Which Loan Is Right For Your Business

In general, the 504 loan is oriented toward commercial real estate and equipment. The 7 loan is for mixed-use or general purpose.

If you need a business loan for working capital, inventory, or for general flexibility of use, the 7 loan will do the job. For land and heavy equipment purchases, the 504 is your go-to loan.

Have you utilized either of these financing options? Tell us about your experience in the comment section below.

Editors Note: This post was updated for accuracy and comprehensiveness in January 2019.

Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any of these entities.

Post by: Fora Financial

Comparing Sba 504 Vs 7 Loans: Whats Best For Your Business

If you are a small business owner looking for a small business loan, you have a lot of options to consider to find the right one for your situation. From selecting the type of loan you need to finding a lender who is determined to support your business goals, the path to financing can be a confusing one. The Small Business Administration supports a number of loan programs to help small businesses obtain access to the necessary resources they need in order to grow. When looking for small business loans, the SBA 504 and the SBA 7 programs are two of the most prevalent that offer unique benefits to businesses that qualify. If you are confused as to which one you should choose we have made the decision-making a little easier for you. Comparing SBA 504 vs 7 loans to find which is best for your situation will offer insight into which one ultimately fits your businesss unique needs.

Benefits Of The 504 Loan

The SBA 504 Loan Program offers borrowers a fixed rate for up to 25 years with a minimum down payment of 10%. Existing equity in the real estate can be considered towards the down payment when applicable. Additionally, SBA Guarantee Fees on the 7a loan vary based on the size of the project. However, with the SBA 504 loan, the fees involved stay flat as a percentage when the loan amount increases.

In regards to interest rates, the 7 loan typically has a variable rate. While such rates are historically low now, they are currently rising and will continue to do so making it a more expensive proposition. Some banks do offer fixed 7 interest rates for any term.

In addition, the 7 loan has the All Collateral Available Test. This is where a small business borrower typically must pledge all collateral available, including their personal residence, when there is a collateral shortfall. This test does not exist with a 504 loan.

From the perspective of a small business owner, the SBA 504 loan can be safer and better for the borrowers bottom line, and can be an important tool for the growth of small businesses.

Read Also: Fha Loan For Land And Manufactured Home

When Might It Be Better To Take Out A 504 Vs 7 Loan

An SBA 504 loan only requires the property being acquired to be used as collateral there is no lien placed on a personal residence or outside collateral. As such, when multiple are partners involved with unequal assets and equity, the 504 could be a better option than the 7 loan, which requires collateral. The additional collateral required in the 7 program could burden the partner with greater value to pledge.

Purpose Of The Loan: Is Your Business An Existing Business Or A New Venture

The first consideration when comparing SBA 504 and 7a loans is the status of your business and the purpose of your loan. If you have an existing business that is looking to purchase commercial real estate, land or commercial equipment, the SBA 504 loan could be the better choice for your business.

If you are a new business or trying to purchase an existing business, the 7a loan may be more appropriate. 7a loans are also used for companies that need to purchase inventory or just need some working capital.

Read Also: Loans To Pay Off Debt

Can A 7 Loan Be Used To Purchase Commercial Real Estate

Yes, though there are higher guaranty and program fees with the 7 loan, and banks are unable to finance those fees. This could make it much costlier upfront. Additionally, a lien on the borrowers home, business or both are generally placed if a 7 loan is financed at 90 percent loan to value. However, 504 loans dont require liens on personal residences.

What Is The Most Common Question Or Concern You Get From Borrowers Regarding The 504 Loan

Borrowers are typically concerned that the process will be long and difficult because they will need approval from the bank, the CDC, and the SBA.

Rest assured, if you provide a complete financial package, youll be able to meet any reasonable deadline these parties may have. And the timing will be no different if you decided to go with a conventional loan or a 7a loan.

Also Check: Instant Approval Loans Bad Credit

Sba 504 Vs 7a: Which Is The Best Loan For My Gym Business

The SBA 504 and the SBA 7a are good options for a small business loan. The SBA 7a is a good choice for business owners looking for a smaller loan to help cover their working capital. This loan offers more flexibility.

The SBA 504 is an excellent option for a business owner looking to make a more considerable investment in their business. This loan is ideal for those considering the purchase of a commercial property.

Whatever your financial needs, the SBA 504 and 7a loans are affordable. These loans can provide you with the financial security your business needs while it continues to grow, and they can also give you peace of mind while you continue to shape your financial future.

for more details on financing options or call 214-629-7223 or email [email protected] for more information. Or, apply now.

An Outsourced CEO and expert witness, Jim Thomas is the founder and president of Fitness Management USA Inc., a management consulting, turnaround and brokerage firm specializing in the gym and sports industry. With more than 25 years of experience owning, operating and managing clubs of all sizes, Thomas lectures and delivers seminars, webinars and workshops across the globe on the practical skills required to successfully overcome obscurity, improve sales, build teamwork and market fitness programs and products. Visit his Web site at: www.fmconsulting.net or www.youtube.com/gymconsultant.

When Should You Consider The Sba 7 Loan

The 7 loan is the SBAs most popular loan program for small business owners and many who would not otherwise qualify for a conventional small business loan find that they qualify for the SBA 7 program. While many people mistakenly think that this loan is only for those starting a new business, the SBA 7 loan is also an excellent financing tool for those who want to expand an established business, buy an existing business, purchase a building, or finance a construction project.

Read Also: Navy Federal Credit Union Home Loans

What Is The Most Common Question Or Concern You Get From Borrowers Regarding An Sba 504 Loan

Borrowers are typically concerned that the process will be long and difficult because they will need approval from the bank, CDC, and the SBA.

Rest assured, if you provide a complete financial package, youll be able to meet any reasonable deadline these parties may have. And the timing will be no different if you decided to go with a conventional loan or a 7a loan.

“If you can get into a 504 and buy your building now youre investing in your own asset.”

Chris Kuran, President, Waterstone Faucets

“When I tell people how I bought a building and was got a loan they are surprised. For me, it is the American dream.”

Mia Davis, Mikko Sushi

“As an immigrant, we came here with very little and we got the opportunity to work hard and open our own business. Now I look back and I am very happy and very thankful for being in this country.”

Duke Huynh, Owner, Ph Ca Dao

“We decided to move forward with the SBA loan and to this day it’s been a great success as we were able to expand our operations, hire new people, and get us ready for the future.”

Jesus Ramirez, JXR Constructors

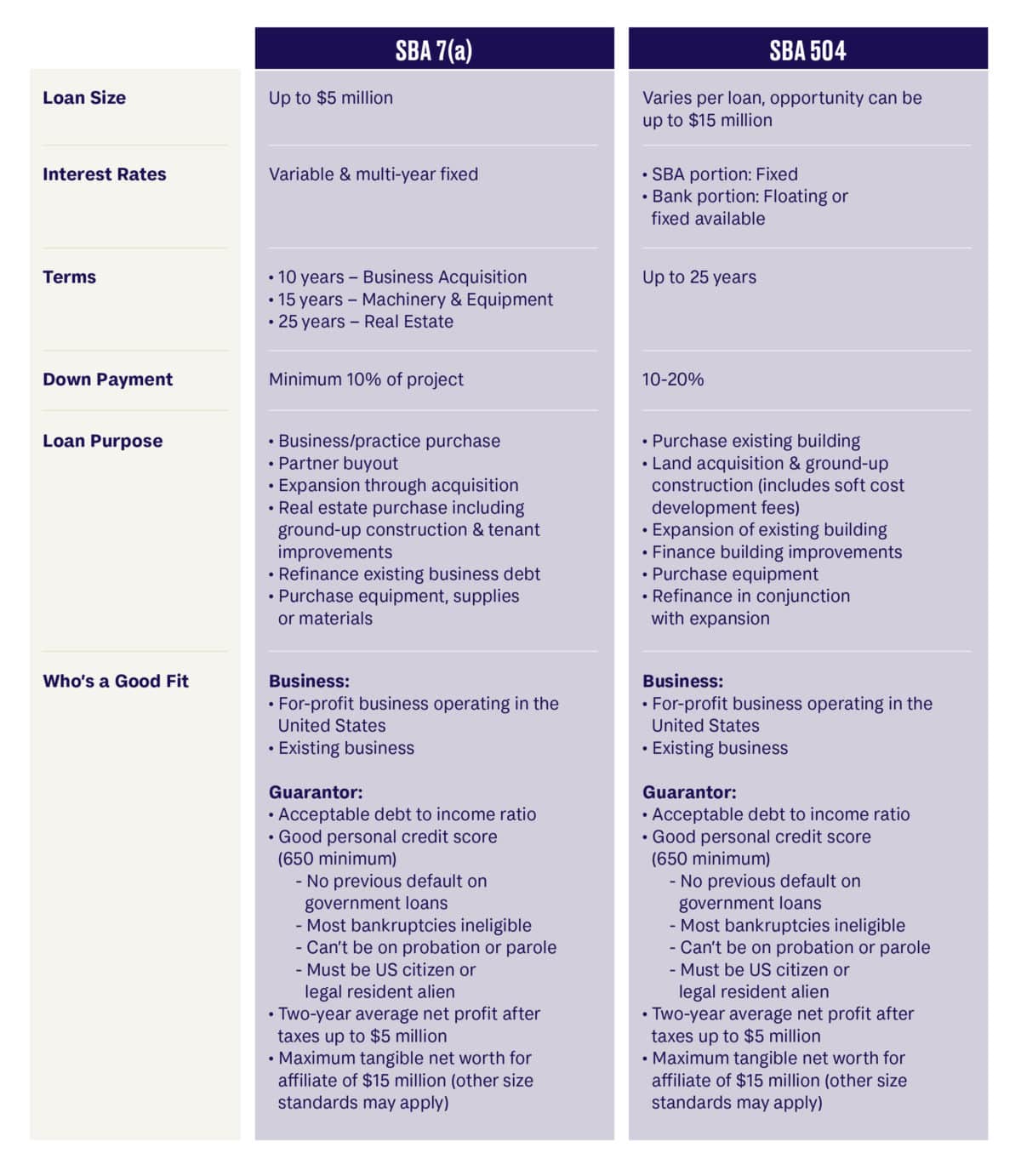

What Are The Key Differences Between The Sba 504 And 7a

First, the basics. An SBA 504 loan is commercial real estate financing for owner-occupied properties. These loans require only a 10 percent down payment by the small business owner and funding amounts range from $125,000 to $20 million.

On the other hand, SBA 7a loans can be used to buy a business or obtain working capital. The maximum loan amount is $5 million.

A 504 loans interest rate is fixed, and no outside collateral is required. Also, fees are lower compared to a 7a loan. Currently, 504 loans are amortized over 20 years, and began to accept applications for the new 25-year term SBA 504 loan, as of April 2018.

The interest rate on a 7a loan, however, can be adjustable and tied to the prime rate. Collateral is required, at 90 percent. These loans are amortized over 25 years.

Heres some history and more specifics on each program: The SBA 504 loan program was designed for small businesses to finance commercial real estate or large equipment for use in the business operations.

The 7a loan program was originally designed for higher-risk loans for things like the acquisition or starting of a business, working capital, or furniture and fixtures, and leasehold improvements.

You May Like: 0 Interest Car Loans For 60 Months

Can You Use A 7a Loan To Buy Commercial Real Estate

Yes, this is possible.

However, the 7a option would be more expensive as it relates to the SBA guarantee and SBA fees.

Also, banks are not supposed to finance those fees with the loan proceeds, so there is a much more expensive up-front cost with 7a loans.

Heres a hypothetical situation:

For projects where the property price combined with tenant improvement exceeds $775,000 the dollar-cost difference is dramatic.

In this case, the fee for the 504 loan would be 1.2 percent of the total loan compared to 2.9 percent for the 7a loan.

Whats more, if the 7a loan is financed at 90 percent loan to value , there is usually a lien on the home, the business , or both.

SBA 504 loans do not require any liens on personal residences.

Main Differences Between Sba 504 Vs 7a Loans

There are several differences between SBA 504 vs. 7a loans. One of the most significant differences is how the loan money can be spent, and each loan has specific requirements as to how the funds can be used.

Another noticeable difference is related to the interest rate. The SBA 504 loan has a fixed rate, while the SBA 7a loan has a variable interest rate.

There is a difference between the SBA 504 vs. 7a maximum repayment term for the loan. Borrowers can repay the SBA 504 loan in 10, 20, or 25-year terms, while the 7a has a maximum repayment term of ten years.

Collateral is needed for the SBA 7a loan but not for the SBA 504. There is no difference between the SBA 7a vs. 504 guarantees a partner owning 20% or more of the company is required to sign a guarantee.

The SBA 7a eligibility terms for a loan require a business owner to have invested their own money in the business and to show they have tried to use other financial resources. The 504 loan requires a 10% down payment from the borrower, and they must show they are creating jobs or supporting public policy goals.

The application process for the 7a is much quicker than the SBA 504.

Also Check: How Va Home Loan Works

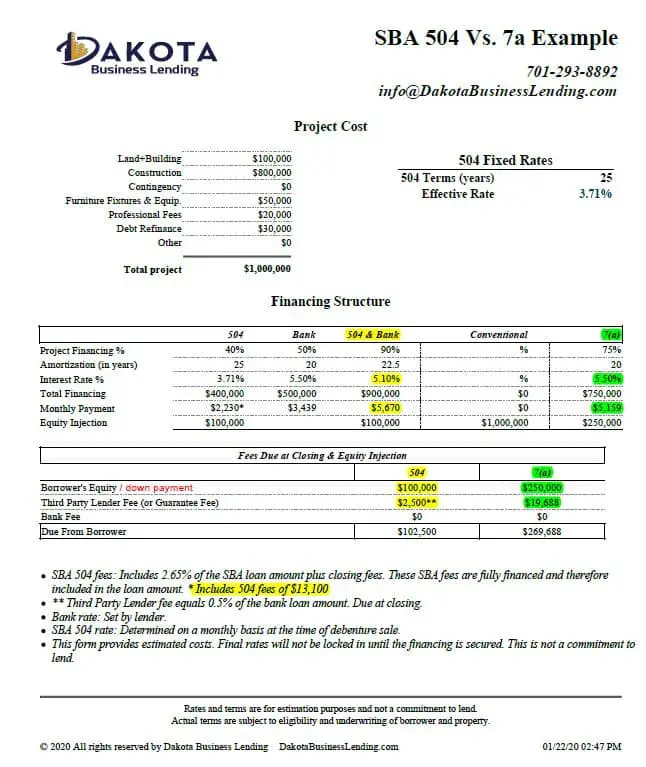

Sba 504 Vs 7 Vs Conventional

The SBA offers both the 504 and 7 loans, each valuable for their differences. The SBA 504 Loan is for the purchase of real estate and other fixed assets, and the 7a loan is more commonly used when working capital financing is needed. The 504 offers a low, fixed rate, while the 7 interest rate is variable and often unpredictable. The project maximum of a 7 loan is $5M and there is no project maximum with an SBA 504 Loan. The project maximum of a 7 loan is $5M and there is no project maximum with an SBA 504 Loan.

| SBA 504 |

|---|

Sba 504 Loan Structure And Limits

The 504 is most often used with another loan so that large projects can be achieved. Generally, the borrower will supply 10 percent of the total cost of the project. The SBA 504 loan would cover 40 percent of the project, and the last 50 percent is covered by the loan from a traditional lender.

If you think about the SBA 504 vs the 7, the 504 is a larger loan. The minimum 504 loan amount is $125,000, and the maximum is between $5-5.5 million, at the discretion of the SBA. The benefits for large commercial real estate is clear, as the 504 has a fixed interest rate and requires a fixed 10% down from the borrower. For land and real estate, the 504 has a 20 year term.

Also, the SBA 504 loan is offered by Certified Development Companies rather than by banks or other lending institutions. There are about 260 CDCs across the United States, and your local CDC office will be able to give you more information about borrower eligibility, down payment requirements, and anything else related to the SBA 504 loan.

Also Check: What Loan Does Not Charge Interest

Sba 7 Vs 504 Loan: Which Is Right For Your Business

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

SBA 504 loans and SBA 7 loans are small-business loans guaranteed by the U.S. government and issued by financial institutions, usually banks. SBA 504 loans are used to finance real estate purchases or renovations. SBA 7 loans can provide businesses with working capital.

If you need a loan for anything other than a real estate or equipment purchase, an SBA 7 loan is your best bet. They can be used for a much wider variety of purposes, including working capital and business expansion. While property development might be part of that, it doesnt have to be.

If youre financing a real estate or equipment purchase, you can choose between an SBA 7 and 504 loan. Here are the key similarities and differences.

Sba 504 Loan Collateral

Most SBA 504 loans are self-secured, meaning that the underlying fixed assets serve as collateral.

Anyone who owns 20% or more of the business must sign a personal guarantee on SBA 504 loans. Even business owners with a solid credit history and excellent financials will have to sign a personal guarantee for the lender’s security.

You May Like: How To Get Loan Without Interest

What Else Should You Know When You Meet With Lenders

Here are three key points to keep in mind when you meet with lenders about your commercial real estate financing needs:

Sba 504 Loan Overview

The 504 loan program has a targeted purpose. You are only able to use funding in this program to purchase, improve or refinance fixed assets such as real estate or equipment.

The structure of these loans is also very different from their 7 counterparts, essentially acting as 2 loans to fund 1 project. SBA 504 loans require a down payment of at least 10%, after which a Certified Development Company licensed by the SBA funds up to 40% of your project cost, up to $5 million.

A third-party lender writing a 504 loan covers up to 50% or more of the total loan. The loan amount, rate and terms are up to the lenders discretion, though interest rates are capped.

The primary purpose of this initiative is to stimulate the economy, so there are strict job-creation goals you must meet to obtain a 504 loan. With exceptions for some small manufacturers and those who will use the funding to achieve certain community development goals, you must create or retain 1 job for every $65,000 you borrow.

Read Also: Can I Refinance My Car Loan With The Same Company

University Of La Verne Sbdc

Getting a small business loan is an integral part of many small businesses to start-up or grow. The most common SBA loans offered for small businesses are 7a and 504 loans. The terms of loans may seem confusing and small business owners may not understand which one they need or qualify for. In this article, we will break down the major differences between the two loan programs and which might be right for your small business.