Who Can Get Federal Student Loans

Anyone attending a four-year college or university, community college, or career school can apply for federal student aid, including:

- Grants, which dont need to be paid back

- Work-study, which is part-time work that allows students to earn money while in school and

- Federal student loans

Most federal aid is decided based on financial need. Students must submit the FAFSA® and meet several other basic eligibility requirements to qualify.

Parents may also apply for federal student loans, called Federal PLUS Loans. These loans can also be applied toward the students educational costs.

Types of Federal Student Loans| for Loans Disbursed Between July 1, 2021 and June 30, 2022 | |||

| Direct Loan for Dependent Undergraduates | Direct Loan for Independent Undergraduates | Direct Loan for Graduates | |

|---|---|---|---|

| No |

1Limit of combined subsidized and unsubsidized funds. back2Additional unsubsidized eligibility available for student whose parent is unable to obtain a PLUS loan. back

When Is Your Maintenance Loan Debt Cancelled

A big part of why were fond of the repayment terms for Maintenance Loans is that no matter how much or how little youve paid back, the balance is always cancelled after 30 or so years.

If youre from England, Scotland or Wales, your loan will be written off 30 years after you first became eligible to repay , while Northern Irish students will have their loans cancelled after 25 years.

No matter where youre from, your loan will also be written off if you have to claim a disability-related benefit and can no longer work .

What Happens If You Default On Student Loans

A student loan default can affect you in many ways. Penalties of default include the following.

To collect on federal student loans, your loan holder can garnish your wages and withhold your tax refunds and other government payments, like Social Security checks.

Private student loan holders cant take your tax refunds or Social Security payments, but they can take you to court. If they receive a judgment in their favor, they can garnish money from your paychecks or even your bank accounts to pay your defaulted loan.

A student loan default and the late payments that preceded it can remain on your credit report for seven years. This negative mark can make borrowing for a car, home or additional schooling more expensive or potentially impossible. Default can also hurt your ability to rent an apartment, sign up for a new cell phone plan or even get a job.

Late fees and interest will continue to build on your debt, increasing the amount you owe. You can also be charged costs for the collection of your defaulted loan. These collection costs may be as much as 25% of your loan’s balance.

For example, lets say you owe $30,000 at the time of default. You could have to pay as much as $7,500 in collection costs on top of that $30,000 balance to pay off your loan.

If you have a student loan default, you cant take on additional student loans or receive other federal aid to return to school.

» MORE:How to go back to school with defaulted loans

You May Like: How Long Is Car Loan Pre Approval Good For

Here’s How Student Loans Can Affect Your Tax Refund

You likely can’t deduct student loan interest if your payments are on hold — but you may qualify for other tax breaks.

Courtney Johnston

Pallavi Kenkare

Pallavi is an editor for CNET Money, covering topics from Gen Z to student loans. She’s a graduate of Cornell University and hails from Atlanta, Georgia. When she’s not editing, you can find her practicing bookbinding skills or running at a very low speed through the streets of Charlotte.

If you’re one of the 43 million Americans with student loan debt, you may be eligible for certain when filing your tax return. If you haven’t started your taxes yet, you’ll want to know how your student loans may help boost your refund — and know how your tax filing status could affect your monthly student loan payments.Find out how the federal student loan pause, education expenses, loan forgiveness and other factors can help lower your tax bill or increase your refund when filing your taxes this year.

Unsubsidized Federal Direct Loans

You are responsible for paying the interest on an unsubsidized loan while you are in school, during the grace period, during deferment periods and during repayment. Interest can either be paid while you are attending school, or it can be postponed until graduation or withdrawal from school. If you have postponed paying interest, it will be capitalized once you enter repayment . Both the Subsidized and Unsubsidized Federal Direct Loans have a variable interest rate that adjusts every July 1.

You May Like: How Long To Refinance Fha Loan

Pslf Limited Waiver Opportunity

Under the regular PSLF rules, only payments made on Direct Loans counted toward the 120-payment minimum. Payments made towards FFEL and Perkins Loans didnât count. Nor did late payments or payments made under the wrong repayment plan.

On October 6, 2021, the Dept. of Education announced it was temporarily relaxing those eligibility requirements. For a limited period of timeâspecifically, until October 31, 2022âborrowers may receive credit for any past student loan payments, regardless if it was made for the wrong loan, under the wrong repayment plan, or was tardy, or was made for less than the full amount. The rule changes will also allow military members to count time on active duty toward the 10 years â even if they put a pause on making their payments during that time.

You Have Options If You Were Denied Pslf

If your application for PSLF was denied, you may be able to receive loan forgiveness under the Temporary Expanded Public Service Loan Forgiveness opportunity.

As part of this opportunity, the Department of Education reconsiders your eligibility using an expanded list of qualifying repayment plans.

This TEPSLF opportunity is temporary, has limited funding, and will be provided on a first come, first served basis. Once all funds are used, the TEPSLF opportunity will end.

Visit StudentAid.gov for detailed information on how to be reconsidered for loan forgiveness.

Limited PSLF waiver: The U.S. Department of Education in October 2021 announced a temporary period through October 31, 2022, during which borrowers may receive credit for payments that previously did not qualify for PSLF or TEPSLF.

Get additional information on Studentaid.gov >

Also Check: Usaa Car Loan Bad Credit

What Is Student Loan Forgiveness

In short, student loan forgiveness is a way to get your lender to eliminate the whole balance you owe for your student loan, or at least part of that balance. It means you are no longer obligated to repay part of or the total of your loan debt.

Student debt has grown enormously, more than doubling over the past two decades. At the end of 2020, 43 million American borrowers owed a total of about $1.6 trillion in federal student loans, with private student loans bringing the sum to $1.7 trillion. While higher education can provide a significant socioeconomic boost to students who complete their degrees, the pile of debt is a serious problem for many student borrowers and potentially the United States economy itself.

Thankfully, the picture has shifted in a slightly more positive direction for those looking for help with their student loansand the situation may ease borrowers debt in the future based on political possibilities. The American Rescue Plan that President Biden recently signed into law makes all student loan forgiveness tax-free, meaning you pay no tax on that erased balance no matter what, a new development. Biden also touted the idea of canceling $10,000 of student loans for each borrower during his campaign. That still hasnt materialized, though his administration is reportedly still looking at paths to enact it.

A Beginner’s Guide To Getting The Loans You Need To Graduate

Unless their parents have somehow saved enough moneyor earn massive salariesmost students need to borrow to pay for college today. Working your way through college is largely a thing of the past, as well. Few students can make enough to pay for college while they’re also taking classes. For that reason, student loans have become increasingly common. Here’s what you need to know about applying.

Read Also: Usaa Loans For Bad Credit

Getting Your Loan Out Of Collection

When you miss 9 months of payments, your federal student loan is sent to the Canada Revenue Agency for collection. Once in collection, you are no longer able to get student aid. To be able to get student aid again, you must bring your loan up to date.

- Contact the CRA to make a payment arrangement and bring your loan up to date

For the provincial or territorial part of your student loan, you need to contact your province or territory. For borrowers from Saskatchewan you may contact the CRA for both federal and provincial parts of your student loan.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Loan Calculator Usaa

Student Loan Forgiveness For Perkins Loans

Perkins Loans are eligible for partial student loan cancellation to complete student loan cancellation. You could get student loan forgiveness for Perkins Loans based on your employment or volunteer service. Its also possible to get Perkins Loans discharged. .

Apply: To get student loan forgiveness for Perkins Loans, you must apply to the school that issued your student loan or to your schools student loan servicer for Perkins Loans.

Grants And Loans For Full

The Canada Student Financial Assistance Program offers student grants and loans to full-time and part-time students. Grants and loans help students pay for their post-secondary education.

- Apply for grants and loans in one application, directly with your province of residence

- You don’t need to repay grants you receive

- You need to repay loans after finishing school, with interest

- You may be eligible for more than 1 type of grant – when you apply with your province, they will assess your eligibility for all available grants

Also Check: Can You Refinance With Fha Loan

What Happens If Your Application Is Denied

Many options for both traditional loan forgiveness as well as assistance based on income or occupation or other factors exist. They all come with specific qualifications for applying. If a particular program denies you, its critical to explore all other options both federal and by state that make sense for your circumstances.

American Opportunity Tax Credit

The American Opportunity Tax Credit is available for first-time college students during their first four years of higher education. It allows you to claim 100% of the first $2,000 of qualifying education expenses, then 25% on the next $2,000 spent — for a total of up to $2,500. If you’re a parent, you can claim the AOTC per eligible student in your household, as long as they’re listed as a dependent.

To claim the full credit, your MAGI must be $80,000 or less . If your MAGI is between $80,000 and $90,000 , you can still qualify for a partial credit.

The AOTC is a refundable credit, which means if it lowers your income tax to less than zero, you might be able to get a refund on your taxes or increase your existing tax refund.

Also Check: Interest Rate For Car Loan With 650 Credit Score

Borrow Subsidized Loans Before Unsubsidized

The FAFSA serves as your application for federal student loans as well. Youll be notified of what you can borrow in the financial aid award letter from any school that accepts you. There are two types of federal loans: subsidized and unsubsidized.

Subsidized federal loans go to undergraduate students with a financial need. The subsidy covers the interest on the loan while youre in school. Unsubsidized federal loans arent based on need, and interest starts to accrue immediately.

» MORE:How much can you get in student loans?

You Sign Your Master Promissory Note

Under certain conditions , you need to sign a Master Promissory Note and go through entrance counseling before you get any federal student loans. The MPN is a legal document stating that you agree to pay back your loans, including any accrued interest and fees, and explains your rights and responsibilities as a student loan borrower.

Recommended Reading: Sofi Vs Drb

Find Out How Much You Owe In Student Loans

When you took out your student loans, you agreed to borrow a set amount and to repay it with interest. Your interest rate can cause your loan balance to grow over time, so you could end up owing thousands more than you originally borrowed.

To make things even more confusing, your loans can sometimes change hands. Some lenders will sell your loans or transfer them to other loan servicers, so who you originally had as a loan servicer may no longer be the right one. Your loan servicer is who you make payments to and go to for questions, so its important to figure out who your current servicer is to repay your debt.

Granite State To Stop Servicing Federal Student Loans When Current Contract Ends

In the next few months, Granite State will be working closely with the U.S. Department of Education to transfer all federal student loans currently held by Granite State to Edfinancial Services.

Please note that this change will not affect the existing terms, programs, or available repayment plans on your loans, nor will it affect the temporary suspension of payments and 0% interest benefits applied for the COVID-19 emergency. Auto-debit information will be transferred to Edfinancial Services however, borrowers should contact Edfinancial Services to verify information once the transfer is complete.

Affected borrowers can expect to receive more information about this transfer from ED and Granite State, and once the transfer is complete borrowers can expect to receive additional information from Edfinancial Services. Be sure to read these notices fully. You can also visit StudentAid.gov/granitestate for the latest updates and information on loan transfers.

You can check your current balance online, and if you have questions, please contact Granite State at 1-888-556-0022.

Don’t Miss: Usaa Pre Qualify

Compare Your Financial Aid Offers

The financial aid offices at the colleges you apply to will use the information from your FAFSA to determine how much aid to make available to you. They compute your need by subtracting your EFC from their cost of attendance . Cost of attendance includes tuition, mandatory fees, room and board, and some other expenses. It can be found on most colleges’ websites.

In order to bridge the gap between your EFC and their COA, colleges will put together an aid package that may include federal Pell Grants and paid work-study, as well as loans. Grants, unlike loans, do not need to be paid back, except in rare instances. They are intended for students with what the government considers “exceptional financial need.”

Award letters can differ from college to college, so it’s important to compare them side by side. In terms of loans, you’ll want to look at how much money each school offers and whether the loans are subsidized or unsubsidized.

Direct subsidized loans, like grants, are meant for students with exceptional financial need. The advantage of subsidized student loans is that the U.S. Department of Education will cover the interest while you’re still at least a half-time student and for the first six months after you graduate.

Direct unsubsidized loans are available to families regardless of need, and the interest will start accruing immediately.

Payments and interest on these loans was suspended in 2020 during the economic crisis, with both resuming in early 2022.

Find Your Financial Aid Via Fsa

If youve heard of the National Student Loan Data System but can no longer access it, youre not alone. The Department of Education rerouted NSLDS services to StudentAid.gov.

To access your loans via this site, log in with your FSA ID and click Manage Loans.

As before, the new setup , will help you keep track of all your federal loans. The site will also include the following information:

- Current balance and interest rate of each loan

- Status of each loan, including whether it is current or overdue on payments

- Type of student loan, such as subsidized or unsubsidized

- Student loan servicer that holds each loan

Read Also: Mortgage Originator License California

What Should I Do After Finding My Loan Servicer

Once you know who your loan servicer is, you can create an account on their site. Youll usually create a username and password and then share relevant information like your full name, address and Social Security number. Youll also likely be asked to create several security questions and answers for your account as well.

Once you are registered, you can connect your bank information and make payments directly from your bank account. You can send checks as well.

Typically, youll get a 0.25% interest rate deduction if you sign up for automatic payments. If youre not interested in autopay, find out if you can sign up for online alerts to be reminded when a payment is due.

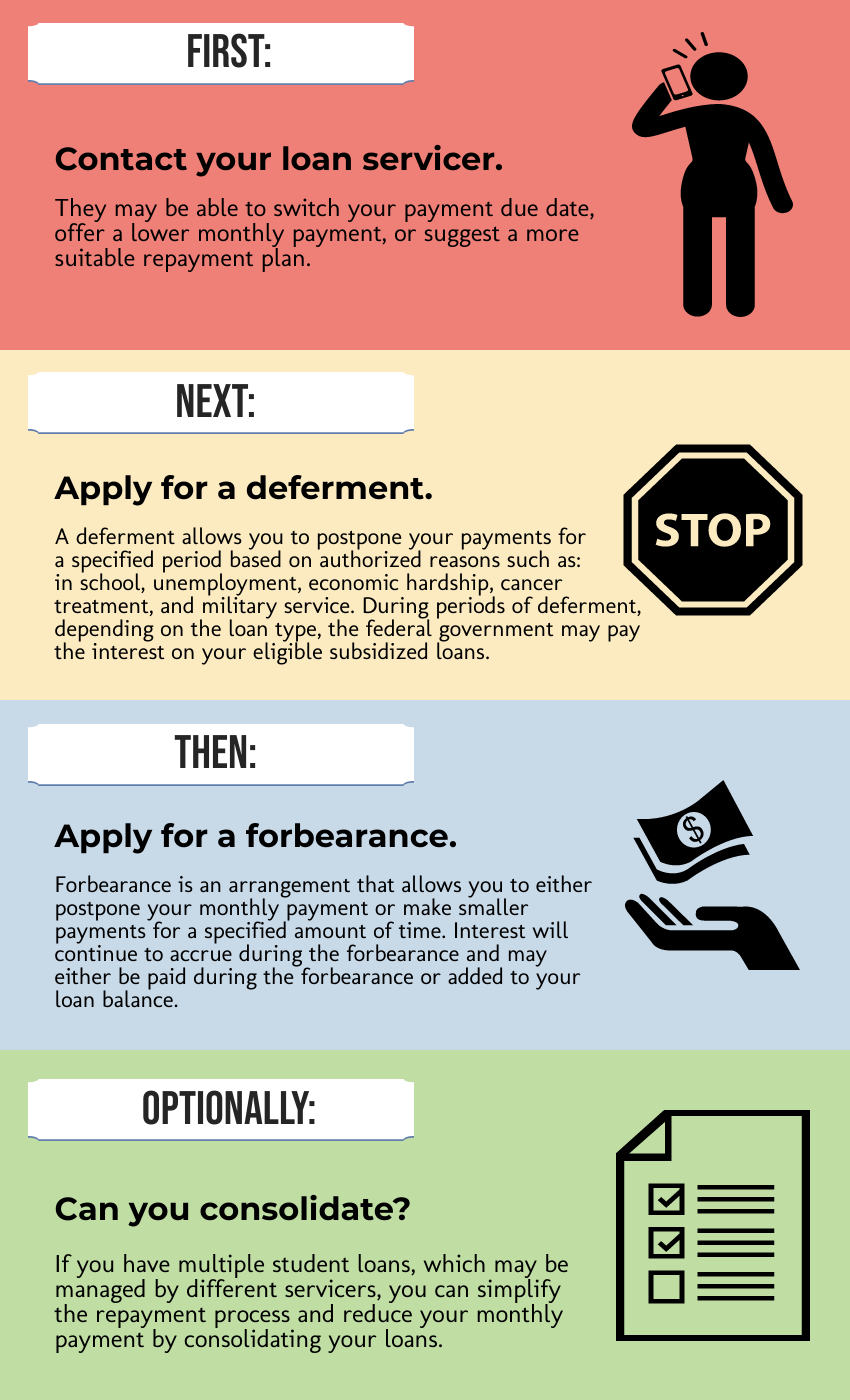

Knowing your student loan servicer is more than just knowing who to pay each month its knowing who to turn to if you need to change your repayment terms or apply for deferment or forbearance.

But since student loan servicers dont always give the best guidance, its important to do your own research so you can make the best student loan decisions for you.

Rebecca Safier and Dillon Thompson contributed to this report.