Specify The Loan Amount And The Date Of The Loan

The document features various yellow-highlighted text parameters. Under the 1. Loan section on the document, youll find yellow-highlighted that indicates where the amount of the loan should be specified.

You can navigate to the field where you can fill in the appropriate information for these yellow-highlighted parameters by going to the Tokens tab on the right side of your browser window.

Here youll find all of the yellow-highlighted parameters for the entire document. You can fill them all in now, or come back to them intermittently as you proceed through the document.

Why Choose A Personal Loan

Working out a personal loan can have advantages for both parties. Borrowers get the funds they need and avoid risky loans from payday and installment lenders. Lenders get the satisfaction of helping a friend or relative plus regular interest payments. In todays low-interest rate environment, even a low-interest personal loan may;provide better returns than a CD or bond.

Our advice? Dont borrow more than you need and can afford to pay back. If youre the lender, dont lend more than you can afford to lose, particularly if there is no collateral you can seize and the lender is not someone youd be willing to sue. You dont want the;personal loan to come between you and the other party. Personal loan agreements help keep messiness and uncertainty out of your financial transaction.

You dont have to be a lawyer to write a personal loan agreement. However, depending on the level of complication involved in the loan, you may want to hire a lawyer to help you with the details of the loan agreement. If you want to take the DIY approach, here are some basics to include;in your document:

What Is An Application Fee

Not to be confused with an origination fee, an application fee is a small, up-front cost some lenders charge to review your personal loan application. These fees are uncommon or, perhaps more appropriately, unnecessary so if a potential lender wants you to pay one, you should ask for it to be waived or search for another loan partner. ;

Also Check: How To Take Loan From 401k To Buy House

How To Borrow From Friends Or Family

The main advantage of receiving a loan from a friend or family member is that your lender is more likely to be flexible about the amount borrowed and payment arrangements. That means you could borrow 100% of the amount you need at a very low-interest rate possibly 0% and get an affordable monthly repayment schedule.

Treat a personal loan issued by a loved one with the same respect and professionalism as you would a loan from a bank. If you plan to borrow money from a bank, credit union or other lending institution, you already know you must be prepared to sign a legal contract outlining your obligations to the lender: On time payments until the loan is paid in full. This contract is called a promissory note.

Should it be any different if you borrow money from friends or family? Not really. Even though they may have known you for years or even a lifetime, they still need assurance that youll pay them back as promised. The fact you know them really well doesnt remove any of the obligations and responsibilities associated with taking on a loan.

It is a wise move to draw up and sign a loan contract regardless of your relationship with the lender. This protects both parties in case of a disagreement. A loan agreement between two individuals is more simplistic but very similar to a standard bank promissory note.

Basic terms for a loan agreement with family or friends should include:

- The amount borrowed

- Interest rate

- Repayment terms

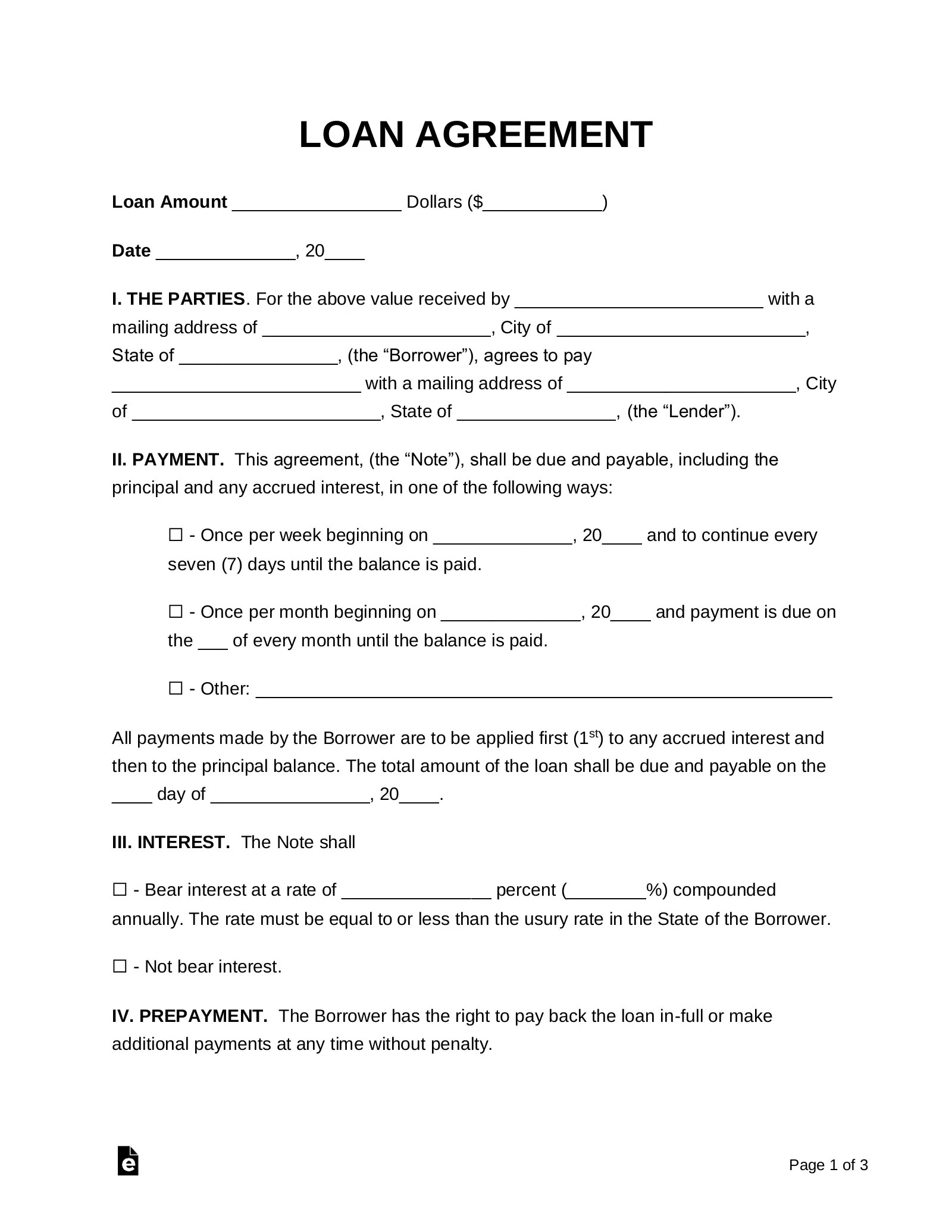

Loan Amount Borrower And Lender

![57 [PDF] A LOAN AGREEMENT TEMPLATE FREE PRINTABLE DOCX ... 57 [PDF] A LOAN AGREEMENT TEMPLATE FREE PRINTABLE DOCX ...](https://www.understandloans.net/wp-content/uploads/57-pdf-a-loan-agreement-template-free-printable-docx.jpeg)

The most important characteristic;of any loan is the amount of money being borrowed, therefore the first thing you want to write on your document is the amount, which can be located on the first line. Follow by entering the name and address of the Borrower and next;the Lender. In this example, the Borrower is located in the State of New York and he is asking to borrow $10,000 from the lender.

Also Check: Should I Get An Unsubsidized Student Loan

Loan Agreement: Everything You Need To Know Contracts

Important Legal Terms Found in Loan Agreements Allows recourse if the borrower defaults on the loan or fails to make a payment. Borrowers benefit;

Dec 7, 2010 1. Starting the Document · 2. Write the Terms of the Loan · 3. Date the Document · 4. Statement of Agreement · 5. Sign the Document · 6. Record the;

Jun 29, 2020 What should be in a personal loan agreement? · Names and addresses of the lender and the borrower · Information on cosigner, if applicable · Amount;

A loan agreement or loan contract is a written agreement that specifies all the details of a personal or business loan, including the amount of money or the;

A loan agreement is: · A borrowers written promise to repay a sum of money, or principal, to the lender · A document that outlines the terms of a loan, including;

Alternatives To Loans From Family Member

A 2009 survey by CNN Money reported that 27% of people who lent money to family or friends didnt receive any money back and 43% were not paid in full. In other words, most of the time loans between family and friends dont work and destroy relationships.

However, there are alternative sources of money if you want to avoid the very real possibility that taking or giving a loan to a family member or friend will not result in a good outcome.

Admittedly, it will be difficult to tap some of the sources for mortgage loans, house renovations or car loans, but if youre looking to start a business, the Small Business Administration is a government agency dedicated to serving small businesses. They offer a variety of loan programs, including a General Business Loan that could get you $50,000 to $250,000. The SBA also has a Microloan program that offers up to $50,000 for startups and some non-profit childcare centers.

When you go online, there are peer-to-peer lending sites such Lending Club and Prosper or crowdfunding sites like Kickstarter and Crowdfunder may deliver the loan you dont want to ask Mom and Dad for.

If youre looking for something that will help with a renovation or be a down payment for a home or new car, you could consider borrowing from your 401 retirement fund or doing a home equity loan or home equity line of credit .

8 Minute Read

Read Also: What Is The Current Va Loan To Value Ltv Rate

What Is A Late Payment Fee

A late payment fee is exactly what the name implies: a fine for failing to pay your monthly bill by the date specified in your loan agreement. Some lenders tack on a flat rate of $25-50 for late payments, while others charge 3-5% of the monthly payment amount.

If you incur a late payment fee, it should appear on the following month’s statement. You can appeal the charge if there’s a good reason your payment was delinquent, but there’s no guarantee the lender will remove it. Either way, being consistently late with your payments will damage your credit score, which can impact your ability to borrow money in the future.

Discover Four Ways A Personal Loan Can Help You Build Credit

Since personal loan agreements differ among lenders, your contract may include more information than these key components. For example, if you’re taking out a secured personal loan, the agreement will list the collateral you’re using to guarantee the loan and explain what could happen to the asset if you default.

Also Check: How To File Bankruptcy On Car Loan

On Demand Vs Fixed Repayment Loans

Loans use two sorts of repayment: on demand and fixed payment.

Demand notes are usually used for short-term borrowing and are often used when people borrow from friends or family members. Sometimes banks will offer demand loans to customers with whom they have an established relationship. These loans typically dont require collateral and are for small amounts.

Their key feature is how they are repaid. Unlike longer term loans, repayment can be required whenever the lender desires, as long as sufficient notification is given. The notification requirement is usually spelled out in the loan agreement. Demand loans with friends and family member might be a written agreement, but it might not be legally enforceable. Banks demand loans are legally enforceable. A check overdraft facility is one example of a bank demand loan if you dont have the money in your account to cover a check, the bank will loan you the money and pay the check, but you are expected to repay the bank quickly, usually with a penalty fee.

Fixed term loans are commonly used for large purchases and lenders often demand that the item purchased, perhaps a house or a car, serve as collateral if the borrower defaults. Repayment is on a fixed schedule, with terms established at the time the loan is signed. The loan has with a maturity date when it must be fully repaid. In some cases, the loan can be paid off early without penalty. In others, early repayment comes with a penalty.

Family Lending Vs Bank Lending

Though taking a formal loan can mean being subjected to considerable vetting, borrowing from family is not necessarily any simpler. Often, the choice to take a family loan means trading one kind of complication for another. You do not have to worry about hurting the banks feelings or alienating its loan officers but the same can certainly not be said for a family loan.

In general, the best course is to imitate the formal process, absent the administrative layers that can prolong and complicate bank transactions. Though borrowing from a family member may be the only option for less-creditworthy borrows, the end goal is usually to repair credit and finances so that future borrowing occurs in the formal sector. While family finance may be a good stop-gap solution, it is unlikely to be the best long-term solution.

You May Like: How Much Does My Loan Cost

Loan Agreements With Family And Friends

There is a right way to execute a loan agreement with family or friends that protects both sides from harm.

Home>>Loans>Loan Agreements With Family And Friends

Money is a funny thing when it passes between family and friends, especially if you are the one borrowing from or lending to a member of your family or a close friend.

The Federal Reserve Survey of Consumer Finances says loans from family and friends amount to $89 billion each year in the United States. A company called Finder did some math after a 2018 survey and said the number was more like $184 billion. Either way, theres a lot of cash flowing between family and friends.

The most popular reasons for asking family members or friends for a loan are to;start a business;or purchase a home. A national survey by Fundable said that 38% of startup businesses relied on money from family or friends. The National Association of Realtor said that 52% of first-time home buyers used money from family, mostly parents, or friends to buy a house.

Another good reason for seeking a loan from loved ones is when a family member becomes unexpectedly unemployed or is hit with a sudden illness. Other popular reasons include buying a car, a computer or other technical equipment or something more personal like an engagement ring or to pay for a family vacation.

Check Out Our Guide to COVID-19 Relief

Ensure A Formal Financial Arrangement

A legal loan agreement or promissory note signed by the two parties is a great way to remove the transaction from the level of friendship and place it in a formal context. This can help reassure the friend loaning the money that the borrower is serious about repaying the note and considers the loan to be a serious debt. This can make the difference when someone is asking for money from a friend or family member because a formal contract lets the lender know that this is not just a handshake and a promise and that the borrower fully intends to repay the debt.

If permitted in our county, you may also consider recording the agreement at the county recorders office to ensure there is a formal copy on record. By properly documenting and recording a personal loan, close friends and relatives can protect their relationship from any issues that might arise during the course of repayment of the loan.

When both parties understand that legal ramifications will ensue if the agreement is breached by either party, it puts the burden on the law rather than the relationship and can help minimize any problems that might occur.

PRODUCTS FOR

Also Check: Is It Easy To Get Loan From Credit Union

How To Write A Loan Agreement Small Business Chroncom

Include the important details in the loan agreement such as repayment terms, contact information of all parties, payment schedule, security, interest rates and;

Aug 26, 2021 Informal family loans may make sense for family dynamics, but a loan is still a contract, and loans have potential tax consequences for both the;

A loan agreement is a contract between a borrower and a lender which regulates the mutual Loan agreements are usually in written form, but there is no legal reason;

Why Is A Loan Agreement Important

Loan agreements are beneficial for borrowers and lenders for many reasons. Namely, this legally binding agreement protects both of their interests if one party fails to honor the agreement. Aside from that, a loan agreement helps a lender because it:

- Legally enforces a borrower’s promise to pay back the money owed

- Allows recourse if the borrower defaults on the loan or fails to make a payment

Borrowers benefit from loan agreements because these documents provide them with a clear record of the loan details, like the interest rate, allowing them to:

- Keep the lender’s agreement to the payment terms for their records

- Keep track of their payments

Read Also: Who Can Loan Me Money

What Is A Loan Agreement

A loan agreement, sometimes used interchangeably with terms like note payable, term loan, IOU, or promissory note, is a binding contract between a borrower and a lender that formalizes the loan process and details the terms and schedule associated with repayment. Depending on the purpose of the loan and the amount of money being borrowed, loan agreements can range from relatively simple letters that provide basic details about how long a borrower has to repay the loan and what interest will be charged, to more elaborate documents, such as mortgage agreements.

Regardless of the type of loan agreement, these documents are governed by federal and state guidelines to ensure that the agreed-upon interest rates are both reasonable and legal.

Contract Length & Amortization

The length of a loan contract is determined by a lenders reliance upon an amortization schedule. Once the lender and the borrower have determined the amount of money needed, the lender will use the amortization table to calculate what the monthly payment will be by dividing the number of payments to be made and adding the interest onto the monthly payment.

Unless there are certain loan conditions that penalize the borrower for early loan payment, it is in the best interest of the borrower to pay back the loan as quickly as possible. The faster the loan debt is retired the less money it costs the borrower.

Don’t Miss: How Much Home Loan Can I Get On 70000 Salary

Sample Of Loan Agreement Between Two Parties

February 17, 2018 by Ayush

A Sample of loan agreement between two parties is a type of contract between any individuals. They can be lender and borrower or among the family individuals. There are many types of loans signed by parties, mainly revolvers, term loans, working capital loans, facilities agreement loans etc. sample loan agreement between two people are also a culprit in destroying any relationship. As money will come and go but once the relationship is destroyed it cant be rebuilt. So make agreements securely and thoughtfully.

What Is A Personal Loan Agreement

As a legally binding contract, a personal loan agreement can be drawn up with an official lender like a bank or credit union or in a more informal situation such as with a friend whos lending you money. Basically, it states :

- How much youre borrowing

- When you promise to pay it back

- Any fees and/or penalties youve agreed to pay, depending on the situation

If you default on the loan, a lender may take action in court to get its money back via wage garnishment or another method.

Most personal loans are unsecured, meaning you promise to pay back the funds based on your creditworthiness as a borrower. If you draft a secured personal loan agreement, you must put up collateral, such as your car or your home, to back up the loan. If you dont pay back the loan, you could lose your collateral to the lender. Make sure to review that section in your agreement.

When lending money to a close friend or family member, its a good idea to draft an official agreement to avoid any misunderstanding that could affect your relationship. While it might seem like overkill for small amounts that can be paid off by the next paycheck, you might want to consider doing the paperwork for larger personal loans that will take longer to repay.

Recommended Reading: Is My Home Loan Secured