Equity Loan Tax Deductions

Tapping your equity for home renovation projects has another advantage. The Internal Revenue Service lets you write off some of the interest on home equity credit as long as you itemize deductions.

Before the Tax Cuts and Jobs Act of 2017, taxpayers were able to deduct interest on up to $1 million of mortgage debt, and there were no restrictions on the usage for deductions. The TCJA instituted new limits and restrictions, which run through the end of 2025.

As of 2022, couples can deduct the interest on up to $750,000 of eligible mortgage debt if the debt is used on the home. The deductions can be applied for first mortgages, second mortgages, home equity loans, and HELOCs if the debt is used to buy, build, or substantially improve the home against which it was secured.

Which Type Of Loan Is Better For You

Choosing the right home equity financing depends entirely on your unique situation. Typically, HELOCs will have lower interest rates and greater payment flexibility, but if you need all the money at once, a home equity loan is better. If you are trying to decide, think about the purpose of the financing. Are you borrowing so you’ll have funds available as spending needs arise over time, or do you need a lump sum now to pay for something like a kitchen renovation?

A home equity loan offers borrowers a lump sum with an interest rate that is fixed but tends to be higher. HELOCs, on the other hand, offer access to cash on an as-needed basis, but often come with an interest rate that can fluctuate.

As a borrower, it pays to shop around and ask a lot of questions to ensure that you are getting the right financing for your needs at the best interest rate possible.

Coronavirus And Home Equity Loans

Due to the current state of the economy, home equity loans may be an attractive option to access emergency cash. Bankrate Chief Financial Analyst Greg McBride says that in 2021, McBride says, rising home prices are making lenders more comfortable with increasing the volume of their home equity lending.

Not only did home prices not go down, but they’ve actually gone up and homeowners have more equity, and so I expect that, from a loan performance standpoint, things are going to end up looking a lot better than had been initially assumed, he says.

If you’re looking to apply for a home equity loan, take advantage of prequalification offers, especially if your credit score is below average. If you have an existing loan and are experiencing financial hardship, contact your lender to ask about loan relief options during this time.

You May Like: What Is Equity Loan Rates

How To Use Your Home Equity To Your Advantage

Tapping into your home equity is a great way to gain access to the funding you need. Because the equity youve worked hard to build acts as collateral for the loan or line of credit you applied for, youll be able to access more affordable rates and often better terms.

When it comes to using your home equity to borrow, its always in your best interest to spend the money on something that will help you save or make more money in the future. Some of the best ways to use your home equity to your advantage are:

- Kitchen or bathroom upgrade

- Add a basement suite

Definition And Example Of Home Equity

Home equity starts with your homes current value. Now subtract the amounts owed on any mortgages or other liens you have against the property. These might be purchase loans that you used to buy the house, or second mortgages that were taken out later. The difference is your home equity.

Suppose your home is worth $300,000. If you have $200,000 left to pay on your mortgage, your home equity is $100,000.

Your lender doesnt own any portion of the property unless you’ve obtained a , which isn’t common. You own the house, but it’s being used as collateral for your loan. Your lender secures its interest by getting a lien against it.

Don’t Miss: What Are Sba Loan Requirements

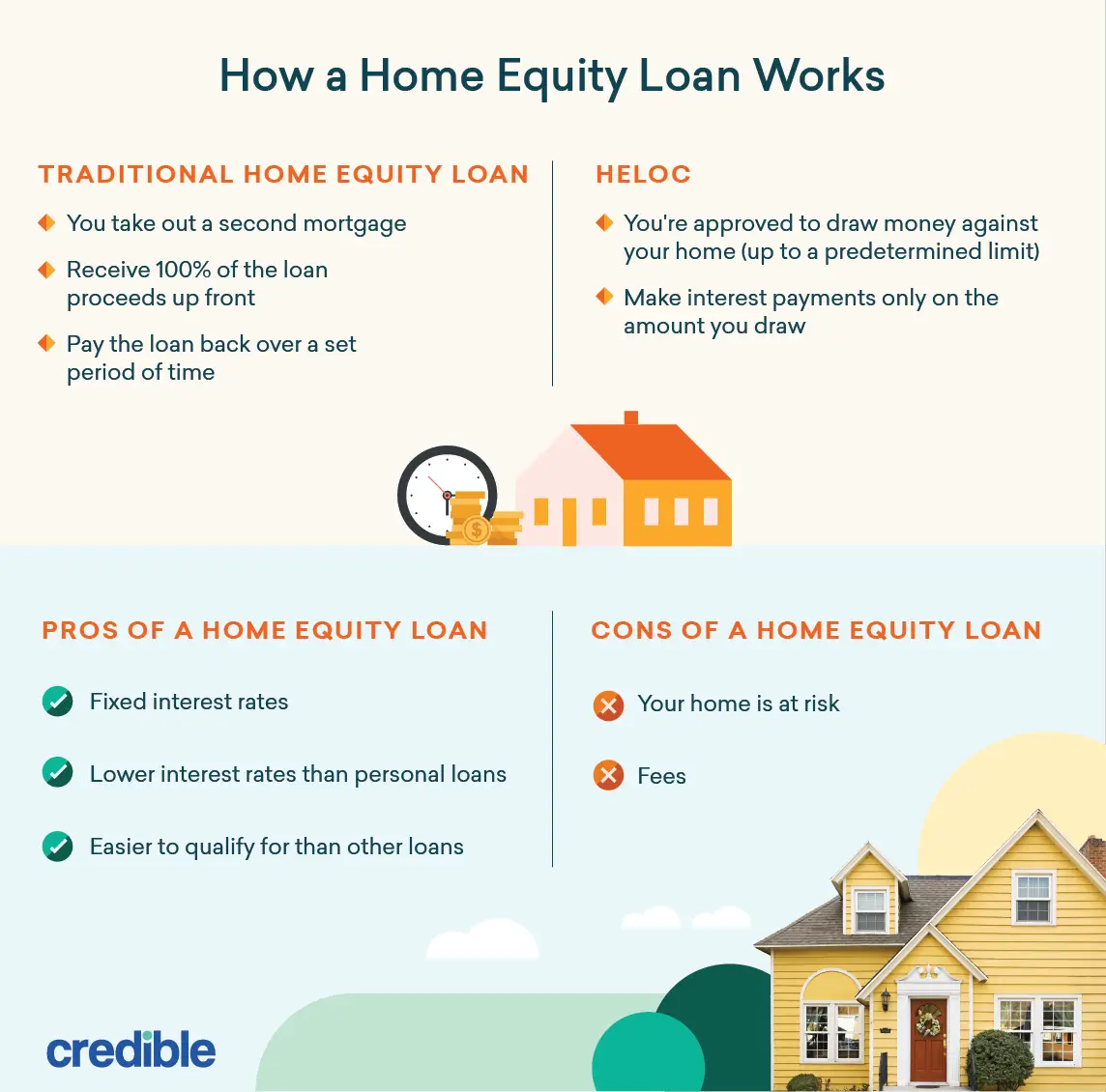

Heloc Vs Home Equity Loan

Home equity loans arent the only way to borrow against the equity in your home. You can also apply for a product known as a home equity line of credit.

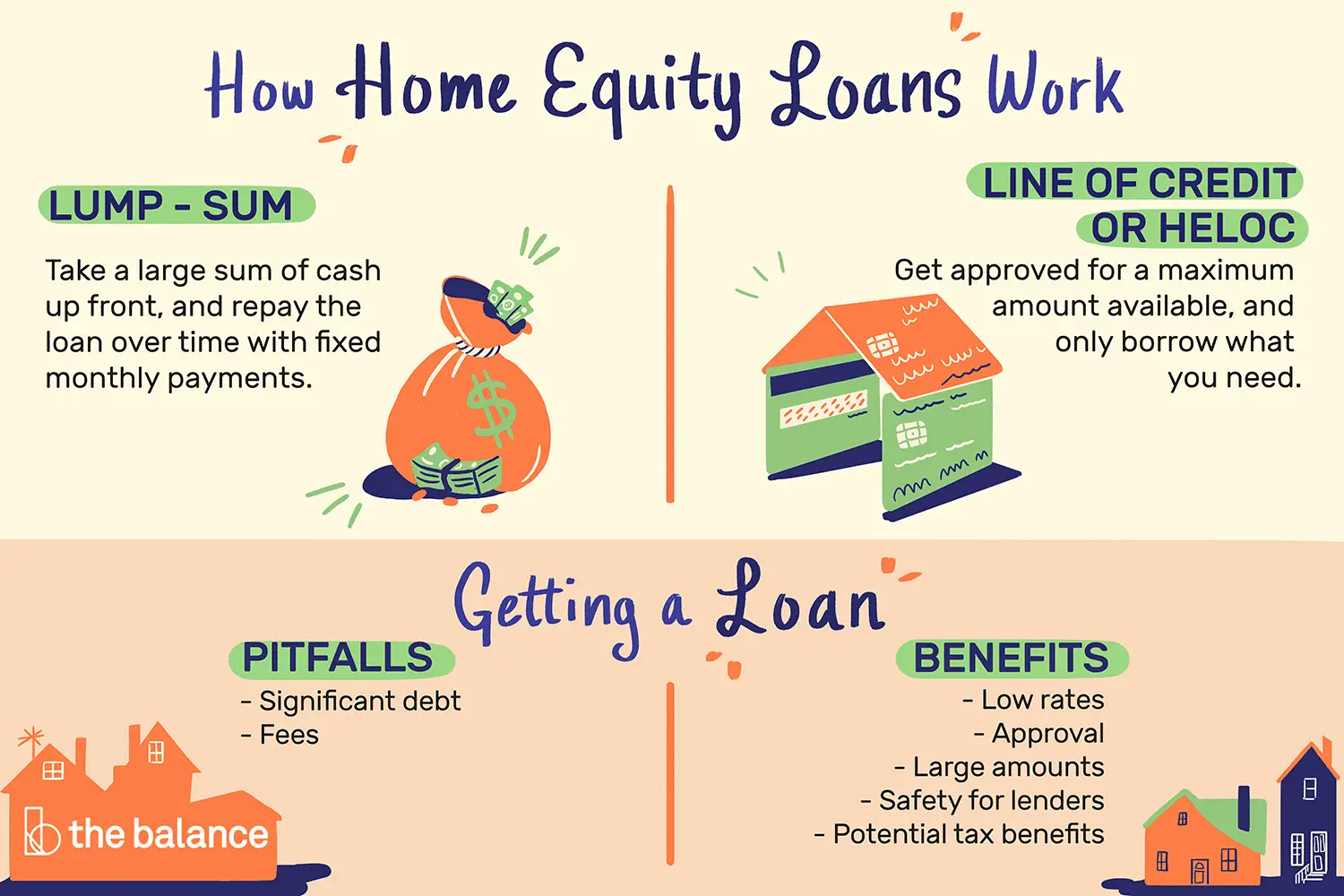

A home equity line of credit acts more like a credit card than a loan, with a credit limit based on the equity in your home. With a HELOC, you only pay back what you actually borrow. They have a draw period and a repayment period.

The draw period lasts for several years at the beginning of the loan, during which youre only required to pay interest on the money you borrow. You can also put the money you borrowed back in during the draw period to take it out again for other purposes.

Once the HELOC enters the repayment phase, you cant borrow anymore. Instead, the principal and interest are paid back over the remainder of the term on any existing balance.

Lets say you get approved for a HELOC of $50,000. If you spend $20,000 to add a primary bedroom to your home, youd pay back that $20,000 not the full $50,000 in monthly payments with interest.

While a home equity loan is good for homeowners with a specific plan in mind for the money theyll receive, a HELOC is a better choice if you want access to a line of credit for expenses that pop up over time. Rocket Mortgage doesnt offer HELOCs at this time.

Cost Of Tapping Into Your Home Equity

Before you take out a HELOC or home equity loan, be wary of the costs associated with this financial program:

- Appraisal fees. Your home may have to be professionally appraised in order for your lender to verify its current market value. Appraisals can range anywhere from $150 to $250.

- Title search fees. A title search will verify whether or not there are any liens on the property, and if there are, this may have to be dealt with before a home equity loan or HELOC is issued. Title searches costs vary from $250 to $500.

- Administration fees. There are admin fees associated with opening a HELOC or home equity loan, which vary quite a bit in cost from one lender to another.

- Closing fees. Closing costs range from $200 to $350 and are charged when you close your HELOC or home equity loan.

- Legal fees. Youll need to pay for the services of your lawyer, which can run you somewhere between $500 to $1,000.

Additional Reading

Read Also: How To Start Fha Loan Process

What Is Home Equity

Home equity is the difference between the amount you owe on your mortgage and what your home is worth. You can build home equity in three ways: By making your monthly principal payments, by the local real estate market appreciating and by completing valuable home improvements.

Heres an example. Lets say you own a house valued at $300,000. You put down $30,000 when you bought it and since then, you have paid $30,000 in mortgage principal. That means you have $60,000 in equity .

Loan Closing And Disbursement Of Funds

At closing we will require all applicants to provide two forms of identification one must be a valid photo ID. After reviewing the terms and conditions of your line of credit, you will be asked to acknowledge and accept those terms and conditions by signing loan documents.

When using a primary residence as collateral, a three business day right to cancel period is required by law to allow applicants the opportunity to cancel their home equity line of credit application.

Once your right to cancel period has expired, the funds from your home equity line of credit will be available.

Recommended Reading: How Hard Is It To Get An Rv Loan

Home Equity Line Of Credit

A home equity line of credit, or HELOC, is a line of credit with a variable interest rate. You are given credit up to a predefined maximum amount, similar to how a credit card works. You can borrow from that line of credit, as much and as often as you like, during the draw period and pay interest only on what you actually borrow, not the entire available credit line. Depending on the terms of your HELOC, you may only be required to make interest-only payments during the draw period. When the repayment period begins, youll start making payments on both principal and interest. Like a home equity loan, a HELOC is secured by your house.

You can tap into that credit line for expenses such as home renovations, or to consolidate higher-interest debt. Because the credit line remains available for a long time a typical term is 10 to 15 years its a good way to fund ongoing home projects it can also be a source of funding for future needs as they may arise.

Are There Exceptions To The Three Day Cancellation Rule

Yes, the federal rule doesnt apply in all situations when you are using your home for collateral. Exceptions include when

- you apply for a loan to buy or to initially build your main residence

- you refinance your mortgage with the same lender who holds your loan and you dont borrow more funds

- a state agency is the lender for a loan

In these situations, you may have other cancellation rights under state or local law.

Also Check: How Much Home Loan Eligibility Calculator

How Does A Home Equity Loan Work

A home equity loan functions much like a mortgage where youre provided a lump sum up at closing and then you begin repayment. Every month, youll make the same payment amount, which is a combined principal and interest payment, until your loan is paid off. In the first half of the loan, youll make interest-heavy payments and then principal-heavy payments in the second half this is called amortization.

Borrow Against The Equity

You can get cash and use it to fund just about anything with a home equity loan, also known as a “second mortgage.” That allows you to tap into your home equity while you’re still living there. But your goal as a homeowner should be to build equity, so its wise to put that borrowed money toward a long-term investment in your future rather than just spend it.

Paying your current expenses with a home equity loan is risky because you could lose your home if you fall behind on payments and can’t catch up.

Don’t Miss: How To Find Your Student Loan Account Number For Irs

Lending And Mortgage Servicing Practices That Can Hurt You

You could lose your home and your money if you borrow from dishonest lenders. Certain lenders target homeowners who are older or who have moderate means or credit problems and then try to take advantage of them by using deceptive, unfair, or other unlawful practices like these:

- Loan flipping happens when the lender encourages you to repeatedly refinance the loan, which often leads you to borrow more money. Each time you refinance, you pay additional fees and interest points. That increases your debt.

- Insurance packing happens when the lender adds to your financing credit insurance or other insurance products that you may not need.

- Bait–and-switch happens when the lender offers one set of terms when you apply, then pressures you to accept higher charges when you sign to complete the deal.

- Equity stripping which involves practices that reduce the value in your home, can happen when the lender offers financing based on the equity in your home, not on your ability to repay. If you cant make the payments, you could end up losing your home.

- Non-traditional products include home equity loans that

- have monthly payments that increase either because they have variable interest rates, or because the minimum payment doesnt cover the principal and interest due

- have low monthly payments, but a large lump-sum balloon payment due at the end of the loan term. If you cant make the balloon payment or refinance, you face foreclosure and the loss of your home.

Will I Owe Any Money On The Contract If I Cancel During The Three

If you cancel the contract, the security interest on your home is no longer valid, your home is no longer collateral and cant be used to pay the lender. You dont have to pay anything, and any amounts you paid must be refunded, including the finance charge and other charges, such as application fees, appraisal fees or title search fees, whether paid to the lender or to another company that is part of the credit transaction. The lender has 20 days after receiving your notice to return all money or property you paid as part of the transaction and to release their interest in your home as collateral, which they must do even though the security interest is no longer valid from the day the lender received your cancellation notice.

If you got money or property from the lender, you can keep it until the lender shows that your home is no longer being used as collateral and returns any money youve paid. Then, you must offer to return the lenders money or property. If the lender doesnt claim the money or property within 20 days, you can keep it.

Read Also: How Many Times Can You Use The Va Loan

What Is A Reverse Mortgage Home Equity Loan

If you are a homeowner in Canada and are 55 or older, you may qualify for a reverse mortgage. For many people, one of the most attractive benefits of a reverse mortgage is that you dont have to make regular payments. You dont need to pay off the loan until you sell or move out. Well outline a reverse mortgage vs a home equity loan although, in reality, a reverse mortgage is really a type of home equity loan.

With a reverse mortgage, the bank makes monthly payments or a lump-sum payment to you. The amount you qualify for depends on the value and equity of your home, your age, amount of secured debt and property type/location. Reverse mortgages are designed to increase your income so that you can have a much more comfortable retirement.

For the CHIP Reverse Mortgage®, as long as the property is well maintained, and property taxes and home insurance are paid, HomeEquity Bank, the provider of CHIP, guarantees that the borrower will never owe more than the home is worth. In fact, on average, borrowers have over 50% equity remaining when they choose to sell their home. Interest is added on to the original amount borrowed. When the amount is repaid, all remaining equity in the home belongs to the homeowners .

Is A Home Equity Line Or Loan Right For You

A HELOC gives you the flexibility of a financial backstop thats there when you need it. If your roof needs repair or a tuition bill comes due when youre short of cash, drawing on a home equity line of credit can be a convenient solution. You decide when to use the funds, and you pay interest only on the money you actually use. On the flip side, with a HELOAN, you get a lump sum of cash at loan closing, and know how much your monthly payments will be and how long it will take to pay off the loan.

With either, the amount you can borrow will depend on the value of your home and the amount of equity you have available. And with both, its important to remember that youre using your home as collateraland it could be at risk if its value drops or theres an interruption in your income.

But if you qualify and your financial situation is stable, a home equity line or a home equity loan could be a helpful, cost-effective tool for making the most of your homes value.

Ready to apply? Apply online now

Read Also: Can You Use Fha Loan For Land

What You Cant Do With A Home Equity Loan

- You cant get a home equity loan for more than your house is worth. In fact, your home equity loan amount plus your current mortgage balance generally must be less than 90 percent of your homes value.

- You cant use investment or commercial properties, or manufactured homes to get a Discover Home Loan.

Remember, a home equity loan uses your home as collateral. Make sure youre comfortable financially with the amount you borrow and the terms of the loan. Your Discover Personal Banking Specialist can answer all your questions to help you make the right financial decisions.

Find your low,

Related Article

- Main

-

- Home loans made by Discover Bank.

The Requirements For A Home Equity Loan

To get a home equity loan, the first thing youll need is a substantial amount of home equity. You can estimate your homes equity by taking the current fair market value of your home and subtracting from it your current mortgage balance plus the balance of any other loans that use your home as collateral.

For example, say your home is worth $300,000 and you have a mortgage balance of $150,000 with no other loans on the home. In this case, your estimated home equity is $150,000. You typically cant borrow the full value of your homes equity with a home equity loan. Instead, you generally can only borrow a portion of the value based on the lenders requirements.

Youll need to complete an application and meet credit, income, and financial requirements to get your home equity loan approved. Your lender may require a home appraisal to establish the current value of your home. Youll probably have to pay closing costs as well.

A home equity loan gives you a fixed amount of money you get as a lump sum when the loan closes. You will begin making principal and interest payments right away on this new loan.

You May Like: How To Check Student Loan Interest