Chapter 13 Bankruptcy And Student Loans

There is not any substantial difference between attempting to discharge a student loan in a Chapter 13 bankruptcy compared to a Chapter 7 bankruptcy. It is clear, however, that any attempt to file an Adversary Proceeding should be considered or reviewed near the end of the completion of the Chapter 13 plan. If an attempt to discharge a student loan is made too early into the plan, the lender will most certainly make the argument that the court should take a wait and see approach as to whether an undue hardship exists at that time.

Three Elements Of Undue Hardship Petition

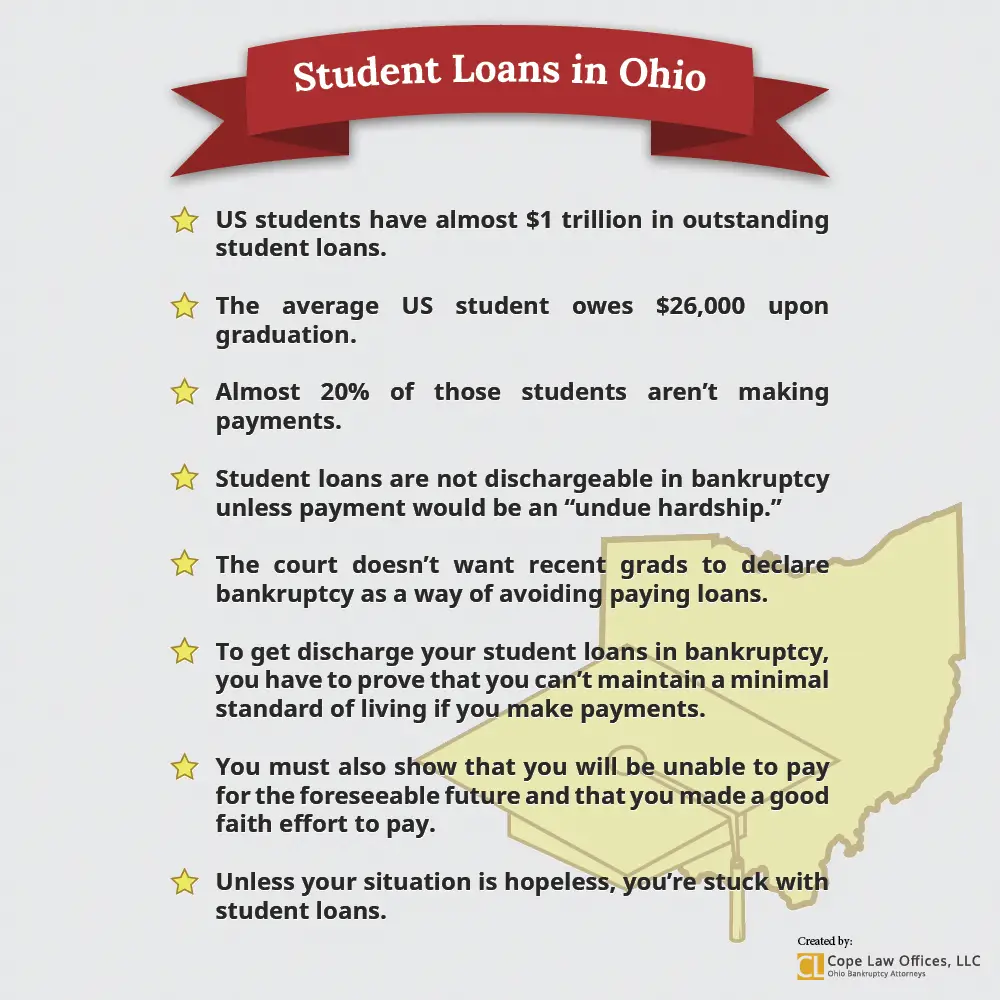

The discharge of student loan debt used to be an easy process but recently U.S. bankruptcy has made this difficult. This difficulty can cause numerous financial problems for post-graduates who are in debt of student loans while also trying to manage other bills and other expenses. However, despite this, people with student loans are not without options.

There are certain factors of an undue hardship that will be estimated when your petition is considered. To have a successful petition, a person will need to prove.

Proved prolonged hardship

Not being able to adhere to basic standards of living

Genuine efforts in paying off loans/debts

If a person can prove all three of these critical aspects of an undue hardship petition, they might be able to discharge some of their student loan debt. This can be critical for people dealing with student loan debt.

Undue hardship is hard to get until and unless the circumstances are genuine. When you are appealing to undue hardship, think a lot about it because it is complicated and costly. Due to some reasons, you cannot achieve undue hardship. It will lead you to more debt.

During the application for a student loan discharge under undue hardship, it is advised to continue making payments towards your loans. If you qualify for undue hardship, you will have several missed payments that will affect your credit history and thereby affect your credibility as a borrower.

The Additional Step: Filing An Adversary Proceeding

Here’s where things get more complicatedas stated earlier, just filing for bankruptcy under either Chapter 7 or Chapter 13 is not enough to have your student loans discharged. You must take the additional step of filing an adversary proceeding.

Under the U.S. bankruptcy code, an adversary proceeding is a proceeding to determine the dischargeability of a debt. In other words, it’s a lawsuit within a bankruptcy case. Included in the adversary proceeding paperwork is “a complaint.” The complaint includes administrative details, such as your bankruptcy case number and the reasons you are seeking to discharge your student loans in bankruptcythe circumstances of your undue hardship.

Thisadditional step is necessary because student loansand a few other types of debthave stricter requirements for discharge. These requirements are described in section 523 of the U.S. bankruptcy code.

The key wording that relates to the discharge of student loans is: A discharge under…this title does not discharge an individual debtor from any debt…unless excepting such debt from discharge under this paragraph would impose an undue hardship on the debtor and the debtors dependents.”

Also Check: How To Check Interest Rate On Loan

Do You Think You Can Prove A Student Loan Undue Hardship Or Need Alternatives

Most lawyers assume they cant win a student loan undue hardship case. That lack of belief in themselves is due to the myth that they cant do it. It is like the elephant chained as an infant to a stake. As a young elephant, he cannot break the chain, and for the rest of his life, he tugs at a small rope that cant stop him as a larger animal. He slightly tugs at it for life, assuming it is restraining him when only his mind keeps him captive.

I wont say every debtor can qualify, but if you meet the standards of undue hardship, you can file for it, and you have about a 50-50 chance even without an attorney.

One of the alternatives I need to outline is that private student loans are no better than a credit card. All of the defenses you can apply to a typical debt apply to private student loan payments, including the statute of limitations. Often these loans are sold and resold, and they have abysmal records of any repayment. If you file a Chapter 13, the years you spend in Chapter 13 do not apply towards the statute of limitations.

However, it does discourage the debt holder so much that he will not pursue collection after Chapter 13 is discharged.

Can You Establish Undue Hardship

Make no mistake, getting your student loans discharged through an adversarial action for undue hardship is not a shoo-in. If youve tried taking other steps to pay down your student loan debt and were unsuccessful, its worth a shot trying to prove undue hardship. You will have to be meticulous in following the test the courts use in your jurisdiction and in logically presenting evidence that establishes the requirements. But 40% or more of those who pursue an undue hardship claim for student loan discharge are successful. If you have substantial student loans, it may very well be worth the time and work involved.

Don’t Miss: Is Prosper Personal Loan Legit

What Does Filing An Adversary Proceeding Do

Filing an adversary proceeding allows the lender to contest the suit. The Consumer Bankruptcy Rights Center found that in 15 years , the Fifth Circuit had not discharged a single student loan debt in cases the lenders contested.

However, evidence suggests student loan lenders fight against discharge in the few cases they think they can win but choose to settle most cases. Settlement results in more favorable outcomes for the debtors, such as decreased balances, lower interest rates, and extended repayment periods.

How Likely Is It That A Bankruptcy Court Will Discharge My Student Loan Debt

Because Congress has never defined the term undue hardship, federal courts have established the legal standard for a student loan borrower to prove undue hardship. Generally, courts have used one of two tests to analyze whether undue hardship is proven: the Brunner test or the Totality of the Circumstances test. Under the Brunner test, you must show that based on your current income and expenses, you cannot maintain a minimal standard of living for yourself and any dependents if forced to repay your loans additional circumstances exist indicating that this state of affairs is likely to persist for a significant portion of the repayment period of the student loans and you have made good faith efforts to repay your loans. Under the Totality of the Circumstances test, the court examines your past, present, and likely future financial resources your reasonably necessary living expenses and any other relevant facts and circumstances.

As you can see, these tests are potentially subjective. Unfortunately, what this means for student loan borrowers is its hard to predict how likely it is your student loans will be discharged in bankruptcy. However, many bankruptcy judges are much more open to discharge all or some student loan debt than they were in the past , which, along with the Department of Educations request, posits potential relief for thousands of people struggling with high student loan debt.

You May Like: What Is Secured And Unsecured Loan

In Re Walker And The Totality Of Circumstances Test

In In re Walker, the bankruptcy court approved discharging the debtors loan on the grounds of undue hardship under the totality of the circumstances test, because the debtor established she could not maintain a decent standard of living for her children if she was forced to pay her student loans. The lenders made the argument that Walker had too many children, and so should not be permitted an undue hardship discharge due to this lifestyle choice. The lenders lost.

Have You Considered Other Repayment And Forgiveness Options

Can you file bankruptcy on student loans? Maybe. Should you? That depends on your personal situation.

Filing bankruptcy on student loans is a complicated, intrusive and extensive process. In fact, Fuller advised not doing it at all if you can. It should be a last resort, he said.

There are many alternative solutions to filing bankruptcy on student loans. For example, federal loans come with options such as income-driven repayment plans and deferment or forbearance. These programs could provide relief without the extreme step of bankruptcy.

You also have the option to apply for forgiveness, either through an income-driven repayment plan or Public Service Loan Forgiveness . PSLF is available to those who work for certain public service organizations, such as government agencies or nonprofits.

And if you have private student loans, talk to your lender. They might have a hardship program for student loans that you didnt know about. Fuller suggested sending to your private loan servicer a letter via certified mail outlining your financial hardships, your income and how much youre able to pay. Your servicer may respond with a repayment plan that provides some relief. After all, you dont lose anything by asking.

Before filing bankruptcy on student loans and trying to fight against a system that makes it difficult to discharge your debt, be sure to research your other debt repayment options for student debt relief.

You May Like: 7 Year Equipment Loan Calculator

What Qualifies As An Undue Hardship For Student Loans

The first appellate court decision which attempted to establish what an undue hardship is was Brunner. The New York Circuit division no longer uses this test. The totality of the circumstances is now used where all the factors affecting a debtor are considered. Although our district still uses the Brunner test, more districts have been using the totality test. The Brunner test is more difficult to pass than the totality of the circumstances.

There are chapters and books on what it takes to pass the Brunner test. The three elements of the test are:

1. Have you made a good-faith effort to repay?

2. Are you unable to maintain a minimal standard of living while making the payments?

3. Is your financial situation likely to persist?

These conditions often exist for any debtor, but the judges and servicers put up a strong defense in these cases.

Consequences Of Student Loan Delinquency And Default

One in eight Americans has student loan debt, and the average U.S. household with student loan debt owes upwards of $58,000, not an insignificant amount when you consider the declining average wage values in the U.S. If you have significant student loan debt and you cant afford your monthly payments, you could end up being delinquent on your loan or in default.

he first day after you miss a payment on your student loan, your loan becomes delinquent, or past due, and it remains delinquent until you pay the past due amount. If you remain delinquent on your student loan or loans, you risk going into default, which can have serious consequences. Defaulting on student loans can affect your credit and make it difficult for you to buy a house or a car or get a credit card. Any tax refunds and federal benefit payments you are entitled to may be withheld and put towards repayment of the amount owed on your loan, your wages may be garnished, and you could even be sued by your loan holder.

Read Also: Should I Pick Variable Or Fixed Rate Student Loan

Help May Be On The Way

Help may be coming as Congress introduces new legislation. Since December 2020, at least two new separate bills have been introduced.

The first bill is called the Consumer Bankruptcy Reform Act of 2020, sponsored by Sen. Elizabeth Warren on December 9, 2020, S. 4991. This bill completely dismantles both Chapter 7 and Chapter 13 bankruptcies and creates a new, single, Chapter 10. This proposed legislation is incredibly generous to debtors and would include the ability to wipe out student loans! No one should get too excited at this point because this is just a proposal and it is unknown what will really happen in 2021 and beyond.

There has also been a second bankruptcy reform act proposed as of February 2, 2021. This bill is called the Medical Bankruptcy Fairness Act of 2021. This bill is a potential break-through for people filing bankruptcy because of too many medical bills and, if that is the reason that they are filing , it also would allow for the discharge of student loan debts. Keep in mind, this is just a proposed bill, and nothing has been approved to date.

Evidence To Support Undue Hardship

The Court is not going to just take your word that paying off your student loans will cause you undue hardship, and you will need to provide them with financial documentation and other evidence. As we have already explained, the tests that courts use to determine undue hardship vary by jurisdiction, and you will want to speak with your bankruptcy attorney to determine exactly what you will need. However, gathering the following information will give you a good start. Some of these will be relevant to you, and some are for people in specific situations.

- Records of all monthly payments including utility bills and rent or mortgage,

- A detailed report of other necessary expenses such as food bills, clothing allowance and household maintenance. Start keeping receipts.

- Medical records and letters from your doctors if they are pertinent to physical disability or injury that limits your ability to work

- Documentary evidence of job loss if that applies

- Proof, possibly through your tax returns, of your number of dependents

- Documentation that you tried to repay your debt and worked with your loan servicer. Provide your monthly loan statements and proof of payments you made. Gather any proof that you changed repayment plans or took other measures to repay the loans. Make copies or screen shots of emails, keep a list of all phone calls, and provide the names of the lender representatives you dealt with. Keep track of dates and times when these communications occurred.

You May Like: How To File Bankruptcy On Car Loan

When To File An Adversary Proceeding: Chapter 13

In a Chapter 13 bankruptcy, when you can file an adversary proceeding also depends on the bankruptcy court rules where you live. Regardless of when you file, your student loan nightmare will not be over if you win the adversary proceeding. That’s because you must wait until you’ve completed the necessary Chapter 13 plan payments and earned your discharge order for your other debts before your student loans will be discharged.

If you are allowed to file the AP early in your case, you might get the proceeding over with sooner and obtain a decision on your student loans. The table below compares Chapter 7 and Chapter 13 bankruptcy.

| Comparing Bankruptcy Options |

|---|

| Varies by state |

Student Loans In Bankruptcy

How do I discharge student loans in bankruptcy?

After graduation, many students are saddled with huge debts. The work they get after they leave college does not pay well enough and they are constantly in default on their student loans. One of the ways that people can discharge debts is by filing for bankruptcy. However, as you may have heard, it can be difficult to discharge student loans in bankruptcy. And, you are wondering, how do I discharge student loans in bankruptcy? Read on for the truth about student bankruptcy loan discharge.

The so-called threshold that you need to cross to get a student loan discharge by bankruptcy is set very high. Nevertheless, difficult does not equal impossible. Some former students have succeeded in discharging their loans through bankruptcy. Learn the exceptions to the law that may allow you to do this and then follow through with the help of a knowledgeable attorney.

Undue Hardship Can Be a Reason to Discharge Student Loan Debt

The bar was raised for the discharge of student loan debt via bankruptcy in 2005. That is when Congress passed the Bankruptcy Abuse Prevention and Consumer Protection Act. This law makes it more difficult for both private and federal student loan debt to be discharged though bankruptcy. An exception to this law is when the former student proves undue hardship caused specifically by the loan.

The Differences between Private and Federal Student Loans

Federal Student Loans

Federal Family Education Loan Program

Read Also: How To Close Mortgage Loan

Fonfrias Law Group Llc

Student Loans Can Be Erased in Bankruptcy But Its Not Easy

To discharge your student loan in bankruptcy, you must show that making the loan payments will impose an undue hardship on you and your dependents. If you prove undue hardship, then your entire student loan will be eliminated.

The test for whether the court will cancel your student loan requires that you prove that if you are required to pay your student loan, you cannot maintain a minimal standard of living for yourself and your dependents your current circumstances are likely to continue for much of the student loan repayment period and you have made an reasonable effort to repay your student loan.

Examples of people who had student loans cancelled because of undue hardship include these:

1. Student Loan Discharged for a 50 year old student who earned $8.50 per hour as a telephone marketer. The court found that the person did not earn enough money to pay the loans and pay his familys expenses, nor did it look like he would be able to break his cycle of poverty.

2. Student Loans Discharged. Often courts have canceled loans for students whose education did not benefit them or who attended schools that were fraudulent.

4. Student Loan Discharged for a woman whose mental impairment convinced the court of her undue hardship. Further, the court agreed that her mental illness would continue to hurt her ability to work.

Chapter 13 Stops a Lenders Attempts to Collect on Your Student Loan