Tips For Paying Off Student Loan Debt

Repaying student loan debt can be difficult, but it is possible. If youre overwhelmed by your student loans, use the following tips to control your debt and pay off student loans faster:

- Find Your Loans:The first step in becoming debt-free is knowing how student loans work. Use the National Student Loan Data System and AnnualCreditReport.com to find out what loans are under your name, how much you owe, and who manages your loans.

- Create a Budget:Make a budget to ensure your income outpaces your spending, and look for areas where you can cut back to free up cash for debt repayment. You Need a Budget and Mint are excellent tools for recent grads and can help you track your spending.

- Enroll in an Income-Driven Repayment Plan:If you have federal loans and your payments are too high, contact your loan servicer and ask to enroll in an IDR plan. The plans base your payments on your discretionary income and an extended repayment term, potentially reducing your minimum payments.

- Find Out of Your Employer Will Help:Some employers offer student loan assistance as an employee benefit. Talk to your HR department to see if your company offers that option.

- Make Extra Payments:Look for additional cash that you can put toward your debt. Even an extra $10 or $20 per month can reduce your repayment term by several months and help you save on interest charges.

An Increase In Attendance

One reason for the increase in graduate student debt is because graduate program enrollment has increased over the past 10 years.

Census data indicates that between 2000 and 2018, the number of people aged 25 and over who earned master’s and doctoral graduate degrees doubled. In 2000, 8.6% of U.S. adults had an advanced degree that figure is now closer to 13.1%.

In the face of sluggish wage growth, many young workers turned to graduate school in hopes of increasing their earnings. For many, graduate school stood out as an opportunity to close stubborn wage gaps.

One reason for that thinking is because women must earn one more degree than men in order to overcome some of the wage disparities they face, a 2018 wage gap report from the Georgetown Center on Education and the Workforce found.

“A woman with a bachelor’s degree earns $61,000 per year on average, roughly equivalent to that of a man with an associate’s degree,” reads the report. “The same rule holds true for women with master’s degrees compared to men with bachelor’s degrees and for each successive level of educational attainment.”

For some, graduate school can help close these gaps, but it has also come at a cost. The federal student loan program has charged interest rates as high as 7.9% in recent years. Currently, they are set at 6.28%.

Student Loan Debt By Generation

As you might imagine, student loan debt heavily falls on Millennials and Generation X. Nearly 43% of Millennial households have an active student loan balance and another 26% of Generation X households:

| Generation |

Once you grasp the chart, it’s pretty enlightening. These two statements follow :

- “Only 8.2% of households in the top 1% of income hold student loan debt.”

- “45% of households led by a person age 25-40 in the top 1% of overall income have student loan debt.”

That’s… a considerable gap. You can see why forgiveness is so controversial, especially with such a high income skew and with younger folks carrying most of the burden.

Recommended Reading: Does A Loan Processor Have To Be Licensed In California

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

The Types Of Federal Student Loans

Over three-quarters of all federal loans are direct loans. They are provided directly by the U.S. Department of Education and are available to most students regardless of financial need. Federal Family Education Loans are indirect loans, provided by accredited institutions but guaranteed by the government.

| Loan Type |

| 42.6 |

Perkins Loans are need-based loans of up to $5,500 a year for undergraduate students with very low household incomes they are issued directly by the universities. Federal loans are among the easiest for students to get, but most havelow annual limits, and interest rates can be high.

Graduates with multiple federal loans can turn to consolidation to streamline their finances and lock in lower interest rates.

Recommended Reading: How Long Before Sba Loan Is Approved

Federal Vs Private Loan Costs

There are two major sources for students loans, the Federal government and the private sector. Federal student loans should be every college students first choice. Federal loans have lower interest rates than their private sector counterparts, and offer much more student friendly repayment options. Many Federal loans also offer deferment plans, which allows for a grace period following graduation before the borrower must begin repayment. That being said, not all college-bound students will qualify for a Federal loan. Federal student loans are determined on the basis of financial need, and not all students will meet the criteria. Even those students who do qualify for Federal loans may find that they are still left with a significant amount of unmet need. Thats where the private, or alternative, loan comes into play.

Students are advised to pursue Federal student loans before considering any private lender loan agreements. Unfortunately, due to a lack of proper financial aid guidance, many students turn to private lender loans before exhausting all of the Federally supported financial aid opportunities. Before taking on any high cost private students loans, be sure to apply for any government sponsored financial aid programs for which you may be eligible.

Student Loan Debt The Fastest

Student loan debt, the fastest-growing debt in the U.S, is currently the second largest slice of household debt trailing only mortgage debt and surpassing credit card and auto loan debt.

Apparently, obtaining a four-year Bachelors or Masters degree and furthering your education is sure to cost a pretty penny.

Total student loan debt over the years

Also Check: How Long Does It Take For Sba Loan Approval

Tips For Avoiding Student Loan Debt

While the majority of college graduates leave school with student loan debt, you may be able to cover the costs of college using other forms of financial aid:

- Work Over the Summer:During school breaks, consider getting a part-time job or picking up a side hustle. Working for a few months and stashing your earnings can help cover a significant portion of your college costs.

- Fill Out the Free Application for Federal Student Aid: Even if you arent sure whether youll qualify for financial aid, fill out the FAFSA. Its what the federal government, states, schools, and some organizations use to determine your eligibility for all sorts of aid, including merit-based scholarships and grants.

- Search for External Scholarships and Grants:You can find gift aid on your own that is issued by companies and non-profit organizations. Use FastWeb and Scholarships.com to find and apply for scholarships and grants.

- Consider Work-Study Programs: Students that need financial assistance may be eligible for federal or state work-study programs. Working with the schools department of financial assistance, youll get a job related to your major and use the income to pay for some of your education expenses.

- Reduce your College Expenses:You can decrease the need for student loans by lowering your college costs. Commute to school, rent an off-campus apartment, and prepare your own meals to save money.

Student Loan Debt By Gender

Student loan debt also varies according to borrowers’ self-identified gender.Go to footnote

- Women carry almost two-thirds of the national student loan debt.

- 41% of women undergraduates go into debt, compared to just 35% of men.

- On average, women borrowers owe $22,000 in student loan debt upon graduation. Men owe $18,880 in student loans when they graduate, on average.

- Black women borrowers owe an average of $37,558 in student loans after graduating.

Don’t Miss: Marcus Goldman Sachs Loan Reviews

Average Number Of Student Loans Per Borrower

Of undergraduate students who borrow federal student loans to pay for a Bachelors degree, more than 95% borrow for at least four years.

On average, 85% of undergraduate students who borrowed a subsidized Federal Direct Stafford loan also borrowed an unsubsidized subsidized Federal Direct Stafford loan, based on data from the 2015-2016 NPSAS. Likewise, 85% of undergraduate students who borrowed an unsubsidized Federal Direct Stafford loan also borrowed a subsidized Federal Direct Stafford loan.

Thus, the typical student who borrows for a Bachelors degree will graduate with 7.5 or more Federal Direct Stafford loans, including both subsidized and unsubsidized loans.

About 11% also borrow institutional or private student loans and about 6% borrow institutional or private student loans without federal student loans. That brings the average number of student loans to 8.2 loans.

Thus, the typical number of student loans at graduation with a Bachelors degree will range from 8 to 12. This does not count Federal Parent PLUS loans.

How Much Is The Typical Student Loan Payment

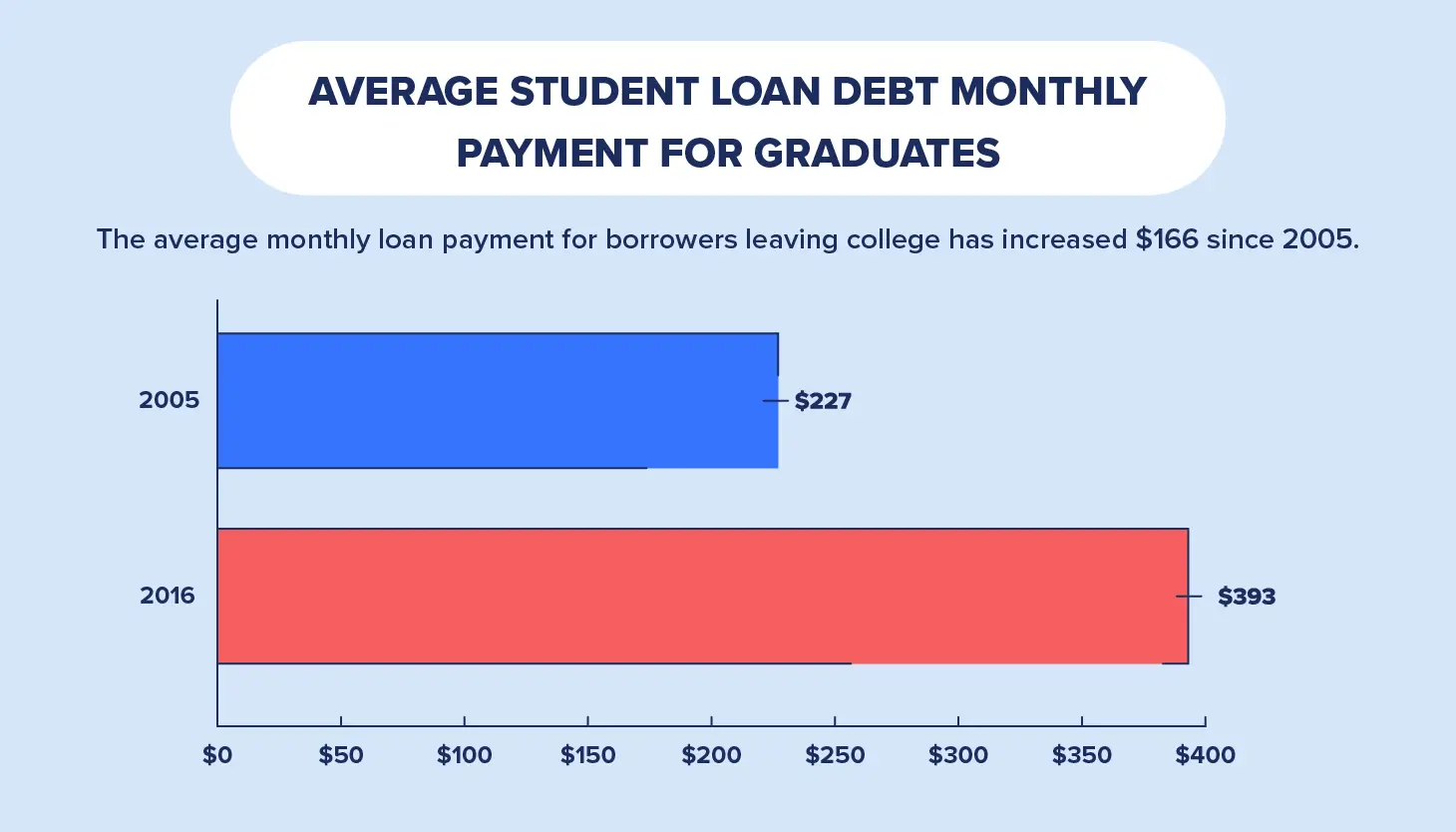

The average monthly student loan payment was $393 in 2016 , which is like buying the newest Apple Watch every two months. That puts the average monthly payment nearly 55% higher than it was a decade ago.

Student loan payments have increased more than two-and-a-half times faster than the rate of inflation. If the typical $227 monthly bill student loan borrowers received in 2005 had kept pace with consumer prices, the cost would only have risen by 22.9% to $279. Paying off student loans is significantly more challenging today than it was in the past, but there are strategies borrowers can use to cut their interest rates and lower their monthly payments.

You May Like: Myeddebt Ed Gov Legit

Average Student Loan Debt By Household Income

Families earning higher incomes tend to have higher student loan balances. Here’s how the average student loan debt breaks down by percentile of income or where a family falls on America’s income spectrum according to the a 2022 report by the Education Data Initiative:

| Income level | |

| 99th+ percentile | $40,550 |

According to the Education Data Initiative’s data, 56% of student debt is held by households with graduate degrees. While graduate school means more time in school, it also tends to mean more debt at a higher interest rate. Federal student loans for undergraduate students disbursed after July 1, 2022 and before July 1, 2023 carry a 4.99% interest rate, while graduate loans are higher at 6.54%.

Households with larger incomes tend to spend more on education. Students from higher-income families are less likely to have student loan debt, but those who do have it tend to have a lot.

According to CollegeBoard data on the debt borrowers held the end of the second quarter of 2021, borrowers from families earning an income over $100,000 made up only 7% of the overall borrowers, while accounting for 37% of the total debt.

| Income level |

| Private nonprofit college or university | $33,600 |

Essential Student Debt Statistics

- 75% of Canadian students have government-backed, while around 36% choose private bank loans.

- Total student debt in Canada is at least $18 billion.

- There are more than 1.7 million student borrowers in Canada.

- The average student debtor owes at least $26,075.

- Students of medicine and related fields have the biggest loans.

- The average interest rate for government loans is around 2.5%.

Don’t Miss: Signing Loan Agent

Student Loan Debt By Age

Today, fewer young people have federal student loan debt compared to previous years. But as students age, they’re taking their debt with them through their forties and sometimes beyond.Go to footnote

- The majority of people with active federal student loan balances are between 25-49.

- At the end of the first quarter of 2022, there were:

- 7.4 million federal student loan borrowers with active balances under 25

- 14.9 million borrowers aged 25-34

- 14.4 million borrowers aged 35-49

- 6.4 million borrowers aged 50-61

- 2.5 million borrowers 62 and older

Source: U.S. Department of Education

Student Loan Repayment Statistics

Since the start of the Covid-19 pandemic, student loan payments have been flipped on their head. Federal student loan payments have been paused nationwide since March 2020, and the majority of federal loans are currently in forbearance.

At the beginning of 2020, just 2.7 million borrowers had their federal loans in forbearance. That number had shot up to 24 million borrowers by the end of 2021. However, this reprieve is set to expire in May 2022, when federal student loan payments are expected to resume.

Here are the current repayment statuses of the federal Direct Loan program.

| Status | |

|---|---|

| $112 billion | 5.1 million |

Private student loans, on the other hand, received no widespread forbearance options during the pandemic. The majority of private student debt is actively in repayment. In the third quarter of 2021, 74% of private loans were in repayment, 17.5% were deferred, 6% were in a grace period and 2.4% were in forbearance.

Sources: Federal Student Aid, MeasureOne

Don’t Miss: How Much Car Can I Afford Based On My Salary

Student Loan Debt In The United States In 2022

- Student loan debt across the United States stood at nearly $1.75 trillion as of Q1 2022, according to Federal Reserve data

- Federal student loan debt is about $1.6 trillion as of Q1 2022, federal data show

- More than $140 billion in student loan debt consists of private student loan obligations as of 2022, according to the Education Data Initiative

- Some 43.4 million borrowers carry federal student loan debt as of Q1 2022, data show

The Survey Of Consumer Finances

In 2019, the Survey of Consumer Finances implied around $1.115 trillion in educational debt outstanding.

As you can see, the SCF likely underestimates total student debt outstanding by roughly 30%-40%, depending on how we score the ‘real’ number.

From a footnote in Bricker et. al, 2015 :

The core is typically the economically dominant single person or couple in the household, plus all other people in the household that are economically interdependent with that single person or couple. In this way, a young adult who is renting a house with roommates will be included in the economic core, but her roommates likely will not be. Likewise, an adult child living at home with her parents but with otherwise independent finances will not be included in the family.

Additionally, we don’t see data from dorms: “…the frame for the SCF excludes institutional residences, including college dorms.”

Luckily for you and me, the three main sources all grow at around the same rate. To that end: the SCF is still useful for student loan stats, but you need to keep its blind spots in mind.

Read Also: When Does Pmi Fall Off Fha Loan

Who Has The Least Debt

According to Federal Student Aid, 24-and-younger borrowers are the only age group to owe less student loan debt in 2021 than in 2017. This may result from college enrollments that have declined in 2020 due to the COVID-19 pandemic. However, while there was a nearly eight billion decrease from Q2 2020 to Q3 2020and a less than three billion recovery in Q4 2020these amounts aren’t atypical compared to the same quarter in the previous year.

The other groups have experienced their total debt burdens increasing at different rates. For example, the total student loan debt owed by 62-and-older borrowers has increased by $45.9 billion since Q2 2017. This could result from the oldest borrowers having either returned to school to improve their career prospects or taken out loans to support their children/grandchildren’s education.

Meanwhile, even though they owe far more per borrower, 25-to-34-year-olds only experienced a $22.8 billion increase. These numbers are far lower than the $137.5 billion increase in total borrowing experienced by 35-to-49-year-olds over the last three years.

One issue with student debt is when an older generation is paying their school debt and helping to pay for college for their children by co-signing or paying student loans.

Student Loan Default By Length

Delinquency and default are often confused. There is a technical difference between the two: you only need to miss your due date and monthly payments to become delinquent, and you enter default status after 270 days.

Below we cover how many borrowers are in current repayment, including the student loan amount, then share the data related to delinquency and default at specific intervals.

The most recent data available is from March 31, 2020, because the reporting of delinquency information has been temporarily suspended due to the CARES Act.

The information and chart below are for Direct Loans as of March 31, 2020:

- Current Repayment: $622.9 billion

- Borrowers in current repayment: 16.20 million

|

Days Delinquent |

Recommended Reading: Should I Get A Fixed Or Variable Student Loan