Find Out Who Got A Ppp Loan With Propublica’s New Tool

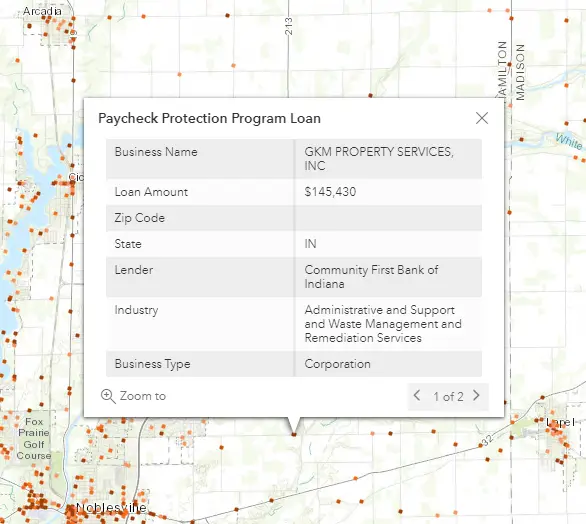

Are you curious to see if your employer or local businesses got a slice of the governments $2.2 trillion stimulus package? This week, ProPublica, an independent, non-profit newsroom, released a new Paycheck Protection Program tracking tool.

This tool includes newly released data from the Small Business Administration , which includes lender-approved loans of $150,000 or more. The ProPublica tool offers four ways to sift through PPP loan data. You can search by organization, lender, zip code, or business type.

The PPP is part of the CARES Act, which passed in response to the coronavirus pandemic. The PPP has made $659 billion available for low-interest small business loans. PPP loans may be forgivable, depending on how companies use the moneywith the goal of keeping employees on the payroll.

The first round of PPP funding ran out by mid-April, sparking a public outcry over which companies had been approved. And complaints only continued as new stories broke of big companies getting PPP moneylike major chain restaurants.

In May, ProPublica, The Washington Post, The New York Times, Bloomberg, and The Dow Jones sued the SBA for access to PPP loan data. The Trump administration finally released the names of some of the companies that have received PPP loans over $150,000. According to the latest report, the SBA has spent over $5.2 billion and saved 51.1 million jobs.

Support For Business Hardest Hit

Congress has included three key provisions designed to support businesses that have been hit the hardest by the pandemic.

- Restaurants, hotels, or live venues that fall under a NAICS code starting with 72 can apply for 3.5 times their monthly payroll costs on their Second Draw .

- Live Event and Production companies that have been forced to close may be eligible for a special grant.

- $12 billion have been earmarked for BIPOC-owned small businesses

As of now, PPP Loans are still available from the Paycheck Protection Program, Round 2. Applying for Round 1 forgiveness is simple, if businesses spent the loan on approved expenditures. There is no reason receiving forgiveness for Round 2 will be any more difficult. The money has been made available to help small businesses survive these difficult times. It is well worth the effort to access this funding and support.

Kew Management

A Herculean Response With A Painful Execution

The equation for the COVID-19-induced small business crisis has been troubling but simple. Starting in March, millions of small businesses stopped generating revenue, but still had payroll and other fixed costs . These businesses needed new sources of immediate liquidity, and Congress designed the PPP to cover their labor costs for 10 weeks. The goal was to avoid a historic wave of small business closures that could tear apart the fabric of the economy.

With this urgency, Congress built on the principles of the Small Business Administrations existing 7 loan guarantee program to distribute loans through certified lenders . SBA removed the majority of the 7 programs rulesrequiring no fees, no credit scores, and no collateral from applicants. This enabled the financial system to move a historic amount of capital in a very short period.

Implementation challenges were immediate. At a Brookings event in April, then KeyBank CEO Beth Mooney characterized the PPP as a Herculean public-private response whose execution was very painful. She reported that KeyBank, the nations ninth-largest SBA lender, typically does about 600 SBA 7 loans annually, or about 50 per month. But in the first half of April alone, they issued 37,000 loans. Mooney acknowledged that KeyBanks initial outreach was to its existing customers, which means that unbanked or underbanked small businesses were not included in that first push.

Also Check: Does Applying For Personal Loan Hurt Credit

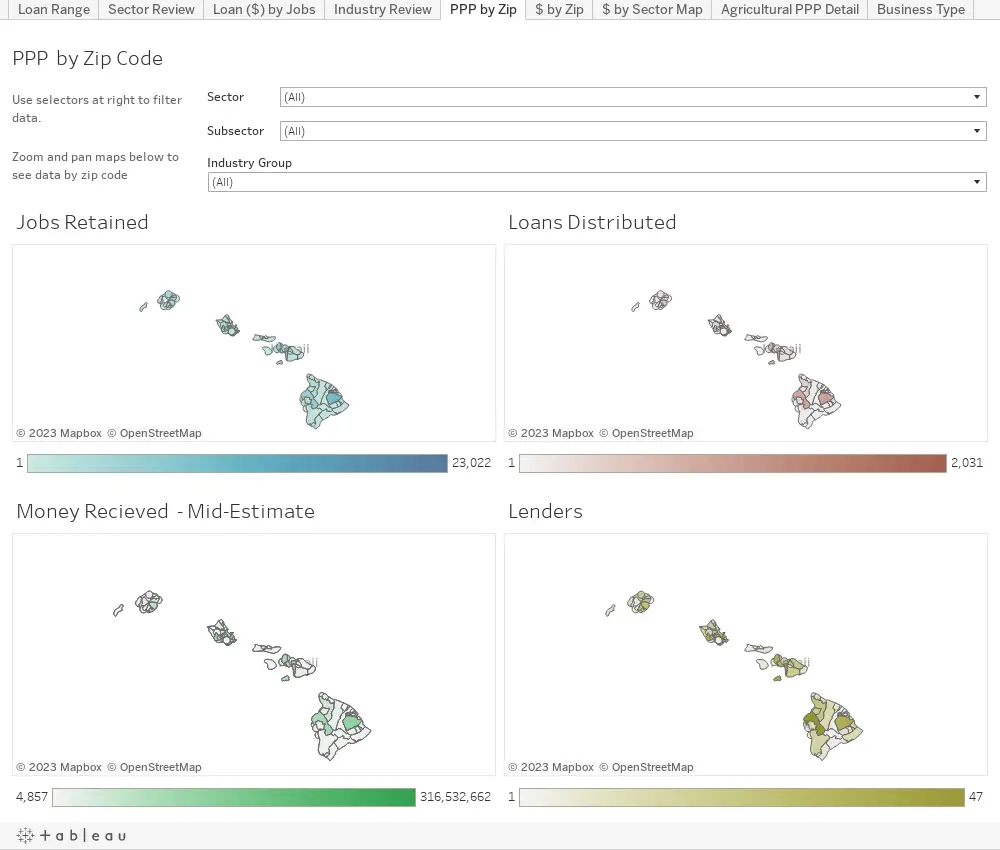

Geocodio’s Additions To The Ppp Data

Geocodio has added latitude/longitude coordinates to the PPP loan data, as well as the 2010 Census boundaries at the request of The Center for Investigative Reporting. The Census boundaries include the FIPS codes, metropolitan/micropolitan statistical areas, and other identifiers that are helpful for connecting to other government datasets. You can see the data key for the general geocoded results here and for the Census data here.

Breaking It Down: How North Texas Ppp Loans Stack Up By Zip Code

The Small Business Administration recently released data on the Paycheck Protection Program earlier this month and it shows a partial breakdown of how the distribution of the loan money played out in North Texas.

The portion of PPP loan information the SBA released contains data down to the ZIP code for recipients approved for the funding.

PPP loans were earmarked to help small businesses weather the economic fallout and uncertainty brought on by the coronavirus pandemic.

The data shows entities that were approved for PPP loans of $150,000 or more, but doesnt show the specific loan amounts for each entity. Instead, the loan amounts are classified in ranges:

- $150,000 to $350,000

- $2 to $5 million

- $5 to $10 million

The data provided by the SBA does not show whether the PPP loans were used by the respective entities or if the small businesses returned the funds. Some companies may have returned loans after deciding they did not need them.

Since the release of the data, the Dallas Business Journal has examined the loan distributions, which industries and areas of North Texas benefited the most:

Don’t Miss: What Is An Fha Jumbo Loan

Ppp Loans: Paycheck Protection Program Round 2

PPP Loans are currently available through the Paycheck Protection Program, Round 2. The United States Small Business Administration is currently accepting loan applications from small businesses working with participating lenders for the Second Draw PPP. Eligible businesses may apply for a Second Draw PPP now. Dont miss out on this essential assistance.

Economic Injury Disaster Loans

In response to the Coronavirus pandemic, small business owners in all U.S. states, Washington D.C., and territories are eligible to apply for an Economic Injury Disaster Loan advance of up to $10,000. This advance will provide economic relief to businesses that are currently experiencing a temporary loss of revenue. Funds will be made available following a successful application. This loan advance will not have to be repaid. If a business received an Economic Injury Disaster Loan advance in addition to a Paycheck Protection Program loan, the amount of the Economic Injury Disaster Loan advance will be deducted from the PPP loan forgiveness amount by SBA.

The SBAs Economic Injury Disaster Loan provides vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing as a result of the COVID-19 pandemic.

This program is for any small business with fewer than 500 employees , private non-profit organization or 501 veterans organizations affected by COVID-19.

Businesses in certain industries may have more than 500 employees if they meet the SBAs size standards for those industries.

The Economic Injury Disaster Loan advance funds will be made available within days of a successful application, and this loan advance will not have to be repaid.

Also Check: What Car Loan Would I Qualify For

Map: More Than 600000 Businesses Got $150000

The Paycheck Protection Program, or the PPP, criticized for helping many that dont qualify as a small business, this month named all its large-dollar loan recipients.

The program has delivered more than $500 billion in close to 5 million loans to businesses across the United States, according to the latest report from the Small Business Administration. These loans supported more than 50 million jobs.

The program, part of the $2 trillion Coronavirus Aid, Relief and Economic Security Act, or CARES Act, aimed to help small businesses stay afloat through the pandemic. Since its launch, the program has weathered more than onecontroversy, including the shut-out of underserved communities and businesses.

Of the almost 5 million loans, more than 4 million were for less than $150,000. Those loans made up less than $150 billion of the awarded $500 billion. The Department of the Treasury published more detailed records of the businesses that received more than that, and those businesses are mapped below. The data is not without its errors: Some businesses have been reported to have received money they didnt actually get and did not apply for.

Ppp Loans: Who Got What And How Much

YOUNGSTOWN, Ohio Nearly 1,000 organizations in Mahoning, Trumbull and Columbiana counties received Paycheck Protection Program loans of more than $150,000, according to data released July 6 by the U.S. Small Business Administration.

On top of that, another 4,750 organizations in the three counties received loans under that amount, totaling nearly $150 million combined, through the federal program aimed at curbing unemployment caused by the coronavirus pandemic.

The data released were broken into two categories: loans of less than $150,000 and loans above that amount. For those under the $150,000 threshold, the SBA published which city and ZIP code the business or nonprofit operated in, its NAICS code and how much money was approved.

For organizations above that amount, the SBA also published the business name and address, but broke the loan amounts into categories $150,000 to $350,000 $350,000 to $1 million $1 million to $2 million $2 million to $5 million and $5 million to $10 million rather than publishing the specific loan amount.

Also published was the number of jobs retained. Nationwide, loans above $150,000 accounted for 75% of all dollars disbursed through the program, the SBA said.

A full list of the 989 businesses based in Mahoning, Trumbull or Columbiana counties receiving loans over $150,000 can be read at BusinessJournalDaily.com. See the URL address on the opposite page.

Recommended Reading: Credit Score Needed For Personal Loan

We Must Commit To Evening The Entrepreneurial Playing Field

With nearly 70% of businesses expecting that it will take at least four months for their operations to return to normal, Congress returns this week with an urgent need to issue a third round of PPP relief. With established rules and regulations from the federal government as well as preexisting relationships between lenders and borrowers, the hope would be that round three of the PPP would work more smoothly and inclusively than rounds one and two. To respond to some of the challenges discussed in this analysis, the SBA has launched new products such as the Community Advantage Recovery Loan, which targets small businesses in underserved communities with capital and technical assistance.

There is a clear rationale behind these efforts. The racial wealth gap in the U.S. is large and persistent, and it stands to reason that enhanced resources and policy changes that close entrepreneurship gaps could help close wealth gaps in communities of color. But to be effective, these new efforts must also understand how the small business lending market has shifted and will continue to shift, especially the neighborhood-level dynamics that this analysis outlines. Providing targeted help to small businesses in underserved communities would create not only a more prosperous economy, but a more just one as well.

Method notes:

What To Know About The Paycheck Protection Program Before Your Chance To Get It Runs Out

As a result, the university said, the federal government directed both public and private capital to native-born white families and away from African American and immigrant families.

Areas colored green on HOLC maps, graded A, were deemed a good risk for bank investment. Areas given the lowest grade, D, were colored red and declared hazardous for investment. In Kansas City, not all redlined areas had Black residents. But all areas with more than a handful of Black residents were redlined. Black residents still make up many of the residents in these investment-starved neighborhoods today.

Public Integrity determined which ZIP code each graded area fell into, then identified each ZIP with a recorded number of Black residents at the point of redlining and more than half of the land area graded D. Four of the five are on the citys East Side, the geographic focus of our story, and together these four received substantially less access to the PPP than if the loans had been equally distributed around the city. ZIP codes where more than half the land area was graded A or B both west of Troost received markedly more.

Victoria Orozco at Drexel UniversitysNowak Metro Finance Lab, Robert Nelson at the University of Richmond, Brent Never at the University of Missouri-Kansas Cityand the National Community Reinvestment Coalitions Bruce Mitchell, Jason Richardson and Jad Edlebi offered feedback and advice at various stages of the analysis.

Don’t Miss: What Does It Mean To Refinance An Auto Loan

How To Find The Postal Code Of Richmond Hill Ontario Use Our Zip Codes Lookup We Offer A Convenient Search By Names And Numbers

How to find your postcode of Richmond Hill?

- Zip code of Richmond Hill – L4B to L4E, L4S

There are situations in life when you urgently need to find some postal code. In such cases, we advise you to use our directory and quickly find the zip code of Richmond Hill. The Bankchart.ca team collected postcodes of all Canadian cities. Therefore, a resident of any city in our country will be able to find easily and quickly the desired postcode.

Our catalog is updated regularly, any changes are displayed instantly on the site. Therefore, you can use the latest zip code information. And if you want to know, L4B to L4E, L4S – is the index of which area? We answer, this is the postal code of Richmond Hill, Ontario.

How To Find A Postal Code

Each administrative division maintains its own postal code for mail delivery purposes. Having the correct code is essential to your mails delivery. Locate the correct postal codes for Richmond Hill in the list above by choosing the destination city or town you are sending to.

Unsure which city to choose? Just use our lookup by address feature at the top of the page or click on the our interactive map to access your needed zip code.

Recommended Reading: Can My Girlfriend Be On My Va Loan

Small Business Paycheck Protection Program

The Paycheck Protection Program established by the CARES Act, is implemented by the Small Business Administration with support from the Department of the Treasury. This program provides small businesses with funds to pay up to 8 weeks of payroll costs including benefits. Funds can also be used to pay interest on mortgages, rent, and utilities.

The Paycheck Protection Program prioritizes millions of Americans employed by small businesses by authorizing up to $659 billion toward job retention and certain other expenses.

Small businesses and eligible nonprofit organizations, Veterans organizations, and Tribal businesses described in the Small Business Act, as well as individuals who are self-employed or are independent contractors, are eligible if they also meet program size standards.

Previous Versions of Applications

Ppp Loan Distribution By Zip Code In Dallas

Nearly 112,000 DFW-based entities were approved for PPP loans and area businesses were approved for 28.8 percent of all PPP loans approved in Texas, according to a Business Journal analysis.

For this research, North Texas is defined as Collin, Cooke, Dallas, Denton, Ellis, Grayson, Johnson, Kaufman, Parker, Rockwall, Tarrant and Wise counties.

The data shows 26,300 Dallas-based entities were approved for PPP loans, while Fort Worth had 10,290 entities approved and 6,400 businesses in Plano. Meanwhile, Arlington had 4,600 businesses approved for the PPP, Frisco had 4,000 loans approved and Irving had 3,720.

PPP loan money that was approved was concentrated more in North Dallas relative to other areas of Dallas. Of the top five ZIP codes that had the most PPP loan approvals in DFW, three ranked on the Business Journals Wealthiest ZIP Codes list in 2019: .

The top ZIP code to receive approval for PPP loan money is 75034, which received 1,871 approvals. The ZIP code has a median household income of $116,962. Meanwhile, 75093 has a median household income of $102,889 and received 1,666 PPP loan approvals. ZIP code 76092 received 1,452 PPP loan approvals and has a median household income of $207,127.

Click here for more on this story.

Don’t Miss: How Do I Pay My Student Loans

Sign Up For The Daily Reach

According to the SBA data, the gas drilling company was not only Bexar Countys largest PPP recipient, it was also the nations largest recipient in the oil and gas industry.

Lewis Energy Group has purchased more than 500,000 acres in the Eagle Ford Shale, and was once one of the most prolific drillers there.

#2 Bill Miller Bar-B-Q Enterprises Ltd.

Loans forgiven: $10,115,342.47

Reported jobs retained: 500

The PPP was intended for firms with fewer than 500 employees. However, exceptions were made for restaurants that employed no more than 500 employees per location, like Bill Miller.

According to forms it submitted to Bexar County as part of a request for tax relief, the chain employs 2,300 full-time employees and 3,000 part-time employees, with most based locally.

Bill Miller temporarily closed its dining rooms in June 2020 because of rising COVID cases. It did so again earlier this year due to staffing shortages.

#3 Buffets LLC

Loans forgiven: $10,113,972.60

Reported jobs retained: 500

This former national buffet empire once claimed 650 stores across multiple brands, but by 2021, it had filed for bankruptcy for the fourth time in a decade. Its restaurants in San Antonio included Furrs Fresh Buffet and Ryans Buffet. It has since renamed to Fresh Acquisitions and has been purchased by a holding company for $4.2 million.

#4 Muy Pizza Tejas LLC

Loans forgiven: $10,113,424.66

Reported jobs retained: 500

#5 Airrosti

Loans forgiven: $9,215,401.24

Reported jobs retained: 500

Ppp Loan Company Lookup Search Tool

Search our entire database for publicly released Paycheck Protection Program information by location, company name, industry , company type, or loan amount. Max 50 results provided for each query.

Information available through this dataset may include name, address, owner information, loan amount, and lender for all companies that received loans through the PPP.

| No Results Found – Please Modify Your Search! |

| } |

You May Like: North Shore Bank Loan Payment