Eligible Property Types For A Fha 203k Loan

To be eligible, the subject property must be a 1-2 family dwelling that has been completed for at least one year. The number of units on the site must be acceptable according to the provisions of local zoning requirements. All newly constructed units must be attached to the existing dwelling. Cooperative units are not eligible.

In addition to typical home rehabilitation projects, this program can be used to convert a single family dwelling to a multi-unit dwelling. Alternatively, an existing multi-unit dwelling could be converted to a single family home. See below for a full list of eligible property types:

- Owner Occupied Properties

- Single Family Residence

- REO, Short Sale, Foreclosure Properties

How To Find An Fha 203k Contractor

We recommend that you look for a contractor who has experience in dealing with FHA 203k loans. There is additional paperwork that they will need to complete before the process can begin. They also need to be familiar with how they are reimbursed for the work through this program.

Your local home improvement store may be able to recommend a contractor who has done work through this program before.

The contractor must provide a Work Write Up which is an estimate of costs and time to complete the project. The lender will have to review the contractors ability to complete the job professionally, timely and within budget.

How The Standard 203 Loan Is Disbursed

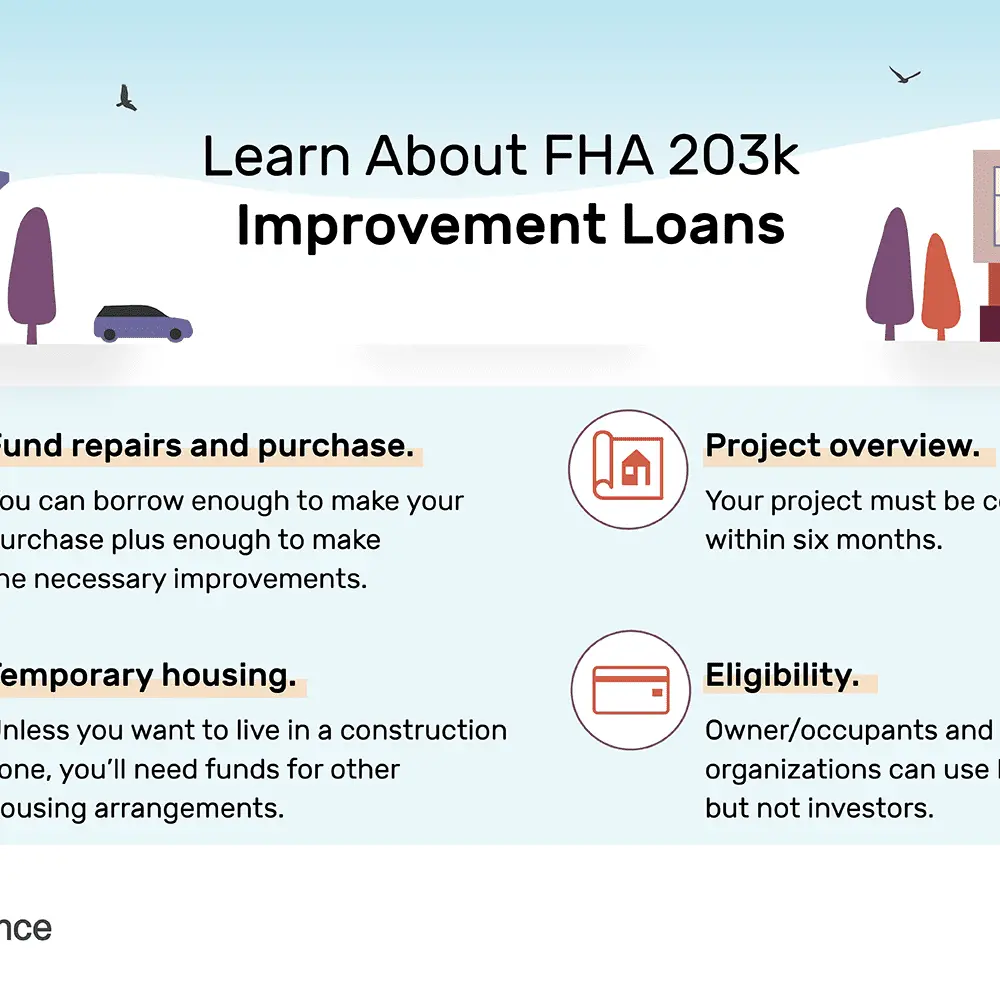

At your 203 loan closing, a portion of the proceeds will be used either to pay the seller, or, if the transaction is a refinance, to pay off the existing mortgage.

The remaining funds those that have been earmarked throughout the loan process as a cost of rehabilitation are then placed in an escrow account and eventually released as each phase of the planned rehabilitation is completed.

Recommended Reading: Does Va Loan Work For Manufactured Homes

Applications Must Be Submitted Through An Fha Approved Lender

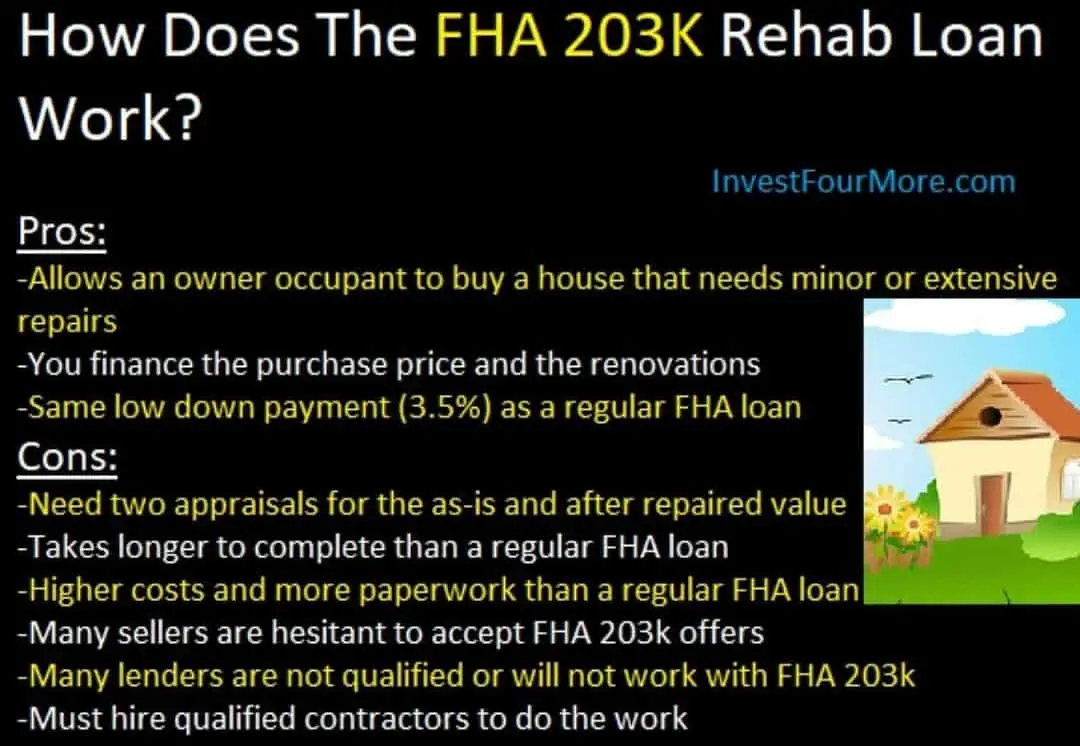

What is a fha 203k loan. Instead of having two different loans the loan is combined as a 203k loan. Hud requires that properties financed under this program meet certain basic energy efficiency and structural standards. Fha loan requirements are similar to a 203k mortgage loan except for a couple of things.

Homebuyers and homeowners can quickly and easily tap into cash to pay for property repairs or improvements such as those identified by a home inspector or an fha appraiser. Fha s limited 203 k program permits homebuyers and homeowners to finance up to 35 000 into their mortgage to repair improve or upgrade their home. Insurance for rehabilitation is authorized under section 203 k of the national housing act 12 u s c.

You can qualify for an fha mortgage with a 500 credit score with 10 down and a 580 credit score with 3 5 down. Because they re government insured 203k loans have more lenient qualification requirements. One of which is the credit score requirement.

Fha maximum debt to income ratio of 31 43. In general an fha 203 k loan allows you to wrap your renovation costs into your mortgage that s just one loan and one closing. When you apply for an fha loan you re required to disclose all debts open lines of credit and all sources of income.

You will also have to provide a detailed proposal of the work you want to do. The amount you borrow is a combination of the price of the home. To get an fha 203k loan you must work with an fha approved lender.

Is It Worth The Trouble

The FHA 203 application process is a lot of work, to be sure. If it seems like too much trouble, you might be better off continuing to search for a home thats closer to move-in ready or continuing to save until you can afford a nicer place. But if you have the time, energy, and patience, the 203 loan is often the only way to finance the purchase of a property needing significant repairs. Otherwise, youll need to have enough cash to pay for the property and the repairs outright.

Don’t Miss: What Happens If You Default On Sba Loan

Streamline 203k List Of Allowable And Non

Many buyers are surprised at what the 203k allows them to do. This loan can be used solely for cosmetic purposes, not just when a home is in severe disrepair. You can remodel a kitchen or bathroom, adding amenities like granite countertops and high end appliances. The repairs dont even need to be necessary to make the home eligible for FHA financing. In other words, if a home has a functional kitchen, but its outdated, the buyer could use a 203k loan to remodel cabinets and countertops, upgrade appliances, and the like, with a 203k loan.

Keep in mind that repairs cant be structural when using the Streamline 203k. This means foundations, load-bearing walls, etc. may not be altered.

If the property you are looking at needs structural repairs to qualify for financing, you will need to use a full 203k instead of a Streamline 203k, or find a different property.

- Alterations to improve commercial use of the property

What Repairs Can You Do

Well, there are two types of Fha 203k loans: the standard loan and the limited loan. Before we talk about what repairs Fha 203k loans cover, we should mention that the maximum repair work can cost you approximately $31,000.

With a limited 203k mortgage loan, most of the work you can do will consist of non-luxury, non-structural repairs. For example, such repairs the real estate investor can do include:

- Bathroom and Kitchen Renovation

- Energy-Efficient Improvements

You are not allowed to perform structural renovation like moving load-bearing walls with this type of loan. Moreover, rehabbing a property by adding a swimming pool will not be approved as well as it will fall into the category of luxury home renovation.

With standard Fha 203k loans, you can do almost everything you want except adding luxury facilities to your fixer upper, of course. So, if you are ready to increase the propertys value, here are a few of the potential repairs that the investor is able to perform on a fixer upper:

- Structural Changes

- Connecting to the Public Water/ Sewer

- Converting a Single Family Home into a 2,3 or 4 Unit Investment Property

You should know that the project for rehabbing a property cannot take longer than 6 months, so make sure you plan well upfront.

Not sure which home renovations to do? Make sure to read 11 Home Renovation Tips to Increase the Value of Your Investment Property.

Don’t Miss: Does Va Finance Manufactured Homes

What Do I Need To Apply For A 203k Loan

Applying for any loan, including the 203K loan requires plenty of preparation and work to come up with the right documents for approval. Just like any other FHA loan, the 203K loan requires your standard documents with the exception of a few extra documents that are required in order to determine your eligibility for the loan.

Using The 203k Loan Step By Step

Here are the steps youllcomplete when buying a fixer-upper with an FHA 203k loan.

Its a little differentfrom a regular loan, because youll be submitting your list of home improvements, and the loandoesnt completely fund until the improvements are complete.

When the loan closes and funds, the seller gets paid. The rest ofthe money from your lender goes into your escrow account.

You May Like: Va Manufactured Home 1976

K Loanrates And Mortgage Insurance

Mortgage rates are somewhat higher for FHA 203k loans than for standard FHA loans.

Expect to receive a rateabout 0.75% to 1.0% higher than for a standardFHA mortgage.

Still, base FHA rates aresome of the lowest on the market, so 203k rates are competitive.

Youll also pay FHA mortgage insurance. This costs 1.75% of the full loan amount as a lump sum and 0.85% yearly .

On a $250,000 loan, thats$4,375 upfront and an extra $177 per month.

What Repairs Can I Do

There are two types of 203kloans. Which one you choose depends on the extent of the repair work.

Limited 203k mortgage

This option allows you todo most cosmetic repair work, including things like kitchens and bathrooms.

The stated limit to costsis $35,000. However, an FHA 203k loan requires a buffer equal to 15 percentof the total bids.

This buffer is called acontingency. Its a just in case fund to cover cost overruns by yourcontractor. .

So, your real maximumrepair costs canbe around$31,000.

Most non-structural,non-luxury items are acceptable:

- Kitchen and bathroom remodels

For more information on the standard vs. limited 203k, see: Should You Choose A Standard Or Limited 203k?

What youcant do with the 203k loan

While FHA203k guidelines are fairly lenient, there are some things you cannot use therehab funds for. For example:

- Minor landscaping

- Adding a luxury amenity like a tennis court, barbecue area, or swimming pool

- Projects that will take longer than 6 months

In these cases, other options might be a better fit, such as getting a home equity loan after purchase, or other alternatives mentioned in the next section.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Why You Need To Work With An Experienced 203k Lender

As with your contractor, finding an experienced 203k lender makes all the difference. Because these loans are more complicated than other mortgage products, choosing an experienced lender can ensure your loan goes smoothly and stays on track.

A seasoned loan officer will be able to walk you through the documentation requirements for the estimate, as well as any other verification needed. There are more moving parts with an FHA 203k loan than a standard mortgage, so having an experienced team on your side is key.

FHA 203k loans have quite the learning curve, and letting a loan officer test the waters on your mortgage could be costly, particularly if you end up closing late. A late closing could mean losing out on thousands of dollars in earnest money and losing out on the house entirely.

What Is The Interest Rate On 203k Fha Loan

An individual can make as low as 3.5% down payment, just like with FHA loans. Because the loan is FHA insured lenders can offer lower interest rates than what borrowers might be able to quote elsewhere for a 203k loan.

Credit history will determine the interest rate for each applicant. However FHA permits people with credit scores below 580 to apply 203k under the FHA Lenders may require a higher score, such as 620 to 644, to be able to issue a mortgage. It is still below the 720 score needed for a standard mortgage. The 203k FHA Loan is not free. A monthly mortgage insurance premium must be paid by the borrower. A grant fee may also be charged by the lending institution. Consider other factors before applying for this program. These include the financial costs, the detailed paperwork and the lengthy time it takes to get a reply from the lender. FHA Both the lender and the borrower. The 203k FHA is a great option for someone with low credit who wants to buy a home that needs repairs and modernization.

Read Also: What Car Loan Can I Afford Calculator

Fha 203 Loan Refinancing

FHA 203 loans can be used both to purchase a fixer-upper or rehabilitate the home you already live in through a refinance. The process to refinance into a 203 loan is similar to a regular refinance, but you must meet the additional requirements of the 203 loan.

After refinancing, a portion of the 203 proceeds will pay off your existing mortgage, and the rest of the money will be kept in escrow until repairs are completed.

Existing 203 mortgages can also be refinanced through the FHA streamline program, which may help you get an even lower interest rate.

Benefits: An Fha 203k Loan Lets You Build Equity Fast

The buy-and-rehab strategycan give home buyers instant equity, and a lot of it.

Homes in need of repair orupdating can be had on the cheap, and the fixes may not be very expensive atall.

For instance, a housepotentially worth $250,000 may sell for just $200,000 when it needs only $20,000 in repairs. That leaves $30,000 in potential equity for a buyerwith the initiative to manage the fixes.

According to real estatedata website Realtytrac, the median home price in a distressed sale was 42percent lower than the price netted in non-distressed situations. Thats a bigdiscount.

The problem comes, however, when the buyer goes to finance the home purchase.

Most mortgage programsrequire homes to be in near-top shape before the loan is approved.

Thats where the FHA 203k rehab loan comes in.

The Federal Housing Administrations 203k loan allows buyers to finance the home and up to $35,000 in repairs with one loan.

Its possible to have lower monthly payments and higher equity in your home the moment you move in, compared to your friends and neighbors.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Renovate An Older Home The Smart Way

Depending on your vision for the home and the scope of work involved to make renovations, the process can grow costly. Before applying for home improvement store credit cards and seeking other alternative forms of borrowing money, clients should consider a FHA 203k loan option. Many people find success in using a renovation loan to finance the major aspects of their home upgrade. Then, if needed, they can turn to home improvement store credit cards to supplement the less expensive remainder of the project.

There are pros and cons to any option worth considering, but check out the following examples to gain a better understanding of what we mean:

You Have To Stay On Track

Youll need to keep a close watch on your project as youve committed to a six-month project deadline. Additionally, renovations must begin within 30 days of loan closing, so youll need to be sure your contractor is ready to go . Dont be afraid to ask for help from a 203k project coordinator or consultant.

Read Also: Is Bayview Loan Servicing Legitimate

Fha 203k Mortgage Loan Rates

Mortgage rates are very competitive for this loan program. To get an exact rate quote for your situation, speak with a Riverbank Finance loan officer. FHA loans, in general, are less credit driven than Conventional loans, therefore, if you have a lower credit score, the FHA 203 mortgage loan program would be a great solution for you and your mortgage needs.

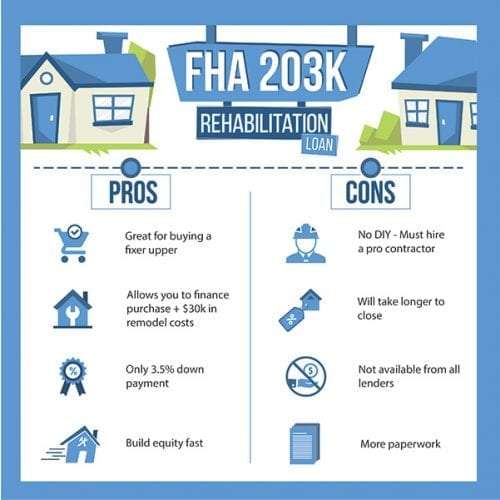

Pros And Cons Of An Fha 203k Loan

Pros

- Low down payment of only 3.5%

- Borrow more than the purchase amount to make necessary repairs

- Borrow up to 6 months of mortgage payments while your home is being repaired.

- Available in both fixed and adjustable rates.

- Available for refinances if you need to rehabilitate a home you already live in

Cons

- The closing time is very long due to the paperwork and coordination required

You May Like: Becu Auto Smart

What Are The Pros And Cons Of These Loans

The main benefit of these loans is that they give you the ability to buy a home in need of repairs that you might not otherwise have been able to afford to buy. Plus, the down payment requirements are minimal, and often you get decent interest rates .

The downsides are that not all properties qualify, there are limits on the funding you can get and applying for the loan isnt easy. For example, to apply for the loan you may need to hire an independent consultant to prepare the exhibits required . Get more information on 203k loans.

Current Mortgage Rates

Who Qualifies For An Fha 203

Although it has a very specific purpose, the 203 loan is still an FHA mortgage at its core. This means it has more lenient qualification requirements than a conventional mortgage and is subject to FHA loan limits.

-

Down payment: The minimum down payment for a 203 loan is 3.5% if your credit score is 580 or higher. Youll have to put down 10% if your credit score is between 500 and 579. Down payment assistance may be available through state home buyer programs, and monetary gifts from friends and family are permitted as well.

-

Max loan amount: FHA loan limits vary depending on where you live, but are generally capped at $356,362 in low-cost counties and $822,375 in high-cost counties.

-

Foreclosure: In most cases, a foreclosure within the past three years will prevent you from qualifying for an FHA loan.

» MORE:Compare FHA vs. conventional loans

Recommended Reading: Minimum Credit Score For Rv Loan