Whats The Difference Between A Jumbo And Conventional Loan

Most conventional loans have to be within local loan limits set by Fannie Mae and Freddie Mac. Jumbo loans, on the other hand, are for mortgage amounts above conforming loan limits. So jumbo mortgages essentially pick up where conventional loans leave off.

- In 2021, in most of the United States, conforming loan limits max out at $548,250 for a single-family home

- That means jumbo loans are typically any amount above $548,250

However, those loan limits are more generous in some high-priced real estate markets. In the most expensive parts of the country, you could get a single-family conforming loan up to $822,375.

Jumbo loan limits vary by lender. But they typically go into the millions. So if you need to borrow more than local loan limits allow, you will likely need a jumbo mortgage.

A note on conventional and conforming loans

Technically, a conventional loan is any mortgage not backed by the federal government. So anything thats not an FHA loan, VA loan, or USDA loan is considered a conventional loan.

Most conventional loans can also be called conforming loans, because they conform to Fannie Mae and Freddie Macs lending requirements .

The two terms conventional and conforming are often used interchangeably. And in this article, we use conventional to mean conforming loans that meet Fannie and Freddies standards.

How To Decide Between A Conventional Loan Vs Fha Loan

Picking a loan program isnt a walk in the park.

If you have 20% saved for a down payment and a great credit score, a conventional loan can be a smart option. And VA loans are popular for service members, veterans, and their families.

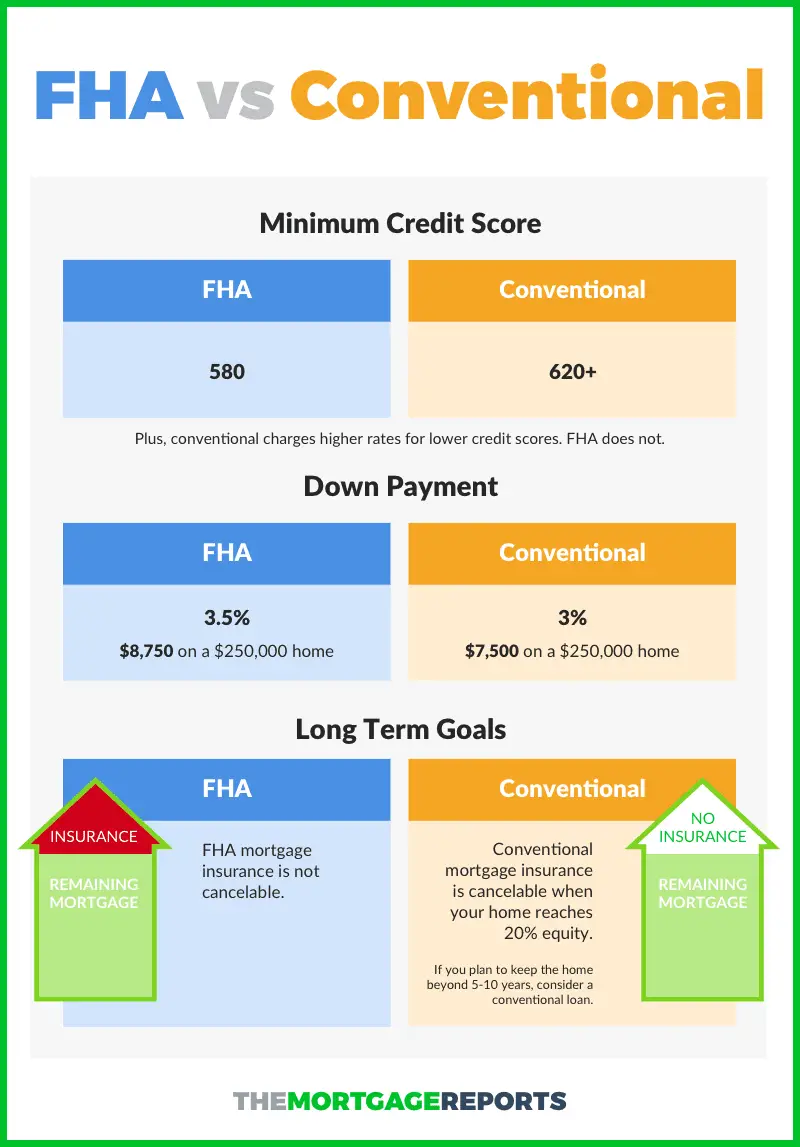

But if your credit score is a little low or you want to buy a home with a smaller down payment, FHA loans can be what youre looking for.

And if youre not sure?

Thats okay, too.

Because the Wendy Thompson Lending Team is here to help.

Well help you pick the best home loan program for your credit score and financial goals and walk you through the lending process.

If youre ready to find your dream home, call the Wendy Thompson Lending Team today!

Dont make that mistake, contact the Wendy Thompson Lending Team today!

You can start the process by clicking the yellow ‘See if I’m Eligible’ button on the right side bar under the ‘Start your quote for a Home Loan’ or call Wendys Team directly at 250-2294, to get started on living the American Dream in the home of your Dreams!

Va Loans Vs Conventional Mortgages: Which One Should You Choose

In 1944, U.S. Congress signed into law the Servicemens Readjustment Act, otherwise known as the G.I. Bill. More than 70 years later, the only provision from the original bill thats still in force is the VA Home Loan Guarantee Program. Are VA loans still a good deal? Heres a detailed comparison of VA loans vs. conventional mortgages

Through the program, veterans have been able to get the financing they need to buy a house. VA loans are often cheaper than conventional mortgage loans. Youll often get a lower interest rate, and you dont have to worry about putting any money down.

But if you look beyond the numbers, the decision might not be so clear-cut after all.

Don’t Miss: Usaa Student Loan Refinance

Va Loan Vs Conventional: Which Is Best For You

If you don’t have a down payment saved, then the decision is clear. Choose a VA loan, because you won’t have to pay PMI.

If you have plenty of savings, however, it’s a bit more of a challenge to choose. If you’re concerned about getting the best rates, choose the VA loan. If you’d like to avoid the upfront funding fee of a VA loan, choose a conventional loan. You can always ask your lender to run the numbers for both scenarios to see which is more affordable in terms of monthly payments and overall loan costs.

Va Loans Are Often The Smartest Choice

MISHKANET.COM” alt=”Fha vs conventional loan calculator > MISHKANET.COM”>

MISHKANET.COM” alt=”Fha vs conventional loan calculator > MISHKANET.COM”> Still, mortgage lenders say that for many veterans, the VA loan will be the smartest financial choice.

Rob Greenbaum, vice president of sales and marketing with AAFMAA Mortgage Services in Fayetteville, North Carolina, said that VA loans are almost always a good choice for veterans, active-duty service members and the spouses of deceased military members.

“VA mortgages are exclusively available to current and former service members, which can be seen as a major benefit because they are catered specifically to these individuals and often take the unique financial challenges of military life into account,” Greenbaum said.

VA loans, of course, aren’t open to everyone. You must be an active-duty member or veteran of the U.S. military or National Guard or military reserves. You can also qualify for a VA loan if you are the spouse of a military member who died while on active duty or because of a service-connected medical condition. Spouses can’t qualify for a VA loan if they have remarried.

If you are eligible, VA loans are often a good choice to help you get into a home.

Compare VA loans to other loan types. FHA loans require small down payments of just 3.5 percent of a home’s purchase price if your FICO credit score is 580 or higher. But while 3.5 percent is a low down payment, it’s still higher than the 0 percent down payment you can qualify for with a VA loan.

Recommended Reading: Usaa Auto Refinance Rate

Pros And Cons Of Conventional Loans

When it comes to conventional loans, they typically close faster than VA loans.

Conventional loans also can receive appraisal waivers, reducing your closing costs and increasing certainty of closure for a real estate purchase, says Davis. And there is no funding fee for a conventional loan.

As mentioned before, primary, second, or investment properties can all be purchased with a conventional loan. And home sellers often look more favorably on a conventional loan than a VA loan.

Conventional mortgages, however, require you to purchase private mortgage insurance if you are paying less than 20% down. And unlike VA loans, they usually require a down payment of 3% or more, notes Nik Shah, CEO of Home.LLC.

Furthermore, unlike VA loans, conventional loans have maximum loan limits. These are set by each county in most counties, the max loan amount you can borrow is $548,250 for a single-family home.

How Do I Choose A Va Loan Vs Conventional

Based on all of the factors listed above, you should be able to make a great financial decision before purchasing your home. There is no right or wrong answer in this instance. There are so many factors affecting this decision that youll need to compare and contrast them in order to choose.

Heres a simple table to help you evaluate the differences between the two types of loans:

| FACTOR |

Don’t Miss: Commercial Loan Rates Today

Apply For A Va Loan Today

In short, the VA loan program trumps the conventional in every way that matters. Because of the VA guarantee, VA loans are easier to qualify for, come with better terms than you could get elsewhere, and have much better options for borrowers in tough financial situations. You really should pursue a VA loan if you are VA-eligible and are looking to purchase a home. The best thing you can do is look for a lender that specializes in VA loans, since they know the program well enough to know all of the great advantages available for you to take advantage of. There are more advantages to the VA loan program than what we have discussed in this article, and you can learn more about them by reading more of our articles or by giving us a call here at Low VA Rates.

Are Jumbo Mortgage Rates Higher

Traditionally, jumbo loans have slightly higher interest rates than those on conventional mortgage loans. But thats not always the case.

Indeed, on the day this was written , Bankrates survey showed average jumbo rates actually lower than conventional ones. And we quickly found a big-name lender offering the exact same rate for both loans.

As with all mortgage products, lenders assess your riskiness as a borrower when deciding the rate theyll offer you. And some are more forgiving than others.

So you should shop around between lenders to find your lowest mortgage rate and best deal, regardless of the type of loan you want.

Recommended Reading: What Car Loan Can I Afford Calculator

Reasons To Refinance From Va Loan To Conventional

If conventional mortgages require A) down payments, B) higher credit scores, and C) PMI, why would a veteran want to refinance from a VA loan to conventional one? Several reasons exist:

- Rental property conversion: If your primary home is financed with a VA loan, you generally cannot use another VA loan to buy a second property . However, many veterans decide to move from one home, turn it into a rental property, and use the VA loan to purchase a new, primary residence. If you refinance the first propertys VA loan into a conventional one, you have the ability to use your VA loan eligibility to purchase your new home. Endstate: your old home becomes a conventionally-financed rental property, and you purchase your new home with the VA loan.

- Better terms: VA loans typically offer extremely competitive interest rates. But, if you have a credit score high enough to qualify for a conventional loan, you may be able to refinance into better terms than a VA loan could provide.

- Do not qualify for IRRRL: The VAs Interest Rate Reduction Refinance Loan provides veterans with VA loans a streamlined way to refinance into a lower interest rate. But, some veterans with multiple mortgages may not qualify for this program. For these individuals, refinancing into a conventional loan may be the only option to take advantage of lower interest rates.

Va Loan Vs Conventional How Do They Compare

If youve served in the armed forces, you may be eligible for a VA loan to help you purchase or refinance a home.

These loans are great for many veterans and active-duty servicemembers because they require no down payment and have no limits on how much you can borrow, depending on how much VA benefit you have available.

But if you qualify for a conventional loan, thats an option worth considering as well.

Some conventional loans require as little as 3% down, and while thats not as good a deal as 0% down, you may be able to use gift funds toward the down payment.

So youd get to buy a home with no money out of pocket, and youd have more flexibility in the types of properties you can buy.

And thats just the tip of the iceberg when comparing the trade-offs of these loan programs.

Thats why weve done a deep dive on how VA loans and conventional loans stack up, so you can figure out the best option for your homebuying plans.

Also Check: What Happens If You Default On Sba Loan

Disadvantages Of Va Loans

For most Americans, the biggest drawback is that theyre ineligible. You can only get a VA loan with a certificate of eligibility and theyre available only to those who meet certain service thresholds.

But there are other drawbacks that can sometimes affect those who have COEs. Here are some reasons you might consider a conventional mortgage instead.

Applying For A Va Loan

Applying for a VA loan is different from applying for a conventional mortgage, and this affects the home-buying process.

The VA recommends working with a real estate agent whos familiar with VA loans and getting prequalified with a lender before making an offer.

There are a number of steps to applying for a VA loan, including

- Obtaining a certificate of eligibility, which verifies to the lender that you meet minimum eligibility requirements.

- Comparing offers from different VA lenders to find the best interest rate and most affordable fees for you.

- Submitting a loan application and providing financial information, including pay stubs and bank statements.

- Obtaining a VA appraisal, which is ordered by the lender.

Your credit information, income and the value of the home will be reviewed, and then the lender will either approve or deny your loan. Make sure your purchase agreement has a clause called a VA option clause, which allows you to avoid financial penalties if the home doesnt appraise high enough.

When your loan is approved, the lender will choose a representative to conduct a closing, during which the money can be released and the property transferred to you.

Also Check: Va Loans On Manufactured Homes

Are Conventional Or Va Loans Cheaper

VA Loans can mean that eligible service members bring $0 to the table and still walk away with keys to a house.

The $0 down payment, no private mortgage insurance , and the ability to roll closing costs into the mortgage remove much of the outright costs to the buy.

The VA does have a VA loan funding fee, but that is waived for anyone receiving disabled compensation. VA loans may cost borrowers more in interest fees in the long run because theyre paying interest on a larger amount than someone who paid a down payment.

Va Mortgage Vs Conventional Mortgage Be Aware Of The Distinction Before You Purchase

VA mortgage vs. conventional mortgage Be aware of the distinction before you purchase

Advertiser Disclosure: viewpoints, evaluations, analyses & information include authors by yourself. This post may incorporate website links from our advertisers. For additional information, kindly read the Advertising plan .

Within the home loan universe, you will find three major types of financial loans VA loans, traditional financing, and FHA financing.

But what are the differences when considering the 3 types?

As standard home funding, VA, standard, and FHA mortgage loans serve the same main purpose.

But discover sufficient differences when considering the 3 to ensure they are each totally various mortgage sort. Understanding how each one of these works can help you see whether or otherwise not its ideal funding selection for you.

You May Like: Drb Student Loan Refinance Reviews

Which Is Easier To Qualify For

Because the requirements for down payments and credit scores are more relaxed, most military-affiliated borrowers have an easier time qualifying for a VA loan than a conventional mortgage. But sometimes there are exceptions. It all depends on the circumstances. The best way to know what you qualify for is to reach out to a lender who can walk you through the requirements.

Different Types Of Loans

Which loan is best for you? When shopping for a mortgage, knowing what specific type of loan is best for you is important.

Mortgages are divided into two main categories: Conventional loans and government-backed loans. And there are meaningful differences between the two.

Loans that are guaranteed by the government are generally easier to qualify for if you have less-than-perfect credit. But these loans usually have extra fees and restrictions, so conventional loans can be more affordable and easier to understand. At Acadia Lending Group, we offer both a 15-Year Fixed Rate Mortgage and a 30-Year Fixed Rate Mortgage conventional mortgages.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

When Is A Va Loan Better

If you qualify for a VA home loan, chances are that its going to offer a better financing deal for you than a conventional loan. Thats because you dont have to put any money down, pay any PMI, or worry about exceeding a maximum loan amount.

Say you are a veteran who wants to purchase a $300,000 home as a first-time buyer, says Davis. Assume you only have $6,000 in savings, which is not enough money to purchase a home using a conventional loan or an FHA loan. You can utilize your VA benefit to purchase the home with zero dollars down and structure the loan either with a lender credit or seller credit to help pay closing costs.

In other words, a VA loan is a better bargain here, especially if you dont have sufficient funds for a down payment.

Another example where a VA loan is a better option would be if a borrower has a credit score below 620 as well as no money for a down payment. A VA loan is the optimal choice in this situation, says Atapour.

What Is The Advantage Of A Va Loan Compared To A Traditional Mortgage

James Gallagher

As youre shopping for a mortgage, it is important to understand all your options. Here are the differences between VA loan and a traditional mortgage you should know.

There are a lot of loan programs out there for you to choose from. But if youre a veteran, an active duty service member, or a member of the National Guard or Reserves, you have a unique advantage that other homeowners and homebuyers dont have: Youve earned the right to apply for a VA mortgage.As youre shopping for a mortgage, it is important to understand all your options. Even if you qualify for a conventional loan, you should still consider a VA home loan, which may be a better option for you and your family.Unlike many other mortgage loans, VA home loans allow 100% financing. For a home purchase, that means not a dollar out of your pocket for a down payment. Even if your credit scores arent perfect, youre still welcome to apply.

Recommended Reading: Usaa Current Auto Loan Rates

How To Stay Competitive Using A Va Loan In A Sizzling Housing Market

- In a sizzling housing market, some military families with VA loans struggle to compete with other buyers and get offers accepted.

- However, VA loan buyers may stand out by working with a specialized lender, making a down payment or a stronger offer, real estate experts say.

In a sizzling housing market, some military families using VA loans are struggling to buy homes, real estate experts say.

VA loans, mortgages partly guaranteed by the U.S. Department of Veterans Affairs, financed 14% of home purchases from July 2019 to June 2020, according to the National Association of Realtors. The loans generally have no down payment, competitive interest rates, no private mortgage insurance and lower closing costs.

However, today’s red hot market has some sellers passing over government-backed mortgage offers, such as VA loans, expecting a faster or smoother closing with other options.

More from Personal Finance:Sweating inflation? This risk-free bond now pays 7.12% annual interest

“The seller wants the most amount of money with the least amount of hassle,” said Cedric Stewart, real estate agent at Keller Williams in Rockville, Maryland, explaining that sellers worry certain mortgages, such as VA loans, are more likely to fall through.

Indeed, 94% of real estate agents said sellers are most likely to accept an offer with conventional financing over a government-backed loan, according to an April 2021 survey from the National Association of Realtors.