Who Determines The Prime Rate

The prime rate is not set by the government. But it does closely follow another interest rate, which is set by the Federal Reserve: the federal funds rate.;

The Fed sets and adjusts the federal funds rate to keep the US economy on an even keel between recession and over-expansion.; When the economy slows down, the rate is lowered to spur economic growth. When the economy grows too fast, the rate gets raised to try and stave off inflation.

Commercial banks use the federal funds rate when charging each other for overnight loans. In turn, these banks use the same rate as the starting point in setting the prime rate for their best-qualified clients.

Commercial banks generally adjust the prime rate roughly three percentage points above the federal funds rate. However, some banks set their lending rates up to five percentage points higher.

What Is The Prime Rate

The prime rate is an interest rate charged on loans. Much like any other interest rate, the prime exists to cover costs and losses associated with financing. It acts as the compensation for the multiple risks banks expose themselves to when extending credit to clients.;

Only stable businesses with the highest credit ratings qualify for this prime interest rate, as they are the ones that pose the least risk of defaulting on their loans. As the name prime implies, it tends to be the best that is, the lowest interest rate the financial institution charges.

Although its a variable, or floating, interest rate, the prime does not change at regular intervals. Rather, banks adjust it according to the shifts in the economy and the business cycle. The prime may not change for years.; Or it can potentially change several times within one year especially in economically turbulent times.

A Line Of Credit To Help Conquer Your Goals

Get convenient access to cash and only pay interest on the funds you use. Enjoy this low introductory rate, equal to CIBC Prime currently at RDS%rate.PRIME.Published%, until March 6, 2022.

All fixed and variable rate loans are based on the CIBC Current Prime Rate.1

Rates as of;RDS%SYSTEM_DATE%

| Loans | |

|---|---|

|

Your choice of term, payment frequency and fixed or variable interest rate. |

1 to 5 years |

|

Get terms up to eight years, with the possibility of no down payment. |

1 to 8 years |

|

Borrow $5,000 to $50,000 to take advantage of unused RRSP contribution room. |

1 to 10 years |

|

Get a lower interest rate by using the equity in your home |

Open ended |

|

Get flexible access to funds at interest rates lower than most credit cards. |

Open ended |

|

Borrow up to $40,000 to help with your post-secondary education costs. |

Open ended |

|

Borrow up to $350,000 to help cover costs. |

Open ended |

Also Check: What Is My Monthly Loan Payment

Income Tax Benefits On Car Loans Taken To Purchase Electric Vehicles

If you have taken a car loan to purchase an Electric Vehicle , you can now enjoy a tax rebate of Rs.1.5 lakh on the interest paid. This was announced in the latest Union Budget by Finance Minister Nirmala Sitharaman and is a part of the governments efforts to stimulate the adoption of environment-friendly mobility solutions. If you have purchased an electric vehicle, you will be able to avail a benefit of about Rs.2.5 lakh during the entire term of the loan. The government has also slashed the tax rates on electric vehicles to 5% from the earlier 12%.

What Are Car Loans And How Do They Work

Auto loans are secured loans that use the car youre buying as collateral. Youre typically asked to pay a fixed interest rate and monthly payment for 24 to 84 months, at which point your car will be paid off. Many dealerships offer their own financing, but you can also find auto loans at national banks, local credit unions and online lenders.

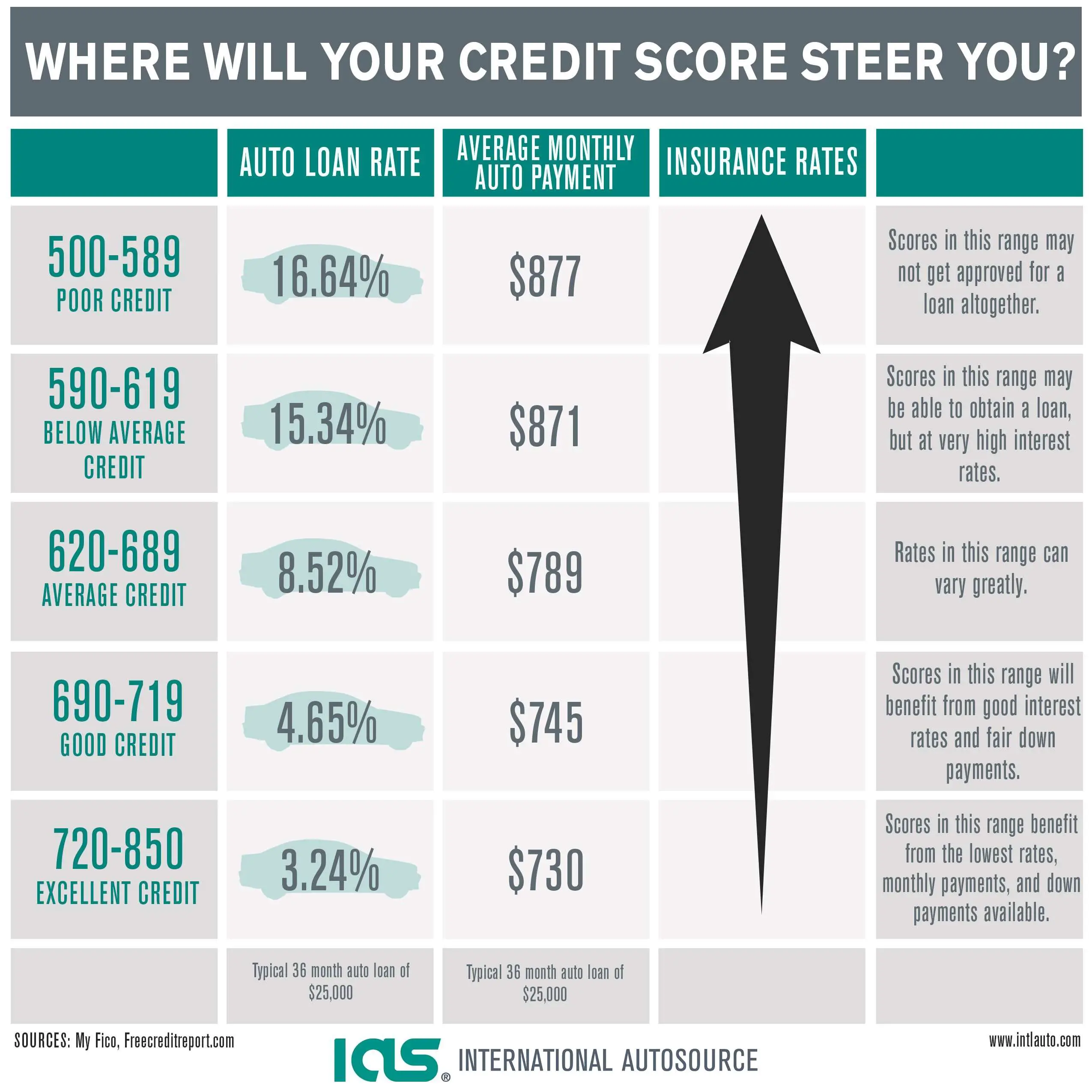

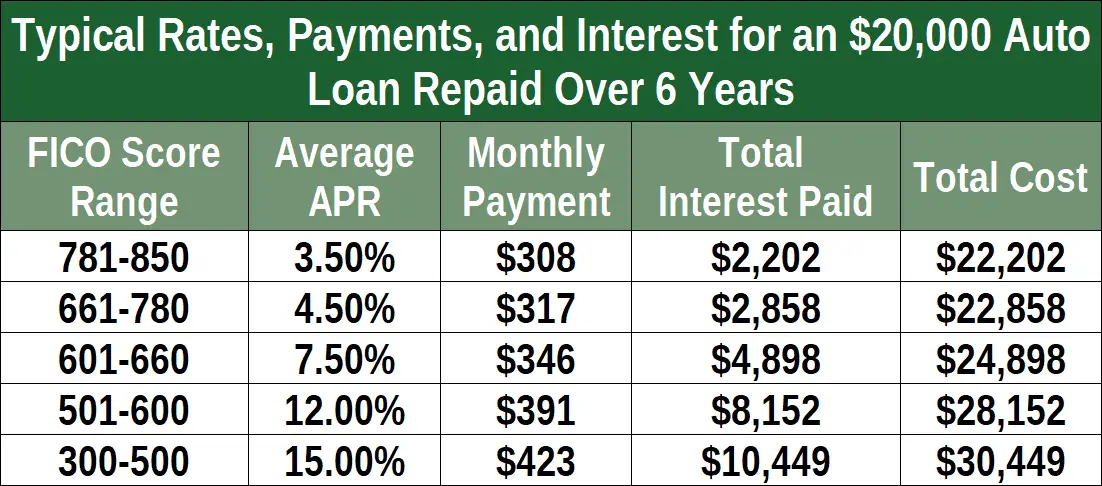

Because auto loans are secured, they tend to come with lower interest rates than unsecured loan options like personal loans. The average APR for a new car is anywhere from 3.24 percent to 13.97 percent, depending on your credit score, while the average APR for a used car is 4.08 percent to 20.67 percent.

You May Like: What Credit Score Is Needed For Conventional Loan

What Is Refinancing A Car Roadloans

Mar 19, 2020 Refinancing a car is the process of taking out a new loan to replace an existing note. The refinanced loan is a fresh contract that gives;

By refinancing, youre taking out a new loan with different terms to pay off your existing loan. This may help you save money by reducing your interest rate,;

Refinancing your auto loan is one way to get better terms and potentially reduce your interest rate and monthly payments, helping you save more money. An auto;

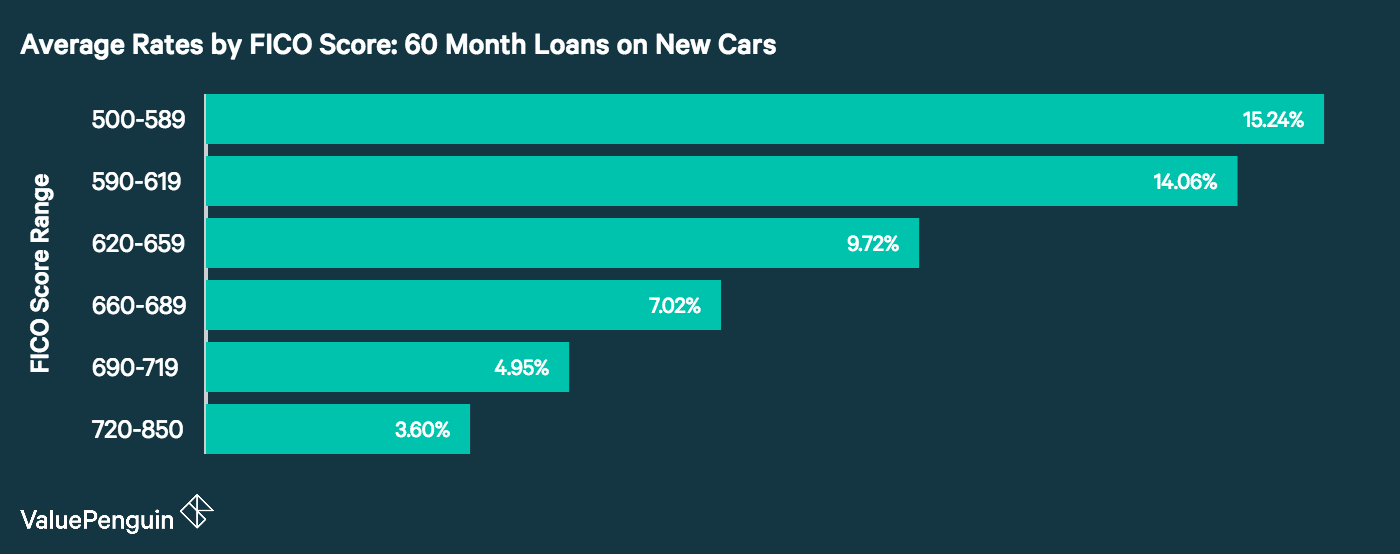

The Higher Your Credit Score The Less It Will Cost To Borrow

are a numerical representation of your credit history. It’s like a grade for your borrowing history ranging from 300 to 850, and includes your borrowing, applications, repayment, and mix of credit types on your credit report. Companies use credit scores to determine how risky they think lending to you would be, and therefore how much they want to charge you for the privilege.;

Auto loans are no exception to the longstanding rule that having a lower credit score makes borrowing more expensive. In the data above, the cheapest borrowing rates went to people with the best credit scores. Meanwhile, those with the lowest credit scores paid about 10 percentage points more to borrow than those with the highest scores.

The interest rate also has a big effect on monthly payment. Using Bankrate’s auto loan calculator, Insider calculated how much a borrower paying the average interest rate would pay for the same $30,000, 48-month new car auto loan:

| Super Prime | 2.34% | $655 |

With the interest rate as the only factor changed, a person with a credit score in the highest category will pay $655 a month, while a person with a score in the lowest category would pay $829 a month, or $174 more for per month for the same car.

Read Also: How To Eliminate Student Loan Debt

Bank Of America: Best Big Bank Option

Overview: Bank of America offers flexible and convenient auto loans you can apply for directly on its website. Rates are competitive, and you can qualify for additional discounts if youre an eligible Bank of America customer.

Perks: Bank of America will finance a minimum of $7,500 and requires that the car be no more than 10 years old, with no more than 125,000 miles and valued at no less than $6,000. Financing is available in all 50 states and Washington, D.C. Bank of Americas APRs start at 2.89 percent for a new car and 2.99 percent for a used car.

If youre a Bank of America Preferred Rewards customer, you can qualify for a rate discount of up to 0.5 percent off.

What to watch out for: If you’re applying online, the term range you can apply for is limited you can pick only a 48-, 60 or 72-month term.

| Lender |

|---|

| None |

Is It Better To Get An Auto Loan From A Bank Or Dealer

Dealerships typically have a network of partner lenders, including banks, credit unions and financing companies. But dealers can and often do mark up that rate for their own profit.

The only way for you to know what rate you deserve is to get your own preapproved offers. Apply to lenders directly, or fill out a single form at LendingTree, and receive up to five auto loan offers from lenders, depending on your creditworthiness.

Don’t Miss: When Do I Pay Back Student Loan

Can I Sell My Car With A Loan

It is possible to sell your car with an outstanding loan, but you may have to go through a few extra steps. If your car is worth less than what you currently owe on the loan, you have what’s known as negative equity meaning you may need to pay the difference out of pocket or refinance the remaining amount with a different type of loan.

If your car is worth more than what you currently owe, on the other hand, you may be able to pocket the difference in cash when you sell the car. Whatever your situation, reach out to your lender about your options, as each lender sets different rules for selling a car with a loan.

Try Our Calculator For Yourself

If youve learned anything today, we hope its that its important to weigh all factors when buying a vehicle, either new or used. Our car financing calculator will be a great tool to help you plan your next vehicle purchase.

It can help determine how much money you want to put down . Based on how much your trade-in value is, it can be a great help when deciding what kind of term you want to choose. Note: some interest rates are term-specific, so even if your credit history says you can get 1.99% interest, for example, you may have to choose a certain term length in order to qualify for that interest rate.

Read Also: How Much House Can I Afford Physician Loan

Ford Partners With Jiosaavn And Google Search To Promote The Freestyle Flair

Ford India has launched a new campaign of the Ford Freestyle Flair Edition with JioSaavn and Google search. Ford has come out with a fun, quirky, and unique way to promote the Freestyle Flair. The company has used the search behaviour on Google and JioSaavn to bring out the exciting character of the car. Google search continues to be a key feature in car research and purchase. Around 68% of individuals use search without an idea of buying a car and around 98% of the buyers use the feature to purchase a car. Ford wishes to launch the new features of the car during the festive season in the country.

1 September 2020

Bank Of America : Best Auto Loan Rates For Those Who Prefer A Bank

- New car loan rates start at 2.39%

- Terms range from 1275 months

- Amounts start at $7,500

While the starting APR for a Bank Of America auto loan is higher than the two credit unions above, you dont need to qualify for membership. B of A offers convenience. It could be your one-stop shop with competitive auto loan rates for any type of auto loan youd like: new, used, refinance, lease buyout and private party.

WHAT WE LIKE

Bank of America has a variety of auto loans that you dont always see from one lender; it has no membership requirements and it is the second-largest U.S. bank by assets.

WHERE IT MAY FALL SHORT

Bank of Americas minimum loan amount is relatively high at $7,500; you could easily find a used car from a private seller for less. By comparison, Navy Federal CU minimum loan amount is $250.

HOW TO APPLY

You could apply for a Bank of American auto loan online or by calling 844-892-6002. If you like to do business in-person, you could schedule a visit online. Be sure to follow all COVID-19 safety precautions if you go in-person.

Recommended Reading: Which Bank Gives Loan For Land Purchase

Average Auto Loan Interest Rates: Facts & Figures

The national average for US auto loan interest rates is 5.27% on 60 month loans. For individual consumers, however, rates vary based on credit score, term length of the loan, age of the car being financed, and other factors relevant to a lenders risk in offering a loan. Typically, the annual percentage rate for auto loans ranges from 3% to 10%.

Can You Sell A Car With A Loan

It is possible to sell a vehicle when you still have a loan, but it adds a few extra steps. There are a few different options in this situation. One option is to pay off the loan in full before selling the vehicle, which involves contacting your lender to determine your payoff amount. After paying off the loan, your lender will release the lien.

You can sell a vehicle that’s financed without paying it off by selling it to a private buyer or trading it in with a dealer.

You May Like: How Much Do I Pay For Student Loan

You Still Have To Pay The Principal

Even if you win a usury lawsuit, understand that the loan itself will not be written off. The lender has bought a vehicle for you, and it will always be entitled to receive the principal loan amount back. Most auto loans are secured against the car, so if you don’t pay back the principal, the lender could repossess your vehicle. It’s important that you keep up your payments unless a court tells you not to.

What Are The Maximum Interest Rates Allowed On Auto Loans

Vehicles are expensive, and that means you may not be able to pay the sticker price up front. Instead, you may be looking into car loans as a way to help you spread the cost of the vehicle over a number of years. Factored into the monthly loan repayment is an amount of interest. The rate varies from person to person, depending on how much you’re borrowing and your personal credit score. Some states limit the amount of interest that lenders are allowed to charge, but the cap doesn’t always apply to car finance companies.

Tips

-

Your state’s usury laws determine the maximum interest rate that a lender is permitted to charge. This could be anywhere from 5 to 24 percent, depending on where you live. However, the rules are complex and the rate caps don’t always apply to car loans.

You May Like: What Size Mortgage Loan Can I Qualify For

Simple Interest Car Loans

Most auto loans are simple interest loans, which means that the amount of interest you pay each month is based on your loan balance on the day your payment is due. If you pay more than the minimum due, the interest you owe and your loan balance can decrease.

On a simple interest loan, interest is front-loaded and amortized. With an amortized loan, part of your monthly car payment goes to the principal, which is the amount you borrowed, and part of your payment goes to the interest charges. Because the loan is front-loaded, a larger portion of each car loan payment applies to interest at the beginning of the loan term and at the end of the term more applies to the principal balance.

For example, If you have a $25,000 car loan with a 48-month term and a 4% interest rate, youll pay an estimated $83 in interest and $481 in principal during the first month of the loan term. By the last month, youll only pay an estimated $2 in interest, and $563 will apply to the principal amount.

Auto Approve: Best For Auto Refinance

- Car refinance APRs start at 2.25%

- Terms range from 12120 months

- Amounts up to $150,000

Auto Approve was the most popular choice for auto loan refinance on the Lending Tree platform by far in Q1, 2021 and it averaged one of the lowest APRs on closed loans. The company does a soft credit pull to show you potential refinance offers from lenders and once you choose an offer, that lender will do a hard credit pull to produce an official offer for your approval.

WHAT WE LIKE

Auto Approve offers lease buyouts and refinancing for motorcycles, boats, RVs and ATVs as well.

WHERE IT MAY FALL SHORT

If you have a specific refinance lender in mind, such as a local credit union, apply to them directly as Auto Approve doesnt have a public list of its lender partners.

HOW TO APPLY

Go to AutoApprove.com and hit the apply button.

Read Also: Is My Home Loan Secured

How Do You Get A Car Loan

Some consumers can pay cash for a new vehicle, but most use financing from a bank, credit union, nonbank auto lender, or dealer. Here are steps you can take in order to get a car loan:

Capital One: Best Auto Loan Rates For Prime And Subprime Credit

- New and used car APRs start at 2.99%

- Terms range from 1284

- Amounts from $4,000+

On LendingTree, Capital One emerged as a favorite for people with prime and subprime credit; and it offered the lowest average auto loan rates within those score ranges.; Besides its competitive rates, Capital One offers prequalification through its Auto Navigator feature, which can give you a ballpark estimate of your auto loan without doing a hard credit pull. If you want a more solid idea of your car loan before you go to the dealer, consider getting a car loan preapproval.

WHAT WE LIKE

Capital One covers both ends of the credit spectrum, offering competitive rates to both prime and subprime borrowers.

WHERE IT MAY FALL SHORT

Capital One only offers car loans for vehicles purchased through its network of 12,000 dealerships. While thats a lot of dealers, its not all of them, so Capital One auto financing might not be available at the dealership you want.

HOW TO APPLY

You can submit a Capital One auto loan prequalification form on its website, or visit one of its participating dealerships.

Also Check: Which Credit Union Is Best For Home Loan