Streamline 203k List Of Allowable And Non

Many buyers are surprised at what the 203k allows them to do. This loan can be used solely for cosmetic purposes, not just when a home is in severe disrepair. You can remodel a kitchen or bathroom, adding amenities like granite countertops and high end appliances. The repairs dont even need to be necessary to make the home eligible for FHA financing. In other words, if a home has a functional kitchen, but its outdated, the buyer could use a 203k loan to remodel cabinets and countertops, upgrade appliances, and the like, with a 203k loan.

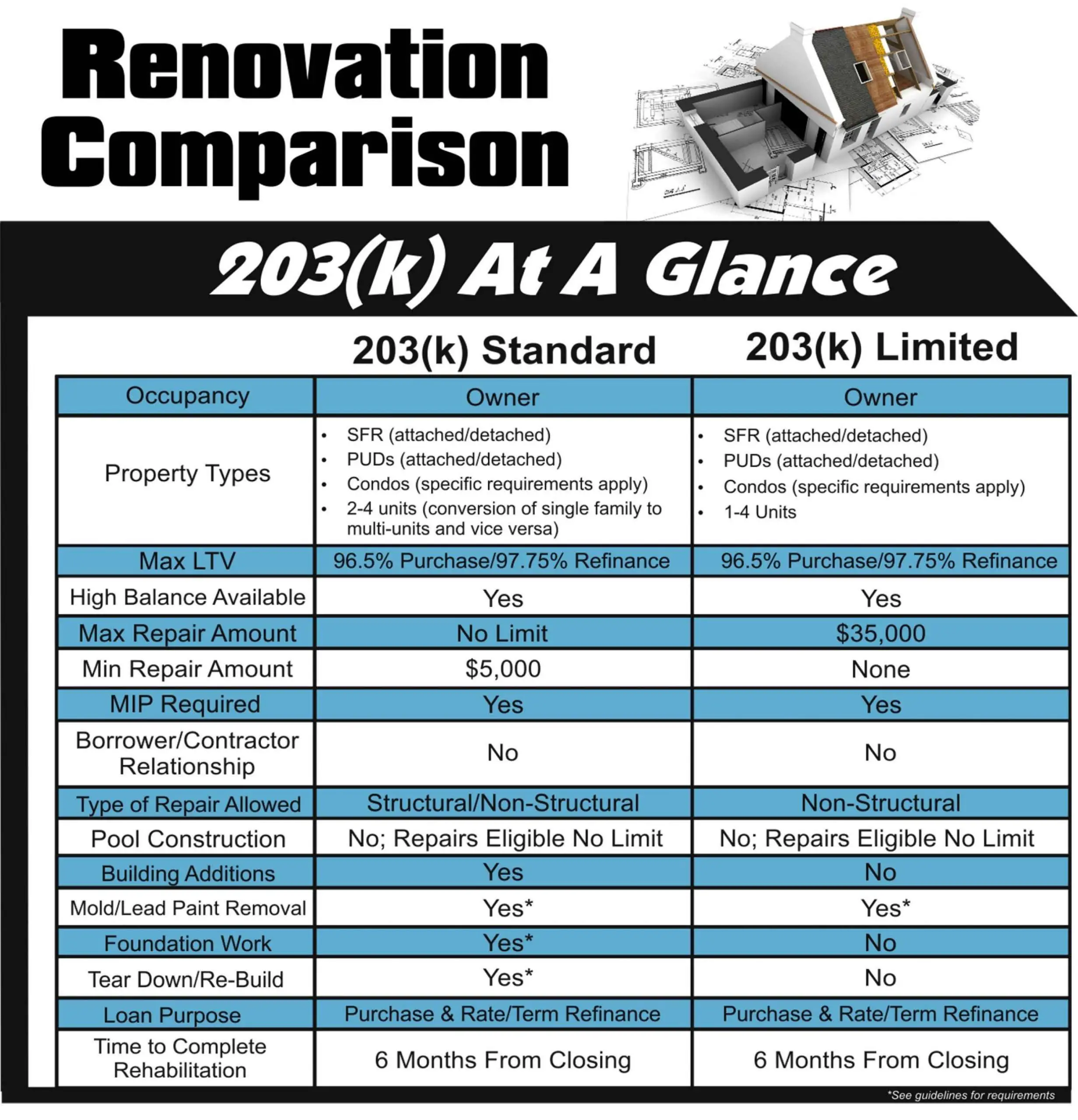

Keep in mind that repairs cant be structural when using the Streamline 203k. This means foundations, load-bearing walls, etc. may not be altered.

If the property you are looking at needs structural repairs to qualify for financing, you will need to use a full 203k instead of a Streamline 203k, or find a different property.

- Alterations to improve commercial use of the property

Who Is Eligible For An Fha 203 Loan

Individuals and nonprofit organizations can use an FHA 203 loan, but investors cannot.

Most of the eligibility guidelines for regular FHA loans apply to 203 loans. They include a minimum of 580 and at least a 3.5% down payment.

Applicants with a score as low as 500 will typically need to put 10% down.

Your debt-to-income ratio typically cant exceed 43%. And you must be able to qualify for the costs of the renovations and the purchase price.

Again, to apply for any FHA loan, you have to use an approved lender.

So You Want To Buy A Fixer

Buying a home that needssome TLC can be a good choice.

Imperfect homes come with less competition from other buyers, and you can build tens of thousands of dollars in additional equity in a short time by making relatively minor improvements.

But theres a reason not as many people want to buy a fixer-upper. It does take more work, planning, and time compared to buying your standard turn-key home.

Up for the challenge? Thenrewards await. Here are your first steps.

Don’t Miss: How To Get Pmi Off Fha Loan

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Eligible Fha 203k Home Repairs

The homebuyer can use the FHA 203 program to finance repairs of anything from painting, to deck replacement, to room additions. Improvements and upgrades can be made, even if the home does not necessarily need them to be livable. All health, safety and energy conservation items must be addressed first, prior to completing general home improvements and upgrades. See below for an example list of upgrades homebuyers have made using the FHA 203 mortgage loan program:

- Structural alterations and additions

- Upgrade central air/heat, and electrical systems

- Repair termite or moisture damage

- Remodeled kitchen and baths, modernize plumbing

- Install or repair well or septic systems

- Repair or Replace roofing, gutters, downspouts

- Interior and exterior painting

- Flooring, tiling and carpeting, interior / exterior painting

- Energy conservation improvements

- Other improvements that are a PERMANENT part of the real estate*

*Luxury items are not permitted to be included in the financing.

For more information please view the FHA 203k Mortgage Worksheet.

Read Also: How To Get Loan Originator License

Applications Must Be Submitted Through An Fha Approved Lender

What is a fha 203k loan. Instead of having two different loans the loan is combined as a 203k loan. Hud requires that properties financed under this program meet certain basic energy efficiency and structural standards. Fha loan requirements are similar to a 203k mortgage loan except for a couple of things.

Homebuyers and homeowners can quickly and easily tap into cash to pay for property repairs or improvements such as those identified by a home inspector or an fha appraiser. Fha s limited 203 k program permits homebuyers and homeowners to finance up to 35 000 into their mortgage to repair improve or upgrade their home. Insurance for rehabilitation is authorized under section 203 k of the national housing act 12 u s c.

You can qualify for an fha mortgage with a 500 credit score with 10 down and a 580 credit score with 3 5 down. Because they re government insured 203k loans have more lenient qualification requirements. One of which is the credit score requirement.

Fha maximum debt to income ratio of 31 43. In general an fha 203 k loan allows you to wrap your renovation costs into your mortgage that s just one loan and one closing. When you apply for an fha loan you re required to disclose all debts open lines of credit and all sources of income.

You will also have to provide a detailed proposal of the work you want to do. The amount you borrow is a combination of the price of the home. To get an fha 203k loan you must work with an fha approved lender.

Can I Do The Work Myself With A Fha 203k Loan

In some cases, this is allowed. Lenders might require documentation that you are qualified to do the work, and can do it in a timely manner. Usually this means that you are licensed as a contractor or in a similar profession, since its tough to othequrwise document that youve had enough experience to do the job.

If you can prove youre qualified, you can only finance the cost of the materials, and you will still need to provide a detailed bid for materials you plan to purchase.

You May Like: Genisys Credit Union Auto Loan Calculator

How The Fha 203k Loan Program Works

- Its a renovation loan and standard mortgage in one

- That requires FHA loan approval

- And lender review of any proposed construction

- Everything is financed in a single loan

It starts off similar to any mortgage application, in that you must qualify for a home loan based on certain income and credit requirements, as discussed above.

An added step requires the borrower to get bids for the work theyd like to complete, or need to complete to get the property up to necessary standards.

In the case of a full 203k loan, a consultant is selected and works with the borrower to determine necessary/wanted repairs, which are then presented to the lender.

They start with a home inspection to address health/safety needs, then move on to borrowers wants.

If its a limited 203k loan, the borrower must still gather contractor bids and send them to the lender for review.

This is a good time to estimate the market value of the property once the proposed changes have been completed.

Assuming everything looks good, the loan is underwritten per usual, the home is appraised with an as-is value and an after-improved value, and eventually funded .

The additional loan proceeds earmarked for the improvements are placed in a rehabilitation escrow account.

Once the project begins, draws can be taken from this escrow account at different intervals to pay the contractor.

Once all the work is completed, it is verified by the consultant and/or an inspector and remaining funds are released.

Fha 203k Guidelines Pdf

PRODUCT GUIDELINES. FHA K STANDARD. PROGRAM CODES: F30FKFULL, H30FKFULL. Version Page 1 of 7. 01/11/ PURCHASE. If you want to purchase a house that needs a lot of repairs before it is ready to be occupied, an FHA loan can be used to complete the transaction. All PRMG staff can access all end Agency guidelines though AllRegs . The FHA Limited K Renovation loan enables borrowers to finance.

HUD does not make direct loans to guidelies to buy houses. At Money Crashers, we Using k s Smartly Only apply through experienced FHA k mortgage lenders because the repair and renovation underwriting requirements for FHA k mortgages can be complex.

Sign Up For Our Newsletter. Not all properties are move-in ready some require an extensive amount of rehab work before they are ready to be occupied.

Read Also: How To Get An Aer Loan

Fha 203k Mortgage Loan Rates

Mortgage rates are very competitive for this loan program. To get an exact rate quote for your situation, speak with a Riverbank Finance loan officer. FHA loans, in general, are less credit driven than Conventional loans, therefore, if you have a lower credit score, the FHA 203 mortgage loan program would be a great solution for you and your mortgage needs.

What Repairs Can Be Made With A Standard Fha 203k Loan

With the standard 203k rehab loan, homeowners can borrow the funds needed to complete repairs or the remodeling project types listed below. It is important to note that the rehab funds go into an FHA escrow account. As the work is completed, the funds are released directly to the contractor.

- Improvements to the homes air conditioning, heating and other major functions.

- Updating of plumbing and electrical systems.

- Structural repairs and alterations .

- Elevating the structure or foundation.

- Purchasing a structure on one site and moving it to a foundation on another site.

- Improvements that help with the homes appearance or bring it up to current standards.

- Installation or replacement of well and septic systems.

- Connecting the home to public sewer and water systems.

- Replacement of roofing, siding, gutters and downspouts.

- Replacing the floors.

- Making aesthetic changes to make the home look better.

- Removing any health and safety concerns from the home such as lead paint.

- Improvements to make the home energy efficient .

- Landscaping and other exterior improvements.

- Installing or repairing driveways, walkways and fences.

- Repairing or removing an inground swimming pool but NOT installing a new one.

- Repairing or installing a new porch, deck or patio.

- Making the home handicapped accessible.

- Converting a 1 family to a 2, 3 or 4-unit property.

With the standard 203kb loan, these extensive repairs can be made.

You May Like: Defaulting On Sba Disaster Loan

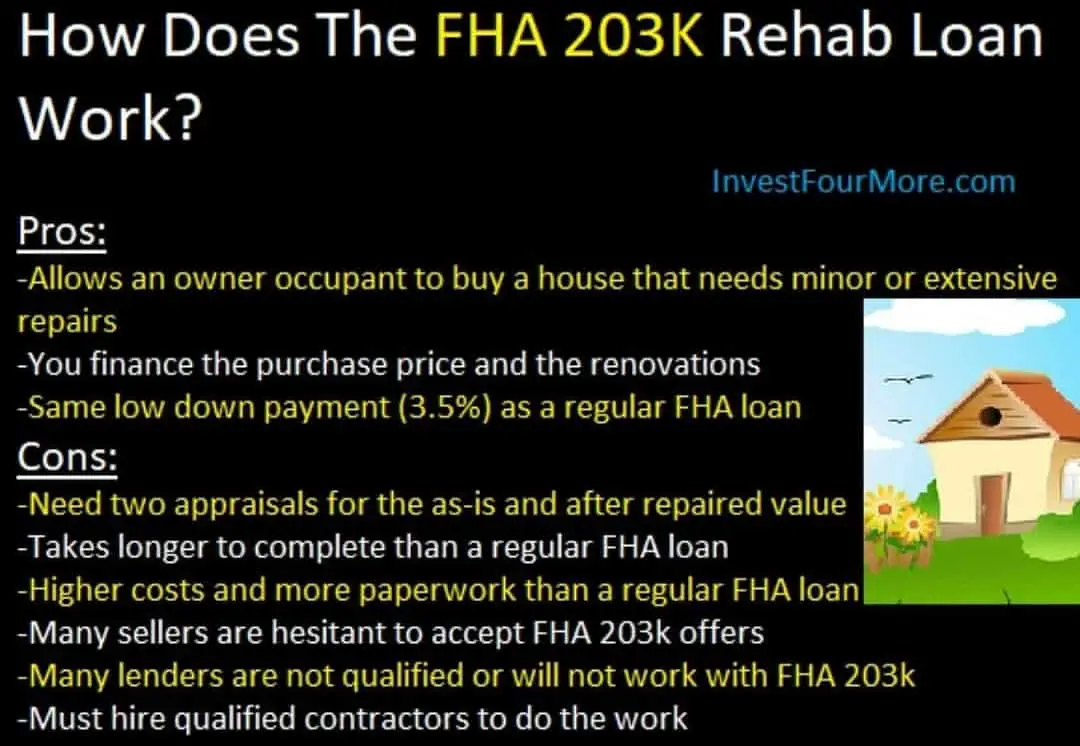

Benefits: An Fha 203k Loan Lets You Build Equity Fast

The buy-and-rehab strategycan give home buyers instant equity, and a lot of it.

Homes in need of repair orupdating can be had on the cheap, and the fixes may not be very expensive atall.

For instance, a housepotentially worth $250,000 may sell for just $200,000 when it needs only $20,000 in repairs. That leaves $30,000 in potential equity for a buyerwith the initiative to manage the fixes.

According to real estatedata website Realtytrac, the median home price in a distressed sale was 42percent lower than the price netted in non-distressed situations. Thats a bigdiscount.

The problem comes, however, when the buyer goes to finance the home purchase.

Most mortgage programsrequire homes to be in near-top shape before the loan is approved.

Thats where the FHA 203k rehab loan comes in.

The Federal Housing Administrations 203k loan allows buyers to finance the home and up to $35,000 in repairs with one loan.

Its possible to have lower monthly payments and higher equity in your home the moment you move in, compared to your friends and neighbors.

What Is The Fha 203k Loan Program

The FHA 203K Loan program is designed to help potential homebuyers purchase a residential abode that needs significant repairs. In order to avail of its advantages, you must work with an FHA-approved lender. You also need to be specific of the work you want done to the property as it will be a determining factor for the final value of the home after all the repairs had been made.

In simple terms, you will be given the financing both to do the repairs and buy the home at the same time.

Recommended Reading: How To Get An Aer Loan

What Sort Of Interest Rates Can I Expect On A 203k Loan

Youll typically see a slightly higher rate on 203k loans than on other mortgages because of the extra work and paperwork required.

Because these loans are insured by the FHA, though, your rates might still be lower than other renovation financing options like home equity lines of credit , home equity loans, and personal loans. Be sure to compare quotes across products and lenders to get the best possible deal.

Are There Restrictions On The Repairs That Can Be Made

Improvements for commercial use are not eligible and funds cannot be used for luxury items such as swimming pools or tennis courts. A minimum of $5,000 must be used for repairs or improvements in the first six months after closing on the loan. Eliminating building code violations, modernizing, or making health and safety-related upgrades to the home or its garage must come first. After that, additional improvements can be made, ranging from room additions to making the home accessible for the disabled to cosmetic changes such as new flooring.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Apply For 203k Fha Loan Loan

The FHA is not a lender. It is a mortgage insurance company. Apply to your bank, credit union, or another lender for the 203k FHA loan. These loans are not offered by all lenders. You can inquire through the lender to find one. HUD .. It is not a provider of home insurance or warranties. It is still necessary for home buyers to obtain insurance and warranties for their properties and homes.

Also Read : Government First time Home Buyer Grants

Documentation Needed For A 203k Rehab Loan

In addition to the documents needed for a standard FHA loan, the following documents will also be needed for an FHA 203k loan and a Limited 203k loan:

Identify of Interest Certification This document is required when the property is being purchased from a family member, a business partner, or any other individual where a conflict of interest may be present.

Borrowers Certification This document states that there is NO identify of interest between the borrower and the seller, the 203k consultant, the lender, or any other third party that is part of the process.

203k Consultants Certification This is completed by the consultant and it certifies that he or she inspected the property for compliance and completed the duties required by HUD.

Rehabilitation Self Help Loan Agreement Form This form must be completed by the borrower if the construction work will be done by the borrower and without a contractor. In this case, the lender also has to verify that the borrower has the skills to do the job, details the costs to complete the project, etc. *Borrowers can perform the work themselves only if they get an exception.

Appraisers Repair Notes If the appraiser identifies things that need to be fixed, the lender must make sure these repairs are included in the rehabilitation plan.

FHA 203k Borrowers acknowledgement Form This formHUD-92700-Amust be completed by the borrower.

Architectural Drawings The lender must review all of the architectural exhibits.

Also Check: What Happens If You Default On Sba Loan

About The Fha 203k Loan

With most traditional mortgage loans, lenders will not pay for home renovations in addition to a purchase. Instead, buyers need to buy the home then A) pay cash for repairs, or B) take out an additional loan. This situation poses a challenge for buyers who want to buy a home and complete some repairs. Fortunately, the FHA offers an alternative means of financing fixer-uppers.

With the FHA 203K loan, buyers can finance two items with the same loan:

- The home purchase, and

- Needed/desired repairs

Furthermore, most lenders wont approve loans for homes that require major repairs let alone actually finance those repairs. Accordingly, the FHA 203K solves two major problems. First, it lets buyers purchase homes that wouldnt otherwise qualify for a mortgage. Second, it lets these same buyers finance those repairs with the same acquisition loan.

NOTE: The FHA still requires that these homes have baseline levels of safety and habitability. If the property is too distressed, it will not qualify for an FHA 203K loan.

How Much Does A 203k Loan Cost

Several costs come with getting a 203k mortgage loan.

First, as with any mortgage loan, there are closing costs. These are typically 2% to 5% of the total purchase price of the home. With 203k loans, there may be additional closing costs, including a supplemental origination fee, which usually clocks in around 1.5% of the loan amount.

Youll also have the following costs associated with a 203k loan:

- HUD consultant fees: Between $400 and $1,000, depending on project cost.

- Inspection fees: Up to $350.

- Interest rates: Usually about 1% higher than traditional FHA loan rates.

- Title update fees: $150.

- Feasibility study: $100.

- Mortgage insurance: 1.75% of the loan balance up front, plus an annual premium.

You may also have fees for building and city permits, surveys, septic certifications, and any necessary engineering and architecture consulting your project requires.

Don’t Miss: Do Loan Officers Make Commission