Why Do I Have To Pay Pmi On Fha

4.7/5FHA Mortgage InsurancePMIyou payyouFHArequired to payFHA mortgage insuranceyouFHA

If you currently pay PMI or MIP mortgage insurance, you can get rid of it by refinancing once your home reaches 20% equity. If you’re shopping for a new home loan, look for options that allow no PMI even without 20% down.

Subsequently, question is, how much is PMI on an FHA loan? FHA MIP Chart

| FHA MIP Chart for Loans Less Than or Equal to 15 Years |

|---|

| Base Loan Amount |

| 0.45% |

Hereof, do you have to pay PMI on a FHA loan?

Most FHA borrowers choose the 30-year loan option and put down 3.5%. Both premiums can be ârolledâ into the loan and paid monthly. So, while FHA does not require PMI , they do require borrowers to pay two different types of premiums â the upfront and annual MIP.

How can I avoid PMI without 20 down?

The traditional way to avoid paying PMI on a mortgage is to take out a piggyback loan. In that event, if you can only put up 5 percent down for your mortgage, you take out a second “piggyback” mortgage for 15 percent of the loan balance, and combine them for your 20 percent down payment.

Always Compare The Full Cost Of The Loan

As a borrower, you should evaluate the full cost of the loan product you are considering. This includes the interest rate, lender and third-party fees, and the cost of mortgage insurance when applicable.

The FHA program has pros and cons. On the upside, its generally easier to get approved for an FHA-insured home loan, compared to a conventional mortgage product. The downside is that you have to pay those two insurance premiums mentioned earlier. There are other disadvantages as well.

Granted, if you can only afford a down payment in the 3% 5% range, youll probably end up paying for mortgage insurance on a conventional loan as well. But it might not cost as much as the MIPs associated with an FHA loan. Borrowers with good credit could potentially save money by choosing a conventional loan rather than an FHA loan . But thats not always the case.

The bottom line is that you have to consider the full cost of each loan product when you are comparison shopping. Do the math to see what works out best over the long run.

To re-answer the question at hand: No, FHA does not require PMI. Thats a private-sector mortgage insurance product. Thats what the P stands for. But they do require borrowers to pay government-provided insurance, and this comes in the form of an upfront and annual premium.

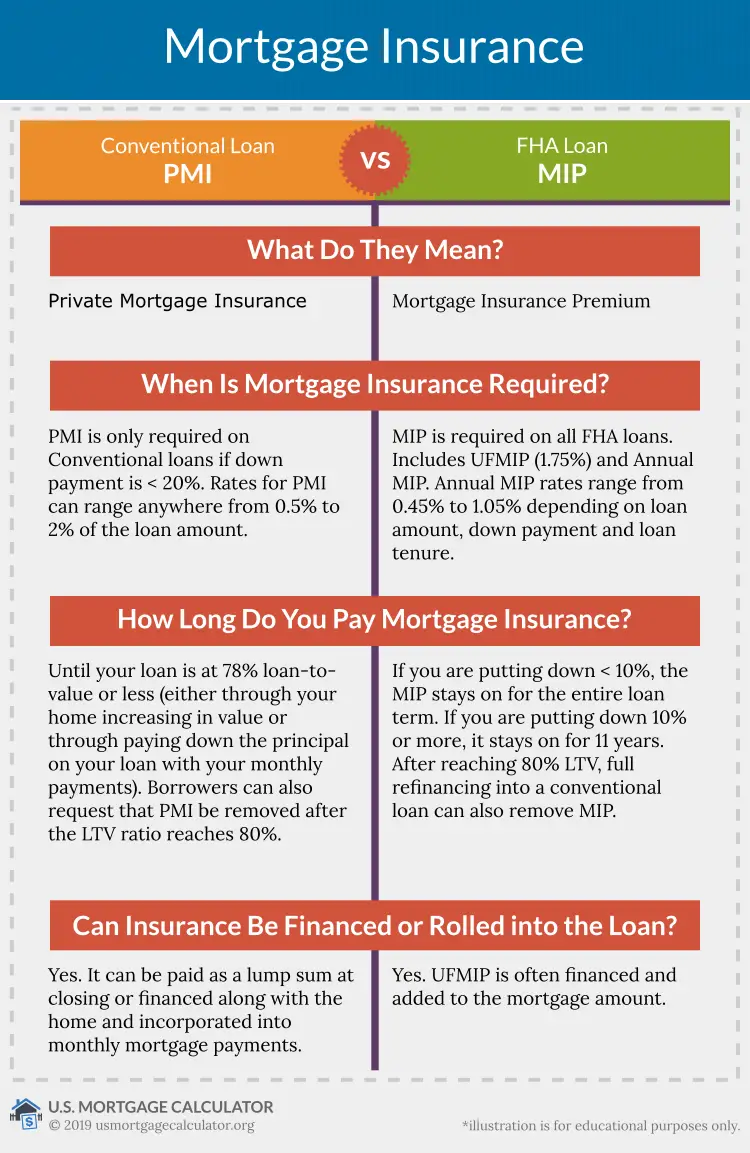

What Is Mortgage Insurance And How Does It Work

Mortgage insurance lowers the risk to the lender of making a loan to you, so you can qualify for a loan that you might not otherwise be able to get.

Typically, borrowers making a down payment of less than 20 percent of the purchase price of the home will need to pay for mortgage insurance. Mortgage insurance also is typically required on FHA and USDA loans. Mortgage insurance lowers the risk to the lender of making a loan to you, so you can qualify for a loan that you might not otherwise be able to get. But, it increases the cost of your loan. If you are required to pay mortgage insurance, it will be included in your total monthly payment that you make to your lender, your costs at closing, or both.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Choose A Different Government Loan Type

If you really want to avoid MIP payments, you may want to consider another type of government loan.

You may be buying a home in a rural area and have a median FICO®Score of 640 or higher. In that case, why not consider a USDA loan? Unlike an FHA loan, USDA loans dont require a down payment. You also dont need to pay PMI or MIP with a USDA loan. Instead, you pay a monthly guarantee fee thats less expensive than the FHA monthly premium.

On the other hand, you might want to consider a VA loan if youre a current or former member of the armed forces or a qualifying spouse. To qualify for a VA loan, youll need a median FICO®credit score of at least 620 and a DTI ratio of 60% or less. Theres no down payment requirement for a VA loan. You also dont have to pay any type of monthly mortgage insurance on a VA loan. Instead, youll pay a one-time VA funding fee and the home must be your primary residence. Veterans receiving VA disability benefits and surviving spouses of veterans who passed in the line of duty or as a result of a service-connected disability are exempt from the funding fee.

Contact a Home Loan Expert to learn more about these FHA loan alternatives and to find out whether you qualify.

Do Fha Mortgage Loans Require Insurance

FHA loans may require lower down payments and have less strict credit requirements than conventional mortgages. However, FHA mortgage loans may require both an upfront mortgage insurance premium and an annual MIP, which you can pay monthly.

Unlike with PMI, you can’t request to cancel your FHA loan’s MIP after you reach 20% equity, and it won’t be automatically removed once you reach 22% equity. In fact, if your down payment is less than 10%, the PMI will remain for the lifetime of the loan.

If you put down at least 10% on your FHA loan, the MIP will be removed after 11 years. Alternatively, you could refinance your mortgage once you’ve established 20% equity to get a new mortgage that doesn’t require mortgage insurance.

Don’t Miss: How Do I Find Out My Auto Loan Account Number

How Much Is Mortgage Insurance On An Fha Loan

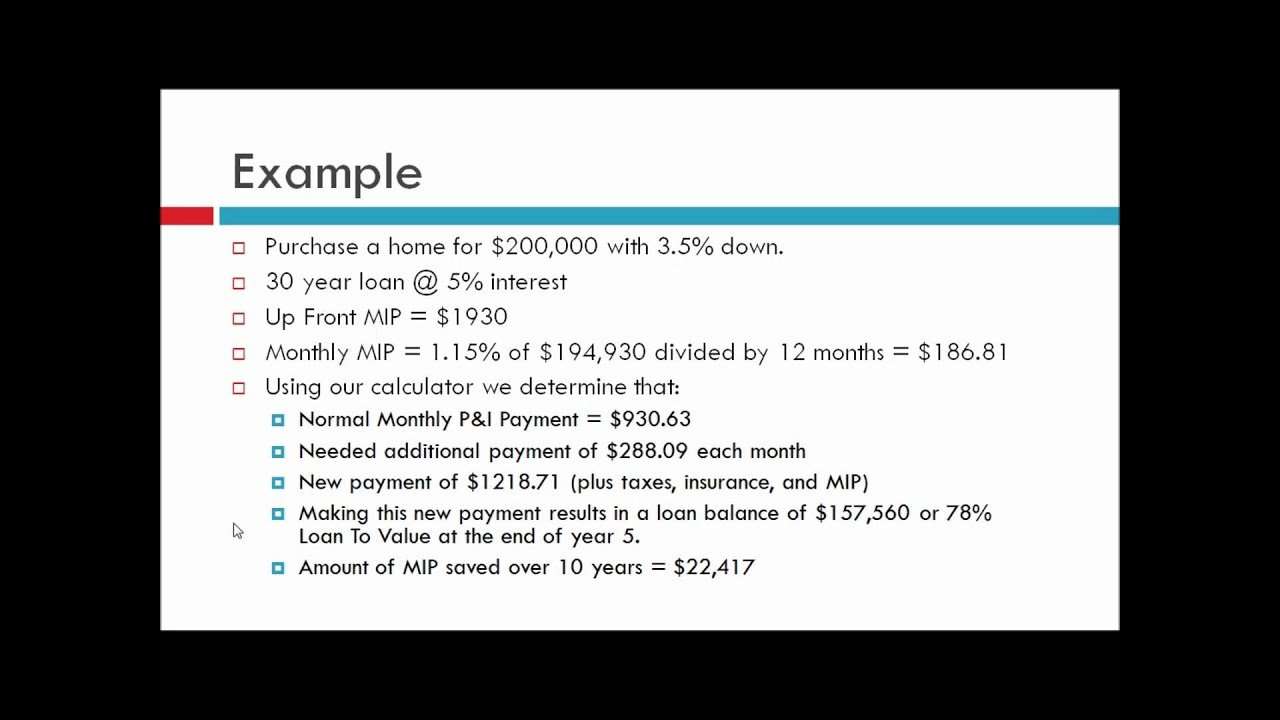

The cost of FHA loan mortgage insurance depends on your loan amount, your loan-to-value ratio , and your mortgage term. This means the cost of mortgage insurance will be different from one FHA homeowner to the next. Lets look at a sample homeowner to give you a sense of how much UFMIP and MIP might cost.

The upfront mortgage insurance premium is equal to 1.75% of the base loan amount. This means if you borrow $250,000 to finance a home with an FHA loan, your upfront premium would cost $4,375. This is a one-time fee you pay at closing or add to your loan amount.

The annual mortgage insurance premiums are affected by base loan amount, your loan-to-value ratio, and your mortgage term. Pretend again you are borrowing $250,000 to buy a home with an FHA loan. Then say you made a 10% down payment, so that your loan-to-value ratio is 90%. Finally, say you choose a mortgage with a 30 year term.

In this case, your annual FHA loan mortgage insurance would cost you 0.80% of your loan amount, which is $2,000 total in the first year of your mortgage. This is a cost that you will pay in installments each month as part of your monthly mortgage bill. In our example, your payments will be about $167 a month.

Your FHA mortgage insurance costs are recalculated each year based on your average outstanding loan balance. This means that as you pay down your mortgage principal, the cost of your monthly mortgage insurance premiums may go down too.

How Long Do Guarantee Fees Last

The downside here is that guarantee fees live for the life of the loan. The only way to get rid of them is by refinancing into a conventional loan and requesting PMI removal after you reach 20% equity.

This isnt common, but there are cases in which you can receive your loan directly from the USDA. In these instances, there are no guarantee fees.

Read Also: When Can I Apply For Grad Plus Loan 2020-21

Conforming Loans With Private Mortgage Insurance

Conforming loans get their name because they meet or conform to Fannie Mae or Freddie Mac guidelines for the loan amount and the borrower’s creditworthiness.

Conforming Loan Insurer

A loan conforming to Fannie Mae or Freddie Mac’s standards is not insured by either Fannie or Freddie. PMI is not government insured it’s backed by private companies.

PMI Cost for Conforming Loans

PMI is generally cheaper than the mortgage insurance premiums on FHA loans. How much a borrower will pay for PMI depends on the loan type, down payment percentage, property type, location and other factors.

Things To Consider With Fha Loans

With private mortgage insurance, lenders usually require an appraisal to prove your loan-to-value ratio is good enough to drop the insurance. That’s bad news if your home’s value has dropped. With FHA mortgage insurance there’s no appraisal. The FHA uses your original purchase price or original appraised value, whichever is lower, as the basis for the cutoff point. On a $250,000 house, you could cancel your insurance when you’d paid the mortgage down to $195,000, even if your home’s value declines in the meantime.

References

Writer Bio

A graduate of Oberlin College, Fraser Sherman began writing in 1981. Since then he’s researched and written newspaper and magazine stories on city government, court cases, business, real estate and finance, the uses of new technologies and film history. Sherman has worked for more than a decade as a newspaper reporter, and his magazine articles have been published in “Newsweek,””Air & Space,””Backpacker” and “Boys’ Life.” Sherman is also the author of three film reference books, with a fourth currently under way.

You May Like: How To Transfer Car Loan To Another Person

Us Department Of Agriculture Loan

If you get a US Department of Agriculture loan, the program is similar to the Federal Housing Administration, but typically cheaper. Youll pay for the insurance both at closing and as part of your monthly payment. Like with FHA loans, you can roll the upfront portion of the insurance premium into your mortgage instead of paying it out of pocket, but doing so increases both your loan amount and your overall costs.

Fha’s Mortgage Insurance Premium Through The Years

The FHA has changed its MIP multiple times in recent years. Each time the FHA raised its MIP, FHA loans became more expensive for borrowers. Each increase also meant some prospective borrowers werent able to qualify for or afford the higher monthly mortgage payments due to the MIP.

In January 2015, the FHA reversed course and cut its MIP to 0.85 percent for new 30-year, fixed-rate loans with less than 5 percent down. The FHA projected that this decrease would save new FHA borrowers $900 per year, or $75 per month, on average. The actual savings for individual borrowers depends on the type of property they own or purchase, their loan term, loan amount and down payment percentage. As of 2019, FHA’s mortgage insurance rates ranged from 0.8 percent to 1.05 percent, depending on the size of the loan and the amount of the down payment.

Changes in FHAs MIP apply only to new loans. Borrowers whove closed their loans dont need to worry that their MIP will get more expensive later.

Borrowers might wonder whether there are ways to lower their FHA mortgage insurance costs. Whether for good or ill, the fact is that FHA insurance is not negotiable or subject to discounts, coupons or the like.

In 2014, the FHA announced plans to introduce a program that would have offered borrowers a small MIP price break if they completed a homeownership class taught by an approved non-profit organization before they obtained their loan.

Don’t Miss: What Car Loan Can I Afford Calculator

What Is The Fha Loan Approval Process

The process for loan approval happens after you submit the required information to the lender for pre-approval. Once you have this pre-approval, you can show the seller the information to indicate you will complete the process for a loan. You need to have found a home you want to purchase to complete the next form.

The next form is the Fannie Mae form 1003, also known as the Uniform Residential Loan Application. You need to include the address of the home you want to buy on this form in addition to supplying all necessary documents to show your income and employment.

With the address on file, the lender can send an FHA-approved home appraiser to assess the propertys value. If the property value falls within the mortgage requirements and the home meets HUD guidelines, you can move forward. If the home has a value too high or too low for the mortgage, you may not have it approved.

After the appraisal, your lender will examine your finances to determine if you qualify for the loan. Once you get the lender to underwrite your home loan, you have approval for your home loan and can continue to the closing process.

Dropping Pmi On Fha Loan Payments

Do you want to learn how to drop PMI from your FHA mortgage payment?

If you have an FHA home loan, part of your monthly mortgage payment goes towards private mortgage insurance . But dont be tricked by the word insurance. This payment doesnt insure you but rather protects your lender in the event you were to default on your mortgage. In this case, you can learn how to drop mortgage insurance from your loan payment via several ways.

Since FHA home loans only require a 3.5% down payment, theyre one of the most affordable ways to buy a home. But since PMI doesnt benefit you, many people want to drop PMI from their monthly mortgage payment.

Believe it or not, there are 4 different ways for you to remove PMI from your monthly payment. Read on to learn more and find out if you qualify for one of the options.

Don’t Miss: How To Get An Aer Loan

Refinance To A Conventional Loan

Many homeowners refinance to a conventional loan when they reach 20% equity. When you have a conventional loan, you dont pay MIP. Instead, your lender might require you to pay PMI but only if you have less than 20% down. You can stop paying MIP without switching to PMI by refinancing to a conventional loan once youve reached 20% equity.

To refinance to a conventional loan, you must meet your lenders minimum requirements. Conventional loan requirements are stricter than FHA loan requirements, so you might need to take some time to build a better borrower profile before you refinance. To qualify for a conventional loan, youll need at least the following:

- A higher credit score: You must have a median FICO® Score of at least 620 points. Making your credit card and loan payments on time and limiting your spending can help you increase your score while you build equity.

- Debt-to-income ratio: You must have a DTI ratio of 50% or less to qualify for a conventional loan. You can decrease your DTI ratio by increasing your household income or paying down your debts.

- Home equity: You should have at least 20% equity in your home before you refinance. If you refinance before you have 20% equity, youll need to pay for PMI instead of MIP. PMI is more expensive than MIP, so be sure you have the right amount of equity before you refinance. If you arent sure how much equity you currently have, contact your lender.

What’s The Difference Between Pmi And Mortgage Protection Insurance

Unlike PMI which is solely for the lender’s protection, mortgage protection insurance will continue to cover your mortgage payments after you die. This insurance can help protect your family members facing foreclosure on the property after you have passed on. This insurance is sometimes referred to as mortgage life insurance.

Recommended Reading: Mortgage Commitment Fee

One Other Option For Avoiding Pmi

There is yet one more way to avoid PMI on a conventional loan, and thats by doing a first/second combination. Thats where you take a new first mortgage equal to 80% of the value of your property, and then cover the remaining balance through the use of a second mortgage or home equity line of credit .

It should be understood however that the first/second combination is generally not an option if you have a low credit score. This is because the credit score requirements for second mortgages and HELOCs are generally higher than for conventional first mortgages.

Typically however, a first/second refinance combination will be limited to an 80% new first mortgage, and a 15% second mortgage or HELOC. That means that your current mortgage cannot exceed 95% of the value of the property otherwise youll have to put up additional cash in order to lower the loan balance to that level.

But if you can use either refinancing strategy to turn your FHA mortgage into a conventional mortgage with no PMI or lower PMI, you can eliminate your FHA mortgage and the PMI that it will charge for the life of the loan.

What Is The Loan

– Kelsey, VA

30-Year Fixed-Rate Refinance Mortgage Example:The payment on a $225,000 30-year fixed-rate cash out refinance loan at 3.250% with a 70% loan-to-value is $979.21 with 2 points due at closing. The Annual Percentage Rate is 3.520%. This assumes a FICO score of at least 690. Payment does not include taxes and insurance premiums, which will result in a higher monthly payment. Interest rates and annual percentage rates are based on current market rates and are subject to change without notice. Rates offered may be subject to pricing add-ons related to property type, loan amount, LTV, credit score, and other variables. Mortgage insurance may be required for LTV > 80%. If mortgage insurance is required, the mortgage insurance may increase the APR and the monthly payment. Stated rate may change or not be available at the time of loan commitment or lock-in.

You May Like: How Does Paypal Business Loan Work