Verify A Website Below

Are you just about to make a purchase online? See if the website is legit with our validator:

vldtr®

PARANORMAL ACTIVITY: Car Goes Uphill by Itself!

TOP 4 MUST-WATCH FRAUD PREVENTION VIDEOS

1. Got a Domain Name? Here’s The Biggest SEO Scam2. Top 5 Amazon Scams in 20213. Top 5 PayPal Scams in 20214. How To Spot a Scam Email in 2021

Review Your Budget And Make A Plan

Now is a great opportunity to review your finances and make a plan for resuming payments. You may need to cut spending in certain areas to make sure you have room in your budget for when payment is due or pull from your emergency fund. Even though the forbearance period has been extended, its still a good idea to take this time to prepare for the future. Sooner or later, your monthly payments will start again and its better to be ahead of the curve.

Is Student Loan Debt Forgiveness Real Debunking The Myth

There are thousands of financial products and services out there, and we believe in helping you understand which is best for you, how it works, and will it actually help you achieve your financial goals. We’re proud of our content and guidance, and the information we provide is objective, independent, and free.

But we do have to make money to pay our team and keep this website running! Our partners compensate us. TheCollegeInvestor.com has an advertising relationship with some or all of the offers included on this page, which may impact how, where, and in what order products and services may appear. The College Investor does not include all companies or offers available in the marketplace. And our partners can never pay us to guarantee favorable reviews .

For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website. All products and services are presented without warranty.

Having student loans can feel like youre drowning. Upside down.

With your feet shackled. But you dont have to be Harry Houdini to escape student loan debt.

Read Also: How Long For Sba Loan Approval

Maintaining Eligibility For Student Loan Forgiveness

Even if you meet all of the requirements for student loan forgiveness, your loans will not be forgiven automatically. Not only do you have to meet the criteria outlined above, you must also certify annually that you continue to meet the requirements for student loan forgiveness. Healthcare workers working for for-profit organizations and healthcare workers working for non-profit organizations without a tax exempt status are ineligible for this type of forgiveness. Healthcare workers who work part-time are also ineligible.

The type of loan and payment plan also matter when determining eligibility for student loan forgiveness – you must have direct loans and you must be paying your loans under an income driven payment plan. If you do not have direct loans, you can consolidate your existing federal loans into a direct loan to qualify. You also should note that your loans do not automatically enter into an income driven payment plan. You will need to contact your loan servicer to choose an income driven payment plan that best fits your needs and goals.

Where Federal Student Loan Forgiveness Stands

Wilson Montoyas final student loan cost was $600 monthly. But with curiosity, he mentioned these funds nonetheless havent made a dent in what he owes.

I started with a $70,000 loan, and now its an $89,000 loan, he mentioned. And Ive been paying for six years, religiously, every month.

As a social employee serving Long Island, NY, paying again loans turned a balancing act between his student debt, mortgage and automobile cost.

It was a struggle every month, Montoya mentioned. Where am I going to get the money from, you know?

Wilson Montoya, a student loan borrower dwelling in New York, says paying his student loans has all the time been a troublesome balancing act, and the pandemic pause on funds gave him some wanted aid.

Millions of debtors like Montoya are ready to see whether or not President Joe Biden will cancel a portion of their federal debt, after he promised on the marketing campaign path to immediately forgive $10,000 per borrower.

The prospect of that promise is now extra pressing for some Americans, as a pandemic pause on student loan funds and curiosity is about to finish on September 30, a freeze first accredited by former President Trump in March 2020.;

Advocates and lawmakers are actually calling on the Biden administration to each prolong that pause and likewise provide long term aid by way of federal debt cancelation.;

Read Also: What Kind Of Loan Do I Need To Buy Land

Bogus Student Help Assistance

If you say yes, regardless if you have a student loan or not, she will proceed by asking a bunch of other personal questions asking you to prove your identity. Once she extracts the personal data that she needs, she will pass you along to a specialist for a bogus student help assistance, who will also grind you on all the info you can give.

Victims that are gullible end up giving bank account numbers and , while others just lose a few hundred dollars as a pre-payment of the whole process, which is promised to save them from the thousands of dollars of debt.

If it was that easy to get away with your student loan, everyone will do it in a second. Sure, certain programs are dealing with student loan forgiveness for teachers, nurses, or others , but their reps are not calling random people offering deals that are too good to be true.

On the other hand, beware of the Biden student loan forgiveness trap. Consider it a red flag every time you hear that term. Many student debt relief companies use it as a catch-all term for free federal programs which they charge to enroll borrowers in.

If you want to enroll in federal programs like income-based repayment and federal student loan consolidation is free to do it on your own through the Department of Education.

See below.

Pei Debt Reduction Program

If youre a PEI resident and you have to borrow at least $6,000 in federal or provincial student loans each year, you could be eligible for a special grant to reduce the debt from your provincial student loan.

Eligible Academic Periods;

If you started your schooling prior to August 1st, 2018, you could qualify for a debt reduction grant of up to $2,000 per year of your studies, which you can apply directly to your unpaid provincial student loan balance. To qualify, you must graduate from your program within one year of filing your application.;

If you commenced your education after July 31st, 2018, you may be eligible for a debt reduction grant of up to $3,500 per year of study. Once again, you may use your grant funds to pay any provincial student loan balances. However, you must graduate within 3 years of sending your application .;

Check out what happens to your student bank account when you graduate.

Eligibility Requirements For The PEI Debt Reduction Program

If you graduated during an academic year prior to, you must submit your application within one year of your graduation date. You also have to submit:

- A completed Debt Reduction Grant application

- A copy of your certificate, degree or diploma

- Your loan statement balances from National Student Loans Service Centre and Edulinx-PEI

Read Also: What Size Mortgage Loan Can I Qualify For

If You Need Student Loan Help

If youre struggling with your student loan debt, first speak with your servicer or lender to:

-

Discuss repayment options.

-

Take a temporary payment pause.

-

Temporarily reduce your monthly payments.

If your problem is with your lender or servicer or youre not getting the help you need, look for a legitimate student loan help organization that offers counseling. Consider these vetted resources for student loan help; they are established organizations with verified histories:

|

Student loan help resource |

|

|---|---|

|

Advice on debt settlement, bankruptcy, default and forgiveness. Licensed in Missouri and Illinois. |

Many of these organizations offer advice for free. In some cases, you may need to pay a fee, as with a certified nonprofit credit counseling agency or if you hire an attorney.

None of the organizations above calls, texts or emails borrowers with offers of debt resolution.

Offers of help that you have not sought out are likely to be scams. While its not illegal for companies to charge for services such as consolidation or enrollment in a payment plan, those are steps you can do yourself for free.

Avoid any debt relief companies that demand money upfront.

Q Are Student Loan Burdens Economically Handicapping An Entire Generation

A. More adults between 18 and 35 are living at home, and fewer of them own homes than was the case for their counterparts a decade or two ago. But these trends are mostly due to these folks entering the work force during the Great Recession rather than due to their student loans. Federal Reserve researchers estimate that 20% of the decline in homeownership can be attributed to their increased student loan debt; the bulk of the decline reflects other factors.

Also Check: Which Credit Union Is Best For Home Loan

Should I Apply For Student Loan Forgiveness

8 Minute Read | September 10, 2021

Back in the day, when you were trying to figure out life after high school, you mightve believed the lie that loans were the only way to pay for college. And now that youre a college graduate staring at a mountain of debt, you probably wish you wouldve explored other options.

It might seem like the government created student loan forgiveness programs because they understand the amount of financial stress graduates face as they struggle to pay back those loans. So nice of them, right? The truth is, forgiveness programs are changing all the timeespecially with all the craziness happening in the world right nowmaking it harder and harder to get those loans forgiven. Heres everything you need to know about these programs and how they actually work.

Student Loan Forgiveness Is Not The Same As Forbearance

Forgiveness eliminates your debt; forbearance postpones your payments. If you’re having trouble making student loan payments, you can ask your lender for forbearance. Your lender may not give you a forbearance if you don’t meet eligibility requirements, such as being unemployed or having major medical expenses.

Interest on your loan will still accrue, and you can pay that interest during the forbearance period if you want. If you don’t pay it, the accrued interest will be added to your principal balance once your forbearance period is up. Your new monthly payment will be slightly higher as a result, and you’ll pay more interest in the long run.

The only relationship between forbearance and forgiveness is that when you’re in forbearance, since you’re not making payments, you’re not making progress toward the payment requirements of a forgiveness program you might be participating in.

Recommended Reading: How Do I Get My Student Loan Number

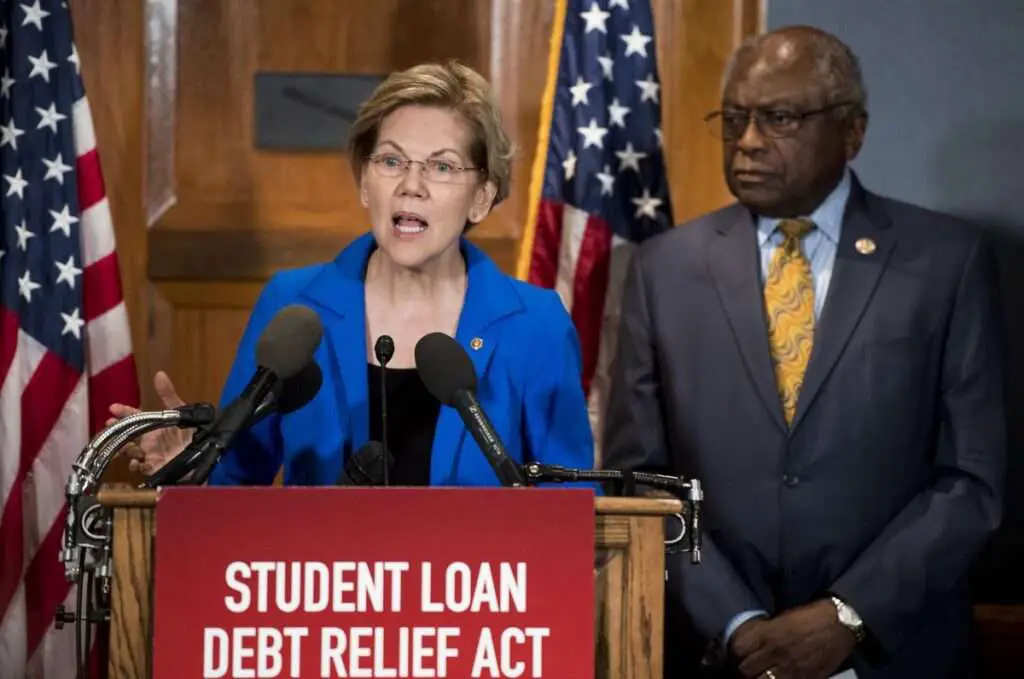

Biden Backed May 2020 Plan To ‘immediately Provide $10000 In Debt Relief’

Then-candidate Biden called for student loan forgiveness several times during 2020.

On March 22, days before Congress passed the $2.2 trillion Coronavirus Aid, Relief, and Economic Security Act stimulus bill, Biden tweeted that the federal government “should forgive a minimum of $10,000/person of federal student loans.”

Additionally, we should forgive a minimum of $10,000/person of federal student loans, as proposed by Senator Warren and colleagues. Young people and other student debt holders bore the brunt of the last crisis. It shouldn’t happen again.

Joe Biden

In May 2020, Biden told The Late Show with Stephen Colbert that he backed a proposal to “immediately provide $10,000 in debt relief as stimulus right now right now for students.”

In October 2020, Biden told CNN town hall questioner that “I’m gonna make sure that everybody in this generation gets $10,000 knocked off their student debt as we try to get out of this God-awful pandemic.”

The pitch was popular: Two national surveys from December 2020 showed that more than half of Americans across the political spectrum supported student loan forgiveness.

After he won the election, however, Biden’s tone shifted.;

In December 2020, President-elect Biden cast doubt on broad student loan forgiveness when he told a meeting of news columnists that the Democratic argument to cancel student debt through executive action was “pretty questionable,” adding: “Im unsure of that. Id be unlikely to do that.

Whats The Earliest My Payment Could Be Due

Student loan payments will resume at the end of January, but thats not necessarily when your student loan payments are due. Look out for a billing statement or some notice from your loan servicer in the next few months to find out your specific due date. The Department of Education suggests visiting its FAQ page regularly between now and then for any general updates.

Also Check: Is Student Loan Refinancing Worth It

Student Loan Forgiveness For Doctors And Nurses In Canada

Eligible family doctors, residents in family medicine, nurse practitioners, and nurses can get Canada Student Loan forgiveness through the federal government. However, only the federal portion of the loan can be forgiven .

Eligibility For Student Loan Forgiveness For Doctors and Nurses in Canada

To qualify for this type of Canada Student Loan forgiveness, you must:

- Have a Canada Student Loan thats in good financial standing

- Be working as an eligible medical professional in an under-served or remote region with a lack of proper healthcare .

- Have been employed for at least one consecutive year in an underserved or remote community and provided at least 400 hours of in-person service.

- Submit an this application

Eligible Medical Professionals

To qualify for Canada Student Loan forgiveness, you must be one of the following medical professionals :

- Family

- Nurse Practitioner

- Family Medical Resident

You may get Canada Student Loan forgiveness for nurses and family doctors and if you are:

- Enrolled in full-time studies

- Repaying a student loan;

- In your non-repayment period

If your loan is in its repayment period, your monthly payments are still mandatory. That said, youre allowed to work as an eligible medical professional in more than one remote or under-served community and with multiple employers if you perform at least 400 in-person hours over a maximum period of 12-months.

Check out what happens to your student debt when you die.

Loan Forgiveness For Nurses

Registered nurses, nurse practitioners and members of nursing faculty, who work in high-need population areas or areas where there is a critical shortage could qualify to have up to 85% of their loans forgiven under the NURSE Corps Loan Repayment Program.

Qualified candidates can have 60% of their student loans forgiven for working two years in an underserved area. Another 25% could be forgiven for working three years.

Some states also offer loan repayment assistance. Go to the Loan Forgiveness for Nurses website to see if yours is one of the 33 states that has one and what the eligibility requirements are.

Read Also: How To Apply Loan In Sss

You’ve Got Options If You Were Denied Pslf

If your application for Public Service Loan Forgiveness was denied, you may be able to receive loan forgiveness under the Temporary Expanded Public Service Loan Forgiveness opportunity.

As part of this opportunity, the Department of Education reconsiders your eligibility using an expanded list of qualifying repayment plans.

This TEPSLF opportunity is temporary, has limited funding, and will be provided on a first come, first served basis. Once all of the funds are used, the TEPSLF opportunity will end.

Visit StudentAid.gov for detailed information on how to be reconsidered for loan forgiveness.

% Of Student Loan Borrowers Will Get Rejected For Student Loan Forgiveness By 2026

According to monthly projections from PHEAA the student loan servicer that manages the Public Service Loan Forgiveness program PHEAA expects only 276,370 student loan borrowers to secure public service loan forgiveness through January 2026. These student loan borrowers represent approximately 20%, or 1 in 5 borrowers out of 1,250,373;who have currently declared their intent to pursue public service loan forgiveness. The first student loan borrowers became eligible for student loan forgiveness in 2017, which means that nearly a decade later, nearly 80% of student loan borrowers will still be rejected.

Read Also: How To Get Sba 7a Loan

Student Loan Forgiveness: Final Thoughts

President Joe Biden has cancelled almost $10 billion of student loans. . Bidens approach has been based on targeted student loan cancellation, but he has not focused on actively revising the Public Service Loan Forgiveness program. . If Congress intended for the Public Service Loan Forgiveness program to provide student loan relief to public servants, then student loan cancellation hasnt been made available as widely as anticipated. Presidents George W. Bush, Barack Obama and Biden all have supported the Public Service Loan Forgiveness program. President Donald Trump eliminated the program from his proposed budget, and believed that student loan forgiveness should continue to be available for everyone through income-driven repayment plans. Biden, along with U.S. Secretary of Education Miguel Cardona, are focused on improving the program and outcomes for student loan borrowers. . The Education Department has been soliciting feedback from the public on how to improve student loan forgiveness and student loan cancellation. This could lead to substantial changes in the program to help more student loan borrowers get more student loan forgiveness. Biden also has proposed to cancel student loans after five years, rather than 10 years, which could result in $10,000 of student loan forgiveness for each year of service for a total of $50,000 of student loan cancellation.