Is A Stafford Loan Right For You

Stafford Loans do tend to have lower interest rates than other types of student loans and provide important borrower protections including the opportunity for loan forgiveness. So these are among your best options for funding your education through a loan.

Its best to exhaust your options for Stafford Loans first before considering alternatives including PLUS Loans or private student loans.

Eligible For Federal Loan Forgiveness

If you plan on going into a public service field, such as teaching, working as a medical professional, joining the military, or becoming a first responder, you may be eligible for federal loan forgiveness programs down the line. These could wipe your debts clean after ten years of payments.

However, these programs only apply to federal loans if youve taken out private loans, you cannot qualify for any federal forgiveness. So, make sure to weigh this if you foresee yourself joining a qualifying field of work.

Direct Loan eligibility require two main things from students:

Once you are accepted to a college, you will receive a financial aid award letter outlining your various options for paying for college .

How Much Can You Borrow

The total amount that you can borrow in Direct Unsubsidized Loans will depend on a number of factors, including whether you are an undergraduate student or an undergraduate student, as well as the specific year of your education for which you are borrowing.

For undergraduate students who are dependent on their parents, you can borrow a total of $31,000 in Direct Unsubsidized Loans. The amount varies by year:

- During your first year you can borrow $5,500 in subsidized loans

- During your second year you can borrow $6,500 in subsidized loans

- During your third year you can borrow $7,500 in subsidized loans

For undergraduate students who are independent of their parents, you can borrow a total of $57,500 in Direct Unsubsidized Loans. The amount varies by year:

- During your first year you can borrow $9,500 in subsidized loans

- During your second year you can borrow $10,500 in subsidized loans

- During your third year you can borrow $12,500 in subsidized loans

For graduate and professional students, you can borrow a total of $138,500 in Direct Unsubsidized Loans. This aggregate includes loans for your undergraduate career. You can borrow a total of $20,500 each year.

Typically, your school will determine exactly how much you can borrow each year and notify you of this amount in your financial aid package.

Don’t Miss: How Much Down Payment For Home Loan

Who Qualifies For Federal Direct Loans

Federal subsidized and unsubsidized loan borrowers must meet the following requirements:

- Enrollment at least half-time at a school that participates in the Federal Direct Loan Program

- U.S. citizenship or eligible non-citizenship

- Possession of a valid Social Security number Satisfactory academic progress

- Possession of a high school diploma or the equivalent

- No default on any existing federal loans

Direct subsidized loans are only available to undergraduates who demonstrate a financial need. Both undergraduates and graduate students can apply for direct unsubsidized loans, and thereâs no financial need requirement.

If you qualify for a subsidized loan, the government pays your loan interest while you’re in school at least half-time and continues to pay it during a six-month grace period after you leave school. The government will also pay your loan during a period of deferment.

To apply for either type of loan, you will need to fill out the Free Application for Federal Student Aid . This form asks for information about your income and assets and those of your parents. Your school uses your FAFSA to determine which types of loans you qualify for and how much youâre eligible to borrow.

The Biden administration extended federally-held student loan forbearance through Dec. 31, 2022. The White House also announced plans for debt relief for certain borrowers, changes to the student loan system, and plans to cut the costs associated with higher education.

Deferrable For Grad School Or Other Approved Reasons

If you decide to go back to school or undergo a life change that makes it difficult to make loan payments for a set amount of time, federal loans are much more flexible than private loans. As long as you qualify for deferment, you can pause your payments with no penalties to your credit score or the amount owed. Subsidized Stafford Loans will even pause the interest on the loan during the period of deferment, whereas Unsubsidized Stafford Loans will accrue interest but incur no other penalties.

Don’t Miss: Does Va Loan Have To Be Primary Residence

Federal Stafford Loan Interest Rates For 2021

Stafford Loan interests rates are set by the federal government each year on June 1st. The current interest rates for Direct Stafford Loans are:

|

5.28% |

Key Takeaways

- Federal Stafford Loans are arguably the best loans available to students, and any search for loans should start with them

- They typically have lower interest rates than other loans, and allow for more flexible repayment options than private loans

- Only undergraduate students with demonstrated financial need qualify for Direct Subsidized Stafford Loans, but all students qualify for Direct Unsubsidized Stafford Loans

- Subsidized Stafford Loans do not accrue interest while you are in school, while they are deferred, or for six months after graduation

- Unsubsidized Stafford Loans begin to accrue interest immediately after being dispersed

- All Federal Stafford Loans qualify for flexible repayment plans, deferral, and forgiveness

How Much Can I Borrow With A Direct Stafford Loan

The amount that you can borrow with a Direct Stafford Loan depends on whether you qualified for an unsubsidized loan or a subsidized loan. The total amount is determined by your school and cannot exceed your financial need depending on which loan type you receive.

The amount that you are allowed to borrow each year also depends on what year you are in school and your dependency status. The following tables show the annual and aggregate limits for unsubsidized and subsidized loans for dependent and independent students as determined by the U.S. Department of Education.

| Unsubidized Loans |

|---|

| $23,000 |

Also Check: Which One Is Better Fha Or Conventional Loan

Applying For A Stafford Loan

Apply for a Stafford loan by completing a Free Application for Federal Student Aid form. This application is also used to determine if youll receive a Perkins loan, another type of federal student loan.

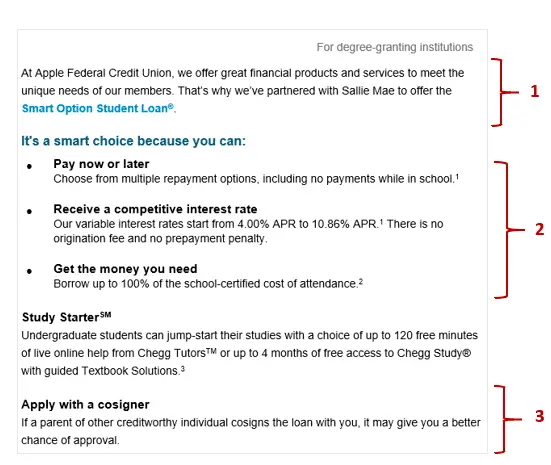

If you are not eligible for any federal student aid, look into private education loans to finance your education. No matter what your financial situation or credit history, you should be able to find a loan to help you pay for your own or your childs higher education.

Direct Stafford Loans: Unsubsidized Vs Subsidized Loans

The difference between an unsubsidized loan and a subsidized loan is that the borrower is responsible for paying the interest on an unsubsidized loan while the student is in schoolprovided the student is attending school at least half-timeand for the first six months after graduating , and during a deferment period. For a subsidized loan, the U.S. Department of Education pays the interest while the student is in school.

If you decide to take out a private student loan you will pay all the interest even while you are in school. If you decide not pay the interest while you are in school, that interest will accumulate over time during a grace or deferment period, and be added to the balance of your loan.

Read Also: What Type Of Loan For Motorcycle

Student Loan Refinance Rates

If you already have student loans and are looking for better rates, refinancing could be a good option for you. However, if you plan to refinance your federal student loans, first consider the benefits you would be giving up, including income-driven repayment plans and student loan forgiveness. Still, you can explore student loan refinance lenders to see what would make the most sense for your student loans.

Keep in mind that interest rates are largely determined by your credit score, which indicates your ability to pay back the loan. If your credit score is not very high, you won’t qualify for the lowest rates available and should consider working to improve your credit score before applying or using a cosigner. Below, we’ve listed some of the best student loan refinance lenders and their rates.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

How Interest Rates Are Determined

Federal student loan interest rates are established each year. There are also interest rate caps:

- 8.25% for Direct Subsidized loans and Direct Unsubsidized loans for undergraduate students

- 9.50% for Direct Unsubsidized loans for graduate/professional students

The interest rates are calculated using a base 10-year Treasury Note Index of 1.710% plus an add-on amount for each loan program

- 2.05% for Direct Subsidized loans and Direct Unsubsidized loans for undergraduate students

- 3.60% for Direct Unsubsidized loans for graduate/professional students

Read Also: How Soon Can I Refinance An Auto Loan

What Are The Interest Rates For A Direct Stafford Loan

The interest rate for Direct Stafford Loans varies depending on whether you choose an unsubsidized loan or a subsidized loan.

- Direct unsubsidized student loans have an interest rate of 4.45% for undergraduates and 6% for graduate students on loans that were disbursed after July 1, 2017, and before July 1, 2018.

- Direct subsidized student loans have an interest rate of 4.45% for loans that were disbursed after July 1, 2017, and before July 1, 2018.

The Difference Between Fixed And Variable Rates

Student loan interest rates can be either fixed or variable. Fixed interest rates are a type of interest rate that doesn’t change over your loan term, so youll know upfront how much your total cost to borrow will be and what your monthly payments will look like. Variable interest rates are a type of interest rate that changes based on market conditions, so your monthly payment may increase or decrease periodically.

Recommended Reading: How To Get Loan Estimate

How To Apply For Bidens Student Loan Forgiveness Program

Most borrowers will have to submit a simple application before their loan forgiveness can be processed. The application is expected to be released in early October. Subscribe to the Department of Educationâs mailing list to be notified when the application is open.

After you submit an application, expect loan forgiveness in four to six weeks. The Department of Education will accept applications until December 31, 2023 and process them as theyâre received. However, if you want your loans forgiven before payments resume on January 1, 2023, the department recommends submitting an application by November 15, 2022.

About 8 million borrowers wonât have to do anything to get forgiveness. If the government has recent income data for you, it can automatically process your loan cancellation. If youâre not sure if this describes you, submit an application to be safe.

How To Accept Reduce Or Decline Your Loan Offer

You can accept or decline a Federal Direct Unsubsidized Loan on your electronic Financial Aid Notification by selecting Accept or Decline in the dropdown box on the Financial Aid Notification Accept/Decline Awards page.

You can reduce your loan by selecting Accept in the dropdown box and entering a lower award amount in the Partial Accept field. If you wish to request loan changes, you should Request Changes on the Financial Aid Notification Information Request page.

A Direct Loan Master Promissory Note and Entrance Counseling session is required for Federal Direct Loans before the loan funds will be disbursed. In most cases, youll only be required to complete one master promissory note and one entrance counseling session during your college career.

Recommended Reading: How Much Interest Is On An Unsubsidized Loan

Current Student Loan Interest Rates

Depending on the kind of student loan you have or are looking to get, interest rates vary. About 90 percent of student loan debt is comprised of federal loans, with interest rates ranging from 4.99 percent to 7.54 percent. Average private student loan interest rates, on the other hand, can range from 3.22 percent to 13.95 percent fixed and 1.29 percent to 12.99 percent variable. While federal student loan rates are the same for every borrower, private student loan rates vary widely based on the lender, the type of interest rate and the borrower’s credit score.

Stafford Loans For Graduate Students

Graduate students have a different set of options when it comes to Stafford Loans. While they do not qualify for Subsidized Stafford Loans, they can take out Unsubsidized ones with a much higher limit than undergrads. In fact, they can take out up to $20,500 per year. While these loans have less favorable terms than Subsidized loans, they are still some of the best loans available.

Graduate students should turn to Stafford Loans for funding before they look at any other options, due to the flexible repayment options, low interest rate, and eligibility for loan forgiveness.

Read Also: No Credit Check Student Loans

To Accept/reduce/decline A Federal Direct Unsubsidized Loan

The student must accept or decline a Federal Direct Unsubsidized Loan on the electronic Award Letter on SalukiNet by selecting Accept or Decline in the dropdown box on the Award Letter Accept/Decline Awards page. The student can reduce the loan amount by selecting Accept in the dropdown box and entering a lower award amount in the Partial Accept field. If the student wishes to request loan changes, they should use the Request Changes on the Award Letter Information Request page of the electronic Award Letter.

The first time a loan is accepted, the student must complete a Electronic Master Promissory Note. The loan will then be credited to the student’s SIUC account, divided into two payments for the academic year. The student will also be required to participate in an Entrance Loan Counseling session.

All or part of the loan can be canceled within 90 days of the date the school notifies the student that the loan has been credited to their account. Loan funds will first be used to pay for tuition, fees, room and board. If funds remain after these charges have been paid, the student will receive the remaining funds by check.

How Do I Apply For A Federal Direct Stafford Student Loan

All students who wish to borrow a Federal Direct Stafford Student loan must complete a Free Application for Federal Student Aid AND your financial aid eligibility must already be determined BEFORE you can apply for a loan and complete the loan activation steps. To view your financial aid eligibility, log into My Canyons at my.canyons.edu and click on “Financial Aid Status”. Federal Pell Grant eligibility must be determined first before we will determine your loan eligibility or before we will process your Direct Loan application. This is to ensure that you get any grant money you are eligible for before choosing to borrow through the Stafford Loan Program.

Also Check: Calculate Pay Off Loan Early

Borrowing & Interest Rates

The total amount that you can borrow in a Federal Direct Unsubsidized Loan cannot exceed your Estimated Cost of Attendance minus other aid received. In addition, the total Federal Direct Subsidized Loan and Federal Direct Unsubsidized Loan cannot exceed your annual maximum loan limit.

The interest rate on loans borrowed by undergraduate students between July 1, 2021 and June 30, 2022 is 3.73%, and the interest rate for graduate students is 5.28%. The interest rate on loans borrowed by undergraduate students between July 1, 2022 and June 30, 2023 is 4.99%, and the interest rate for graduate students is 6.54%. The loan origination fee for loans borrowed after October 1, 2020 and before September 30, 2023 will be 1.057%, and will be deducted from your loan at time of disbursement.

Youre charged interest on this loan from the time the loan is disbursed until it is paid in full. If the interest is allowed to accumulate, the interest will be added to the principal amount of the loan and increase the amount to be repaid.

Federal Student Loan Interest Rates: 2019

Student loan interest rates will decrease for the 2019-2020 school year for all federal loan types disbursed between July 1, 2019 and July 1, 2020. The disbursement date for any student loan is the date on which you receive payment from the lender. Below, we have listed the current student loan rates on the available types of federal loans. Note that these percentages represent the amount of interest you will pay on an annual basis.

| Loan Type |

|---|

| 4.236% |

Also Check: Can I Give My Car Loan To Someone Else

Interest On Subsidized And Unsubsidized Loans

Federal loans are known for having some of the lowest interest rates available, especially compared to private lenders that may charge borrowers a double-digit annual percentage rate :

- For loans disbursed on or after July 1, 2021, and before the July 1, 2022, school year, direct subsidized and unsubsidized loans carry a 3.73% APR for undergraduate students.

- The APR on unsubsidized loans for graduate and professional students is 5.28%. And unlike some private student loans, those rates are fixed, meaning they donât change over the life of the loan.

There’s also one other thing to note about the interest. While the federal government pays the interest on direct subsidized loans for the first six months after you leave school and during deferment periods, youâre responsible for the interest if you defer an unsubsidized loan or if you put either type of loan into forbearance.

Income-driven repayment plans can mean lower monthly payments, but you might still be making them 25 years from now.