What Are Other Important Car Ownership Costs To Consider

Beyond the cost of monthly car loan payments, car insurance can be a significant expense. Make sure you understand car insurance rates and the best car insurance companies available in order to select the best car insurance coverage for your needs.

Estimate your monthly payments with our handy Auto Loan Calculator.

What Are Car Loans And How Do They Work

Auto loans are secured loans that use the car youre buying as collateral. Youre typically asked to pay a fixed interest rate and monthly payment for 24 to 84 months, at which point your car will be paid off. Many dealerships offer their own financing, but you can also find auto loans at national banks, local credit unions and online lenders.

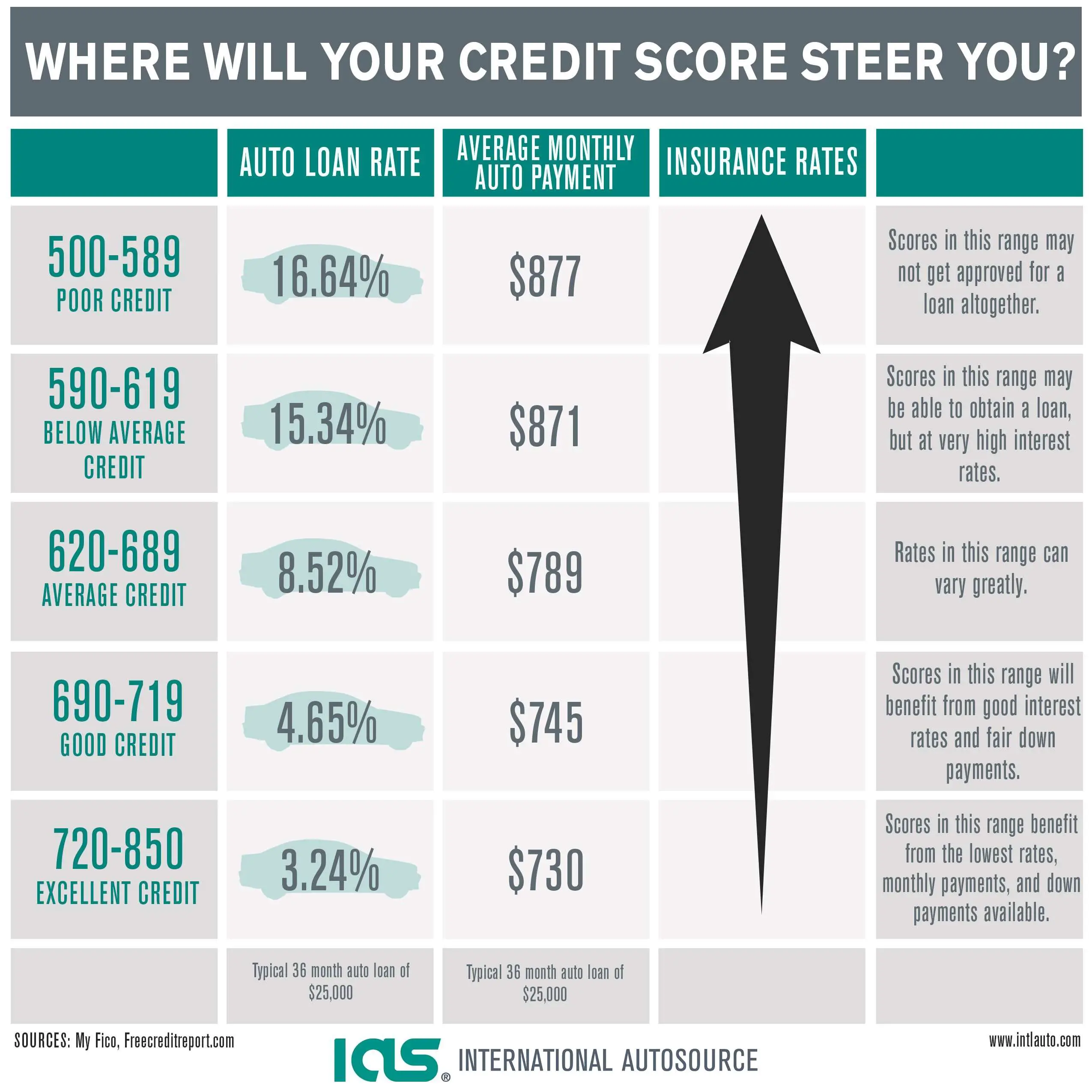

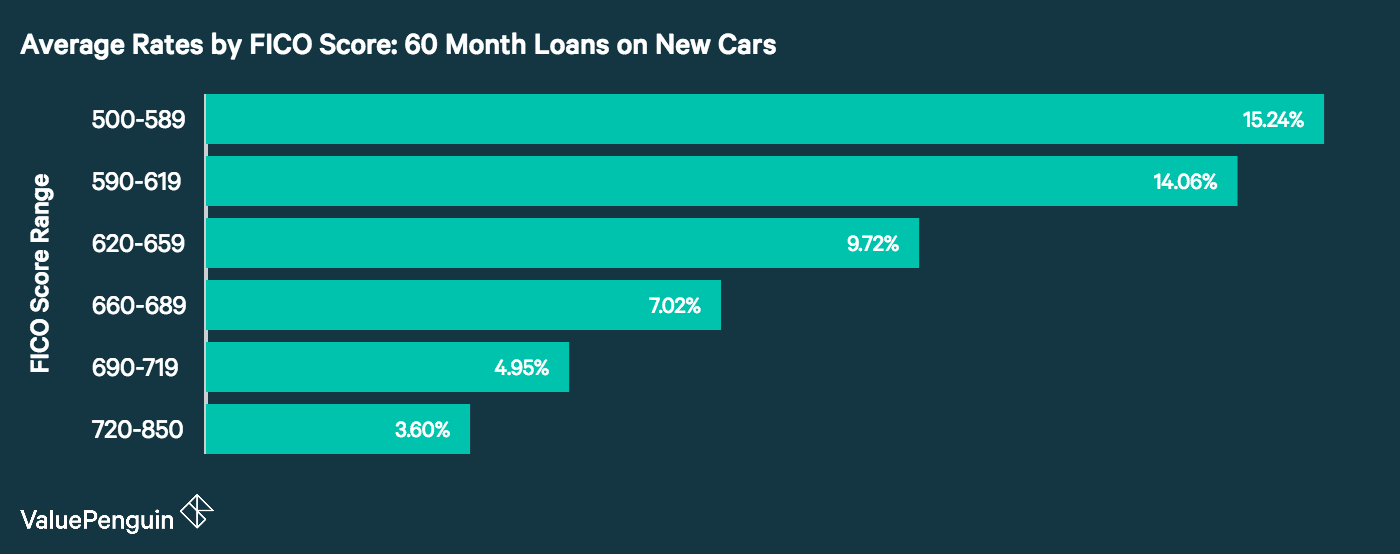

Because auto loans are secured, they tend to come with lower interest rates than unsecured loan options like personal loans. The average APR for a new car is anywhere from 3.24 percent to 13.97 percent, depending on your credit score, while the average APR for a used car is 4.08 percent to 20.67 percent.

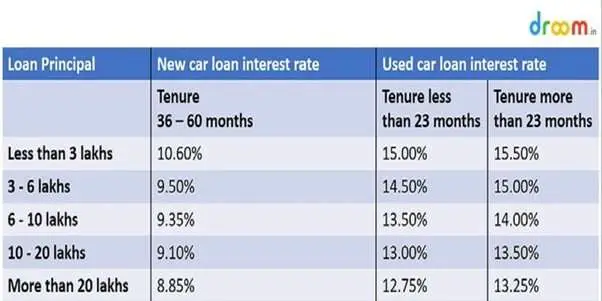

Whats The Difference Between New And Used Car Interest Rates

Loans for newer cars tend to have lower interest rates than those for used cars. Lenders see newer cars as less of a risk theyre less likely to break down, and lenders can identify exactly how much theyll depreciate over time. Newer cars have more predictable resale value down the line than newer cars, and that predictability results in a lower interest rate.

Don’t Miss: Is Bayview Loan Servicing Legitimate

Check Latest Car Prices In India

With the automobile industry expanding at a rapid pace and with more and more car manufacturers establishing their bases in India, buying a car has become a hassle-free procedure. Car prices in India vary depending on the segment of the car purchased and with the additional features provided by the manufacturer. BankBazaar offers a comprehensive list of car prices across various models of cars sold in India. Be it a hatchback, sedan, luxury sedan, SUV or MUV, we equip you with the necessary pricing information to help you decide on the right car suited for your needs and current financial situation.

What Is The Average Interest Rate On A Car Loan

This handy chart shows average new and used car loan rates based on APR and credit scores.

| Average Credit Score for New Car | Annual Percentage Rate | Average Credit Score for Used Car | Annual Percentage Rate |

| 300-500 | 19.32% |

To help you better understand your place in the chart, lets look at a common example: A three-year car loan has an average interest rate of between 3% to 4.5%. However, your credit score can swing the needle in either direction. Thats why its best to compare car loans and interest rates by looking at various lenders across San Diego and Escondido.

You May Like: How To Get An Aer Loan

The Cost Of Bad Credit

Let’s look at how higher interest rates affect a car loan, using an example. Let’s say you’re buying a used car, and the loan is for $14,000 with a term of 60 months . Check out how different auto loan interest rates influence the monthly payment and overall cost of the car:

| Monthly Payment | |

| $8,395 | $22,395 |

Using the average used car loan interest rates from the first table, you can see that as credit scores drop and the interest rate increases, the total cost of financing goes up dramatically.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Also Check: What Happens If You Default On Sba Loan

Can You Sell A Car With A Loan

It is possible to sell a vehicle when you still have a loan, but it adds a few extra steps. There are a few different options in this situation. One option is to pay off the loan in full before selling the vehicle, which involves contacting your lender to determine your payoff amount. After paying off the loan, your lender will release the lien.

You can sell a vehicle that’s financed without paying it off by selling it to a private buyer or trading it in with a dealer.

Whats The Average Interest Rate On A Car Loan

According to the Federal Reserve, in the first quarter of 2021, the average auto loan rate on a 48-month new-car loan was 5.21%, and the average rate on a 60-month new-car loan was 4.96%.

A range of factors can affect what interest rates you might be offered, including your credit scores, the size of your down payment and the length of your loan term. Your rate may be higher or lower than average depending on your financial situation.

Read Also: How To Get Loan Originator License

What Is A Simple Interest Loan

Most car loans are simple interest loans, as opposed to compound interest loans:

- With simple interest loans, the interest charge is calculated only from the amount owed on the loan, which saves the driver money:

- amount owed on the loan principal x interest rate

Increase Your Likelihood Of Approval

Knowing your credit score will help you plan a realistic approach toward financing your next vehicle. While you can still get approved for a loan with a lower credit score, you may have a higher interest rate.

If this is the case, or if your credit score is too low for approval, consider signing with a co-applicant. A co-applicant is an individual who enters the loan with you and may maintain part ownership of the vehicle under that loan.

Buying a vehicle is an exciting experience, but it can also be overwhelming with so many variables to consider. Here are some helpful tips to make your buying experience a little easier:

- Think about how you plan to use your vehicle, considering things like interior space, car size, maintenance, and gas mileage.

- Do your research, and test drive all of the cars you’re interested in. Consulting a reference guide for general specifications and fair market values is always a good idea.

Considerations when buying a new vehicle:

Considerations when buying a used vehicle:

Don’t Miss: How Long For Sba Loan Approval

What Should You Consider When Choosing An Auto Loan

There’s a lot to take into account when choosing an auto loan. Your credit score, for example, has a major impact on the rates you get. The best rates typically go to those with excellent credit. At the end of Q1 2021, the average credit score was 734 for a new-car loan and 663 for a used car loan, according to a report from Experian.

In Q2 2020, borrowers who received the lowest rates had a score of 781 or higher. Those borrowers, also known as super-prime borrowers, received an average APR of 3.24% for new cars and 4.08% for used cars. Prime borrowers with a credit score between 661 and 780 received an average APR of 4.21% for new loans and 6.05% for used loans, while nonprime borrowers with credit scores between 601 and 660 received an average APR of 7.14% for new car loans and 11.41% for used.

It’s also important to consider what term fits your financial situation. Longer terms generally have lower payments but cost more over the life of the loan.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Also Check: How To Transfer Car Loan To Another Person

Best For Refinance: Autopay

- As low as 1.99%

- Minimum loan amount: $2,500

AUTOPAY offers several different refinance options, competitive rates, and has flexible credit requirements. Borrowers can easily compare offers from different lenders on AUTOPAY’s site and choose the best deal.

-

Considers all credit profiles

-

Excellent credit required for the best rates

While AUTOPAY’s rates start at 1.99%, only those with excellent credit will qualify. According to AUTOPAY, they can, on average, cut your rate in half on a refinance.

AUTOPAY offers more refinance options than many lenders. In addition to traditional auto refinancing, borrowers can choose cash-back refinancing and lease payoff refinancing.

AUTOPAY is a marketplace that makes it easy to shop around for the best deal. It caters to individuals who are rebuilding credit or improving their credit.

Best For Bad Credit: Myautoloan

MyAutoLoan

- As low as 2.49%

- Minimum loan amount: $8,000

myAutoloan not only offers reasonable low rates, but it also has lenders that work with people who have a history of credit problems. The marketplace provides a great opportunity for borrowers with poor credit to shop deals from multiple lenders at once.

-

Accepts borrowers with poor credit

-

Offers new, used, and refinance loans

-

Higher minimum loan amount requirements

-

Not available in Hawaii or Alaska

myAutoloan is a marketplace that allows you to compare multiple offers from lenders based on your credit profile. This type of company can help you cast a wide net and get the best offer available. It offers new, used, refinance, private party, and lease buyout loans.

Speed is one of myAutoloan’s benefits. Its online form takes just a couple of minutes to fill out and, once submitted, matches you with up to 4 lender offers. After you choose a lender, you can receive an online certificate or a check within as little as 24 hours.

Requirements in myAutoloan’s market vary by lender, but they say they have lenders who work with borrowers with lower scores.

Recommended Reading: How To Find Student Loan Number

Capital One: Best For Convenience

Overview: Capital One will let you borrow as little as $4,000, but it requires you to purchase the car through one of its participating dealers. In a lot of ways, its financing works as a one-stop shop for your auto loan and vehicle purchase.

Perks: The Capital One Auto Navigator site lets you search for inventory in your area and gives you the ability to see how different makes, models and features will impact your monthly payment. This will give you a lot of information before you head to the dealer. Also, the quick prequalification allows you to check your rate through a soft inquiry, so your credit score wont be impacted.

What to watch out for: You can only use Capital One auto financing to shop at one of its participating dealerships, which makes this a poor option if you find a car you love elsewhere.

| Lender |

|---|

| Late fee |

How Is Interest Calculated On A Car Loan

Lenders calculate interest on auto loans in one of two ways simple or precomputed. With a simple interest loan, your interest is calculated based on your loan balance on the day your car payment is due. The amount of interest you pay each month changes. On a car loan with precomputed interest, the interest is calculated at the start of your loan and based on your total loan amount. The amount of interest you pay each month remains the same. Lets take a closer look at each type of interest.

You May Like: How To Get Loan Officer License In California

Banks And Credit Unions

Most banks who offer auto loans provide similar rates as low as 3% to the most qualified customers. However, there is much variance amongst banks in the highest allowed APR, with top rates ranging from as low as 6% to as high as 25%. Banks who provide higher rate loans will generally accept applicants with worse credit, while more risk averse lenders wont offer loans to applicants with scores below the mid-600s.

The typical large bank has specific eligibility requirements for loans, including a mileage and age maximum for cars, and a dollar minimum for loans.

Generally, credit unions extend loans at lower interest rates than banks, have more flexible payment schedules, and require lower loan minimums . However, credit unions tend to offer loans exclusively to their membership, which is often restricted to certain locations, professions, or social associations.

| Financial Institution |

|---|

| 14.99% |

Your Monthly Paymentand The Total

The interest rate that you get on the loan has a dramatic impact on these numbers. Consider how the numbers change if you had to pay a 6% rate instead of 4% for the same car.

- The monthly payment on a five-year loan for $30,287 at 6% interest would be $585.53. You would pay $35,131.80 in monthly payments. Throw in the 10% down payment, and the car costs $38,497.

- If stretched to an 8-year term, the monthly payment on that $30,204 loan at 6% interest drops to $398.01 a month. The loan payments would total $38,208.96. Add in the 10% down payment and the car costs $41,574.16.

You can run the numbers for yourself using BankRateMonitor.com’s loan calculator.

Don’t Miss: Genisys Loan Calculator

Interest Is What You Pay To Borrow Money From A Lender When You Finance The Purchase Of A Vehicle

Interest charges are included in your monthly loan payment and can add thousands of dollars to the amount you have to repay. Thats why its important to understand how car loan interest is calculated, what factors can affect your rate and how to minimize interest charges.

The Difference Between An Interest Rate And The Annual Percentage Rate Apr On An Auto Loan

Most car loan contracts list two rates, your APR and your interest rate.

Interest rate or note rate is the lower of the two rates and represents the cost per year of borrowing money NOT including fees or interest accrued to the day of your first payment.

is the higher of the two rates and represents the total cost of financing your vehicle per year , including fees and interest accrued to the day of your first payment. APRs are useful for comparing loan offers from different lenders because they reflect the total cost of financing. The higher the APR, the more youll pay over the life of the loan.

Mathematically, these rates will give you the same monthly payments and will result in you paying the same amount for your car in the long run. However, the higher the APR, the more youll pay over the life of the loan. Lenders will give you both rates on your car loan paperwork so that you can better understand your loan.

The distinction between these rates is simple in many ways, but it is important that you understand how to interpret each.

Don’t Miss: How To Reclassify A Manufactured Home

Uncontrollable Economic Factors That Affect Interest Rate

There are many factors that affect what interest rates people get on their mortgages and auto loans. Although these largely cannot be controlled, having knowledge of these factors may still be helpful.

Economic Policy and Inflation

In most developed countries today, interest rates fluctuate mainly due to monetary policy set by central banks. The control of inflation is the major subject of monetary policies. Inflation is defined as the general increase in the price of goods and services and the fall in the purchasing power of money. It is closely related to interest rates on a macroeconomic level, and large-scale changes in either will have an effect on the other. In the U.S., the Federal Reserve can change the rate at most up to eight times a year during the Federal Open Market Committee meetings. In general, one of their main goals is to maintain steady inflation .

Economic Activity

Unemployment Rate

When the unemployment rate is high, consumers spend less money, and economic growth slows. However, when the unemployment rate is too low, it may lead to rampant inflation, a fast wage increase, and a high cost of doing business. As a result, interest rates and unemployment rates are normally inversely related that is, when unemployment is high, interest rates are artificially lowered, usually in order to spur consumer spending. Conversely, when unemployment within an economy is low and there is a lot of consumer activity, interest rates will go up.

Supply and Demand