Keep Credit Card Accounts Open

Dont close old credit cards. If you have old credit cards that you arent using, its still a good idea to keep them. Closing old accounts can hurt your score by shortening your average account age and reducing your overall credit limit.

When youre ready to buy a car, deal with that first before you consider financing for anything else. Its also best to do your rate shopping relatively quickly so it doesnt look like youre applying for a bunch of new loans.

Remember, no matter how tempting it may be to go with a fancier car, you have to be able to afford your monthly payments. After all, being late or overdue will only hurt your credit score and your chances of better rates on future loans.

How Fico Decides Your Base Score

The exact process used to gauge your credit score is a bit of a mystery. That said, there is a basic formula used to gauge your credit. This formula includes your payment history, how much you owe, the length of your credit history, new credit sources, and the type of credit you are currently using. It is important to understand that these variables are not weighed at the same percentage.

For example, payment history and amounts owed make up 35 and 30 percent of your score, respectively. As a result, they dictate nearly two-thirds of your credit score.

The length of credit history, new credit sources, and the types of credit you are currently using are weighed at 15, 10, and 10 percent. As a result, the history of your loan amounts is much more important than current credit amounts.

This fact means that having a 650 base score isn’t too bad for n auto loan. That’s because it showcases you have done an average job of paying your debts and owe a reasonable amount of debt. It also indicates to lenders that you are currently managing your credit at a reasonable rate.

However, your auto FICO score, while influenced by your base score, is rated differently and can vary from your base score in hard-to-predict ways.

How To Improve Your Credit Score Before Applying For A Mortgage

While a FICO® Score of 650 may be sufficient to get you a mortgage, you may be able to improve your credit profile as preparation for a mortgage application within as little as six months to a year. Taking steps to increase your credit scores could help you qualify for lower interest rates, saving you many thousands of dollars over the life of a mortgage loan.

Measures to consider for improving your credit score include:

A 650 credit score can be a solid platform for getting the house you need. It can help you qualify for a mortgage, but it’ll likely be one that carries a fairly steep interest rate. It’s also a score you can build on to help you get a more affordable loan, today or in the future, when you refinance or buy a new home.

Don’t Miss: What Does Usaa Certified Dealer Mean

The Importance Of Improving Your 650 Credit Score

Imagine what you could do with the extra $2,200 you could have saved over that seven-year lending period. You could have gone on a vacation to Acapulco or visited Europe for a few weeks. That’s why it is so essential to take steps towards improving your credit score.

Thankfully, you can boost your score from 650 more quickly than you’d think.

How Does A Car Loan Affect Your Credit Score Test

Applying for a car loan will reduce your usage of the loan, which in turn will increase your credit score before you make your first payments. When you start paying, your loan utilization increases, lowering your credit rating until the loan is paid off or the balance is 30% or less of the original loan amount.

Read Also: What Credit Score Does Usaa Use For Mortgage

Is Capital One Trustworthy

Capital One is rated an A by the Better Business Bureau. The BBB, a non-profit organization focused on consumer protection and trust, determines its ratings by evaluating a business’ responses to consumer complaints, honesty in advertising, and clarity about business practices.

Keep in mind that a top-notch BBB score doesn’t ensure you’ll have a good relationship with a company.

Capital One does have one recent controversy. The US Treasury Department fined Capital One $80 million after the Office of the Comptroller of the Currency said the bank’s poor security around its cloud-based services helped to account for a 2019 data breach in which a hacker accessed over 140,000 social security numbers and 80,000 bank account numbers.

What Is The 650 Credit Score Auto Loan Interest Rate

You can get a car loan with a . Looking for a 650 Credit Score Auto Loan Interest Rate can be a daunting task, but it’s doable.

You cant expect the best interest rate but you can expect to have some space to work with and you have room to improve.

A lender will give you a chance and depending on your other resources, you can get an interest rate that wont completely break the bank.

You are in the FICO Fair zone and you will still have a few options to take advantage of when shopping around.

Also Check: Bayview Loan Servicing Reviews

Do Auto Lenders Use The Same Credit Score As Other Lenders

There are a wide variety of credit scores to help meet different lenders needs. Because auto lenders place more importance on certain credit information, such as your history of making car payments, the credit score one auto lender sees may be slightly different from the score pulled by other lenders. Some of the credit score models specific to auto loan decisions include:

- FICO® Auto Score 2

- FICO® Auto Score 5

- FICO® Auto Score 8

There shouldnt be a huge difference between the score you may see for free from your bank or credit card issuer, but if youre really curious to see your FICO® Auto Score, youll have to pay a fee of $29.95 a month to myFICOs FICO® Advanced service.

Student Loans: What Interest Rate Hikes Mean

For the last several years, the Federal Reserve has kept interest rates low. In 2022, the Federal Reserve indicated that it may raise interest rates up to three times to combat inflation. Generally, when the Federal Reserve hikes interest rates, the cost of borrowing increases. This means that your mortgage, for example, could become more expensive. While debt become more expensive to borrow, savers can earn a higher return on the money in their bank account. Specifically, the Federal Reserve changes the federal funds rate, which is the rate that financial institutions charge each other to borrow money overnight. The change in the federal funds rate impacts the interest rate you pay on your credit card debt or the funds you earn in your savings account. What about student loans? .

Don’t Miss: Co Applicant For Home Loan

What Credit Score Do I Need For A Car Loan

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

A better credit score can increase your chances of approval for loans and credit cards and can also get you better interest rates and other terms. With some types of loans, like mortgages and credit cards, you simply cannot get approved if your credit score is below a certain amount.

Auto loans are a different story. There isn’t a set FICO® Score floor for auto lending, and a good percentage of auto loans made in the U.S. are to borrowers with ultra-low credit scores.

With that in mind, here’s a rundown of how to check and interpret your own , what it means to you as a potential auto loan borrower, and a few money-saving tips that you should use in the auto-buying process, regardless of your credit score.

Find The Right Option To Continue Building Credit

When youre young, turning 18 can feel like receiving the keys to the kingdom or, at least, part of the kingdom. But while new opportunities are unlocked at age 18, not even hitting adulthood opens every door it will take longer for some things to become available.

Similarly, having a credit score between 600 and 650 unlocks a number of credit doors firmly closed to consumers with lower scores. However, some credit products will still require more work.

To continue on the credit journey and unlock even greater credit opportunities, youll need to keep up the work of building your credit score and history. With time and responsible credit use, few credit products will be out of your reach.

Range of credit scores covered in this article: 600, 601, 602, 603, 604, 605, 606, 607, 608, 609, 610, 611, 612, 613, 614, 615, 616, 617, 618, 619, 620, 621, 622, 623, 624, 625, 626, 627, 628, 629, 630, 631, 632, 633, 634, 635, 636, 637, 638, 639, 640, 641, 642, 643, 644, 645, 646, 647, 648, 649, 650

Also Check: How Long Does Sba Loan Take To Get Approved

How Lenders View A 650 Credit Score Car Loan

When you have a 650 credit score, you are in a unique situation. While 650 is considered a fair credit score, it is very close to being considered a poor rating. Even dropping a single point will put you in the poor category. As a result, lenders may be a little jumpy when offering you a loan for a car.

That said, you shouldn’t have a hard time getting some loan from most lenders. However, you are more likely to run into some complications. That’s because lenders see those with a 650 credit score is capable of two types of changes.

First of all, you could improve your credit and make all of your payments on time over an extended period. This payment success showcases that you are not a risk and will make them happy to loan you.

However, you are also a risk with this rate because your score could drop if you miss even a single payment during your loan’s lifetime. As a result, having a 650 credit score is kind of like walking a tightrope over a raging waterfall.

Making it to the other side will be fantastic, but one false step and you’re tumbling into dangerous territory. Unfortunately, it’s not quite as exciting as this description would lead you to believe.

That is why having a 650 credit score may complicate your auto loan shopping and make it more difficult for you to get the car you want.

For example, lenders who see you have a 650 credit score may:

How Does A Car Loan Affect Your Credit Score To Check

Getting a new car loan has two predictable effects on your credit score: It adds extensive research to your credit report that can temporarily lower your score by a few points. Car refinancing affects your credit in a similar way. This increases your creditworthiness, which is beneficial if you always pay on time.

Recommended Reading: Upstart Vs Avant

How Does The Auto Loan Calculator Work

Instead, it can help you estimate the interest rate to enter into the car loan calculator based on the average interest rates that people of different credit received on car loans in the first quarter of 2021. Keep in mind that there are different solvency models. and different lenders may use different models.

What Credit Cards Can I Get With A 650 Credit Score

As stated above, a 650 credit score falls into the fair credit category but its only 20 points away from jumping into good territory.

You can gain those 20 points as negative items on your credit report, such as late payments, get a little older and lose some impact on your score. If you arent in a hurry to acquire a credit card, you may want to consider waiting until you graduate into good territory and evaluate the credit cards available to you then.

But if you cant wait or you want to acquire a credit card to help you make that jump then you can research your options for fair credit, including the cards listed above.

The cards youll potentially qualify for will often include higher interest rates and added fees. Some issuers offer multiple cards for consumers in different credit categories. In many cases, the issuer can upgrade you to a better card when you prove that youre a responsible cardholder and your credit score improves.

Recommended Reading: Usaa Used Auto Loan

Can A Car Loan Improve My Credit Score

Given a score of 650, youve probably had a few slip-ups in terms of debt repayment or unpaid bills, but nothing too major like bankruptcy or repossession. Still, getting your score into the 700s could save you a lot of money in the long run. Heres the good news: a paid-as-agreed vehicle loan will improve your scores. Thats because its a significant debt to take on, and paying it off as agreed displays a good deal of financial responsibility just the kind of thing a lender is looking for in a borrower. Your score will not just magically go up the moment you pay off the loan. Rather, your history of on-time monthly payments is the important factor, not the pay-off even itself. Therefore, your scores will gradually improve as you pay off the loan.

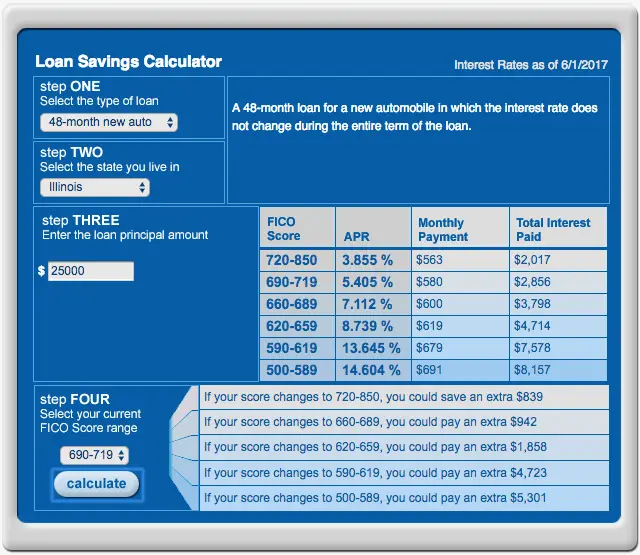

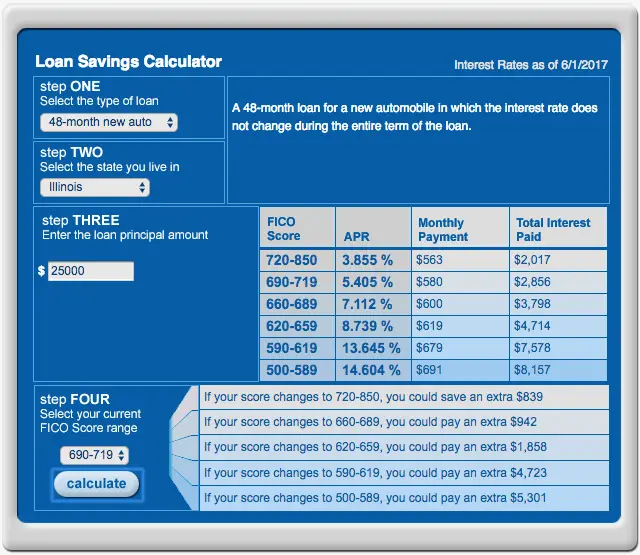

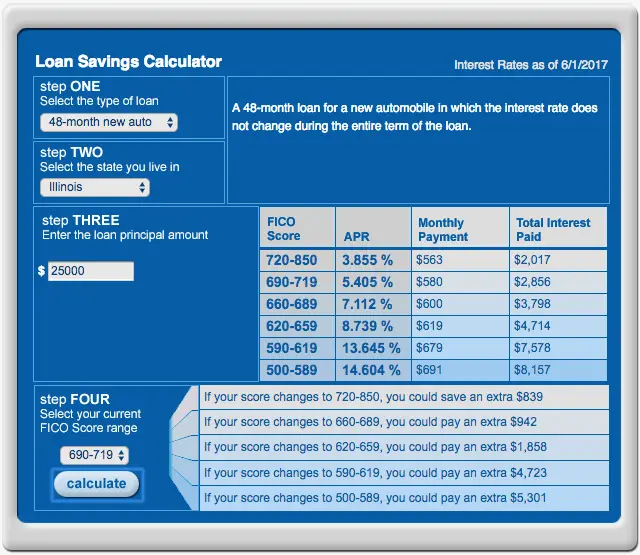

How Does My Credit Score Affect My Car Loan Interest Rate

In general, however, the following applies: The higher your creditworthiness, the greater your chances of a low interest rate and less stringent credit conditions. For example, if you have good credit, you can finance a new car purchase for $30,000 annually for 60 months.

Whats a good credit score to buy a carWhat’s the lowest credit score you can have to buy a car? A credit score of 660 or higher should get you a car loan at a good interest rate, but borrowers with a score of only 600 or even 500 have options.Can I buy a car with a poor credit score?Yes really! You can buy a car with bad credit, but you may have to pay a higher annual rate or need a family member or friend as collateral. Yes really! You can

Recommended Reading: Refinance Car Loan Usaa

Hard Inquiries Affecting Credit Score

Of course, there are many options for auto loans with a , itll just take a bit of research.

Just be aware that dealerships will send your information to multiple lenders in hopes of finding decent financing terms.

Typically, inquiries will remain on your credit report for two years. Theyre categorized as hard inquiries and usually negatively affect your credit score.

However, will be made.

For this reason, FICO® counts hard pulls made within 45 days for auto and home loans as one, VantageScore® has a shorter time-frame at only 14 days.

Disclaimer: The information on this site should not be considered as expert financial advice. Please seek a professional for any financial guidance in any way.

Related Articles

Beware These Car Loan Mistakes

Regardless of whether you have excellent credit, terrible credit, or you’re somewhere in between, there are a few potentially-costly mistakes that are important to avoid.

Recommended Reading: Usaa Refinance Car Loan

Increase Your 650 Credit Score And Lower Your Auto Loan Interest Rate

As we can see from the data mentioned above, a 650 credit score auto loan interest rate will be approved. The main downside is the higher interest rate a borrower would have to pay.

If you were to hold off on purchasing a car until youve reached a higher rating, then you could potentially save hundreds of dollars off future loan payments.

Conversely, if a vehicle is needed relatively soon, making on-time monthly payments will eventually increase your score which opens up the possibility to a favorably refinancing situation.

How Can I Increase My Odds Of Getting A Low

Before you apply:

When you apply:

Recommended Reading: How Much Loan Officer Commission