Navy Federal Personal Loan Requirements & Application Info

Category Rating: 3.8/5

The biggest thing you need to do to become eligible for a Navy Federal personal loan is join Navy Federal Credit Union. Membership is open to people who have served in the U.S. armed forces or the Department of Defense, or who are relatives of people who have.

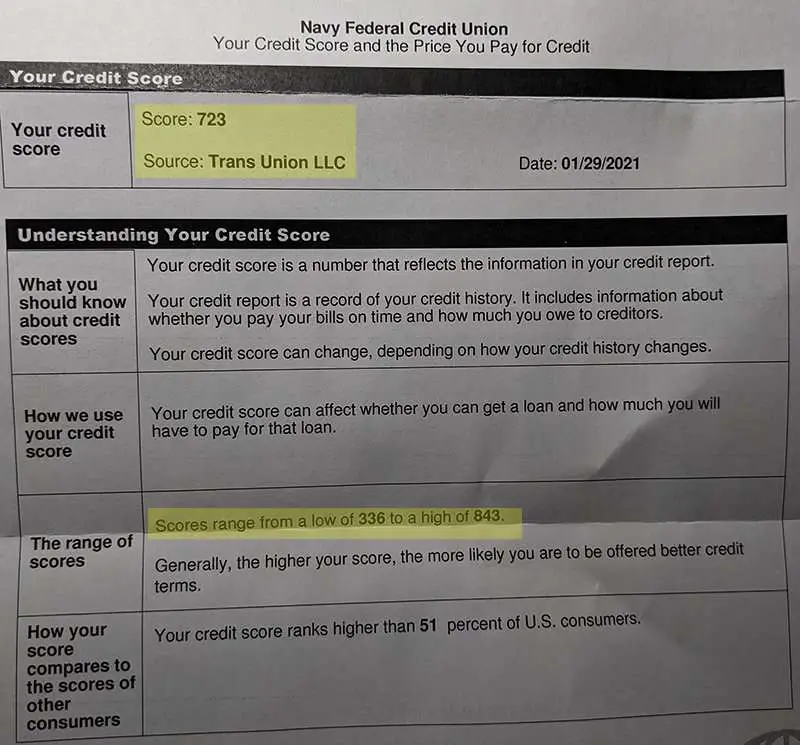

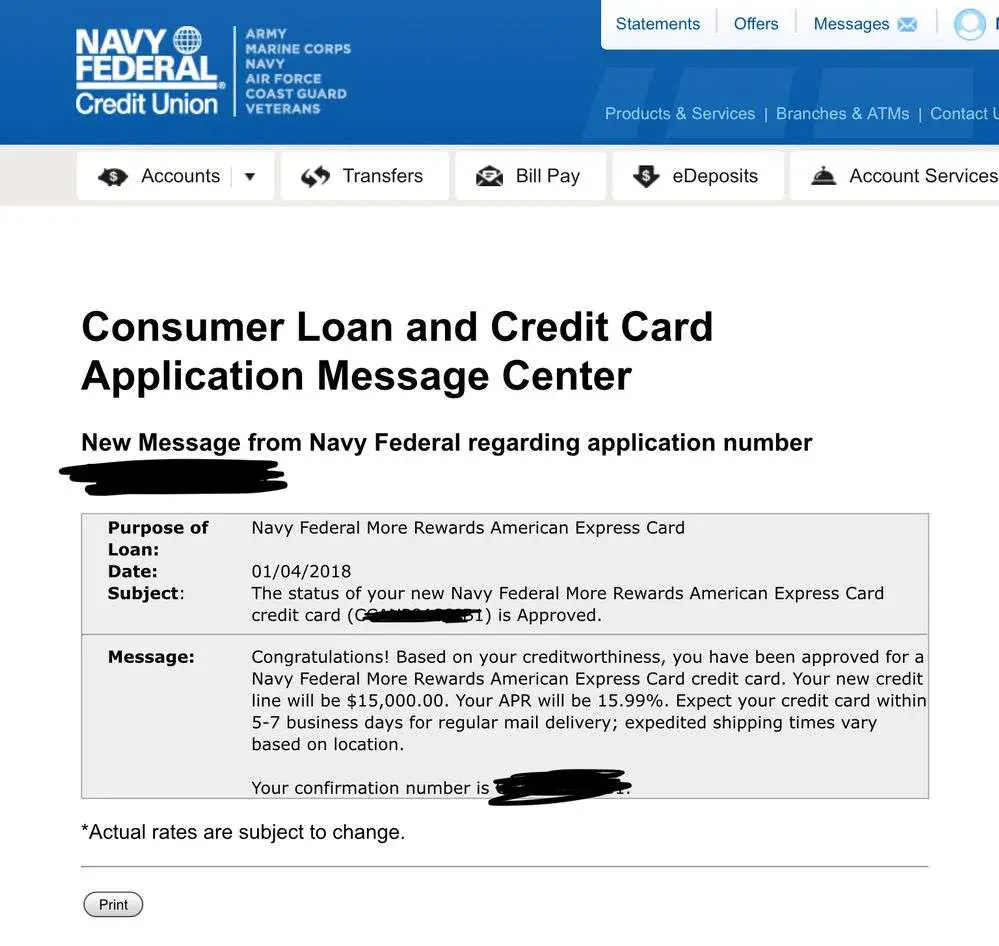

There are no openly disclosed Navy Federal credit score requirements or income requirements, either officially or from third-party sources. Of course, Navy Federal will look at your credit and income during the application process. But according to representatives, they will also look at other factors such as your standing within NFCU.

To get a personal loan from Navy Federal, you will have to be at least 18 years old. You can apply using either a Social Security number or an Individual Taxpayer Identification number. You can be a U.S. citizen, permanent resident or immigration visa holder, as long as youre otherwise eligible for membership with Navy Federal.

Unlike many lenders, Navy Federal does not offer pre-qualification to let you estimate your approval odds and rates before you apply, which is the biggest reason why NFCU loses points in this category. To find out your rates, you will need to submit an application, which will result in a hard pull of your credit. You can apply for a Navy Federal personal loan online, by phone 1-888-842-6328 or at one of NFCUs 300+ branches.

Navy Federal Auto Loan Rates And Terms: At A Glance

These terms apply for purchases from dealerships, private parties and for refinancing.

| New autos Three most recent model years, up to 7,499 miles. |

| Starting APR |

| Three most recent model years between 7,500 and 30,000 miles. |

| Starting APR |

| Between 3 and 20 years old or any model with 30,000 miles or more. | |

| Starting APR | |

| 4.99% | 6172 months |

Amounts. The minimum amount you need to borrow for a Navy Federal auto loan is $250 for terms up to 84 months and $30,000 for terms of 85 to 96 months.

Refinance loans and private party loans have the same starting APRs as new and used vehicles, which isnt always the case with other lenders. As of Dec. 11, 2019, Navy Federal offered $200 to those who refinanced a loan from another lender Navy Federal doesnt refinance its own loans.

Classic auto loans. Navy Federal Classic auto loans have a starting APR of 8.09% and a maximum term of 180 months.

Re: Interested In An Auto Loan From Navy Fed

Are you already a NFCU member? If so, for how long, and have you had any negative issues with them? They seem to value your membership on a broader level than just your scores for approvals, i.e., look at your account history, recent inq’s, past loans/acounts with them.

I by no means have totally cleaned my reports yet, but was approved for a 9% loan on a used car. Yes, they pulled EQ for their Auto loans, TU for CC.I have been a member for about 5 years with no negative issues with them. I would think you would get approval, but possibly a higher rate than your wanting, but don’t quote me on that. Treat NFCU well, and they will do the same in return!

Good luck with your loan apps, let the forums know how it goes!

You May Like: Commercial Loan Rates Today

Navy Federal Auto Loan Preapproval

If you havent picked out the exact vehicle you want yet, you could get an auto loan preapproval to take with you to the dealership. You do need to know how much youd like to borrow including any fees, taxes and add-ons and for how long, and provide your personal information. Based on this, Navy Federal might approve you for an amount, a loan term and an APR.

You could then get the preapproval check in the mail or by visiting a branch. Then, its time to go kick some tires knowing youre already approved for a car loan and for how much. A quick tip: You may want to shop for a vehicle that is a couple thousand dollars less than your preapproval in order to have enough to cover fees, though its certainly possible to request a larger loan amount. Once youve picked out the car, you could contact Navy Federal or have the dealer contact the credit union to finalize the loan.

Getting A Large Auto Loan From Navy Federal Credit Union

Hi everyone,

I’ve never applied for a big auto loan before and I suspect I will be OK, but would like some input from those better in the know.

I am buying a 2021 Corvette with an MSRP of $74,710. I am putting $35,000 down and will be financing about $46,000 after tax. I make about $100,000 per year, my credit scores are 792 and 794 and my payment will be just under $700. I am not overextended… my total outgoing bills right now are about $2,000. I have not been late on any payments as far back as my credit report goes, no negative indicators, no inquiries showing and lots of past auto credit history for a couple of smaller loans and some leases My FICO Auto 8 is 813 and my FICO Auto 9 is 781.

I figure this scenario will be adequate to get their lowest 72 month rate of 2.29%. Will they have any probably with this loan, given I am increasing my monthly obligations from $2,000 to $2,700? I am about 60 days away from applying and want to make sure I have all eventualities covered, including more money down if necessary.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Alternative Ways To Build Credit

If you are looking to build your credit history, a credit builder loan is a good option, but it is not the only option. In fact, depending on your individual situation, opening a credit builder loan may not even be the best choice for your credit.

The below alternatives can help you build credit while also conforming to your financial needs.

Where Navy Federal Stands Out

Wide range of loan amounts: Borrowers can choose loan amounts from $250 to $50,000 when applying for a personal loan at Navy Federal. This is an especially wide range among lenders and could make the loan a fit for a small expense like an emergency repair or something larger like a home improvement project.

Term availability: For most loans, repayment terms range from one to five years, but borrowers funding a home improvement project have more choices. With a $25,000 minimum loan amount, you could qualify for a term from five to seven years, and with a $30,000 minimum, you could qualify for a term up to 15 years.

» MORE:Best home improvement loans

Co-signed, joint and secured loans: Members can add a co-signer or co-borrower to their application. Adding someone with better credit or higher income can help your chances of getting a lower rate or a higher loan amount. Co-signers will not have access to the funds but are responsible for any missed payments.

Borrowers can also secure their loan with a Navy Federal savings account or CD, which could help you qualify for an especially competitive rate. Depending on the account you choose, your APR would be your share rate or certificate rate, plus 2% to 3%.

» COMPARE: Best bank loans

Also Check: Usaa Auto Refinance Rates

Navy Federal Auto Loan Details

| Starting APRs for New, Used and Refinance Car Loans | |

|---|---|

| Vehicle Age | |

| New, up to 7,499 miles | 1.79% |

| Used, within 3 model years, 7,500-30,000 miles | 2.29% |

| N/A |

Long auto loans

We dont recommend an auto loan longer than 72 months. The longer your term is, the more youre going to pay over the life of the loan. Navy Federal offers a 96-month auto loan, but no one wants to be paying back a car loan for eight years. Stick to your budget and remember not to focus solely on the monthly payment take the overall cost of the loan into consideration.

Does Navy Federal Have A Credit Builder Loan

If you are looking for a way to build your credit history and you are a Navy Federal Credit Union member, there are a selection of personal loans they offer that could help you reach your goals.

While Navy Federal does not offer a traditional, no-minimum-score-required credit builder loan, they do offer two different types of secured loans that operate in a similar fashion.

Navy Federal Credit Union also has a credit building secured credit card that can speed you towards qualifying for one of their unsecured credit cards.

But, if you dont qualify for one of Navy Federal Credit Unions credit building products, either because your credit score is too low or because you are not a member of Navy Federal, there are other banks that do offer credit builder loans.

And there are always additional alternative credit building solutions that you can consider.

Read Also: Va Loan Requirements For Mobile Homes

Tips For Improving Credit

Here are some simple steps to get you started.

Use Navy Federals Mission: Credit Confidence Dashboard to see tips and resources to build, rebuild or manage credit. Use our tools to:

Who Is A Navy Federal Car Loan Best For

Navy Federal auto loans are best for members who have direct deposit to their Navy Federal banking account or are willing to establish it. These members are eligible for rates that could be as low as 2.24%.

Those with great credit will find their best rates, but new car buyers might be able to qualify for 0% financing through the manufacturer. No matter your credit, comparing rates and terms is the best way to find the best deal for you.

Read Also: What Does Usaa Certified Dealer Mean

How To Apply For A Navy Federal Auto Loan

Once youve applied to be a member, you can apply for an auto loan. Its possible to apply online, in person or by calling 888-842-6328.

Navy Federal has no minimum credit score requirement. Instead, it uses a holistic approach to determine members creditworthiness, according to a spokesperson. Heres what youll need to apply for membership and/or an auto loan:

- Direct membership eligibility: Your military branch, rank, date of discharge.

- Membership eligibility: The Navy Federal Access Number, Social Security number and date of birth of the person who makes you eligible for membership.

- Personal: Name, Social Security number, address and contact information.

- Employment: Employer name, address and contact information.

- Vehicle: VIN or year, make, model and mileage.

- Trade-in vehicle: Title or loan information and registration

This is not a complete list of the information you may need. Navy Federal may ask for more or less information, including proof of income and proof of residence.

Pros Of Navy Federal Auto Financing

- Competitive rates. Navy Federal offers very competitive rates.

- Direct deposit discount. Active-duty and retired military members with direct deposit could get a 0.25% APR discount on a new auto loan as an additional amount off the advertised as low as APR.

- Refinance cash back. If you refinance your auto loan with Navy Federal, you could recieve $200 cash back after 65 days and once youve made your first scheduled payment.

- Many ways to apply. Navy Federal lets you apply for an auto loan three ways: by phone, online and in person.

- Overseas auto-buying program. Navy Federal offers an overseas auto-buying program. You could buy a car with Navy Federal whether youre on a boat or in a foriegn nation and have the car delivered to you stateside or overseas.

Don’t Miss: Minimum Credit Score For Rv Loan

What Is The Maximum Auto Loan Term You Can Get With Navy Federal Auto Loan

Navy Federal auto loan has car loans with terms ranging from 12 to 96 months. Having the option of longer terms — terms can range up to 144 months — allows borrowers to take on larger auto loan amounts while keeping monthly payments more affordable. However, the longer the term of your auto loan, the more interest you will pay.

Usaa Or Navy Federal For Auto Loan Pre

I have my checking account set up through navy federal and Im in AIT currently. When I get to my duty station in about 2 weeks Ill be in need of insurance and a car Ive decided that I want to finance one through a credit union. My credit score is not bad I have a 660 but Ive heard a lot of places want you to have 700 or above. Anyways that being said I planned on getting insurance through USAA, but I need a car first so I wanted to know whether itd be a good idea to get an auto loan pre approval through the people I bank with, or with the people who I have insurance through, or does it not matter? If anyone knows any helpful tips about the process feel free to chime in I appreciate it!

-

20yr old married male

-

3 reported accidents

-

$2,000 for down payment

-

wife is new licensed driver

-

military/Army/E-2

You May Like: Drb Student Loan Refinancing Review

Navy Federal Credit Union Auto Loan Review

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

Navy Federal Credit Union, like other credit unions, offers low auto loan rates. The catch is that you must be a member in order to qualify for them. Eligible members will find a range of options at Navy Federal, whether youre interested in a new, used or even classic car or refinancing a vehicle you already have.

How Navy Federal Credit Union Car Loans Work

As we mentioned earlier, you need to be a member before you can directly apply for a Navy Federal Credit Union auto loan. Well discuss membership requirements in more detail, below, but Navy Federal serves those with a connection to a branch of the military or the U.S. Department of Defense. Once youre a member, you can apply online, by phone or by visiting a branch, but its worth mentioning that there are only a handful of U.S. branches. Navy Federal also offers motorcycle, boat and RV loans, but for the purposes of this review, well focus on auto loans.

Don’t Miss: How Much Car Can I Afford For 500 A Month

How To Get A Free Car From The Government 2021

how to get a free car from charity, Government Free car program. The Government Car program is to help those who really need to receive a free car. free government cars will be your own cars and the government will not interrupt in any case later. government car assistance For Needy is really helpful.I will also guide you through how to get free money from the government.

Navy Federal Personal Loan Reviews & Transparency

Category Rating: 2.8/5

- Better Business Bureau: Navy Federal Credit Union receives an A+ rating from the BBB but is not accredited with them.

- Consumer Financial Protection Bureau: The CFPB has around 140 complaints about Navy Federal personal loans on file. Some complaints include a borrower being unable to find out how much they were charged in late fees and another claiming Navy Federal made automatic payments without authorization.

- WalletHub: Navy Federal Credit Union has an average user score of 4.1/5 stars across 2,400+ reviews.

- Transparency: Navy Federal Credit Union is clear about the range of terms borrowers can expect. However, they are not transparent about their credit score requirement, and they dont have pre-qualification, which many lenders offer.

Navy Federal loses some points for having a relatively high amount of complaints compared to many other lenders and for not being clear about some of their requirements.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Navy Federal Credit Union Car Loans Q& a

Get answers to your questions about Navy Federal Credit Union Car Loans below. For more general questions, visit our Answers section.

We work hard to show you up-to-date product terms, however, this information does not originate from us and thus, we do not guarantee its accuracy. Actual terms may vary. Before submitting an application, always verify all terms and conditions with the offering institution. Please let us know if you notice any differences.

Ad Disclosure: Certain offers that appear on this site originate from paying advertisers, and this will be noted on an offerâs details page using the designation “Sponsored”, where applicable. Advertising may impact how and where products appear on this site . At WalletHub we try to present a wide array of offers, but our offers do not represent all financial services companies or products.

Editorial and user-generated content on this page is not provided, commissioned, reviewed, approved or otherwise endorsed by any issuer.