How To Decide Which Private Student Loan Is The Best For You

While our evaluation of our private student loan partners was created as a starting point for students and their families to find the best private student loan, we recommend you do your own research as well.

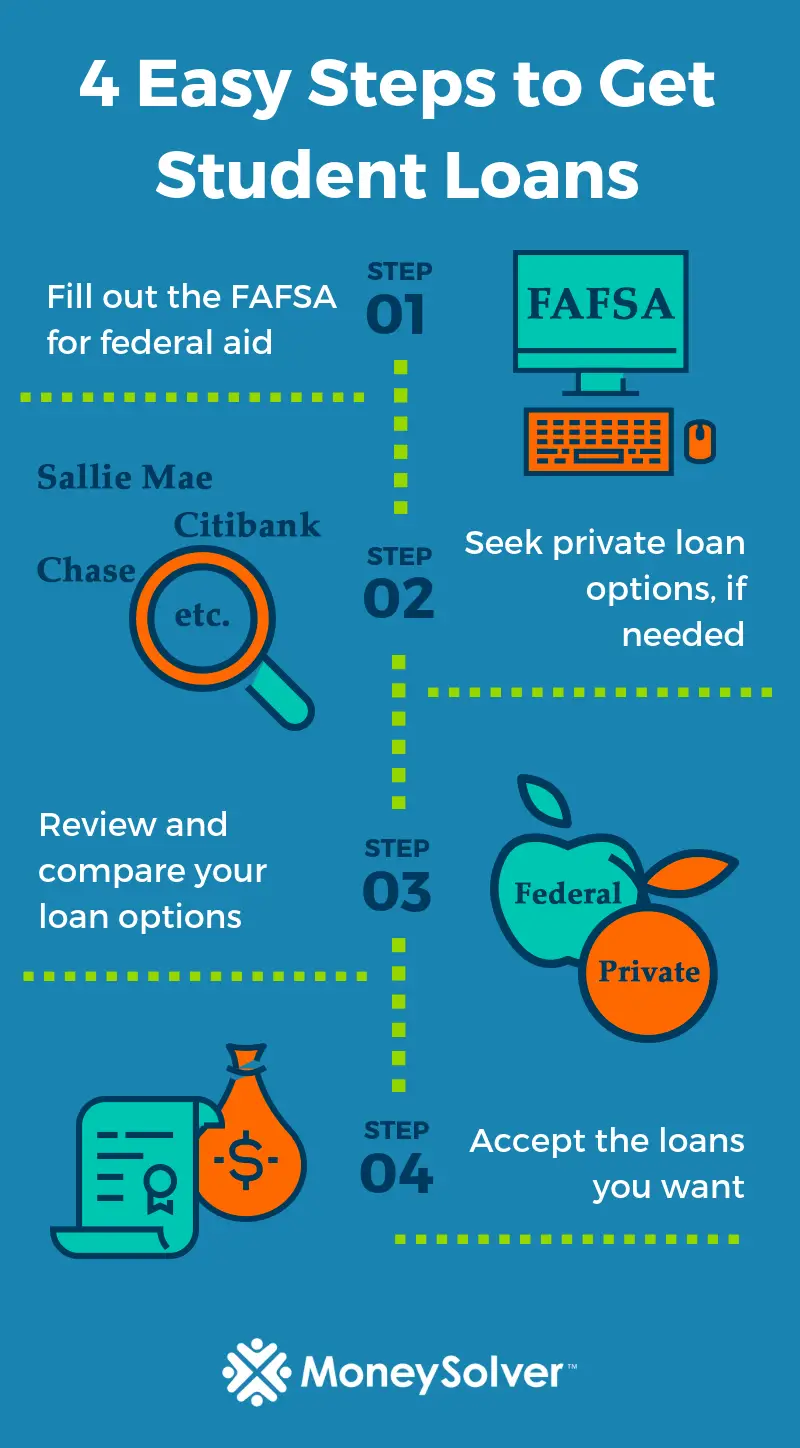

When looking for a private student loan, comparing your options is the most important thing you can do. By doing this, youll be able to find an affordable loan that comes with borrower-friendly repayment terms. Here are the steps we recommend taking to find the best private student loan:

Biden Weighs Broad Student Debt Cancellation

Biden is expected to announce by the end of August whether he will more broadly cancel student loan debt for the 43 million federal student loan borrowers.

Key Democratic lawmakers, including Senate Majority Leader Chuck Schumer and Massachusetts Sen. Elizabeth Warren, have been calling on Biden to cancel $50,000 per borrower. But Biden has consistently pushed back on canceling that much and has suggested he would support wiping away $10,000 per borrower, in line with a pledge he made on the campaign trail in 2020.

Until now, Biden has taken a more targeted approach to student debt relief. His administration has authorized the cancellation of nearly $32 billion so far more than any other administration largely for borrowers who were defrauded by their for-profit colleges and for permanently disabled borrowers.

He has also temporarily expanded the Public Service Loan Forgiveness program that forgives the debt of government and nonprofit workers after 10 years of payments, and made changes to the income-driven repayment plans, bringing millions of borrowers closer to forgiveness.

Pay More Than The Minimum Payment

Federal student loan borrowers are automatically enrolled in a Standard Repayment Plan with a repayment term of 10 years. If you want to pay off your student loan in under a decade, youll need to make extra payments toward the loan principal.

You can do that by paying extra with your monthly payment or sending a lump sum whenever you have funds available.

You can also make an extra payment every year by switching to bi-weekly payments. When you make bi-weekly payments, you make 26 half payments per year rather than the 12 monthly payments youd normally make. To make this strategy work, you must make both halves of your payment by the due date.

Whichever method you choose, make sure your extra payments go toward the loan principal rather than prepaying interest. Your loan servicer should be able to tell you how to make principal-only payments.

You May Like: What Is The Maximum Subsidized Student Loan

The Types Of Loans Are:

- Direct Subsidized: A federal loan for undergraduate students. You dont get charged interest while youre in school. It is need-based, so whether you qualify depends on your FAFSA information.

- Direct Unsubsidized: A federal loan that any undergraduate or graduate student can get . You are charged interest while you are in school. To cut costs, pay the interest as you go.

- Direct PLUS: Federal loans for the parents of undergraduate students, or for graduate and professional students. You must pass a credit check to get these loans.

- Private: Loans offered by banks or credit unions. You should shop around for the best offer you can find. Students generally need a parent or other family member to co-sign.

Depending on where you live and other factors, you may have other options. Some states provide low-cost education loans for residents. There are also nonprofits and other organizations that offer low-or zero-interest student loans, often within a specific city or state.

Can I Get A Student Loan Without A Co

Its possible to get a student loan without a co-signer, but the difficulty of doing so depends on your situation.

Nearly every type of federal student loan does not require co-signers. Because you dont need a high credit score to qualify for these types of loans, most students are eligible without a co-signer if they can meet a few basic requirements.

Private student loans, however, may be harder to get on your own. These types of loans require a high credit score of at least 670 to qualify for the lowest rates. If you cant qualify individually, you may need to add a co-signer to your application. However, some lenders offer a co-signer release after you meet certain requirements, so look for that feature as you compare your options.

Some private lenders specialize in student loans without a co-signer instead of reviewing your credit, they may consider things like your performance in school and field of study instead. While it may be easier to qualify for these loans, they typically come with higher interest rates.

You May Like: How Much Can I Borrow Fha Loan

Applying For A Student Line Of Credit

You may need somebody, like a parent, to co-sign your line of credit application. This person will also be responsible for the debt if you cant pay it back.

Your financial institution will set the maximum amount of money youll be able to borrow. The amount you can borrow may depend on the program youre studying and the school or academic institution offering the program. It may also depend on your living expenses, credit history and ability to repay the money you borrow.

You can apply for a student line of credit at any time. Usually, you apply online, over the phone or in person. Contact your financial institution to find out how to apply for a student line of credit.

You usually need to provide proof that youre either a full-time or part-time student at a recognized Canadian post-secondary institution to be eligible for a student line of credit.

How To Get A Student Loan

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Learn more about private student loans

-

Find a student loan: Compare private student loans, types and rates

-

How to apply: Wondering where to apply for student loans first?

Most students 7 in 10 borrow money to pay for college. If you’re one, you have two types of student loans to choose from: federal or private.

If you’re an undergraduate, always start with federal loans. They don’t require a credit history or a co-signer and they offer more generous protections for borrowers, such as income-driven repayment and loan forgiveness, than private student loans do.

» MORE: Your guide to financial aid

Before you borrow, think ahead to how youll repay debt. Put a dollar figure on it by using a student loan payment calculator. This is the bill youll be paying every month for 10 years or longer. Borrow only what you need, and dont take on an amount or an interest rate you cant expect to handle right after graduation.

Here’s how you can get federal and private student loans.

Don’t Miss: What Bank Has The Best Home Equity Loan Rates

Terms And Conditions Of Federal Loans Vs Private Loans

All student loansfederal and privateinclude terms and conditions. Here are the most important items you should understand when taking out a loan for college:

- Is this a federal student loan or private student loan?

- Who is the servicer?

- Is there a cosigner on the loan?

- What is the interest rate?

- Is the interest rate fixed or variable?

- When are you required to make paymentswhile in school or after?

- What is the penalty for late payments?

Is A Private Student Loan A Good Option For You

Federal student loans are limited to a certain amount each year of undergraduate study. If you need to borrow more, your options might include federal Parent PLUS loans, private student loans, and some states have loan programs for residents or students in the state.

With all loans, you should understand your budget once you graduate. Once you pay for your basic necessities such as housing, food, and transportation, you should have enough left over to pay the monthly student loan payments from your expected starting salary. If it looks like this will be a problem, more student debt may not be the answer to pay for your college expenses.

Be sure you and your family compare all the costs and repayment options for the various student loan choices.

Also Check: Where Can I Apply For Student Loan Without Cosigner

Faqson Undergraduate Student Loans

Private student loans are credit-based, which means we will check your credit when you submit your application. Students were 4X more likely to be approved with a cosigner.9 A cosigner is an adult with good credit, usually a parent, who shares responsibility with you for paying back the undergraduate student loan.

You can apply just once a year with a single credit check and funds are sent for each term directly to your school. You can cancel future disbursements as needed with no penalty. No interest is charged until money is sent to your school, so you can relax, knowing you’ve got the funds when you need them.

It takes about 10 minutes to apply and get a credit decision. After youre approved, you choose your undergraduate loan rate type and repayment options, accept your loan disclosure, and the loan is certified by your school. We send the funds directly to the school. The process can take 10 business days or less from application to disbursement.

Whether you study online or on campus, you can borrow to cover the costs at a degree-granting institution, even if you’re not a full- or half-time student. The loan’s flexibility makes it a good choice for many situations:

How To Borrow Responsibly For College

When youre borrowing money for college, its important to . We recommend these three steps:

Other tips for borrowing responsibly: Consider what your salary will be after you leave school, remember that youll have to pay back your loans with interest, and dont borrow more than youll need for school costs.

FAFSA is a registered service mark of U.S. Department of Education, Federal Student Aid.

Also Check: Which Bank Offers The Lowest Auto Loan Rates

Runner Up For Best Lender: Citizens Bank

Citizens Bank

- Min credit score: Not disclosed

- Terms: 5-15 years

-

Rate discounts up to 0.50% with autopay and Citizens account holders

-

Multi-year approval simplifies borrowing over time

-

Options for parents and graduate students

-

No specific options for loans without a cosigner

-

Co-signer and discounts required for lowest rates

Citizens Bank offers some of the lowest interest rates among the best student loans. After enrolling in autopay and signing up for an additional account at Citizens Bank such as a checking or savings account, borrowers can apply for various loans with potentially low rates. Interest rates depend on if you’re a student or parent and whether you’re an undergrad or graduate student, and there are no application fees.

After taking out your first Citizens Bank student loan, multi-year approval also makes it easier to access additional student loans if your expenses change. Citizens Bank student loans come with terms of five, 10, or 15 years, and you can borrow between $1,000 and $350,000 over time, depending on your degree, level of education, and if your parents are borrowing on your behalf.

Borrowers can choose one of three repayment options: full immediate repayment, interest-only payments while in school, or a full in-school deferment. Undergraduates may need a co-signer to qualify, though a co-signer release is offered after you make 36 on-time payments. Citizens Bank also offers student loan refinancing.

Current Student Loan Rates

Based on an analysis of 30 lenders’ reported rates as of July 29, 2022, the average interest rates are:

-

Minimum fixed interest rate – 4.42%.

-

Maximum fixed interest rate – 12.97%.

-

Minimum variable interest rate – 2.31%.

-

Maximum variable interest rate – 12.09%.

These rates represent a slight increase from the averages in June 2022 for all categories and follow a general upward rate trend over the last nine months.

Don’t Miss: How Long Does Mortgage Loan Underwriting Take

Best Student Loans Of August 2022

- Best Overall Lender: Ascent

- Runner Up for Best Lender: Citizens Bank

- Best Site for Comparing Student Loan Offers: Credible

- Best for Graduate Students: SoFi

- Best for Co-Signers: Sallie Mae

- Best for Flexible Repayment Options: College Ave

- Min credit score: Not disclosed

- Terms: 5-20 years

-

No student loan refinancing options

-

Only available for tuition and expenses at 2,200 schools

Ascent’s interest rates are competitive, and it’s the only lender on our list to offer student loans specifically for undergraduate borrowers without a co-signer. You can also use loans to pay for an approved career preparation program or graduate school.

Ascent offers non-co-signed student loans to undergraduate juniors and seniors and graduate students with a GPA of 2.9 or higher and no credit score. This includes a future income-based student loan for undergrads. However, rate offers could be higher than those on co-signed loans.

Both types of loans come with a 0.25% interest rate discount when enrolled in autopay. If you have a co-signer, you can release them from the loan after 24 consecutive months of on-time payments. Ascent offers a 1% cash-back reward on the initial loan balance once the borrower graduates and meets certain criteria.

How Do You Borrow College Money Under Federal Loan Programs

There are five letters to remember: FAFSA. To qualify for a federal loan, you will need to complete and submit the Free Application for Federal Student Aid, aka FAFSA. Borrowers must answer questions about the student’s and parents’ income and investments, in addition to other relevant matters, such as whether the family has other children in college. Using that information, the FAFSA determines the Expected Family Contribution, which is being rebranded as the Student Aid Index. That figure is used to calculate how much assistance you’re eligible to receive.

Don’t Miss: Can You Use Va Loan For Renovations

Other Sources Of Funding

-

Registered Education Savings Plans

A Registered Education Savings Plan is a long-term investment account that lets people save up to $50,000.00 for a childs education. Money deposited into an RESP grows in 2 ways:

- Funds are put towards either fixed investments or equity investments . Interest earned on these investments is not taxed.

- Through the Canada Education Savings Grant , the federal government matches annual RESP contributions by 20% if the the future students receiving the funds are 17 or younger. The CESG applies on the first $2,500.00 of annual contributions up to a lifetime limit of $7,200.00.

- Through the Canada Learning Bond program, children from low-income families will get up to $2,000.00 in RESP contributions from the federal government. This is not a matching program no personal contributions are necessary to get the CLB.

Contributions to an RESP are not tax deductible. Withdrawals from an RESP for educational purposes are called educational assistance payments and count as part of the students annual taxable income. Should funds go unused and get returned to the contributor, he or she can receive the funds without paying additional tax.

Unable To Repay Student Loans

If you cant pay the full amount due on time or have to miss a student loan payment, your loan may be considered delinquent and you may be charged late fees. Contact your loan servicer immediately for help, and ask them about your options.

Learn about COVID emergency relief for federal student loans that has been extended through January 31, 2022.

You May Like: Can You Lower Your Student Loan Payments

Welcome To The Best Loan Option For School

Our Smart Option Student Loan® gives you the money and tools you need for your undergraduate journey.

Lowest rates shown include the auto debit discount.

Lowest rates shown include the auto debit discount.

Lowest rates shown include the auto debit discount.

Lowest rates shown include the auto debit discount.

Start With The End In Mind

As you apply for loans, remember that youll have to repay them someday. Run some numbers to understand what youd be getting yourself intobefore you pull the trigger on getting a loan. Plug your loan details into a loan amortization calculator, and see how much youd have to pay each month, and how much youd pay in interest over the life of your loan.

Before you take any student loans, consider your prospective career field and your likely ability to repay quickly. Your education should be an investment that will pay off, not a financial burden you’ll carry for decades.

You May Like: When Do I Have To Start Paying Student Loans

$73 Billion In Student Loans Discharged For Public Servants

In October last year, the Department of Education announced “transformative” changes to the Public Service Loan Forgiveness program, immediately making 22,000 borrowers immediately eligible for debt cancellation. The department expects its policy changes to enable more than 550,000 borrowers who had consolidated their loans to eventually become eligible for debt forgiveness.

The PSLF program cancels the remaining balance on a student loan after the borrower makes 120 qualifying monthly payments. Anyone who works for a federal, state or local government agency can apply for the program, including teachers, firefighters, military members, nurses and other employees in the public sector. The PSLF program has canceled $7.3 billion in student loan debt for 127,000 borrowers so far during Biden’s term.

The biggest changes to PSLF let borrowers count all previous payments made on Federal Family Education Loans and Perkins Loans and waive requirements of full-amount and on-time payments. However, to receive this relief, borrowers need to submit a PSLF application by . Note: if you need to consolidate your debt to qualify for PSLF relief, that process can take 45 days, so build time into meeting that end of October deadline.

For more information about PSLF policy changes and to see if you are eligible for the program and the waiver for previous payments, visit the PSLF Help Tool on the Federal Student Aid website.