Aim For A Higher Credit Score

Ultimately, the answer to having the right credit score, is to have the highest number possible. If you can stay in the excellent range , great. Even if you can maintain a score in the very good range , you wont have any problems securing a loan that offers you great rates and discounts. By means of responsible payment habits, youll find it easy to maintain a score that gets you nothing but the best deals on car loans.

How To Improve Your Credit Score

If your credit score is on the lower end of the spectrum and you want to position yourself to be eligible for a better rate on an auto loan, there are steps you can take to improve it before you start car shopping.

Your payment history accounts for 35% of your credit score, so making credit card payments on time each month is critical to boosting that score. If you’re able to, consider making an payment twice each month, or paying more than the minimum. Setting up automatic payments is a good way to make sure you never miss a payment.

Your utilization rate, or how much credit you’re using compared to how much creditis available to you, is the second most important factor when determining your credit score. “You shouldn’t use more than 30%,” Matt Schulz, chief industry analyst at CompareCards told Grow in 2019. “That’s when it starts impacting your credit score.”

Small changes to your behavior can make a big difference to your credit score, says Ted Rossman, industry analyst at Bankrate. And, he says, “the most impactful thing that consumers can do to quickly improve their credit score is to lower their credit utilization ratio.”

That means if you have a $1,000 balance on a card with a $5,000 line of credit, your utilization rate on that card is 20%. If the total credit you have available across two credit cards is $10,000 and you have a total balance of $1,000, then your overall utilization rate is 10%.

More from Grow:

What Are The Reasons To Choose A Personal Loan Vs Other Types Of Loans

Personal loans are best used when borrowers need access to cash for unexpected expenses, projects, and other large purchases. Some examples are funeral costs, minor home renovations, and debt consolidation.

The main advantage of choosing this route is that borrowers can take one on for just about any reason and gain quick access to funds ranging from $500 to $100,000. While most fall in between those amounts, the flexibility offered by these products makes them ideal for those looking to borrow without relying on assets to back the loan.

If youre considering a personal loan with 600 credit score or lower, there are several ways you can improve your situation and get approved. As you weigh your options, here is a further breakdown of the benefits and drawbacks.

Read Also: How Much House Can I Afford Physician Loan

How Is Your Credit Score Calculated

Your payment history has the biggest impact on your credit score. It makes up for 35% of your score, followed closely by your credit utilization. The reason these two indicators are weighted so heavily is they give the clearest picture of your ability to pay back loans on time.

Other factors that determine your credit score include the duration of your history, the number of recent inquiries and the variety of accounts you have. A lengthy credit background shows an ability to manage financial obligations for extended periods of time, while multiple inquiries at once may hurt you. If your credit is a good mix of credit cards, mortgage and auto loans, you may be in a better position than if all of your debt stems from credit cards.

Improve Your Credit Score & Interest Rate

Here are some ideas for potentially raising your credit score prior to applying for a car / auto loan:

- Get current on as many debts and bills as you can.

- Sign up for Experian Boost to get your utilities and phone bill payments to count toward your credit score.

- Order your free credit reports, check them for errors, and contest any you find.

- Some creditors are willing to forgive one-time mistakes and expunge them from your record. Check into this if it is applicable to your situation.

Also Check: How Much Can We Borrow Home Loan

What Credit Score Do You Need For An Auto Loan

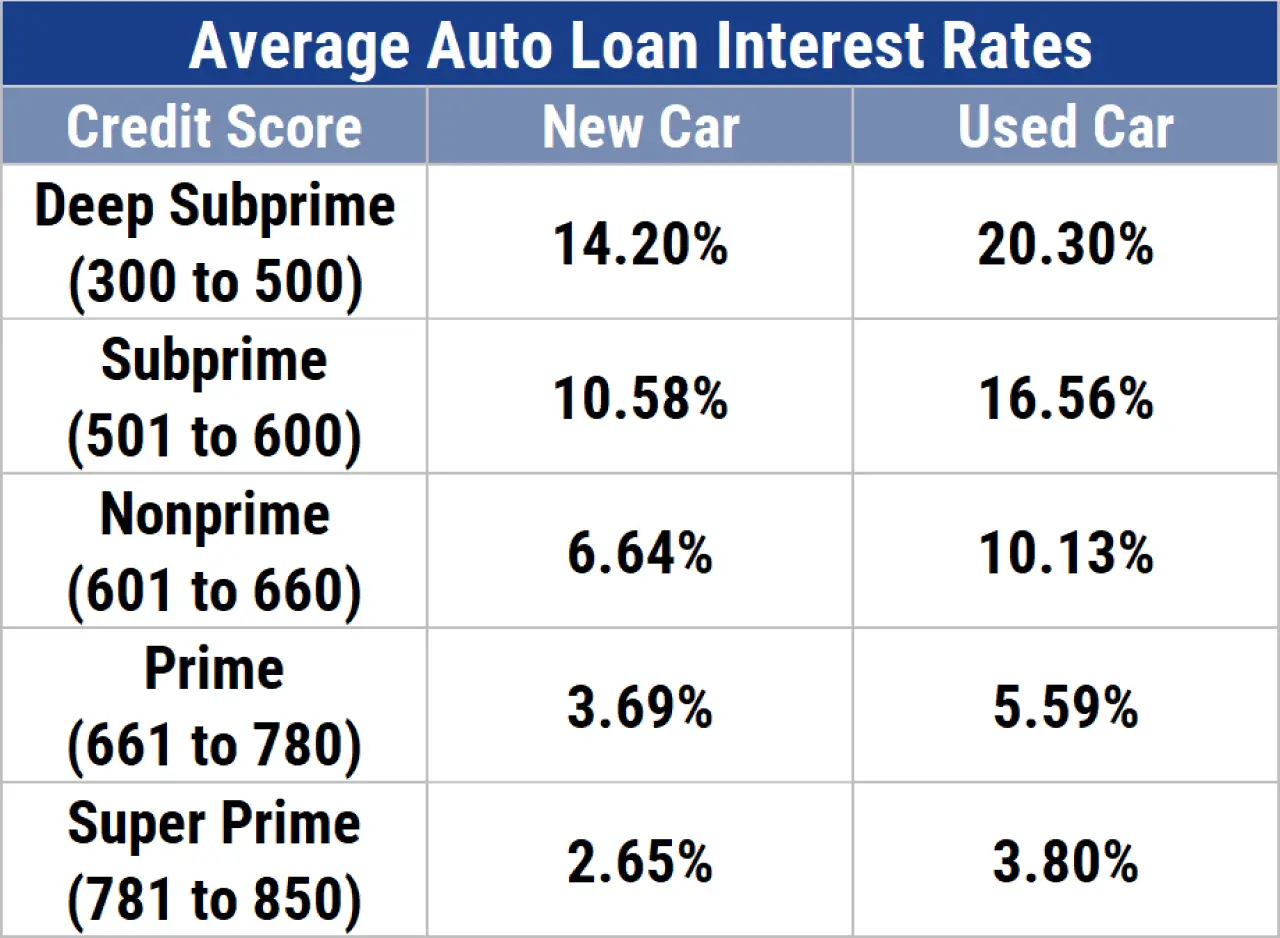

Everyone knows that cars are expensive , but rarely do people know how their credit score affects the final price they pay. Affording a new ride often requires us to find financing, usually through a lender in the form of auto loans. The interest rate attached to the loan could cost you thousands of dollars extra. What determines your interest rate? Your credit score.

Loans For A 600 Credit Score: What To Know And Where To Find One

Taking out a personal loan with a credit score of 600 isnt impossible but it may require some creativity, and you may not get the best loan terms.

Whether youre looking to get a mortgage, open a new credit card account, or even purchase auto insurance, you probably recognize the power that your credit score can have. The closer you are to a good credit score , the more likely you are to qualify for better rates on credit products.

So, what if youre trying to take out a loan with a credit score closer to 600? Its important to note that credit-scoring models generally put a 600 credit score in the mid-range of “fair.” While this may not qualify you for all lenders or terms, a 600 credit score doesnt put you out of the running for a good personal loan.

Lets take a look at how your credit affects your ability to get a loan, how lenders view a fair score, and the best personal loans for a 600 credit score.;

Don’t Miss: What Happens To My Parent Plus Loan If I Die

What Is A Good Credit Score For An Auto Loan

While lenders can set their own standards when assessing an individual’s FICO score, generally accepted standards across the board for multiple lenders. According to Experian, “higher scores represent better credit decisions and can make creditors more confident that you will repay your future debts as agreed.”

So what’s a “good” credit score? Anything above 700 will at least allow borrowers to be in a good position to obtain auto loans. Once you build your score over 800, you can pretty much be assured of your excellent credit and an ace up your sleeve when negotiating your annual percentage rate and your loan terms. However, if you credit score is higher than 600 and lower than 750, you’re in line with most borrowers. The average credit score in America is 657.

Credit Score: What It Means For You

Categories

Chances are, youve heard about credit scores. Ranging from 300 to 900, your credit scores are one of the factors used by potential lenders and creditors to determine your creditworthiness .;

Governed by two Canadian credit bureaus, TransUnion and Equifax, the exact formulas that are used to calculate your scores are private. But we do know that there are five general factors that do affect the calculation of your credit scores: payments, credit history, debt levels, credit inquiries, and the types of credit accounts you have. Although keep in mind that one factor may affect your scores more than others.;

Don’t Miss: What Is Fast Cash Loan

Apply With A Cosigner

Even subprime borrowers have plenty of financing options. If you think youll have a hard time getting approved for an auto refinance loan by yourself, you can apply with a cosigner for most people, this is usually a parent or relative.

In essence, you use the cosigners credit to qualify for the refinance loan. Youre still responsible for the loan, but the cosigner is obligated to take responsibility if you stop making payments. This is an easier way for nonprime borrowers to get better auto loan rates.

Maintain Good Credit For Future Auto Purchases

While improving your credit for your next car purchase can save you money in the short term, maintaining good or excellent credit can provide even more savings in the long run, on future auto purchases as well as other financing options.

Make it a goal to monitor your credit regularly to keep an eye on your credit score and the different factors that influence it. Keeping track of your credit can also help you spot potential fraud when it happens, so you can address it quickly to prevent damage to your credit score.

Also Check: How To Refinance Sba Loan

Best Auto Loan Rates With A Credit Score Of 600 To 609

A review of the best auto loan rates for new, used & refinanced vehicles based on credit scores between 600 to 609.

Your credit score will play a big factor if you are looking to get the best rates for an auto loan in 2020.

According to the;Huffington Post; about 10% of Americans have a credit score between 600 and 609 which is categorized as Fair or Non-Prime.

Still, even with a credit score around 603, you will have plenty of auto loan options, albeit, at a slightly higher interest rate than a score closer to 675.

Can I get a car loan with a credit score of 600?

Regardless of if you are looking to purchase a truck, daily driver or even a hybrid car, we can help you find the best interest rates for both new or used auto loans.

With a 600 credit score there still is a lot of room for improvement and even more financial incentives for you to improve it.;

Disclaimer: Credit score refers to the FICO score in this article. ;If you have a different score , that does not likely equal your FICO. ;For example, a 645 VantageScore could equal any FICO score 643, 644, 645? ;Who knows? ;You can;get your FICO score here.

In this post:

Best Va Loan Rates For 600 To 609 Credit Score

While the Veterans Affairs office does not require a high credit score to qualify for a VA mortgage, generally, a lower credit score like 600, 605 or even 609, will not give you very many options.;;

This doesnt mean you will not be approved. It just means that your loan lender will look at additional factors.;;

Let’s look at some sample quotes:

Recommended Reading: How Much Credit Score Required For Car Loan

What Credit Score Do I Need To Buy A Car

A car is a necessity for a lot of useither for work, school or just getting around every day. But not everyone can afford a decent car outright. Enter the auto loan. Theyre a convenient way to split the cost into affordable monthly chunks. So, what is a good credit score to buy a car? In short, youll probably get a better interest rate if your score is over 661. But if your credit score is lacking, loans are available at nearly all credit levels.

In this article, well take you through the ins and outs of credit and car loans. Well start with a brief overview of the credit scores you need to aim for to get into the non-prime, prime and super prime lending markets. Then, well explore subprime auto loans. Finally, well talk about what you need to do to get pre-approved for a car loan.

How Much Of A Loan Can You Get With A 600 Credit Score

To lenders, your credit score is a reflection of your ability to repay debt on time and in full. Many lenders require a minimum 600 credit score when you apply for a personal loan.What credit score is needed for a personal loan?Credit score rangeAverage APR680-71911.88%660-67918.53%640-65926.15%620-63938.64%4 more rowsAug 21, 2020

Don’t Miss: How Long To Get Approved For Student Loan

How To Earn A Fair Credit Score:

If you are trying to get your credit score into the “fair” range, pull your credit report and examine your history. If you see missed payments or defaulted loans or lines of credit, do your best to negotiate with the lender directly. You may be able to work out an agreement that allows you to make manageable, on-time payments. Getting back on track with these consistent payments could help improve your credit score over time. As you work through meeting your debt obligations, take care not to close any of your accounts. Open accounts with a long history could be positively contributing to your score and can continue to be used responsibly in the future.

Look at your credit report, create a budget that sets aside money to pay off your debts, and learn more about how credit scores are generated: these are the three fundamental steps in moving your credit score upwards.

What Is A Good Credit Score

FICO® credit scores are the industry standard and are used by more than 90% of lenders when making decisions. A FICO® credit score above 670 is generally considered “good.”

The FICO® Score is computed based on factors including the borrower’s payment history, amounts owed on loans and credit accounts, the length of their credit history, and more. It is expressed on a scale ranging from 300 to 850, with higher scores being better.

Read Also: Can You Take Out More Than One Student Loan

Be Willing To Pay A Higher Interest Rate

If you have poor credit, lenders see you as a riskier applicant. You may be able to get a car loan, but you’ll likely pay a much higher interest rate than someone with good or excellent credit will.;

For example, the average interest rate for prime borrowers purchasing new cars was 4.21% in 2020. For nonprime borrowers, the rate was 7.14%, while for deep subprime borrowers, it was 13.97%.

That higher rate can add substantially to your total loan cost. For example, if you financed $37,000 with a four-year loan at 4.21% interest, you’d have an $839 monthly payment and would pay $3,268 in total interest.;

But if you financed that same amount and only qualified for a four-year loan at 13.97% interest, your payment would jump to $1,011 per month. And youd pay $11,505 in total interesta difference of $8,237.;

| The Better Your Credit Score, the Lower Your Interest Rate |

|---|

| ; |

| $48,505 |

How Does My Credit Score Affect My Auto Loan Rate

Depending on your credit score, the interest rate you receive can vary widely. In fact, the difference in interest rates on a new car loan for someone with excellent credit versus someone with very poor credit can vary by as much as ten percentage points.

Use our 3-step loan calculator to determine the difference in interest rates.

For example, if your excellent credit qualifies you for 6% interest rate on a $18,000 vehicle rather than the 12% interest rate for which a less-than-stellar credit score might qualify, you’ll save more than $50 each month over the five-year term of the vehicle loan. That’s a $3,000 savings thanks to your good credit!

When it comes to car buying, your credit score plays a major role in the type of financing that’s available to you. For people with a strong score, this works in your favor. You might be in the perfect position to obtain an auto loan.

For those with lower scores or no credit, this may pose a bit of a challenge, but don’t despair! There are actionable steps you can take toward improving your score. The good news is that a properly managed auto loan can improve your credit score moving forward. So once you secure an auto loan, you can work toward strengthening your credit history for your next car, truck, or recreational vehicle.

Now that you are armed with all the facts you need to obtain an auto loan, all that’s left to do is find the right vehicle for you.

You May Like: Can You Pay Off Sofi Loan Early

Minimum Requirements You Need To Meet

In general, lenders want to see an LTV under 115 percent. This is the percentage of the vehicles cost that you want to finance.; With a 600 score, you may need a lower LTV. They also tend to restrict loans to vehicles with fewer than 100,000 miles that are less than eight years old. With a credit score of 600, lenders will most likely ask for a down payment that is 20 percent of the purchase price. The vast majority of lenders want to see that you have a gross income of at least $1,450. The amount of DTI that you can have depends on your credit score. With a score of 600, you will probably need a DTI that is under 35 percent of your gross income. Lenders want to see that you have been at your current job for at least two years or working within the same industry for that period of time.

Loans Under 60 Months Have Lower Interest Rates

Loan terms can have some effect on your interest rate. In general, the longer you pay, the higher your interest rate is.

After 60 months, your loan is considered higher risk, and there are even bigger spikes in the amount you’ll pay to borrow. The average 72-month auto loan rate is almost 0.3% higher than the typical 36-month loan’s interest rate. That’s because there is a correlation between longer loan terms and nonpayment lenders worry that borrowers with a long loan term ultimately won’t pay them back in full. Over the 60-month mark, interest rates jump with each year added to the loan.

Data from S&P Global for new car purchases with a $25,000 loan shows how much the average interest rate changes:

| Loan term | |

| 72-month new car loan | 3.96% APR |

It’s best to keep your auto loan at 60 months or fewer, not only to save on interest, but also to keep your loan from becoming worth more than your car, also called being underwater. As cars get older, they lose value. It’s not only a risk to you, but also to your lender, and that risk is reflected in your interest rate.;

Also Check: How To Calculate Maximum Loan Amount Fha Streamline