Dont Close Your Credit Cards

If you dont use a credit card anymore or have just paid off the entire balance, your first instinct may be to close it and never look back. The credit bureaus think otherwise. The longer you hold onto a credit card and use it responsibly, the better you look on your credit report. For any card you dont intend to use as a primary credit card, charge a monthly bill to it and set the cards balance to be paid automatically each month. That way youre reaping the benefits of an old credit card without the hassle.

Fha Loan Requirements In 2021

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

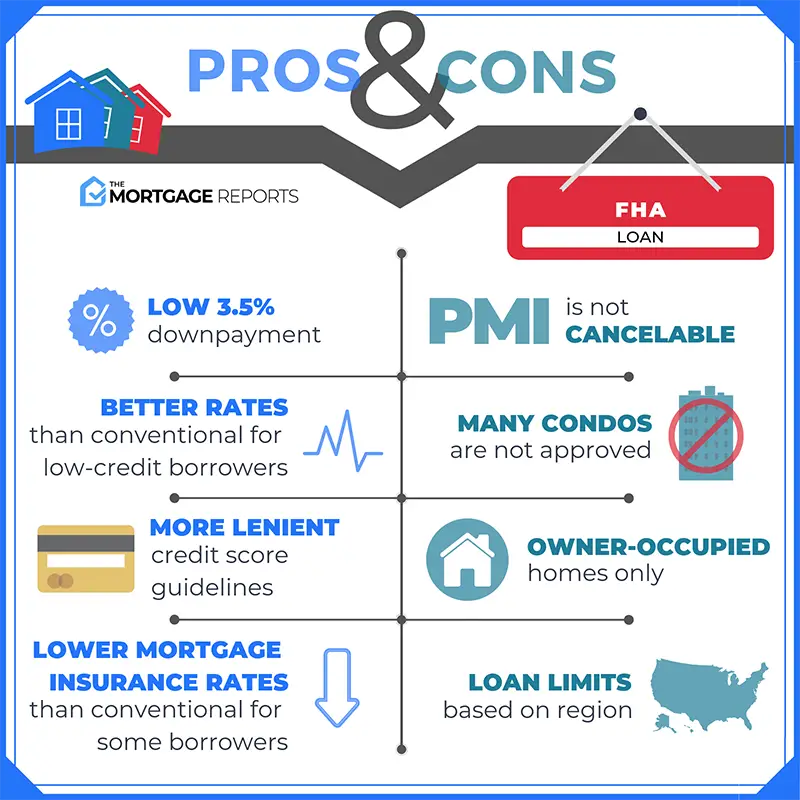

A Federal Housing Administration loan can be an attractive option for borrowers with less-than-perfect credit and limited down payment funds. If you fit in this category, its crucial to first understand FHA loan requirements before applying for a mortgage.

First Time Homebuyer Credit Score: How It Affects Your Interest Rate

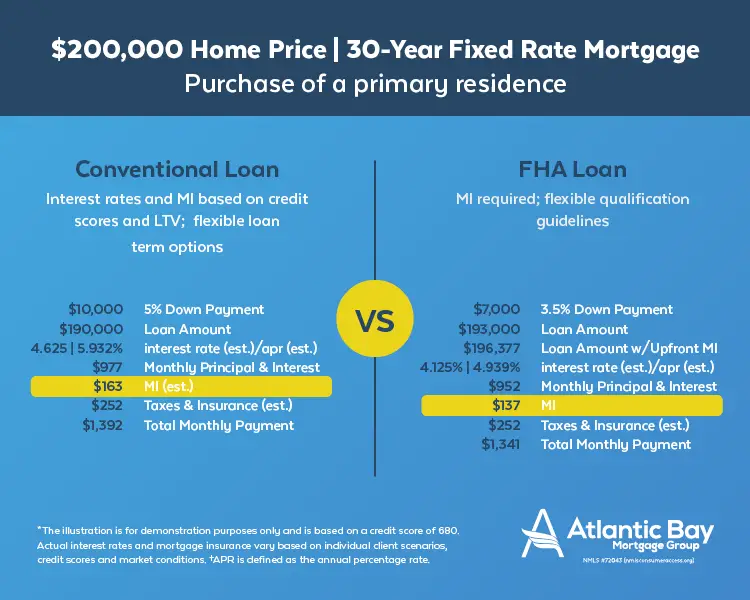

A higher credit score shows lenders that you have a history of successfully managing and paying off debt. When your credit score goes up, lenders will be more likely to offer you lower interest rates because they see your loan as less of a risk. FHA loans make homeownership available to borrowers with significantly lower credit scores, which traditionally means there would be a higher risk that the borrower could miss a payment or default on the loan. The FHA balances this risk by requiring borrowers with the lowest credit scores to make larger down payments. Thats why youll see the minimum down payments for FHA loans range from 3.5% to 10% of the homes purchase price.

Also Check: Usaa Auto Loan Interest Rates

What Are The Fha Loan Limits

As mentioned above, you are limited in the amount that you can qualify for with an FHA mortgage. Lets look more closely at the limits of a few different types of mortgage loans.

Loan limits by popular mortgage loan types for 2018Description: A comparison of what the loan limits are for popular mortgage loan types for FY 2018

| Mortgage Loan Type |

|---|

| $453,100 |

Compared to VA Loans and conventional mortgage loans, you can see a marked difference in the FHA Forward loan. VA and conventional loans both allow for a loan limit of $453,100 however, a basic standard FHA Forward loan allows for $294,515. This is another example of how FHA is geared towards low-income owners. The higher the loan, the higher the monthly mortgage payment will be, and so while the FHA could have a higher limit, it would not fit with their intended market.

Debt In An Fha Dti Ratio Calculation

You must disclose all debts and open lines of credit on your loan application. You might wonder why you need to describe your open line of credit. These can become debt if the homebuyer goes on a shopping spree before closing, so the FHA directs lenders to keep an eye on open lines of credit.

Let’s start by calculating a back-end DTI ratio with example numbers.

The FHA calls the back-end ratio the total fixed payment expense DTI Ratio. Disclose your college loans, balances on your credit cards, auto loans, and how much you’ll pay in both auto insurance and homeowners insurance. Include any personal loans from family, and other debts.

Spousal and child support obligations are considered debt to the person required to make the payments.

Now let’s use the same numbers to calculate a front-end DTI ratio:

The FHA calls the front-end DTI ratio the total mortgage expense DTI Ratio.

Recommended Reading: Va Business Loan For Rental Property

Fha Credit Score Requirements In 2020 According To Hud

The Department of Housing and Urban Development manages the FHA home loan program. They also set the rules for credit scores, down payments, debt ratios, and other eligibility criteria. They are the official source for rules and guidelines.

According to HUD, mortgage lenders must “determine the borrower’s minimum decision credit score … The MDCS will be used to determine the maximum insured financing available to a borrower with traditional credit.”

Here is how HUD defines the MDCS:

- When the lender pulls three scores , the middle number must be used for FHA qualification purposes.

- When two scores are pulled , the lower number must be used to determine eligibility.

- When only one score is obtained, that becomes the MDCS.

The table below shows the minimum credit score for FHA eligibility in 2020. This table was adapted from a draft version of HUD’s Single Family Housing Policy Handbook, which was published earlier this year

| If your score is… | |

| eligible for maximum financing | |

| between 500 and 579 | limited to a maximum LTV of 90% |

| 499 or lower | not eligible for an FHA-insured mortgage loan |

As you can see from the table above, the minimum score required in 2020 is 500. That is the absolute minimum for borrower eligibility. If your “decision” credit score is below 500, you won’t be able to qualify for an FHA-insured mortgage loan .

How To Get Approved For An Fha Loan

For many years, the Federal Housing Administration was regarded as a destination for borrowers with low to zero credit scores. However, the same cannot be said about the department today. The FHA is now a go-to-place for moderate-to-low income workers with good credit histories. A home is a long-term investment, however, when purchasing a home, you may be unable to provide up-front cash for the house. In this case, an individual needs to get a mortgage loan to boost their home purchasing finances.

Related: Know How and When to Apply for Home Loans in 2021

With a low credit score, you may not be eligible to apply for a loan in a conventional financial institution. However, you may still qualify for an FHA loan. To ensure that you’re eligible for a federal housing loan, review the tips below:

Read Also: How To Get A Mortgage License In California

Ways To Increase Your Credit Score

- Pay down credit card balances Credit utilization ratio is the amount of available credit you have used compared to your cards limit. It accounts for a whopping 30% of your FICO score. Only your payment history has a bigger impact on your score. A .

- Do not apply for new credit Every time you apply for a loan or credit card, your credit report is pulled by the lender. This results in a hard credit inquiry being added to your report, which will harm your score. Hold off on applying for anything until after your mortgage loan is closed.

- Stay on top of your payments Payment history is the biggest factor in your score. Make sure you stay on top of all your bills. A single late payment could cause you to be declined for a loan.

- Dispute negative information The three credit bureaus allow you to dispute any information on your report you feel is inaccurate. Go through your report and file a dispute on inaccurate and negative account information. The credit bureaus have 30 days to validate the account if they cannot, it will be removed from your credit report.

Please read our article for more tips on improving your credit before applying for a mortgage.

Freddie Mac Home Possible: Minimum Credit Score 660

Freddie Macs firsttime home buyer program, Home Possible, is helping buyers get into homes with a very low down payment and moderate credit.

Home Possible is available for low and moderateincome borrowers and allows for a down payment of just 3%. And, for borrowers who cant save up the down payment, Home Possible allows a variety of down payment assistance programs.

To qualify for the Home Possible loan with reduced private mortgage insurance rates, most lenders will require a 660 or better credit score.

Recommended Reading: Auto Loan Calculator Usaa

Do All Fha Lenders Have The Same Fha Loan Requirements On Fha Loans

These stricter requirements are called lender overlays and they are perfectly legal. Just because you do not qualify for an FHA loan at one lender does not mean that you cannot qualify at a different lender with no lender overlays. If youre concerned about qualifying, its smart to ask lenders about their overlays before you waste time applying with them. Gustan Cho Associates imposes NO OVERLAYS on home loans including FHA mortgages. So if youre wondering, Can I get a mortgage loan if my credit scores are under 620? The answer is yes youre eligible to apply for an FHA mortgage with a credit score of 580 with 3.5% down and 500 with 10% down.

Related: Mortgage With 580 Credit Score

Fha Credit Score Requirement Drops 60 Points

Its getting easier for borrowers to get an FHAbacked home loan.

Major lenders will now approve 96.5 percent FHA mortgage applications for borrowers with FICO scores of 580. It marks a 60point improvement over previous years, when FHA lenders required 640 FICO scores or better to get approved.

The news comes at a time when FHA loans are in demand.

The programs 3.5% downpayment minimum is among the most lenient for todays home buyers and underwriting requirements on an are flexible and forgiving.

FHA loans account for close to onequarter of all loans closed today.

Don’t Miss: Usaa Car Loan Application

Learn More About Home Loans

We think it’s important for you to understand how we make money. It’s pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform . But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can.

How Credit Affects Your Home Buying Options

Your credit history directly impacts whether youre approved for an FHA mortgage. It also determines your mortgage interest rate. Borrowers with low credit scores and more recent credit problems have a higher risk of default. So they typically pay higher mortgage rates, which increases the cost of their loan. A higher rate means paying more in interest over the life of the loan, as well as a higher monthly payment.

Don’t Miss: Can You Get A Va Loan On A Manufactured Home

Refinance Your Fha Loan With Bad Credit

If you have an FHA mortgage you may be eligible to refinance to a lower interest rate and mortgage payment with bad credit. Streamline refinancing often doesnt include a credit check, so no matter how bad your credit is you can still refinance your FHA loan.

You must wait 210 days from the time you closed on your loan before youre eligible. An FHA streamline refinance requires very little documentation,

Streamline Refinance Requirements

- Must be current on your mortgage

- No late payments on the mortgage in the past 6 months

- No more than one late payment in the past 12 months

- Refinancing must produce a net tangible benefit

First Time Homebuyers Considering An Fha Loan

The Federal Housing Administration insures FHA loans to make homeownership more accessible for all Americans. This enables approved lenders to offer FHA loans to homebuyers with lower than average credit scores. If you want to buy a home now but have a lower credit score and dont have the cash for a 20% down payment, an FHA home loan could be the right mortgage for you.

You May Like: Usaa Refinance Auto Loan Calculator

The Dash Home Loans Process

Getting a home loan is often a stressful process, especially when most mortgage lenders work with a middleman who you never meet.

Dash simplifies the process for you by cutting out the middleman. With our team, the process of getting an FHA loan is very easy. Our Mortgage Coaches will work with you to prequalify you for these loans, going to bat for you as your advocate with the underwriters who review your application. Well work closely with you to ensure you meet all FHA loan requirements, including completing the necessary application and all required paperwork.

And if you dont qualify for an FHA loan? Well tell you immediately and work with you to find another option that meets your needs.

Ready to get started? Contact our team.

Let’s get started

How To Improve Your Chances Of Fha Loan Approval With A Low Credit Score

FHA guidelines state that Borrowers who have made payments on previous and current obligations in a timely manner represent a reduced risk.

Conversely, if a borrowers credit history, despite adequate income to support obligations, reflects continuous slow payments, judgments, and delinquent accounts, significant compensating factors will be necessary to approve the loan. If your credit score is low because you dont use much credit or because you have a lot of accounts, youll probably be able to get a mortgage if you meet other program guidelines. But if your score is low because of poor repayment history, youll need compensating factors. What are compensating factors that can overcome bad credit history? Heres a list of the most common ones.

Read Also: Transfer A Car Loan

Bad Credit Mortgage Faq

What mortgage company works with bad credit?

Different mortgage lenders will see your application differently, so its important to shop around when you have bad credit. Online mortgage lenders have opened up more choices for many low credit score borrowers.

Can I get a home loan with a 500 credit score?

It is possible to find an FHA lender willing to approve a credit score as low as 500. You may also be able to find a nonQM conventional lender with a 500 credit score minimum. But you wont have many choices, and youll need to be prepared to make a larger down payment. Itll also help if you have few other debts compared to your monthly income.

Can I get a home equity loan with a 500 credit score?

This is unlikely, as most lenders require a credit score in the 600s or higher for a home equity loan. You may find exceptions if you have a very low debttoincome ratio and lots of equity. A home equity loan is a second mortgage thats secured by the value of your home.

What credit score is considered bad credit?Can a cosigner help me get approved?

A cosigner or coborrower might help you get mortgageapproved with bad credit if the lender is willing to average both scores. However, some lenders only consider the lower of the two credit scores on an application. So make sure you shop around and ask about different lenders policies.

Will a bad credit mortgage require higher closing costs?Does mortgage insurance cost more when you have bad credit?

But Dont Expect To Buy A Mansion With An Fha Loan

You may see a swimming pool and a big house for you and your family. But be realistic. There are limits to how much you can borrow with an FHA loan.

These limits vary by county and are based on home prices in the area. If you can afford a home that costs more than the limits, chances are you dont need an FHA loan and can qualify through for a conventional loan, i.e., one that isnt backed by the government.

You May Like: Transferring Mortgages To Another Bank

What Is It Like To Get An Fha Loan Right Now

Although HUD’s minimum requirements for FHA loans havent changed, FHA-approved lenders seem to favor applicants with higher credit scores. Over 71% of FHA borrowers had FICO scores of 650 or above in September 2021, with an average score of 676 for FHA purchase loans, according to data from ICE Mortgage Technology.

On average, it took longer to close an FHA purchase loan in September 2021 than in September 2020 52 days compared with 49 days a year earlier. Conventional purchase loans, meanwhile, closed in an average of 49 days in September 2021, according to ICE data.

The most recent HUD data shows that over 33% of FHA loans were for amounts between $250,000 and $399,000 by far the most common range. Over 68% of FHA loans issued during this period covered at least 96% of the homes estimated value, implying that most FHA buyers are making the minimum FHA down payment of 3.5%.

Fha Mortgage: Minimum Credit Score 500

FHA loans backed by the Federal Housing Administration have the lowest credit score requirements of any major home loan program.

Most lenders offer FHA loans starting at a 580 credit score. If your score is 580 or higher, you need to pay only 3.5% down.

Those with lower credit may still qualify for an FHA loan. But youd need to put at least 10% down, and it can be harder to find lenders that allow a 500 minimum credit score.

Another appealing quality of an FHA loan is that, unlike conventional loans, FHAbacked mortgages dont carry riskbased pricing. This is also known as loanlevel pricing adjustments .

Riskbased pricing is a fee assessed to loan applications with lower credit scores or other lessthanideal traits.

There may be some interest rate hits for lowercredit FHA borrowers, but they tend to be significantly less than the rate increases on conventional loans.

For FHAbacked loans, this means poor credit scores dont necessarily require higher interest rates.

Keep in mind, though, that FHA requires both an upfront and annual mortgage insurance premium which will add to the overall cost of your loan.

Read Also: California Loan Officer License