Consumer Group Launches Website To Track All The Public Companies That Got Ppp Small Business Loans

The U.S. governments Paycheck Protection Program for small business coronavirus relief loans reopened on Monday for round two with a fresh $310 billion in the chamber, after the first round ran through $349 billion in 13 days.

The second round of PPP expressly seeks to prevent publicly traded companies from applying, after a number of large chains qualified the first time around thanks to a carveout that allowed restaurants and hotels to apply as long as they have fewer than 500 employees per location.

But the public backlash has grown louder, not quieter. Shack Shack , which got a $10 million loan, and Kura Sushi , which got $6 million, announced they would return their PPP loans, before Treasury came out on April 23 and explicitly demanded that publicly traded companies return their loans by May 7. Ruths Chris Steakhouse , which got $20 million by applying on behalf of two subsidiaries, and Potbelly Sandwich Shop , which got $10 million, have since announced theyll return their loans.

Based on reported estimates, between $770 million and $870 million of the first round funds went to publicly traded companies. The SBA said on Monday that about $2 billion is back in the PPP pot from returned loans so far.

Now Allied Progress, a left-leaning nonprofit consumer advocacy group that tracks predatory financial institutions, has launched a site listing every public company that received a PPP loanand the list is more extensive than you might have thought.

The Artist Jeff Koons

Koons, a modernist sculptor, is known best for his work with large, metallic balloon-like animals. His “Rabbit” sculpture fetched $91 million at auction last year.

Koons’ studio was approved for $1 million to $2 million, the government’s data shows. His studio said it employed 53 people before the pandemic. The PPP loans can be forgiven if employers use most of the money to keep their workers on the payroll.

Small Business Paycheck Protection Program

The Paycheck Protection Program established by the CARES Act, is implemented by the Small Business Administration with support from the Department of the Treasury. This program provides small businesses with funds to pay up to 8 weeks of payroll costs including benefits. Funds can also be used to pay interest on mortgages, rent, and utilities.

The Paycheck Protection Program prioritizes millions of Americans employed by small businesses by authorizing up to $659 billion toward job retention and certain other expenses.

Small businesses and eligible nonprofit organizations, Veterans organizations, and Tribal businesses described in the Small Business Act, as well as individuals who are self-employed or are independent contractors, are eligible if they also meet program size standards.

Previous Versions of Applications

Don’t Miss: Can I Pay Off My Child’s Student Loan

Celebrities Whose Companies Received Covid

In March, Congress passed the CARES ACt, a $2 trillion Coronavirus economic relief plan that includes stimulus payments to individual taxpayers, moratoriums on evictions and foreclosures and forgivable government loans for small businesses in the bills long list of relief programs.

Under the CARES Act, small businesses with up to 500 employees may be eligible for a forgivable Paycheck Protection Program loan through the Small Business Administration to help the business stay afloat during the pandemic and keep employees on the payroll.

Borrowers can apply for loan forgiveness if they meet certain qualifications such as using at least 60% of the loan for payroll costs. The loans have helped countless struggling small businesses remain open, and even gig workers, freelancers and sole proprietors can apply.

Yet several businesses owned by wealthy celebrities also took out PPP loans ranging from $350,000 to $5 million. Click or swipe for 6 celebrities whose companies received PPP loans.

But First: Heres Why The Ppp Loan Program Didnt Work

The Paycheck Protection Programwas aimed at giving Americas small businesses and self-employed a lifeline to keep them open during the economic shut down due to the coronavirus pandemic.

$349 BILLION was allocated towards United States small businesses by the SBA. There are over 53 million combined small businesses and self-employed persons in the United State which we are going to simply call in the table below small companies.

4,400 of the approved PPP loans exceeded $5 million according to the SBA. The size of the typical loan nationally was $206,000. The SBA will forgive the loans if companies meet certain benchmarks, such as keeping employees on payroll for eight weeks.

Of the estimated 45 million applications for PPP the Small Business Administration received, only 4% were approved.

| PPP funds set aside for small businesses April 3 | $349 BILLION |

| per month |

Its obvious the first round of PPP loan funding was never going to cover demand for the program even though $349 BILLION had been allocated for it.

There was never enough funding for small companiesand big companies applying for taxpayer-backed PPP loans only exacerbated the problem. They knew better.

Never forget who these big companies are because screwed over small companies and the self-employed by holding much needed funding for small businesses hostage.

Don’t Miss: Online Bad Credit Payday Loans

Ppp Loan Recipient List By State California

California has a total of 1,271,195 businesses that received Paycheck Protection Program loans from the Small Business Administration.

This table shows the top 5 industries in California by number of loans awarded, with average loan amounts and number of jobs reported.

The tool below can be used to search all publicly released PPP recipients in CA. Filter the list or search for specific companies.

| Top Industries |

|---|

| No Results Found – Please Modify Your Search! |

| } |

FederalPay’s PPP Information Policy

Paycheck Protection Loan data has been made public by the Small Business Administration for all private companies that received a PPP loan.

All information displayed on this page is publicly available information under PPP loan guidelines, in compliance with 5 U.S.C. § 552 and 5 U.S.C. § 552a and is published unmodified, as provided by the SBA. FederalPay does not modify the data and makes no claims regarding its accuracy.

Any corrections or modifications to this data can only be made via the SBA. For more information, please see the .

% Of Public Companies That Got Ppp Loans Kept The Funds

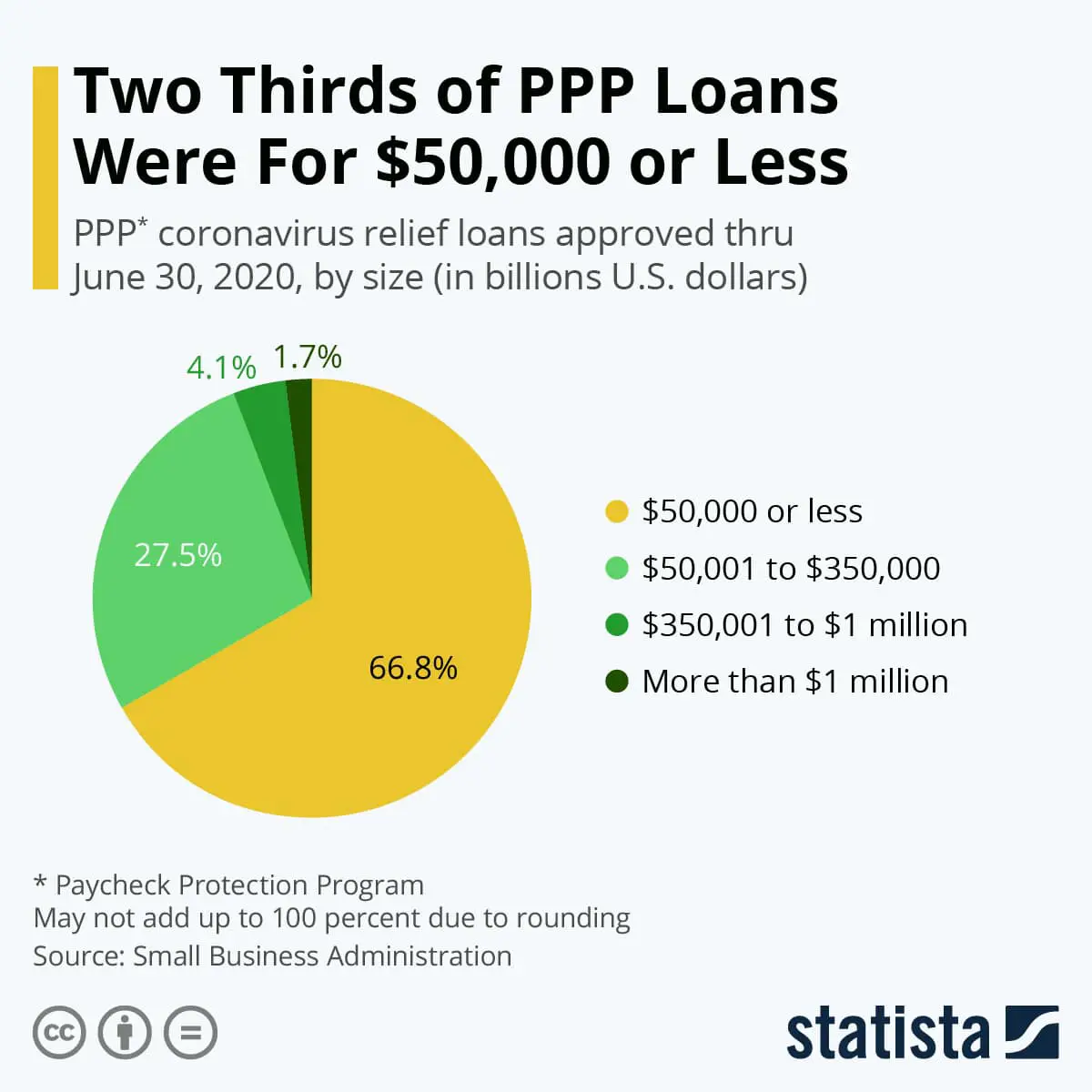

Most public companies that got PPP loans kept the funds, but the majority of them were modest: under … $1 million

getty

Public companies were criticized for getting loans via the Paycheck Protection Program , which was ostensibly created to help small businesses weather the economic impacts of the pandemic. Since public companies raise capital in the stock markets and have established banking relationships for lines of credit, some critics say Congress should have excluded public companies of any size from applying for funds via the PPP. Under the CARES Act, the PPP allowed companies with up to 500 employees to apply for forgivable loans of up to $10 million.

While a few high-profile public companies gave back their PPP loans under pressure from media scrutiny, a study shows that only a small percentage of public companies returned PPP funds. It also finds, however, that most took out loans of less than $1 million.

You May Like: How High Can An Fha Loan Go

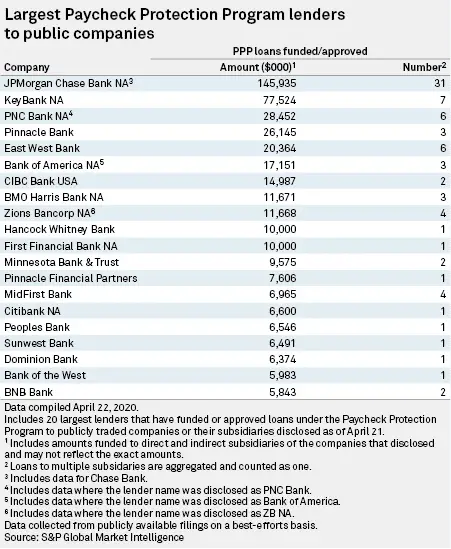

Biggest Publicly Traded Companies Approved For Ppp Loans

Well be updating this list as more information becomes available.

NOTE: Big companies not publicly traded are noted next to company/brand name.

The list GROWS daily. We will update this list as we can, and here a COMPLETE LIST that is updated frequently. This mess is about to hit $1 BILLION in taxpayer-backed PPP loans that publicly traded companies received.

| COMPANY |

|---|

The Messy Fall Semester

Harvard, Princeton and other schools have begun to outline how the coming academic year will play out amid the pandemic. Its a mix of online and on-campus education with a heavy emphasis on the former.

Heres what different schools are doing:

Harvard will allow up to 40 percent of undergraduates on campus this fall, with first-year students getting priority. All classes will be held online, regardless. The university will charge full tuition currently set at about $50,000 but some students studying remotely will receive a $5,000 stipend.

Princeton wont allow more than half of undergraduates on campus at any point. Some small classes might be held in person. The school will cut its tuition by 10 percent, to $48,500.

Georgetown will invite first-year students on campus only. It hasnt yet decided whether to cut tuition, currently set at $57,000.

Expect lots of coronavirus testing. Harvard will test students on campus every three days, while Cornell will test weekly. Georgetown says tests will be available whenever they are needed.

Plenty of questions remain:

What are students getting for their education? They are exposing the kids to increased virus risk, something that is arguably justifiable in exchange for in-person learning, which everyone agrees is better than online, Ken Bradley, the father of a Yale student, told The Times. But no, the kids will do remote learning, from campus! At full tuition!

Don’t Miss: How Can I Apply For Fha Loan

Economic Injury Disaster Loans

In response to the Coronavirus pandemic, small business owners in all U.S. states, Washington D.C., and territories are eligible to apply for an Economic Injury Disaster Loan advance of up to $10,000. This advance will provide economic relief to businesses that are currently experiencing a temporary loss of revenue. Funds will be made available following a successful application. This loan advance will not have to be repaid. If a business received an Economic Injury Disaster Loan advance in addition to a Paycheck Protection Program loan, the amount of the Economic Injury Disaster Loan advance will be deducted from the PPP loan forgiveness amount by SBA.

The SBAs Economic Injury Disaster Loan provides vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing as a result of the COVID-19 pandemic.

This program is for any small business with fewer than 500 employees , private non-profit organization or 501 veterans organizations affected by COVID-19.

Businesses in certain industries may have more than 500 employees if they meet the SBAs size standards for those industries.

The Economic Injury Disaster Loan advance funds will be made available within days of a successful application, and this loan advance will not have to be repaid.

Francis Ford Coppola Presents

Francis Ford Coppola Presents LLC, the film, wine and lifestyle company associated with Francis Ford Coppola, the famed producer, director and writer of Oscar-winning films such as The Godfather and Apocalypse Now, received a PPP loan for between $5 million and $10 million dollars, according to the SBA.

The company reported 469 employees to be retained with loan funds.

You May Like: How To Get Someone Off Your Car Loan

Khloe Kardashians Good American Line

Reality star Khloe Kardashians Good American clothing company, which she owns with business partner Emma Grede, received a Paycheck Protection Program loan worth between $1 million and $2 million, according to the SBA. The company reported having 57 employees at the time.

Kardashian, famous for her reality-star role in Keeping Up with the Kardashians along with being Kanye Wests sister-in-law had a net worth of around $40 million in 2018, according to Money.com.

California Ppp Funded Companies

This directory is composed of all companies that have received loans under the Paycheck Protections Program according to data provided by the U.S. Treasury. This is NOT a directory of companies that received a loan using SBA.com® loan request service. The information provided here may not reflect the most up to date data put out by the U.S. Treasury.

Small Business Advice offers business advice, information and other services related to the formation, financing, operation and management of businesses. See our Advertiser Disclosure for more information on how we try to connect you with a small business lender. This website is not a lender and does not accept loan applications, assist with loan applications, broker loans, make loans or make any credit decisions. Nothing on this website is an offer or a solicitation for a loan. This website is not an agent, representative or broker of any lender and does not endorse or charge you for any service or product. None of the information on this site constitutes legal advice.

Read Also: When Do Student Loan Payments Begin

Kanye Wests Yeezy Brand

Hip-hop star and presidential candidate Kanye Wests sneaker and clothing company Yeezy LLC received a loan of between $2 million and $5 million, according to SBA loan records.

Yeezy, which reported 106 employees to be kept on the payroll with the loan, is famous for its controversial celebrity owner and pricey sneakers, some of which cost $2,000 or more a pair.

Us Virgin Islands Ppp Funded Companies

This directory is composed of all companies that have received loans under the Paycheck Protections Program according to data provided by the U.S. Treasury. This is NOT a directory of companies that received a loan using SBA.com® loan request service. The information provided here may not reflect the most up to date data put out by the U.S. Treasury.

Small Business Advice offers business advice, information and other services related to the formation, financing, operation and management of businesses. See our Advertiser Disclosure for more information on how we try to connect you with a small business lender. This website is not a lender and does not accept loan applications, assist with loan applications, broker loans, make loans or make any credit decisions. Nothing on this website is an offer or a solicitation for a loan. This website is not an agent, representative or broker of any lender and does not endorse or charge you for any service or product. None of the information on this site constitutes legal advice.

You May Like: How To Calculate Dti For Mortgage Loan

Why Is It Important That Small Businesses Get Ppp Loans Jobs

Small companies are the backbone of America and account for an astounding 64% of all new jobs created in the United States.

The number of people in the U.S. who are self-employed has grown over 9%, while the growth rate of businesses that employ people has only grown by 4.4%.

Self-employed people in the United States still pay taxes, and have to pay for their own healthcare. However, they are often ineligible for federal and state welfare and unemployment programs unless they go get a real job.

The rise of entrepreneurship in the U.S. has given rise to more self-employed people who value flexibility over staying at one company for most of their career.

Entrepreneurship is now called the new American dream.

| Percent of all U.S. jobs created by small businesses | 49.2% |

List Of Totally Wtf Moments Where Big Companies Got Ppp Loans

| Company | ||

|---|---|---|

| $2.1 million | *Same day they received PPP loan funds, they renewed the CFOs employment term for 2 years at $325,000 for 2020 $375,000 for 2021*Also gave CFO a sign-on bonus of $100,000 | |

| Fogo de Chao | $20 million | *Two subsidiaries applied and received $10 million each by taking advantage of loophole in the CARES Act*About 40 locations*Last known revenue $314.4 million in 2017*CEO Barry McGowan defended the decision to apply for small business PPP loans by saying, The scale of our business doesnt matter. |

Recommended Reading: Is Personal Loan Better Than Credit Card Debt

Jim Justice Billionaire Governor

West Virginia Governor Jim Justice’s family companies received at least $6.3 million from the program.

Justice, a Republican, is considered to be West Virginia’s richest person through his ownership of dozens of coal and agricultural businesses, many of which have been sued for unpaid debts. At least six Justice family businesses were approved for loans, including the Greenbrier Sporting Club, an exclusive club attached to a lavish resort that Justice owns called the Greenbrier.

Justice, a billionaire, acknowledged last week that his private companies received money from the program but said he didn’t know the dollar amounts. A representative for the governor’s family companies didn’t immediately return emails seeking comment.

Sba Paycheck Protection Program Data Lookup

Under open government transparency guidelines, information on recipients of the $793B in forgivable government loans issued through the 2020 Paycheck Protection Program by the US Small Business Administration are a matter of public record. FederalPay.org has created a powerful search tool that allows public access to the PPP loan database.

Also Check: How To Transfer Personal Loan From One Bank To Another

$2 To $5 Million Range

- Self-driving trucking company TuSimple plans to save 324 jobs. TechCrunch recently reported that this startup, which gained unicorn status in 2019, has hired Morgan Stanley as it seeks $250 million in new funding.

- Yeezy LLC, a company owned by Kanye West, is listed and the money will retain 106 jobs.

Recent Issues On Americas College Campuses

- Harvard Slavery Report: After the university issued a report investigating its ties to slavery earlier this year, both Harvard and the descendants of enslaved people with links to the school are debating, What is justice now?

- Mumia Abu-Jamals Papers: Brown University has acquired the personal archive of the former Black Panther, who became the face of the anti-death penalty movement.

Quibi faces a reckoning.Vulture takes a long look at Jeffrey Katzenbergs embattled short-video streaming service, which has struggled to attract subscribers despite raising $1.75 billion in funding.

Recommended Reading: How To Calculate Apr On Auto Loan