How Your Home Equity Can Increase

One way you can increase your home equity is by making mortgage payments. Part of this payment goes towards paying down the principal, which is the amount of money you owe for your home.

In the early years of homeownership, more of your monthly bill goes to paying for the interest than paying down the principal. That means your mortgage payments are likely to make only modest contributions to your home equity. You may be able to build equity faster by paying more than you owe each month, by making an extra mortgage payment each year, or by moving to bi-weekly mortgage payments. Making additional payments also helps save on interest because you are paying off your loan faster.

The other way your home equity can increase is when the value of homes in your community increases. As housing prices around you go up, your homeâs value will probably go up too.

For example, if you bought your house five years ago for $250,000 and the current fair market value of your house is $300,000 â that extra $50,000 becomes part of your home equity. This is great because rising home prices can help you build equity.

Remember that when home prices in your community fall, the amount of your home equity can go down as well. If the fair market value of your home declines from $300,000 to $280,000 then your equity will decline by $20,000.

Using Home Equity Lines Of Credit To Invest

Some people borrow money from a home equity line of credit to put into investments. Before investing this way, determine if you can tolerate the amount of risk.

The risks could include a rise in interest rates on your home equity line of credit and a decline in your investments. This could put pressure on your ability to repay the money you borrowed.

Pay Down Your Principal

Every time you make a mortgage payment, you gain a little more equity in your home. In the beginning years of your mortgage, you gain equity slowly. This is because most of the money you pay in the first few years of your loan goes toward interest instead of principal.

As you pay down your balance, a higher proportion of your monthly payment goes toward principal instead of interest. This process, called amortization, means that you build equity faster toward the end of your loan term.

If you want to build equity faster in the first few years of your mortgage, you can pay more than your minimum monthly payment. Just tell your lender that the extra money should be applied to your principal.

Read Also: Can Other Than Honorable Discharge Get Va Loan

Also Check: How To Get Mlo License California

How Much Should You Put Down On A 300k House

Fannie Mae and Freddie Mac require a down payment of only 3% of the purchase price. Thats $9,000 on a $300,000 home the lowest possible unless youre eligible for a zerodownpayment VA or USDA loan.

Can I buy a house if I make 45000 a year? Its definitely possible to buy a house on $50K a year. For many borrowers, lowdownpayment loans and down payment assistance programs are making homeownership more accessible than ever.

Are home equity loans tax deductible?

Interest on a home equity line of credit or a home equity loan is tax deductible if you use the funds for renovations to your homethe phrase is buy, build, or substantially improve. To be deductible, the money must be spent on the property in which the equity is the source of the loan.

How is equity calculated? All the information needed to compute a companys shareholder equity is available on its balance sheet. It is calculated . If equity is positive, the company has enough assets to cover its liabilities. If negative, the companys liabilities exceed its assets.

How To Use Your Home Equity To Your Advantage

Tapping into your home equity is a great way to gain access to the funding you need. Because the equity youve worked hard to build acts as collateral for the loan or line of credit you applied for, youll be able to access more affordable rates and often better terms.

When it comes to using your home equity to borrow, its always in your best interest to spend the money on something that will help you save or make more money in the future. Some of the best ways to use your home equity to your advantage are:

- Kitchen or bathroom upgrade

- Add a basement suite

You May Like: Reloc Line Of Credit

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Subtract Your Mortgage Balance From Your Homes Value

Once youve determined your homes value and how much you own on the mortgage, calculating your home equity is relatively simple math: Subtract the mortgage balance from the homes value to get the dollar-amount of equity.

For example:

| $160,000 | $90,000 |

If youre estimating your home equity to understand how much money you could make from a sale of your house, you can essentially stop here. The exact amount youd walk away with depends on the exact lender payoff details, as well as closing costs, but this number can give you a high-level idea of what you could make from selling your home, provided it sells around that market value number you come up with.

Read Also: Current Usaa Car Loan Rates

Where Can I Get A Home Equity Loan

A variety of banks and credit unions offer home equity loans. If you have an existing relationship with a bank, it may be best to start your search there, but its always a good idea to shop around with a few lenders to compare rates, fees and loan terms.

A good way to do this is by taking advantage of prequalification forms, which let you see your potential rates and eligibility with a lender without impacting your credit score.

Can You Borrow Off Your Equity

If you own your home chances are youve built up some equity. You can borrow against equity to buy an investment property, renovate or achieve other goals.

Can you borrow money anytime on a home equity loan? You can get a lump sum of cash upfront when you take out a home equity loan and repay it over time with fixed monthly payments. You dont receive a lump sum with a home equity line of credit but rather a maximum amount available for you to borrowthe line of creditthat you can borrow from whenever you like.

What scenario do most homeowners use the equity in their home?

Homeowners sometimes use home equity to pay off other personal debts, such as car loans or credit cards. This is another very popular use of home equity, as one is often able to consolidate debt at a much lower rate over a longer-term and reduce their monthly expenses significantly, Hackett says.

What happens if I dont use my HELOC? Though HELOCs carry lower interest rates than credit cards, they are still borrowed money. You eventually must repay the HELOC, and the more you borrowed and used, the larger your payments will be. If you dont, the lender will foreclose.

Don’t Miss: What Happens If You Default On A Sba Disaster Loan

How Does A High

If your existing LTV ratio is above 80%, you can be considered a high-LTV borrower, said Stearns. For example, if the LTV ratio on your first mortgage is 90% and youre looking to borrow from your available 10% equity though many lenders wont let you borrow up to the maximum the additional loan youre applying for would be considered a high-LTV loan.

Some lenders, such as Arsenal Credit Union and Signature Federal Credit Union, offer 100% LTV home equity loans. Arsenal offers no-closing-cost loans, while Signature Federal offers closing costs savings of up to $1,000.

Still, if youre taking out a home equity loan without paying closing costs, you may be on the hook for those costs if you pay off and close the loan within three years, or sometimes less. Keep in mind that home equity loan closing costs typically range from 2% to 5% of your loan amount.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: Usaa Car Loan Pre Approval

Comparing Popular Funding Options Leveraging Home Equity

Some of the main criteria in comparisons should be fees and interest rates, tax advantages, monthly payments, terms and intended use of the money.

We will look at four of the more common options for harvesting equity and refinancing and when each option may make a smart move for you.

This table shows that most share the qualities of traditional financing, but a HELOC offers more flexibility:

| Feature | |

|---|---|

| X | X |

Interest rates offered, best to worst, would likely be home equity loan, cash-out refinance, personal loan then the HELOC. Fees are likely to be highest with a cash-out refinance, as are your qualification hurdles.

Where To Find The Best Home Equity Line Of Credit

As an industry standard, most lenders allow you to take up to 80% of your homeâs value out in a HELOC. Here at Lower, we offer up to 95%âand the difference can be huge. To use the example above, if your home is valued at $250,000 and you still owe $150,000, your 95% LTV HELOC would be up to $87,500. At 80% LTV, it would only be $50,000. Thatâs a big difference in how much you can access.

Recommended Reading: Capitalone Com Auto Pre Approval

Whats The Difference Between A Home Equity Loan And A Home Equity Line Of Credit

As mentioned above, a home equity loan is paid out in a lump sum and repaid in fixed monthly installments over a set term. On the other hand, a home equity line of credit , works much like a credit card. You can use the credit line up to the established limit, but you pay only for what you use plus interest. HELOCs have a set draw period, during which you can use the credit line. When the draw period ends, the HELOC goes into repayment and you cant tap any more equity from the credit line.

Recommended Reading: Usaa Auto Loans

Home Equity Loan With Low Income

The ability to repay is dependent on income, so it is going to be difficult to get approved for a home equity loan with low income.

Having a cosigner would help your case. A cosigner is someone with good credit and high income that agrees to pay your debt in case you default on your loan. It also helps to have a large amount of equity in your home, and really good credit is required.

If you are in between jobs, and plan to use a home equity loan to pay for bills, there is a chance you can be approved if you have other revenue streams like rental properties. File for unemployment income and use that to build your case.

A home equity loan is a risky venture if youre able to get approved, especially for someone with low income. The lender has the right to foreclose on your home if you cant make payments.

Recommended Reading: Genisys Auto Loan Calculator

What Is Home Equity And How Do You Calculate It

Home equity is the stake you have in your property, as opposed to the lender’s stake. To calculate your home equity, subtract your current mortgage balance from the appraised value of your home. Over time, you build up equity in your home as you make payments on your mortgage. Home equity is one way to measure your personal wealth because you can borrow from your home equity in the form of loans or lines of credit.

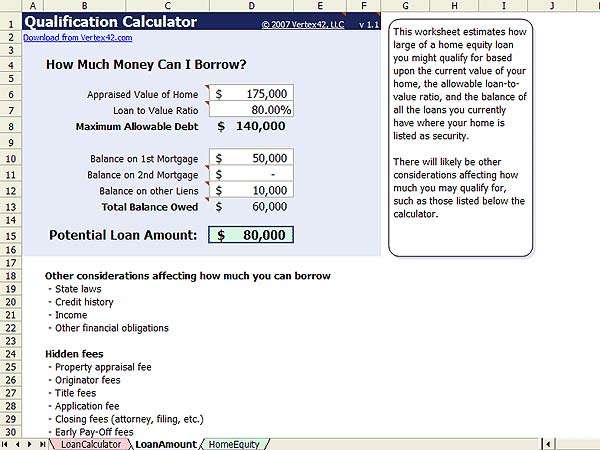

Youll need a substantial amount of equity in your home to qualify for a home equity loan. A home equity calculator can help you figure out how much you can borrow.

Home Equity Loans Guide

Home equity loans and home equity lines of credit let homeowners borrow money by using their home equity as collateral.

Along with home improvement loans and refinancing, these types of loans are some of the most popular ways to finance home renovations. Both home equity loans and HELOCs are tax-deductible as long as funds are used for home renovations.

Read on for a step-by-step guide on how to get a home equity loan and the different options available.

Read Also: How Long Do Sba Loans Take

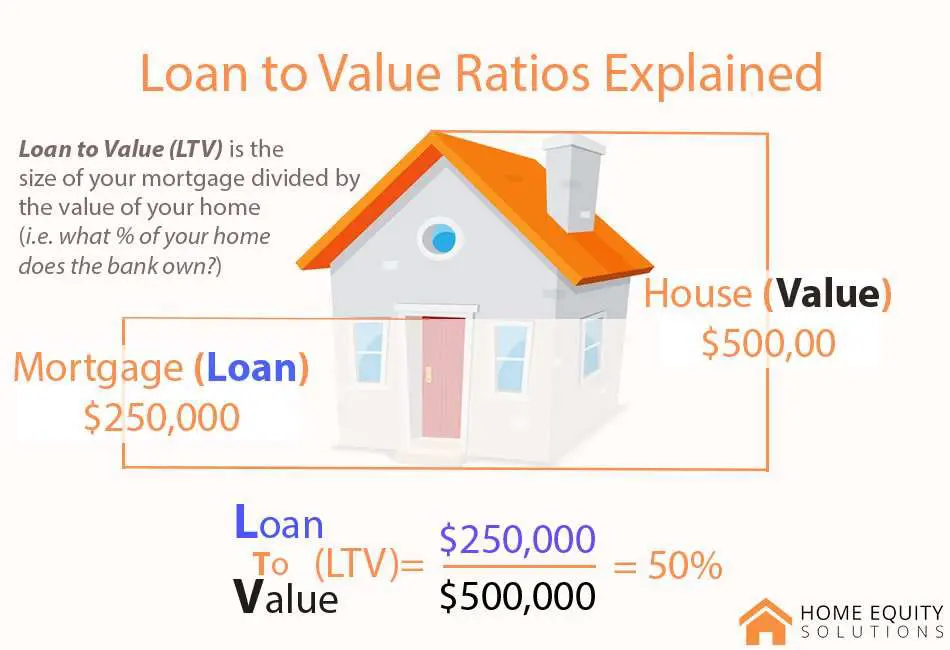

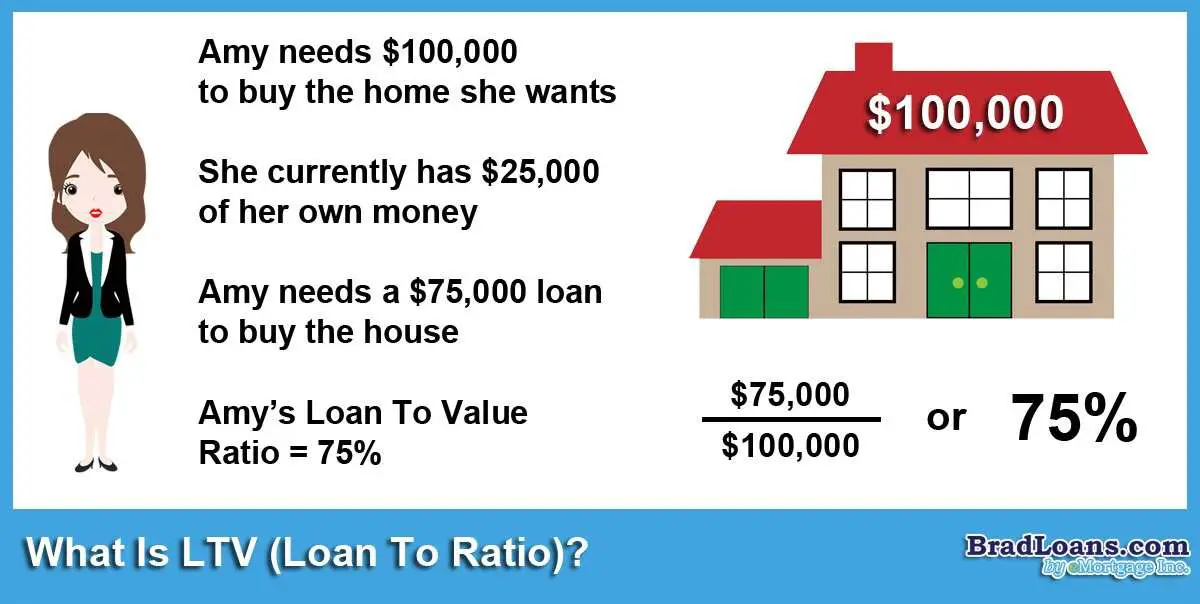

How To Calculate Your Loan

Your loan-to-value ratio shows the percentage of your homes total value that you still owe. You need to know this because lenders consider your loan-to-value ratio when deciding what kinds of loans such as mortgages, home equity loans, and home equity lines of credit you might be eligible for.

Your loan-to-value ratio also determines the interest rate youd pay if you borrowed against the equity in your home, as well as whether youll need to pay for private mortgage insurance, which protects the lender in the event you default on your loan.

To calculate your loan-to-value ratio, youll divide your current loan balance by the current appraised value of your home.

For example, if you owe $140,000 on a $250,000 home, youd divide $140,000 by $250,000 to get a loan-to-value ratio of .56. Loan-to-value ratios are usually expressed as a percentage, so multiply this number by 100 to get your LTV ratio of 56%.

Can You Borrow Against Your House

A home equity loan is a secured loan lenders loan you the money secured against the value of your home. They are sometimes referred to as homeowner loans. An alternative to home equity loans is home mortgage refinancing.

How much is closing cost on a home equity loan? Bear in mind that you typically must pay closing costs if you take out a home equity loan. Closing costs generally range from about 2 to 5 percent of the loan amount.

What are the disadvantages of a home equity line of credit?

Cons

- HELOCs can come with a minimum withdrawal amount.

- There can be limitations to how you access the funds.

- There is a set withdraw period after which you cannot access any further funds.

- There can be fees associated with a HELOC.

- You can hurt your credit if you do not make payments on time.

- Harder to qualify right now.

How much equity can I get in my home after 5 years? In the first year, nearly three-quarters of your monthly $1000 mortgage payment will go toward interest payments on the loan. With that loan, after five years youll have paid the balance down to about $182,000 or $18,000 in equity.

Read Also: How Long Does Sba Loan Take

How Much Equity Should I Get From My House

Depending on your financial history, lenders generally want to see an LTV of 80% or less, which means your home equity is 20% or more. In most cases, you can borrow up to 80% of your homes value in total. So you may need more than 20% equity to take advantage of a home equity loan.

Can I take equity out of my house? Equity release is a way to unlock the value of your property and turn it into cash. You can do this via a number of policies which let you access or release the equity tied up in your home, if youre 55+. You dont need to have fully paid off your mortgage to do this.

Is it worth getting equity release? Is equity release a good thing? Equity release can be a good idea for older people who would like to gain some extra cash in retirement. Equity release can help you make home improvements, pay for the costs of care, help a loved one who is struggling financially, or pay off other debt.

How much is a $50000 home equity loan payment? Loan payment example: on a $50,000 loan for 120 months at 3.80% interest rate, monthly payments would be $501.49.

How To Use The Home Equity Loan Calculator

Enter your homes value .

Enter the amount remaining on the loan .

Choose the range that reflects your current credit score .

The tool will immediately calculate your current loan-to-value ratio. If you own at least 20% of your home , youll probably qualify for a home equity loan, depending on your financial track record.

The calculator will also show the dollar amount youll likely be able to borrow so you can determine whether a home equity loan meets your financial needs.

You May Like: Does Capital One Do Auto Refinancing

Get Money From Your Home Equity Line Of Credit

Your lender may give you a card to access the money in your home equity line of credit. You can use this access card to make purchases, get cash from ATMs and do online banking. You may also be given cheques.

These access cards don’t work like a credit card. Interest is calculated daily on your home equity line of credit withdrawals and purchases.

Your lender may issue you a credit card as a sub-account of your home equity line of credit combined with a mortgage. These credit cards may have a higher interest rate than your home equity line of credit but a lower interest rate than most credit cards.

Ask your lender for more details about how you can access your home equity line of credit.