Interest Rate By Loan Term

The interest rate you get can also depend on your cars loan term. In fact, the average interest rate on a 60-month car loan from a commercial bank in the first quarter of 2021 was 5.21%, according to the Federal Reserve.

While some lenders may charge lower rates for a longer term, others like credit unions offer higher rates for longer terms.

How does loan term change the amount I pay?

The longer your loan term, the lower your monthly payment. However, it makes the total cost higher. For example, if you borrow $15,000 for a used car and your lender offers you a 10.5% interest rate, your monthly payments and total interest can vary greatly.

| Loan term | |

|---|---|

| $281.68 | $5,281.29 |

As you can see, your monthly payments are lower the longer you borrow, but youll end up paying about $1,000 more in interest each year your loan is outstanding.

Moreover, lenders generally charge lower interest rates for shorter loan terms. If you want to get the lowest rate possible, calculate your monthly car loan payments and interest charges based on different loan terms. This helps you determine the minimum term you can afford based on your interest rate to save money.

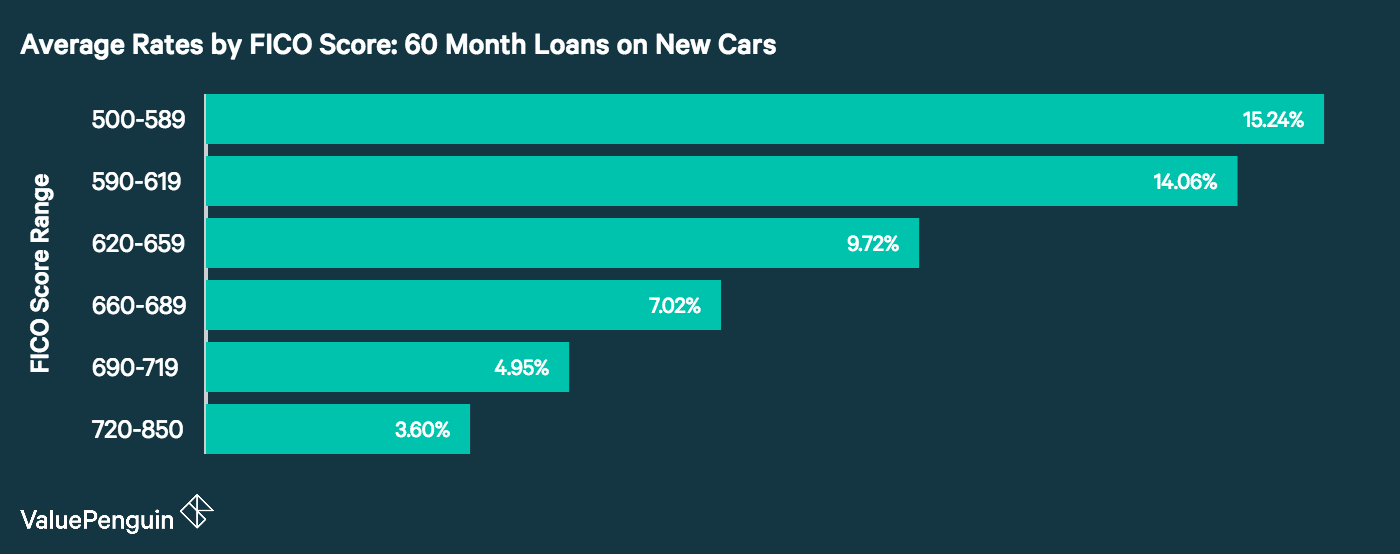

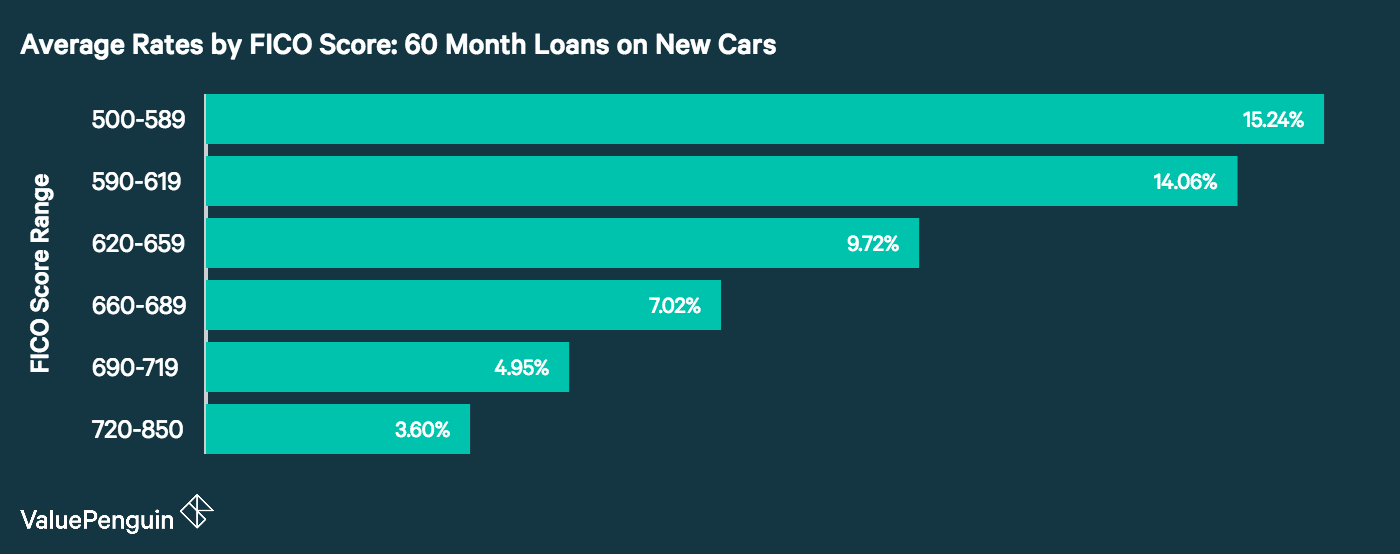

What Is A Good Interest Rate For Your Car Loan

When you are , you want to avoid overpaying and make sure you get the best interest rate possible for your car loan. Keep your credit score in mind when taking a look at the chart below. Here, you can learn more about the average new and used car loans based on credit scores and the APR, or Annual Percentage Rate, for that average. To take some of the hassles out of shopping for a new car, you can apply for financing in advance from the comfort of home.

How Does A Low Apr Save Me Money

A shorter loan term with a low APR is the best option for a financially beneficial car loan. The less time is spent paying off the loan, the less time there is for interest to accrue so a two to five year loan is ideal. Lenders also offer lower APR with shorter terms because the borrowers will take less time to repay the loan. A high APR paid even over a short loan term will quickly add up. Longer loans can provide lower monthly payments, but cost most in the long run.

A five-year loan at $28,800 with a 4.96 percent APR will accrue $3778 over the life of the loan. The same loan amount and term with an 11.93 percent APR will accrue $9577. For borrowers in the deep subprime credit ranking, that same loan amount and term with an APR of 23.81 percent will cost them $20,721 in interest over the life of the loan. Therefore, a low APR can save over $15,000 throughout the term of a car loan.

You May Like: Usaa Pre Qualify Home Loan

Should I Get An Auto Loan From The Dealership Or The Bank

Choosing between a dealership and a bank for an auto loan is complicated. In general, dealerships may offer higher rates than banks but this may not be the case for used cars. Regardless, it’s important to get quotes from a few banks or online lenders first that way you can come to the dealership prepared. Ask for a quote from the dealership as well, comparing rates, terms and any additional fees.

Get Current Auto Loan Rates And Choose A Loan Thats Right For You

Car loan interest rates change frequently, so its important to keep track of them. Your loans interest rate influences how much youre going to pay for month to month. And a lower interest rate can mean thousands of dollars in savings. Our rate table can help you know the best time to buy a new or a used car.

Current auto loan interest rates| 4.40% |

Also Check: Usaa 84 Month Auto Loan

Additional Car Related Expenses To Think About

While your monthly car payment is likely the biggest expense associated with owning a vehicle, there are a variety of other expenses you should prepare for.

- Gas An SUV, pickup truck or another gas guzzler will cost you far more in the long run than a car with a smaller engine or hybrid-electric power.

- Maintenance The more luxurious or rare your car is, the more expensive and difficult it can be to maintain. It can also lose value if you dont keep it in shape.

- Repairs Some cars are harder and costlier to fix than others. Your mechanic might charge extra if they dont specialize in working on your specific vehicle or a part is hard to find.

- Insurance Many things can lead to high car insurance premiums. For example, if youre younger than 25, you buy a newer car, or you have a bad drivers history.

- Registration Fees can vary based on your region, what type of license plate your car needs and how heavy it is .

Buying a car? Learn how to properly budget for a car.

Average Rates For Auto Loans By Lender

Auto loan interest rates can vary greatly depending on the type of institution lending money, and choosing the right institution can help secure lowest rates. Large banks are the leading purveyors of auto loans. , however, tend to provide customers with the lowest APRs, and automakers offer attractive financing options for new cars.

Also Check: Capital One Auto Loan Private Seller

What Is The Average Car Loan Interest Rate In Canada

Home \ Auto \ What is The Average Car Loan Interest Rate in Canada?

Join millions of Canadians who have already trusted Loans Canada

Want To Lower Your Car Payments?

Speak with a Loans Canada representative today and learn how you can refinance your car loan and save. Call us today at:

Note: Program is currently not offered in Quebec.

If youre in the market for a new or used car, its likely that youll need to secure some financing for your purchase. When applying for a loan, youll find that the interest rate is an important factor in determining exactly how much the loan will cost you. The interest rate identifies how much extra money you will be paying back in addition to the principal. Interest rates vary, and to get a competitive rate, you will need to have a strong financial status capital, income, and credit rating. Lets take a look at car loan interest rates in Canada.

More Ways To To Get A Good Interest Rate On A Car Loan

Aside from raising your credit score, opting for the shortest loan term you can afford, and choosing the right car, there are several other ways to get a better loan rate.

Shop around. A 0% promotional offer from a manufacturer or dealer could be hard to beat. Otherwise, you may find that dealer financing is more expensive than going through your local bank or or using an online lender. With a bank or credit union, you can apply for preapproval, which will tell you how much money they are prepared to lend you and at what interest rate. Being preapproved for a loan also gives you leverage in negotiating with the car dealer.

Negotiate. Just like the price of the car, the interest rate youll pay on a car loan can be negotiable, particularly at the dealership. Car dealers often work with one or more lenders. After they have reviewed your financial information, the lenders will propose an interest rate to charge you, known as the buy rate. The dealer, however, is likely to pad that rate and offer you a higher one as a way to increase their profit margin. That gives you some room to negotiate.

Get a cosigner. If a low credit score is the problem, then asking a relative or other person with a better score to cosign the loan could help you get a lower rate.

Recommended Reading: When Can You Refinance An Fha Loan

What Determines Average Auto Loan Rates

The most important factor that decides your auto loan rates is your credit score. The better your score, the lower your APR will be. The best rates are reserved for those with credit scores above 800, but according to Equifax, any score above 670 makes you a low-risk borrower and opens the door to lower average auto loan rates.

However, your credit score isnt the only determining factor. Employment status, income, and the type of vehicle you purchase also affect rates. Having a steady income stream and purchasing a newer vehicle will result in better auto loan rate offers.

How Average Interest Rates Vary For Loans For New And Used Vehicles

The average interest rates on auto loans for used cars are generally higher than for loans on new models. Higher rates for used cars reflect the higher risk of lending money for an older, potentially less reliable vehicle. Many banks wont finance loans for used cars over a certain age, like 8 or 10 years, and loans for the older models that are allowed often carry much higher APRs. One leading bank offers customers with good credit interest rates as low as 2.99% for purchasing a new model, but the minimum interest rate for the same loan on an older model from a private seller rises to 5.99%.

The typical auto loan drawn for a used car is substantially less than for a new model, with consumers borrowing an average of $20,446 for used cars and $32,480 for new. However, terms longer than 48 or 60 months are generally not allowed for older model used cars, as the potential risk for car failure grows with age.

Recommended Reading: What Car Can I Afford With My Salary

How Do Lenders Decide What Interest Rate To Charge You

When it comes to deciding the interest rate for a car loan, lenders will consider many different factors, including:

Car Loan Terms

When buying a new car, lenders often offer longer loan terms to accommodate new buyers. However, the longer loan term will certainly be accounted for in the interest rate. Generally, a longer loan term equates to a higher interest rate and a higher overall price.

Vehicle Status

If you opt for a secured personal loan, your car will act as security or collateral in the event that you cannot pay the lender back. Cars are quickly depreciating assets so, lenders will account for that throughout the term of the loan. If you cannot pay your loan and your car has depreciated or malfunctioned, the lender takes a risk. They may increase the interest rate after some time has passed. Furthermore, old cars tend to encourage higher interest rates. New cars may encourage lenders to offer lower interest rates.

Experts recommend knowing your before you apply for a car loan. Your credit score is important to a lender, as it lets them look at your history of debt repayment. If you have a lot of debt and expenses, lenders will see you as a higher risk borrower, resulting in a higher interest rate. If you have a great credit score, you have a higher chance of securing a lower interest rate.

Down Payment

Debt-to-Income Ratio

Employment Stability

The Economy

Production Starts For The Skoda Octavia Ahead Of Its Launch In The Country

Production has begun for the Skoda Octavia ahead of its launch in India. The car will launch later in April and deliveries will begin from the end of May. The car was earlier spotted testing in the country. Some of the main features of the vehicle are leather upholstery, three-zone climate control, and an electric sunroof. The car is powered by a 2.0-litre petrol engine that is BS6 compliant. The vehicle is expected to be priced between Rs.18 lakh and Rs.24 lakh. The new Octavia will compete against the Hyundai Elantra.

7 April 2021

You May Like: Loan License In California

What Is The Difference Between An Auto Loan And A Personal Loan

It’s possible to use a personal loan or an auto loan to finance a vehicle, but the two differ in some important ways:

- Purpose: Personal loans are unsecured or secured and can be used for many different purposes, including to finance a vehicle, pay for a vacation, or make improvements to a home. Car loans, however, are strictly to finance a vehicle and are secured against the vehicle you purchase. The vehicle serves as collateral.

- Interest rates: Because auto loans are secured, rates on car loans are generally lower than personal loans.

- Availability: Auto loans are typically easier to obtain than personal loans, especially for those with a poor credit history.

Where To Find The Best Auto Loan Rates

The table below shows the lenders that offer the lowest auto loan rates. However, just because a loan provider offers low APRs does not mean everyone is eligible for that rate. Loan terms vary by individual, and there is no single best lender for all drivers.

Some lenders, like PenFed, offer car buying services. This means you can shop for a car and finance it in one place. Also, some lenders offer both purchase and refinancing loans, while others will offer either one or the other.

Best Auto Loan Rates| Varies by lender |

Drivers with poor credit are unlikely to be eligible for the interest rates noted in the table above. If you have poor credit, try comparing offers from multiple lenders using a site such as AutoCreditExpress.com. This site also specializes in finding loans for borrowers with bad credit, so if you have trouble finding auto loan offers, its worth checking.

When comparing loans, be sure to only submit applications to auto lenders that allow you to prequalify without a hard credit check. Hard credit checks can hurt your credit score even further. A good first step is to use an auto loan calculator to predict what your payment and total loan cost would be.

Recommended Reading: Capital One Auto Loan Approval

Dealer Financing Vs Car Loan Rates

Dealership financing is often more expensive than borrowing from a third-party lender. But there are some situations where you can get a better deal, such as:

- When it offers 0% financing. Some dealerships offer financing as low as 0% especially if they want to move certain models out of the lot.

- When you have a preapproved loan. You can use your preapproved loan from another lender as leverage to get a better rate at the dealership.

- When you want to negotiate. Even if you arent preapproved, dealerships are often flexible about rates and terms on their loans, unlike other car loan providers.

Can I really get a car loan with a 0% APR?

Its possible, but it depends on your credit and most deals are only available from manufacturers on new cars. Often, youll need nearly perfect credit to qualify, and its usually only available for certain makes and models.

Agreeing to a 0% APR auto loan may also mean foregoing other offers or promotions, like a manufacturers rebate. Ultimately, if you qualify, youll want to crunch the numbers to make sure its the best deal for you.

LEARN MORE: What dealerships dont want you to know about 0% car loans

Can I Get 0% Financing On A Car Loan

You may see dealerships advertising 0% financing on their cars. With 0% financing, you buy the car at the agreed-on price, and then make payments on the principal of the car with no interest for a number of months. However, keep these points in mind:

- 0% interest may only be offered for part of the loan term.

- To be approved, youll need spectacular credit .

- Negotiating the car price will be difficult.

- 0% interest car financing is only available to certain models.

- You may not get as much money for your trade-in vehicle.

- The loan structure will likely be set in stone.

Recommended Reading: Usaa Student Loan Rates

National Average Auto Loan Interest Rate

As of 2021, the average interest rate for a 48-month loan on a new car is 5.21 APR. The average rate for a 60-month loan is 4.96 APR.

These rates are constantly changing and there will be many different factors that determine your individual rate but this will help you decide if your offered rate is close to the national average.

If you have been considering purchasing a new car, it is important to know what the average auto loan interest rates are. Understanding this will help you pay the least amount for your car possible and can give you a good idea of what a reasonable rate is. Having something to compare with the loan rate you are being offered is a great way to shop around and get the best deal.

There are many different ways that auto loan interest rates are calculated. It should be noted that interest rates are never set in stone and they will fluctuate with the automotive finance market. There are also a lot of things you can do to save yourself some money on a new or used car loan.

How Do I Refinance My Car Loan

Refinancing a car loan is essentially just taking out a new car loan so the steps for applying are mostly the same. You’ll need your driver’s license, Social Security number and proof of income, as well as details about your car. If approved, you’ll use the funds from your new loan to pay off your old car loan, then begin making monthly payments with your new interest rate and terms.

Read Also: One Main Financial Approval Odds