What Are Your Options

If you arent sure what type of federal student loans you have, log in to your studentaid.gov account. Learn how to find your student loans.

Missed Payments If youve missed payments but your loans havent defaulted yet, both deferment and forbearance can be applied retroactively to let you catch up.

Lower Payments Are you considering refinancing your student loans? Heres a guide to help you through the student loan refinancing. And check out the financial marketplace for the best student loan refinance option.

Request The Extended Repayment Plan

Available for: federal student loans

A second option for getting an extension on federal student loans is the Extended Repayment Plan, but you must owe more than $30,000 to qualify. If you do, the Extended plan will set your repayment term at 25 years.

Lets go back to that example of the $35,000 loan at a 5.05% rate. If you paid it off over 25 years, your monthly payments would go down to $206.

You can choose to make fixed monthly payments on this plan, or you can request graduated payments. With a graduated payment approach, your payments start out small but increase every couple of years.

Unlike an income-driven plan, the Extended Repayment Plan doesnt end in loan forgiveness, nor will your payments count toward Public Service Loan Forgiveness. So an income-driven plan is probably a better choice if you can qualify.

Discharge After 20 Or 25 Years In An Income

After 20 or 25 years in an income-driven repayment plan, the remaining debt is forgiven.

- 25 years under Income-Contingent Repayment

- 25 years under Income-Based Repayment

- 20 years under Pay-As-You-Earn Repayment

- 20 years under Revised Pay-As-You-Earn Repayment for borrowers who have only loans for undergraduate school

- 25 years under Revised Pay-As-You-Earn Repayment for borrowers with any federal loans for graduate or professional school

Time spent in an economic hardship deferment counts toward the 20 or 25-year repayment term in an income-driven repayment plan, but not toward Public Service Loan Forgiveness, according to the current regulations.

The payment pause and interest waiver counts toward the 20 or 25-year forgiveness.

Time spent in other deferments or forbearances does not count toward the 20 or 25-year forgiveness. Likewise, periods of delinquency and default does not count toward loan forgiveness. Any payments made on a defaulted loan, whether voluntary or involuntary, do not count toward the 20 or 25-year forgiveness period.

The forgiveness will be automatic. Borrowers do not need to apply for the 20 or 25-year forgiveness, but must continue repaying their loans until they are notified that the remaining balance has been forgiven. Any excess payments will be refunded to the borrower.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Private Student Loan Deferment

Most private lenders also offer deferment in a variety of situations. For example, Sallie Mae offers deferment when students return to school or enter an internship, fellowship, clerkship, or residency program.

Private lenders options are often more limited. Contact your private student loan lender as soon as possible to have your private loans deferred.If deferment is not possible, grants and loan forgiveness programs can pay off all or part of private student loan debt.

False Certification And Unpaid Refund Discharges

If the students college certified the student as eligible for federal student aid, but the student is ineligible for employment in the occupation for which they are being trained due to age, criminal record, or physical or mental conditions, they may be eligible for a false certification discharge .

If the students college signed their name to a loan promissory note without the students authorization, the students federal education loans may be eligible for a false certification discharge . Note that the student must not have received the loan proceeds, had the loan proceeds applied to charges owed by the student to the college, or otherwise benefited from the loan.

If the student did not have a high school diploma or GED, the students federal education loans may be eligible for a false certification discharge .

If the student is a victim of identity theft in connection with their federal education loans, they may be eligible for the Identity Theft Discharge, sometimes called the Forgery Discharge.

When a student withdraws from a college, some or all of their federal education loans borrowed during the academic term must be returned to the U.S. Department of Education. If the college did not do this, the student may be eligible for an Unpaid Refund Discharge of their federal education loans.

To apply for a false certification discharge, submit the appropriate form to the loan servicer.

Recommended Reading: Usaa Refinance Auto Loan

What Is A Forbearance

Apart from the student loan deferment, there is another type of waiving. The second form is called a forbearance, and it is, generally, sought by applicants who did not qualify for the student loan deferment.

The major difference between a deferment and a forbearance is that a student loan deferment can be approved for an extended period, while the forbearance has a limited availability .

Furthermore, in the case of a deferment, depending on which type of loan you apply for, the Federal Government may pay the interest for you. On the other hand, if you apply for a forbearance, your scheduled payments will be postponed, but you will still need to pay the interest.

As in the case of deferment, there are many types of forbearances, and the conditions vary according to their nature.

Reasons To Seek Student Loan Deferment

Most student loans already start out in deferment. You typically dont have to make payments on your loans while youre still in school, during whats known as the in-school deferment period. Youll have to start repaying your loans again following a six-month grace period after you graduate, or drop down below half-time enrollment.

Once youve left school and your grace period is over, there are two main reasons you might want to seek out student loan deferment:

- If youve hit a temporary rough patch with your finances, due to circumstances such as medical treatment or unemployment

- If youre on active-duty military service or serving with the Peace Corps

Recommended Reading: How Long For Sba Loan Approval

When To Defer Your Student Loans

Student loan deferment offers relief when unable to make your payments. However, it may not always be the best option. Its important to know that, in most cases, interest will continue to accrue on your loans in deferment. The only loans that you wont be responsible for paying interest on are ones that are subsidized by the federal government.

Depending on your loan type, borrowers may continue paying interest while in deferment. The interest might then be added to your balance, and increase the total loan balance. Take the time to fully understand how capitalized interest works before signing off on deferment.

Student loan deferment can also have an impact on your eligibility for forgiveness under the Public Service Loan Forgiveness Program or income-driven repayment plans. Periods of deferment often dont count toward these programs.

Because of the impact that student loan deferment can have, consider it to be a last-resort option. First, talk to your loan servicer to discuss your options and your eligibility for loan deferment.

Now that you know about the consequences of deferring your loans, lets dive into the kinds of deferment available and how to get started.

How To Apply For Student Loan Unemployment Deferment

If you’re unemployed and worried about making your student loan payment, this article will help you understand some of your options.

Sarah Li Cain

It might feel hard to keep up with your student loan payments if youre currently unemployed. The good news is that you may be able to qualify for unemployment deferment on our loans. If approved, youll be able to pause your student loan payments temporarily, which could free up your time to search for a new job.

If youre interested in applying for student loan unemployment deferment, heres what you need to know.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

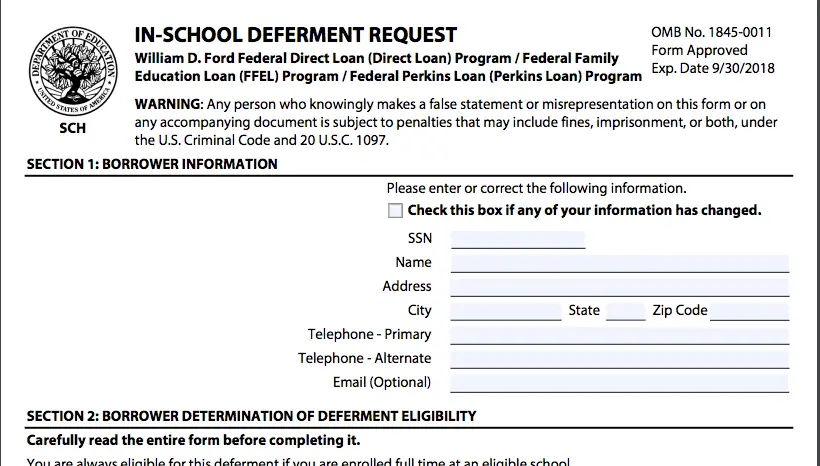

How To Apply For A Student Loan Deferment Step

Before applying for student loan deferment, you should make sure that you fulfill all of the eligibility conditions posted above. If that is your case, then you may take the first steps to obtaining financial aid for your student loan. Another important aspect to keep in mind is that working with your schools Financial Aid office or with your loan services is paramount to your deferment approval.

Always investigate alternatives: do I qualify for the student loan deferment or for the forbearance? If everything is in order, heres what you will need to do in order to apply for the deferment:

Length Of Deferment Period

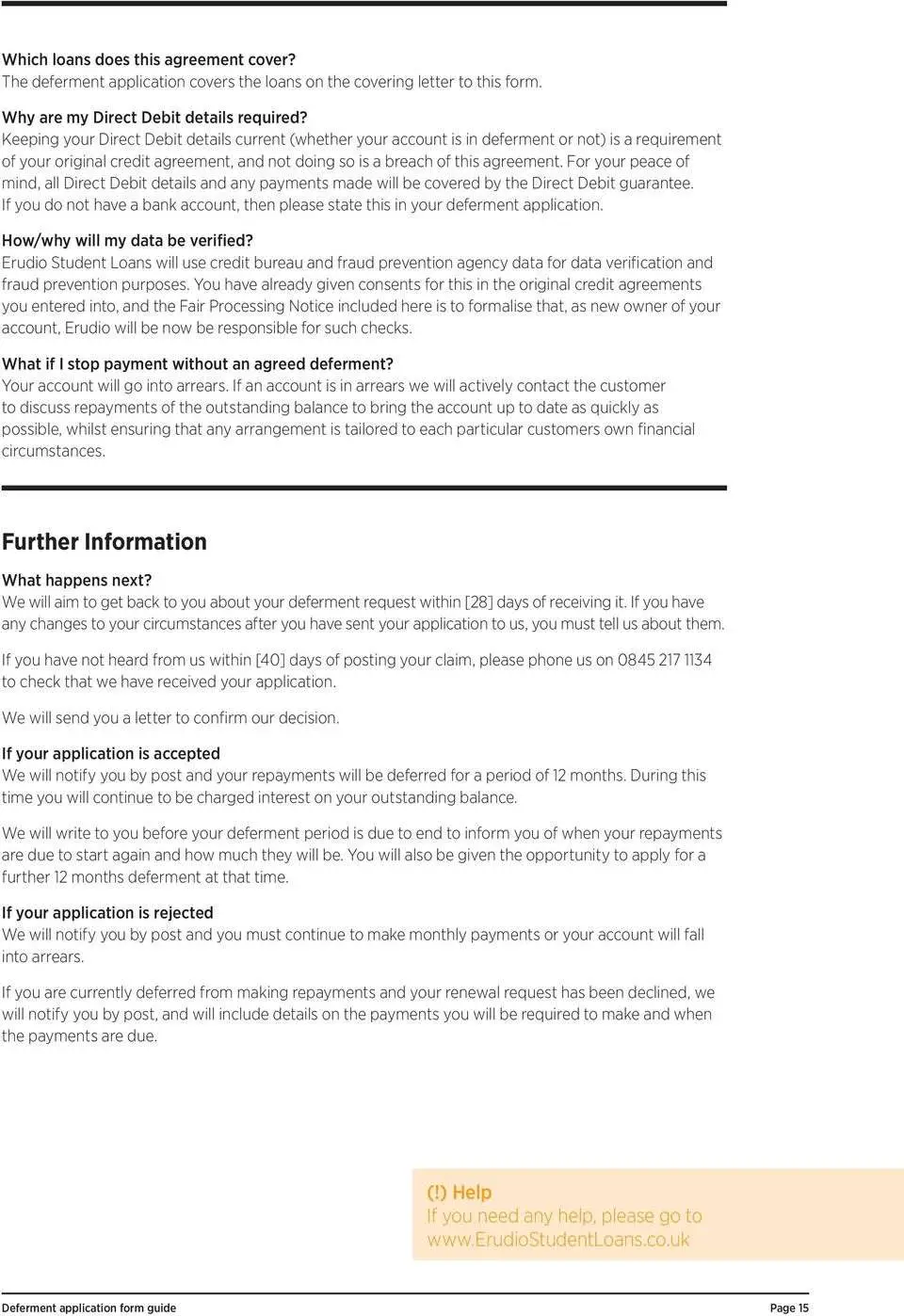

Once youve been approved for deferment, youre probably wondering how long the deferment period will last. The answer is that it depends on the type of loan.

For federal student loans, your deferment period will generally be approved for anywhere from six to 12 loans itll depend on the exact loan you have. If youre still unemployed afterwards, you may be able to qualify for unemployment deferment for up to three years. To remain eligible, youll have to keep showing documentation that youre attempting to look for full-time employment and are eligible to receive unemployment benefits.

Contrast this to private student loans, where ultimately the length of your deferment will be up to your lender. If your unemployment deferment period is going to end and you still havent found full-time employment, contact our lender as soon as possible. You may be able to work out a new plan, or at least see what your options are.

Read Also: Usaa 84 Month Auto Loan

Borrower Defense To Repayment Discharge

Borrowers may be eligible for discharge of their federal education loans if their college engaged in fraudulent, deceptive or illegal practices concerning their student loans or education under federal or state law. Examples include providing false information about college costs, accreditation, job placement statistics or the ability to transfer credits.

Borrowers who qualify for the borrower defense to repayment discharge may also qualify for a refund of some or all of the payments they made on the loans.

To apply for a borrower defense to repayment discharge, submit an application on the U.S. Department of Educations website.

Difference Between Deferment And Forbearance

When student loan payments are unaffordable, deferment and forbearance can both postpone them. The big difference is that forbearance always increases the amount you owe, while deferment can be interest-free for certain types of federal loans. Increasingly, many private lenders offer borrowers forbearance benefits too.

You May Like: Does Va Loan Work For Manufactured Homes

Becoming Eligible For A Student Loan Deferment

Note that in order to become eligible for a such a waiving, certain conditions must be fulfilled. Depending on which type of student loan you have applied for, the Federal Government may approve or deny your temporary postponement.

Furthermore, applying for a student loan deferment does not mean that you should cease to deliver your scheduled payments. Until the deferment is approved, you should continue making the payments on time, or else you will be deemed as delinquent and lose the loan.

Below, you will find the major eligibility conditions based on the type of student loan you have applied for:

Applying For An Unemployment Deferment

You will need to submit an unemployment deferment application to your student loan servicer to receive this postponement. With your form, you must do one of the following for approval:

-

Attach proof of unemployment benefits. You must provide documentation that shows youre currently eligible for unemployment, such as a copy of your benefits from your states Department of Labor. This documentation needs to include your name, address and Social Security number.

-

Confirm youre seeking full-time work. You must have made at least six attempts in the last six months to gain full-time employment. You must also be registered with an unemployment agency, unless there isnt one within 50 miles of your home. Using a temp agency or job search website doesnt count.

You can also get an unemployment deferment if youre underemployed working, but not full time. That means a job thats less than 30 hours a week and wont last more than three months in a row. You cant qualify if youve rejected any recent offers of full-time employment even if you were overqualified for the position.

If you meet the requirements for an unemployment deferment, your servicer cannot deny your application.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

What’s The Difference Between Forbearance And Deferment

| Interest continues to accrue during the forbearance term | Interest doesnt accrue on subsidized debt but continues to accrue on unsubsidized loans | |

| Who qualifies | Show you meet the financial hardship criteria set by your servicer | Usually tied to a specific event, such as going back to school or losing your job |

Refinancing Your Student Loans

Refinancing your student loans is generally a good idea because it can help you reduce the overall amount you pay in loans by lowering your interest rate. It can also lower your monthly payments whether its because you’re extending your loan term or your rate has gone down.

In most cases, youll need to have good credit to qualify for the most competitive refinancing rates. Thats not to say that if you have less than stellar credit you wont qualify. Keep in mind that if youre refinancing your federal loan to a private one, youll lose federal benefits such as student loan forgiveness programs and income driven repayment plans.

That being said, it doesnt hurt to see how much you can save start by shopping around as many lenders to find the right fit. Luckily, has made this easy for you by doing the research and leveraging their resources to negotiate low refinancing rates. Theres no need to commit check out your refinancing options to help you continue to afford your student loan payments.

Don’t Miss: Can I Refinance My Sofi Personal Loan

Deferring Your Loans While Returning To College Or Going To Graduate School

Deferring your loans while youre in school can help you lower your payments when your income may be limited, but you may end up paying more for the loan overall.

Considerations

- Your payments will be smaller than they would be if you were paying full principal and interest.

- You can request a deferment of up to 48 months for a Smart Option Student Loan® or a Sallie Mae graduate student loan so long as youre enrolled full-time or half-time.

Your interest will continue to accrue while your loans are deferred and Unpaid Interest will capitalize at the end of a deferment. This can increase your Total Loan Cost.

- To request a deferment for college or graduate school, your school will need to verify that youre enrolled at least half-time. If your school is listed at studentclearinghouse.org, theyll verify it electronically. If they arent listed, youll need to request the deferment period yourself by submitting this to us.

- Be sure to continue making your payments until we let you know if your deferment request has been approved.

- You can ask to have the deferment period removed at any time if you want to return to making principal and interest payments.

Deferring Your Loans For An Internship Clerkship Fellowship Or Residency

With an internship, clerkship, fellowship, or residency deferment, you wont have to make principal and interest payments while youre in your internship, clerkship, fellowship, or residency program. Your interest will continue to accrue , however, which will increase your Total Loan Cost. Any additional payments you can make during this period can help lower the Total Loan Cost.

If your request is approved, your student loan will return to the repayment option you initially chose . That means that if you were paying either interest-only or a fixed payment when you were in school, youll continue to make those payments throughout the deferment.

You can request a deferment if youre accepted into an approved internship, clerkship, fellowship, or residency program.

To enroll, the program must:

- Require you to have a bachelors degree as a prerequisite for acceptance.

- Be a supervised training program that results in one of the following:

- Leads to a degree or certificate.

- Is required for the student to be certified for professional practice or service.

Approval of your internship, clerkship, fellowship, or residency program deferment request is solely at the discretion of Sallie Mae.

To request a deferment, download an . You and an official from your internship, clerkship, fellowship, or residency program must complete the form prior to submitting it to us.

You May Like: How To Transfer Car Loan To Another Person

Refinance For A Longer Repayment Term

Available for: federal and private student loans

Last but not least, you could get an extension on student loans by refinancing your loans for new terms. When you refinance, you give one or more of your student loans to a new lender and take out a new loan in its place.

Depending on your credit, you could qualify for a better interest rate, which could save you money and lower your monthly payment. Plus, you can select a new repayment term. Most refinancing providers, such as Earnest and CommonBond, offer terms between 5 and 20 years.

If you opt for a longer term of 15 or 20 years, you can lower your monthly payments. If youre able to pay more in the future, you can always pre-pay your loan ahead of schedule without penalty.

While refinancing has a number of benefits, unfortunately not everyone will qualify. Youll need to have strong credit and sufficient income .

Whats more, refinancing is a private process with a bank, credit union, or online lender. When you refinance federal student loans, you lose access to federal plans, such as income-driven repayment. Before refinancing federal loans, make sure to weigh the benefits with the potential drawbacks. .

Since everyones financial situation is different, theres no one-size-fits-all approach to getting an extension on student loans. By considering all your options, you can find the strategy thats the best fit for your personal goals.