Requirements For New Middle School And Secondary School Teachers:

In addition to the requirements for all teachers, new middle school and secondary school teachers must demonstrate a high level of competency in each of the subject areas they teach, specifically by EITHER:

- passing a rigorous state academic subject test in each of those areas OR

- completing an academic major, a graduate degree, the coursework equivalent to an undergraduate academic major, or an advanced certification or credential in each of the academic subjects in which they teach.

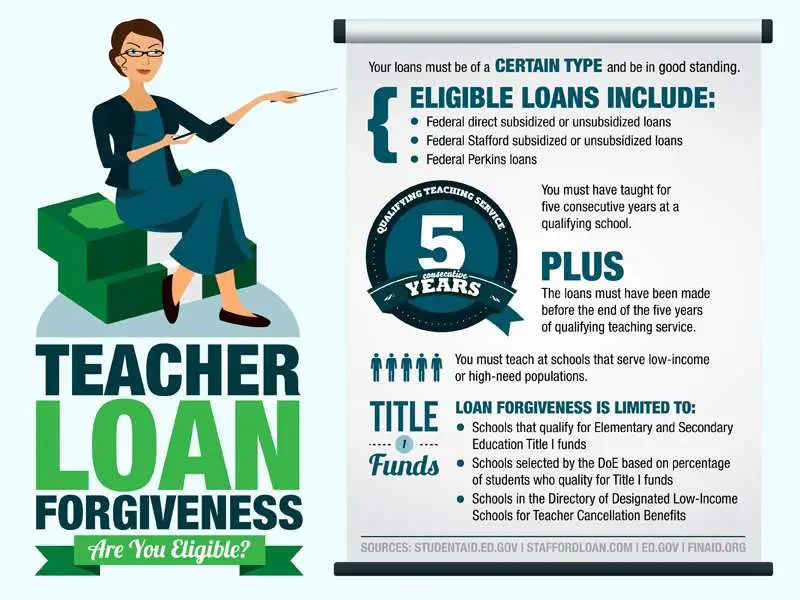

How Does Teacher Loan Forgiveness Work

There’s more than one way to achieve student loan forgiveness for teachers, but the teacher loan forgiveness program is the most prominent. The program is designed for qualified teachers who have eligible loans and have taught at an eligible school or schools for at least five consecutive years.

This time requirement is half the time it takes to qualify for forgiveness under the Public Service Loan Forgiveness program, which is another way teachers can achieve forgiveness on their student loans.

The amount of student loan debt that you can get discharged under the teacher loan forgiveness program depends on the subject area you teach and the school level. The $17,500 maximum benefit is reserved for select math, science and special education teachers, while teachers who teach other subjects can receive up to $5,000.

Cant Qualify Other Options For Managing Your Debt

While the Teacher Loan Forgiveness program can be a great option for canceling a chunk of your student loan debt, its not available to everyone and it only provides so much loan forgiveness.

Here are two other options to consider:

- Public Service Loan Forgiveness : Cancels all of your federal student loan debt after 10 years in public service. Note that while you can double up with PSLF and Teacher Loan Forgiveness, you cant work toward both at the same time. In other words, the five years you spend pursuing Teacher Loan Forgiveness cannot be used toward PSLF youll need to reset the clock and start from scratch.

- Student loan refinancing: Helpful for both federal and private student loans, and could save you a bunch on interest. Learn more about student loan refinancing in this guide, or head to our list of the best student loan refinancing lenders.

Just note that refinancing federal loans with a private lender turns them private, so its not a good idea if youre working toward student loan forgiveness for teachers, PSLF, or another federal program.

By exploring your options and staying on top of debt repayment, you can find strategies for managing your student loans better and hopefully get out of debt ahead of schedule.

Read Also: How To Refinance An Avant Loan

Your Path: Earning Teacher Loan Forgiveness

There are several paths a person can take to qualify for teacher loan forgiveness. However, there are several steps that almost any prospective teacher planning to earn loan forgiveness or loan cancellation should take:

- Step 1

- Make all qualifying loan payments on time to maintain eligibility.

- Step 6Apply for loan forgiveness programs.

AccreditedSchoolsOnline.org is an advertising-supported site. Featured or trusted partner programs and all school search, finder, or match results are for schools that compensate us. This compensation does not influence our school rankings, resource guides, or other editorially-independent information published on this site.

What Kind Of Loans Can Be Forgiven

Only certain federal student loans can be forgiven. There are no loan forgiveness programs for private student loans, so if your student loans arent federal loans, you wont qualify for federal loan forgiveness. If your loan isnt eligible for forgiveness, you may be able to refinance your loan or negotiate better terms with the lender. If youre struggling to repay your student loans, it may be worth reaching out to the lender.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Teacher Loan Forgiveness Has Narrow Benefits

The federal Teacher Loan Forgiveness Program is popular among teachers looking for relief from their student loan debt. However, its designed to encourage borrowers in the teaching profession to work in areas with a shortage of qualified teachers. So, the program has strict requirements.

You can qualify for up to $17,500 in loan forgiveness after working five consecutive academic years as a full-time teacher in a low-income qualifying school or educational service agency if you meet additional eligibility requirements.

For teachers outside of those requirements, you might still qualify for loan forgiveness help but only up to $5,000.

How To Apply For Teacher Loan Forgiveness

If you believe you qualify for the teacher loan forgiveness program, you’ll need to submit an application to each of your loan servicers after you’ve taught for at least five years. The chief administrative officer at your school or educational service agency will certify on the application that you’ve met the requirements.

If you have Perkins loans, they’re administered by colleges and universities themselves instead of the Department of Education. So you’ll need to contact the school where you received the student loan to process your application.

Don’t Miss: What Is The Commitment Fee On Mortgage Loan

Valuable Financial Benefit For Teachers At Low

Teacher Loan Forgiveness and Cancellation programs are designed to attract and retain teachers in low-income schools to help all children receive the best education possible, regardless of their economic status.

- which program is right for you

- dollar amounts available

- eligibility criteria

- program rules

- application forms and procedures.

Teacher Loan Forgiveness and Cancellation programs are designed to attract and retain teachers in low-income schools to help all children receive the best education possible, regardless of their economic status.

- which program is right for you

- dollar amounts available

- eligibility criteria

- program rules

- application forms and procedures.

What Are My Responsibilities

Once you have been approved for the B.C. Loan Forgiveness Program, there are things you must do to maintain eligibility:

- One year after your program registration date , you must submit via StudentAid BC online account, mail or courier a signed letter from your employer documenting your hours of in-person service in an eligible occupation at a publicly-funded facility in British Columbia either in an eligible under served community or working with children. The letter must include the following:

- Letterhead and name of the facility where you are employed

- Your name, occupation and community

- Dated within 30 days of your 12 month anniversary date

- Signature of your employer and,

- The number of in-person service hours provided during the 12-month period prior to the anniversary date.

- Maintain your current mailing and email address information with StudentAid BC.

Note: If your verified in-person hours of service is less than 400 and greater than 99 hours, your benefits under the program for that year will be prorated as indicated below.

| Total Annual Hours of In-Person Service | Annual Percentage of BC Student Loan Debt Forgiveness |

|---|---|

| 0 to 99 |

Read Also: Car Loan Transfer To Another Person

How To Choose Between Loan Forgiveness Options

Considering the rule that payments made for the Teacher Loan Forgiveness Program cant also count as PSLF payments, it would make more sense to just start out pursuing PSLF instead of Teacher Loan Forgiveness. PSLF is less strict in regard to teaching qualifications. But it also would wipe out your entire student loan debt, not just a portion of it.

A drawback to PSLF, though, is that you need to make 10 years of qualifying payments in order to be eligible. What if your career goals change or you decide to stop teaching? A lot can change in the life of a teacher in 10 years.

Related: Teacher Loan Forgiveness vs. Public Service Loan Forgiveness for Teachers: Which Is Better?

Perkins Loan Cancellation For Teachers

Forgives up to 100% of your Federal Perkins Loan Program if you teach full-time at a low-income school, or if you teach certain subjects.StudentAid.gov/teach-forgive

Here are some highlights:

- This program can only forgive your Federal Perkins Loans. Check to see if you have Perkins loans at StudentAid.gov.

- If you are eligible for this program, up to 100 percent of the loan may be canceled for teaching service, in the following increments:

- 15 percent canceled per year for the first and second years of service

- 20 percent canceled for the third and fourth years

- 30 percent canceled for the fifth year

- Each amount canceled per year includes the interest that accrued during the year.

- To find out if a school is classified as a low-income school, check our online database for the year you have been employed as a teacher.

- Even if you dont teach at a low-income school, you may qualify if you teach mathematics, science, foreign languages, bilingual or special education, or different subject determined by your state education agency to have a shortage of qualified teachers in your state.

- Private school teachers can qualify if the school has established its nonprofit status with the Internal Revenue Service , and if the school is providing elementary and/or secondary education according to state law.

To apply for Perkins Cancellation, contact the school where you obtained the Perkins Loan. Each school has its own process.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

What About Private Student Loan Forgiveness

If you took out private student loans to pay for a teaching degree, whether forgiveness is available and under what conditions will depend primarily on your lender. And if you are able to have your loans forgiven, it may only be for limited circumstances, such as if you become permanently disabled or you pass away.

If you have private loans that you’re struggling to repay, there are some things you can do to manage them. You might try refinancing your loans, for example, to get a lower interest rate and potentially a lower monthly payment. A lower rate can save you money over time if you’re paying less interest overall.

You could also reach out to your lender to see if financial hardship or forbearance programs are available if you’re experiencing a temporary cash-flow issue. Again, whether these options exist and whether you qualify will depend on your choice of lender.

Perkins Loans Teacher Forgiveness Programs

Teachers are also eligible for the federal Perkins Loans forgiveness program. You can can have Perkins loans forgiven or reduced if you meet certain guidelines:

- Teach at a school that serves students from low-income families.

- Be a special education teacher.

- Teach in an area where the state has a shortage of qualified teachers, such as math, science, foreign languages or bilingual education.

Perkins loan forgiveness can eliminate a substantial amount of student loan debtup to 100% of your loan. The program is based on an incremental model, with the loan forgiven steadily over a five-year basis. Perkins loan forgiveness provides teachers loan relief in the following incremental fashion:

- Year 1: 15% of a Perkins student loan is forgiven.

- Year 2: Another 15% of a Perkins student loan is forgiven.

- Year 3: 20% of a Perkins student loan is forgiven.

- Year 4: Another 20% of a Perkins student loan is forgiven.

- Year 5: The remaining 30% of the Perkins student loan is forgiven.

One thing to keep in mind if you’re currently a student or considering going back to school is that Perkins Loans are no longer available as of September 2017.

Read Also: How Do I Find Out My Auto Loan Account Number

Option # : Teacher Financing Forgiveness

The Teacher Loan Forgiveness Program is yet another system available to instructors which took down federal debts. Is qualified to receive this system, a person need:

This program offers mortgage forgiveness for up to $17,500 in eligible loan bills. The actual quantity of financial loans you can get forgiven relies on which subject areas you teach-in. Full-time mathematics and science teachers in the additional level, for instance, can get as much as the $17,500 max.

In that respect, it really is less large than the public-service Loan Forgiveness plan, which does not cap the actual quantity of college student obligations which can be forgiven. Commercially, you can sign up for forgiveness through instructor Loan Forgiveness program and also the Public Service mortgage Forgiveness regimen, however cannot get forgiveness for debts for the same time period teaching solution.

To utilize both, you would need to load all of them, following Teacher financing Forgiveness 1st, after that Public Service mortgage Forgiveness second, says tag Kantrowitz, publisher and vp of analysis at Savingforcollege.com. However, meaning it may need 15 years until your financial troubles is actually completely forgiven, rather than just several years with PSLF. The key advantage is if you happen to be not sure whether you wish to realize a lifetime career in coaching, Teacher Loan Forgiveness becomes you some forgiveness earlier.

Fedloan Servicing Has Announced That It Will Stop Servicing Federal Student Loans When Its Current Contract Ends

In the coming months, we will be working with Federal Student Aid to conduct a smooth transition of your loans to a different servicer over the next year. FedLoan Servicing will continue to service all loans until they are transferred to another FSA-designated servicer. Please note that this change will not affect the existing terms, programs, or available repayment plans on your loans nor will it affect the temporary suspension of payments and 0% interest benefits applied for the COVID-19 emergency.

Communications will be sent as more details become known. You can also visit StudentAid.gov/fedloan for the latest updates and information on loan transfers.

Official Servicer of Federal Student Aid

FedLoan Servicing is a Servicer to Federal Student Aid

You have a network of support to help you succeed with your federal student loan repayment. Find out how Federal Student Aid partners with loan servicers to be here when you need help.

Support You Can Trust

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Ideas On How To Get Teacher Loan Forgiveness If You Were To Think You Be Eligible For The Instructor Financing Forgiveness Plan You Will Need To Submit An Application To Each Of Your Own Financing Servicers After You Have Coached For At Least Five Years

Ideas on how to Get Teacher Loan Forgiveness. If you were to think you be eligible for the instructor financing forgiveness plan, you will need to submit an application to each of your own financing servicers after you have coached for at least five years.

The principle management officer at your college or educational service agencies will certify about application that you have fulfilled certain requirements.

For those who have Perkins financial loans, they can be applied by universities and colleges by themselves as opposed to the Department of studies. And that means youll need to contact the school where you gotten the student loan to plan the job.

Financial Assistance For Current Teachers

- Teacher Loan Forgiveness is available for teachers who have Direct Subsidized Loans, Direct Unsubsidized Loans, Subsidized Federal Stafford Loans, and Unsubsidized Federal Stafford Loans.

- To meet the eligibility requirements for this program a teacher must have been:

- Employed as a full-time, highly qualified elementary or secondary teacher for five complete and consecutive academic years, and

- Employed at a designated low-income school during this period.

Also Check: Becu Lienholder Address

Disclosure: Mycitytitleloanscom Just Isnt A Loan Provider In Every Deal And Doesnt Make Loans Loan Commitments Or Lock

All credit choices, like the conditional prices and terms you may be provided, will be the duty of this participating loan providers and certainly will differ based on your loan demand, your specific financial predicament, and requirements based on lenders to who youre matched. Only a few customers will be eligible for the rates that are advertised terms. Any inquiry may be forwarded to third-party loan providers or agents whom could make specific disclosures for your requirements. These disclosures will soon be sent to you by the financial institution you choose to continue with for the loan requirements

Loan approval is susceptible to fulfilling the lending companys credit requirements, which could consist of supplying appropriate home as security. Real loan quantity, term and apr for the loan that a consumer qualifies for can vary greatly by customer. Loan profits are meant mainly for individual, household and family purposes. Minimal loan amounts differ by state. Customers need certainly to show capacity to repay the mortgage.

Form Inquiry procedures might take five moments to perform. Upon conclusion, an approval that is conditional be provided with pending post on documents. Funding time is founded on the time from last approval following receipt and report on all needed papers and signing.

Option #: Public Service Loan Forgiveness

The Public Service Loan Forgiveness Program was established in 2007 and is designed to provide student loan forgiveness for people working in public service careers, including teachers. The minimum qualification requirements for this program include:

- Working full-time for a government agency or certain nonprofits

- Being enrolled in an income-driven repayment plan

- Making 120 qualifying payments

Sounds simple enough, but there are some caveats for teachers. For one thing, this loan forgiveness program doesn’t extend to teachers working for private, for-profit schools. And for another, it’s notoriously difficult to qualify for loan forgiveness even if you are eligible.

The problem got so bad that, in 2018, Congress passed the Temporary Expanded Public Service Loan Forgiveness program to help some of the rejected borrowers, but few applications for that program have been approved, too. According to a report from the Government Accountability Office , 99% of borrowers who requested loan forgiveness between May 2018 and May 2019, the first year forgiveness eligibility began, were rejected. The reasons for rejection included not submitting a PSLF application, not making 120 qualifying payments under an eligible repayment plan, and owing loans that were ineligible for the program.

Also Check: 84 Month Auto Loan Usaa