Know Exactly What You Can Afford

While it’s important to take your time to find the best deals available, it’s crucial that you make sure your new car payment works for your budget.

To determine how much car you can afford, factor in all of the costs that come with buying and owning a car, including:

- Loan payments: This includes both the principal amount of the loan and its interest charges. Your loan amount will include your vehicle’s sales price as well as taxes, fees and add-ons like service contracts. What you’ll pay every month depends on your loan amount, loan term and interest rate.

- Auto insurance: A lot of factors go into deciding your insurance premiums, including the make, model, age and condition of your vehicle. Get a quote from an insurer to find out what to expect. In many states, your credit score is another factor that determines what you’ll pay for insurance.

- Maintenance and repairs: Every car requires maintenance and repairs over time, but the older the vehicle, the likelier it is that you’ll have these expenses on the regular. Buying an older car may save you upfront costs but you’ll have to plan for when things may go wrong.

- Fuel: Depending on how much time you spend behind the wheel and the fuel economy of your vehicle, run some numbers to determine how much you’ll be paying in gas.

Carvana: Best Fully Online Experience

Overview: Carvana lets you shop for a car online and pick up your purchase from a giant car vending machine. Its process lets you enjoy a unique experience, yet Carvana also offers competitive car loan rates and terms.

Perks: Carvana is a great option for those who want to shop for their new car from home, as well as those with poor credit. Carvanas only requirements are that you are at least 18 years old, make $4,000 in yearly income and have no active bankruptcies. When you prequalify, Carvana does not make a hard inquiry on your credit, so your credit score wont be impacted; a hard inquiry is made only once you place an order.

What to watch out for: After you are prequalified, you have 45 days to make a purchase from Carvana inventory and either pick up the car, have it delivered to you or fly to the car and then drive it back.

| Lender |

|---|

| Varies |

Other Ways To Reduce Your Auto Loan Interest Rate

Banks and credit unions charge interest to compensate for the risk they take on when lending money. So one key to lowering your interest rate is to reduce the risk you present to prospective lenders. Here are some ways to do that:

Consider these and other ways to reduce your interest rate before it’s time to negotiate with the dealer or lenders.

Recommended Reading: When Do Student Loan Payments Start After Graduation

What Is A Good Interest Rate For My Credit Score

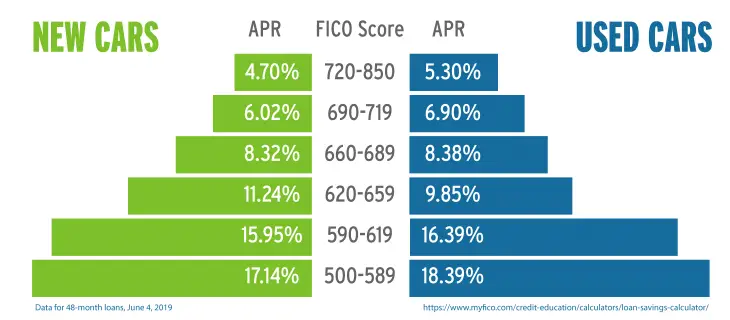

The interest rate you receive depends on your credit score as well as the size of the loan. And while they can be negotiated, on average, drivers can find an interest rate ranging from 3.2% to 12.9%. Based off of credit scores, here are estimated interest rates:

- 800 – 740 Credit Score — 3.2% average interest rate

- 739 – 680 Credit Score — 4.5% average interest rate

- 680 Credit Score and Below — 6.5% – 12.9% average interest rate

What Is A Good Interest Rate On A Car

What is a good interest rate on a car? Several factors can influence the interest rate that lenders will offer you. It’s wise to come prepared with knowledge and strategies before entering into negotiations for a car loan.

What is a good interest rate on a car? Several factors can influence the interest rate that lenders will offer you. It’s wise to come prepared with knowledge and strategies before entering into negotiations for a car loan. You can take steps to potentially reduce your car loan rate if you prepare beforehand.

Don’t Miss: Who Can Qualify For An Fha Loan

Financing Through A Bank

Bank financing involves going directly to a bank or credit union to get a car loan. In general, you’ll get preapproved for a loan before you ever set foot in the dealership. The lender will give you a quote and a letter of commitment that you can take to the dealer, saving yourself some time when finalizing the contract. Having a specific approved loan amount on paper could also keep the car salesperson from trying to persuade you to include add-ons that you don’t need.

Depending on the bank or credit union, you can apply for preapproval online or at a local branch. You may need to provide information about the vehicle, which could cause some delays if you’re not yet sure what you want.

The rate offer from a bank or credit union will be the true interest rate and doesn’t include any markup, which can happen when you work with a dealer. In general, though, the rate quote you get isn’t a final offer. When you head to the dealership to purchase the car, the lender will run a hard credit check and review your full credit report before approving your application and determining your loan rates.

One thing to keep in mind is that your options may vary depending on whether you’re buying a new or used car. Some banks and credit unions have limits on the vehicle’s age and mileage, and new vehicles may qualify for lower interest rates in general.

Can I Finance A Car Even If I Have No Credit

When you have low or no credit you might feel anxious about the loan options available to you. There are many valid reasons why a person may have no credit including simply being too young to have built any or being new to Canada. If you have no credit history, dont worry. We are pleased to help match you with a financing option that uniquely suits your needs. Apply for auto financing at Autorama and let us help you find the perfect solution when it comes to your auto loan and vehicle too. For more information on no credit financing see our previous article,Financing a Car With Little or No Credit.

You May Like: What Is Fha And Conventional Loan

Opt For A Shorter Loan Term

Another important factor is the length of your loan. The longer your loan term is, the longer youll have to keep making payments. That means that, even if the APR stays the same, youll end up paying more in total. For instance, a five-year, $15,000 loan at 4% costs $16,575 ;$632 more than a three-year loan at the same APR.

However, longer-term loans usually dont have the same APR as shorter ones; theyre usually higher. According to ValuePenguin, the average APR for a three-year loan is 3.71%; for a five-year loan, its 3.93%. So choosing a shorter loan term will save you money twice: the APR will be lower, and the payments wont last as long.

How To Get The Best Car Interest Rates

If you are like many prospective car buyers, you will need to take out a car loan in order to make the purchase of a new car. There are many considerations to think about when youre figuring out how much car you can afford and how much your loan will cost you in the short and long term.

But theres one often-overlooked factor that can make a big difference: your auto loans interest rate.

The chart below shows the average 60-month auto loan rates by credit score

Getting the best interest rate possible on a car loan can save you hundredsif not thousandsof dollars on the total cost of your vehicle over the long run. While it may not always be possible to get the interest rates that you see advertised on TV, it is still possible to secure a good interest rate if you put in some preparation ahead of time.

Here, you can learn what it takes to get the best interest rate on your next big car purchase.

You May Like: Is It Too Late To Apply For Ppp Loan

How Is Interest Calculated On A Car Loan

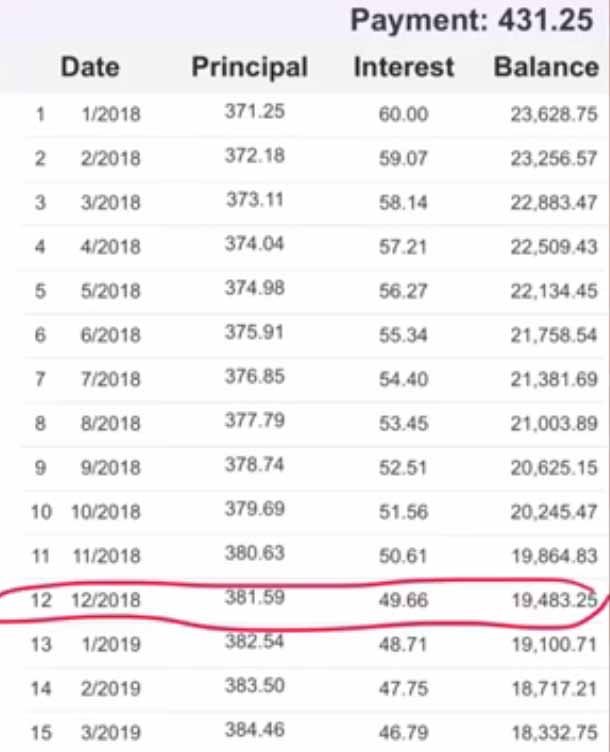

Lenders calculate interest on auto loans in one of two ways simple or precomputed. With a simple interest loan, your interest is calculated based on your loan balance on the day your car payment is due. The amount of interest you pay each month changes. On a car loan with precomputed interest, the interest is calculated at the start of your loan and based on your total loan amount. The amount of interest you pay each month remains the same. Lets take a closer look at each type of interest.

Structure My Deal Recent Activity

Structure My Deal tools are complete you’re ready to visit Land Rover of Naperville!

We’ll have this time-saving information on file when you visit the dealership.

- Access your saved cars on any device.

- Receive Price Alert emails when price changes, new offers become available or a vehicle is sold.

- Securely store your current vehicle information and access tools to save time at the the dealership.

- Access your saved cars on any device.

- Receive Price Alert emails when price changes, new offers become available or a vehicle is sold.

- Securely store your current vehicle information and access tools to save time at the the dealership.

Make the most of your shopping experience!

Also Check: Is My Home Loan Secured

Is It Better To Get An Auto Loan From A Bank Or Dealer

Dealerships typically have a network of partner lenders, including banks, credit unions and financing companies. But dealers can and often do mark up that rate for their own profit.

The only way for you to know what rate you deserve is to get your own preapproved offers. Apply to lenders directly, or fill out a single form at LendingTree, and receive up to five auto loan offers from lenders, depending on your creditworthiness.

Refinancing A Car Loan During The Pandemic

Consider these five factors before moving forward with a refinance:

1. The interest rate on your loan. If the interest rate on your current car loan is higher than youd like, look around at different banks and credit unions to see what comparable lenders are charging. Getting a better interest rate is the main reason people refinance, as it means lower and more manageable monthly payments.

Even if you can only reduce your car payment by just a bit, that small amount might be worth the effort and up-front expense. For example, lowering your car payment by just $25 per month when you have three years left on your loan can result in $900 of overall savings.

2. The state of your credit scores. Your ability to secure a lower interest rate through refinancing depends on your credit history and credit scores. Therefore, you are in a good position to refinance if your credit has improved since you got your current auto loan. Refinancing can also help improve your credit scores if youre struggling to make your car payments on time and in full.

If your credit has not improved since getting your original auto loan, you probably will not benefit from refinancing as its unlikely that youll qualify for a better interest rate.

Additionally, its important to remember that a shorter loan term will mean that you increase the amount you pay each month, so make sure this additional expense is something youre prepared to cover in your monthly budget.

Recommended Reading: How To Get Loan Signing Jobs

How To Get Lower Interest On A Car Loan

Can you lower interest rates on a car loan? How can I lower my car loan interest rate? There are a number of strategies to getting a lower interest rate on auto loans, and Land Rover of Naperville has laid them out in a handy guide. Learn more below, and if you have any questions about auto loans near Aurora, the experts at our finance department can go over all your options.

How Do You Get Prequalified For An Auto Loan

You can get prequalified for an auto loan online and without ever leaving your home. All you have to do is select one of the lenders on this list and choose its online option to get prequalified or apply for a loan. Many lenders let you get prequalified for an auto loan without a hard inquiry on your credit report.

Also Check: Which Bank Gives Loan For Land Purchase

When You Shouldnt Refinance Your Car Loan

If youre in the middle of shopping for a personal loan, mortgage or other financing option, now is not the right time to refinance your auto loan. Applying for a loan would hurt your credit score and possibly cause you to receive a higher interest rate on any loan offers.

If your current auto loan has a prepayment penalty, then refinancing could incur that penalty. Depending on the penalty and your current interest rate, it may not be worth refinancing. If youre not sure whether your loan has a prepayment penalty, look up the loan contract or call the lender and ask them. Some prepayment penalties only apply if you recently took out the loan, so its best to verify over the phone or through documentation.

Can I Negotiate The Interest Rate On An Auto Loan With The Dealer

Yes, just like the price of the vehicle, the interest rate is negotiable.

The first rate for the loan the dealer offers you may not be the lowest rate you qualify for. With dealer-arranged financing, the dealer collects information from you and forwards that information to one or more prospective auto lenders. Those lender may propose a rate to the dealer to finance the loan, referred to as the buy rate or may decline to finance the loan. The interest rate that you negotiate with the dealer may be higher than the buy rate because it may include an amount that compensates the dealer for handling the financing.; Dealers may have discretion to charge you more than the buy rate they receive from a lender, so you may be able to negotiate the interest rate the dealer quotes to you. Ask or negotiate for a loan with better terms. Be sure to compare the financing offered through the dealership with the rate and terms of any preapproval you received from a bank, credit union, or other lender. Choose the loan that best fits your budget.

TIP:

Ask or negotiate for a loan with better terms. ;Since dealers and lenders are not generally required to offer you the best rates available, negotiating like this could save you hundreds or thousands of dollars over the life of the loan.

Read Also: What Are Assets For Home Loan

Can I Sell My Car With A Loan

It is possible to sell your car with an outstanding loan, but you may have to go through a few extra steps. If your car is worth less than what you currently owe on the loan, you have what’s known as negative equity meaning you may need to pay the difference out of pocket or refinance the remaining amount with a different type of loan.

If your car is worth more than what you currently owe, on the other hand, you may be able to pocket the difference in cash when you sell the car. Whatever your situation, reach out to your lender about your options, as each lender sets different rules for selling a car with a loan.

Visit Infiniti Of Tacoma At Fife For More Information

At INFINITI of Tacoma at Fife, well work with you to get you behind the wheel best suited for you while creating a package that wont break the bank. Whether youre looking for details on how you can lower your interest rate on a car loan or need assistance finding your next luxury vehicle, be sure to contact us at your earliest convenience.

- Inventory

Don’t Miss: Is My Loan Fannie Mae

What To Know Before Applying For An Auto Loan

When looking for a car loan, it’s best to shop around with a few lenders before making your decision. This is because each lender has its own methodology when approving you for a loan and setting your interest rate and terms.

Generally, your credit score will make the biggest impact in the rates offered. The higher your credit score, the lower APR you’ll receive. Having a higher credit score may also allow you to take out a larger loan or access a broader selection of repayment terms. Choosing a longer repayment term will lower your monthly payments, although you’ll also pay more in interest overall.

If you’ve found a few lenders that you like, see if they offer preapproval going through this process will let you see which rates you qualify for without impacting your credit score.

Tips To Getting A Lower Interest Rate On Auto Loans

Also Check: What Are The Qualifications For Rural Development Loan