Which Lender Is The Most Trustworthy

We’ve reviewed each institution’s Better Business Bureau score to help you make the best decision possible when choosing an auto loan. The BBB measures businesses’ trustworthiness based on factors like truthfulness in advertising, honesty about business practices, and responsiveness to consumer complaints. Here is each company’s score:

| Lender | |

| Clearlane by Ally | D- |

A majority of our top picks are rated A or higher by the BBB, with the exception of Clearlane by Ally. Keep in mind that a high BBB score does not guarantee a good relationship with a lender, and that you should keep doing research and talking to others who have used the company to get the most helpful information you can.

The BBB currently rates Clearlane by Ally a D- in trustworthiness because of 53 complaints filed against the business, including one unresolved complaint. Due to the lenders’ BBB scores, you might prefer to use a different auto loan company on our list.

What Are Your Financing Options With Ally When You Go To The Dealership

- Buying a Car: When you finance the purchase of a vehicle, you make monthly payments until your retail installment contract has been paid off. Once you pay all amounts due under the finance contract, you own the vehicle outright and can keep it as long as you want to. Why buy? Learn here.

- Leasing a Car: When you lease, you are using the vehicle and making monthly payments for a set term. At the end of your lease, you must return the car and may have an option to purchase it. Why lease? Learn here.

New Ally Program Could Help Bad Credit Car Customers

Ally Wallet Wise program will offer both online and in person advice on budgeting credit and banking even for people with poor credit car loans

Helping you

If you have poor credit you may be looking for something in addition to terrible credit auto loans that can raise your credit scores and improve your current credit situation.

We understand this because we’ve been involved in bad credit auto sales for nearly twenty years here at Auto Credit Express. In that time frame, we’ve gotten approvals for hundreds of buyers for a bad credit car.

We can show you why a tote the note dealer won’t help your credit score and we can also walk you through the loan process to lessen the possibility of repossession. Buyers outside our retail area can also fill out an online auto loans application to find the right kind of dealer in their area.

But we realize that there are also other things you can do to improve your credit scores, which is why we want to pass on to you the recent news from Ally Financial.

Ally Wallet Wise

For some consumers, issues such as credit, household budgets, banking and investing can be challenging topics, especially if they don’t know where to go for guidance. Ally Financial Inc. has launched a new financial literacy programAlly Wallet Wisethat can help take some of the unknown out of personal finance.

As we see it

Recommended Reading: Where Do I Apply For Ppp Loan

How Does Ally Auto Finance Auto Loans Work

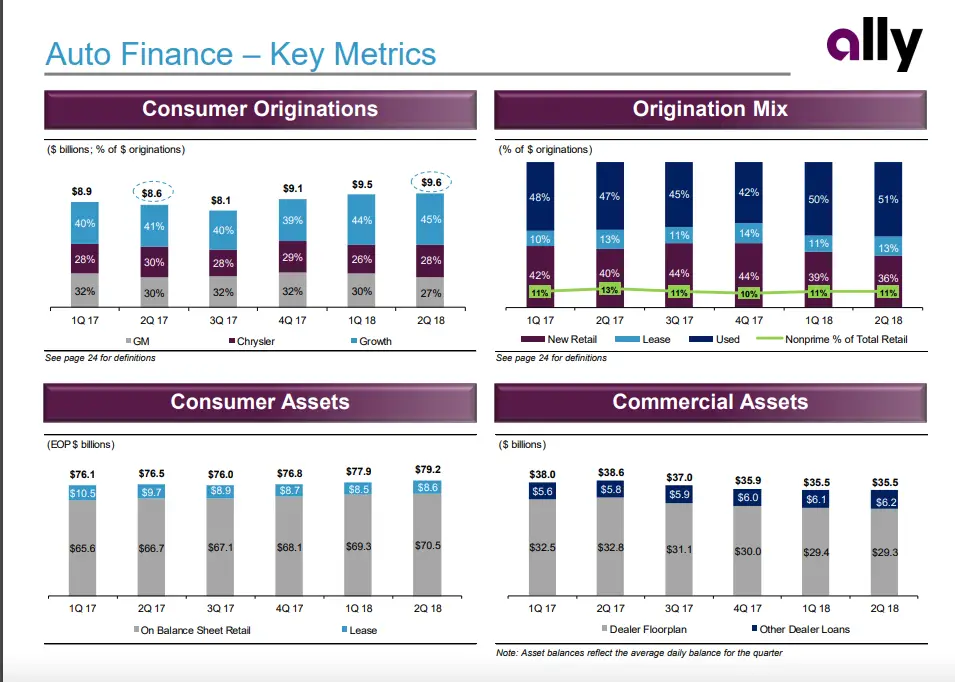

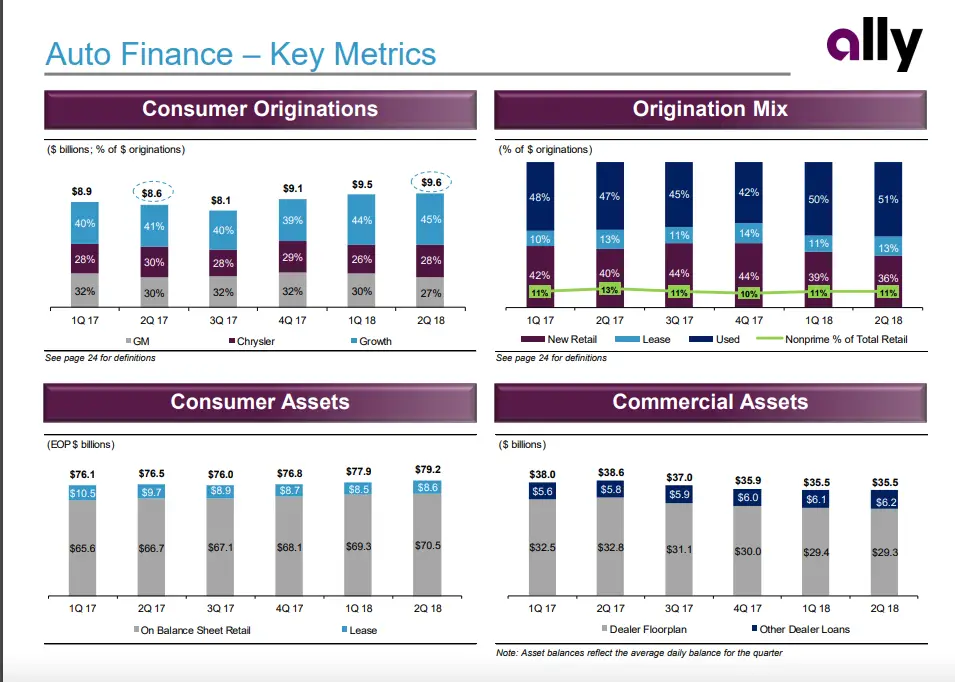

Ally Financial Auto Loans are only offered through dealerships at brands like, GM, Chrysler, and Mitsubishi.;

The only way you will be able to get an Ally Financial/Auto Loan would be through one of their network of dealerships.;

If you have just received a loan offer from My Ally Auto then the first step is to get some competing rates.;

Getting an Ally Auto Loan is like doing your grocery shopping at 7/11, it is going to cost you a lot more money!

Any of those auto lenders can give you a pre-approval letter that you can use to buy your new or used car today.;

Regardless of which lender you choose, you will need to take the following steps to receive a car loan.;

Ally Bank Auto Loans Vs Alternatives

There are other popular auto lenders that could give Ally a run for your business, including our list of some of the best credit unions for auto loans. Here are two other potential car loan providers that are also national financial institutions.

- Terms up to 75 months

- Terms from 12 to 84 months

- Loan amounts starting at $4,000

Don’t Miss: How To Return Ppp Loan

When Can You Refinance

You do not need to wait any minimum amount of time before refinancing your car loan. You just have to meet all the requirements for the new loan to refinance. Refinancing is possible immediately after buyingeven before you make your first monthly payment. Just be sure that you actually end up with a better deal, and that refinancing doesnt cause you to pay more for your vehicle.

In some cases, you may be unable to refinance until you have documentation from your states Division of Motor Vehicles . Gathering registration details may slow you down somewhat.

Ally Financial Bbb Better Business Bureau

Ally Financial BBB has had a file at the Better Business Bureau since 1984.

Ally Auto Loans has an A+ BBB rating with 1,421 complaints in the past three years . ;

Ally Financial BBB complaints tend to be financial related with claims of payoffs taking weeks to be applied while additional fees were uncured.

My Ally Auto Loan BBB reviews and customer complaints are taken seriously by the company as most receive a response which is why they have an A+ BBB rating.;

You May Like: What Is An Ellie Mae Loan

Which Is The Best Lender To Refinance With

The higher your credit scores and the stronger your finances, the more choices youll have. Apply to multiple lenders to see what new interest rate you can qualify for. Comparing several offers gives you the best chance of finding the lowest rate.

Keep in mind that rate shopping can also lead to being contacted by multiple lenders, especially if you use a service that compares offers for you. Consider opening a new email account and getting a free Google Voice phone number that you can check separately.

Most lenders use what is known as a soft credit check that gives you a rate estimate but does not hurt your credit score. If you apply to more than one lender that requires a full application and hard credit check, credit scoring formulas tend to treat multiple inquiries in a short time period as a single event. For most FICO formulas, for example, that period is 45 days.

How To Refinance A Car Loan With Bad Credit

Even if your credit score has gone up, if its still under 640, getting the best rates on an auto refinance is unlikely. There may be, however, some cases in which refinancing may be beneficial:

If auto loan rates have gone down – While new-car rates are different from refinance rates, you may have some wiggle room. If your goal is a lower monthly payment – If your main refi driver is decreasing your monthly payment, this may mean extending your loan term. The downside is that this will extend the life of your debt, and youll therefore pay more in interest as well.

If youre determined to refinance your car loan despite a spotty credit history, follow the steps outlined above. It may make sense to check out competing offers on a marketplace website such as LendingTree or rateGenius. You may also be able to get a better deal with a lender that allows you to add a co-signer to your loan.

Also Check: Does Applying For Personal Loan Hurt Credit

Sell The Car To Get The Loan Out Of The Borrower’s Name

This will only help in situations where there is some form of equity available. So the person will need to research that value first, before exploring this approach. As an example of how it will work, if the Kelley Blue Book value of the car is $10,000, and the balance of the loan is $4,000, then there is $6,000 of positive equity. This means a sale may be an option.

One issue to be aware of is that the longer the length of the loan originate the greater the chance of their being negative equity on the account. This means that there is more money is owed than the car is worth. With more people using 5-8 year long financing agreements, it can be very difficult for them to get help as it is very difficult to have a positive equity in those cases. The shorter the payment terms, the more likely selling the auto will be an option.

If a sale looks possible, then contact the lender. They need to be involved in the process. All of the parties involved in the transaction will need to close out the loan with the existing bank. Or they will all need to be involved in the transfer of the title or financing agreement as well.

If the loan is paid off using the proceeds of the sale, this will usually be done using the money from the contract agreed to by the buyer/seller. So all deal terms need to be clearly defined in order to get this approach to be successful. Also a contract documenting the transaction is required.

If Your Financial Situation Has Changed Or You Just Want Better Car Loan Terms Refinancing Your Car Loan May Be A Good Move

When you refinance your car, you take on a new loan to pay off the balance on your current car loan. Maybe your credit has improved and you might qualify for a lower interest rate, or your financial situation has gotten better and you want to remove the co-signer from your original loan. Refinancing with a new loan could mean getting better terms and rates that are more in line with your current financial needs and long-term plans.

Read on for tips to help you determine if a refinance is right for you, and to learn how to refinance a car loan.

Read Also: Is My Loan Fannie Mae

Car Loan Refinance Process

If you want to learn more information about the process of obtaining car loan refinance, this section is where you can find them. This is a list of the most frequently asked questions to inform you about the steps you need to take.

test

When should you refinance your car loan?

If you experience financial trouble and want to make your cars monthly payments easier to manage, you should consider refinancing that loan. This will provide you with a more affordable monthly payment requirement for a long term.

What happens if you refinance your car loan?

Refinancing a car loan involves taking out a new loan to pay off the existing one. The vehicle is used as collateral for the new loan. With the loan refinancing, you will get a new payment structure and term.

Can you refinance a car for 72 months?

Most consumers refinance a car loan to lengthen the payment term and make monthly payments more affordable. There are plenty of car refinancing structures for a 72-month period. It is up to you to choose the right lender so you can qualify.

How long should I wait to refinance my car?

Refinancing your car loan should be looked at as a final resort. Use this option only when you encounter financial trouble and find it difficult to meet your current monthly car payments.

Is refinancing a car loan worth it?

Aside from lowering your monthly payments, you can also lower your interest rate when you apply for a car loan refinance.

Do you get money back when you refinance a car?

Best Bank For Auto Refinance: Bank Of America

Bank of America

- Minimum credit score: Not stated

- Loan terms : 48 to 72 months

If youre looking to refinance your auto loan at a big bank, Bank of America is a good option. The lender features multiple refinance options and an easy online application process.

-

Transparent rates and terms online

-

Established financial institution

-

Minimum finance amount of $7,500

-

Must have fewer than 125,000 miles

-

Car can’t be valued at less than $6,000

Among big banks, Bank of America offers competitive refinance rates and an easy overall process. It’s open to borrowers throughout the nation and scored exactly the average in J.D. Power’s 2020 U.S. Consumer Financing Satisfaction Survey.

Also Check: Can You Take Out More Than One Student Loan

Accept An Offer And Pay Off Your Old Loan

To accept an auto refinance offer, contact the lender and follow through with the paperwork. You wont have to do anything to decline other offers. Without an acceptance response, auto loan offers expire within 30 to 45 days.

Your new lender will pay off your old loan once youre approved and accept the offer, though the specifics of how this is done can vary. According to Nelson, some lenders, like LightStream, may send you a check or give you a direct deposit and allow you to pay off your old loan yourself. Other lenders will pay off the old loan on your behalf.

Either way, your previous lender will then transfer the vehicles title to your new lender, who will keep it on hand until youve paid off the loan in full.

If your old loan has a payment due soon, you may want to contact them to let them know that your entire loan will be paid off, so you can avoid being charged a late fee.

How To Apply For Ally Bank Auto Financing

Unlike other auto loan lenders, you cannot apply directly to Ally for a new or used auto loan youll need the dealer for that. But there are several steps you can take to prepare for the trip to the dealership. First, get an auto loan preapproval. Once you have a car loan offer you like from a lender of your choice, you can then:

Don’t Miss: When Do Student Loan Payments Start After Graduation

Applying To Refinance Your Vehicle Loan

When it comes to refinancing an auto loan, the application process is relatively quick and painless. In fact, you’ll likely find it much easier than when you applied for your original loan. Many lenders, banks and credit unions among them, allow customers to apply for refinancing online, often with same day approval. You may even be able to finalize the loan online with an e-signature, or by printing out the loan documents and returning them by mail. Having said all that, it is always helpful to speak with a loan officer in person to ensure that you fully understand the terms of the agreement, and in order to negotiate the best deal possible.

Whether you decide to apply online or in person, you will need to have some specific information at your fingertips in order to complete your application. The following checklist should help ensure that you have all of the necessary documents at hand when it comes time to contact a lender.

Keep in mind that while you are researching lenders, and applying for a refinance loan, you must maintain your current repayment schedule. Should you miss any payments, you will not qualify for refinancing. Your responsibilities to your original lender will remain in force until the refinance agreement is finalized and your new lender has resolved the original debt.

Where To Apply For Refinancing

Banks and credit unions are usually the best options when it comes to refinancing your vehicle. Online lending companies are also a viable alternative, and some even specialize in auto refinancing. However, online lenders rarely offer the competitive interest rates that are available from traditional banking institutions. Moreover, dealing one on one with a bank or credit union in your community typically makes the entire loan process easier. You can speak with a loan officer directly, and go over all aspects of your refi agreement before you sign the contract. You will also have direct access to customer support throughout the life of your loan.

As with any car loan, you will want to investigate a few different lenders in order to find the best deal that is available. Compare and contrast three to four different refinancing offers, and pick the one the best suits your financial needs at the time. Remember, refinancing a vehicle is simply paying off one loan with another, and you do not want to rush into any agreement that you don’t fully understand, or that you are not completely comfortable signing.

Recommended Reading: How Much Do I Pay For Student Loan

Should You Refinance Your Car

Whether you should refinance your car loan depends on your situation.

Here’s when it’s beneficial to refinance your auto loan:

- If interest rates have dropped. Refinancing into a lower rate can reduce the overall interest costs on your loan.

- If you want to lower your monthly payments. Getting a new loan can help you free up cash for bills and other costs.

- Your credit has improved since you purchased the vehicle. If your credit score has jumped up since you first purchased your vehicle, you might be able to get a better loan.

Here’s when it’s not beneficial to refinance your auto loan:

- If you’re going into negative equity. You don’t want to owe more on the car than it’s worth. If refinancing will put you upside-down on your car loan, consider other options.

- Extending the loan term. Lengthening the term of your car loan typically will cause you to pay more interest over the life of the loan and more for your car. Though longer terms can lower your monthly payment, long-term loans are generally more expensive.

Refinancing your auto loan can help you decrease your payments and the amount of interest you pay over the life of the loan. But whether you should refinance depends on your situation. If you decide that refinancing is the right move for you, seek out a lender and loan terms that meet your needs and help improve your overall financial picture.