Best Bank For Refinancing Your Huntington Loan

Best Auto Loan Refinance Companies of 2021

- Best for Great Credit: Credit Unions

- Best for Checking Rates Without Impacting Your Credit: Capital One.

- Best Trusted Name: Bank of America, Chase or WellsFargo.

- Best for The Most Options: WithClutch.

- Best for Members of the Military: USAA or Navy Federal CU.

- Best for Peer-to-Peer Loans: LendingClub although not recommendable.

- Digital Credit Union and PenFed.

Enroll For Huntington Loan Payment Online

On their www.huntington.com, click the link on the right side of the page reading Enroll Now.

https://www.huntington.com/

You can enroll using either your account number or your Huntington debit card.

To use your personal account number, enter your account number and your Social Security number. If you want to use your debit card, click on the button reading Personal Debit Card and enter your debit card number, your PIN, and your Social Security number.

After entering your information, click the orange button saying Continue.

Follow the prompts to finish enrolling your account. You will need to create a username and password.

What To Watch Out For

Consider these potential downsides before taking out an auto loan with Huntington:

- Origination fee. Youll be on the hook for a $150 origination fee if you borrow through Huntington. Some car loan providers dont charge a fee at all.

- Limited state availability. You need to live in one of the seven states it lends in to qualify.

- Need to know which vehicle you want to buy. Be prepared to provide the year, make, model, mileage, VIN number and asking price during the application.

- Your dealership may not partner with Huntington. Find out if it does before a hard inquiry is made on your credit score.

- No autopay discount. Some lenders shave a small percentage off your interest rate if you sign up for automatic payments. Not here.

- No specifics about credit worthiness. You wont find minimum requirements for income, credit scores and other key factors online.

Must read: You might be offered a personal loan instead of an auto loan

The car, truck or motorcycle youre looking to purchase needs to be a 2012 model year or newer and have under 100,000 miles to qualify for an auto loan. If it doesnt fit those criteria, you may be offered an unsecured personal loan.

But hold up before sign on the dotted line: Interest rates for an unsecured personal loan are typically higher than an auto loan, since the vehicle isnt used as collateral. Shop around you may find a lender thats willing to offer you an auto loan elsewhere.

Recommended Reading: Refinance Auto Loan With Same Lender

What Apr Does Huntington Bank Car Loan Offer On Its Car Loans

Huntington Bank Car loan offers a fixed apr car loan productthat ranges from 4.72% APR.

Your APR can vary depending on several factors, such as your credit score. Find out what your credit score is and whether there is any false or inaccurate information in your credit history with these credit monitoring tools.

Highlights Of Huntington Auto Loan Financing

- You can fill out the online form in a matter of minutes.

- It offers flexible payment options, such as the ability to choose your payment schedule or to skip payments and make them up later.

- Theres no prepayment fee if you decide to pay off the loan early. A customer service representative also said theres no application or origination fees.

You May Like: Can I Refinance My Sofi Personal Loan

Financing For The Road You’re On

Auto Loans

Put your new car dreams in motion. Huntington auto loans offer flexible terms, great rates and no application fees.

Lending products are subject to credit application and approval.Investment, Insurance and Non-deposit Trust products are: NOT A DEPOSIT NOT FDIC INSURED NOT GUARANTEED BY THE BANK NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY MAY LOSE VALUE

Huntington Auto Loans: At A Glance

Before you can settle on an auto loan, its crucial to shop around for pre-approvals to make sure youre getting the best rate possible. If you submit multiple applications, do so in the same 30-day window. That way, the credit bureaus will treat it as one application with one hard pull on your rather than multiple that could lower your score each time.

If youre thinking about using Huntington for your auto loan, here are a few factors that you may want to take into consideration as you make your comparisons:

- Huntingtons APRs vary by ZIP code and the model year of the car youre trying to finance. Beginning rates are lower for newer vehicles. For example, lets look at the 43215 ZIP code Columbus, where Huntington is headquartered. APRs start as low as 5.22% for a 66-month term on a 2019 vehicle. For a 2011 vehicle, youd get an APR as low as 6.22% on 36-month term. Huntington doesnt specify on its website how high the APRs can reach.

- Terms available: It offers financing terms between 36 and 66 months.

- Loan amount: $3,000 or higher.

- Other types of financing: Besides its auto loan, which covers new and used cars, Huntington offers natural disaster assistance on vehicles, boats and recreational vehicles damaged during storms.

- Its only available in certain states: Auto loans are available only to residents of Illinois, Indiana, Kentucky, Michigan, Ohio, Pennsylvania, West Virginia and Wisconsin.

Read Also: Usaa Auto Loan Pre Approval

Quick Answers To Your Bill Pay Top Questions

- If I use Bill Pay, will my payment be guaranteed by my due date?

-

KeyBank offers a Bill Pay Guarantee*, to ensure your payments are received accurately and on time. Double check the amount and schedule your:

- Electronic payments at least 2 business days before the due date.

- Check payments at least 4 business days before the due date.

If payments are made within the above guidelines of the guarantee and KeyBank does not properly complete a bill payment on time or for the correct amount, KeyBank will pay any late fees and finance charges that result solely from that failed bill payment and send any correspondence necessary to rectify credit reporting.

- Why can’t I see or edit my payee’s address and phone number?

-

If you cannot see or edit the address and phone number for a payee, it means that KeyBank has a relationship with that payee and keeps that information updated for you.

- Can I make multiple payments at once?

-

Yes. Sign on to online banking and go to Bill Pay. Select ‘Access Additional Bill Pay Features’, then follow the prompts.

- Can I edit, cancel or delete a pending payment or transfer?

-

Yes. In online banking, upcoming activity is displayed in the account details page of each account. Select the payment to edit or delete it. Scheduled payments can also be canceled from the mobile app by selecting the + button and Activity icon. Select the payment you wish to cancel in the Bill Payments menu.

Can I Pay My Huntington Car Loan Online

can i pay my huntington car loan online is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on .

Note: Copyright of all images in can i pay my huntington car loan online content depends on the source site. We hope you do not use it for commercial purposes.

Don’t Miss: Usaa Refinance Auto Loan Calculator

Other Ways To Make Your Huntington Loan Payment

You have other options for making your Huntington Loan payment.

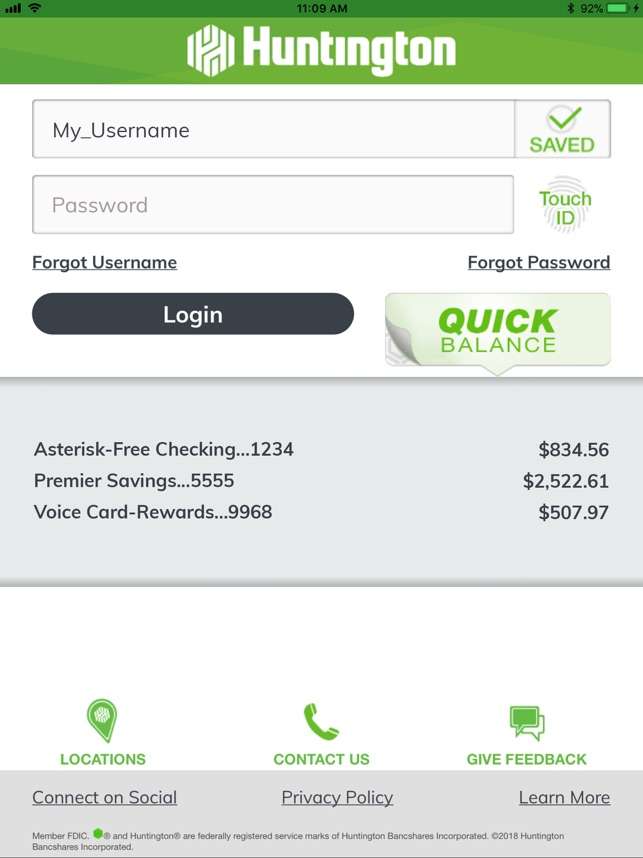

- Pay by app: You can make a payment by downloading the Huntington app on App Store or . Log into the app to make your payment.

- Pay in person: You can visit any Huntington branch location to make a payment in person. You can find the closest branch by visiting their website.

- Pay by mail: You can mail a check or money order toHuntington Installment LoansColumbus, OH, 43218.

Things To Consider Before Refinancing

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Here Are The Main Factors Most Lenders Consider:

Probably the most important factor in determining the interest rate on any loan is your credit score. Lenders use credit scores to review your financial responsibility, history and reliability, which is affected by your on-time-payment history, the numbers of open credit lines you have, how long those credit lines have been open and any negative marks. It’s good to know your credit score and review it for accuracy before you discuss your loan interest rate with your lender. to access your free credit score and report.

Your debt-to-income ratio is a measure of your ability to repay a prospective lender. For example, having a lot of outstanding debts could lessen your perceived reliability as a borrower and result in a higher interest rate. If you have available income to pay back the loan, you may get more competitive terms.

Lenders look at your credit worthiness as well as how much they’ll need to lend you. Making a down payment signals that you’re more likely to pay off your loan in a reliable way. Plus, the down payment reduces the amount of the overall loan. A lender could raise your interest rate to balance their exposure if you decide to purchase or lease without a down payment.

What Types Of Car Loans Does Huntington Offer

You have the option of taking out four types of car loans through Huntington:

- New car loans. Borrow to buy a car from a dealership that partners with Huntington.

- Used car loans. Complete your application with a Huntington-associated dealership.

- Private-party auto loans. Huntington cuts a check and pays the selling party directly.

- Auto refinancing loans. Refinance your existing auto loan for a potentially lower rate or better term.

You May Like: Www Chfainfo Com Homebuyer

Compare Other Car Loan Offers

| 3.8 out of 5 stars, based on 29,044 customer reviews | |

| Customer reviews verified as of | 19 October 2020 |

|---|

A modest seven reviews populate Huntingtons Trustpilot profile as of October 2020 and the majority of them are Excellent. However, its Better Business Bureau profile tells another story. It has just over 1 star from its 134 reviews, and it has over 500 complaints.

There are no 2020 reviews regarding car loans from Huntington. But those from 2019 and 2018 state issues with title transfers, making payments and customer service.

Getting A Huntington Bank Personal Loan

Huntington Bank offers unsecured personal loans, which means borrowers dont have to put up any type of collateral. The bank will look at a borrowers credit history and income to determine whether they will be able to repay their loan.

Huntington Bank doesnt state their minimum credit requirements, but a borrowers credit history will be a factor determining their eligibility. If you dont have a good credit score, you can submit your loan application with a cosigner to qualify for a better rate.

You can apply for a personal loan over the phone, in person, or on Huntington Banks website. The application process is usually fairly quick, though it may take longer if youre applying with a cosigner because the bank will need additional information.

Read Also: Car Loan Transfer To Another Person

How To Refinance Your Bank Of The West Auto Loan

- Navy Federal Credit Union

- and a few more.

How Do Repayments Work With Huntington

You have the option to choose your own payment due date and frequency of payment. Huntington also allows you to wait up to 60 days to make your first payment though interest likely accrues during this time, making your loan more expensive in the long run. You might want to see if its possible to sign up for autopay, so you dont have to worry about manually making a repayment each month.

See how Huntington stacks up to other lenders with our guide to car loans.

Read Also: What Car Loan Can I Afford Calculator

What Happens After I Apply

If you submitted your application between the hours of 7 a.m. and 10 p.m. ET on any day of the week, youll receive an immediate response indicating whether your application has been tentatively approved, declined or if more time is needed to review it. Did you apply outside of that time period? You likely wont get a response as quickly.

If approved, a Huntington loan consultant will call you and walk you through the rest of the process, including how to verify your income and employment.

Once approved, the next step is to sign the contract and receive your funds. If you applied at a dealership, youll complete the process there and possibly drive off in your new vehicle that same day.

Otherwise, youll need to make an appointment to visit your local branch. If youre buying a car through a private seller, the seller also needs to be at the branch when you close.

Financing Is Made Easy At Huntington Beachhyundai

Choosing a dealership to finance your vehicle is agood choice, choosing Huntington Beach Hyundai to finance your vehicle is agreat choice! Our finance team has years of experience, making sure that theycan get you the best monthly rate for your loan or lease. We believe that everydriver should have access to a vehicle that will meet their needs, which is whywe work with you through every step of the process to make sure you are alwaysgetting the most reasonable rate for your life.

We have all of the most popular Hyundai models foryou to choose from, including the Elantra, Azera, Santa Fe, Sonata, and more,making sure that you can find one that will meet all the needs of your life.Our team will ask the important questions to determine what you are looking forout of a vehicle. For instance, if you wanted a lot of space, the Santa Femight be suggested, but if you are looking for a fun and sporty ride, theElantra GT would be recommended.

Recommended Reading: Average Loan Officer Income

How Do Lenders Decide My Auto Loan Interest Rate

Answered by Jim Manelis is a car enthusiast and Chase Auto Executive.

Buying and financing a vehicle can seem like a daunting transaction, but you can accelerate the process by being prepared with the right information. One of the most common questions people ask is how lenders decide on what their auto loan interest rate will be.

Huntington Federal Loan Payment Options

Huntington Federal loan payments can be made using several different methods. Please review your payment options below. If you have any questions, or would like to enroll for auto-payments, please contact our office at 304-528-6230.

- Transfer Management System Re-occurring monthly payments automatically deducted from a checking account at Huntington Federal, or any other financial institution.

- HFSB Retail Online Banking & Mobile Banking System Payment automatically deducted from a Huntington Federal checking account or statement savings account. Set up a single payment or re-occurring payments.

- BillMatrix Loan Payment Service Payment electronically deducted by debit card or ACH from a checking account at Huntington Federal, or any other financial institution. Set up a single payment or re-occurring payments.

- Payment Book and funds presented at one of our offices for manual processing.

Don’t Miss: Loan Originator License California

Huntington Bank Customer Upset About $247 Auto Loan Prepayment Penalty: Money Matters

When I called Huntington for a payoff amount, they told me there was an early pay-off fee of $247 and it was applicable anytime the loan was paid off early. After asking the Huntington representative if they belonged to the mafia he replied, “It was in your contract when you signed the papers.”

I’ve recently asked PNC if they do this this, and they said no. Are you aware of this and is Huntington the only one that does this? The only way to avoid this fee was to make the payments as scheduled.

A.R., EuclidA: Without knowing more, I’ll have to side mostly with the bank on this. First, prepayment penalties are not unusual on a car loan in exchange for a lower interest rate, or a low or no application fee.

There are costs for the bank to run your credit report, evaluate your application and do the paperwork. If you were to suddenly pay off your loan after one or two months, the bank probably wouldn’t have made enough in interest to cover its expenses. The bank doesn’t want to lose money on you, and it wouldn’t be fair for the bank to raise rates for everyone to compensate for someone who cost the bank money.

Huntington is not the only bank with a prepayment penalty on auto loans. Many banks do for this exact reason.

However, I’ve never heard of a prepayment penalty during the entire life of a 75-month loan. That’s more than six years! Most prepayment penalties are one to two years.

J.S., Brunswick