What Are Rates For A Conventional Mortgage

Interest rates for conventional mortgages change daily. Conventional mortgage interest rates are usually slightly lower than FHA loan interest rates and slightly higher than VA loan interest rates. However, the actual interest rate you get will be based on your personal situation.

While many sites can give you estimated conventional loan interest rates, the best way to see your actual interest rate for a mortgage is to apply. When you apply with Rocket Mortgage®, youll be able to see your real interest rate and payment without any commitment.

Using Gift Money From A Third Party

Borrowers who cant afford the minimum down payment for a conventional home loan might be able to get by using gift funds. Many of the mortgage products available today allow borrowers to obtain funds from a third-party to cover some of the down payment expense. This is true for both FHA and conventional home loans.

Depending on the type of mortgage you use, you might be able to obtain gift money from family members, close friends, employers, or other approved sources. So be sure to ask your lender about this option, if its important to you.

The basic rules for using down payment gifts are:

- The gift must be fully documented with a letter from the person donating the funds.

- A clear paper trail should show how the money was donated from one person to another, including applicable bank statements.

- The money must not be a loan in disguise. It must truly be a gift, with no repayment expected.

Disclaimers: This is a basic overview of the minimum down payment required for a conventional home loan in 2022. There are a lot of variables involved in the mortgage lending process. Additionally, there are exceptions to many of the general rules stated above. As a result, your situation could differ from the examples presented in this article. Portions of this article might not apply to your specific situation. The best way to find out how much you have to put down is to speak to a lender, or multiple lenders.

Other Requirements To Borrow A Conventional Home Loan

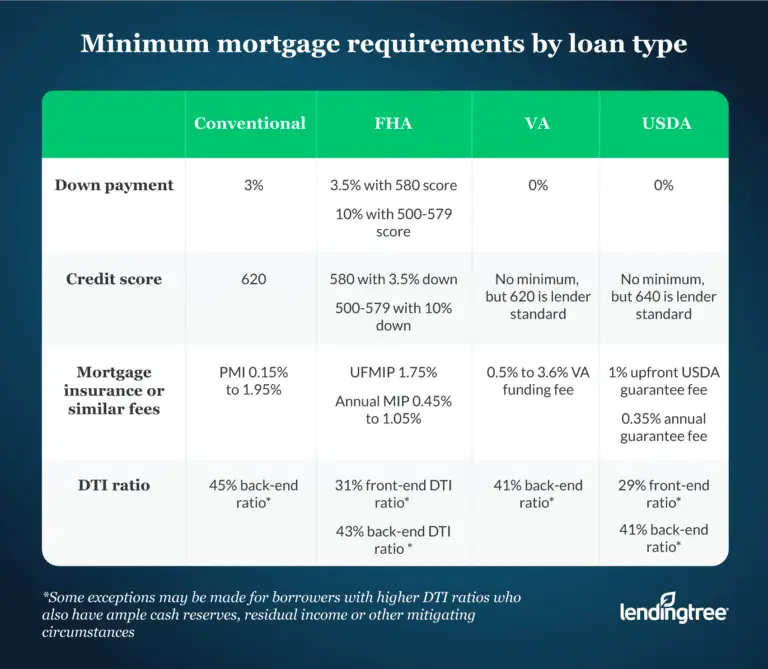

To take out a conventional mortgage, you need a credit score of at least 620.

However, borrowers with higher credit scores can get lower interest rates.

Youll also need a debt-to-income ratio of less than 43% and steady income and employment.

You can use a traditional loan to borrow up to $510,400 in most areas, but your lender will be able to tell you how much you are able to borrow when you get pre-qualified. Specific requirements can vary by lender.

Its best to look around and get pre-qualified with multiple lenders to find the one that works best for you.

You May Like: How Much Do Mortgage Loan Officers Make

Benefits & Disadvantages Of A Conventional Loan

Did you know that conventional loans offer advantages, such as more credit access? Conventional loan rates can be very competitive too. These are sometimes lower than what is available through an FHA loan. Another differentiating factor is mortgage insurance. Consumers do not have to pay mortgage insurance on conventional loans, but they do on most traditional FHA loans.

FHA or Conventional Loan? Which Is Better?

This depends on a persons individual situation. FHA loans and other government-backed loans can be a good deal. Federally backed loans may offer loans to those who have lower credit scores or a smaller down payment. Yet, they may have stricter requirements and may not loan as much as a conventional loan would. It is best to compare both options before making a decision contact one of our Mortgage Coaches to see which home loan best fits your needs!

Disadvantages Of Conventional Loans

The benefits of a conventional home loan are generally a result of lenders being willing to provide better rates and terms for lower-risk borrowers. The downside of conventional loans is they are much more exclusive than government insured options. Conventional loans have strict eligibility requirements related to your credit history, current financial situation and how much of a down payment you are capable of providing up front.

You May Like: How Much Is My Student Loan Payment Going To Be

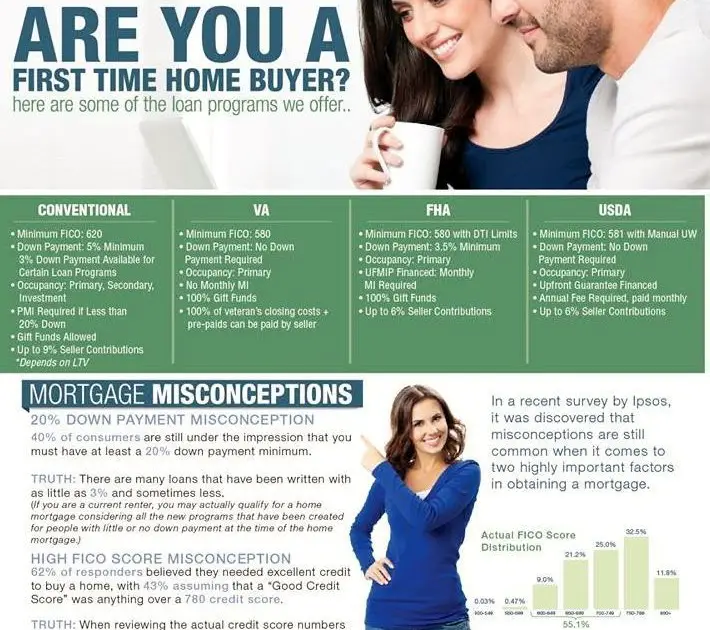

The 20% Myth: What You Really Need For Your Down Payment

While many people still believe it’s necessary to put down 20% when buying a home, that isn’t always the case. In fact, lower down payment programs are making homeownership more affordable for new home buyers. In some cases, you might even be able to purchase a home with zero down.

How much down payment you’ll need for a house depends on the loan you get. While there are benefits to putting down the traditional 20% or more it may not be required.

For many first-time homebuyers, this means the idea of buying their own house is within reach sooner than they think.

Prove A Stable Income

To qualify for a conventional loan, your monthly mortgage payments and monthly non-mortgage debts must fall within certain ranges. For instance, a lender may require your monthly mortgage payments not exceed 28% of your gross monthly income. In addition, your monthly mortgage payments, when combined with your other monthly debt payments , may be limited to a maximum of 36% of your gross monthly income.

Read Also: Where Can You Get An Fha Loan

Conventional Loans Vs Usda Loans

While conventional loans are available in all areas of the country, USDA loans* can only be used to purchase properties in qualifying rural areas. Those who qualify for a USDA loan may find that its a very affordable loan compared to other loan options. Although Rocket Mortgage doesnt offer USDA loans currently, were providing this information to you to help you understand all of your choices for mortgages.

Theres no maximum income for a conventional loan, but USDA loans have income limits that vary based on the city and state where youre buying the home. When evaluating your eligibility for a USDA loan, your lender will consider the incomes of everyone in the household not just the people on the loan.

USDA loans dont require borrowers to pay private mortgage insurance , but they do require borrowers to pay a guarantee fee, which is similar to PMI. If you pay it upfront, the fee is 1% of the total loan amount. You also have the option to pay the guarantee fee as part of your monthly payment. The guarantee fee is usually more affordable than PMI.

The right home is out there.

Find it online at RocketHomes.com.

How Much Down Payment Do You Need For A Conventional Loan

Its a common misconception that you always need a 20% down payment for a conventional loan. The truth is that it can be as little as just 3%.

However, not everyone qualifies for a 3% down payment. To put down this minimum, you will need a high credit score, sometimes as high as 660 to prove to lenders that you are not a risk to lend to.

In most cases, a 5% down conventional loan is more doable. However, you will still need a high credit score of about 620 and an acceptable debt-to-income ratio to qualify.

Of course, the main benefit of saving up for a 5% down payment is that it will result in lower monthly mortgage payments than a 3% down conventional loan would. But one thing to bear in mind is that any down payment less than 20% will usually require private mortgage insurance which is another cost to factor into buying a home.

You May Like: How Much Are Student Loan Payments Per Month On Average

Pros And Cons Of Conventional Loans

Conventional loans are not limited to purchasing a primary residence. For example, eligible borrowers can use the loan to buy a rental property or vacation home. Lenders of conventional mortgages typically only require borrowers to purchase mortgage insurance when they cant come up with a 20% down payment, but once a borrower pays down enough of the mortgages principal, insurance can be canceled.

Because conventional mortgages are not guaranteed by the government, they typically have stricter lending requirements, including a higher credit score and a lower debt-to-income ratio.

What Qualifies You For A Conventional Loan

Conventional Loans require a down payment of either 3% or 5% and a minimum score of 620. Additionally, the debt-to-income ratios should be between 45% and 50% and the overall credit profile should exhibit a good pay history. Without higher credit scores, expect to need a large down payment to receive an approval. Your lender will need to verify everything you provide on your application, including your income, work history, assets, as well as a credit report. This is required by the Lender in order for you to be able to verify your ability to repay your loan.

Fannie Mae and Freddie Mac have imposed some minimum conditions for all conventional loans however, each Lender has the ability to apply its own, stricter rules, which are referred to as lender overlays in the industry. Lenders are not allowed to impose rules that might be considered discriminatory in the mortgage industry.

These are the minimal conventional loan standards you should be aware of as a Borrower:

You May Like: Can I Qualify For An Auto Loan

Loan Limits On Conventional Loans

The nationwide loan limit on conventional loans starts at $647,200 but can go higher according to the location.

For example, Freddie Mac And Fannie Mae allow loan amounts to go up to $822,375 in some of the high-priced ZIP codes. The applicants that require loan amounts that exceed the standard limits should check on the limit for that specific area. The loans that exceed the conventional loan limit of an area are known as non-conforming loans. These usually require what is known as a Jumbo Loan rather than a conventional mortgage loan.

What You Need To Know About Fannie Mae Guidelines

Down payment. Fannie Maes HomeReady® and standard loan programs require only a 3% down payment for a single-family home, as long as its a primary residence. The programs allow gift funds from family members if you dont have the money saved up.

. 620 is the minimum credit score for a conventional mortgage, but youll qualify for better mortgage rates and lower private mortgage insurance premiums with a score of 680 or higher. Check with your lender if youre financing an investment or multifamily home the rates are higher.

. Youll need to wait up to seven years after a foreclosure to take out a conventional loan. A Chapter 7 bankruptcy will require a four-year wait before you can qualify. You may want to consider an FHA loan if you want to buy a home sooner: The waiting period is only two years after a Chapter 7 bankruptcy and three years after a foreclosure.

Debt-to-income ratio. Your DTI ratio is calculated by dividing your total monthly recurring debt by your gross monthly income and multiplying the result by 100 to get a percentage. Although 45% is the standard maximum, lenders may accept a DTI ratio up to 50% if you have higher credit scores and ample mortgage reserves.

Property types. Conventional loan requirements allow you to finance a home with up to four units in a regular subdivision, a co-op, condominium building or a planned unit development . Fannie Mae offers a manufactured home loan program for manufactured homes attached to a permanent foundation.

Recommended Reading: Can You Finance 2 Cars On One Loan

Make A Sizeable Down Payment

The standard down payment for a conventional loan is anywhere between 3% and 25% of a homeâs value depending on the borrowerâs credit and financial condition. For example, a $100,000 home could require a $20,000 down payment.

However, depending on a lenderâs unique specifications, a borrower may be able to put down as little as 3% at closing. Just keep in mind, this option is typically only available to those who meet additional requirements, like being a first-time homebuyer. Remember, with a larger down payment, homeowners also enjoy immediate equity in their home.

How To Choose A Conventional Loan Lender

If you decide to pursue a conventional mortgage, its worth shopping around different lenders to find the best rate. Its a myth that applying for loans with different lenders will hurt your chances of getting approved. In fact, this is one of the best ways to get a good deal on your mortgage rate as long as your mortgage applications are performed within a 30-45 day window.

Just as lenders will examine whether you are an eligible borrower, you should be considering if they are the best lender for you. Also, youll have more leverage if you can show prospective lenders the kinds of rates and deals youre finding elsewhere.

When looking for a conventional loan lender, be sure to consider closing costs and lender fees. Several mortgage lenders may advertise the same or similar rates, but their closing costs can vary significantly.

In addition to considering a lenders fees, you should pay close attention to their rates. By comparing each loans APR, you can get a better picture of the loans overall cost. To compare both fees and rates, youll need to submit applications to various lenders so that you can use their loan estimates.

Stay in the know with our latest home stories, mortgage rates and refinance tips.

In your inbox every Thursday

- A valid email address is required.

- You must check the box to agree to the terms and conditions.

Thanks for signing up!

Don’t Miss: Do You Pay Closing Costs With Fha Loan

Drawbacks Of A Conventional Mortgage

Conventional loans may be more popular, but that doesnt mean theyre for everybody.

There is a catch to the benefits of a conventional mortgage: you need a rock-solid financial profile. If you have a pristine credit score of 760+ and enough saved up for a 20% down payment, then you can qualify for the best mortgage rates and avoid paying for PMI.

But as your credit score and down payment decrease, your interest rate will go up. Your PMI premium can also increase with a lower credit score or smaller down payment.

Government-backed loans can be good options for first-time homebuyers because some of these programs, like USDA and VA loans, have no minimum down payment requirement.

Its also harder to qualify for a conventional mortgage if you have blemishes on your credit report. The FHA lending guidelines have always been more flexible, and they are more lenient about past financial challenges like bankruptcies, DeSimone says. And its the only loan available to people with credit scores as low as 500, if they put 10% down, she says.

Conventional Loan Vs Usda Loan

Depending on where in the country you want to buy a home, a USDA loan may be an option. You can get a USDA loan with little or no money down. The main criterion is that you need to purchase a home in a rural area that qualifies for the USDA loan program. If you want to buy in a city or a well-developed suburban area, a conventional loan is likely your better option.

Recommended Reading: Do You Get Student Loan All At Once

Dont Have The Down Payment Its Time For A Gift

The most common roadblocks to becoming a homeowner are high down payments.

If you dont have enough saved but want to buy a home, many lenders allow borrowers to use gift money as a down payment.

There are various restrictions on who can give you a down payment gift based on the type of mortgage youre applying for.

The down payment gift for a conventional loan must come from family. Fiancés and domestic partners are also considered part of the family.

Conventional Loan Credit Scores

In general, conventional loans are best suited for those with a credit score of 680 or higher. If you have a higher credit score, its possible that a conventional loan will offer the lowest mortgage rate. Applicants with lower scores may still qualify, but they can expect to pay higher interest rates.

Buyers with lower credit scores might benefit from a different type of mortgage, perhaps one backed by a government agency. Some other loan programs may cost less overall. For example, Fannie Mae and Freddie Mac impose Loan Level Price Adjustments to lenders who then pass those costs to the consumer. This fee costs more the lower your credit score.

For instance, someone with a 740 score putting 20% down on a home has 0.25% added to their loan fee. But, someone with a 660 score putting the same amount down would have a 2.75% fee added. These fees are not paid upfront but rather, translate to higher interest rates for homeowners.

See the complete matrix of LLPAs.

Also Check: Green Arrow Loans Phone Number

Down Payment For Conventional Mortgages

The minimum down payment for a conventional mortgage is 3%, however, there are several limitations such as income, a requirement to be a first-time home buyer, as well as debt to income ratio maximums. If these requirements cant be met, the minimum down payment is 5%. However, keep in mind, the down payment can be a gift from an acceptable source, essentially allowing the home buyer to purchase a home without a down payment of their own.

- If youre interested in an adjustable-rate mortgage loan, youll need a 5% down payment.

- For purchases of multi-unit properties, a down payment of 15% or more may be required.

- Purchases of second homes, a down payment of at least 10% is required.

- Youll need to leave at least 20% equity in your property if youre doing a cash-out refinance loan.

- Youll need 10.0125 percent equity to refinance a jumbo loan, depending on the loan amount.