How Can I Pay Less Interest On My Car Loan

Interest charges can add thousands of dollars to the amount you have to repay. But there are ways you may be able to minimize the impact on your wallet if you need to finance your car purchase.

- 0% APR financing If you have excellent credit and the auto manufacturers finance division offers special financing, you may be able to take advantage of 0% APR financing for a certain amount of time.

- Early repayment If you have a simple interest loan, you can reduce your interest charges by paying more than the minimum due each month or paying off the balance early.

- Shorter loan term Choosing a shorter repayment term will lower the total amount of interest you pay in the long run. But itll increase your monthly payments, so be sure you can afford it.

- Refinance down the road If interest rates drop or your credit improves after you get your car loan, you may be able to get a lower rate by refinancing.

There’s More To A Loan Than A Monthly Payment

That same wise shopper will look not only at the interest rate but also the length of the loan. The longer you stretch out the payments, the more expensive the loan will be. Let’s take that same $20,000 loan above at 5% at 5 years and see how much we can save by paying it off in 3 years. So, $20,000 at 5% for 36 months will cost $21,579.05 saving you $1,066.43. Using the calculator above you will see that the monthly payment for the 5 year loan is $377.42 and the monthly payment for the 3 year loan is $599.42. If you can easily handle the higher payment the savings are well worth it.

If your credit drastically improves & your initial loan was at a higher interest rate, it may be worth looking into refinancing at a lower rate.

Effective Interest Rate On A Discounted Loan

Some banks offer discounted loans. Discounted loans are loans that have the interest payment subtracted from the principal before the loan is disbursed.

Effective rate on a discounted loan = /

Effective rate on a discounted loan = / = 6.38%

As you can see, the effective rate of interest is higher on a discounted loan than on a simple interest loan.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Understanding 0% Financing Vs Factory Rebate

Many times dealerships will offer a choice of 0% financing or a factory rebate. How do you know which is better? Figure out the interest you would pay for the life of the loan if you financed with your bank. If the interest is more than the rebate, then take the 0% financing. For instance, using our loan calculator, if you buy a $20,000 vehicle at 5% APR for 60 months the monthly payment would be $377.42 and you would pay $2,645.48 in interest. If the rebate is $1,000 it would be to your advantage to take the 0% financing because the $1,000 rebate is less than the $2,645.48 you would save in interest. Be aware though, that unless you have a good credit rating, you may not qualify for the 0% financing and this option may only be offered on selected models. People with poor credit are a major source of profits because they can be charged far higher interest rates. Some “buy here, pay here” dealerships specifically focus on subprime borrowers.

Average Auto Loan Interest Rate By Credit Score

Whether you are buying a new or used car, your interest rate will depend heavily on your credit score. The good thing about this is that you can always work to improve your credit score if you are given too high of an interest rate on a loan. The average rates here are expressed as an APR so you can have a good idea of what the total cost may be to you.

Deep Subprime:Deep subprime credit scores are generally in the 300 to 500 range. While these must be included, you should know that it would be very difficult to get a car loan with poor credit and it may end up being too expensive.

The average APR on a new car loan with this credit score is 14.59 percent. The average APR for a used car is 20.58 percent. These are incredibly high rates and you would probably end up paying much more for the vehicle than what it is worth if your credit score was low enough to warrant them.

Subprime:Subprime credit is in the range of 501 to 600 range. For this kind of credit, you could get a car loan with an average APR of 11.03 percent for a new car. If you wanted to get a used car loan, you could get an average APR of 17.11 percent. These are still high percentages that are more on-par with credit card APRs instead of car loans and may not be worth getting.

Also Check: Avant Refinance

Simple Interest Car Loans

Most auto loans are simple interest loans, which means that the amount of interest you pay each month is based on your loan balance on the day your payment is due. If you pay more than the minimum due, the interest you owe and your loan balance can decrease.

On a simple interest loan, interest is front-loaded and amortized. With an amortized loan, part of your monthly car payment goes to the principal, which is the amount you borrowed, and part of your payment goes to the interest charges. Because the loan is front-loaded, a larger portion of each car loan payment applies to interest at the beginning of the loan term and at the end of the term more applies to the principal balance.

For example, If you have a $25,000 car loan with a 48-month term and a 4% interest rate, youll pay an estimated $83 in interest and $481 in principal during the first month of the loan term. By the last month, youll only pay an estimated $2 in interest, and $563 will apply to the principal amount.

How Much Will My Car Payment Be

Monthly payments on car loans are based on multiple factors, so it can be difficult to estimate what youll pay each month until you know the price of the car you want to buy and your specific loan terms. However, by entering some basic information into the auto loan calculator above, you can get a pretty good idea of what might end up paying.

Don’t Miss: How Long For Sba Loan Approval

How To Get The Best Deal

Got new car fever? Well, first, you need to do a little homework. With the internet, the mystery of the automobile buying process has been unveiled and you can be a well-informed buyer ready to negotiate for the best price. First of all, go to ConsumerReports.org to check out vehicle reliability. You may be eying that shiny red sports car, but if its review states that this manufacturer has a history of poor performance or something like electrical issues, you may want to reconsider.

Test drive the vehicle you have in mind, but renting one from a car rental company for a couple days is the ultimate test.

How To Calculate Total Interest Paid On A Car Loan

This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin. This article has been viewed 339,242 times.

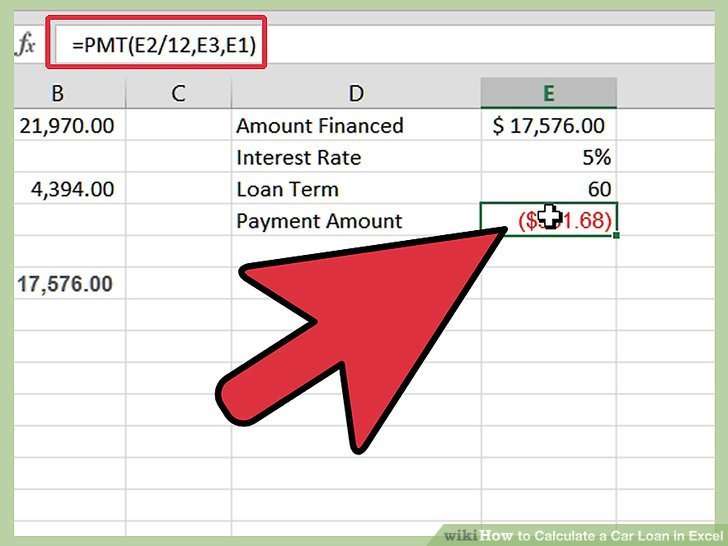

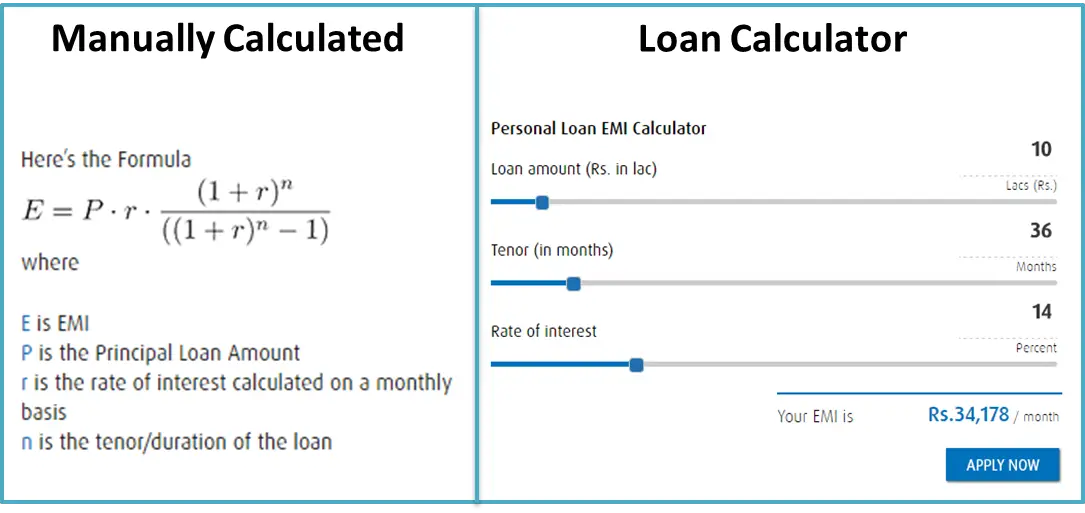

There are several components that are used to compute interest on your car loan. You need to know the principal amount owed, the term of the loan, and the interest rate. Most car loans use an amortization schedule to calculate interest. The formula to compute amortization is complicated, even with a calculator. Car buyers can find amortization calculators on the web. If your car loan uses simple interest, you can use the calculator to determine your monthly payment amount.

Also Check: Usaa Personal Loan Credit Score

Why An Auto Loan Calculator Is Important

If youre planning on financing your new vehicle purchase, the overall price of the vehicle isnt really the number you need to pay attention to. The most important number, for you, is the payment. Because, as our auto loan calculator will show you, the price you ultimately end up paying depends on how you structure your deal.

The factor that will change your monthly payment the most is the loan term. The longer your loan, the less youll pay each month, because youre spreading out the loan amount over a greater number of months. However, due to the interest youll be paying on your loan, youll actually end up spending more for your vehicle by the time your payments are over. Why? Because the more time you spend paying off your loan, the more times you will be charged interest.

Speaking of interest, the interest rate is the second most important number to consider when structuring a car loan. The interest rate is the percentage of your purchase that is added to the cost of your vehicle annually. So, if you buy a vehicle with 4.99% financing, then youre paying roughly 5% of your vehicles overall price in added interest every year.

Next, consider how much your vehicle is worth if youre trading it in. If youre trading in a vehicle thats worth $7000 and youre buying a vehicle thats worth $22,000, then you will only have to take an auto loan out for $15,000 .

Calculate Auto Loan Interest For Your First Payment

If you want to learn how to calculate auto loan interest for the initial payment, you can use this fast calculation:

This is the amount you will be paying in interest for the first month.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Car Loan Emi Calculator

Calculate how much you may have to pay every month for your car loan with this interactive car loan EMI calculator

The rate mentioned in the calculator is an indicative rate only. The actual rate may vary.Owning your car is an effortless process in todays times. With finances readily available, bring home that dream car for you and your family. At HDFC Bank, we strive to meet your every requirement with utmost convenience and accessibility. We aspire to bring to you, services and facilities to fulfil every want of yours, including that of purchasing your dream car. With our tailor-made Car Loan EMI Calculator, we offer you the provision to identify the exact principal amount, with the interest rate and equated monthly instalments payable over a specific tenure before you intend to apply for your Car Loan.Regardless of whether you are a salaried individual or self-employed, with HDFC Bank, you have the advantage of purchasing a car through our Custom-Fit Car Loans. With the Car EMI Calculator, you only need to input the necessary information whether you intend to buy a new car or a pre-owned car, the sanction loan amount required, tenure of the loan, interest rate and select calculate. The Auto Loan EMI Calculator offers you a detailed view of your yearly principal and interest repayment amounts.

Use Our Interest Rate Calculators

If all of that looks like way too much math to stomach, or if you donât have time to become a spreadsheet expert, you can use our handy financial calculators to do the work for you.

Our repayments calculators will tell you the repayment youâll make on a monthly, fortnightly or weekly basis, and give you the total amount of interest youâll wind up paying on your car, personal or home loan. And our credit card debt payment calculator will show you how long it will take you to pay off a credit card debt, plus how much youâll pay in interest and fees.

You May Like: What Happens If You Default On Sba Loan

Effective Interest Rate With Compensating Balances

Some banks require that a small business applying for a business bank loan hold a balance, called a compensating balance, with their bank before they will approve a loan. This requirement makes the effective rate of interest higher.

Effective rate with compensating balances = Interest/

Effective rate compensating balance = 6%/ = 7.5 percent

Determining The Amount To Finance

Recommended Reading: Usaa Credit Score

Some Used Cars Are A Real Bargain

Before you take the plunge of buying a new car, consider a used one. Frugal shoppers know that new cars depreciate as soon as they are driven off the lot, and in fact lose on average 15-25% of its value each year the first five years. Buying one that’s a couple years old can still provide you with a reliable vehicle for thousands less while letting someone else take the depreciation hit. If you trade in every few years then depreciation is something to consider, so look for vehicles that traditionally hold their value such as Honda, Toyota or Lexus. If you keep your automobile until it falls apart, then depreciation is not a concern for you. New models for the upcoming year usually arrive late summer or early fall. Although selection may be limited, this is a great time to consider buying last year’s model because the dealer will need to make room for the new ones.

Do Not Buy a Lemon!

Check the used car history by the VIN# on sites like Carfax or AutoCheck. This will help eliminate anything that looks questionable. Anything that says it’s a salvage should raise a red flag. Salvage vehicles are those in accidents that the insurance company has determined repair costs are more than it is worth. Some shops will try to repair them and sale them at a steep discount. These are given salvage titles. Unless you are mechanically savvy, it’s best to avoid these.

Program Cars Are Often a Great Value

How Is An Interest Rate Calculated

There are two different ways that financial institutions will calculate a loans interest rate: simple and precomputed. Both these types of loans have their own benefits and drawbacks and the type you get will depend on where you are getting the loan and what kinds of terms are available. This is why it is so important to shop around for a car loan instead of immediately taking the financing terms at the dealership.

Simple:A simple interest loan is the most common car loan and is based on what you owe each month. On the day your loan payment is due, your rate will be applied to the amount you owe. Because of this, your interest payments will be less as you pay off more of the loan.

Simple interest allows you to pay more on your monthly payments and pay less in interest. This means that you can end up paying less overall for your car loan by paying off the principal early. If you can do this, a simple interest loan is the cheapest way to finance a new car.

Precomputed:A precomputed loan is less common, but some lenders prefer them and they may be better for some borrowers. Precomputed loans have their total amount of interest calculated at the beginning of the loan term and then added onto the principal. Then, this amount is divided by the number of months in the term to get your monthly payment.

Also Check: Refinance My Avant Loan

Home Equity Line Of Credit

A HELOC is a home equity loan that works more like a credit card. You are given a line of credit that can be reused as you repay the loan. The interest rate is usually variable and tied to an index such as the prime rate. Our home equity calculators can answer a variety of questions, such as: Should you borrow from home equity? If so, how much could you borrow? Are you better off taking out a lump-sum equity loan or a HELOC? How long will it take to repay the loan?

Interest Is What You Pay To Borrow Money From A Lender When You Finance The Purchase Of A Vehicle

Interest charges are included in your monthly loan payment and can add thousands of dollars to the amount you have to repay. Thats why its important to understand how car loan interest is calculated, what factors can affect your rate and how to minimize interest charges.

Recommended Reading: Where To Refinance Auto Loan