lets say you have taken a car loan equal to Rs.5 lakh for a 3-year tenure. The interest rate for about a year is 10% so the EMI payable, as in the example above is Rs.16,134. After completion of 1 year, you have an outstanding balance of Rs.3,36,409. The car loan interest rate at that time is then changed to 8%. So, for the rest of the tenure, the EMI payable will be Rs.15,215.

Note that the interest rate may increase or decrease within the loan period depending on market fluctuations.

You May Like: Loan Options Is Strongly Recommended For First-time Buyers

The Right Time To Get A Car Loan

While its tempting to jump into the first car that catches your eye, remember that your payments can be very difficult to manage if youre not ready for them. There is a right and a wrong time to apply and its essential to know which is which.

Only consider applying for a car loan if you have:

- Researched the vehicle youre looking to finance. Have seen what various makes and models are going for, as well as how much they will cost to finance and how much value they could lose over time.

- Compared lenders and dealerships in your area to find a reputable source of financing. They should have a good reputation with customers, offer reasonable rates, and possess valid business credentials.

- Gotten a proper, affordable price quote. All legitimate lenders/dealerships should be willing to answer any questions you have concerning their fees/rates and must display those costs within their contracts.

- , cut down on unnecessary costs, and saved up an emergency fund. Some vehicles take years to finance, so be sure you can afford all costs throughout your payment plan, even during a period of reduced income or unemployment.

- Saved for an appropriate down payment. Although a down payment isnt always necessary, a sizeable one can reduce the length of your debt and make you more qualified for a favourable loan.

- Had the vehicle inspected by your own mechanic. Though this may require a deposit, it will be worth to avoid buying something thats unreliable or unsafe.

How To Use The Cleartax Car Loan Calculator

- Use the slider and select the loan amount.

- You then select the loan tenure in months.

- Move the slider and select the interest rate.

- The calculator would show you the EMI payable, total interest and the total payable amount.

- Recalculate your EMI anytime by changing the input sliders.

- EMI will be calculated instantly when you move the sliders.

Don’t Miss: Fha Title 1 Loan Rates

How To Calculate Auto Loan Interest

Paying for a car using a loan means receiving a lump sum of money from the lender, and then paying it back, with interest added, over a set period of time. The monthly amount you pay back depends on several factors: the amount borrowed, the number of installments and the interest rate.

Typically, car loans are calculated using simple interest, meaning the interest is charged only on the amount owed on a loan. This way it saves money to the borrower, as opposed to compound interest. Amortization is used when paying car loans, that is more interest is paid at the beginning of the term than toward the end.

Here is an example of a monthly payment calculation for a loan of $20,000, paid over a period of 48 months with an interest rate of 8%. If you calculate it using our car finance calculator you can see the monthly payment would be $488.

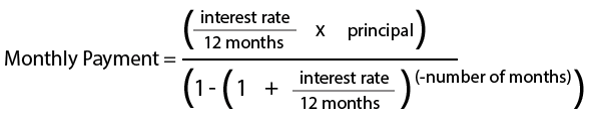

Alternatively, you can calculate it yourself using the below formula. The result for this calculation or any other combination of loan, interest rate, principal and number of the month will be identical if you calculate it manually or if you use our car loan calculator below.

Hyundai To Launch The New Elite I20 In The Beginning Of November

Hyundai is likely to launch the third-generation Elite i20 in the first week of November. The new car has already started arriving at dealerships. Few dealerships have already started bookings for the car for Rs.25,000. The previous model of the car was launched in August 2014. The new car comes with fog lamps, sleep projector headlamps, and a large grille. The interior features of the car include a sunroof, a Bose sound system, a flat-bottom steering, and a 10.25 touchscreen infotainment system. The car is available in both diesel and petrol variants. The car is expected to be priced from Rs.6 lakh and will compete against the likes of the Volkswagen Polo, Honda Jazz, Tata Altroz, Toyota Glanza, and the Maruti Baleno.

22 October 2020

You May Like: Usaa Student Loans Refinance

Calculation Of Car Loan Emi

The table below provides you the car loan repayment schedule for a loan amount of Rs.5 lakh, EMI of 10,624, tenure of 5 years, interest rate of 10% p.a. and processing fee of 1%.

| Year |

|---|

| Rs.6,37,411 |

In the above example, if you make a prepayment of Rs.50,000 after paying 4 EMIs:

You will Save Rs.32,505 in total loan amount Loan tenure will be reduced by 7 months

Without Pre-payment

Interest: Rs.1,09,906 EMI tenure: 4 years 5 months

You can make use of the Car Loan EMI calculator to estimate the amount you have to pay each month towards your car loan. The online EMI Calculator offered by BankBazaar will calculate the monthly instalments as well as provide you with a detailed loan repayment table presenting you with details such as the principal amount and interest amount being paid and the outstanding balance after payment of the instalment.

How Is Interest Calculated On A Car Loan

An auto loan calculator shows the total amount of interest you’ll pay over the life of a loan. If the calculator offers an amortization schedule, you can see how much interest you’ll pay each month. With most car loans, part of each payment goes toward the principal , and part goes toward interest.

The interest you pay each month is based on the loan’s then-current balance. So, in the early days of the loan, when the balance is higher, you pay more interest. As you pay down the balance over time, the interest portion of the monthly payments gets smaller.

You can use the car loan calculator to determine how much interest you owe, or you can do it yourself if you’re up for a little math. Here’s the standard formula to calculate your monthly car loan interest by hand:

Recommended Reading: Fha Limits In Texas

Go Autos Car Loan Calculator

Purchasing a vehicle usually requires a significant financial investment. Even a modestly priced vehiclelets say $8,000 to $10,000is more than most people can afford to pay with cash. Which means most people need to take out an auto loan in order to buy a car. But loans come with monthly payments, and it can be hard to figure out how much youre likely to pay once you factor in things like the loan term, the interest rate, the payment frequency, and the trade-in value. To be totally honest, its pretty confusing. But dont worry. Our car loan calculator can do all the hard work for you.

What You Need To Know

Before you can calculate your exact payments, you’ll need to collect some information about your car and finances. The Consumer Financial Protection Bureau has a handy worksheet you can use to gather this information. Just fill in your details next to the example scenario.

First, figure out the overall value of the car and registration. This figure includes the sticker price of your car, along with any taxes, titling fees, warranties, and prior car loan amounts being rolled over into your new car loan. Once you’ve calculated this cost, you can subtract your down payment, along with any applicable rebates and the trade-in value of your previous vehicle.

Next, take a close look at the terms of the loan. To determine the car payment amount, you will need to know the length of the loan and the interest rate you will pay. The period of vehicle loans is generally stated in months, even if it lasts for years.

The CFPB has documented a steady rise in the length of car loans. Term lengths of six years or more made up just 26% of car loans issued in 2009. By 2017, these long-term loans made up 42% of car loans.

Also Check: Can You Refinance An Upside Down Car Loan

Advantages Of Using The Car Loan Emi Calculator

- Break-Up of the Due Amount is Provided: The car loan EMI calculator helps you calculate the processing fees, interest that is paid, the total amount that must be paid, and the principal amount.

- Your Budget can be Planned: Once you know the EMI that must be paid, you can plan your budget accordingly. In case the loan amount that is being availed is large, you may think of opting for a longer tenure. These details can be determined by using the car loan EMI calculator.

- Accuracy: For the details that are being provided on the calculator, the results that are displayed are accurate. Manual calculations may not provide accurate results.

- Saves Time: The main aim of the Car Loan EMI calculator is to save time. Once the relevant details are entered, the results are displayed almost immediately.

- No Limit: There is no limit to the number of times the calculator can be used. Therefore, you use the calculator with different variants. This can help you choose the best lender and the down payment that must be paid.

- Compare: As there is no limit to the number of times that the calculator can be used, you can compare the EMIs for different values.

Why Do Interest Rates Change

There are a number of things the RBA will take into account when deciding whether to change the cash rate. Chief among them are domestic conditions, such as employment and inflation, though global financial conditions are also important.

If the economy is booming and high demand is pushing up prices, the RBA might increase the cash rate to make sure inflation doesnât spiral out of control. And if the economy is weak and demand is low, the RBA might decrease the cash rate to encourage spending, borrowing and investment.

Recommended Reading: Fha Build On Own Land

How Does Our Auto Loan Payment Calculator Work

With our car loan repayment calculator, car buyers anywhere in Canada can calculate their monthly payments. A car payment estimator will allow the car buyer to see how much they have to put aside every month in order to pay for their car loan. Anyone can use this monthly car payment calculator simply by filling in the details required to get the monthly payment amount.