Lendio: Best Overall For Startup Loan For Business

Data as of 9/8/22. Offers and availability may vary by location and are subject to change.

*Does not represent the typical rate for every borrower, and other fees may apply.

With everything from equipment financing to lines of credit to long-term loans, Lendio offers one-stop comparison shopping for small-business loans.

Lendio isn’t what you’d call a “traditional” lender. Instead, it’s a lending marketplace that partners with 75 or so lenders to help you find the right loan for your needs. So instead of spending time applying to multiple lenders to see who will approve you and what kind of offers you get, you fill out just one application and get multiple loan offers to compare and choose from.

To qualify for a Lendio loan, youll need to have been in business for six months and have at least a 500 credit score. Now, meeting those bare minimum qualifications wont get you the lowest rates or biggest loans. But given that Lendio works with more than 75 lenders , theres a good chance youll find some kind of funding for your startup.

Itemize Your Business Costs

This sounds simple enough, but it actually requires meticulous detail. You have a lot of startup business costs to consider, after all. Some recurring costs include things like rent, utilities, salaries, employee benefits, supplies, and any other materials, services, items, etc. that you need. Youll also need to look at one-time costs like conducting , outside training, consultant fees, office furniture, etc. And its important to look at hidden costs so that nothing gets left behind. Like does the company pay for Joannes lunch? Or stock the vending machines? Or provide coffee? These may seem like simple, benign details but those charges can quickly add up. You want to ensure that youre both careful with your money and that you know how much money to ask for when applying for funding.

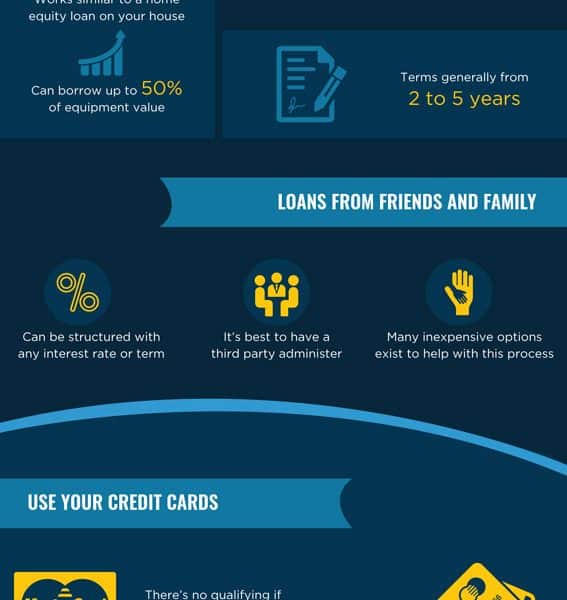

Personal Loans And Financing

Using personal money to start your business can help you get the funds you need when business loans arent available. Here are a few options to consider:

- Personal savings.Bootstrapping your startup can set your business up for later success it can improve your chances of getting a business loan down the road, as lenders prefer to work with business owners who have some skin in the game. However, you might not have enough personal savings to fully fund your needs or grow your business as quickly as youd like.

- Personal loan. Personal loans can be easier to get than business loans because most personal loan lenders look only at your personal credit score. However, personal loans tend to be offered in lower amounts than business loans, and the interest rates tend to be higher.

- 401 loan. If your 401 plan allows loans, youre almost guaranteed to get approved and you wont even need a credit check, since youre essentially borrowing money from yourself. However, 401 loans are risky: If you leave your employer, you may have to pay back the money right away.

- Home equity loan or HELOC.Home equity loans and home equity lines of credit are often some of the lowest-cost borrowing options in terms of interest rates because theyre secured by your home. However, home equity loans and HELOCs can have substantial closing costs. Plus, you also risk losing your home if you cant afford to repay the loan or line of credit.

You May Like: Home Loan Rates In India

Documents Required To Get A Startup Business Loan

- 2 Passport sized photographs

- Proof of identity

- Last six months bank statement

- Proof of income

- Signature proof

- IFSC Code Proof

People can use advanced technology to build start-ups and sell them to large businesses. Amazon and Uber used to buy these buyable start-ups that have the potency to grow. You can also find charitable start-ups that do not generate sales and revenue. These companies are founded by good people who aim to serve the community free of cost.

Is It Hard To Get A Startup Business Loan

Getting a startup business loan can be more difficult than getting approved for financing as an established business. This is because most lenders gauge their risk of borrowing based on the financial stability and history of an applicants business. When considering a new business application, financial institutions must instead base lending decisions on business plans, revenue projections and other theoretical information.

Therefore, it is imperative that startups take time to draft a comprehensive business plan that demonstrates their ability to make on-time debt payments. Startup owners also can increase their approval odds by waiting to apply for a loan until after they can demonstrate established revenue.

You May Like: What Is The Jumbo Loan Limit For 2021

Things To Keep In Mind When Looking To Apply For A Startup Business Loan

Startups looking to get such a loan should ensure the following:

- Make a crisp and detailed business plan.

- State clearly how you intend to use the loan amount in your business plan.

- Summarise the objectives and goals of the business along with a chart that will highlight the potential returns and growth of the venture.

- Give a clear approximation of the funds.

Secured Startup Business Loans

A secured loan requires a pledge of assets to guarantee repayment. If the borrower defaults, then the lender seizes the property to cover the unpaid debt. Assets must equal or exceed the value of the loan. Lenders will also check to ensure that the assets will hold their value over the course of the loan term.

Read Also: Green Arrow Loans Phone Number

Business Loan For Startups

With many entrepreneurs making their mark and moving ahead with path-breaking strides, startups are no longer a derogatory word, in fact, they have become the current buzzword.

At Fullerton India, we offer startup loan for new business to assist young entrepreneurs achieve their entrepreneurial dreams. You can avail a startup business loan if you are of a small or medium-sized firm for different requirements. Your requirement could be a working capital loan – to finance the working capital requirements during expansion or an equipment purchase loan – for purchase of new machinery or specialized equipment, or any other such expense.

Best For Retail: Ondeck

Our favorite for retailers, OnDeck provides a simple yet focused package consisting of a business line of credit and a short-term business loan that can help a store grow out of its infancy and into a noticeable startup, while adapting to the seasonality so common in retail.

-

Requires low minimum credit score

-

Less paperwork than most lenders

-

SmartBox Capital Comparison Tool provides jargon-free cost transparency

-

Financing is not available in Nevada, North Dakota, and South Dakota

-

Not available to businesses in some industries

-

One year in business required

-

Requires frequent repayments

Retail businesses can have seasonal fluctuations, but OnDecks short-term loan and line of credit provide flexible access to smaller amounts of money when it is needed, which keeps the borrowers total interest expense low, making it our best retail startup lender.

Founded in 2007 and headquartered in New York City, OnDeck is an online small business lender. Currently, it is offering two types of business loans: short-term loans and revolving lines of credit. It was one of the first lenders to rely primarily on technology.

Loan Amounts:

- Short-term loans: $5,000 to $250,000

- Revolving line of credit: From $6,000 up to $100,000

Loan Repayment Terms:

- Short-term loans: Repaid daily or weekly for three to 12 months

- Line of credit: Repaid weekly for up to 12 months

- Short-term loans start at 35%

- Line of credit start at 35.9%

Ineligible Industries:

Read Also: Home Loans For People On Disability

How Startup Business Loans Can Help

A startup business loan is designed to help a new business that might not have business credit or access to other types of loans get funding to cover their startup costs and expand the business.

These loans can help small business owners cover a wide range of expenses, such as:

- Buying furniture, computers and other equipment

- Purchasing or leasing office space

- Paying utilities and other overhead expenses

- Purchasing inventory

- Hiring employees

Essentially, you can use a startup business loan for just about any ordinary and necessary expenses for launching and growing your business.

How The Sba 7 Loan Works

You dont get SBA 7 loans directly through the SBA. Instead, they simply guarantee a percentage of a loan made through a regular bank, credit union, or other lending institution.

Once youve shown that you need the funds and have given the lender a business plan thats deemed both reasonable and sound, theyll process your loan and give you the funding. Remember that its critical to draw up a careful budget for using those funds.

Recommended Reading: Valley National Bank Auto Loan

What Types Of Loans Are Available To Start A Business

There are several small business loans available for startups. Youll want to consider all the benefits and risks involved before applying. Any loan you take on for your business should suit your capital needs and growth potential while also having a payback timeline that you can make work. Take note of the following features for any loan you consider:

- Total loan amount

- Interest rates and any associated fees

- Application and processing time

- Repayment timeline

- Collateral requirements and any penalties for late or missed payments

Every viable startup business loan should be able to provide you with this information, if its not available before applying then it should be when the loan is offered.

Is It Possible To Get A Startup Loan If I Have Bad Credit

It is possible to get a startup loan with bad credit, but its more difficult than for better-qualified applicants. Prospective borrowers can bolster their loan applications by developing a comprehensive business plan that specifies how the company plans to make money and describes the business marketing strategy. Some financial institutions also specialize in lending to low-credit borrowers, but these loans may come with higher interest rates and origination fees.

You May Like: When Can I Refinance Out Of Fha Loan

Apply For A Start Up Loan For Your Business

Apply for a government-backed Start Up Loan of £500 to £25,000 to start or grow your business.

Unlike a business loan, this is an unsecured personal loan. Youll need to pass a credit check.

Youll get free support and guidance to help write your business plan, and successful applicants get up to 12 months of free mentoring.

on the Start Up Loans website

Alternative Small Business Startup Loan Options

It can be hard to get a business off the ground without working capital. While there are many ways to go about getting necessary funding, each option has its own drawbacks and advantages. And some startup loans may come with unexpected expenses and fees that can end up limiting a new company in the long run. Those seeking alternative loans for new businesses can consider the following:

- Business Credit Cards: Business credit cards can be a good option for expenses that do not exceed $10,000, especially when you can pay back the invoice each month before interest starts accruing. An added benefit of using this type of financing is that it comes with rewards, like miles or cashback, depending on the card. Keep in mind, though, that a credit card can have higher interest rates than a line of credit. That said, the credit card will be much cheaper if you regularly pay off the card in full each month.

- Angel investor: Young companies can also gain funds through an angel investor. These types of funds often require you to give up some of your equity. Business owners should be careful with this option though, as angel investors could end up owning more of the company than owners might want.

- SBA loan: Individuals who are at the start of their business endeavors, or who may be struggling with current financial imbalances in their companies, can consider applying for grants for small business owners and small business startup loans, such as an SBA loan.

You May Like: How Much Will My Personal Loan Payment Be

Pros And Cons Of Startup Business Loans

If youre considering applying for a business loan, here are a few potential benefits and drawbacks to keep in mind.

| Pros | Cons |

|---|---|

|

Taking on some form of debt allows you to preserve your personal savings You may get immediate access to the funding you need to start or grow your business You dont need to sell part of your business to investors, so you retain complete control |

Most lenders require some time in business, making startup loans elusive for brand new startups Repaying business debt may be difficult if you dont yet have stable revenue Loans available to new businesses may come with higher interest rates and fees |

What Startup Costs Can I Use The Sba 7 Loan For

The SBA 7 loan can be used for a surprisingly wide range of start-up costs, many that you may not have even realized you could use a hand with. Along with buying merchandise and paying employees, you can also finance these items in many cases:

Land. Now, to be clear, you cant buy investment land and sit on it this land has to be the future home of some aspect of your business. But, whether its the new warehouse or the new HQ, you can finance it with your SBA 7 loan. You can also wrap construction costs into that package.

Existing debt. If your existing debt is becoming a crushing mountain of bills, the SBA 7 loan can help you tame it. Instead of 15 payments, youll have one and itll have a lower interest rate and a longer term, making the check much easier to cut.

New equipment or furniture. Whether you need a conveyor system or a cubicle farm, your SBA 7 loan is ready and waiting for you. Maybe one of each?

Also Check: How To Fill Loan Application Form

Do You Meet The Criteria

Apply today and get support with creating your business plan and cash flow forecast.

If youre in a business partnership, buying an existing business or starting a franchise, you can apply for a Start Up Loan if you meet the criteria above. Scroll down this page to find out more about the process for these applicants.

Determine The Type Of Loan You Need

So youve finished your business plan and are ready to prove youll be an ideal borrower. Now its time to be choosy with the type of loan you apply for. You want to ensure you can meet the loan terms, after all. The good news? There are many business loans for startups.

If youre able to qualify, apply for a traditional loan through a bank because youll likely get the best loan rates. However, its difficult for startup businesses to qualify for a traditional bank loan. So if your bank is a no-go, consider some alternatives, most often provided through online lenders. These alternatives can also help you build your business creditjust make sure that your loan reports to the Big 3 . If your loan and payments dont show up on your credit report, you wont build your credit. And that would be a shame.

By signing up I agree to the Terms of Use.

You May Like: Is Grace Loan Advance Legit

Review The Startup Costs You Need To Cover

Here are some common costs that come with starting a business:

- Equipment purchases, like cash registers, machinery, and vehicles

- Technology purchases, like computers, tablets, and printers

- Initial inventory purchases

- Permits and licenses, like city, country, and state licensing

- Initial office supplies

- Business furniture

After you pay these initial costs, youâll have ongoing expensesâlike taxes, rent or mortgage payments, employee payroll, etc.âthatâll you need to cover as you grow your startup.

Once you have a solid understanding of how much funding you need, youâre ready to pursue your startup funding options.

Do Banks Give Loans To Startups

Yes, banks give loans to startups. Whether your startup is in its first week and has not earned its first dollar yet, or your company is in its fifth year borrowing for a new location or additional equipment, banks have programs for you. Most bank programs will require heavy documentation during the application process, and they could range from a business bank credit card to a business line of credit to a short-term or long-term loan.

Read Also: Do I Need Appraisal For Home Equity Loan

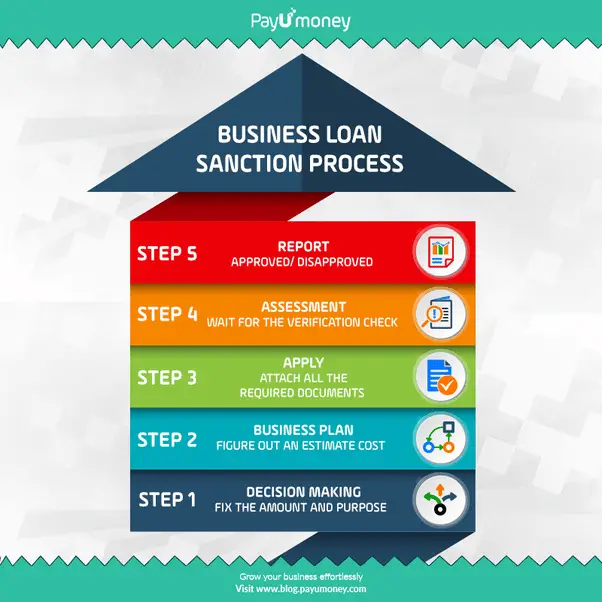

How To Apply For A Startup Business Loan

Step-by-step guide for applying for a startup business loan:

Unsecured Startup Business Loans

Unsecured startup loans do not require a pledge of assets, this means no collateral is required. Typically, the loan decision is made based entirely on the potential of the business and the personal credit history of the business owner. Because the lender carries a greater risk of loss in unsecured lending, interest rates for these types of loans are typically higher than secured interest rates.

You May Like: Minimum Credit Score For Rv Loan