How To Calculate A Personalized Debt

Your personalized debt-to-income ratio should account for recurring, unavoidable personal or family expenses not included in the Step 2 definition of debts. Such expenses might include:

- Health insurance

- Home insurance, if not bundled in escrow

- Childcare costs, if you have young kids in a single-parent or two-earner household

- Income taxes, if not wholly withheld from your paycheck

- Utility and communications expenses

- Groceries

Obviously, the more expenses you include, the closer youll come to simply rehashing your households budget.

You can avoid that by concentrating on the largest obligations: in most cases, health insurance and childcare. Before calculating your personalized debt-to-income ratio, subtract your health insurance costs and childcare costs from your gross income.

If you qualify for tax credits or deductions related to either expense, add those back in. Depending on your income, you may qualify for a tax credit equal to 20% to 35% of qualifying daycare or other supervisory expenses for children and dependents under age 13, capped at $3,000 in expenses for one child and $6,000 in expenses for two or more children. The full credit is only available to lower-income parents. If you earn more than $43,000 per year, your credit is capped at 20%.

How Do You Calculate Your Debt

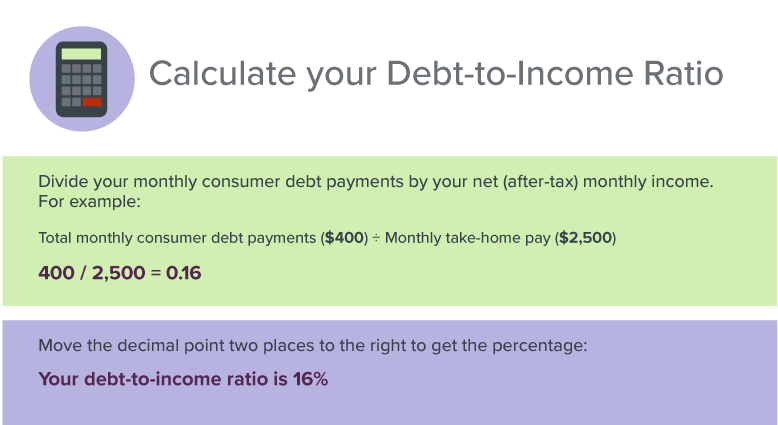

Now that you know what a debt-to-income ratio is, how do you go about calculating it? Thankfully, it is a fairly simple process and shouldnt take you that long at all to figure out. It is calculated by dividing the debt payments you make each month by how much money you make each month, the number is normally presented as a percentage.

For example, if you make $4,000 a month and have debt that includes a $1,000 mortgage payment and a $500 car loan payment, you will have a debt-to-income ratio of 37.5%. So, the calculation we made for that was $1,500 divided by $4,000 . We got .375, and then we turn that number into a percentage and get 37.5%!

But the question you are probably asking is what does that number mean? If you have a low DTI ratio, you have a good balance between debt and income and are in no real danger of not being able to keep up with your debt, even if an emergency comes up. However, if you have one that is high, it can sometimes signal that you are carrying too much debt for how much money you are making. Also, having a high DTI ratio can simply make it hard for you to pay bills every month with so much of your income going to your debt payments.

Is your car loan payment worth more than your car? Heres what to do.

What is a Good Debt-to-Income Ratio?

Interested in getting serious about paying down your debt? Check out this infographic.

Avoid Adding New Debt

While youre paying down your current debt, dont take on any new debt. Even if you dont use a new credit card, the fact that youre applying for a new one will be a red flag to lenders.

There is one exception: the balance transfer offer. If you can qualify for a credit card with an extremely low introductory rate, it might be worth applying and transferring your higher-interest balances to it.

The lower interest rate will enable you to pay off debt faster because most of your payment will go toward paying off the balance rather than paying interest. Keep in mind that to make this work from a DTI standpoint, you should formally close your other credit accounts and stick to your payoff plan.

Don’t Miss: How Far Back Do Underwriters Look At Bank Statements

You Need To Know This Number If You’re Going For A Mortgage

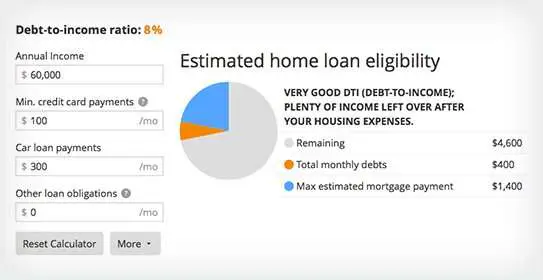

Your debt-to-income ratio is a personal finance measure that compares the amount of debt you have to your gross income. You can calculate your debt-to-income ratio by dividing your total recurring monthly debt by your gross monthly income

Why do you need to know this number? Because lenders use it as a measure of your ability to repay the money you have borrowed or to take on additional debtsuch as a mortgage or a car loan. It’s also a helpful number for you to know as you consider whether you want to make a big purchase in the first place. This article will walk you through the steps to take to determine your debt-to-income ratio.

How To Calculate Your Income

Calculate your monthly income by adding up income from all sources. Start with your base salary and add any additional returns you receive from investments or a side business, for example. If you receive a year-end bonus or quarterly commissions at work, be sure to add them up and divide by 12 before adding those amounts to your tally.

Don’t Forget Your Spouse!

Your spouse’s income is also included in your income calculation provided you are applying for the loan together.

What if Your Spouse Has Poor Credit?

If one spouse has poor credit and the other buyer would still qualify without including their spouse on the loan, then it can make sense to have the spouse with better credit apply for the mortgage individually. If the spouse with poor credit is included on a joint application the perceived credit risk will likely be higher. Bad credit mortgages charge higher interest rates.

Recommended Reading: Refinance Auto Loan With Usaa

How Can You Lower Your Debt

Since the formula for your debt-to-income ratio uses two different numbers, there are a couple of different ways to lower your DTI ratio. The first is to lower the amount of debt that you owe.

You can do this by paying off your credit cards or loan balances ahead of schedule. Even if youre having trouble paying beyond your minimums, look at refinancing options to lower your monthly debt payments with a lower interest rate.

How To Improve Dti Ratio For A Better Chance Of Car Loan Approval

If you have a high debt-to-income ratio, its better to improve it first to increase your chances of getting approved for a car loan. Here are some tips:

- Review Your Expenses

Check your expenses first. Create a list of all your monthly debt payments. For example, your rent or mortgage, credit card debt, student loans, and property taxes. Evaluate all your monthly expenses including your gym memberships, groceries, Netflix subscription, internet, and cable bills those that have automatic deductions are worth your careful review. Decide which ones you can do without and be disciplined enough to take the corrective action required. .

- Lower Your Debt

There are different ways to pay down your debts. You can use the snowball method wherein you concentrate your payment efforts toward your smallest debt first or the avalanche method where you make minimum payments on all your debts, including your mortgage, except the one that has the highest interest rate.

- Increase Your Gross Monthly Income

You can increase your gross monthly salary by finding a job that pays more or asking for a raise if you think you deserve it. But if these options are not possible, you can also get a part-time job.

- Create A Budget And Stick To It

Budgeting helps you avoid overspending and making unnecessary purchases. It will also allow you to set aside money for debt repayments.

- Consider Refinancing Your Loans

Don’t Miss: Usaa Auto Loan Requirements

Why Do Lenders Care About My Debt

When a lender considers whether or not to let you borrow money, it wants information about how you handle your finances both past and present. So lenders will look at different factors like your , and debt-to-income ratio to get an idea of your financial picture.

When lenders see a healthy debt-to-income ratio, it can help them feel more confident that youll be able to make your loan payments. This might help you qualify for financing.

Divide Your Debt Payment By Your Gross Income

Now that you’ve determined your monthly gross income and your monthly debt payments, use the following formula to finish your calculations:

monthly debt payment total / gross monthly income = debt-to-income ratio

In other words, divide your monthly debt payment total by your gross monthly income.

For example:Using the values above, divide your monthly debt payment total of $2,400 by your gross monthly income of $3,467. This would result in a debt-to-income ratio of 0.69.

You May Like: Usaa Auto Loan Eligibility Requirements

How To Reduce Your Debt

There are times when having a high debt-to-income ratio makes sense. For example, it’s not terrible to have a high ratio if you’re aggressively paying off your debt. On the other hand, if your ratio is high and you’re only making minimum payments, that’s a problem.

Generally, there are two ways to lower your debt-to-income ratio. First, you can increase your income. That could mean working some overtime, asking for a salary increase, taking on a part-time job, starting a business, or generating money from a hobby. The more you can increase your monthly income the lower your debt-to-income ratio will be.

The second way to lower your ratio is to pay off your debt. While you’re in debt repayment mode, you’ll have less discretionary income at your disposal because you’ll be spending more of your monthly income on debt payments.

If you need help lowering your debt-to-income ratio, a nonprofit credit counselor can help you come up with a personalized plan.

An Acceptable Debt To Income Ratio

- 100% or higher DTI – these prospective borrowers represent a huge risk and do not show an ability to make regular mortgage payments. Almost all lenders will reject an application in this instance.

- 75% to 99% DTI – borrowers who are very high risk. A select few specialist lenders will be willing to look at the application and make a positive decision where other factors are given more weight, such as credit score and a clean credit history or substantial deposit.

- 50% to 74% DTI – high risk borrowers. Some specialist lenders are willing to accept applications at this level, but terms are less favourable and larger deposits are required.

- 40% to 49% DTI – moderate risk borrowers. Specialist lenders will want to see good credit history and may ask for larger deposits.

- 30% to 39% DTI – acceptable risk. Most specialist lenders will offer a mortgage at this level at standard terms.

- 20% to 29% DTI – good borrower. Almost all lenders are happy to approve mortgage applications at this level.

- 0% to 19% DTI – very low risk borrower. All lenders will consider an application.

Also Check: Usaa Auto Interest Rates

Comparing Frontend Vs Backend Ratios

Now that you have your average monthly income you can use that to figure out your DTIs.

- Front end ratio is a DTI calculation that includes all housing costs As a rule of thumb, lenders are looking for a front ratio of 28 percent or less.

- Back end ratio looks at your non-mortgage debt percentage, and it should be less than 36 percent if you are seeking a loan or line of credit.

Impact Of A High Debt

A high debt-to-income ratio can have a negative impact on your finances in multiple areas. First, you may struggle to pay bills because so much of your monthly income is going toward debt payments.

A high debt-to-income ratio will make it tough to get approved for loans, especially a mortgage or auto loan. Lenders want to be sure you can afford to make your monthly loan payments. High debt payments are often a sign that a borrower would miss payments or default on the loan.

While your credit score isn’t directly impacted by a high debt-to-income ratio, some of the factors that contribute to a high debt-to-income ratio could also hurt your credit score. More specifically, high credit card and loan balances, which may play a role in your high debt-to-income ratio, can hurt your credit score.

You May Like: The Mlo Endorsement To A License Is A Requirement Of

Are There Different Types Of Debt

The short answer: sort of.

If youre trying to get a loan to buy a house, mortgage lenders will also look at your front-end ratio . Your front-end ratio only factors in your housing costs, such as mortgage payments, property taxes, and homeowners insurance. Instead of total debt payments, youd divide your monthly housing payments by your monthly gross income.

In the mortgage world, lenders consider both your front-end ratio and your back-end ratio. Your back-end ratio is the same formula we used in the previous section calculating DTI: your total monthly debt to total monthly income.

Lets stick with our previous example. Youre ready to buy a house. Since houses are significant purchases, you decide to apply for a mortgage which has a $1,000 monthly payment .

Pre-tax income: $4,000

Front-end ratio: $1,000 ÷ $4,000 x 100 = 25%

Back-end ratio: $1,925 ÷ $4,000 x 100 = 48.1%

In this example, your front-end ratio would be 25% , while your back-end ratio would be 48.1% .

What Are The Other Expenses To Consider When Buying A Car

Owning a car goes beyond the monthly loan payments. Youll have to consider other expenses, which include the following:

- Regular insurance premiums

- Auto maintenance and repair costs

- Taxes and registration

- Parking fees

You will find several car repayment calculators online to help in your calculation of how much mortgage youre going to be paying every month for the amount of money that would like to borrow.

How much can I borrow for a car? Thats a fairly common question for car buyers. You can also find free car loan calculators that could give you an estimate on how much fund you can get from lenders based on your credit, gross income a month, and debt factors.

Recommended Reading: Can A Va Loan Be Used For An Investment Property

How Can I Improve My Debt

There are a number of ways you can try to improve your debt-to-income ratio. The basic idea is lowering your debt or increasing your income. Here are some ideas.

- Pay down debt early. If you have room in your finances, make more than the minimum payments on your debts each month so that you pay them down faster. For example, pay more than your minimum credit card payment every month.

- Cut monthly expenses to pay off more debt. Look at your budget and consider ways you can adjust your spending so that you have more money to use toward debt repayment.

- Consider a debt-consolidation loan. If you cant make extra payments on your debt or trim your budget, a debt-consolidation loan could be a good option. This may help you reduce the amount of interest you pay while you work to pay down your debts.

- Get a side hustle or ask for a raise. Extra income from side jobs can count toward your income when you calculate your debt-to-income ratio. The boost in salary youd get from a raise could also help to lower your DTI.

What Is An Automated Underwriting System

Themortgage underwriting processis almost always automated using an Automated Underwriting System . The AUS uses a computer algorithm to compare your credit score, debt and other factors to the lender requirements andguidelines of the loanyou’re applying for. While lenders use to manually underwrite loans, only a few do so today and usually only under a few special circumstances like:

- If you do not have aFICO scoreor credit history

- If you’re new to building credit

- If you’ve had financial problems in the past like a bankruptcy or foreclosure

- If you’re taking out ajumbo loan

Also Check: Usaa Auto Loan Refinance Rates

What Can I Do When My Mortgage Is Declined Due To Affordability

When lenders decline your loan due to affordability, it could mean that your debt-to-income ratio is too high. Have a look at your credit report and see if youre using more than 30% to 35% of your revolving credit. Another way to improve affordability is to put down a higher deposit. You may also need to increase your income or decrease your non-essential expenditure.

Should I Include My Spouses Debt

In states where you have the option to do so, this depends on how beneficial it is for you. Having two incomes available means that you could qualify for larger loans. Combined debt and income could give a lower, stronger DTI ratio.

Applying as a couple would be ideal in such a case. However, if a couples combined credit score and debt-to-income ratio severely affect the prospects of qualifying for a good mortgage, it might be better to apply as an individual.

- Categories

Read Also: Fha Limits In Texas

Tips To Improve Your Debt

Reducing your debt-to-income ratio may seem self-explanatory, but paying down debt is often easier said than done. Follow these tips to make a meaningful, timely impact on your debt-to-income ratio before you apply for a mortgage or another major loan: