When Do You Have To Start Paying Back Student Loans

Usually there is an automatic grace period of six months before you have to start paying your student loan after graduation. However, if you are having trouble finding a job, six months may not be long enough. If you find yourself in this situation, delay paying your student loan until you receive income.

What Is The Difference Between A Subsidized And Unsubsidized Student Loan

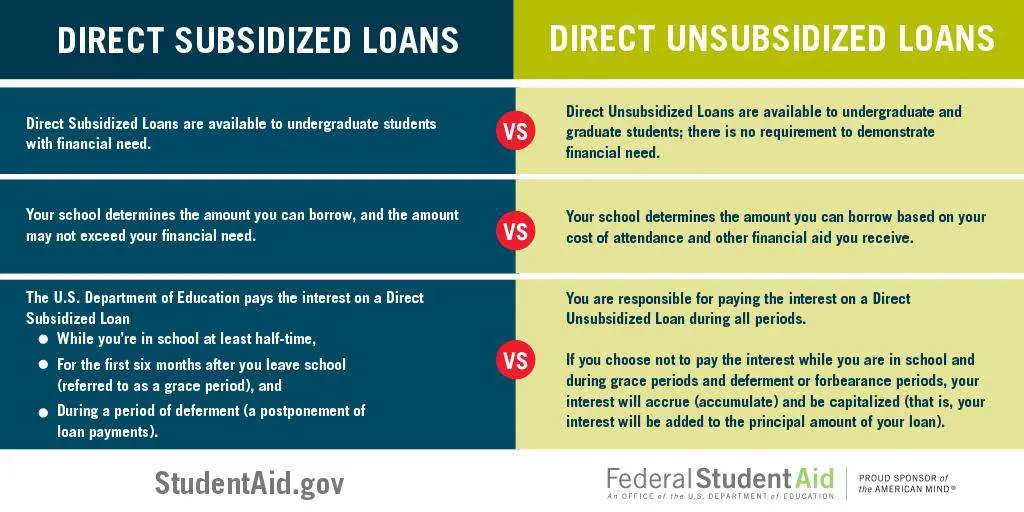

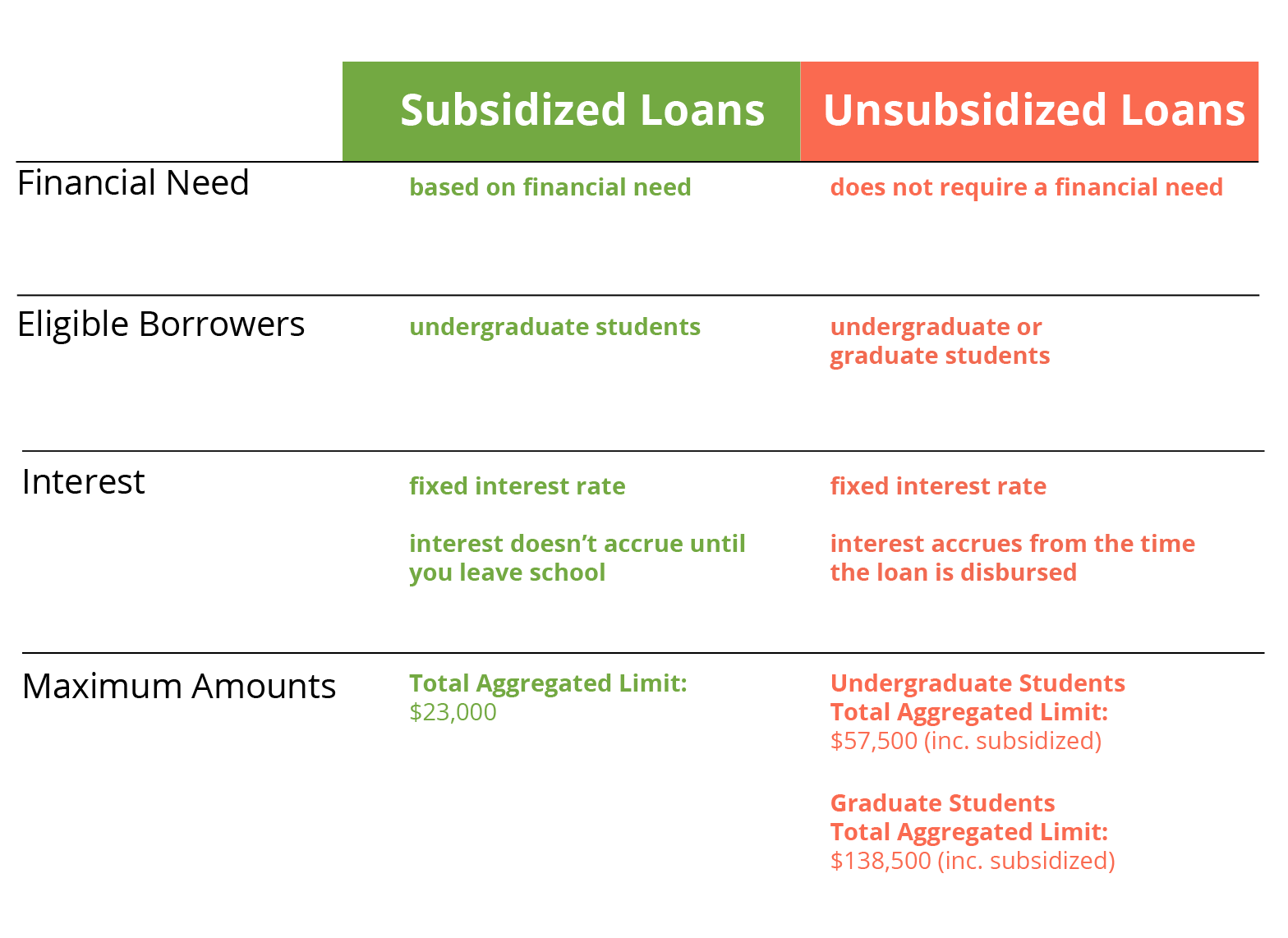

The key differences between an unsubsidized loan and a subsidized loan are the interest, loan limit and eligibility.

Unsubsidized student loans are more expensive than subsidized loans because interest starts accruing sooner on unsubsidized loans. The borrower is responsible for the interest that accrues on unsubsidized student loans during in-school and grace periods, as well as deferments and forbearances. Borrowers can choose to pay the interest as it accrues or to defer paying the interest until the student loans enter repayment. All federal student loans have a fixed interest rate.

If the borrower does not pay the interest as it accrues, the interest will capitalize and be added to the principal loan balance when the loan enters repayment. This can increase the size of the loan by as much as a tenth to a quarter. It also leads to interest compounding, since interest will be charged on the capitalized interest.

Subsidized loans are awarded based on financial need. Unsubsidized loans are available to all students, regardless of need.

Overborrowing: Just Say No

Believe it or not, lenders may offer you more money than you really need to pay for school. Yes, theyre increasing their risk of not getting paid back by allowing you to potentially overextend yourself. But theyre also increasing their potential profits by having you pay them more interest.

Student loans are so hard to discharge in bankruptcy and can be collected in so many ways that you should assume lenders dont have your best interests at heart. That said, its your job to figure out the smallest amount you need to borrow to earn your degree.

You always have the option to turn down additional loans or even reduce the amount for which you are approved, says Josh Simpson, an investment advisor representative with Lake Advisory Group. The strategy of only borrowing what you need may seem obvious but it is often overlooked, he says.

You May Like: Capital One Pre Approval Auto Loan

How Will I Receive My Loan

When your loan is disbursed, your school will take out sufficient funds to pay for tuition, room and board and any other fees. If there is any money remaining from your loan proceeds, your schools financial aid office will refund it to you within 14 days. Remember, funding from student loans can only be used for legitimate educational expenses.

To Accept/reduce/decline A Federal Direct Unsubsidized Loan

The student must accept or decline a Federal Direct Unsubsidized Loan on the electronic Award Letter on SalukiNet by selecting Accept or Decline in the dropdown box on the Award Letter Accept/Decline Awards page. The student can reduce the loan amount by selecting Accept in the dropdown box and entering a lower award amount in the Partial Accept field. If the student wishes to request loan changes, they should use the Request Changes on the Award Letter Information Request page of the electronic Award Letter.

The first time a loan is accepted, the student must complete a Electronic Master Promissory Note. The loan will then be credited to the student’s SIUC account, divided into two payments for the academic year. The student will also be required to participate in an Entrance Loan Counseling session.

All or part of the loan can be canceled within 90 days of the date the school notifies the student that the loan has been credited to their account. Loan funds will first be used to pay for tuition, fees, room and board. If funds remain after these charges have been paid, the student will receive the remaining funds by check.

Recommended Reading: Can You Refinance An Fha Loan

Pros And Cons Of Subsidized Loans

Subsidized loans come with some great benefits:

- Because the federal government pays the interest during the periods noted above, subsidized loans will save you money.

- They offer flexible repayment options you won’t find with private loans.

- You’ll pay lower interest rates on these loans than on comparable private student loans.

But they also have some drawbacks you should be aware of:

- You’re limited in how much you can borrow in subsidized loans each year and in total. Your school determines your maximum loan amount based on federal limits , your financial need and your year in school. If you need more than the maximum amount, you can take out unsubsidized or private loans to cover the difference.

- They’re only available for undergrads, so graduate students have to look elsewhere.

- Financial need must be demonstrated to qualify, so you may not be eligible if your parents’ income is too high.

To Receive Your Subsidized Or Unsubsidized Loan:

Also Check: Usaa Rv Loan Terms

How Private Student Loans Change The Interest Payment Picture

Lets say the federal student loan limits dont fully cover your tuition and fee shortfall after grants, scholarships, and parental contributions. What does the math look like with larger loan amounts and private loan interest rates?

Well assume youll need to borrow $15,000 per year and youll max out your federal loans. That leaves $7,500 to $9,500 per year in private loans.

| Private Student Loan Interest Accumulation During School | |

|---|---|

| Loan year | |

| $40,742 | $42,225 |

Table created by the author with the help of calculations from Student Loan Heros Student Loan Deferment Calculator.

Private student loan interest rates depend on many factors. This includes your , your cosigners credit history , market interest rates, and the lenders offerings. Youll also have the option of a fixed- or variable-rate loan. Remember that variable loan rates often start out lower than fixed rates but can escalate over time.

For simplicity, we chose a 9.0% fixed interest rate for our private student loan example in the table above. Private lenders are not required to offer a grace period, but many do, so we showed that option as well.

You May Like: Does Va Loan Work For Manufactured Homes

What Is A Subsidized Loan

A subsidized loan is only available to undergrads through the Federal Direct Loan Program. They are called subsidized because interest is paid by the government while the student is in school.

The interest rates are fixed for the life of the loan, and are set by the government.

A student does not need to demonstrate a specific income or credit score to qualify. Instead, students fill out the Free Application for Federal Student Aid to apply for these loans. Eligibility is based on financial need.

The government covers the interest on subsidized loans as long as the student is enrolled at least half-time, and during periods of deferment or forbearance after graduation.

No payments are due on subsidized loans until six months after graduation.

Unfortunately, graduate students and parents of students do not qualify for this type of federal loan.

In addition, students who cant demonstrate financial need wont be awarded subsidized loans. As of the 2019-2020 school year, the total amount for subsidized loans is capped at $23,000 for the full span of an undergraduates education.

When comparing subsidized vs. unsubsidized loans, youll find that subsidized loans are less expensive although the amount a student can borrow is limited.

Read Also: Fha Loan Refinancing Requirements

Student Loan Disbursement 101

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

Youve applied for financial aid, agreed to take out a student loan or two and are about to head off to college. But when will you receive your student loan disbursement, and will the funds go to you or your school?

If youre borrowing student loans, its crucial to understand how student loan disbursement works. This guide will explain how student loans are distributed, whether youre borrowing from the federal government or a private lender. Specifically, lets answer the following questions:

The Downside Of These Is That The Government Never Pays The Interest On Unsubsidized Loans

Heres the unsubsidized loan definition. Mar 07 2019 These federal student loans include subsidized and unsubsidized direct loans as well as PLUS loans which your parents can apply for separately. What Is the Difference Between Subsidized and Unsubsidized Loans.

On a Federal Direct Unsubsidized Loan you are responsible for paying all of the interest on the loan. A Direct Unsubsidized loan is one type of financial aid provided by the US federal government or more specifically the US Department of Education. Loan amounts are based not on financial need but on costs of school and any other aid a student has received.

Borrowers are responsible for the whole amount from day one through the life of the loan. Sep 05 2018 An unsubsidized student loan is one in which the interest starts accruing the moment you or your school receive the loan funds. Borrowers do not have to demonstrate financial need to take out an unsubsidized loan.

The unsubsidized student loan means once loan funds are in a borrowers account the interest starts accruing while youre in school and after you leave. Since the interest is paid for you while you are in school on a subsidized loan it doesnt accrue. Borrowers are responsible for the.

Any students can borrow regardless of financial need. So the amount you owe after the post-graduation grace. If the student does not make the interest payments then those payments are simply added onto the principal amount.

Federal Direct Loans Financial Aid Scholarships

You May Like: How Do I Find Out My Auto Loan Account Number

Maximum For Unsubsidized Direct And Plus Loans

Cost of Attendance

+ $2,500 Maximum Unsubsidized loan

= $7,500 Maximum Direct loan

A dependent students maximum eligibility, whether it subsidized or a combination of subsidized and unsubsidized loans, cannot exceed the amounts shown above. Independent students, however, are eligible to borrow additional funds from the Unsubsidized Direct Loan program. In cases where the parents of the dependent student are denied eligibility for the Parent Loan for Undergraduate Students due to a negative credit history, the dependent student may borrow additional funds from the unsubsidized loan program. Student borrowers do not need a co-signer and there is no credit check done by the federal government.

Frequently Asked Questions

How do I apply for a Stafford Loan?

The same way you do the other federal student aid, by completing the Free Application for Federal Student Aid . You will need to submit a loan request form to your CUNY college to get a Stafford loan processed. You will also need to sign a promissory note, a binding legal document that states you agree to repay your loan according to the terms of the note.

What is my repayment period?

The repayment periods for Stafford Loans vary from 10 to 30 years depending on which repayment plan you choose. When it comes to repayment you can pick a repayment plan thats right for you. You can get more information about repayment by going to the U.S. Department of Education web site www.studentaid.ed.gov.

What if I cant make my payments?

What Is An Unsubsidized Loan Definition And Explanation

You have a general idea of what it means to take out a loan, but calling a loan “unsubsidized” makes it sound a bit suspicious. What is an unsubsidized loan, and how are they different from subsidized loans? Are they good options if you’re considering taking on student debt?

Here’s the unsubsidized loan definition: a Direct Unsubsidized loan is one type of financial aid provided by the US federal government, or more specifically, the US Department of Education. You can also receive Direct Subsidized loans as part of your financial aid package.

In this post, I’ll discuss why these loans exist, before talking in more detail about how loans usually work. With this information, you’ll be able to get a full understanding of the details of Direct Unsubsidized loans and whether they may be a good option for you.

Read Also: Usaa Auto Loan Credit Requirements

Are Unsubsidized Student Loans A Bad Idea

However, you must be an undergraduate student to be eligible and you must be able to demonstrate financial need. Also keep in mind that only a small portion of your loan qualifies for financing, so unsupported funds may be part of your total student loan. That said, unsubsidized loans aren’t necessarily a bad choice.

Subsidized Vs Unsubsidized Student Loans: What They Have In Common

The loan you choose depends on several factors, like how much financial help you need, your current financial status, the amount you can qualify for, and how quickly you think youll be able to repay your debt. Each student is unique in their academic journey, and loans reflect that divergence.

Here are some of the features that subsidized and unsubsidized loans have in common.

You May Like: Refinance Car Usaa

Subsidized And Unsubsidized Loan Examples

Example 1:

Alberta Gator is a first year dependent undergraduate student. Her cost of attendance for Fall and Spring terms is $17,600. Albertas expected family contribution is $10,000 and her other financial aid totals $9,000.

Because Albertas EFC and other financial Aid exceed her Cost of Attendance, she is not eligible for need-based, Subsidized Loans. She is, however, eligible for an Unsubsidized Loan. The amount she would be awarded would be $5,500. Even though her cost of attendance minus other financial aid is $8,600, she can only receive up to her annual loan maximum .

How The Unsubsidized Loan Process Works

The first step in qualifying for any type of financial aid is completing the FAFSA. The FAFSA for the following academic year is usually available online on October 1 of the preceding year and must be filed at the latest by June 30 to receive funding for the following fall semester. Some schools may have earlier deadlines, and the earlier you apply, the better.

Upon completion of the FAFSA, you’ll receive a general idea of your expected family contribution . Your FAFSA information is then sent to your selected colleges, which each provide an individual financial aid award package. Students should first take advantage of any scholarships and grants, which do not have to be repaid, then use student loans, which do have to be repaid and may have some kind of subsidization. Your financial aid award letter will list your eligibility for certain types of federal student loans. You might see wording such as Direct Subsidized Loan or Direct Unsubsidized Loan.

Your loan offer will include information on how to accept the offer. This will likely include signing a promissory note to guarantee you’ll pay back the loan. You may also have to go through entrance counseling if it’s your first federal loan.

Read Also: Usaa Boat Loan Credit Score

What Does An Unsubsidized Loan Mean

Most other educational loans are unsubsidized. The Federal Direct Loan program offers unsubsidized student loans PLUS and private loans are also not subsidized.

With an unsubsidized student loan, the borrower is responsible for making interest payments as soon as the loan is issued.

This could mean paying interest payments during school, or it could mean adding those interest payments to the principal of the loan, to be repaid after graduation.

Direct Unsubsidized Loans are not based on financial need, and are available to graduate students as well as undergraduates. They have fixed interest rates, and students need to fill out the FAFSA to apply.

The aggregate cap for Direct Unsubsidized Loans is $31,000 total. Interest is due immediately, even during the post-graduate grace period and during deferment or forbearance, although it can be added to the principal instead of being paid right away.

Other unsubsidized loans have their own terms and conditions.

PLUS loans are also through the federal government, and private loans are available from a variety of lenders.

In all cases, however, you will find the interest either due during school or added to the balance of the loan and due during repayment.

How Interest Accrues For Unsubsidized Loans

Interest starts accruing as soon as the loan is disbursed . The entire time youre in school, your loan amount is adding up. You have a grace period of six months after graduation to begin payments, but the interest is still accruing. If you defer your unsubsidized loans, interest collects and will be added to your principal, which increases the total amount owed.

Also Check: Transfer Auto Loan To Another Bank

In What Situations Do I Lose The Subsidy On My Existing Direct Subsidized Loans

-

when I reach the subsidy limit and stay enrolled in my program.

-

when I reach the subsidy limit, didn’t graduate, and transfer to an undergraduate program that’s the same length or shorter than my prior program.

-

when I transfer into a shorter program and lose eligibility for Direct subsidized loans because I already received them for a period that is equal to or more than my new, lower, maximum eligibility period.

-

when I reach the subsidy limit, didn’t graduate from my prior program, and transfer to a longer program.

-

when I graduate from my program before or at the time I reached the subsidy limit, and enroll in another undergraduate program.