Other Benefits Of Fha Home Loans Include:

- Being able to get a FHA loan with no credit score. Who would think that you would be able to get a home loan without any credit? HUD does not allow FHA to not consider you for a loan because you do not have a credit score. It is possible to have nontraditional credit as the basis for a home loan, such as payments for rent, utility bills and cell phone bills.

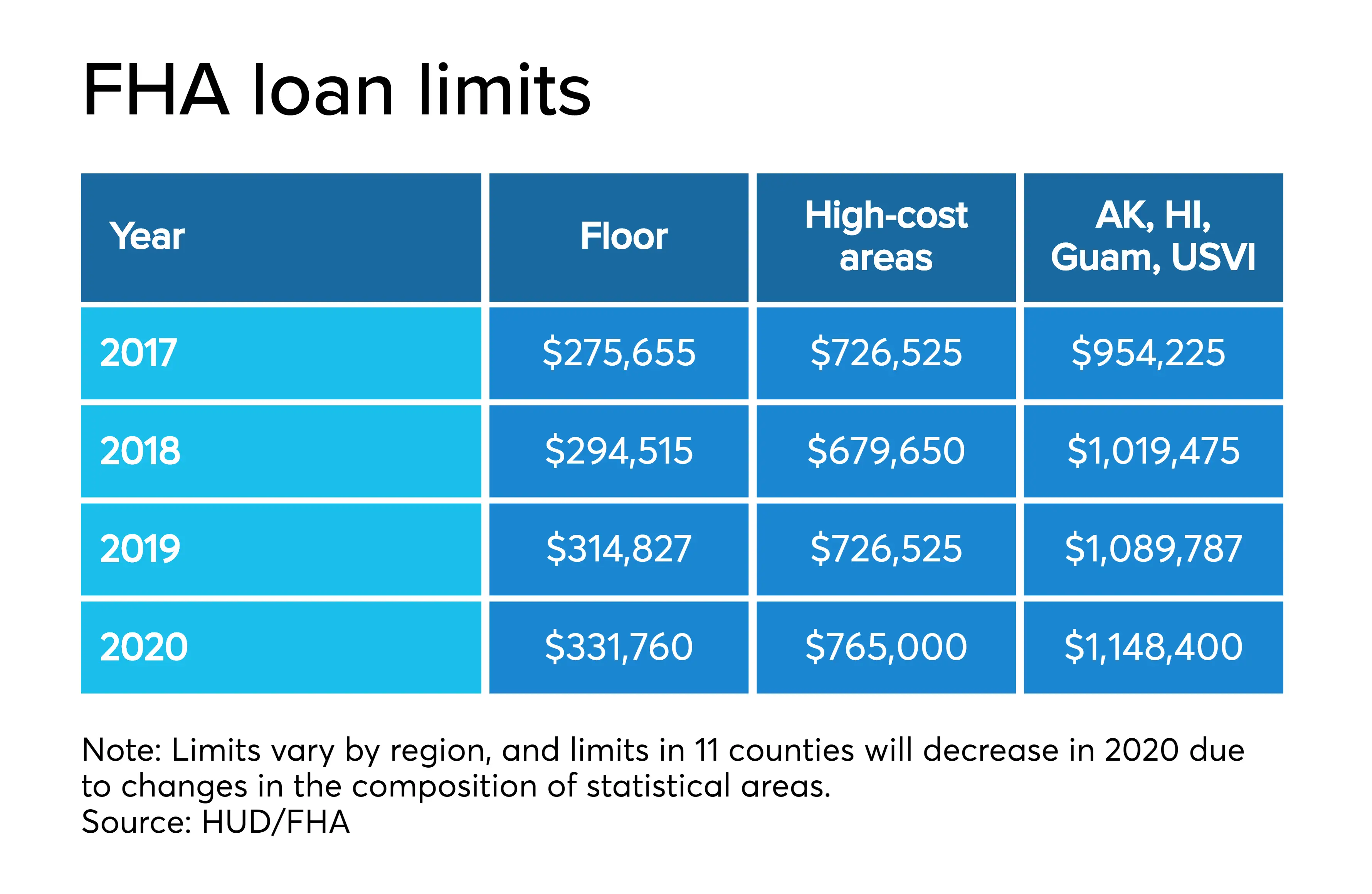

- Larger loan limits for higher priced areas. You might think if you want to buy a home in an expensive area that FHA would not insure the loan. However, FHA has different sizes of loans it will guarantee, depending upon the cost of real estate in that area. In a cheaper area such as Pittsburgh, you can get an FHA loan for a home up to $294,000. But in San Francisco, you may get a FHA max loan amount for a home that costs more than $700,000.

- FHA home loans can be used for most property types. You can get a single-family home, a duplex or a triplex, or a condominium. Modular homes and manufactured houses may also be eligible.

- You can assume an FHA home loan. An FHA mortgage may be assumed by a new buyer. This is a big advantage when interest rates are going up. It is possible to keep a much lower rate from years ago if you buy a home with FHA financing in place. You do need to qualify for the FHA mortgage, though.

- You can do a streamline refinance with no appraisal if rates drop. If you have an FHA mortgage and want to get a lower rate, you can do an easy refinance with minimal checks of your income or credit.

Advantages Of Fha Loans

FHA loans are not limited to first-time homebuyers, but they are meant to help borrowers with limited or spotty credit histories. By design, their eligibility requirements are less stringent than what you’d find with many conventional mortgages that are not backed by government agencies.

- Down payment: The 3.5% minimum down payment requirement on FHA loans is lower than what many conventional loans require. If you have a credit score of about 650 or higher, the low down payment requirement is likely the main reason you’d be considering an FHA loan. As you’ll see below, however, there are other low-down-payment options worthy of consideration if this is the case for you.

- The credit score requirement of 580 on FHA loans is lower than what most lenders require for conventional loans. It’s even possible to qualify for an FHA loan with a FICO® Score as low as 500, but you must put down 10% of the purchase price to do so.

- Debt-to-income ratio: All mortgage lenders look at your debt to income ratio , the percentage of your monthly pretax income that goes toward debt payments. Lenders view borrowers with high DTIs as posing more financial risk, and they tend to prefer DTIs of 36% or less for conventional mortgages. You can qualify for an FHA loan with a DTI ratio as high as 43%.

Do I Have To Be Rich To Get An Fha Loan

Nope! On the contrary, the FHA wants to loan to Americans who might otherwise have a hard time financing a home purchase, like young people who havent yet saved up enough for a big down payment.

Down payment requirements for FHA loans go as low as 3.5% of the home value. That 3.5% doesnt have to be money youve saved yourself, either. The money for your down payment can come from a friend or family members gift.

Though you dont need to be rich to get an FHA loan, you will need to meet debt-to-income requirements.

Also Check: Usaa Certified Dealers List

Fha Loan Limits Rise: Here’s What You Need To Know

by Maurie Backman | Updated July 19, 2021 – First published on Jan. 26, 2021

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

FHA borrowers now have more options when it comes to more expensive homes.

If you’re looking to buy a home but don’t have a lot of money to put toward a down payment, you might consider an FHA loan. These government-backed loans allow you to put as little as 3.5% down on a home purchase, and they have lower credit score requirements, too. With a conventional mortgage, you’ll generally need a score of at least 620 to get approved, whereas FHA lenders will usually accept a score of 580.

That said, there are limits on how much you can borrow with an FHA loan. But this year, those limits are rising. Here’s what you need to know.

Can You Get An Fha Loan If Youre Self

MISHKANET.COM” alt=”Fha vs conventional loan calculator > MISHKANET.COM”>

MISHKANET.COM” alt=”Fha vs conventional loan calculator > MISHKANET.COM”> If youre self-employed, you may be qualified for an FHA loan if you can prove that you own at least 25% of your business. Self-employed borrowers need to provide their personal and business tax returns for two years, balance sheets, and profit and loss statements. Your self-employment income should be sufficient based on lender standards.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

History Of The Federal Housing Administration Loan

Congress created the Federal Housing Administration in 1934 during the Great Depression. At that time, the housing industry was in trouble: Default and foreclosure rates had skyrocketed, loans were limited to 50% of a property’s market value and mortgage termsincluding short repayment schedules coupled with balloon paymentswere difficult for many homebuyers to meet. As a result, the U.S. was primarily a nation of renters, and only approximately 40% of households owned their homes.

In order to stimulate the housing market, the government created the FHA. Federally insured loan programs that reduced lender risk made it easier for borrowers to qualify for home loans. The homeownership rate in the U.S. steadily climbed, reaching an all-time high of 69.2% in 2004, according to research from the Federal Reserve Bank of St. Louis. As of the second quarter of 2020, it’s at 67.9%.

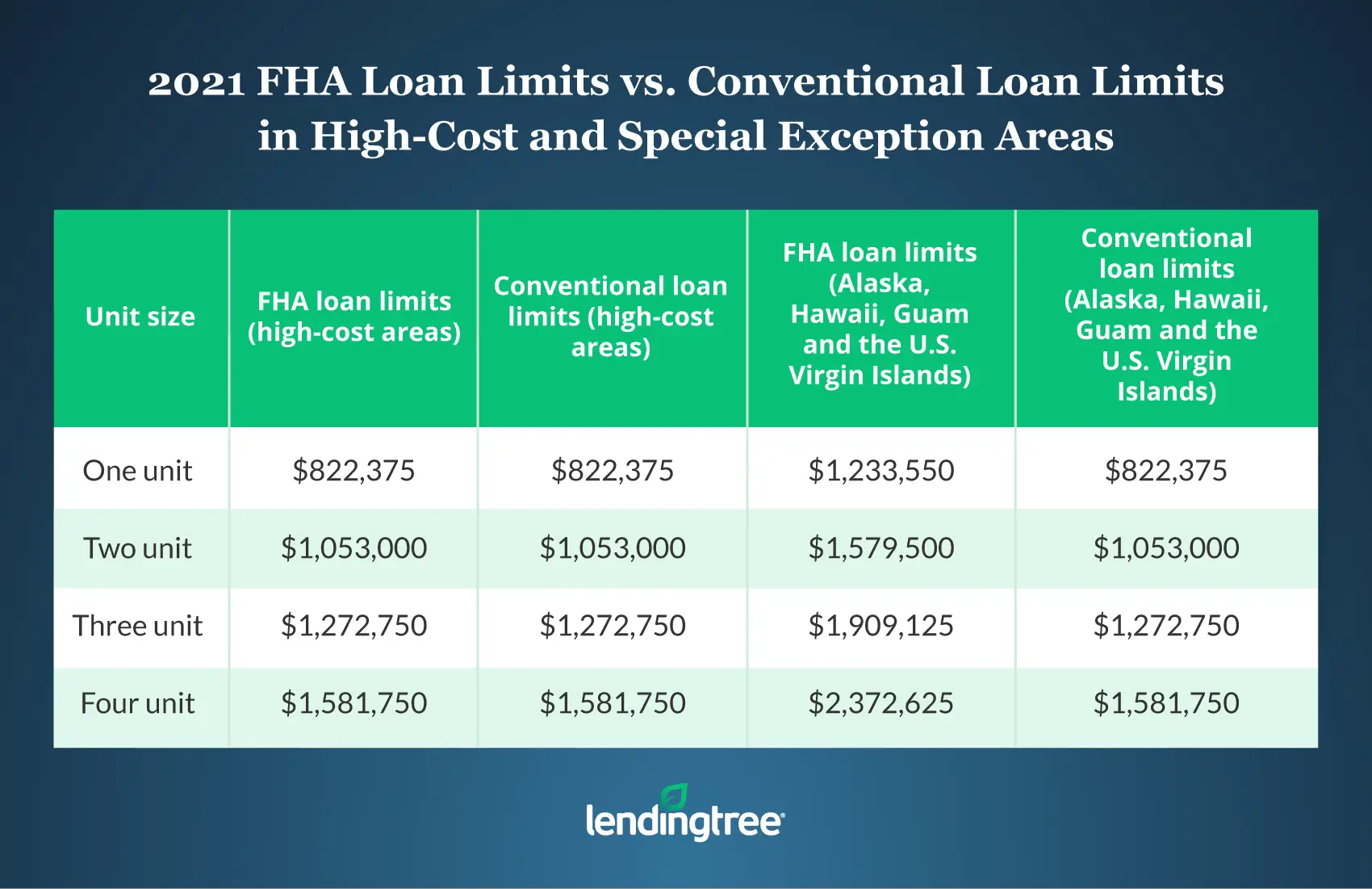

How Does This Affect Reverse Mortgages

In addition to handling FHA loans, the FHA also is responsible for insuring conforming home equity conversion mortgages, more commonly referred to as reverse mortgages.

Reverse mortgages do not vary by county and have one set limit across the U.S. The FHA raised the limits on reverse mortgages from $765,600 in 2020 to $822,375 in 2021..

Rocket Mortgage® doesnt currently offer reverse mortgages, but cash-out refinance could be a great alternative.

Read Also: Who Can Qualify For An Fha Loan

Fha Energy Efficient Mortgage

This program is a similar concept to the FHA 203 Improvement Loan program, but its aimed at upgrades that can lower your utility bills, such as new insulation or the installation of new solar or wind energy systems. The idea is that energy-efficient homes have lower operating costs, which lower bills and make more income available for mortgage payments.

Types Of Fha Home Loans

There are a number of different types of FHA loans. The type of FHA loan you choose limits the type of home you can buy and how you can spend the money you receive. This makes it especially important to be sure that youre getting the right type of loan. If none of the following loan types match your goals, you might want to consider another government-backed FHA loan alternative.

Lets take a look at a few different FHA loan classifications.

Don’t Miss: Becu Auto Loan Phone Number

Final Thoughts On Fha Loans

If you’re in the market for a loan with lenient credit, lower down payment and low-to-moderate income requirements, an FHA loan might be right for you. Check out your options online with Rocket Mortgage®.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Fha Standard Refinance Loans

The standard FHA refinance loan is the 203 loan, mentioned above. FHA refinance rates and other guidelines are similar to those on a home purchase, although you can qualify with only 3.25 percent home equity, just under the 3.5 percent down payment required on a purchase.

This can be a good option for borrowers with a non-FHA mortgage who are having difficulty refinancing due to a low credit score or lack of home equity, as FHA refinance guidelines are less stringent than for conventional refinancing.

You can use this type of refinancing to get a lower mortgage rate, to shorten the term of your current mortgage to pay it off more quickly, to convert an ARM to a fixed-rate mortgage or vice versa, or to extend your current mortgage term in order to lower your monthly payments.Your lender may allow you to roll your closing costs into the loan with a standard FHA refinance, or may waive them in return for charging a somewhat higher mortgage rate.You do not need to refinance with your current lender, nor do you need to currently have an FHA loan to refinance into an FHA mortgage.

You May Like: How Do I Find Out My Auto Loan Account Number

Fha Loan Limits In California

The Federal Housing Administration issued their 2021 fha loan limits in California and the good news for homeowners is that theyve increased their California FHA loan limits for most areas. The FHA increase in loan limit size is a big win for homeowners in California as it will open the door to additional opportunities for many current and potential homeowners.

As its been reported in the news weve seen significant jumps in California housing prices over the last 12 months and because of this FHA is able to raise their floor and ceiling loan limits.

What Are The Differences Between An Fha Loan And A Conventional Loan

It’s easier to qualify for an FHA loan than for a conventional loan, which is a mortgage that isn’t insured or guaranteed by the federal government.

-

FHA loans allow for lower credit scores than conventional loans and, in some cases, lower monthly mortgage insurance payments.

-

FHA rules are more liberal regarding gifts of down payment money from family, employers or charitable organizations.

-

FHA loans may involve closing costs that aren’t required by conventional loans.

» MORE: Details on FHA vs. conventional loans

You May Like: Does Va Loan Work For Manufactured Homes

Fha Home Equity Loans

The FHA does not offer conventional home equity loans, where you can borrow money for any purpose. However, it does offer several loan options for making home improvements that are backed by your home equity, as well as reverse mortgages for seniors. See FHA 203 loans, FHA Title 1 loans, Energy Efficiency Mortgages and FHA Reverse Mortgages, described below.

Fha Limits Arizona Larger Cities

The following information is for a single-family home and is based on the 2021 FHA limits for Arizona.

The FHA loan limit in Phoenix, AZ is $368,000.

The FHA loan limit in Tucson, AZ is $356,362.

The FHA loan limit is Mesa, AZ is $368,000.

The FHA loan limit in Chandler, AZ is $368,000.

The FHA loan limit in Scottsdale, AZ is $368,000.

The FHA loan limit in Glendale, AZ is $368,000.

The FHA loan limit in Gilbert, AZ is $368,000.

The FHA loan limit in Tempe, AZ is $368,000.

The FHA loan limit in Peoria, AZ is $368,000.

The FHA loan limit in Surprise, AZ is $368,000.

The FHA loan limit in Yuma, AZ is $356,362.

The FHA loan limit in San Tan Valley, AZ is $368,000.

The FHA loan limit in Avondale, AZ is $368,000.

The FHA loan limit in Goodyear, AZ is $368,000.

The FHA loan limit in Flagstaff, AZ is $389,850.

The FHA loan limit in Buckeye, AZ is $368,000.

The FHA loan limit in Casa Grande, AZ is $368,000.

The FHA loan limit in Lake Havasu City, AZ is $356,362.

The FHA loan limit in Sierra Vista, AZ is $356,362.

The FHA loan limit in Prescott Valley, AZ is $356,362.

The FHA loan limit in Prescott, AZ is $356,362.

The FHA loan limit in Apache Junction, AZ is $368,000.

The FHA loan limit in Queen Creek, AZ is $368,000.

The FHA loan limit in Kingman, AZ is $356,362.

The FHA loan limit in Anthem, AZ is $368,000.

The FHA loan limit in Nogales, AZ is $356,362.

The FHA loan limit in Payson, AZ is $356,362.

The FHA loan limit in Show Low, AZ is $356,362.

IMPORTANT MORTGAGE DISCLOSURES:

Also Check: How Long For Sba Loan Approval

How Does An Fha Loan Work

The Federal Housing Administration doesnt actually lend money to homebuyers. Instead, it guarantees loans, making lenders less wary of extending mortgages and helping more Americans build equity in a home of their own. When you shop around for an FHA loan youre really shopping for an FHA-backed loan.

The Pros And Cons Of Fha Loans

Before you choose what type of loan youll use, it’s important to weigh the pros and cons. A home is a big purchase, and theres a lot to consider.

- Pro: Lower qualification standards. FHA loans are often easier to get than other types of loans. If you have bad credit or a bankruptcy in your past, this option might be right for you.

- Con: Lower lending limits. FHA loans have much lower lending limits than traditional loans. If you want to purchase a home above these limits, you’ll need to use a different type of loan or find a different house.

- Pro: Lower down payment. This is one of the main draws of an FHA loan. With as little as 3.5% down, homeownership can become a reality for borrowers who wouldn’t otherwise qualify.

- Con: Mortgage insurance. FHA loans require MIP. The amount you pay depends on the price of your home and your loan-to-value ratio, but MIP will ultimately increase the overall cost of your loan. Unlike conventional loans, the MIP on an FHA loan wont be eliminated when the LTV is reduced to 78%.

- Pro: Competitive interest rates. FHA loans may offer interest rates at or below conventional loan rates. This can help reduce your monthly payment.

- Con: Primary residence only. While FHA mortgages can be used for single-family and multi-family homes, they can only be used for your primary residence. This means if you’re looking to buy a vacation home or second home, FHA loans won’t work for you.

Read Also: Va Loan Requirements For Manufactured Homes

Fha Maximum Financing Calculator

This calculator helps determine the minimum allowable down payment and maximum FHA mortgage allowed on a home purchase. It creates an estimate of closing costs and required upfront Mortgage Insurance Premium . This tool is designed to determine the FHA mortgage limit for a particular purchase, not the maximum allowed for any home in your state and county. To determine the maximum purchase price for your specific area you should use at the HUD.gov. Then, with that data in hand, use the below calculator to determine the required down payment, FHA mortgage limit and required upfront Mortgage Insurance Premium .

A Beginner’s Guide To Fha Loans

Applying for a home loan should be an exciting time in your life. But if you’re a first-time homebuyer, the process can be a little overwhelming. Where do I start? What type of loan do I need? These questions are common during the application process.

If you’ve done your research, you’ve probably heard of FHA loans. These loans are a great option for first-time homebuyers, but you may also qualify for this type of mortgage even if you’ve purchased a home before. Let’s take a closer look at FHA loans and how they differ from regular home mortgages.

You May Like: Does Va Loan Work For Manufactured Homes

A Great Option For Some Homeowners

A FHA loan is not for everyone however it does provide an opportunity for thousands of Californians every year to either refinance their current mortgage or purchase a new home.

FHA loan programs typically come with lower rates however they do come with Mortgage Insurance . More on what Mortgage Insurance is below.

Fha Guidelines On Debt To Income Ratio And How Is Dti Calculated

Debt To Income Ratio, also referred to as DTI, is calculated as adding the total sum of all monthly debt payments which includes the new proposed P.I.T.I. and dividing it by the mortgage loan borrowers monthly gross income.

- This will yield the back end debt to income ratio

- The front end debt to income ratio is the P.I.T.I. divided by borrowers gross monthly income

Monthly debt payments include all monthly minimum payments such as the following:

- minimum credit card payments

- alimony payments

- any other monthly debt payments

Monthly expenses such as utilities, auto, and health insurance, and cellular phone payments are not calculated in the debt to income ratio calculations.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

What You Need To Know About An Fha Loan

FHA loans are loans issued by private lenders but backed by the Federal Housing Administration . Because they’re insured by the FHA, these loans bring home ownership into reach for low- or moderate-income buyers who might otherwise have a hard time getting approved by conventional lenders.

These loans are not right for everybody, but they have several appealing features, allowing buyers to:

- Make down payments as small as 3.5%

- Get approved despite thin credit or credit history problems

- Buy not only single-family homes, but condos, multi-unit properties, or manufactured homes

- Get funding beyond the amount of purchase for renovations and repairs through the FHA 203 program

- Fund a down payment with gift money or help from the seller

- Purchase a foreclosure