How Long Do You Pay Fha Mip

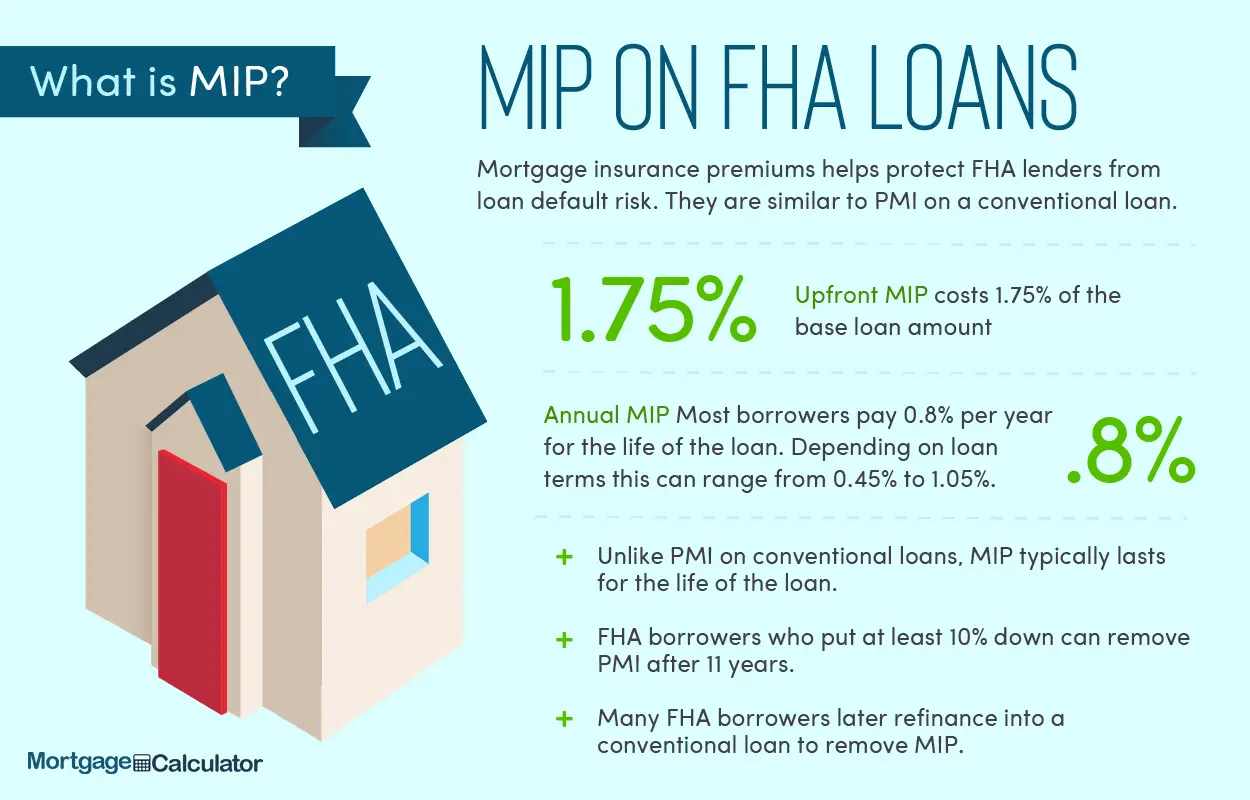

Although the law has been amended more than once on the matter, the current guidelines state that borrowers who are on less than 10 percent of an FHA loan must pay for FHA mortgage insurance until the entire loan term is up. However, if you drop at least 10 percent, you can have FHA MIP removed after 11 years of payment.

The length of time a borrower pays the monthly mortgage insurance premium depends on the original loan terms, says Boomer.

Conversely, the PMI for a conventional loan can usually be canceled once a homeowner has 20 percent equity in their home.

Why Does The Fha Offer Streamline Refinancing

A lowhassle refinance program with ultralow mortgage rates might sound too good to be true. But actually, its in the Federal Housing Administration and HUDs best interest to offer a Streamline Refinance loan.

The FHA can readily favor low rates because its an insurance plan and not a lender.

The agency has no incentive to keep borrowers in highrate loans because it doesnt profit from the interest paid on FHA loans.

To the FHA, lower rates mean smaller monthly mortgage payments. Smaller payments are easier for borrowers to handle. And that means fewer claims against its mortgage insurance program.

The same is true for the Department of Veterans Affairs Streamline Refinance for VA loans.

Getting Around The Fha Mortgage Insurance Requirement

The above standards apply to the average FHA homeowner that puts down less than 10% on the home. If you are among the elite few that put down more than 10% on a home bought with an FHA loan, you may be able to cancel your mortgage insurance.

Borrowers that put down 10% or more and take any FHA term between 15 30 years can have their mortgage insurance canceled after 11 years. While it doesnt seem to make sense to use FHA financing if you have more than 10% to put down on the home, some borrowers still need the FHAs flexibility, especially when it comes to credit scores. The FHA only requires a 580 credit score, whereas conventional loans typically require at least a 680 credit score.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

How To Get Rid Of Pmi Mip On An Fha Loan

An FHA loan sounded like a good idea at the time.

But now that youre paying high mortgage insurance premiums, month after month and year after year, you might not be so sure. In fact, someone with a $250,000 FHA loan can expect to pay about $30,000 in mortgage insurance premiums over the life of the loan.

The good news is you can cancel your FHA mortgage insurance and you can start today.

There are two methods for removing your FHA mortgage insurance, commonly known as FHA MIP.

Does A Lower Rate Make Refinancing Worthwhile

Going from a higher interest rate to a lower one doesnt always make refinancing worthwhile.

You want to see how many months it will take before loan savings break even with your upfront closing costs. If youll stay in the home past the breakeven point, youll start seeing real savings.

After the breakeven point, your savings will continue to grow over the life of the loan.

You should also watch out for lenders that define savings as the difference between your new mortgage payment and your old one.

Look out for lenders that define savings as the difference between your new payment and your old one. Its possible to lower your monthly payment but increase your longterm cost.

Its not that easy to measure your savings. Refinancing starts your mortgage loan over, so its possible to lower your monthly mortgage payments but actually increase your overall cost.

This can happen because youre spreading the loan balance and interest payments over a new 30year term.

Don’t Miss: Apply For Avant Loan

How To Get Rid Of Fha Mortgage Insurance

Paying for FHA mortgage insurance for 11 years or longer might sound like a drag, but the expense doesnt have to last forever.

Many borrowers use FHA loans as a stepping stone that can help them reach the dream of homeownership, says Gary Acosta, co-founder and CEO of the National Association of Hispanic Real Estate Professionals. From there, they take steps to improve their credit scores and acquire more equity in their homes so they can refinance out of their FHA loan into a conventional loan with better terms.

The FHA is a wonderful starter loan but, at some point, it can also be beneficial to refinance out of it for lower monthly payments, including no or PMI, Acosta says.

Its also possible to get out of FHA mortgage insurance by paying down your mortgage, but that can take a significant amount of resources to do. Before paying off your loan, make sure to weigh the financial pros and cons.

Get Used To The Fha Mortgage Insurance Life

Head of FHA ‘not considering changes’

The Federal Housing Administration said it is not considering any changes to the mortgage insurance life-of-the-loan policy despite recent calls to eliminate it.

Ed Golding, who serves as the head of the FHA, testified before a House Financial Services subcommittee on Thursday, shedding more light on what is happening in the government when it comes to mortgage insurance.

According to report from Compass Point Research & Trading, while Golding did not provide updated guidance regarding mortgage insurance premiums, he did address the FHAs life-of-loan premium policy, which requires borrowers to pay annual mortgage insurance premiums for the life of the loan.

I am actually not considering changes to the life-of-loan policy, Golding said.

Compass Point pointed out that this is the first explicit statement from the FHA reaffirming its life-of-loan premium policy, which is significant given persistent conjecture regarding FHA pricing.

In , the FHA announced it would require most borrowers to continue paying annual premiums for the life of their mortgage loan.

In 2001, the FHA cancelled required MIP on loans when the outstanding principal balance reached 78% of the original principal balance. However, FHA would still remain responsible for insuring 100% of the outstanding loan balance throughout the entire life of the loan.

Compass Point said this represented the first pricing cut since the housing crisis.

Recommended Reading: How To Transfer Car Loan To Another Person

Fha Mortgage Insurance Premium: 30 Year Fixed Rate Fha Loans

Home Buyers seeking an FHA insured mortgage loan, a 3.5% down payment is required towards the home purchase.

- Borrowers will also be charged a 1.75% upfront FHA MIP which can be rolled into the mortgage loan balance

- For 30 years fixed rate FHA loans, there is also a 0.85% annual MIP

- This is paid monthly along with mortgage payment

- The annual mortgage insurance premium is 0.85% of the mortgage balance

- Borrowers need to pay this mortgage insurance premium for the life of the FHA loan

The only way Borrowers get out of paying the monthly FHA mortgage insurance premium is when they pay off the mortgage.

What Is Mortgage Insurance For Fha Loan

Unlike other forms of insurance, such as homeowners or life insurance, FHA mortgage insurance protects the lender. Each FHA mortgage contains a premium to safeguard the lender against poor loans.The FHA mortgage insurance premiums are accumulated and used to compensate lenders who have foreclosed on delinquent borrowers. Due to the FHA’s default insurance, lenders are more likely to lend to prospective house purchasers who might not qualify for a mortgage otherwise.For example, the down payment on an FHA house loan is now 3.5 percent, and the approval requirements are much less stringent than those on conventional home loans.

Currently, the cost is 1.75% of the loan amount. Here is the FHA mortgage insurance premium calculation.

30-year FHA upfront mortgage insurance example| 1. Sales price | |

| 2. Less down payment | $ 7,000 |

| 5. Funding fee cost | $3,377.50 |

The combined cost of the basic mortgage and the financing charge results in a total loan amount of $196,377.50.The principle and interest payment is determined by the “base” mortgage amount and the upfront fee.

30-year mortgage insurance calculation| 5% to 9.99% down payment | 1/26/2015 |

| 4.99% or less down payment | 1/26/2015 |

| Less than, and equal to 5% down payment | 1/26/2015 |

| Greater than 5% down payment | 1/26/2015 |

| Sales price | |

| / = | $ 136.71 |

- 1-unit home – $356,362

- 4-units – $685,400

Don’t Miss: Usaa Car Loans Bad Credit

Refinancing Is An Option

But you can refinance your debt to get out of paying FHA MIP. This means taking out a conventional loan to pay off your FHA loan. Usually, youll have to wait for your finances to improve to do this.

Youll also want to make sure you get a better interest rate on the conventional loan. After all, the idea is to lower your monthly payment. Biding your time will likely work in your favor. Youll have more equity in the home and hopefully its value will go up.

Is It Worth Refinancing To Get Rid Of Pmi

It ultimately depends on your break-even point with closing costs. If you plan to remain in your current home for the foreseeable future, getting rid of PMI can lead to significant savings in the long run. That said, such a move may not be in your best interest if you’re considering a move in the next few years.

Don’t Miss: How To Transfer Car Loan To Another Person

The Refinance Must Have Purpose

Streamline Refinance applicants must demonstrate a Net Tangible Benefit from the refinance meaning there will be a clear monetary benefit to the new loan.

Loosely, Net Tangible Benefit is defined as reducing the combined rate by at least one-half of one percent.

For instance, say a homeowner has an FHA loan opened in May 2019 with a rate of 4.00%, and an annual mortgage insurance premium equal to 0.85 percent of the mortgage amount.

The combined rate is 4.85%.

The homeowner looks into a Streamline Refinance, and receives a rate quote at 3.25% with MIP of 0.85 percent.

The new combined rate would be 4.1%, or three-quarters of one percent lower than the existing combined rate. This FHA refinance would be eligible.

Another allowable Net Tangible Benefit is to refinance from an adjustable-rate mortgage to a fixed-rate mortgage.

This is considered a benefit because fixed-rate mortgages have predictable rates and payments that carry less risk of default.

Taking cash out of your equity is not an allowable Net Tangible Benefit, but the FHA does have a cash-out refinance loan that well discuss below.

Are Fha Loans Worth It

Many borrowers choose an FHA loan despite the potentially higher cost of FHA mortgage insurance. One reason is that the FHAs minimum down payment of just 3.5 percent is one of the smallest allowed on any type of loan.

While some conforming, VA and USDA loans also allow borrowers to make a very small down payment, these loans can be more selective than the FHA loan in terms of who can qualify.

Fannie Mae insures one type of loan that has a minimum down payment of 3 percent with PMI. This loan is available only to buyers who haven’t owned a home during the previous three years and homeowners who want to refinance certain types of existing loans.

The VA loan allows borrowers to buy a home without a down payment. This loan is available only to U.S. military servicemembers, veterans and certain other borrowers. The FHA loan also offers low closing costs and easier credit qualifying guidelines, according to the FHA website.

Borrowers who have a moderately low credit score might be able to qualify for an FHA loan with a reasonable interest rate, while that same credit score might trigger a significantly higher interest rate for a non-FHA loan. Though the FHA mortgage insurance might be more expensive, the lower interest rate offsets some of that cost to the borrower.

Borrowers whose credit score is very low might be limited to the FHA loan for that reason alone. Most other types of loans have higher minimum required credit scores.

About the Author

Read Also: How To Get A Loan Officer License In California

Fha’s Annual Mortgage Insurance Premium

The annual premium is divided by 12, and that amount is added to the borrower’s monthly mortgage payment. This system means the borrower doesnt have to pay the full amount all at once every year.

An individual borrowers MIP can vary from less than $60 to several hundred dollars per month, depending on the borrowers loan amount, loan term and down payment percentage. The borrowers credit score doesnt affect his or her MIP for FHA loans.

The monthly MIP calculation is complicated, so you should consult a mortgage professional for an FHA loan quote based on your situation.

How Long Are You Required To Pay For Mortgage Insurance

One more important difference between MIP and PMI is the length of time you are required to pay it. If you buy a house today with an FHA loan, you will be required to pay mortgage insurance premiums for at least 11 years. If you make a down payment of less than 10%, you will need to pay MIP throughout the life of the loan. Homeowners with FHA loans sometimes refinance to a conventional loan to stop paying mortgage insurance premiums.

With a conventional loan, you only need to pay for private mortgage insurance until your home equity reaches 20%. Then you can request your lender cancel your PMI payments. Learn more about how to remove PMI from your mortgage.

Recommended Reading: Does Va Loan Work For Manufactured Homes

Low Minimum Down Payment

There is two minimum down payments for FHA home loans according to your credit score. This amount is derived from the houses original purchase price.

You either pay at least 3.5% if you have a 580 credit score or higher, or you have to deposit a minimum of 10% in case your score is lower.

According to the numbers from Experian, more people would be eligible to pay a minimum 3.5% down payment for an FHA loan. Sixteen percent of Americans have scores below 580, while eighteen percent have scores from 580 to 669.

Types Of Mortgage Insurance

Although several loan programs have mortgage insurance, the requirements are not all the same.

FHA loans: FHA loans have an upfront and annual mortgage insurance premium . The annual MIP is adjusted every year based on your remaining loan balance.

Conventional loans: Borrowers who put down less than 20% on a conventional loan pay annual private mortgage insurance .

USDA loans: Like FHA loans, USDA loans have an upfront and annual mortgage insurance requirement.

VA loans: There is no annual mortgage insurance requirement on VA loans, but there is an upfront funding fee, which is charged as a percentage of the loan.

Mortgage insurance doesnt just benefit lenders. It allows borrowers who can afford a monthly mortgage payment but cant save up the traditional 20% down payment to purchase a home.

Don’t Miss: Mortgage Commitment Fee

Employment And Income Are Not Verified

The FHA does not require verification of a borrowers employment or annual income as part of the FHA Streamline process, unless the borrower needs a credit qualifying loan.

For non-credit qualifying Streamline loans, there is no verification of employment, nor are there paystubs, W-2s or tax returns required for approval.

Its A Sellers Market At The Moment

If you have at all glanced at the news in the past couple of months, youd be aware that we currently have a sellers market. Although the effects of COVID-19 are easing up, there are still not enough houses to meet the demand, and buyers are competing with each other to snatch up available homes.

More or less, using an FHA loan for a home purchase in 2021 might mean that youll be negotiating with sellers for weeks or even months. The requirements for FHA loan approval are not beneficial for most home sellers.

Do or do not. There is no try.

As Yoda might say: if youre in, you have to be all-in. The housing market is a strange and frequently unpredictable place, but the experience can also be exhilarating. Youre deciding of a lifetime.

Are you thinking about getting a mortgage because there is a home that has captured your heart? If there is one already, its up to you to decide how far youre willing to fight for it.

So are you in or out?

Recommended Reading: Usaa Car Interest Rates

Making A Plan To Get Rid Of Fha Mortgage Insurance Is A Great Financial Decision

When youre youre making a home purchase, youre mainly focused on getting into a place where you can set down roots and build a solid future. The down payment can be a big hurdle so high FHA PMI costs can be a worthwhile trade-off.

But now youre settled in, its time to think about getting rid of FHA mortgage insurance. These high monthly PMI payment costs could and should be going into savings, a childs college fund, or toward loan principal.

Dont delay. Even if youre not able to cancel your mortgage insurance now, make a plan for how youre going to do it.

Ten or twenty years down the road, youll be glad you did.

One Other Option For Avoiding Pmi

There is yet one more way to avoid PMI on a conventional loan, and thats by doing a first/second combination. Thats where you take a new first mortgage equal to 80% of the value of your property, and then cover the remaining balance through the use of a second mortgage or home equity line of credit .

It should be understood however that the first/second combination is generally not an option if you have a low credit score. This is because the credit score requirements for second mortgages and HELOCs are generally higher than for conventional first mortgages.

Typically however, a first/second refinance combination will be limited to an 80% new first mortgage, and a 15% second mortgage or HELOC. That means that your current mortgage cannot exceed 95% of the value of the property otherwise youll have to put up additional cash in order to lower the loan balance to that level.

But if you can use either refinancing strategy to turn your FHA mortgage into a conventional mortgage with no PMI or lower PMI, you can eliminate your FHA mortgage and the PMI that it will charge for the life of the loan.

You May Like: What Credit Score Is Needed For Usaa Auto Loan