Whats The Average Interest Rate On A Car Loan

According to the Federal Reserve, in the first quarter of 2021, the average auto loan rate on a 48-month new-car loan was 5.21%, and the average rate on a 60-month new-car loan was 4.96%.

A range of factors can affect what interest rates you might be offered, including your credit scores, the size of your down payment and the length of your loan term. Your rate may be higher or lower than average depending on your financial situation.

How We Chose Our Picks

We examined closed LendingTree auto loans from H1 2022. We wanted to know: 1) which lenders consumers chose most often, and 2) which ones offered the lowest average APR. We also looked at the advertised starting car loan rates of large, national lenders to compare.

To find the best rates for those with military connections, we looked at rates offered by USAA Bank, Navy Federal Credit Union, Pentagon Federal Credit Union and Randolph-Brooks Federal Credit Union, and chose the one with the lowest advertised APR for a traditional new car loan not including any other discounts that may be available, such as breaks for using a car-buying service.

How To Calculate Total Interest Paid On A Car Loan

This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin. This article has been viewed 366,817 times.

There are several components that are used to compute interest on your car loan. You need to know the principal amount owed, the term of the loan, and the interest rate. Most car loans use an amortization schedule to calculate interest. The formula to compute amortization is complicated, even with a calculator. Car buyers can find amortization calculators on the web. If your car loan uses simple interest, you can use the calculator to determine your monthly payment amount.

Also Check: What Interest Rate On Car Loan

Outlook For Auto Loan Interest Rates

2022 has already proven to be a complicated one in all facets of American finance. And, unfortunately, the automotive industry has not come out unscathed. Decisions made by the Federal Reserve and the remaining supply chain issues all play a part in how much it’s going to cost to finance your next car.

The increased Fed rate, sitting at 2.25-2.5 following the July meeting, will indirectly affect your rates. But, while the federal funds rate determines what lenders base their rates on, it is not the only consideration.

When combined with the tumultuous state of the car-buying market, it results in a more expensive experience overall. Kelley Blue Book reports that new vehicle costs were as high as $48,000 in June 2022.

With all of this in mind, consider approaching your next loan with extra care. Be sure to apply for preapproval and shop multiple lenders.

How To Determine If Youre Getting A Good Rate

There are a lot of numbers involved with buying a new car, and your loans APR is just one of them. Getting a good APR, however, means that youre not giving up any more of your hard-earned cash than you need to.

But how do you determine if youre getting a good APR?

When youre comparing loan offers from two or more different lenders, pay special attention that youre comparing apples-to-apples APR to APR, not APR to interest rate. Auto loans arent as regulated as mortgages and some other types of loans, so you may have to do some digging through paperwork to find the APR of a given loan.

Make sure, too, that youre comparing APRs based on the same loan term. The APR of a 36-month loan, for instance, is going to be less than that of a 48-month term. If, however, a 36-month term is out of your budget, it doesnt matter what that offers APR is.

Also Check: How To Home Loan Process

Average Auto Loan Interest Rates: Facts & Figures

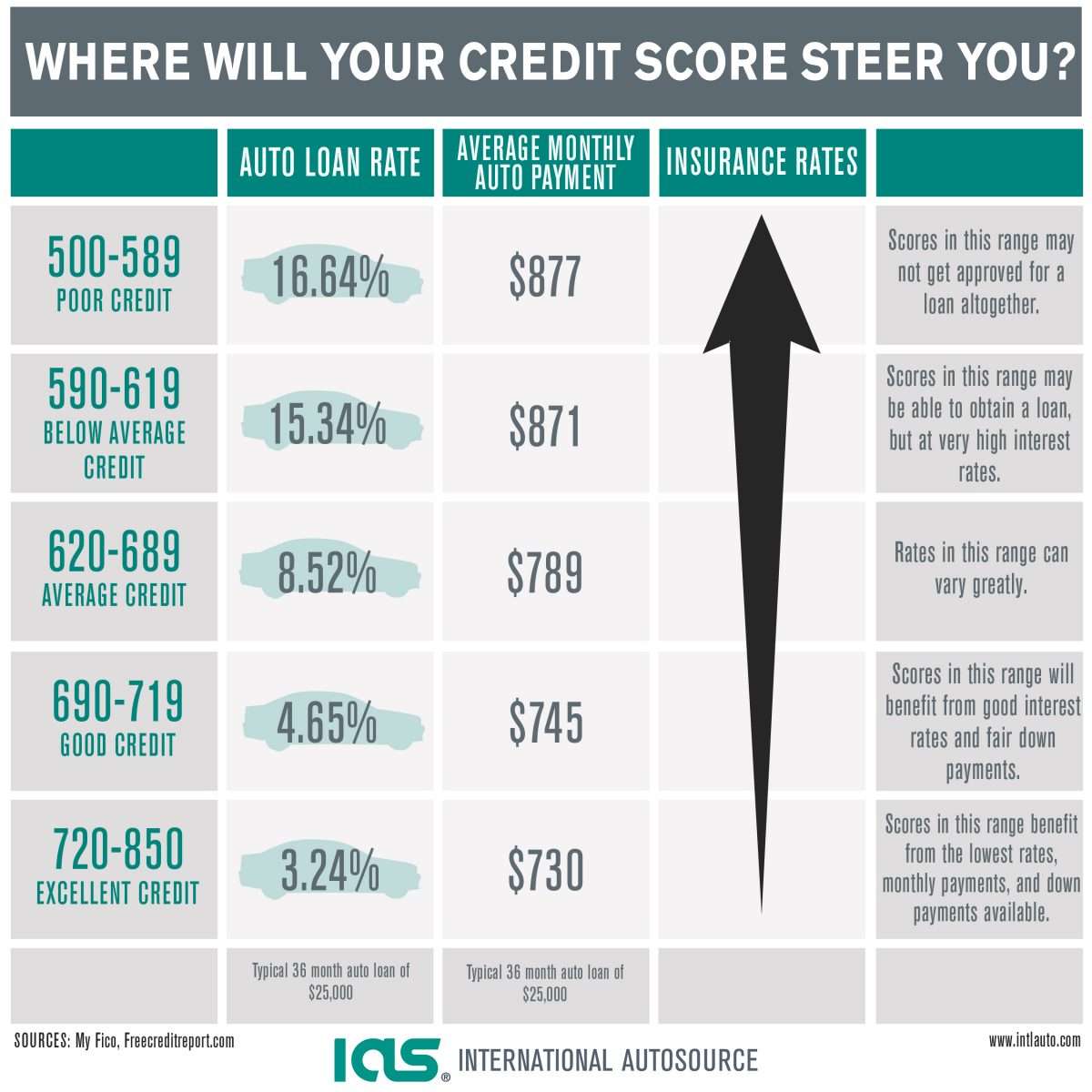

The national average for US auto loan interest rates is 5.27% on 60 month loans. For individual consumers, however, rates vary based on credit score, term length of the loan, age of the car being financed, and other factors relevant to a lenders risk in offering a loan. Typically, the annual percentage rate for auto loans ranges from 3% to 10%.

Your Credit Score Is One Of Several Variables Considered

The higher your credit score, the lower the interest rate you may qualify for.

This important three-digit number typically ranges from 300 to 850 and is used in all sorts of consumer credit decisions. Lenders also typically use information such as your income and other monthly expenses.

A good score generally is above 670, a very good score is over 740 and scores above 800 are considered exceptional, according to credit-reporting firm Experian. Scores below 670 are considered fair anything below 580, poor.

The difference in the interest rate available across different credit scores can be stark.

For illustration: With a in the 720-850 range, the average interest rate for a five-year, $45,000 car loan is just under 5.8%, according to FICO’s latest data. That translates into monthly payments of $865, and the amount of interest you’d pay over the course of the loan would be $6,890.

Compare that to what someone whose credit score fell between 660 and 689 would pay. That same loan would come with an average rate of almost 9.4%, resulting in monthly payments of $942 and $11,514 in interest over the life of the loan.

While it’s hard to know which credit score will be used by a lender they have options having a general goal of avoiding dings on your credit report helps your score, regardless of the specific one used, experts say.

“That said, there are some things you can do to improve your score quickly,” he said.

Don’t Miss: Does Va Loan Have To Be Primary Residence

What Determines Your Apr On A Car Loan

APR accounts for both your car loan interest rate and the cost of any financing fees and prepaid expenses. The Truth In Lending Act , a federal law, requires lenders to disclose the APR on your vehicle purchase before signing a loan agreement. An example of a prepaid expense would be an origination fee.

Interest rate

Your interest rate usually makes up the biggest part of the total APR on your vehicle. Because of this, lowering your interest rate can help you get the best APR on your car loan.

Origination fees

A loan origination fee is the amount of money youll pay upfront to cover the cost of processing your loan. These fees can be a small percentage of your loan amount or a flat fee.

Comparing Interest Rate Vs Apr

| Interest rate | |

| Based on a loans principal | Based on a loans principal and interest rate, plus any other fees and expenses wrapped into the loan |

| Reflects the cost of borrowing money | Reflects the broader cost of taking out a loan |

| lower than APR | Usually higher than a loans interest rate, except in certain scenarios |

Also Check: How To Get First Loan

What Are Good Interest Rates & Aprs For Car Loans

When it comes to purchasing a vehicle, theres a lot to consider, such as what make and model youd like, what gas mileage you need, and so on. But figuring out how to finance your next vehicle purchase is one of the most important steps in the process. When youre comparing car loan options, youll see two terms interest rate and APR. These both give you an idea of how much it costs to take out a car loan. Well show you the difference between APR and interest rate and share some tips to help you get better rates next time you buy a vehicle.

Factors That Impact The Interest Rate

You’ll. be a more informed car shopper if you know the factors that can affect the interest rate on your car loan. We’ve listed some of the most important ones below.

- Current Interest Rates: In a strong economic environment, interest rates tend to be higher. In weaker periods, they can be lower. If rates are high, consider putting off your purchase until they drop.

- Good are attractive to lenders and can mean lower interest rates. Conversely, lower credit scores can mean offers of loans with higher interest rates.

- Down Payment: The amount you can pay upfront for a car can affect your loan’s interest rate. The more you put down, the lower the rate you may get because less is at risk for the lender. With small down payments, lenders may charge higher rates due to the risk of default on a larger loan amount.

- Term of Loan: Rates vary depending on a loan’s term. Longer-term loans can come with higher interest rates.

- Lender Type: If you have a choice, consider a car loan from a . Normally, credit unions offer more attractive rates on car loans than banks. Similarly, take a look at what’s on offer in the finance department of the carmaker. It may offer specials that include lower interest rates.

- New or Used Cars: Whether a car is new or used can affect the interest rate on a loan for it. Rates on loans for used cars are typically higher than on loans for a new car.

Read Also: What Size Loan Do I Qualify For

Tips For Reducing Average Car Loan Rates

The best way to reduce the average auto loan rates you find is to improve your credit score. This can be done by paying your bills on time and keeping your credit card balances low. Paying your monthly payments in full can also help. Outstanding debts or collection notices can impact your credit score, so paying these off will improve your credit.

However, building your credit score can take time and the advice above may not be practical for everyone, especially those with a limited income struggling to pay minimum balances each month.

There are a few other things that can reduce your auto loan rates:

- Have someone cosign: Many lenders allow you to have another person cosign a loan. A cosigner with strong credit can reduce your interest rates.

- Buy a new car instead of a used one: While new cars are more expensive, lenders typically offer lower auto loan rates for new car purchases.

- Place a bigger down payment: A bigger down payment can reduce your interest rate as well as the amount of time it takes to pay off your loan.

You might also consider trying to pay your loan in a shorter time frame. While this may not reduce your loan interest rate, it will mean that you pay off your loan sooner and will have to pay less interest. However, be sure to read your loan contract language carefully. Some lenders charge a prepayment penalty an extra fee for paying down your auto loan too early.

Best For Fair Credit: Carvana

Carvana

For fair credit borrowers in the market for a used vehicle, Carvana provides the ability to shop online for financing and a vehicle at the same time. It has no minimum credit score requirement, providing a financing solution for those with damaged credit.

-

Entirely online dealer and lender

-

Excellent credit borrowers get the lowest rates

-

Minimum income requirement of $4,000 annually

-

Only for used vehicles

As with most lenders, borrowers with the best credit get Carvana’s most competitive rates. Carvana does not advertise its rates or publish a table, but you can estimate your monthly payment with an online calculator. That said, even the calculator does not reveal the rate it is using. You must prequalify to know what your interest rate will be.

Carvana is a completely online used car dealer that also provides direct financing. It makes it possible to secure financing, shop for a vehicle, and get a used vehicle delivered without leaving your house. There is no credit score minimum for its financing program, making this an attractive option for fair credit borrowers. However, you must have an income of at least $4,000 annually and no active bankruptcies.

Recommended Reading: What Are Home Improvement Loan Rates

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How To Apply For An Auto Loan

You can apply for an auto loan online, at a financial institution, or at the dealership when purchasing a car. Some lenders allow you to browse the inventory of participating dealerships after your loan is preapproved. Because most loan applications require vehicle information, you may need to have a particular car in mind before applying.

When you apply for a car loan, be sure to have the following information handy, as it may be required to prequalify and will certainly be required before you submit your formal loan application:

- Personal details such as name, address, and age

- Social security number

- Gross annual income information

- Vehicle information such as age, mileage, and vehicle identification number

While not required during prequalification, before you can secure your loan, you may need additional documentation such as your drivers license, pay stubs, and personal references.

If you plan to have someone cosign your loan, that person will also need to supply the information and documents mentioned above.

Also Check: How To Apply For Student Loan Deferment

Improving Your Credit Score

If you’re able to take a few months to improve your credit score, you can lower your interest rate. One of the best ways to do this is to lower your debt-to-income ratio by paying down other debts you owe. You can also continue to make on-time payments to reduce the impact of recent late payments.

A higher credit score will help you qualify for better loan rates, but it may take several months for you to improve your score. Some people see faster results when they make two payments each month instead of one, depending on how often the creditors report to credit bureaus.

How Is Interest Calculated On A Car Loan

Lenders calculate interest on auto loans in one of two ways simple or precomputed. With a simple interest loan, your interest is calculated based on your loan balance on the day your car payment is due. The amount of interest you pay each month changes. On a car loan with precomputed interest, the interest is calculated at the start of your loan and based on your total loan amount. The amount of interest you pay each month remains the same. Lets take a closer look at each type of interest.

Recommended Reading: Is Bayview Loan Servicing Legitimate

The Kia Sonet Gtx+ Automatics Launched In India At A Price Point Of Rs1289 Lakh

The Kia Sonet was launched recently in India. However, the price tags of the top-variant models of the car were not revealed at the time of the launch. The automakers have recently revealed the prices of the petrol and diesel variants of the top-spec model.

The Kia Sonet GTX+ will be available in both petrol and diesel variants and will come with automatic transmission setups. Both the cars have been priced at Rs.12.89 lakh . As per the latest revelations of the prices, the petrol range of the car now starts at Rs.6.71 lakh and goes up to Rs.12.89 lakh and the diesel variant starts at Rs.8.05 lakh and goes up to Rs.12.89 lakh. There is a total of 17 different trims of the car on the basis of the engine, trim, and so on. The two petrol unit variants of the car churns out 83 hp and 120 hp respectively. The diesel unit is a 1.5-litre setup which churns out 100 to 115 hp of max power and 240 Nm to 250 Nm of peak torque.

30 September 2020

How To Calculate Auto Loan Interest

Its smart to determine your expected auto loan interest rates prior to signing off on your next loan. Not only will it put you in control of your finances, but it can ensure that you dont end up paying more interest than you should. Here are a few ways that you can calculate your car loan interest rate.

- Calculate on your own. You will need the interest rate, term and loan amount, just as you would for any other method. Divide your interest rate by the number of payments in a year, then multiply it by your loan balance. The resulting number will be how much your interest payment for the month is.

- Use an auto loan calculator. If you are looking for a simpler route to avoid any mental math, an auto loan calculator will handle all the calculations. Bankrates auto loan calculator will present you with your estimated monthly payment, total interest paid and a full amortization schedule.

- Speak directly to a loan officer. Finally, connecting directly with a loan officer will provide you with a more tailored experience. This way they can tell you expected rates with your credit history in mind. Speaking directly to a loan officer is also a great way to gather and compare a few options.

Also Check: What Do I Need To Get Loan From Bank