Secured And Unsecured Consumer Loans

Lenders offer two types of consumer loans secured and unsecured that are based on the amount of risk both parties are willing to take.

Secured loans mean the borrower has put up collateral to back the promise that the loan will be repaid. The borrower risks losing that collateral if he/she defaults on the loan. Lenders offer lower interest rates on secured loans because they have the collateral to fall back on.

Homes, cars, boats and property are good examples of secured loans.

Unsecured loans have no collateral backing them. This means there is nothing to repossess and sell if the borrower defaults. That puts more risk on the lender, who seeks protection by charging a higher interest rate.

How Payday Loan Finance Charges Are Calculated

The average payday loan in 2021 was $375. The average interest or finance charge as payday lenders refer to it for a $375 loan would be between $56.25 and $75, depending on the terms.

That interest/finance charge typically is somewhere between 15% and 20%, depending on the lender, but could be higher. State laws regulate the maximum interest a payday lender may charge.

The amount of interest paid is calculated by multiplying the amount borrowed by the interest charge.

From a mathematical standpoint, it looks like this for a 15% loan: 375 x .15 = 56.25. If you accepted terms of $20 per $100 borrowed , it would look like this: 375 x .20 = 75.

That means you must pay $56.25 to borrow $375. That is an interest rate of 391% APR. If you pay $20 per $100 borrowed, you pay a finance charge of $75 and an interest rate of 521% APR.

Interest Rate Legal Limits

In our last example, the APR was 92%, in Canada this is over the legal limit. In fact, the legal limit for Canadians is 60% APR including fees and charges. There is an exception to this legal limit, payday loans. The payday loan industry is regulated provincially and has different legal limits.

A payday loan is a last resort loan in which you are lent an amount of money you must repay by your next payday this is typically a two week period. Payday lenders charge high-interest rates and fees to their customers in order to make short-term profit. Here is a chart presenting the legal limits allowed for payday loans per province.

Thinking of getting a payday loan, make sure you know your rights and responsibilities.

| Province |

Read Also: Can I Use A Va Loan For An Investment Property

What Are The Different Types Of Interest And Why Do They Matter

Interest comes in many forms, and borrowers and investors should get to know them, if they want the maximum bang for their buck.

Interest is the grease that that gets the credit and lending trains rolling, and is an integral part of the way money moves in the financial sector.

The broad definition of interest is straightforward.

Interest is the additional payment, , on top of the principal paid to a lender for the right to borrow money. The interest rate is expressed as an annual percentage rate, and the payment could be a fixed amount of money or rates paid on a sliding scale

Basically, interest is the toll you pay to travel on the credit highway, at a specific price and for a specific period of time.

Know these five keys about interest when you’re applying for credit or taking out a loan:

- The amount of interest paid depends on the terms of the loan, worked out between the lender and the borrower.

- Interest represents the price you pay for taking out a loan – you still have to pay off the base principal of the loan, too.

- Interest on loans is usually pegged to current banking interest rates.

- Your interest rate on a credit card, auto loan or another form of interest can also depend largely on your credit score.

- In certain cases, like with credit cards, your interest rate can rise if you’re late on a payment, or don’t make a payment.

Here’s a breakdown of the various forms of interest, and how each might impact consumers seeking credit or a loan.

What Credit Score Is Needed For A Personal Loan

Youll generally need a good to excellent credit score to qualify for a personal loan a good credit score is usually considered to be 700 or higher. Your credit score also plays a major role in determining what interest rates you qualify for. In general, the better your credit score, the lower the interest rates youll likely get.

Here are the credit score ranges you can typically expect to see as well as how they can affect the interest rates youre offered:

Poor :

Fair :

While there are several lenders that offer fair credit personal loans, you can generally expect to pay a higher interest rate. Having a cosigner might get you a better rate, even if you dont need one to qualify.

Good :

A good score greatly increases your chances of qualifying with several personal loan lenders. Youre also more likely to receive more favorable rates. While you likely wont need a cosigner to get approved for a loan, having one might help you get the best interest rates.

Fair :

Scores above 750 will qualify you for the vast majority of personal loans as well as help you get the lowest interest rates advertised by lenders.

Don’t Miss: Usaa Auto Financing

What Type Of Loan Is The Cheapest

What’s your cheapest option when you need a loan? The answer isn’t always the method with the lowest interest rate. Costs involved in any loan can vary widely, so add up all the fees and interestand understand the fine print. Availability and credit requirements are also critical factors. That said, some loans are decidedly less costly than others. Here are some of the cheapest options and how to find them.

Student Loan Private Lenders

When you’re looking to finance your education, it’s best to use all available federal loan options before you apply for a private student loan. Unlike federal loans, any private student loans require you to make payments while you are in school, and they also tend to be more expensive than federal loans. Interest rates for private loans either can be fixed or variable, depending the type of loan. The average student loan interest rate has a wide range but some lenders offer interest rates as low as 2%, and rates can run as high as 18%, based on credit score. Any undergraduate, graduate, or parent can apply for a private loan. Approval for student loans involves a credit score and history check. Due to most students’ lack of credit history, it helps to apply with a cosigner, typically a parent, to increase the likelihood of approval.

| Loan Type | |

|---|---|

| Private Loan Refinancing** | 2.57% – 8.24% |

*Range taken from six popular private lenders

**Fixed and variable rate range taken from six popular private refinancing lenders

Don’t Miss: Usaa Auto Loan Rates Today

Personal Loan Vs Credit Cards With Promotional Rates

If youre looking to consolidate debt, then you may want to consider credit cards with promotional rates instead of a personal loan. Many credit cards come with 0% introductory APR on purchases and balance transfers for as long as 15 months, and those go a long way in helping pay down debt if you can qualify for such offers. Keep in mind, however, that its strongly encouraged that you pay off the card within the introductory period. Otherwise you may face interest rates between 15% and 25%. Additionally, if you miss a payment, the 0% APR will revert to the regular purchase and balance transfer APR.

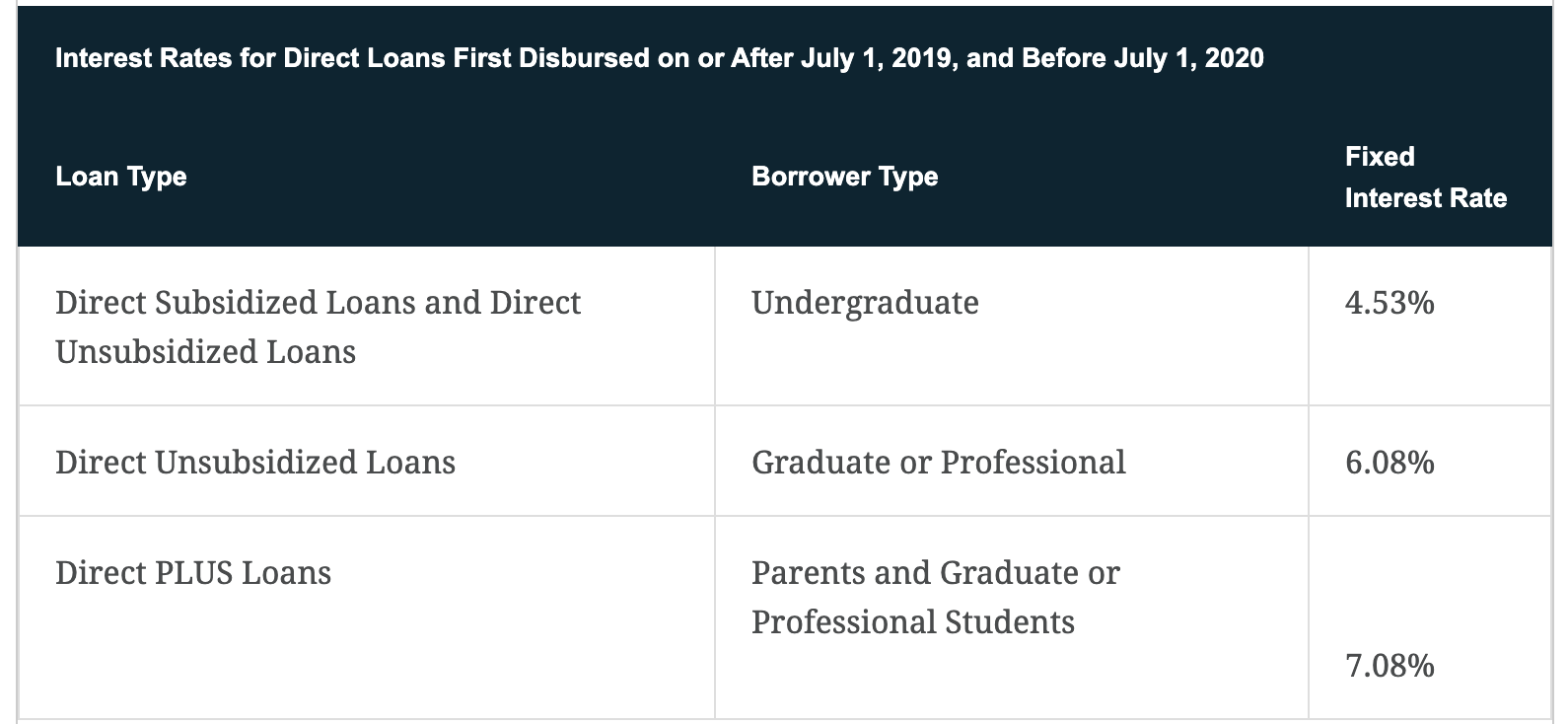

How Are Student Loan Interest Rates Set

Since 2013, federal student loan interest rates are set each year based on the 10-year Treasury note rate following the May auction .

There is a set margin of 2.05 percentage points for undergraduate student loans, 3.60 points for graduate student loans and 4.60 points for PLUS loans. Rates are fixed for the life of the loan, although rates for new loans are set each year.

Here are the calculations for 2017-18:

- Undergraduate student loans 40 rate plus 2.05 percentage points equals 4.45% interest rate.

- Graduate student loans 40 rate plus 3.60 percentage points equals 6.00% interest rate.

- PLUS loans 40 rate plus 4.60 points equals 7% interest rate.

The current interest rate system was established in 2013, when President Barack Obama signed the Bipartisan Student Loan Certainty Act. After July 1, 2013, all annual percentage rates were linked to the 10-year U.S. Treasury Rate. The law also capped all Stafford loan rates at 8.25% and 9.50% .

U.S. Sen. Richard Burr said the law has saved borrowers about $58-million in student loan interest since it was enacted.

Don’t Miss: Usaa Used Auto Rates

Best Mortgage Rates From Top Lenders

We looked at the 40 biggest mortgage lenders in 2020 to see how their interest rates stacked up.

The 25 companies with the best mortgage rates on average are as follows:

| Mortgage Lender | |

| Citizens Bank | 3.27% |

Note that average rates shown in this table are from 2020, when rates were near record lows almost all year. Todays mortgage rates could be higher than whats shown.

You can still use last years interest rates as a tool to compare lenders side by side. But before you lock in a loan, youll want to get custom interest rates from a few different lenders to make sure youre getting the best deal available today.

What Are Current Mortgage Rates

Current mortgage and refinance rates are still at historic lows, creating great deals for home buyers and homeowners.

Comparing loan offers from a variety of lenders is key to finding your best rate. But rate shopping is just one part of the home buying process.

Getting the right loan type and saving money on closing costs and other fees can help you lower your overall borrowing costs.

Be sure to look at fees, loan terms, and longterm borrowing costs as well as interest rates when youre mortgage shopping. Thats the surest way to save money on your new home loan.

1Top 40 lenders for 2020 sourced from S& P Global, HousingWire, and Scotsman Guide.

2Rate and fee data were sourced from self-reported loan data that all mortgage lenders are required to file each year under the Home Mortgage Disclosure Act. Averages include all 30-year loans reported by each lender for the previous year. Your own rate and loan costs will vary.

Read Also: 1-800-689-1789

Borrowing From Retirement & Life Insurance

Those with retirement funds or life insurance plans may be eligible to borrow from their accounts. This option has the benefit that you are borrowing from yourself, making repayment much easier and less stressful. However, in some cases, failing to repay such a loan can result in severe tax consequences.

Learn more about retirement accounts.

Todays Best Mortgage Rates

Mortgage rates can change on a daily basis. If youre in the market for a home loan, youll want to keep an eye on those movements.

Knowing when rates are rising or falling can help you decide when to lock a rate especially if youre refinancing. And it can give you some idea of how competitive your own rates are compared to the overall market.

To give you a basis for comparison, here are todays best mortgage rates according to our lender network.*

| Loan Type | |

| VA 15-Year Fixed | % |

*Rates shown here are based on a daily survey of The Mortgage Reports lender network. Your own rate will be different. See our full mortgage rate assumption here.

Also Check: Can You Use The Va Loan To Buy Land

When You Should Get A Personal Loan

The best reason to get a personal loan is to consolidate debt. As long as you get a favorable interest rate and make payments on time, youll be benefitting from the simplicity and lower payments of a single loan that takes the place of multiple credit cards or other loans with varying and higher APRs. Home repairs, such as termite extermination and leaking roofs, are also sensible reasons for personal loans, but you need to have a solid plan for repaying the debt.

Payments Made After 120 Days

You make a payment after 120 days from the disbursement date on any of your loans.

Auto Pay, Pay Online, U.S. Mail, or Bill Payment Service

Your payment will be applied in this order:

* For loans in forbearance, any amount that goes to principal will be applied to the highest interest rate loans, beginning with unsubsidized loans.

** For PLUS loans that are in repayment, have an active Payment Schedule and Disclosure, and have disbursements within 120 days, the payments will automatically be applied to interest and principal. If you want payments during this time to be applied as a refund, please send a written request asking for it to be treated as a refund. Keep in mind that the refund will not be considered a monthly payment so upcoming monthly payments will still be due.

For a Direct subsidized loan taken out after July 1, 2012 and before July 1, 2014, interest is not subsidized during the loan’s grace period. You’re responsible for interest that accrues during your grace period. If you make payments during your grace period, any paid interest will not be capitalized.

Your student loan agreement requires us to follow federal rules on how we apply payments. The rules require that a payment be applied first to outstanding interest, and any remaining amount is applied to the principal balance.

$100

Recommended Reading: What Happens If You Default On A Sba Disaster Loan

Types Of Credit Options

The two major categories for consumer credit are open-end and closed-end credit. Open-end credit, better known as revolving credit, can be used repeatedly for purchases that will be paid back monthly. Paying the full amount due every month is not required, but interest will be added to any unpaid balance.

The most common form of revolving credit is credit cards, but home equity lines of credit also fall in this category.

Credit card holders incur interest charges when the monthly balance is not paid in full. The interest rates on credit cards average 16%, but can be as high as 30% or more, depending on the consumers payment history and credit score. Loans for bad credit may be hard to find, but lower interest rates are available through nonprofit debt management programs, and credit scores are not a factor.

Closed-end credit is used to finance a specific purpose for a specific period of time. They also are called installment loans because consumers are required to follow a regular payment schedule that includes interest charges, until the principal is paid off.

The interest rate for installment loans varies by lender and is tied closely to the consumers . The best interest rates go to borrowers with credit scores of 740 and higher. Interest rates go up as credit scores go down.

The lending institution can seize the consumers property as compensation if the consumer defaults on the loan.

Borrowing From Friends And Family

Borrowing money from friends and relatives is an informal type of personal loan. It can result is considerably less interest and administrative fees for the borrower, but it isnt always a good option. A few missed payments may strain a relationship. To protect both parties, its a good idea to sign a basic promissory note.

Learn more about borrowing from friends and family.

You May Like: Usaa Car Loan Pre Approval

Types Of Consumer Credit & Loans

Consumer loans and credit are a form of financing that make it possible to purchase high-priced items you cant pay cash for today.

Banks, and online lenders are the source for most consumer loans and credit, though family and friends can be lenders, too.

The loans and credit come in many forms, ranging from something as simple as a credit card to more complex lending like mortgages, auto and student loans.

Regardless of type, every loan and its conditions for repayment is governed by state and federal guidelines intended to protect consumers from unsavory practices like excessive interest rates. In addition, loan length and default terms should be clearly detailed in a loan agreement to avoid confusion or potential legal action.

In case of default, terms of collection for the outstanding debt should specify clearly the costs involved. This also applies to parties in promissory notes.

If you need to borrow money for an essential item or to help make your life more manageable, its a good thing to familiarize yourself with the types of credit and loans that might be available to you and the terms you can expect.

Why Do Banks Charge Higher Interest Rates On Loans

When demand is low, such as during an economic recession, like the Great Recession, which officially lasted between 2007 and 2009, banks can increase deposit interest rates to encourage customers to lend, or lower loan rates to incentivize customers to borrow. Local market considerations are also important.

Also Check: Usaa Auto Loan Interest Rates

What Is An Origination Fee

Some lenders charge an origination fee on personal loans, which can include application costs, underwriting, funding, and other associated administrative services. The amount of this fee can vary by lender but is typically between 1% and 8% of your loan amount.

Also note that an origination fee is usually deducted from your loan proceeds before you get your funds. For example, if you borrow $15,000 with a 5% origination fee, $750 would go to the fee, and youd receive $14,250.

If the lender you choose charges an origination fee, be sure to consider it when choosing your loan amount otherwise, you could end up with less money than you need.