Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnât feature every company or financial product available on the market, weâre proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward â and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Dont Miss: What Credit Score Is Needed For Usaa Auto Loan

How To Open A Huntington Bank Account

Opening a Huntington Bank account is simple and can be done online or at a branch.

To open an account online, go to Huntington Banks website and select the Open an Account tab. From there, youll be prompted to choose the type of account youd like to open. If youre attempting to earn a bonus, youll need to apply directly from the offer page or enter your email address to receive a promotional code that you can bring into a branch location.

Youll need to provide some personal information, such as your name, address and Social Security number as part of the application process. After youve completed the application, Huntington will conduct a credit check and verify your identity. If everything goes smoothly, youll be approved for an account and can start using it right away.

Huntington National Bank Hours

Call 480-2265 for general account information, Huntington National Banks Automated Account Information available 24 hours a day.

- For loan customer service, Huntington can be reached during these times: M to F, 8:00am to 8:00pm ET, Sat, 8:00am 2:00pm ET, Sun, CLOSED.

- For loan payment assistance, schedule is M to F, 8:00am to 9:00pm ET, Sat, 8:00am to 1:00pm ET, Sun, CLOSED.

- For credit card payment assistance, for personal & business, these are the schedules: M to Th, 8:00am to 11:00pm ET, Friday, 8:00am to 9:00pm ET, Sat, 8:00am to 4:00pm ET, Sun, CLOSED

- To speak with a customer service representative, call 480-2265 daily from 7:00 a.m. to 8:00 p.m. ET.

In cases where there are suspicious communications or any fraudulent activities that allegedly came from Huntington, contact

Also Check: How Do Loan Officers Get Leads

When Does Huntington Charge Overdraft Fees

Huntington Banks standard overdraft fee is $15. However, youre only charged this fee if you overdraft by more than $50 and fail to pay the difference within 24 hours.

Youre never charged a fee on overdrafts of $50 or less. This is thanks to Huntington Banks $50 Safety Zone feature. If you overdraft by more than $50, youre good as long as you pay it back within the banks 24-hour grace period. Otherwise, the $15 fee will kick in.

What Happens After I Apply

If you submitted your application between the hours of 7 a.m. and 10 p.m. ET on any day of the week, youll receive an immediate response indicating whether your application has been tentatively approved, declined or if more time is needed to review it. Did you apply outside of that time period? You likely wont get a response as quickly.

If approved, a Huntington loan consultant will call you and walk you through the rest of the process, including how to verify your income and employment.

Once approved, the next step is to sign the contract and receive your funds. If you applied at a dealership, youll complete the process there and possibly drive off in your new vehicle that same day.

Otherwise, youll need to make an appointment to visit your local branch. If youre buying a car through a private seller, the seller also needs to be at the branch when you close.

Read Also: How To Calculate Income For Home Loan

Huntington Bank Business Checking Account Bonus: Earn Up To $750

Huntington Bank also offers bonuses when you sign up for a business checking account.

The Huntington Business Checking 100 account offers up to 100 monthly transactions and carries no monthly maintenance fees. Huntington Unlimited Business Checking and Huntington Unlimited Plus Business Checking offer unlimited transactions and additional services. The Huntington Unlimited Business Checking account has a $20 monthly maintenance fee, and theHuntington Unlimited Plus Business Checking account has a $40 monthly maintenance fee.

You may trigger a $20 fee if you dont keep a Huntington business checking account open at least 180 days.

Highlights Of Huntington Auto Loan Financing

- You can fill out the online form in a matter of minutes.

- It offers flexible payment options, such as the ability to choose your payment schedule or to skip payments and make them up later.

- Theres no prepayment fee if you decide to pay off the loan early. A customer service representative also said theres no application or origination fees.

Don’t Miss: Loans For People On Disability

How Do Lenders Decide My Auto Loan Interest Rate

Answered by Jim Manelis is a car enthusiast and Chase Auto Executive.

Buying and financing a vehicle can seem like a daunting transaction, but you can accelerate the process by being prepared with the right information. One of the most common questions people ask is how lenders decide on what their auto loan interest rate will be.

How Do I Apply

First, double-check the basics: Make sure you live in an eligible state and are at least 18 years old. If you meet those criteria, you can apply at a local branch, on the phone or online.

Follow these steps to get started online:

1. Go to the Huntington website and click Borrowing in the main navigation bar.2. Under Personal Loans, select Auto Loans. Click Apply now.3. The application begins with a series of questions called What You Want. Select Buy a vehicle.4. Under Auto Loan, indicate that you have a specific car in mind. Youll be prompted to fill in the year, make, model and mileage.5. Fill in the amount that you want to borrow.6. Indicate whether its an individual or joint application.7. Click Next. In the required fields, add your personal and contact information.8. Click Next. Add your financial information to the required fields.9. Click Next. Review and submit your application.

Also Check: How Much House Can I Afford Loan Calculator

Financing Is Made Easy At Huntington Beachhyundai

Choosing a dealership to finance your vehicle is agood choice, choosing Huntington Beach Hyundai to finance your vehicle is agreat choice! Our finance team has years of experience, making sure that theycan get you the best monthly rate for your loan or lease. We believe that everydriver should have access to a vehicle that will meet their needs, which is whywe work with you through every step of the process to make sure you are alwaysgetting the most reasonable rate for your life.

We have all of the most popular Hyundai models foryou to choose from, including the Elantra, Azera, Santa Fe, Sonata, and more,making sure that you can find one that will meet all the needs of your life.Our team will ask the important questions to determine what you are looking forout of a vehicle. For instance, if you wanted a lot of space, the Santa Femight be suggested, but if you are looking for a fun and sporty ride, theElantra GT would be recommended.

How To Apply For Financing

Applying for a Huntington auto loan is as easy as filling out its self-described five-minute form. That number does jump to 10 minutes if you have a co-applicant.

Its application has three sections: loan information, personal information and financial information.

The loan section covers whether youre looking to insure a specific car or whether youre going to shop for a new one and would like a pre-approval. Youll need to provide an estimate of how much you expect to borrow. There is an option for Huntington to contact you if you qualify for more financing than you estimated.

The personal section asks for a variety of contact information, including your phone number, email and address. Itll ask for a previous address if youve lived in your current home for less than two years. You also have to provide your Social Security number and the name and phone number for a contact person.

The financial section is a run-down of your income. Youre asked to provide the name and contact info for your employer, plus a summary of your occupation and wages. Theres also a place to report additional sources of income like a side hustle, or any money you receive in child support.

Don’t Miss: Green Arrow Loans Phone Number

What Do You Need To Qualify For Huntington Auto Loans

Huntington Auto Loans does not have or does not disclose a minimum annual income eligibility requirement. Huntington Auto Loans only considers borrowers who are employed. Note that borrowers can add a cosigner to either meet eligibility requirements or qualify for lower interest rates.

The Military Lending Act prohibits lenders from charging service members more than 36% APR on credit extended to covered borrowers. Active duty service members are eligible to apply for a loan via Huntington Auto Loans. Their rates fall within the limits of The Military Lending Act.

Permanent resident / green card holders are also eligible to apply.

To qualify, applicants may need to provide the following documentation:

- Recent pay stubs

- Proof of citizenship or residence permit

Financing For The Road You’re On

Auto Loans

Put your new car dreams in motion. Huntington auto loans offer flexible terms and great rates.

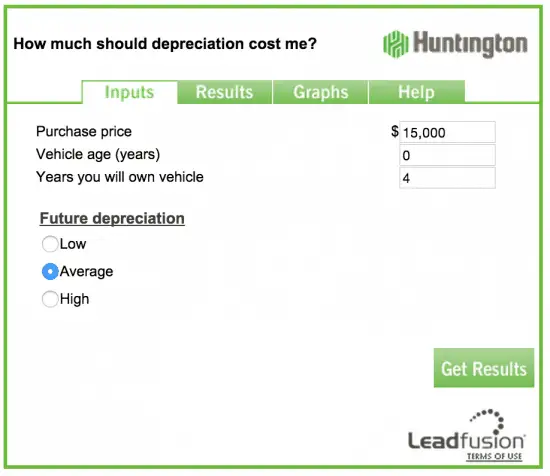

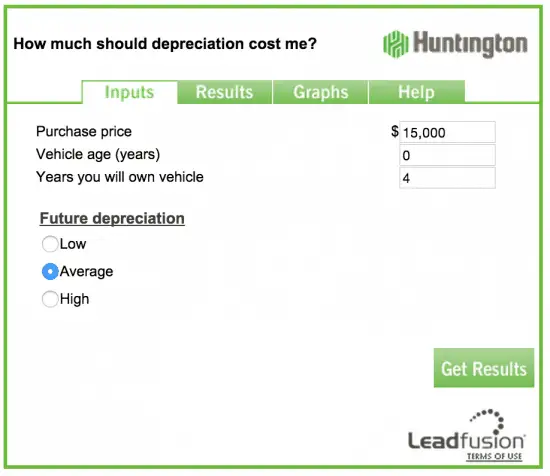

Auto Buying Resources

Let Huntington help you shop smart. Browse our auto buying resources before you buy or lease. You’ll find helpful tips and advice on auto dealers, average vehicle prices and more.

Natural Disaster Help

Huntington has resources to help our loan customers through the insurance claims process for damage to vehicles.

Don’t Miss: What Does 85 Loan To Value Mean

Additional Huntington Bank Features:

Of course, Huntington has some great features that are standard for all its banking customers. Huntington is here to provide the protection you need and to make your life easier. You can download the Huntington Mobile app via IOS or Android, for easy to access service at all times. Check balances, pay bills, review your account, whether youre at home or on the go. Mitigaterisk and protect everything you hold dear with Huntington Commercial Business Security Management.

Learn different types of payment methods your customers can choose from with Huntington Bank Small Business Receivables Management. Huntington will find solutions that optimize your business, allowing it to bloom and expand. Some notable features are Huntingtons Billing service, Lockbox service, Merchant service, vault deposit service, and more!

We are in awe at just the number of services Huntington offers. Check out Huntington Bank Employee Relocation Services if you want to reduce the hassle of relocation. Notable features include Direct Bill which allow advance funds for employees closing cost, Flexible Private Mortgage Insurance that cut PMI down to 10% from normal 20%, and Recast options adjust monthly payments based on mortgage amount.

Huntington Bank Payoff Address

The Huntington Bank payoff address is GW1N10, 5555 Cleveland Ave, Columbus OH 43231.

Hence, if you need the official payoff mailing address for Huntington Bank, you need to use the address GW1N10, 5555 Cleveland Ave, Columbus OH 43231.

That is the Standard or Regular mailing address.

Please note that the payment mailing address for the mortgage loan may be different and if that is actually the case for you, we will advise you to contact Huntington Bank for assistance.

Also Check: New Conventional Loan Limits 2022

Huntington Bank My Car Loan Amount Has Magically Gone Up

In Feb 2013 I took out a car loan in the amount of 20,532.00 from First Merit Bank. I’ve been paying on it with them until earlier this year when Huntington bought them out. Everything has stayed the same, no biggie but in the last 5 months or so I’ve been paying extra principal only payments. Now these are seperate payments. I go in usually every week with something extra. Sometimes they apply them to principal only, where other times they have went to my regular payment which is wrong. My car will be paid off at the end of October. 10 months early.

And today I got a credit alert from Experian saying I have a credit line increase. The original amount of my car loan went from 20,532.00 to 20,768.00. I don’t see any reason why that number would change. It hasn’t changed in 4 1/2 years. My balance yes, but not the original amount of the loan. Are they trying to sneak a few hundred dollars on there to milk out any extra interest from me that they can since they know I’m paying this loan off fast? Seems really fishy to me. Thoughts?

Huntington Bank Auto Loans

Are you thinking about buying a new or used car, truck, or motorcycle and need an auto loan to finance your purchase? An auto loan from Huntington Bank is a great option with its highly competitive rates, flexible payment options, and online account management tool. Huntington also provides you with great resources to help you manage the car buying process. These resources will provide you with tips to help you be well prepared and get the most out of the car buying process. Keep reading for an in depth look at the features and services from Huntington Banks auto loan.

| TOP HUNTINGTON BANK PROMOTIONS |

Recommended Reading: How To Find Interest On Loan

Huntington Bank Bonuses Are For New Customers

Huntington Banks personal and business checking welcome bonuses are only available to new customers. The banks terms also state that customers who closed a checking account within the last six months are not eligible to receive a welcome bonus. Huntington Bank limits customers to one bonus per 12-month period, and you cannot receive multiple welcome bonuses if you have multiple businesses. Additionally, government customers and brokers are not eligible to receive welcome bonuses.

Benefits Of Huntington Bank

- Quick Application Process: Getting started with Huntington Bank is fairly easy. You can apply on their website in just 10 minutes and most customers find out whether or not they are approved fairly quickly. Also, the bank never charges any application or prepayment fees.

- Interest Rate Discounts Available: Huntington Bank doesnt list their interest rates on their website. However, they do offer a discount to customers who enroll in autopay, and for current customers who already have a Huntington Bank checking account.

- Flexible Repayment Options: You can pay your loan payments on a weekly or bi-weekly basis. This can help you pay off your loan more quickly and pay less in interest.

- Exceptional Customer Service: Many customers appreciate the banks exceptional customer service. Customer support is available 24/7 by phone and they have over 600 branch locations in the Ohio Valley area.

- Manage Loan Online: You can also manage your loan online through Huntington Banks customer portal. You can check your loan balance and track your payment history. You can also make extra payments by transferring money from your checking account.

- Option to Delay & Skip Payments: Borrowers are also given some leeway when repaying their loan. Huntington Bank will let you delay your first loan payment for up to 60 days. And they will let you skip a payment one time without charging any additional fees.

Read Also: Lending Tree Personal Loan Calculator

Compare Other Car Loan Offers

| 3.8 out of 5 stars, based on 29,044 customer reviews | |

| Customer reviews verified as of | 19 October 2020 |

|---|

A modest seven reviews populate Huntingtons Trustpilot profile as of October 2020 and the majority of them are Excellent. However, its Better Business Bureau profile tells another story. It has just over 1 star from its 134 reviews, and it has over 500 complaints.

There are no 2020 reviews regarding car loans from Huntington. But those from 2019 and 2018 state issues with title transfers, making payments and customer service.

Huntington Auto Loans: At A Glance

Before you can settle on an auto loan, its crucial to shop around for pre-approvals to make sure youre getting the best rate possible. If you submit multiple applications, do so in the same 30-day window. That way, the credit bureaus will treat it as one application with one hard pull on your rather than multiple that could lower your score each time.

If youre thinking about using Huntington for your auto loan, here are a few factors that you may want to take into consideration as you make your comparisons:

- Huntingtons APRs vary by ZIP code and the model year of the car youre trying to finance. Beginning rates are lower for newer vehicles. For example, lets look at the 43215 ZIP code Columbus, where Huntington is headquartered. APRs start as low as 5.22% for a 66-month term on a 2019 vehicle. For a 2011 vehicle, youd get an APR as low as 6.22% on 36-month term. Huntington doesnt specify on its website how high the APRs can reach.

- Terms available: It offers financing terms between 36 and 66 months.

- Loan amount: $3,000 or higher.

- Other types of financing: Besides its auto loan, which covers new and used cars, Huntington offers natural disaster assistance on vehicles, boats and recreational vehicles damaged during storms.

- Its only available in certain states: Auto loans are available only to residents of Illinois, Indiana, Kentucky, Michigan, Ohio, Pennsylvania, West Virginia and Wisconsin.

Also Check: Are Student Loan Payments Tax Deductible