Common Uses For A Loan

People take out a loan to buy particular assets that might not be available to lease. A loan is a better option if you intend to use the assets for all its durable life.

The thing about loans is that its more versatile: you can use them to buy the asset and to invest in many other things: like consolidate debt, invest in marketing, strengthen your cash flow, and more.

The Traits Of A Bank Loan

Similar to a lease, loans have distinct characteristics that make them different. Its important to understand these nuances in effort to make the best recommendation for your customers. Here are some qualities that make a bank loan unique:

- Interest amortizes with more due at the beginning, and less at the end

- Rates can fluctuate and are tied to prime and economic factors

- Customer owns the equipment when loan is paid off

- The bank can put liens on customer assets as collateral

- Ties up customers business credit line and limits

- Limits customers ability to borrow for other investments

- Requires a down payment or deposit

- Inconvenient to upgrade or add additional equipment as needed

- Can be a rigorous approval and underwriting process

- Customers with less established credit may face higher rates

Business Use And Tax Benefits

If you use your car for business purposes, you’re entitled to tax benefits no matter whether you lease or buy. According to the IRS, if the vehicle is solely used for business, you can deduct the entire cost of operation . But if the vehicle is used for business and personal reasons, you can only deduct business use expenses.

There are two methods to calculate deductible expenses:

Don’t Miss: How Long In Military To Get Va Loan

The Pros And Cons Of Buying A Car

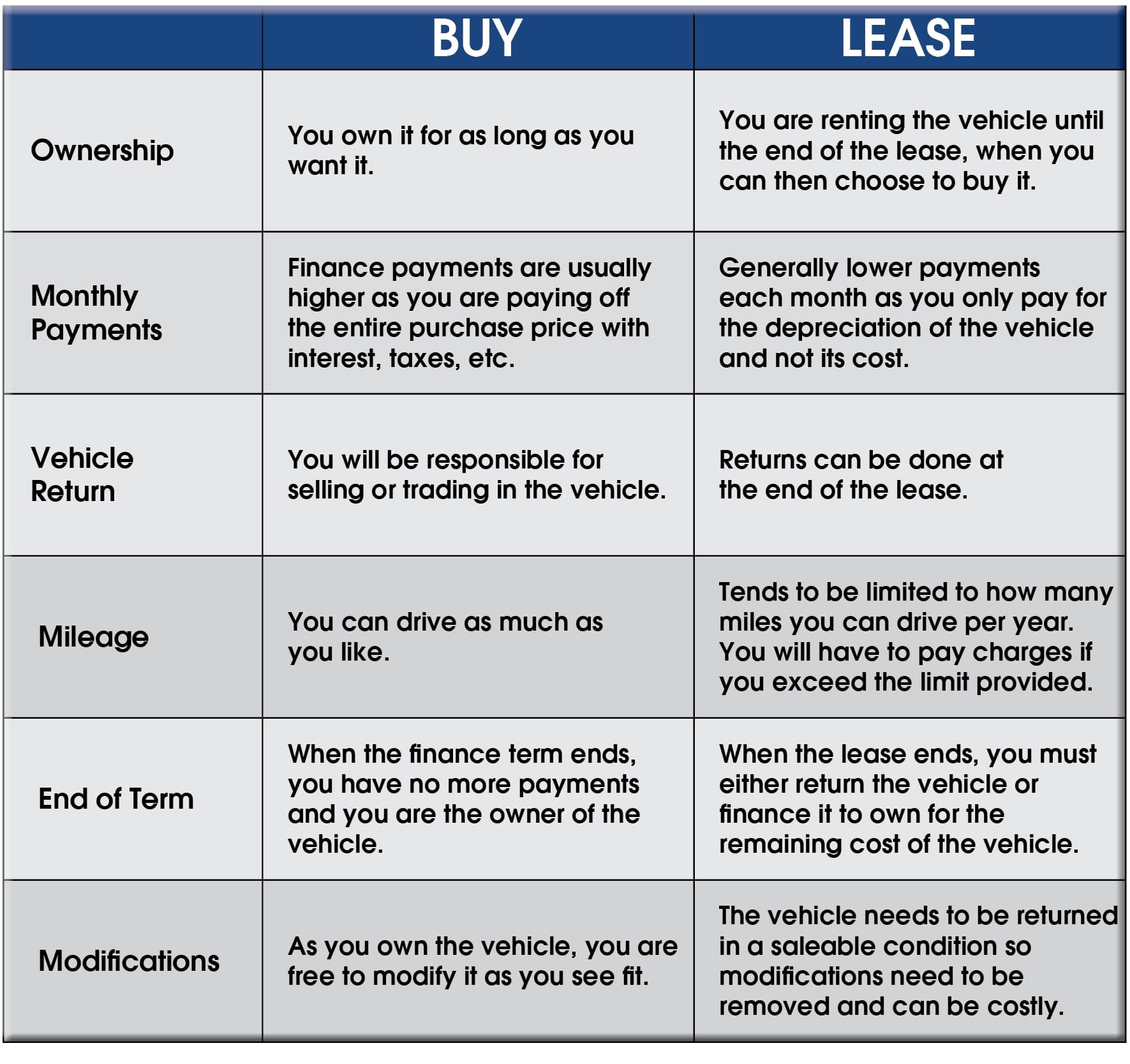

There are several pros to buying a car, including that the car is yours to keep. If you have a far commute to work or take frequent road trips, your mileage adds up. This lifestyle is often conducive to owning a car since you dont have to worry about extra mileage fees at the end of a lease. We discuss these fees further below.

Once your financing is paid off, you no longer have a monthly car payment to include in your budget. You do, however, have to consider any regular maintenance costs that the car may need over time.

Another pro includes that you dont have to worry about paying mileage fees. When you buy the car, you can drive as many miles as you want without having to worry about paying a fee for going over the set mileage, unlike a lease where you usually will be liable for charges for going over a set amount of miles. There are also no damage fees that are typically incurred with a lease.

Owning a vehicle may look like the right option for you to consider, but there are some other factors to keep in mind.

Financing a vehicle may be more expensive than leasing. Car prices today are relatively high, especially for luxury brands. You may have to make a sizeable down payment before your monthly payments begin. Once youve paid off your financing, the costs dont stop there over time you will end up having to pay for maintenance, inspections and other costs that may have been covered in a lease agreement.

Legal Heir Certificate Vs Succession Certificate

We can draw the conclusion that legal heir certificates and succession certificates are two distinct legal entities with different purposes. The simple explanation provided here will help you quickly understand the meaning of these phrases.

- Contrarily, the Succession certificate offers protection to all parties in charge of such securities or outstanding debts with regard to any payments made to a person who has been granted a succession certificate. The testators heir must submit a petition for the succession certificate to the appropriate Court whose territory the testators property is located.

- The legal heir certificate is a legal document used to demonstrate a relationship between the testator and legal heirs who are eligible to inherit particular property. Due to its simpler legal process, this certificate may be used instead of a succession certificate.

In August 2020, the Honorable Supreme Court ruled that daughters who were born before the 2005 amendment to the Hindu Succession Act, 1956 would also enjoy equal coparcenary rights in HUF properties, regardless of whether their father coparcener had already passed away before the amendment.

The aforementioned fact makes it clear that, despite their identical names, legal heir certificates and succession certificates are two separate legal documents with different functions.

Read more

Recommended Reading: What Is Teacher Loan Forgiveness

Auto Financing: Lease Vs Loan

Most shoppers who take home a Ford Escape, Fusion, Explorer or F-150 from Broadway Ford of Green Bay choose either a lease or loan option. So, which option is right for you? We’ve broken down the pros and cons of both below. Take some time with the descriptions to figure out which you might prefer.

Finance Vs Leasing: Which Is Better

What are your goals? We all have different prioritiesin cars, life, and finances. When deciding on leasing vs. financing, what’s right for one person can be totally wrong for another.

Generally, leasing offers lower monthly payments than financing, as well as the benefit of owning a new car every two or three years. However, financing offers its own set of advantages.

Luckily, we have a team of finance experts who are happy to help you find the best option for you. Call or any Go Auto dealership to book a free consultation.

Also Check: Where Can I Find My Student Loan Information

How Car Loans Work

Once youve shopped around and selected the vehicle you like, you fill out an application for a car loan. While applying for a car loan at the dealership is a common route, you can also apply for a car loan directly via a bank or, in some cases, online.

To get a car loan, youll likely have to provide copies of pay stubs, income tax assessments , a valid Canadian drivers license and other documents.

Advantages To Finance And Lease Options

There are advantages to both purchasing and leasing your next commercial truck, whether youre considering an Isuzu, Mack or Volvo, with no one-size-fits-all approach.

|

Leases |

Loans |

|

Flexibility to get what you really want. A lease allows room for growth and you can drive a newer vehicle more often. |

At the end of your loan contract you own the vehicle. A loan is ideal for high mileage or severe duty applications. |

|

Monthly payments are typically lower than loans because you only pay for the portion of the truck value used during your lease. You pay for the vehicle as it pays for itselfthrough use. |

You build future equity and have greater asset management control. You are free to modify, trade-in or sell your vehicle on your terms. Isuzu trucks command a high resale value. |

|

At the end of your lease contract, you have flexibility to buy the vehicle or return it to the dealer, as well as exchange or refinance. |

There is no limit on the number of miles you drive. |

|

Because money is not borrowed when you lease, your working capital and business credit line are still available for your companys growth. |

A loan provides the means for you to conserve cash by paying the balance over time. |

Also Check: How To Get Pre Approval For Home Loan

An Alternative To Long Loans

Some car buyers opt for longer-term car loans of six to eight years to get a lower monthly payment. But long loans can be risky, and these buyers might find leasing to be a better option.

Longer loans make it easy to get upside downwhen you owe more than the vehicle is worthand stay that way for a long time. If you need to get rid of the car early on or if its destroyed or stolen, the trade-in, resale, or insurance value is likely to be less than you still owe.

Buying a car with a loan isnt the way to go if you want to drive a new car every couple of years. Taking out long-term loans and trading in early will leave you paying so much in finance charges compared with principal that youd be better off leasing. If you cant pay off the difference on an upside-down loan, you can often roll the amount you still owe into a new loan. But then you end up financing both the new car and the remainder of your old car.

If your goal is to have low monthly payments and drive a new vehicle every few years with little hassle, then leasing may be worth the additional cost. Be sure, however, that you can live with all of the limitations on mileage, wear and tear, and the like.

Example: Leasing A Car

Unless youre planning to use it for 5+ years, buying a car is rarely a good idea. If you buy a new one, it devalues the moment you drive off the lot. And if youre reselling an unreliable model, fewer people will accept your offer.

If you dont want to be stuck, its better to lease for the chance of trading in cars. At least, you can leave without purchase obligation.

Compared to renting, leasing is cheaper long-term, except when you want to resell the car.

If you keep a vehicle for 5+ years, it wont be long before you have to deal with car repair problems. Why not switch to another model?

When your lease term ends, you can apply the equity you created to a new car purchase or lease. So if your cars residual value is $10K and your lease contract was $8K, that $2K applies for your next deal. You can buy any car brand you want.

Although it depends on your strategy, the best way to save on vehicles is to use, not own. Unlike properties, cars devalue and dont make you money .

Don’t Miss: How To Get Out Of My Car Loan

Loans Are Borrowed Money Towards A Purchase

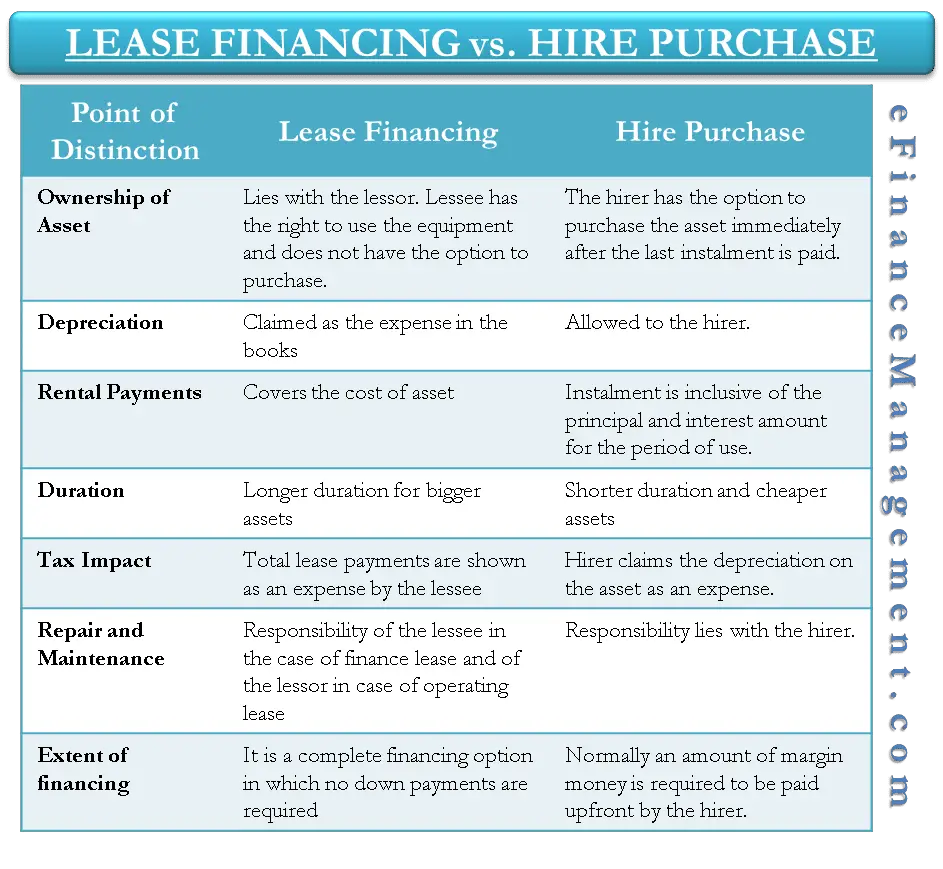

Loans are used to borrow money for the purchase of equipment, to acquire real estate, or to finance receivables and inventory. If youve ever had a car loan, an equipment lease is essentially the same, only with a larger loan amount. With an equipment loan, you typically only borrow a portion of the money you need to purchase the equipment and make up the difference with your own finances in the form of a down payment. The debt will appear on your balance sheet, and you may expense the interest and depreciation on a monthly basis.

Loan agreements are between a lender and you, the borrower. A loan contract details how much you borrowed and at what interest rate you will pay it back over a set amount of time. With a traditional loan, the principal and interest vary from month to month depending on how quickly you are paying the loan back and whether you pay before, on, or after the day your payment is due. So, your loan payments may fluctuate over time. You can work with a financial institution or an independent financing partner like Team Financial Group to get an equipment loan.

Ownership: Your business owns the equipment purchased with the borrowed money.

Should Your Business Lease Or Loan

Both options will preserve your cash flow and keep your business financially flexible but your businesss financial situation and equipment needs will determine which choice is right for you. If your equipment requires regular upgrades, the trade-up option from leasing is a major benefit. If you prefer tax deductions in the long run, rather than in the short term with leasing, a loan is your best choice.

Still unsure which option is right for you? Complete our form below or give us a call at 1-888-599-1966 and an Account Manager will help answer your equipment financing questions.

Recommended Reading: Online Bad Credit Payday Loans

Leasing Vs Financing: Know The Difference

The significant difference between leasing and financing concerns ownership. When you lease a vehicle, you do not own the car. Instead, you pay to use it for a specified period. Once your lease ends, you either renew the lease, return the car, or buy it. With financing, you own the vehicle outright.

Also, lease payments are 30- to 60% lower than loan payments for the exact vehicle and term. With leasing, you deal with fewer maintenance problems, as leases run for the same length of time as the manufacturer’s warranty coverage.

When you buy a car via financing, you’ll have to deal with costly repairs down the road once the manufacturer warranty runs out. Further, if a leased vehicle undergoes excessive wear and tear, you may be required to pay a penalty fee to the leasing company. There are no such worries when you finance the vehicle. However, excessive wear and tear may impact the resale value of a financed car.

Buy Or Lease The Latest Mini Models At Vista Mini Coconut Creek

If you’re in the market for the latest MINI Cooper Hardtop or desire the MINI Cooper S Clubman, Vista MINI Coconut Creek offers attractive lease deals that’ll put you on the wheel of your most preferred vehicle for the least cost possible.

Whether you need to take a car loan or prefer to lease a car, we’ll work with MINI financial services to get you a vehicle that fits your lifestyle and budget. Visit us today at Vista MINI Coconut Creek, Coconut Creek, FL, for more details on how we can assist you.

Recommended Reading: What Are Current Auto Loan Rates

Why Equipment Leasing Is Sometimes Better Than An Equipment Loan

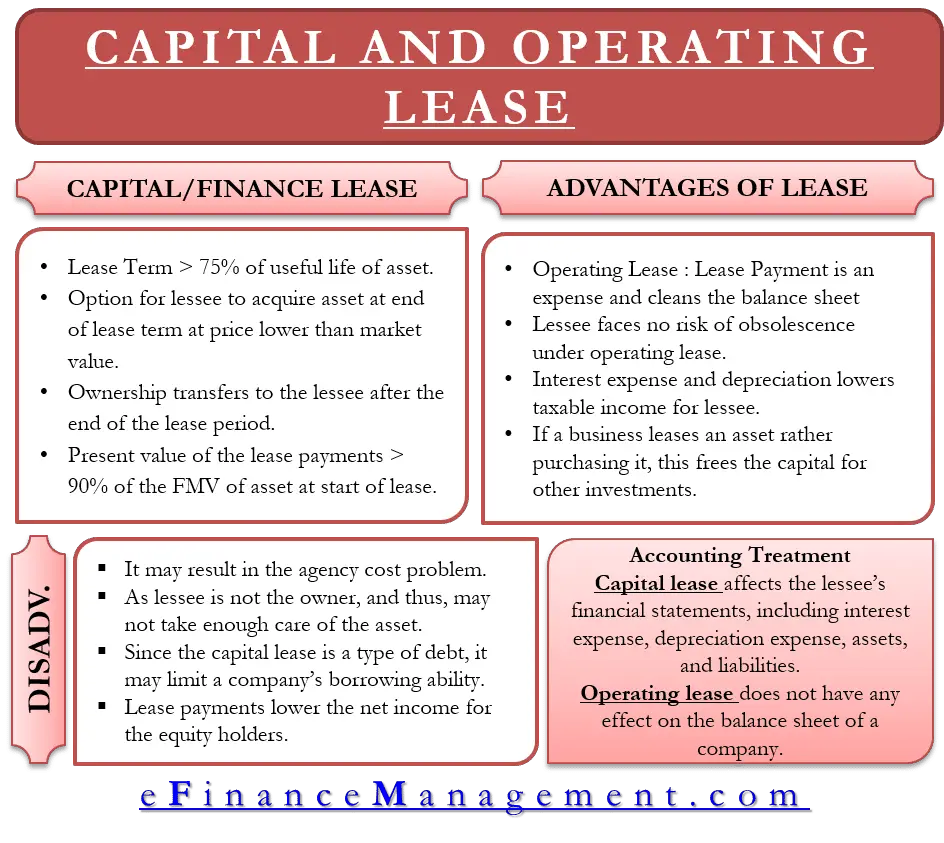

Let’s say you buy some equipment for $50,000 and want to finance it over 4 years. With an equipment loan, no matter which way you spread the deduction, your total write-off of the depreciation is going to be $50,000.

With an equipment lease, however, you write off all the payments as an operating expense.

Difference Between Lease And Finance

Last updated on by Surbhi S

Nowadays, it is very difficult for an individual or entity, to buy an expensive asset in one go. In such a case, lease and finance are the two best courses of action, that allows a person to make use of the asset when they dont have ample sum to pay the price. The lease contract is an arrangement, wherein the entity can use and control the asset without actually buying it. It is a type of renting asset.

On the other hand, finance is another alternative to buying the asset, in which the finance company pays the price for the asset on the firms behalf and then the firm repays the amount to the finance company, in monthly installments. Most of the people utter confusion regarding these two terms. So, carefully read the given article to know about the important differences between lease and finance.

Also Check: How To Close Mortgage Loan

What Is A Loan

A loan is a financial product that allows you to borrow money: it may be either a personal loan or a commercial loan.

When choosing between lease vs. loan, you should understand that you receive a lump sum of cash when it comes to loans.

The financial entity is the lender, and those who take a loan are the borrowers, debtors, or lenders.

#DidYouKnow

How Do You Know If A Loan Is Right For You

When choosing if a loan is right for you, you must think about how much it would cost you not to acquire a loan or to miss the opportunity it provides.

Also, the loan term, monthly cost, how much you will be paying interest, and other factors.

Let me explain with an example:

For example, if you are looking for heavy equipment financing and decide on a loan, you need to as yourself the following questions:

- How much would it cost your business if you didnt have this piece of equipment?

- How much would this alternative means of production cost?

- Are there even other alternatives out there?

If the cost of these other alternatives or processes is higher than the total cost of the monthly loan payment, you should definitely apply for the loan.

The truth is that, in the finance lease vs. loan debate, it all depends on which option is cheaper.

Also Check: Where To Loan Money With Low Interest

Loans Leases And Finance Agreements: Which One Is Right For My Business

When you need equipment to start a new business, expand operations, or update existing systems, figuring out how to finance your business needs can be a headache. This is especially true if you have unique business requirements or are a small business without the resources for traditional financing.

Independent lenders like Team Financial Group typically offer any combination of loans, leases, and financing agreements. But sometimes, the average business owner can get lost trying to understand their options.

In this article, well discuss the differences between loans, leases, and finance agreements and explain how to decide which one is right for your business.

What’s The Difference Between A Lease And A Loan

If you have ever bought a house or a car, or started a business, you likely have experience with loans. A question you or your customer may be wondering is when to lease and when to borrow using a loan? In this blog, we will compare the two, as well as provide resources to equip you to have this conversation with your customers.

A loan is ideal for collateral you want to own at the end of the term something that holds its value past the life of the agreement. A lease is best for something that depreciates quickly – like technology – and will not hold its value past the term.

The most important distinction between a lease and a loan is how the finance charges are paid. In a loan, the interest is amortized throughout the term. In other words, your customer is paying more interest at the beginning and more principal at the end. Leasing isn’t free, but the finance charges are fixed throughout the term and are not paid separately from the borrowed amount.

Also Check: Can You Pay Off Affirm Loan Early