Understanding Fha Loan Mortgage Insurance

FHA borrowers have to pay two types of FHA mortgage insurance to protect FHA-approved lenders from the financial risk of defaults. The first is an upfront mortgage insurance premium of 1.75% of your loan amount, which is charged at closing and typically added to your mortgage balance.

The second is an ongoing annual mortgage insurance premium that ranges from 0.45% to 1.05%, depending on your down payment and loan term. Its charged annually, divided by 12 and then added to your monthly payment. Heres an example of how much FHA mortgage insurance youd pay on a $300,000 loan amount assuming you make a 3.5% with an annual MIP charge of 0.85%.

FHA UFMIP calculation:

- Convert 1.75% to the decimal

- Multiply by the loan amount: 0.0175% x $300,000 = $5,250 FHA UFMIP premium added to your loan amount

- Convert 0.85% to a decimal

- Multiply by the loan amount 0.0085% x $300,000 = $2,550

- $2,550 divided by 12 = $212.50 monthly MIP charge added to your monthly payment

There are some important differences between FHA mortgage insurance and conventional private mortgage insurance :

Youll typically pay FHA MIP for the life of your loan. This is true if you make a minimum FHA 3.5% down payment. However, if you can make at least a 10% down payment, MIP drops off after 11 years. You can get rid of conventional PMI once you can prove you have 20% equity.

Questions To Ask Your Lender Or Broker When Getting Preapproved

When getting preapproved, ask your broker or lender the following:

- how long they guarantee the preapproved rate

- if you will automatically get the lowest rate if interest rates go down while youre preapproved

- if the pre-approval can be extended

Ask your lender or broker about anything you dont understand.

Read Also: What Is The Average Auto Loan Interest Rate

Fha Loans: What You Need To Know In 2021

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

The Federal Housing Administration backs home loans with flexible borrowing guidelines for homebuyers who might not qualify for conventional loans with more stringent requirements. FHA loans are popular with first-time buyers who may have little savings and credit issues, and the government backing allows many lenders to offer lower average rates than conventional mortgages.

You May Like: Usaa Rv Buying Service

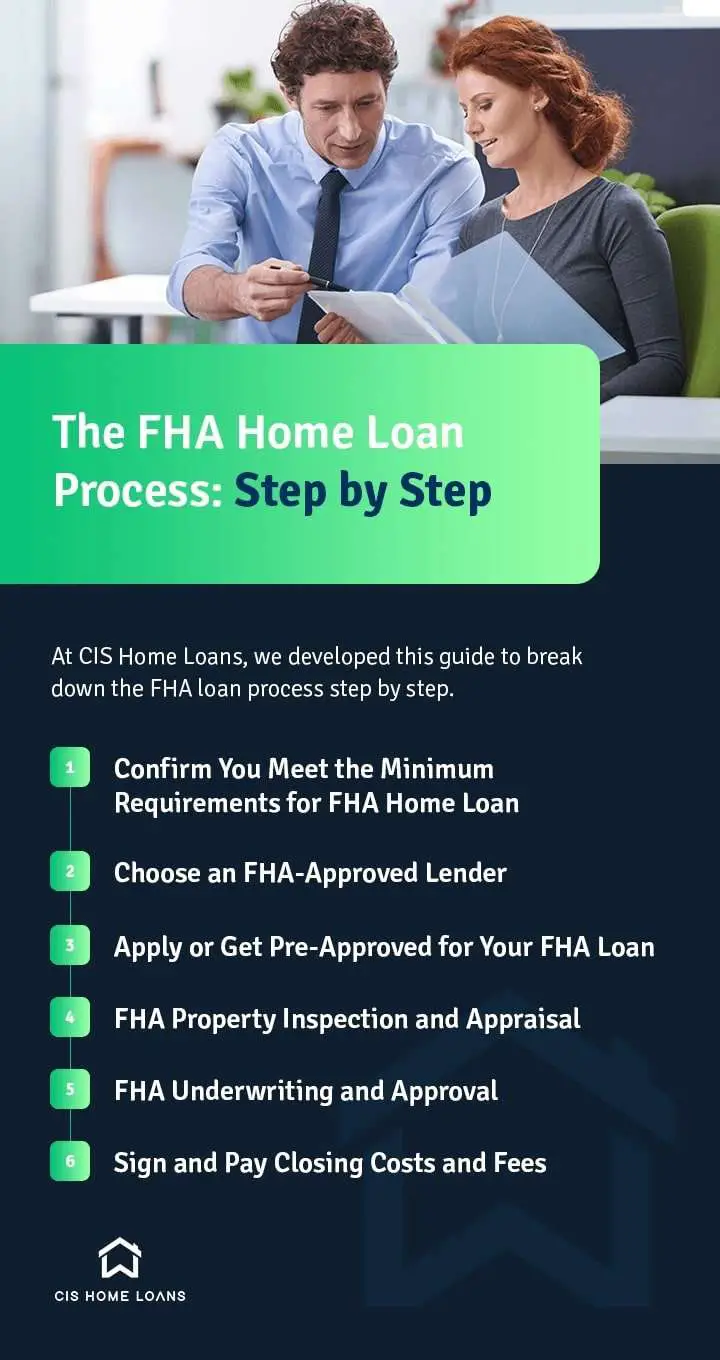

What Happens After You Apply For An Fha Loan

The typical timeline from application to closing with an FHA loan ranges from 30 to 45 days.

During this time, your loan file goes through underwriting. The underwriter takes a closer look at your application and reviews supporting documents to ensure you meet the minimum guidelines for FHA financing.

- The underwriter will review your current debts and minimum payments, then calculate your debttoincome ratio

- The underwriter will review your bank statements and other assets to confirm that you have enough in reserves for the down payment and closing costs. If your down payment is coming from a cash gift or down payment assistance, youll need documents verifying the source of the funds

- The underwriter will review your previous tax returns and W2s statements to confirm a twoyear history of stable, consistent income

- The underwriter will review your recent pay stubs to confirm youre still employed and earning income

- The mortgage lender will schedule an appraisal to determine the homes current market value. You cannot borrow more than the property is worth

You should also schedule a home inspection after getting a purchase agreement. A home inspection isnt required for loan approval, but its recommended because it can reveal hidden issues with the property.

If your offer was subject to a satisfactory home inspection, you can ask the seller to correct these issues before closing.

Submit requested information as soon as possible to keep closing on schedule.

Benefits Of Fha Loans

There are a variety of benefits to FHA loans. One of the main benefits is the ability to purchase a home with an incredibly low down payment, e.g., as low as 3.5% of the homes value. Other loan programs typically involve a significantly higher down payment and/or require the borrower to achieve an excellent FICO score .

Another benefit comes with assumable FHA loans. Buyers can assume someone elses FHA loan, simply picking up in the repayment process where the previous borrower left off. This practice might enable the assuming borrower to reap the benefits of lower interest ratesInterest RateAn interest rate refers to the amount charged by a lender to a borrower for any form of debt given, generally expressed as a percentage of the principal. if the loan was originated during a time when interest rates were substantially lower than at the time the loan is assumed. If the buyer needed to obtain a new mortgage, it would come with a higher interest rate and correspondingly higher mortgage payments.

Don’t Miss: Fha Loan Limits In Texas

A Little Preparation Goes A Long Way

Finding the right home takes time, effort, and a bit of luck. If you’ve managed to find a property that’s right for you and your budget, then it’s time to get one step closer to homeownership by applying for a mortgage loan. And while this is one of the biggest financial decisions you can make, knowing how to start and what you need will put you one step ahead of other potential homebuyers.

Finish Forms And Provide Documentation

Finish the form MU1 filing. This is a needed application for all new units. It contains the basic organization information or data and the economic history of the organization and the officers. Finish this in detail to save delays or denial. Give any supplemental documentation needed. Finish a and background.

If you plan to be a mortgage loan provider the original lender- some additional economic documents are needed in the application procedure. Most mortgage organizations broker the loan out looking for a suitable situation for their customer and are not loan providers.

Don’t Miss: Fafsa Entrance Counseling Quiz Answers

What Is An Fha Loan

An FHA loan is a government-backed mortgage insured by the Federal Housing Administration. FHA home loans require lower minimum credit scores and down payments than many conventional loans, which makes them especially popular with first-time homebuyers. In fact, according to FHAs 2020 Annual Report, more than 83 percent of all FHA loan originations were for borrowers purchasing their first homes.

While the government insures these loans, they are actually offered by mortgage lenders that have received the FHAs stamp of approval.

How Long Is The Process Of Buying A House

The house buying process can differ greatly and is one of the biggest decisions youll make in your life. It takes about 6 months in total to buy a house, however this varies from move to move so be sure to do your research in advance.

What not to do after being pre approved?

What Not to Do During Mortgage Approval

Does pre-approval amount include down payment? The Pre-approval Letter

Pre-approval letters typically include the purchase price, loan program, interest rate, loan amount, down payment amount, expiration date, and property address.

How can I make my closing faster? To help speed up the closing process:

Recommended Reading: Capitalone Com Auto Pre Approval

Outline Your Mortgage Needs

Along with your other financial goals, you should make a list of what youâre looking for in a mortgage product. To start, ask yourself a few questions:

- Does your monthly budget have room for you to increase your mortgage payment amount?

- Do you think youâll receive any bonuses or inheritances that you could put towards your mortgage?

- Do you think youâll have the option to pay off your mortgage entirely, in this next term?

- Do you think you will want to borrow more money from your lender during this next term?

- Is there any chance youâll be selling your home and/or moving in the next 5 years?

Fha Loan Limits In 2021

Each year, the FHA updates its loan limits based on home price movement. For 2021, the floor limit for single-family FHA loans in most of the country is $356,362, up from $331,760 in 2020. For high-cost areas, the ceiling is $822,375, up from $765,600 a year ago. These limits are referred to as ceilings and floors that FHA will insure.

FHA is required by law to adjust its amounts based on the loan limits set by the Federal Housing Finance Agency, or FHFA, for conventional mortgages guaranteed or owned by Fannie Mae and Freddie Mac. Ceiling and floor limits vary according to the cost of living in a certain area, and can be different from one county to the next. Areas with a higher cost of living will have higher limits, and vice versa. Special exceptions are made for housing in Alaska, Hawaii, Guam and the Virgin Islands, where home construction is generally more expensive.

Home prices have reached record highs in 2021, so its safe to assume that the FHA loan limits for 2022 will increase in most areas of the country.

Recommended Reading: Can You Do A Va Loan On A Second Home

Where Can I Get An Fha Loan

Many lenders offering government-secured loans offer FHA loans. Assurance Financial offers a range of home loan products and is one place you can go if you have been wondering where to get an FHA loan. The FHA does not offer mortgages â you still need to work with an approved lender to get this type of financing.

Other Financial Factors In The Fha Pre

There are a few things that may have an impact on your total pre-approval amount. One of the largest factors will be the annual taxes for the property that you plan to purchase. When the lender creates an initial loan scenario, they will use the average tax rate for the area where you plan to buy a home.

The higher the property taxes, the less you can borrow. If the home that you find after your pre-approval has high taxes, it may result in an adjustment to your loan amount or maximum purchase price.

Another factor will be the monthly liabilities and any collections that may show up on your credit report. The higher your monthly liabilities, the less you will be approved for when applying for an FHA loan. Examples of these monthly liabilities are car payments and monthly credit card minimums.

Don’t Miss: Usaa Auto Loan Pre Approval

Create A Business Plan

If you are willing to start your business self-sufficiently, you will need to plan help to create your structure and explain your objectives to potential employees and investors. Explain the industry you want to reach and how you plan to focus on them. As the mortgage business is crowded, you will have to find how you intend to make and fill a niche in the in the face of stiff competition.

Basic Mortgage Business Logistics

Various mortgage conducts the mainstream of their business online and moves part from brick-and-mortar space however, this can be a challenging benefit to fascinate customers who want to calmly sit and review their economic situations. Whether or not you contain physical space and maintain a way of communication with customers that is efficient and quick.

Maintain relationships with mortgage financers that underwrite loans. Contain a series of lenders and banks that work with brokers to provide loans, equity lines, and refinances.

Recommended Reading: Usaa Car Refinance

How To Apply For An Fha Home Loan

After you find a home and make an offer, you will complete a Uniform Residential Loan Application, also known as Fannie Mae form 1003, though you may fill out this form at a different stage of the process. On this application, you will provide the property address and the type of loan you want. If your lender asks you to complete this application earlier in the process, such as during the pre-approval stage, you will leave the line for the property address blank.

Completing your loan application may take some time, and you will need to have a lot of information on hand, including:

- Recurring debts

- Housing expenses

- Your previous and current employers

Be honest on your loan application and complete it to the best of your knowledge. At this stage, you may also need to pay a fee for the mortgage application. If not, your lender may include this fee in your closing costs, which you pay at the end of the process.

Go Rate Shopping And Choose A Lender

You may have already decided on a mortgage company when you got preapproved.

But if youre still shopping, now that youve found a home and your offer has been accepted, its time to make a final decision about your lender.

When shopping for a mortgage, remember your rate doesnt depend on your application alone. It also depends on the type of loan you get.

Look at a few different lenders rates and fees, but also ask what types of loans you qualify for. This will affect your rates and eligibility.

Of the four major loan programs, VA mortgage rates are often the cheapest, beating conventional mortgage rates by as much as 0.40% on average. Next are USDA mortgage rates. Third come FHA mortgage rates, followed by conventional rates.

So look at a few different lenders rates and fees, but also ask what types of loans you qualify for.

There may be much better deals available than what you see advertised online.

For a detailed explanation of how to compare offers and choose a mortgage lender, see: How to shop for a mortgage and compare rates

Also Check: Auto Loan With 650 Credit Score

Fha Minimum Credit Score: 500

FHA guidance allows lower credit scores, which is one reason first-time home buyers are often attracted to FHA loans. The FHA lets borrowers with credit scores as low as 500 be considered for home loans.

However, it’s important to bear in mind that while the FHA sets out guidelines for credit score minimums, FHA lenders may require higher minimum scores. FHA loans don’t come directly from the government the FHA insures them on behalf of the lender. Despite having that as backup, lenders often choose to minimize their risk by mandating higher credit minimums. This is one of the reasons why it’s smart to shop and compare FHA lenders. Not only might they have different qualifications, but you can also weigh different lenders’ rates and fees.

It’s worth noting that even with a lender who’s following FHA guidelines to the letter, you’ll get better terms if you have a higher credit score. A stronger credit score should also help you get a better FHA mortgage rate.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: Credit Score Usaa

How Many Months In Advance Should You Start Looking For A House

The best time to start looking for houses is about five months before you want to move in. This gives you enough time in the process to get things in order, look for a home and move in without feeling rushed.

Does pre approval speed up closing? It puts you on the fast track to closing.

Because most of your information is in the lenders system, a mortgage pre-approval accelerates the loan process once you make an offer.

Can I change lenders before closing? You have the right to change lenders anytime in the process before you close on your loan. Before you switch, you should consider the potential costs and delays involved in starting from scratch with a different lender.

Does a pre-approval hurt your credit? Inquiries for pre-approved offers do not affect your credit score unless you follow through and apply for the credit. The pre-approval means that the lender has identified you as a good prospect based on information in your credit report, but it is not a guarantee that youll get the credit.

Where Can You Apply For An Fha Loan

Most banks and other mortgage lenders offer FHA loans. However, their lending standards, and the fees and rates they charge, can vary significantly from lender to lender, so its important to shop around and compare rates and terms that lenders will offer you. One way to do that is by using the from at the top of this page to request free rate quotes from several lenders at once.

Once you choose a lender, there are two ways you can apply for an FHA loan. You can go to the bank itself, obtain the necessary application forms, fill them out either there or at home, then submit them to your loan officer for review.

However, many lenders now allow you to apply for an FHA loan online as well. You log into a special section of the lenders web site where you can complete the necessary forms, scan or otherwise obtain electronic copies of the documentation required, and submit the whole thing electronically. Your loan officer can then review your FHA loan application and let you know if other information is needed, which you can conveniently submit from home.

Keep in mind that an FHA loan doesnt issue the loan itself, but ensures lenders are in line with the generous rates and that all the advantages are presented to the borrowers.

Don’t Miss: Usaa Auto Loan Credit Score Requirements