Upcoming Eligible Usda Map Changes

USDA had slated changes to its eligibility maps for October 1, 2015. However, according to a source inside USDA, map changes had been postponed.

According to the source, eligibility maps are now reviewed every three to five years. The last review happened in 2014.

USDA runs on a fiscal year of October 1 through September 30. This is why most big changes to the program happen in October. For this reason, watch for a geographical boundary change on October 1, 2020.

Changes are more likely in 2020 and 2021. The reason: The 2020 census. USDA bases its maps on these US-wide population counts that happen every 10 years. Since the USDA has not made major changes to maps since the year 2000, its becoming more and more likely that big updates will happen soon.

Verify A Home’s Address For A Usda Loan

If your prospective home falls near or in an area that does not appear to meet the rural designation, a USDA-approved lender can verify the address through the USDA’s online portal.

To verify your address for a USDA loan, it is best to speak with a USDA-approved lender. A USDA-approved lender can verify all properties you are interested in and ensure you don’t waste valuable time on properties that may not be eligible.

More:Connect with a USDA lender.

Does Usda Offer A Streamline Refinance Program

Yes. To qualify, the borrower must currently have a USDA loan currently and must live in the home. The new loan is subject to the standard funding fee and annual fee, just like purchase loans. Refinancing borrowers must qualify using current income but may qualify with higher ratios than generally accepted if the payment is dropping and they have made their current mortgage payments on time.

If the new funding fee is not being financed into the loan, the lender may not require a new appraisal.

Read Also: Is Federal Student Loan Forgiveness Real

What Is A Usda Rural Development Loan

The USDAs Rural Development Program guarantees loans made through its Single-Family Housing Loan initiative. The goal is to make housing more affordable for people with limited financial resources living in rural communities by offering low-interest, fixed-rate loans. These loans come with 100-percent financing, zero down payments and generous repayment terms.

USDA Rural Development loans come in two formsthe Single-Family Housing Direct Loan Program and the Single-Family Housing Guaranteed Loan Program:

-

Single-Family Housing Direct Loan Program: USDA Rural Development provides low-interest, fixed-rate homeownership loans directly to qualified applicants. This is also known as the Section 502 Direct Loan Program and may provide payment assistance subsidies that reduce interest rates to as little as 1 percent as well as offer extended repayment terms.

-

Single-Family Housing Guaranteed Loan Program: Private lenders offer fixed-rate loans that USDA Rural Development guarantees for qualified applicants. USDA provides lenders with a 90% loan note guarantee for 100% financing, eliminating the need for a down payment.

USDA Rural Development Loans are meant to help people with low or moderate-income levels buy, build, relocate, repair or renovate a home. You can also use USDA loans to purchase land and prepare a site or lot for a home you intend to build upon.

Benefits And Disadvantages Of A Usda Loan

A USDA guaranteed loan is a great option for some people. The biggest benefit of this loan is that it will offer competitive rates. Often, USDA loan rates are more affordable than conventional loan rates. In addition, your USDA mortgage may be easier to qualify for if you have a limited credit score.;

The major disadvantage of a USDA mortgage is its location restriction. You have to be willing to buy a home in an area that is rural. You also need to fall within income limits, which may not work for all individuals and families.;

Recommended Reading: How Do I Get My Student Loan Number

Usda Loans Have Been Cheaper Since 2016

On October 1, 2016, USDA reduced its monthly fee from 0.50% to 0.35%. Your monthly cost equals your loan amount or remaining principal balance, multiplied by 0.35%, divided by 12.

Additionally, the upfront fee fell from 2.75% to just 1.00%. This is a good opportunity for home buyers to get lower monthly payments with this loan program.

What Are The Income Requirements For A Usda Backed Mortgage

Typically, no more than 41% of your income should be allocated to future home payments and other outstanding debt. This debt to income ratio may be increased based on higher credit scores. However, it is important to note that if your household income exceeds 115% of the median income in the area of your home, you will be ineligible for a USDA loan.

Recommended Reading: What Kind Of Loan Do I Need To Buy Land

Usda Loan Qualifications Faqs

Who qualifies for a USDA loan?

To be eligible for a USDA loan, you must purchase a home in a qualifying location and meet the USDA income limit requirements. Lenders will also look at your credit score, debt-to-income ratio, and other factors to determine your creditworthiness and how much you can borrow.

What are the income limits for USDA loans?

In general, borrowers must have an adjustable household income equal to or less than 115% of the median income in the area of the home for sale.

What disqualifies a home from USDA financing?

A home may not be eligible for USDA financing if it is not rural in character, is too small or too large, does not meet USDA appraisal guidelines, and does not pass the USDA appraisal process.

Single Family Housing Guaranteed Loan Program

- National Homeownership Month:Annual Lender Rankings

What does this program do?;

The Section 502 Guaranteed Loan Program assists approved lenders in providing low- and moderate-income households the opportunity to own adequate, modest, decent, safe and sanitary dwellings as their primary residence in eligible rural areas. Eligible applicants may purchase, build, rehabilitate, improve or relocate a dwelling in an eligible rural area with 100% financing. The program provides a 90% loan note guarantee to approved lenders in order to reduce the risk of extending 100% loans to eligible rural homebuyers so no money down for those who qualify!

Who may apply for this program?Applicants must:

- Meet income-eligibility

- Agree to personally occupy the dwelling as their primary residence

- Be a U.S. Citizen, U.S. non-citizen national or Qualified Alien

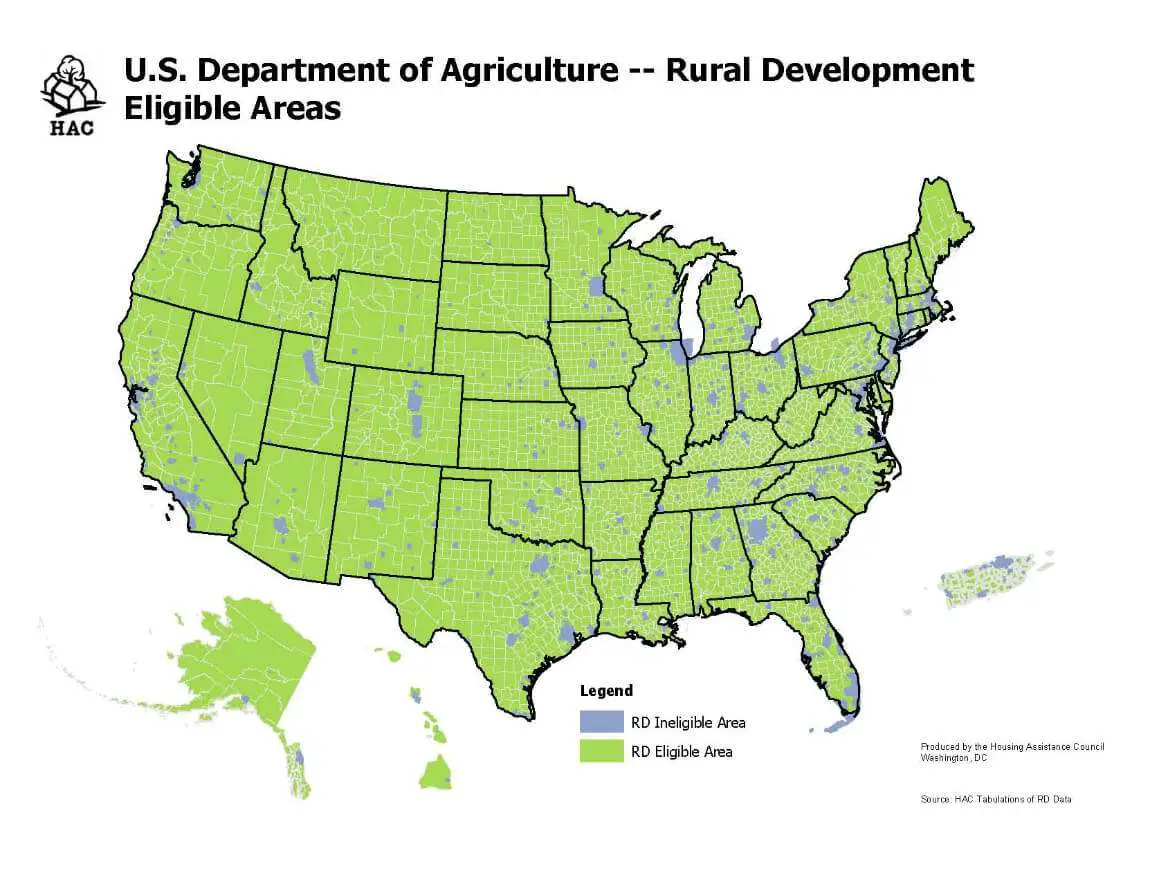

What is an eligible rural area?Utilizing this USDA’s;Eligibility Site you can enter a specific address for determination or just search the map to review general eligible areas.;

Why does Rural Development do this?

This program helps lenders work with low- and moderate-income households living in rural areas to make homeownership a reality. Providing affordable homeownership opportunities promotes prosperity, which in turn creates thriving communities and improves the quality of life in rural areas.;

How do I apply?

This list of;active lenders is searchable by state and every effort is made by the SFHGLP team to keep this up to date.

Also Check: Are Va Loan Interest Rates Lower

Usda Loan Limits 2021

Heres another great feature of USDA Single-Family Guaranteed Loans: There are no loan limits, or caps on the amount a lender can approve you for on the loan.

However, your finances will determine your borrowing power. Even without USDA loan limits, a lender will cap your loan amount based on your income, credit score, DTI, and down payment.

The USDA programs income requirements indirectly curtail loan size, since lenders wont approve loans likely to create financial hardship for applicants, Martucci said. Thats why, depending on the location, USDA loans larger than $400,000 are uncommon.

There are loan limits for the USDA Single-Family Direct Loan program, but the majority of USDA borrowers take out Guaranteed loans and will not be subject to loan limits. USDA Direct loans are issued by the USDA itself, not through private lenders, and are geared toward very low- and low-income borrowers.

Usda Mortgage Lenders In Nc And Sc

Only USDA approved lenders can offer USDA home loans. Dash is an approved USDA mortgage lender that offers USDA loans throughout North Carolina and South Carolina. If youre interested in a USDA loan, get in touch. We have offices in Charlotte and Raleigh, and were always available to help you.;

Let’s get started

You May Like: Who Can Qualify For An Fha Loan

Usda Loan Eligibility In North Carolina And South Carolina

To get a USDA rural home loan, you will need to meet specific requirements, most notably purchasing a home in a rural area. To help you determine if your home is in a rural area, you can use the USDA eligibility map. The USDA eligibility map will help you find areas in North Carolina and South Carolina that have a population under 20,000 people, meaning they fit the rural designation put in place by the U.S. Department of Agriculture. You can check out eligibility maps through the USDA.

USDA Loans in NC: Eligibility Areas

North Carolina has a large number of rural areas that may be eligible for USDA loans. Areas that are not eligible typically surround major cities, including Charlotte, Raleigh, Fayetteville, Jacksonville, Greenville, Wilson, Wilmington, and Greensboro. Youre likely to be eligible for a USDA loan in NC if you are planning to buy a property thats a significant distance from these cities.

USDA Loans in SC: Eligibility Areas

Similar to North Carolina, the areas in and around major cities are not eligible for USDA loans in SC. Some of those major cities include Columbia, Florence, Spartanburg, Myrtle Beach, Charleston, Greenville, Anderson, Aiken, and Rock Hill.

Other USDA Loan Eligibility Requirements

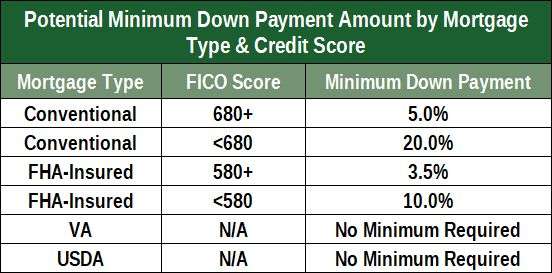

The USDA rural housing loan has additional requirements such as having proof of a steady job and income, as well as a FICO credit score of at least 640 and a debt-to-income ratio of 41 percent or less.

Shop Around For A Usda

This is the fun part: going on home tours and scrolling through Zillow. Whatever home youre seeking should be in an approved rural or suburban area. Otherwise, you wont be eligible for the USDA loan. Additionally, you should prepare to live in the home you purchase, since vacation homes and investment properties are not allowed.

Once youve put in an offer and been approved, youll start the underwriting process. USDA loans take longer to underwrite , so talk to your loan officer about the expected timeline. USDA mortgage applications are paperwork-heavy, says Green. You dont want long approval times to jeopardize your closing date.

Read Also: How To Get Sba 7a Loan

Usda Loan Eligibility Requirements

USDA loans are mortgages designed to stimulate homeownership and the economies of rural areas across the U.S. You can only take advantage of a USDA loan if you agree to purchase a home in a qualified rural area. The location must meet certain guidelines and meet state property eligibility requirements. Here are some other quick facts about USDA loans:

- The USDA has strict rules regarding income levels. These rules depend on the location of the home youd like to buy and the number of people in your household. Youre ineligible for a USDA loan if your household income exceeds 115% of the median income for your area. Select your state to see the income limits for the county where you plan to purchase your home.

- You must have a of at least 640. Your credit score is a three-digit number that shows how consistent you are in paying back debt.

- Your debt-to-income ratio , or the amount you spend versus how much income you have coming in, must be fairly low, around 50% or less.

- USDA loans are zero-down loans, which means youre not required to have a down payment.

Qualifying For A Usda

Income limits to qualify for a home loan guarantee vary by location and depend on household size. To find the loan guarantee income limit for the county where you live, consult this USDA map and table.

USDA guaranteed home loans can fund only owner-occupied primary residences. Other eligibility requirements include:

-

U.S. citizenship

-

A monthly payment including principal, interest, insurance and taxes thats 29% or less of your monthly income. Other monthly debt payments you make cannot exceed 41% of your income. However, the USDA will consider higher debt ratios if you have a above 680.

-

Dependable income, typically for a minimum of 24 months

-

An acceptable credit history, with no accounts converted to collections within the last 12 months, among other criteria. If you can prove that your credit was affected by circumstances that were temporary or outside of your control, including a medical emergency, you may still qualify.

Applicants with credit scores of 640 or higher receive streamlined processing. Below that, you must meet more stringent underwriting standards. You can also qualify with a nontraditional credit history.

Applicants with credit scores of 640 or higher receive streamlined processing. Those with scores below that must meet more stringent underwriting standards. And those without a credit score, or a limited credit history, can qualify with nontraditional credit references, such as rental and utility payment histories.

You May Like: How To Transfer Car Loan To Another Person

Usda Mortgage Insurance Requirements

The USDA single-family housing guaranteed program is partially funded by borrowers who use USDA loans.

Via mortgage insurance premiums charged to homeowners, the government is able to keep the USDA rural development program affordable.

USDA last changed its mortgage insurance rates in;October 2016. Those rates remain;in effect today.

Todays USDA mortgage insurance rates are:

- 1.00% upfront fee, based on the loan size

- 0.35% annual fee, based on the remaining principal balance

As a real-life example of how USDA mortgage insurance works, lets say that a home buyer in Cary, North Carolina is borrowing $200,000 to buy a home with no money down.

The buyers mortgage insurance costs include a $2,000 upfront mortgage insurance premium, plus a monthly $58.33 payment for mortgage insurance.

Note that the USDA upfront mortgage insurance is not required to be paid as cash. It can be added to your loan balance to reduce your funds required at closing.

Do I Qualify For A Usda Home Improvement Loan And Grant

The USDA also runs the Housing Repair Loan & Grants program to help very-low-income individuals restore or improve their homes in USDA-designated areas. Eligible borrowers 62 or older can use grants of up to $7,500 to remove hazardous or dangerous material from their homes.

You must meet the following requirements to qualify for a USDA home improvement loan or grant.

- Be unable to obtain affordable credit elsewhere

- Have a family income ranking below 50% of the median income in your area

- For grants: be age 62 or older and unable to repay a repair loan

Recommended Reading: What Are Assets For Home Loan

How Usda Loans Work

Using a USDA loan, buyers canfinance 100 percent of a homes purchase price whilegetting access to better-than-average mortgage rates. This is because USDAmortgage rates are discounted as compared to other low-down paymentloans.

Beyond that, USDA loans arent allthat unusual.

The repayment schedule doesntfeature a balloon or anything non-standard; the closing costs are ordinary;and, prepayment penalties never apply.

The two areas where USDA loans are different is with respect to the loantype and down payment amount.

- With a USDA loan, you dont have to make a down payment. This is one of only two major loan programs that allow zero-down financing

- The USDA loan program requires you to take a fixed-rate loan. Adjustable-rate mortgages are not available via the USDA rural loan program

Rural loans can be used byfirst-time home buyers and repeat home buyers alike.Homeowner counseling is not requiredto use the USDA program.

What Are The Qualifications For A Usda Loan In Michigan

Lastly, qualifying for a USDA Rural Development Loan is easier than conventional financing. You may be able to eligible buy a home with only 2 years following a bankruptcy and only 3 years after a foreclosure. Conventional financing requires 4 years after bankruptcy and 7 years after a foreclosure.

Riverbank Finance is a locally owned Michigan mortgage company specializing in home loans. Let us know how we can help your family with your next home purchase or mortgage refinance!

Submit your information now and a licensed residential loan officer will contact you within 24 hours. If you need immediate assistance then please call us now at 1-800-555-2098!

Riverbank Finance LLC is a Michigan mortgage company in Grand Rapids, MI specializing in mortgage home loans for both refinancing and new home purchase mortgages. Our extensive list of mortgage programs allows us to offer competitive low wholesale mortgage rates. We hire only the best licensed loan officers to serve our clients and take pride in our superb customer service.

Also Check: What’s Better Refinance Or Home Equity Loan

How Do I Apply For A Usda Loan

The process for getting a USDA loan will differ depending on whether youre getting a guaranteed or direct loan. Since most USDA borrowers have guaranteed loans, well offer directions for that process here. If you have low income and are considering a loan directly through the USDA, we recommend checking your eligibility and contacting your local USDA office, which will have an application available to you.;

Advantages Of Usda Loans

You might be able to become a homeowner sooner without this obstacle in your way.

Lower interest rates

You can lock in a lower interest rate with a USDA loan than a conventional loan, especially if you have a good to excellent credit score. This could save you tens of thousands of dollars in interest over the lifetime of the loan.

Less expensive mortgage insurance;

Although USDA loans do require mortgage insurance called a guarantee fee, it’s much more affordable than private mortgage insurance and FHA insurance. You’ll pay an upfront fee at closing equal to;1% of your loan amount;and 0.35% of the loan amount annually .;

More thorough appraisal

Lenders order an appraisal to determine a property’s value before finalizing your loan. This ensures they are not lending you more money than the home is worth, protecting their investment. USDA appraisals have;stricter guidelines;than conventional loans, which could save you from pulling the trigger on a home requiring expensive repairs.

Designed for low-income buyers

If a conventional lender has turned you down because of your income, a USDA loan might be the right option towards homeownership.;

Recommended Reading: Does Applying For Personal Loan Hurt Credit