What Mortgage Rate Can I Expect With My Credit Score

In the table below, you can see how much your interest rate might be depending on your credit score, how much your monthly payment might be, and how much youd likely pay in total interest.

This is based on a $200,000, 30-year loan and the interest rates as of Aug. 13, 2020.1

Keep Reading: 750 Credit Score Mortgage Rate: What Kind of Rates Can You Get?

What Is An Insured Mortgage Anyways

You may be wondering what an insured mortgage is in the first place. Often referred to as a CMHC mortgage, it applies to any mortgage where the borrower contributes a downpayment of less than 20%, down to the minimum downpayment of 5% of a homes purchase price.

The insurance refers to mortgage default insurance, which protects the lender against default should the mortgagor fail to pay the mortgage as agreed. CMHC is the leading provider of mortgage default insurance in Canada, alongside two other providers: Genworth Financial and Canada Guaranty. For more information, check out our guide to mortgage default insurance.

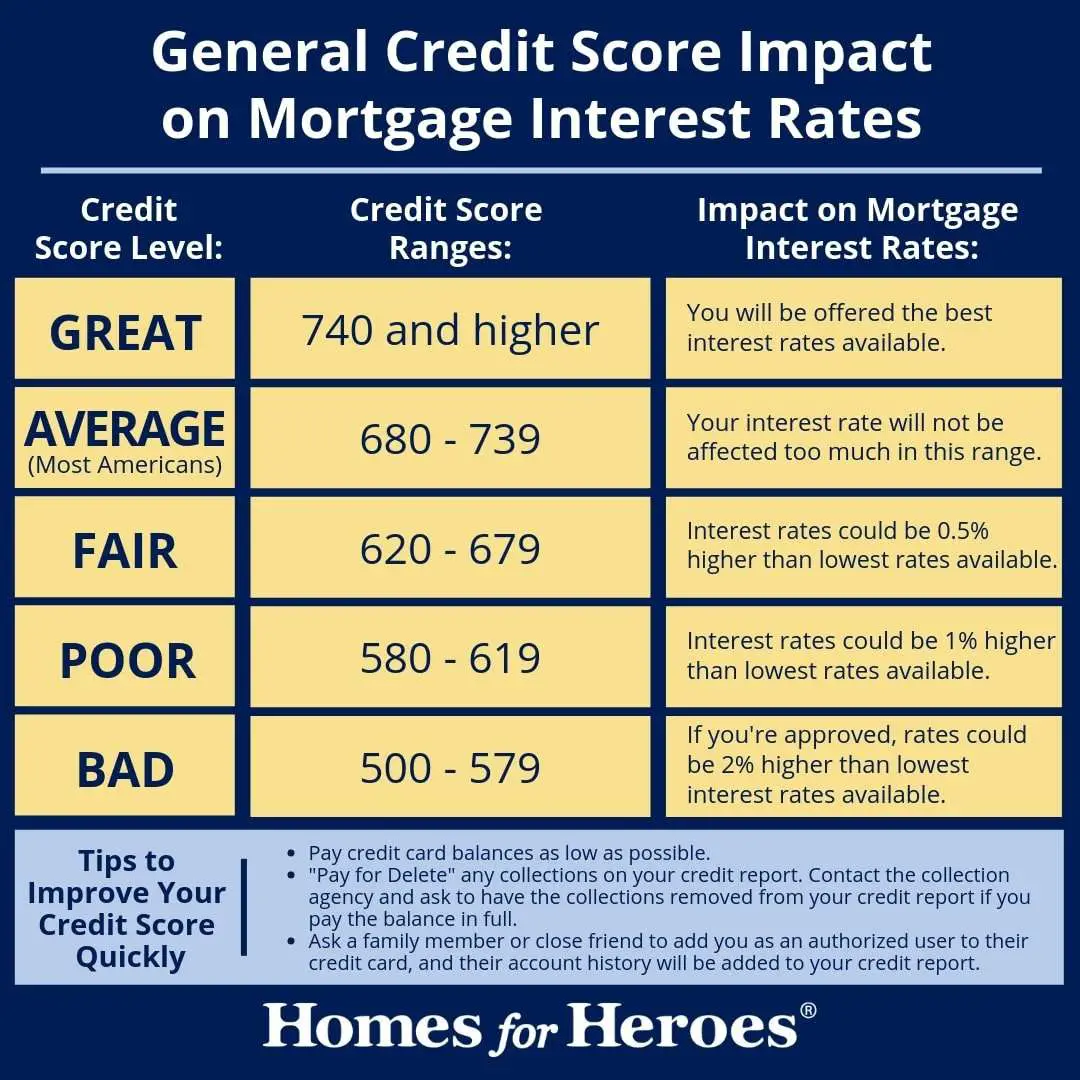

How Credit Scores Affect Mortgage Rates

A loan savings calculator, such as the one offered by myFICO, can demonstrate the impact of credit scores on mortgage rates. Enter your state, mortgage amount, and credit score range, and get an idea of what your mortgage terms would be. Such calculators provide only estimates. Your mortgage lender can give you exact terms after reviewing your complete financial details and down payment.

Enter a $200,000 principal on a 30-year fixed-rate loan, and your credit score ranges, mortgage rates, and overall costs, as of February 2020, might look something like this:

- 760 to 850: APR of 3.199% with a monthly payment of $865. The total interest paid on the mortgage would be $111,337.

- 700 to 759: APR of 3.421% with a monthly payment of $889. The total interest paid on the mortgage would be $120,145.

- 680 to 699: APR of 3.598% with a monthly payment of $909. The total interest paid on the mortgage would be $127,264.

- 660 to 679: APR of 3.812% with a monthly payment of $933. The total interest paid on the mortgage would be $135,981.

- 640 to 659: APR of 4.242% with a monthly payment of $983. The total interest paid on the mortgage would be $153,860.

- 620 to 639: APR of 4.788% with a monthly payment of $1,048. The total interest paid on the mortgage would be $177,237.

You can experiment with your own numbers, including down payment amount, loan term, and property taxes, using our mortgage payments calculator.

Also Check: How To Eliminate Student Loan Debt

Your Income Is Important

Having a good credit score alone is not enough to qualify for a mortgage. You must be able to demonstrate stable employment and an income thats high enough to service the mortgage payments.

To determine whether your income is high enough, lenders use something called debt servicing ratios, both Gross Debt Servicing and Total Debt Servicing . These ratios give the lender an indication of whether you can afford to pay the mortgage each month. Its not a perfect measure because it doesnt account for your discretionary spending habits, but it factors in most of your financial obligations.

GDS calculates your monthly housing costs against your gross monthly income. Ideally, this ratio will be less than 32%. TDS takes into account all other debt payments along with the mortgage as a percentage of your gross monthly income. The maximum TDS is 42%, but the lower, the better.

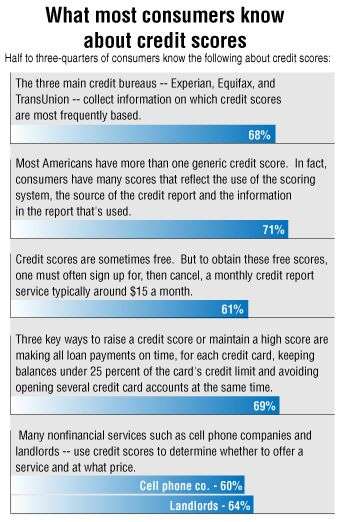

How Is Your Credit Score Calculated

Most talk of credit scores makes it sound as if you have only one score. In fact, you have several credit scores, and they may be used by different lenders and for different purposes.

The three national credit bureaus Experian, Equifax and TransUnion collect information from banks, credit unions, lenders and public records to formulate your credit score. The most common and well-known scoring model is the FICO Score, which is based on the following five factors:

You May Like: What Kind Of Loan Do I Need To Buy Land

Calculating A Credit Score

Each time you pay your bills, you are building credit. Companies that bill you for goods and services report your payment history and credit use to credit bureaus. Your credit score is primarily calculated by tracking your payment history, use of different types of credit, and the length of time that you have utilized your credit.

You may not know that there are different types of credit, and using more than one type of credit helps you build a better credit score. Utilizing these various types of credit and paying all bills on time is the best way to build your credit score.

Do Conventional Loans Require Private Mortgage Insurance

When you get an FHA loan, youre required to get mortgage insurance, except in some instances. But do conventional loans require PMI? In cases where your down payment is less than 20%, theres a good chance your lender will require PMI.

There are some ways to avoid PMI even with a smaller down payment, but, typically, if you arent putting 20% down, you can expect to have PMI added to your monthly payment. The good news is that at some point, once your home reaches a certain value relative to your mortgage balance, the PMI payment can be removed.

Also Check: How Much Do I Pay For Student Loan

S To Qualify For A Conventional Mortgage Loan

When determining how to qualify for a conventional home loan, its important to plan ahead. A home is a big purchase, and if you want to increase the chances that you meet the conventional home loan qualifications, these steps can help.

Review Your Credit History

Start by taking a look at your credit history. Because your credit score is based on the information in your , its important to make sure the information is accurate. The Consumer Financial Protection Bureau regularly sees complaints about inaccuracies, and a Federal Trade Commission report found that 26% of consumers have errors on their credit report that could negatively impact their financial outcomes.

Improve Your Credit Score

Your credit score is one of the first factors a lender looks at when considering you for a home loan. According to a New York Federal Reserve report from November 2019, 90% of borrowers who took mortgages during the first quarter of 2019 had a score of at least 650. If you want to boost your chances of being approved for a mortgage, a better credit score can help.

Save Up Your Down Payment

The higher your conventional loan down payment, the smaller your mortgage will be. Additionally, with a 20% down payment, you can avoid PMI. Youre also more likely to get a better mortgage rate. However, a 20% down payment isnt necessary, and while many lenders offer a 5% conventional loan, some are starting to offer conventional loans with down payments as low at 3%.

Reduce Your DTI

Conventional Loan Requirements For 2021 Nerdwallet

Conventional loan credit score requirements To qualify for a conventional loan, youll typically need a credit score of at least 620. Borrowers with credit;

Feb 11, 2021 Minimum Credit Score Needed: At Quicken Loans, your credit score for a conventional loan must be 620 or higher. Various lenders have different;FHA loan requiring 10% down payment: 500 Type of loan: Minimum FICO® ScoreFHA loan requiring 3.5% down payment: 580VA loan: 580

Instead, these loans follow standards set by government-sponsored mortgage loan companies, Fannie Mae and Freddie Mac. Conventional loans may be secured by one;

Read Also: What Does Jumbo Loan Mean

Conventional Loan Requirements For 2021

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

When buying a home, many people opt for a conventional loan, a type of mortgage thats readily available from most lenders.

Conventional loans arent backed by a government agency, but they usually follow some government guidelines. Most conventional loans conform to loan limits set by the Federal Housing Finance Agency and follow the credit score and down payment minimums set by the government-sponsored enterprises known as Fannie Mae and Freddie Mac.

Here are the basic requirements for conventional loans.

Conventional Loan Interest Rates

Conventional home loan rates vary based on your financial profile, including your down payment, credit score, and debt-to-income ratio.

Its a good idea to get quotes from at least three mortgage lenders. Comparing multiple quotes will give you a sense of your interest rate range, and it will allow you to see who is offering the best deal overall.

You want to look not just at the interest rate, but at the other fees theyre charging, including origination and processing fees.

Also Check: What Are Assets For Home Loan

How To Get Your Credit Score Ready For A Mortgage

No matter what type of mortgage you seek, it’s always advantageous to apply with the highest credit score you can manage. Meeting the minimum score requirement for a loan is just the start. Lenders also use your credit score to help set interest rates and fees on the loan, and generally speaking, the higher your credit score, the better your borrowing terms will be and the less you’ll pay in interest and fees over the life of the loan.

If you’re planning to apply for a mortgage in the next 12 months, you may be able to take steps starting today to spruce up your credit score so your loan application reflects the best credit score you can get.

Any credit score that helps you qualify for a mortgage you can afford can be considered a good score. Even so, most of us have room to improve our scoresand reap potential savings over the lifetime of a mortgage loan.

Down Payment Requirements For A Conventional Loan

Your down payment can make a difference in how much you end up borrowing and what the interest rate will be for your loan. The bigger your down payment, the less debt youll acquire and the better your chance of getting the best possible mortgage rate.

Conventional loan down payment requirements vary by lender, but, in general, its possible to get a conventional mortgage with 5% down. Some lenders are even starting to offer conventional loans to buyers who qualify with less than 5% down. While its possible to find lenders willing to accept a lower down payment, homebuyers will usually need to qualify for a special government-backed homebuying program such as an FHA loan or USDA loan to get a lower down payment.

While you can get a conventional mortgage with as little as 3% down, some lenders may prefer you to have at least 10% to put toward a down payment. If you have less than 20% for a down payment, youll likely have to pay private mortgage insurance with a conventional loan. PMI can raise your monthly mortgage payment by $100 or more.

Read Also: Can You Use Fha Loan If You Already Own House

Final Thoughts On The Minimum Credit Score For A Mortgage

When applying for a mortgage, having a good credit score is important. Ideally, you want to make sure your credit score is over 680. If it isnt, it doesnt mean that you wont qualify, but you might not be able to access the top lenders and the lowest mortgage rates. Heres the good news: if your credit score isnt where you want it to be, there are things you can do to improve your score.

If youre not already a Borrowell or Credit Karma member, I highly recommend that you sign up for your free credit report. After all, as the saying goes, what gets measured gets improved. When you get your credit report, look for ways to improve your score by following the steps I outlined above.

Excellent Credit Score Home Loans

An excellent credit score of 750 and above is the best place to be when youre shopping for a mortgage. It will help you get the lowest interest rate whether you want a conventional, USDA, VA, or FHA loan:

- Conventional loan: With an excellent credit score, youll be able to get competitive bids from multiple lenders on a conventional loan. And, if youre putting down less than 20%, an excellent credit score will help you get the most favorable PMI premiums.

- USDA or VA loan: Qualifying borrowers with excellent credit might still choose a USDA or VA loan if they dont have a down payment.

- FHA loan: Theres little reason to get an FHA loan when you have excellent credit. You will probably qualify for a conventional loan and avoid paying the FHAs mortgage insurance premiums. An exception might be if your DTI ratio, including your proposed mortgage payment, is 45% to 50% and youve been rejected by multiple lenders for a conventional loan.

Find Out: 800 Credit Score Mortgage Rate: What Kind of Rates Can You Get?Other factors your lender will consider for your mortgage rate:

- Income: Youll need a documented history showing two years of steady income in the same line of work.

- Debt: Your debt cannot consume so much of your income that your mortgage and living expenses wont be manageable.

- Down payment: The higher your down payment, the less risky you are to lenders. The gold standard is 20% or more.

Find Out: How to Get the Best Mortgage Rates

Also Check: Are There Student Loan Forgiveness Programs

Conventional Loan Minimum Credit Score Faqs

What is the minimum credit score for a conventional loan?

The minimum credit score for a conventional loan is 620.

Can I get a conventional loan with a 640 credit score?

You may qualify for a conventional loan with a 640 credit score, since the minimum credit score for these mortgages is 620. With a 640, you may receive lower rates and mortgage insurance costs with an FHA loan. For either loan, lenders look at several factors to determine whether you qualify, including your credit score, income, and debt-to-income ratio. You can apply for preapproval with a lender to find out whether you qualify and how much you may be able to borrow.

How do you qualify for a 5% conventional loan?

Mortgage lenders look at a number of factors to qualify you for a 5% down conventional loan, including your credit score, income, and debt-to-income ratio. The minimum down payment for a conventional loan is 3%, so being able to put down 5% can help your chances, assuming you meet all of the other criteria for the loan program and any additional guidelines set by the lender.

It’s Not Just About Your Credit Score For A Mortgage

Your credit score for a home loan is certainly an important factor, but it is just one piece of the puzzle. In addition to your FICO® Score, your mortgage lender will consider:

- Your down payment: The minimum down payment for a conventional loan is 3% for first-time buyers. But higher down payments can increase your approval chances and also lower your interest rate. Plus, if your down payment is less than 20%, you’ll likely have to pay for PMI.

- Your income: Lenders want to know that you earn enough money to justify the loan. Generally speaking, lenders want to see that your new housing payment will make up less than 28% of your pre-tax income and that your total debts will be less than 45% of your income.

- Your assets: If you have substantial money in savings, lots of investments, or other assets, it can help bolster your mortgage application. In fact, lenders generally require that you have a certain number of mortgage payments in reserve.

- Your employment history: Not only does your lender want to see enough income to justify the loan, but it also wants to know that your income is likely to continue for the foreseeable future. As a general rule, lenders want to see at least two years of steady employment in the same industry, with no significant gaps.

- A total DTI ratio of 36% or less, and a down payment of at least 25% of the purchase price.

- A DTI of 45% or less, a down payment of at least 25%, and two months’ worth of mortgage payments in reserve.

Read Also: What’s Better Refinance Or Home Equity Loan

Is A Conventional Loan Suitable For You

A conventional loan is an excellent choice for people who plan on living in their homes for many years and want to know what their monthly payments will be for the duration of their loan. The other side of the coin is adjustable-rate mortgages . ARMs offer a lower interest rate for a short term during the first few years of the term usually from 3 to 10 years, after which the interest rate can change. If you intend to own your home for a brief period, you could save money with an ARM at todays low rates. If you plan to stay in your home longer, a fixed rate could be your best option.

A conventional loan is a mortgage that isnt received from a government agency. It is the most common type of loan, requiring acceptable credit and reasonable down payment. Most borrowers find this loan attractive because of its two different rate options and;lower;interest rates than government loans, such as those guaranteed by the Federal Housing Association and the Department of Veterans Affairs. As a long-term option for most homebuyers,;conventional loans offer fixed and adjustable-rate options. Depending on your situation, one may work better than the other. However, a significant draw for most is the option to choose their rate in general.

Lets take a closer look at conventional home loans.